If you compare radicant with Neon, you are probably looking for a convenient banking solution, whether it’s for managing your money on a daily basis, traveling, or saving on transaction fees.

Both of these neobanks offer interesting alternatives to traditional banks like UBS or PostFinance, particularly thanks to reduced fees and features designed to meet modern needs.

radicant and Neon are digital banking apps available on the Apple App Store and Google Play Store. Both offer a free bank account with a free debit card, catering to users who value simplicity and transparency.

Let’s take a closer look at what each neobank offers.

radicant vs Neon – Which neobank is better for you?

If you don’t have time to read this article, here’s which neobank to choose based on your usage:

| Radicant | Neon | |

|---|---|---|

| Overall rating | 8.1/10 | 8.4/10 |

| Free account | 👍 | 👍 |

| For use in Switzerland | 👍 | 👍 |

| For travel | 👍 | |

| For free SEPA transfers | 👍 | |

| For payments abroad | 👍 | |

| For trading | 👍 | 👍 |

To know how each criterion is judged, keep reading: we review important options for Switzerland (IBAN CH, CHF transfers, TWINT) and abroad (card withdrawals, SEPA transfer fees, currency transfers).

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

radicant vs Neon – 1 point each

| Radicant | Neon | |

|---|---|---|

| Quick account opening | ✅ via the app in 15 minutes | ✅ via app in 15 minutes |

| Secure | ✅ Subsidiary of BLKB, Swiss banking license | ✅ Partner Hypothekarbank Lenzburg |

| IBAN (CH) | ✅ | ✅ |

| eBill | ✅ | ✅ |

| Free CHF transfers | ✅ | ✅ |

| Push notifications | ✅ | ✅ |

| Compatible with Apple Pay, Google Pay | ✅ | ✅ |

radicant and Neon are tied on these criteria, although sometimes the experience may differ during account opening, both neobanks allow for quick and easy account setup in 15 minutes.

radicant vs Neon – Promo Code

By opening an account with radicant or Neon, you receive a welcome gift in cash, which is always appreciated.

In addition to the 50 CHF welcome gift, radicant offers an investment bonus of up to 200 CHF, for a total potential of 250 CHF. We explain the details in our article on the radicant promo code.

Therefore, the advantage goes to radicant, which offers a better welcome package.

1 point for radicant

radicant vs Neon – Free Account

Both radicant and Neon offer completely free bank accounts with a Swiss IBAN (CH). This means you do not have to pay any monthly fees for managing your current account.

These neobanks focus on reducing banking fees for their users, allowing for everyday transactions without additional costs.

1 point each

radicant vs Neon – Debit Card & Withdrawals

radicant and Neon offer debit cards with different fees for withdrawals in Switzerland and abroad.

In Switzerland, radicant offers 12 free withdrawals per year in CHF, then charges 2 CHF per withdrawal. neon free, meanwhile, charges 2.50 CHF from the first withdrawal, but allows unlimited free withdrawals via Sonect at partner kiosks and stores. Neon’s paid plans (Plus, Global, Metal) include 2 to 5 free withdrawals per month.

For withdrawals abroad, radicant charges a flat 2 CHF per withdrawal, with no additional commission—advantageous for large withdrawals. neon free applies 1.5 % + 0.35 % fees, while the higher plans reduce or waive these charges.

| Radicant | Neon | |

|---|---|---|

| Free debit card | ✅ Free virtual card ❌ Physical: CHF 15 | ❌ 20 CHF for delivery |

| Free withdrawals in CHF | ✅ 12 withdrawals per year, then 2 CHF | ❌ CHF 2.50 with Neon free ✅ 2–5 free/month depending on plan ✅ Free with Sonect |

| Free withdrawals abroad | ❌ CHF 2 per withdrawal | ❌ 1.5% + 0.35% with Neon free ✅ Reduced or free with paid plans |

Regarding card payments in foreign currencies, radicant applies no conversion fees. neon free, on the other hand, charges 0.35 % exchange fees, with no markup on the interbank rate—paid plans offer 0 %.

Conclusion

radicant has the edge for fee-free foreign currency payments and large withdrawals abroad. Neon becomes more competitive with its paid plans, especially if you use Sonect or make small withdrawals abroad.

1 point for radicant

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before March 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

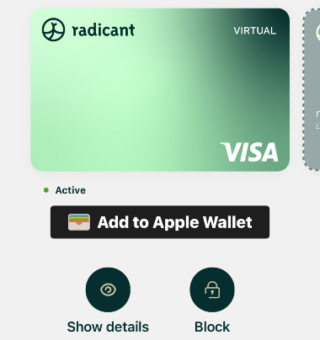

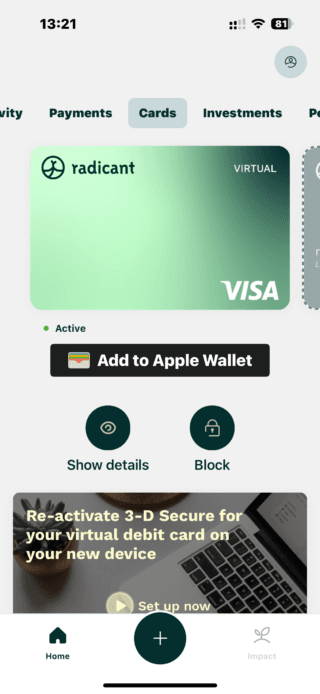

radicant vs Neon – Virtual Card

Virtual cards are digital versions of credit or debit cards, accessible via a mobile app. They offer enhanced security, as they can be blocked and replaced instantly in case of fraud. Additionally, they are immediately usable without waiting for a physical card and allow for quick and secure payments via Apple Pay or Google Pay.

radicant offers a free Visa Debit virtual card, available as soon as the account is opened. This virtual card is perfect for making online payments or using Apple Pay and Google Pay, offering great flexibility right from the start.

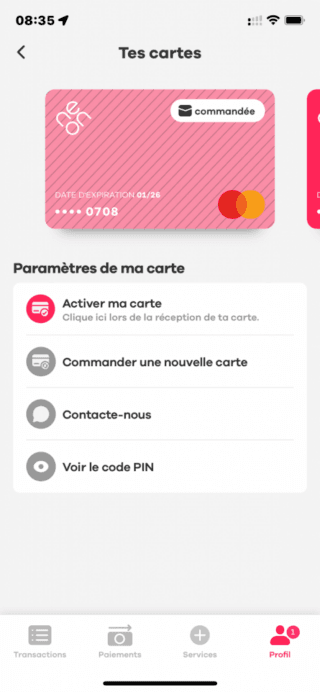

Neon does not offer a virtual card. You must wait for the physical card to arrive before you can start making payments or online purchases, which can be inconvenient.

radicant takes the lead with its virtual card, allowing immediate payments after account opening. Neon lags behind on this point.

1 point for radicant

radicant vs Neon – Contactless Mobile Payments

radicant and Neon both support contactless mobile payment systems, such as Apple Pay and Google Pay, allowing you to pay directly from your phone. These solutions are convenient and secure, eliminating the need to take out a physical card for each transaction.

Here’s an overview of the mobile payment systems supported by radicant and Neon, as well as other Swiss neobanks:

| Neobank | Apple Pay | Google Pay | Samsung Pay | Fitbit Pay | Garmin Pay | Swatch Pay |

|---|---|---|---|---|---|---|

| Alpian | ✅ Yes | ✅ Yes | 🚫 No | 🚫 No | 🚫 No | 🚫 No |

| N26 | ✅ Yes | ✅ Yes | 🚫 No | 🚫 No | 🚫 No | 🚫 No |

| Neon | ✅ Yes | ✅ Yes | ✅ Yes | 🚫 No | ✅ Yes | ✅ Yes |

| Revolut | ✅ Yes | ✅ Yes | 🚫 No | ✅ Yes | ✅ Yes | ✅ Yes |

| Wise | ✅ Yes | ✅ Yes | 🚫 No | ✅ Yes | ✅ Yes | ✅ Yes |

| Yuh | ✅ Yes | ✅ Yes | ✅ Yes | 🚫 No | 🚫 No | 🚫 No |

| Zak | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

In terms of compatibility, Neon offers broader support than radicant, including Samsung Pay, Garmin Pay, and Swatch Pay. radicant, while supporting Apple Pay and Google Pay, remains more limited in its support for other devices.

1 point for Neon

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before March 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

radicant vs Neon – Transfers and Exchange Rates

SEPA Transfer Fees

Currently, radicant does not allow SEPA transfers, although this feature is announced as available soon. This limits the possibilities for those who need to send funds within the eurozone.

On the other hand, Neon, although it does not offer a sub-account in EUR like Yuh, allows SEPA transfers via Wise. Euro transfers require conversion from a CHF account, with exchange fees of 0.8 %. This pricing is competitive for occasional transfers or small amounts.

International Transfer Fees

radicant also does not offer international transfers at the moment, this feature is also expected in a future update.

Neon, thanks to its partnership with Wise, allows international transfers in several currencies. The fees vary between 0.8 % and 1.7 %, depending on the currency and the amount transferred. This solution is ideal for occasional transfers, offering transparency and competitive rates, especially for modest to medium amounts.

In the absence of SEPA or international services at radicant, Neon is currently the best of the two for these types of transactions.

1 point for Neon

radicant vs Neon – TWINT

| Radicant | Neon | |

|---|---|---|

| TWINT | ✅ Radicant TWINT | ✅ TWINT Prepaid |

Like Yuh TWINT, radicant has its own TWINT app, while Neon requires you to use the less convenient TWINT Prepaid app.

1 point for radicant

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

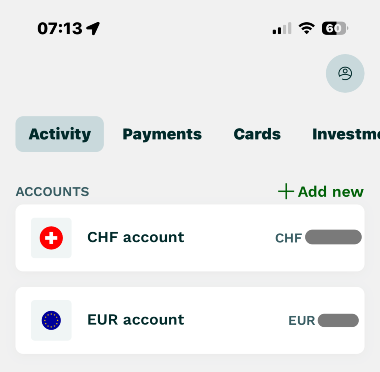

radicant vs Neon – EUR Account

radicant offers an EUR account in addition to its CHF account, with free SEPA transfers and a competitive CHF-EUR conversion rate of 0.9%. Unlike Yuh, which offers a true multi-currency account with 13 currencies and an interchangeable card, radicant is limited to two currencies and does not yet allow flexible use of its card.

To avoid conversion fees, it is recommended to fund the EUR account directly in euros from another bank account. radicant stands out for offering attractive interest rates on EUR deposits but is less versatile than Yuh for users with multi-currency needs.

Neon offers an account only in CHF, with foreign currency payments subject to an interbank rate and a 1.5% fee. Thanks to its partnership with Wise, Neon supports payments outside the SEPA zone, subject to conversion fees.

In our article on the Best CHF/EUR Exchange Rates, we found that Revolut and Wise offer the best exchange rates.

radicant vs Neon – Sub-accounts

The SPACES feature, popularized by N26, allows you to create sub-accounts to better manage your budget. However, radicant does not offer a comparable feature, leaving Neon with a slight advantage with its sub-accounts offering.

At Neon, this feature is also called SPACES and works like a personal savings pot. However, it is limited compared to other offerings like those from Zak or N26:

- SPACES is a personal savings pot, useful for saving for specific projects.

- SPACES cannot be shared, unlike shared sub-accounts offered by N26.

- SPACES does not have a dedicated IBAN, an advanced option that N26 offers to its users.

With the complete absence of SPACES or a similar feature at radicant, Neon takes the lead on this point, although its SPACES are still basic.

1 point for Neon

radicant vs Neon – Joint Account (Shared Account)

Neon offers a joint account with its Neon Duo service for just 3 CHF per person per month. This option includes two debit cards, allowing two people to manage their finances together, pay shared expenses, and save in the same account. It’s an ideal solution for couples or families wanting to share the management of their expenses.

In contrast, radicant does not yet offer joint accounts. For those looking for other options, international neobanks like N26 and Revolut also offer shared accounts.

1 point for Neon

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before March 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

radicant vs Neon – Savings and Interest Rates

With interest rate hikes in 2023 and 2024, several neobanks like radicant and Neon have offered attractive returns on current accounts. However, with recent cuts in central bank rates, neobanks are also adjusting their interest rates for accounts.

Here are the interest rates offered by radicant and Neon as well as other Swiss neobanks for the month of March 2026:

| Neobank | Interest Rate | Interest Cap | Withdrawal Limit |

|---|---|---|---|

| Alpian | 0.15 % | Above 125,000 CHF. 0.01 % below. | None |

| Neon | 0.00 % | - | None |

| Yuh Bank | 0.00 % | - | None |

| Zak | 0.05 % | Up to CHF 25,000 | None |

radicant thus offers a better interest rate than Neon.

1 point for radicant

radicant vs Neon – Trading and Investment

radicant offers exclusively sustainable investment options, aligned with the UN’s Sustainable Development Goals (SDGs). The offer includes 3 actively managed funds (sustainable stocks and bonds) and 8 thematic certificates focused on issues like clean water or climate stability. Investments start at 1,000 CHF, with personalized strategies based on your risk profile.

Neon, through Neon Invest, offers a classic and versatile approach. You can invest in more than 240 Stocks and 70 ETFs, covering a wide range of sectors and markets. Neon focuses on a simple and accessible interface, allowing users to start investing quickly directly from the app. The fees are transparent and competitive: 0.5% on Swiss stocks and ETFs, and 1% for international stocks.

| Radicant | Neon | |

|---|---|---|

| Free Custody Fees | ✅ | ✅ |

| Swiss Stock Trading | ❌ | 0.50% |

| Swiss ETF Trading | ❌ | 0.50% |

| Foreign Stock Trading | ❌ | 1.00% |

| Foreign ETF Trading | ❌ | 1.00% |

| Theme Trading | 0.90% to 0.50% depending on the amount invested | ❌ |

| Cryptocurrency Trading | ❌ | ❌ |

radicant and Neon compete with Alpian or Yuh, but with different rates that we will compare in a future article.

radicant’s approach, although focused on sustainable and thematic investments, remains much more restrictive compared to Neon’s versatile and accessible offering.

1 point for Neon

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

radicant vs Neon – Saveback Loyalty Program

Currently, Neon does not offer a specific loyalty program, although an ecological initiative is available with Neon Green, allowing users to offset the carbon footprint of their transactions.

On the other hand, radicant offers the Saveback program which allows you to earn up to 1 % of your card spending, directly credited to your investment portfolio. Standard users earn 0.25 % with a minimum investment of 1,000 CHF and monthly contributions of 150 CHF. Premium users earn 1 % with 10,000 CHF invested and monthly contributions of 1,000 CHF.

1 point for radicant

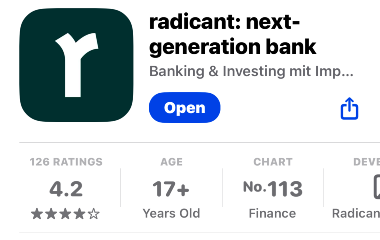

radicant vs Neon – Customer Reviews and Ratings

radicant is rated 4.2 on the App Store with 126 reviews, while Neon has a higher rating of 4.6 on the App Store, based on a significant number of 6,600 reviews. While both neobanks are highly rated, Neon clearly stands out with a higher average rating and a larger review base, reflecting greater customer satisfaction.

1 point for Neon

radicant vs Neon – Which App is More User-Friendly?

Discussing usability can be very subjective, but it comes down to which app is the most intuitive and easiest to use, for example:

- How many clicks to access an important function?

- How many clicks to complete a transaction?

- Does the app crash often?

- Is the app fast?

Without getting into a detailed ergonomic analysis (this is not the purpose of this article), both the radicant app and the Neon app are modern, well-designed, and intuitive, each with its strengths.

The designs of both apps are inspired by the standards of neobanks like N26 and Revolut, but they distinguish themselves by some particularities:

radicant app

- The app focuses on sustainability and includes detailed information on investments aligned with the SDGs.

- Navigation is smooth, with tools to personalize your risk profile and investments.

- Features like ESG impact analysis are well-integrated and clear.

Neon app

- The app is minimalist and intuitive, offering simple and fast navigation.

- All essential features like payment and withdrawal management are quickly accessible.

- The integration of Neon Invest is well thought out, making it easy to access investments directly from the app.

In conclusion, radicant shines with its focus on sustainable investment, while Neon excels in simplicity and smoothness.

1 point each

radicant vs Neon – Banking Licenses

radicant and Neon, two players in the Swiss banking sector, operate under distinct regulatory structures, each offering security guarantees for their customers.

radicant holds its own banking license from FINMA (Swiss Financial Market Supervisory Authority), allowing it to operate as an independent bank. As a subsidiary of Basellandschaftliche Kantonalbank (BLKB), radicant benefits from the support and expertise of an established cantonal bank. Deposits at radicant are protected up to 100,000 CHF, in line with the Swiss deposit guarantee system.

Neon does not have its own banking license. It partners with Hypothekarbank Lenzburg, a Swiss institution with a full banking license supervised by FINMA. Through this partnership, Neon customers’ accounts are hosted with Hypothekarbank Lenzburg, ensuring deposit protection up to 100,000 CHF, according to Swiss regulations.

Although radicant and Neon differ in their regulatory structures, they both offer equivalent deposit protection for their customers, up to 100,000 CHF, in line with Swiss standards. Therefore, in terms of deposit security, both institutions are equal.

1 point each

radicant vs Neon – Which neo-bank is best?

Considering all of these criteria:

- radicant Bank scores 10 points

- Neon Bank scores 9 points

👉 radicant therefore holds the overall advantage, thanks in particular to no currency conversion fees, cheaper withdrawals abroad, and a sustainable approach. It is especially recommended for users who want to invest in line with the Sustainable Development Goals (SDGs) while keeping fees simple and transparent.

Neon remains an excellent alternative, better suited if you’re looking for a cleaner interface, a variety of investment options with Neon Invest, or better control over Swiss ATM withdrawals via Sonect.

💡 Our advice: both neo-banks are free. Feel free to test them side by side to see which one best fits your daily needs.

Frequently Asked Questions (FAQ) on radicant vs Neon

✅ What are the main differences between radicant and Neon?

radicant stands out with its commitment to sustainable investments, offering products aligned with the United Nations’ Sustainable Development Goals (SDGs). Neon, on the other hand, focuses on a simplified banking experience with attractive fees and also offers an investment service called Neon Invest.

✅ Are radicant and Neon accounts free?

Yes, the basic accounts at radicant and Neon are free. However, some specific services may incur additional fees.

✅ What cards do radicant and Neon offer?

radicant offers a free Visa Debit virtual card. If you want a physical card, a delivery fee of 10 CHF applies. Neon offers a free Mastercard, but also charges a delivery fee of 10 CHF for the physical card.

✅ What investment options are available with radicant and Neon?

radicant offers investments in sustainable funds, thematic certificates, and strategies aligned with SDGs. Neon, through its Neon Invest service, allows you to invest in stocks and ETFs with competitive fees.

✅ What is the security like at radicant and Neon?

radicant operates under the banking license of Basellandschaftliche Kantonalbank (BLKB), while Neon partners with Hypothekarbank Lenzburg. In both cases, customer deposits are protected up to 100,000 CHF, in line with Swiss regulations.

✅ Do radicant and Neon offer interest on personal or savings accounts?

Yes, radicant offers interest on the balances of personal accounts. Neon offers interest on funds placed in “Spaces,” but not on standard personal accounts.

✅ Is it possible to open a child account with radicant and Neon?

Currently, radicant does not offer child accounts. Neon allows account opening from the age of 15, under specific conditions.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before March 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

As the founder of Neo-banques.ch, Philippe uses several Swiss and European online banks on a daily basis, including Yuh, Alpian, N26, Wise, and Revolut for his personal and professional transactions.

He has also previously used Neon and Zak as primary accounts before migrating to other solutions.