Wealth management solutions have become increasingly numerous—but also increasingly complex. Between traditional banks, private banks, and digital players, it is not always easy to identify what truly adds value on a day-to-day basis.

It is in this context that this article fits. Here, I explain why in 2026 I use Alpian in addition to my private bank, what this approach has concretely brought me, and in which cases it does—or does not—make sense.

Alpian is a Swiss digital bank offering a multi-currency bank account and wealth management solutions accessible via a mobile application. Portfolios are built exclusively from ETFs, with a deliberately limited number of positions, allowing for a clearer view of allocation and risk.

The goal of this article is not to compare promises, but to share a real-life experience, with money invested, over time.

🔒 Confidentiality note: For privacy reasons, I deliberately do not mention the name of my private bank in this article.

Why I chose to use Alpian

I have been using the services of a Swiss private bank for many years. This relationship was built over time, and I am overall very satisfied with it. The advice is high quality, the wealth support is solid, and the management matches my long-term needs.

When I started looking into Alpian, the goal was therefore neither to change banks nor to question this existing relationship. It was rather an exploratory and pragmatic approach.

🎯 My idea was simple: use Alpian with real money invested in order to compare it concretely with a private bank—not based on brochures or marketing promises, but on measurable elements:

- 📊 the portfolio structure

- 🔍 the readability of the management

- ⚖️ the consistency of the allocation

- 📈 the results over time

What pushed me to take the step was that Alpian did not present itself as a simple banking app. Its positioning was clearly oriented toward wealth management, with a structured and disciplined approach—even for amounts that do not fall under traditional private banking (from CHF 10,000 with the Guided by Alpian offering discussed here).

🧪 I therefore started with a deliberately limited allocation. The goal was not to “choose a camp,” but to see whether a digital bank could, in certain specific aspects, do as well—or even better—than a private bank, while offering a simpler and more readable experience. It was this logic of a real-world test, without preconceptions, that guided my decision to use Alpian.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Alpian is not just a neobank: what reassured me from the start

Coming from a private bank, there are criteria on which one does not compromise. Even before looking at an application, an interface, or an investment offering, I wanted to make sure that Alpian rested on solid banking foundations.

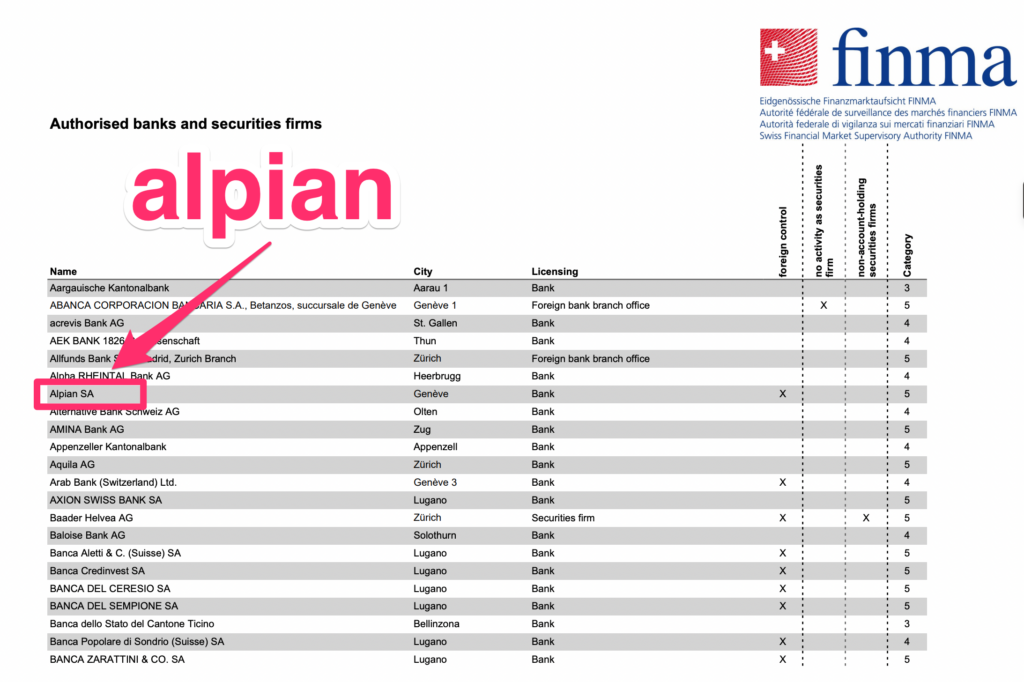

🏛️ What reassured me right away was that Alpian is a fully licensed Swiss bank, regulated by FINMA and holding a full banking license. For me, this is not a minor detail:

- 🔐 deposit protection in line with Swiss standards

- 📜 clear regulatory supervision

- 🧱 banking infrastructure designed to last

Alpian was incubated by REYL & Cie, a Swiss private bank, and since 2024 it has been majority-owned by Fideuram – Intesa Sanpaolo Private Banking, the private banking division of the Italian banking group Intesa Sanpaolo. This shareholder structure gives Alpian a solid institutional foundation, built on recognized partners within the European banking sector. (Wikipedia)

From the perspective of a serious benchmark against a private bank, this point was essential. Comparing management strategies or performance only makes sense if the foundations are comparable. At this level, Alpian operates in the same category as a traditional bank, even if the experience offered is very different.

✅ Once this framework was validated, I was able to go further in my analysis, without the doubts one can sometimes have with certain lighter neobanks from a regulatory standpoint. This allowed me to focus on what really mattered to me: the portfolio structure, the readability of the management, and the results over time.

Private bank vs Alpian: two very different day-to-day experiences

On a day-to-day basis, the difference between a private bank and Alpian is felt very quickly—not in terms of seriousness or competence, but in how one monitors and manages their wealth.

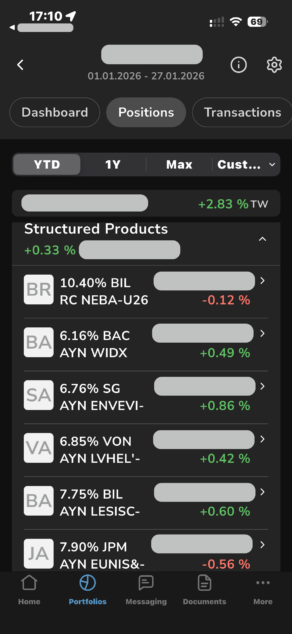

🏦 On the private banking side, the approach is very comprehensive—sometimes even too much.

Portfolios are built using a multitude of instruments: in-house funds, third-party funds, structured products, options, and regular tactical adjustments. On paper, everything is coherent.

Private Bank Interface

In practice, this requires:

- ⏱️ time

- 🧠 attention

- 💬 regular discussions to understand what has been changed, why, and with what real impact on the overall portfolio.

📱 With Alpian, the experience is almost the opposite.

Information is centralized in the app, portfolios rely exclusively on ETFs, and the number of positions remains deliberately limited.

👉 As a result, in just a few minutes, I can:

- track portfolio performance

- understand risk allocation

- see where I am exposed

It is not more simplistic—it is simply more readable.

✨ This difference in daily experience quickly became important to me. Even while keeping a private bank for primary management, I found in Alpian a more direct and clearer way to follow my investments, without having to decode a fragmented strategy dependent on a multitude of instruments.

👉 This readability, more than the tool itself, is what made the comparison between the two approaches particularly interesting.

My first steps with Guided by Alpian

To start, I chose the Guided by Alpian offering. In my view, it was the most logical entry point to test Alpian’s management in a concrete way, without immediately switching to fully discretionary management.

🧭 Guided by Alpian is based on allocation recommendations proposed by Alpian, built from ETFs and tailored to a risk profile defined at the outset. The important nuance—and what mattered to me—is that it remains possible to adjust each position individually.

Unlike fully discretionary management, the investor retains oversight and direct control over the portfolio composition.

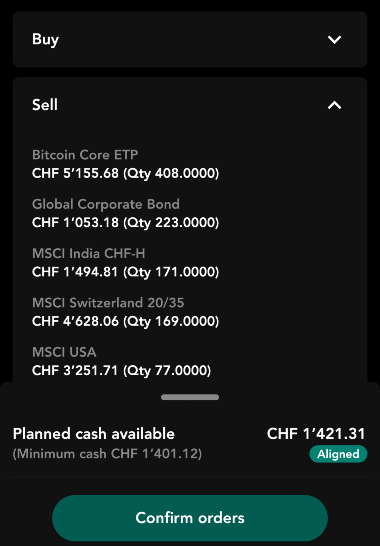

Alpian Buy and Sell ETFs Advice

In practical terms:

- 🧩 the proposed allocation serves as a working baseline

- ✏️ each line can be modified

- 👀 you can track precisely the choices made

This setup is fairly close to what you find in a traditional private bank, with the option to delegate… or not. It was precisely this flexibility that convinced me to start with this offering.

🎯 At this stage, my goal was not to chase short-term performance, but rather to:

- 🔍 understand the logic behind the recommendations

- 📊 observe how the portfolio behaved over time

- ⚖️ compare the consistency of the allocation with that of my private bank

So I invested a first portion of my portfolio via Guided by Alpian, treating this phase as a real-world test.

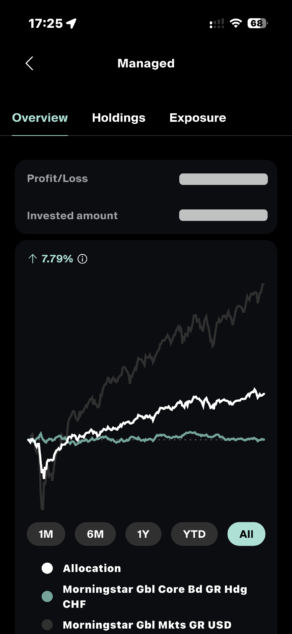

Solid performance, but penalized by my own adjustments

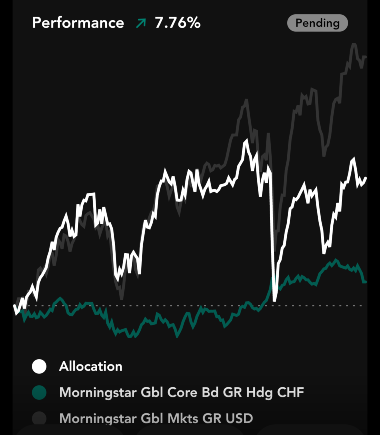

Over time, the performance achieved with Guided by Alpian was positive, but lagging the market. In hindsight, this gap is not explained by the quality of Alpian’s recommendations, but by my personal choices.

Guided by Alpian 9-Month Performance

📉 The flexibility offered by Guided by Alpian has a downside: it leaves room for sometimes irrational decisions.

In my case, some adjustments were made:

- 🕒 at the wrong time

- 🎯 with excessive conviction

- 😬 under the influence of market noise

In other words, I did exactly what many investors do when they have the wheel: over-intervene.

📊 When comparing my results with:

- the market

- the Managed by Alpian offering

- and even the initial, unmodified recommendations

- it became clear that the underperformance came primarily from my deviations from the proposed strategy.

👉 I also detailed this analysis—performance, composition, and the impact of adjustments—in a dedicated article: Guided by Alpian after 9 months: 7.76% performance

This realization was decisive. It made me understand that, in my case, flexibility was not necessarily an advantage, but rather a source of mistakes. It is precisely this observation that led me to rethink my approach and consider more delegated management via Managed by Alpian.

Why I moved 90% of the portfolio to Managed by Alpian

After this phase with Guided by Alpian, one thing became clear to me: the framework worked, but flexibility also had its limits. The adjustments I made myself did not add value over time, and sometimes introduced biases or decisions that were not very rational.

🔄 About a year ago, I therefore decided to revisit my approach and delegate more of the management. Concretely, I moved 90% of the portfolio to the Managed by Alpian offering, while keeping 10% in Guided by Alpian.

This split served two distinct objectives:

- 📊 entrust the bulk of the portfolio to professional, disciplined management

- 🧪 keep a more experimental sleeve, with 100% Bitcoin ETF exposure

🎯 The choice of Alpian Managed was not based on a promise of outperformance, but on a simpler conviction: in my case, fully delegated management was more suitable than repeated personal rebalancing—especially for a long-term portfolio.

With this change, the goal was not to alter the level of risk, but to:

- reduce unnecessary interventions

- gain consistency in the allocation

- observe the management over time, without interference

👉 This new setup—a mostly managed portfolio, with a freer sleeve alongside it—served as the basis for the comparisons observed in 2026, and led to the conclusion described in the next section.

Balanced portfolio, higher performance: the turning point

With the majority shift to Managed by Alpian, the portfolio remained balanced. The risk profile did not change, nor did the investment horizon. The comparison with a more traditional wealth management approach therefore remained relevant.

📈 Over the last 12 months, I observed slightly higher performance on Alpian’s side, compared with the equivalent management of my portfolio at my private bank.

Nothing spectacular or systematic, but a gap that was consistent enough to catch my attention.

What surprised me was not so much the level of performance as the context in which it was achieved:

- ⚖️ comparable risk level

- 🔄 few allocation changes

- 📦 simple structure, using ETFs

💱 Note: part of the ETFs used by Alpian are hedged against currency risk in CHF (notably for U.S. and Japanese markets). This does not explain the performance gap, but it makes the reading of results more straightforward in Swiss francs. Other approaches leave more room for currency effects, which sometimes complicates comparisons.

👉 The real turning point for me, therefore, was not a supposedly “better” management, but the realization that a disciplined portfolio with few holdings and few moves could deliver very competitive results—while being much easier to follow day to day.

It was this operational simplicity, more than performance itself, that marked a shift in how I think about managing my portfolio.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

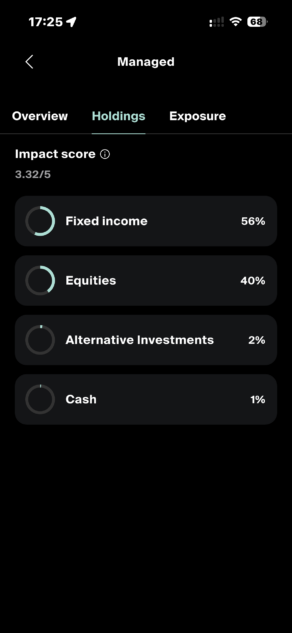

ETFs only vs complex portfolios: an underestimated advantage

In hindsight, one of the most concrete differences between the two approaches is not directly about performance, but about the portfolio structure and how easily it can be read and managed.

📦 In a portfolio built exclusively with ETFs, like at Alpian, each line has a clear role. Exposure to U.S. equities comes via an MSCI USA ETF, global diversification via an MSCI World or Europe, and the defensive sleeve via a bond ETF. In just a few minutes, it becomes possible to understand:

- where the main exposure sits

- which markets explain recent moves

- how risk is distributed

By contrast, in a traditional private bank, that same exposure can be spread across multiple funds—sometimes multi-asset, sometimes actively managed—with successive adjustments. Individually, each instrument has its own logic. Together, the overall picture becomes harder to reconstruct.

🔍 This difference is particularly visible when tracking over time.

With an ETF portfolio:

- holdings change little

- allocation shifts are easy to identify

In a more sophisticated structure, movements are often more numerous and spread across several instruments, which complicates after-the-fact analysis—even with detailed reporting.

👉 In my case, this structural simplicity did not change the seriousness of the management, but it clearly improved my ability to understand what I held and keep an overall view without excessive effort. It is an operational advantage that is often underestimated, but very tangible over time.

When Alpian becomes a steering tool… including for my private bank

Quite paradoxically, it was this readability that turned Alpian into a real steering tool, including in my exchanges with my private bank.

📱 On several occasions, I used screenshots of my Alpian portfolio to discuss strategy—not to compare performance line by line, but to set the framework: overall allocation, risk distribution, geographic exposure. With few lines and a clear structure, the discussion becomes immediately more efficient.

In a more complex portfolio, you often need to go through:

- detailed reporting

- intermediate explanations

- a progressive reconstruction of the overall logic

With Alpian, the information is already structured. In a few minutes, you can see what really matters, which makes it possible to refocus the discussion on allocation decisions rather than the mechanics of the instruments.

👉 That is where Alpian’s role changed for me. Beyond a simple investment tool, it became a visual and strategic reference, used to clarify, challenge, or simplify certain decisions, regardless of the management framework.

In practice, it was not performance that reversed the roles, but the ability to make a strategy readable. And on that point, a simple, well-structured, easy-to-read portfolio can become an excellent decision support—even versus far more sophisticated approaches.

The human side at Alpian: what I actually use (and what I don’t)

In a digital bank, the question of human support always comes up. With Alpian, that element does exist, but it does not play the same role as in traditional wealth management banking.

🤝 In my usage, exchanges with Alpian advisors are occasional and targeted. I mainly contact them when I need to clarify a specific point: understanding an adjustment, the allocation logic, or how a service works. The answers are generally fast, clear, and sufficient to move forward.

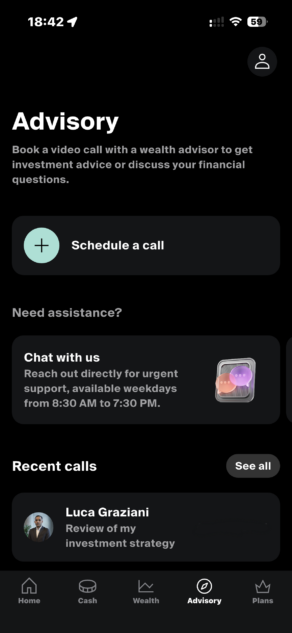

Alpian Advisory

On the other hand, I do not use Alpian as a substitute for a long-term wealth relationship. On my side, there are no regular discussions about the overall situation, estate planning, or complex structures. And that is not what I expect from a solution like Alpian.

📱 What also reduces the need for frequent interactions is the portfolio structure itself. With few holdings, clearly identifiable ETFs, and a readable allocation, many questions are resolved directly in the app, without requiring a human exchange.

👉 In practice, the human element at Alpian therefore plays the role of efficient support, but not a central one. It complements the platform when necessary, without trying to impose itself. For my usage, this balance works well: enough availability when needed, without unnecessary relationship layering.

What my private bank provides—and Alpian does not cover

If I use Alpian as a complement, it is also because a private bank covers wealth dimensions that go beyond what a digital bank offers today.

🏦 A first key element is access to advanced credit solutions, such as a Lombard loan. This type of financing, secured by the portfolio, makes it possible to manage liquidity, optimize certain situations, or fund projects without having to sell assets. It is not within Alpian’s scope, and it is not its role.

📊 The private bank also plays a central role in second-pillar management. Even when the assets are held in a separate foundation, it is the private bank that ensures investment oversight and integrates this sleeve into the overall wealth strategy. Alpian does not intervene on this front, which remains structurally important over the long term.

👨👩👧 Another very concrete point is the consolidated view of family wealth. Accounts for several family members—spouse, children—can be viewed in a single interface, which facilitates monitoring, allocation consistency, and household-level discussions. This “family” dimension is not covered by Alpian.

📚 Finally, a private bank provides cross-cutting support on topics such as:

- estate planning

- tax optimization

- wealth structuring over time

These topics go far beyond portfolio management and require a holistic view, often built over several years, with trade-offs that are not purely financial.

👉 This is precisely why I do not try to pit Alpian against a private bank. Alpian is very effective for managing a simple, readable, disciplined portfolio. The private bank, on the other hand, remains essential as soon as you enter areas involving credit, retirement planning, family, or wealth structuring.

That complementarity explains why, even today, both coexist in my financial strategy.

Why I use Alpian as a complement—and not as my only bank

Over time, one thing became clear to me: Alpian is never meant to replace a private bank in all aspects of wealth management. And that is not what I ask of it.

Alpian established itself as an effective solution to manage a portion of the portfolio in a simple, readable, disciplined way, with a clear structure and few unnecessary moves. That is precisely what makes it, in my view, an excellent complement.

Conversely, a private bank remains essential as soon as you move beyond the strict investment framework: wealth structuring, consolidated family view, retirement planning, taxation, succession, or advanced credit solutions.

👉 That said, for people who do not (or not yet) have a private bank, Alpian can play a much more central role. The combination of a regulated Swiss bank, professional portfolio management, a clear framework, and occasional human access already provides services that, in some respects, come close to what traditional wealth management offers.

In practice, everything depends on the profile and needs. In my case, Alpian works as a complement. For others, it can absolutely become a primary solution, especially when simplicity, readability, and discipline matter more than wealth complexity.

It is this flexibility of use, more than the promise of a single model, that explains why Alpian finds its place in very different financial strategies.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️