You are hesitating between Yuh Bank and Zak Bank and you do not know which neobank is the most advantageous for you, here is a comparison that will help you choose.

In our ranking of the best Swiss neobanks you can see that Yuh Bank is at the top of the ranking while Zak comes in 3rd position.

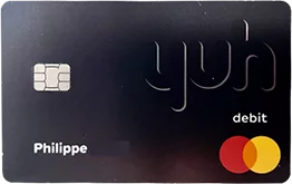

Yuh is a neobank based in Switzerland that offers a bank account with IBAN CH and allows you to have a main account in CHF, EUR or USD, as well as sub-accounts in several currencies (13 in total). Yuh also offers a Yuh Card, a prepaid Mastercard for online and offline purchases.

Zak is a neobank owned by Banque Cler and offers simple and accessible banking services. It offers current accounts, savings books and a free bank card, all without hidden fees. Zak is aimed at customers who want to manage their finances independently and efficiently.

Yuh vs Zak – Which neobank is better for you?

If you don’t have time to read this article, here is which neobank to choose according to your usage:

| Yuh | Zak | |

|---|---|---|

| Overall rating | 8.6/10 | 7.9/10 |

| Free bank account with free debit card | 👍 | 👍 |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 | |

| To make free SEPA transfers | 👍 | 👍 |

| To transfer money abroad | 👍 | |

| For Trading | 👍 250 SWQ+50 CHF Trading Credits with our promo code |

To find out how each criterion is judged, read on: we review important options for Switzerland (IBAN CH, transfers in CHF, TWINT) and for abroad (withdrawals with the card, SEPA transfer fees, transfers in foreign currencies).

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Yuh vs Zak – 1 point each

| Yuh | Zak | |

|---|---|---|

| Free bank account | ✅ | ✅ |

| Free debit card | ✅ Mastercard | ✅ Mastercard |

| Quick account opening | ✅ 15 min. with the app | ✅ 15 min. with the app |

| Safe | ✅ Subsidiary of Swissquote | ✅ Partner of Hypothekarbank Lenzburg |

| IBAN (CH) | ✅ | ✅ |

| eBill | ✅ | ✅ |

| Free CHF transfers | ✅ | ✅ |

| Push Notifications | ✅ | ✅ |

| Compatible with Apple Pay, Google Pay | ✅ | ✅ |

Yuh and Zak are tied on these criteria, even if sometimes the experience can be different during the account opening the 2 neobanks allow a quick and easy opening in 15 minutes.

Yuh vs Zak – Promo code

By opening an account with Yuh or Zak, you receive a welcome gift in cash on your account, which is always appreciated.

The advantage goes to Yuh which offers a slightly better welcome offer than Zak.

1 point for Yuh

Yuh vs Zak – Debit card & withdrawals

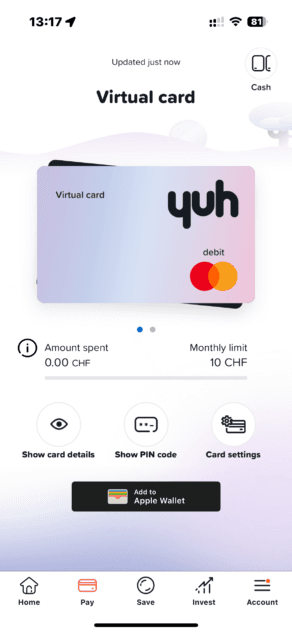

At Yuh, the debit card is multi-currency, that is to say that you can use it indifferently for all the currencies available on your account, it will automatically charge the corresponding currency.

For example if you have CHF and EUR in your account and you pay a restaurant in France, the card will use the EUR available on your account.

At Zak, the card is in CHF and you can use it for payments and withdrawals in EUR.

| Yuh | Zak | |

|---|---|---|

| Free Debit card | ✅ MasterCard | ✅ Visa |

| Free CHF Withdrawals | ✅ 1/week, then 1.90 CHF, up to 10,000 CHF/mo. | ❌ 2 CHF each or free with Banque Cler |

| Free Withdrawals Abroad | ❌ 4.90 CHF each | ❌ 2% + 5 CHF each |

So Yuh offers you 4 free withdrawals in CHF per month while Zak charges 2 CHF/withdrawal unless you withdraw from a Banque Cler ATM.

Abroad, Zak’s fees are clearly dissuasive: withdrawing 100 EUR in France for example, will cost you 7 CHF in fees.

1 point for Yuh

Yuh vs Zak – TWINT

| Yuh | Zak | |

|---|---|---|

| TWINT | ✅ Yuh TWINT | ✅ TWINT Prepaid |

Unlike Yuh TWINT you will not find a dedicated Zak TWINT application and you will have to use the TWINT Prepaid application, which is less practical.

1 point for Yuh

Yuh vs Zak – EUR Account

Zak offers an account in CHF which implies that any payment in EUR or other currency will be subject to an exchange rate and possible fees. Payments outside the SEPA zone and payments in currencies other than CHF and EUR are not currently offered by Zak.

In our article on Best CHF/EUR Exchange Rates we found that Revolut and Wise offer the best exchange rates.

Yuh bank offers a multi-currency account with the choice of the main currency: CHF, EUR or USD, which makes it an ideal bank account for cross-border workers and non-residents.

Yuh allows you to create sub-accounts in 13 different currencies: CHF – USD – EUR – GBP – JPY – AUD – CAD – SEK – HKD – NOK – DKK – AED – SGD

Incoming bank transfers are free on the available currencies, which is an advantage over Zak which can only accept CHF without fees.

But, because there is a but! Yuh applies 0.95% exchange fees, so crediting your Yuh account in CHF to convert them to EUR or another available currency will cost you 0.95%.

To avoid exchange fees on the EURO, the trick is to fund your Yuh account in EUR from another EUR account (an account at UBS for example), you will then benefit from fee-free payments in the EURO zone.

1 point for Yuh

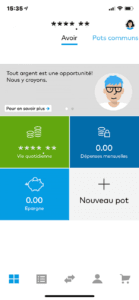

Yuh vs Zak – Spaces and Common Pots

SPACES is a feature originally launched by N26: it is similar to a shared sub-account at N26, but Yuh Banque and Zak are not yet at the same level.

At Yuh, this feature called SAVE is similar to a piggy bank that cannot be shared with other users, unlike Zak for example:

- SAVE is a personal piggy bank

- SAVE cannot be shared

- SAVE does not have a dedicated IBAN (option offered by N26)

At Zak, the Shared Pots are shared with other Zak users, but no IBAN is attached to a Shared Pot, which limits the use.

1 point for Zak

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before February 28, 2026 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️

Yuh vs Zak – Travel and Exchange Rates

As said above: Yuh bank offers a multi-currency account, while Zak offers a CHF account which implies that any payment in EUR will be subject to an exchange rate and possible fees.

The 2 neobanks are very transparent on the issue of exchange fees:

- Yuh applies 0.95% fees on currency exchanges, as well as 4.90 CHF/withdrawal abroad

- Zak applies a 2% markup on the Visa interbank rate as well as 2.00 CHF/withdrawal in Switzerland (except at Banque Cler) and 5.00 CHF/withdrawal abroad

Despite the 4.90 CHF fixed fees, Yuh remains more attractive than Zak for payments and withdrawals in EUR.

1 point for Yuh

Yuh vs Zak – Loyalty program

Zak offers a Cashback offer with Shopmate and Yuh offers a loyalty program that pays you in Swissqoins (SWQ): the crypto-currency created by Yuh.

When the program was launched, the rate was 1 Swissqoin = 0.01 CHF approximately, so 250 SWQ = 4 CHF, today we are more like 1 Swissqoin = 0.015 CHF, an increase of 50% in less than 2 years.

Yuh pays you on the following operationsantes :

- One-time deposit of 500 CHF when opening the account = 250 SWQ

- Each trade with Yuh = 10 SWQ

- Each payment with the Yuh Mastercard = 2 SWQ

Shopmate’s offer is interesting because it allows access to many partners, but we prefer Yuh’s Swissqoins which can be converted into cash if you wish.

1 point for Yuh

Yuh vs Zak – Trading Account

Yuh was the first Swiss neobank to offer a trading account, giving you access to over 300 stocks, 58 ETFs, trading themes, and 32+ cryptocurrencies, including Bitcoin.

To date, Zak still does not offer a Trading offer.

| Trading | Yuh | Zak |

|---|---|---|

| Custody fee | ✅ | - |

| Trading of Swiss Stocks | 0.50% | ❌ |

| Trading of Swiss ETF | 0.50% | ❌ |

| Trading of Foreign Stocks | 0.50% | ❌ |

| Trading of Foreign ETF | 0.50% | ❌ |

| Trading of Themes | 0.50% | ❌ |

| Trading of crypto-currencies | 1.00% | ❌ |

Yuh is therefore competing with Alpian, Neon and Revolut but with different rates that we can compare in a future article.

1 point for Yuh

Yuh vs Zak – Customer reviews and ratings

Yuh is rated 4.7 on the App Store (13k reviews) and Zak is rated 4.6 on the App Store (11k reviews). The customer reviews are therefore comparable in terms of rating and suggest that customers are generally satisfied with the 2 neobanks.

1 point each

Yuh vs Zak – Banking Licenses

Yuh being a subsidiary of Swissquote, it is the banking license of Swissquote Bank SA that is used.

With Zak, it is the banking license of Banque Cler.

In both cases your deposits are protected up to 100,000 CHF.

1 point each

Yuh vs Zak – Which app is more user-friendly?

Debating usability can be very subjective, but it comes down to which app is more intuitive and easier to use, for example:

- How many clicks does it take to access an important function?

- How many clicks does it take to complete a transaction?

- Does the app crash often?

- Is the app fast?

Without doing a complete ergonomic analysis (this is not the subject of this article), we note that the Yuh app is generally better than the Zak app:

The design of the Yuh app is very modern, close to N26 and Revolut which are the references in terms of neobanks, while Zak seems to be built from a classic banking application.

At Yuh:

- the application is fluid and fast

- it is possible to change the monthly limit of the card (it is still less good than Revolut or N26)

- all the functions are directly accessible

At Zak:

- the application is slower, you often have to re-enter your credentials to connect

- the application does not allow you to manage the card limits, you have to call customer service!

- the Zak Store adds a step to use certain functions

Yuh offers a better experience user.

1 point for Yuh

Yuh vs Zak – Which neobank is the best

If we consider all of these criteria:

- Yuh Bank gets 10 points

- Zak Bank gets 3 points

So Yuh clearly has the advantage, but Zak remains an excellent neobank.

- if you want an account in EUR or USD, choose Yuh

- if you make withdrawals once a week, choose Yuh

- if you want an account that offers a trading account, choose Yuh

Otherwise, do not hesitate to test both because these neobanks are free and are possibly complementary: