If you’re hesitating between Yuh Bank and Neon Bank, and you do not know which neobank is the most advantageous for you, here is a comparison that will help you choose.

In our ranking of the best Swiss mobile banks you can see that Yuh and Neon Bank are neck and neck, being equal on almost all criteria, but there are some differences that may be important for you.

Yuh vs Neon – Which Neobank is Best for You

If you don’t have time to read this article, here is which neobank to choose according to your use:

| Yuh | Neon | |

|---|---|---|

| Overall rating | 8.6/10 | 8.4/10 |

| Free bank account with free debit card | 👍 | |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 | |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 250 SWQ+50 CHF Trading Credits with our promo code |

To find out how each criterion is judged, read on: we review important options for Switzerland (IBAN CH, transfers in CHF, TWINT) and abroad (withdrawals with the card, SEPA transfer fees, transfers in designs).

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Yuh vs Neon – 1 Point Each

| Yuh | Neon | |

|---|---|---|

| Free debit card | ✅ Mastercard | ✅ Mastercard |

| Quick account opening | ✅ 15 min. with the app | ✅ 15 min. with the app |

| Safe | ✅ Subsidiary of Swissquote | ✅ Partner of Hypothekarbank Lenzburg |

| IBAN (CH) | ✅ | ✅ |

| eBill | ✅ | ✅ |

| Free CHF transfers | ✅ | ✅ |

| Push Notifications | ✅ | ✅ |

| Compatible with Apple Pay, Google Pay | ✅ | ✅ |

Yuh and Neon are equal on these criteria, even though sometimes the experience can be different during account opening the 2 neobanks allow for a quick and easy opening in 15 minutes.

Yuh vs Neon – Free Bank Account

Yuh and Neon both offer completely free bank accounts with a Swiss IBAN (CH). This means there are no monthly fees for managing your current account.

These neobanks focus on reducing banking costs for their users, allowing them to carry out everyday transactions without additional charges.

1 point each

Yuh vs Neon – Promo code

When you open an account with Yuh or Neon, you receive a welcome gift (cash) in your account, which is always nice.

The advantage goes to Yuh that offers a bigger welcome bonus.

1 point for Yuh

Yuh vs Neon – Debit card & Withdrawals

All banks try to limit cash withdrawals at the ATM, but some allow you to do so for free within certain limits.

| Yuh | Neon | |

|---|---|---|

| Free Debit card | ✅ | ✅ 20 CHF delivery fee |

| Free CHF Withdrawals | ✅ 1/week, then 1.90 CHF, up to 10,000 CHF/mo. | ❌ 2.50 CHF/withdrawal with neon free, free (2 to 5/month) from neon plus. Sonect always free. |

| Free Withdrawals Abroad | ❌ 4.90 CHF each | ❌ 1.5% + 0.35% (free with neon metal) |

For CHF withdrawals, Yuh is more advantageous if you regularly use ATMs: 4 free withdrawals per month versus none with neon free (CHF 2.50 each). However, Neon offers unlimited free withdrawals via Sonect, which is useful if you live near a partner kiosk or store.

1 point each

Yuh vs Neon – Travel and Exchange Rates

As said above: Yuh bank offers a multi-currency account, while Neon offers a CHF account which implies that any payment in EUR or any other currency will be subject to an exchange rate and possible fees.

Both neobanks are very transparent on the issue of exchange fees:

- Yuh applies a 0.95% fee on currency exchange, as well as 4.90 CHF/withdrawal abroad

- Neon free charges 0.35% in foreign exchange fees on payments, with no markup on the interbank rate. Paid plans (Plus, Global, Metal) offer 0% fees. For ATM withdrawals abroad, Neon charges 1.5% + 0.35% on the free plan, with reduced or no fees on higher plans.

Yuh is strongly penalised by the 4,90 CHF fixed fee. Indeed, unless you withdraw 1,000 EUR – which is usually not possible – Neon Bank will always be cheaper on foreign withdrawals.

Yuh is also penalised on card payments because of the 0.95%, so Neon remains better positioned than Yuh on travel and exchange rates

1 point for Neon

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Yuh vs Neon – Account in EUR

Neon offers a CHF account which means that any payment in EUR or other currencies will be subject to an exchange rate and possible fees. Neon uses Wise for foreign currency transfers and we have seen in our article on the Best CHF/EUR Exchange Rates that Revolut and Wise offer the best exchange rates and Neon – due to the Wise partnership – is just behind.

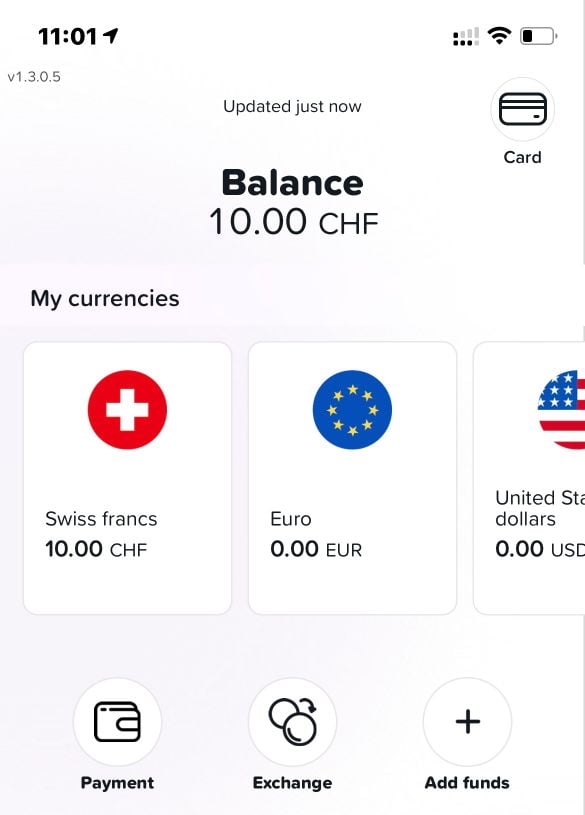

Yuh bank offers a multi-currency account with the choice of the main currency: CHF, EUR or USD which makes it an ideal bank account for cross-border commuters and non-residents.

Yuh allows you to create sub-accounts in 13 different currencies: CHF – USD – EUR – GBP – JPY – AUD – CAD – SEK – HKD – NOK – DKK – AED – SGD

Incoming bank transfers are free of charge on the available currencies, which is an advantage over Neon, which can only accept CHF without fees.

But, because there is a but! Yuh applies 0.95% exchange rate fees, so crediting your Yuh account in CHF to convert them to EUR or another available currency will cost you 0.95%, which is not always advantageous compared to Neon.

To avoid exchange fees on EURO, the trick is to fund your Yuh account in EUR from another account in EUR (an account at UBS for example), you will then benefit from free payments in EURO zone.

1 point for Yuh

Yuh vs Neon – Savings and Interest Rates

With interest rate increases in 2023 and 2024, several neobanks, such as Yuh and Neon, offered attractive returns on current accounts. However, with the recent reductions in central bank interest rates, neobanks are also adjusting their interest rates for accounts.

Here are the interest rates offered by Yuh and Neon, as well as those of other Swiss neobanks for February 2026:

| Neobank | Interest Rate | Interest Cap | Withdrawal Limit |

|---|---|---|---|

| Alpian | 0.15 % | Above 125,000 CHF. 0.01 % below. | None |

| Neon | 0.00 % | - | None |

| Yuh Bank | 0.00 % | - | None |

| Zak | 0.05 % | Up to CHF 25,000 | None |

Therefore, Yuh offers a better interest rate than Neon.

1 point for Yuh

Yuh vs Neon – Trading and investment

Yuh was the first Swiss neobank to offer a trading account, allowing you to invest in over 300 stocks, 58 ETFs, trading themes, and 32+ cryptocurrencies such as Bitcoin.

Neon also allows you to use its app for trading and enables you to invest in more than 240 stocks and 70 ETFs as well. Read here our review of Neon Invest.

| Trading | Yuh | Neon |

|---|---|---|

| Custody fee | ✅ | ✅ |

| Trading of Swiss Stocks | 0.50% | 0.50% |

| Trading of Swiss ETF | 0.50% | 0.50% |

| Trading of Foreign Stocks | 0.50% | 1.00% |

| Trading of Foreign ETF | 0.50% | 1.00% |

| Trading of Themes | 0.50% | ❌ |

| Trading of crypto-currencies | 1.00% | ❌ |

Yuh and Neon therefore compete with Alpian and Revolut, but with different prices that we will be able to compare in a future article.

Since Neon’s fee are higher than Yuh’s, the point is for Yuh.

1 point for Yuh

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Yuh vs Neon – TWINT

| Neon | Yuh | |

|---|---|---|

| TWINT | ✅ UBS or TWINT Prepaid | ✅ Yuh TWINT |

Unlike Yuh TWINT, Neon does not offer a dedicated TWINT application but asks you to use the TWINT application from UBS or TWINT Prepaid, which is less practical.

1 point for Yuh

Yuh vs Neon – SPACES

SPACES is a feature originally launched by N26: it’s similar to a shared sub-account at N26, but Yuh Bank and Neon are not yet on the same level.

Called SPACES at Neon and SAVE at Yuh, this feature is similar to a piggy bank without the possibility of sharing with other users, unlike Zak for example:

- SPACES is a personal piggy bank

- SPACES cannot be shared

- SPACES does not have a dedicated IBAN (option offered by Bunq.com)

We remain on our hunger as well at Yuh as at Neon. If you need this feature, check out Zak.

1 point each

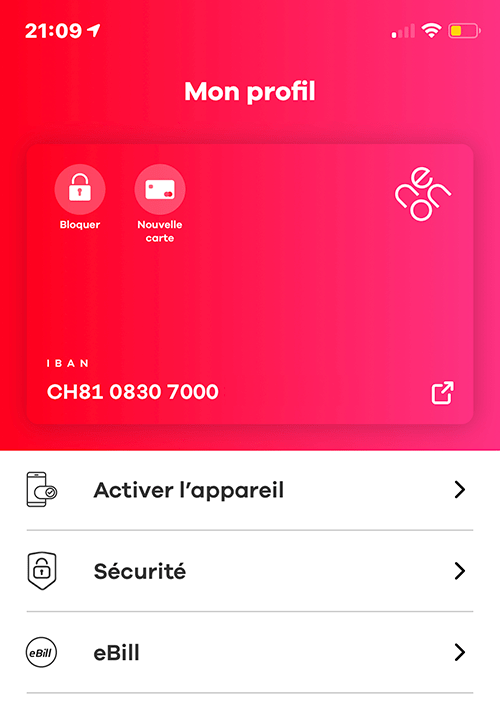

Yuh vs Neon – Which app is more ergonomic?

Discussing usability can be very subjective, but it comes down to which app is more intuitive and easier to use, for example:

- How many clicks to access an important function?

- How many clicks to complete a transaction?

- Does the app crash often?

- Is the app fast?

Without going into a detailed ergonomic analysis (this is not the purpose of this article), the Yuh app and the Neon app are both modern, well-designed, and intuitive to use, each with its own strengths:

The designs of both apps are inspired by references like N26 and Revolut, but they show notable differences:

With Yuh:

- The app is smooth and fast, offering an enjoyable navigation experience.

- The ability to adjust the monthly card limit is very practical.

- Most features, such as investment tracking, are well integrated.

With Neon:

- The app is clear and simple to use, with a minimalist approach.

- It ensures quick access to all essential functions.

- Access to Neon Invest is well integrated, making investments easy directly from the app.

Both apps offer excellent ergonomics and well-thought-out features. It is difficult to decide between them on this point.

1 point each

Yuh vs Neon – Swissqoins Loyalty Program (SWQ)

While Neon doesn’t offer a loyalty program yet (except for a carbon offset with Neon Green), Yuh offers a loyalty program that pays you in Swissqoins (SWQ): the crypto-currency created by Yuh.

At the launch of the program the rate was 1 Swissqoin = 0.01 CHF, so 500 SWQ = 4 CHF, today we are rather on 1 Swissqoin = 0.015 CHF, that is to say an increase of 50% in 2 years.

Yuh pays you on the following operations:

- Single deposit of 500 CHF at the opening of the account = 250 SWQ

- Each trade with Yuh = 10 SWQ

- Each payment with Yuh Mastercard = 2 SWQ

1 point for Yuh

Yuh vs Neon – Banking Licenses

Although Neon partners with a Swiss bank (Hypothekarbank Lenzburg) and Yuh was founded by Swissquote and PostFinance, neither holds its own banking license. Neon relies on the license of Hypothekarbank Lenzburg, while Yuh operates under the banking license of Swissquote Bank SA, of which it is now a 100% subsidiary.

In both cases your deposits are protected up to 100,000 CHF.

1 point each

Yuh vs Neon – Customers ratings and reviews

Yuh is rated 4.7 in the App Store (7.4k reviews) and Neon is rated 4.6 in the App Store (4.5k reviews) , it means that customers are quite happy with both neobanks.

1 point each

Yuh vs Neon – Which neobank is the best one

If we consider all of these criteria:

- Yuh Bank gets 10 points

- Neon Bank gets 7 points

Yuh therefore clearly has the advantage, but Neon remains an excellent neo-bank.

- if you want an account in EUR or USD, choose Yuh

- if you make withdrawals once a week, choose Yuh

- if you want an account that offers a Mastercard and a trading account, choose Yuh

Otherwise, do not hesitate to test the 2 because these neobanks are free and are complementary:

Questions fréquentes (FAQ) sur Yuh vs Neon

✅ Quelles sont les principales différences entre Yuh et Neon ?

Yuh propose une plateforme intégrée pour la gestion des comptes, l’investissement en actions, cryptomonnaies et ETF. Neon se concentre sur la simplicité bancaire avec des frais attractifs et propose un service d’investissement appelé Neon Invest.

✅ Les comptes Yuh et Neon sont-ils gratuits ?

Oui, les comptes Yuh et Neon sont gratuits.

Yuh et Neon offrent toutes deux des cartes Mastercard gratuites. Toutefois Neon applique des frais de livraison de 10 CHF pour la carte.

✅ Quelles options d'investissement sont disponibles avec Yuh et Neon ?

Yuh permet d’investir dans des actions, ETF et cryptomonnaies. Neon propose Neon Invest, permettant d’investir dans des actions et ETF, avec des frais compétitifs.

✅ Quelle est la sécurité chez Yuh et Neon ?

Yuh utilise la licence bancaire de PostFinance et Neon celle de la Banque Hypothécaire de Lenzbourg. Les fonds sont protégés jusqu’à CHF 100,000 pour les deux.

✅ Yuh et Neon proposent-ils des intérêts sur les comptes privés ou d'épargne ?

Yuh propose des intérêts sur le solde des comptes privés. Neon, quant à lui, offre des intérêts sur les dépôts effectués dans les Spaces, mais pas sur les comptes privés standard.

✅ Est-il possible d'ouvrir un compte pour enfant chez Yuh et Neon ?

Yuh ne propose pas encore de compte pour enfant. En revanche, Neon permet l’ouverture d’un compte à partir de 15 ans, sous certaines conditions.