If you compare Neon with Revolut, you are probably looking for a bank account for travel and for your transactions abroad.

It is indeed very interesting to consider these neobanks compared to traditional banks such as UBS or Credit Suisse because they generally offer better exchange rates with very little transaction fees.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon vs Revolut Switzerland – Which bank account is the best?

If you’re looking to optimize your financial management in Switzerland, Revolut and Neon are two neobanks worth considering, each offering distinct advantages.

Revolut, a popular UK-based neobank, offers five account types, allowing you to manage multiple currencies, make international payments, and invest in stocks. It also lets you consolidate all your bank accounts in one place and organize your finances with sub-accounts in CHF and 29 other currencies. However, Revolut accounts are in EUR, which is ideal if you need an account in EUR.

On the other hand, Neon provides a Swiss IBAN account in CHF only, with the ability to make international transfers through their partnership with Wise. Neon offers easy bill payments, transfers in over 40 currencies, and access to practical insurance options. What sets Neon apart is its clear pricing, low fees, and the option to invest cost-effectively in ETFs. You can also create “Spaces” to better organize your savings.

These two neobanks offer distinct solutions depending on whether you seek flexible international management or a simple, local approach.

Don’t have time to read the entire article? Here’s which neobank to choose based on your usage:

| Neon | Revolut | |

|---|---|---|

| Overall rating | 8.4/10 | 7.7/10 |

| Free Swiss bank account | 👍 | |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 withdrawals above 300 CHF | 👍 up to 300 CHF/m. |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 |

To find out how each criterion is judged, read on: we review important options for Switzerland (IBAN CH, transfers in CHF, TWINT) and abroad (withdrawals with the card, SEPA transfer fees, transfers in designs).

Neon vs Revolut Switzerland – Coupon Code

By opening an account with Neon you receive a welcome cash gift on your account, which is always appreciated.

Use the promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌 with Neon Bank. Get the Neon app ➡️On the other hand at Revolut, you get zero, zip, nada, zilch!

1 point for Neon

Neon vs Revolut Switzerland – Account plans & fees

With both Neon and Revolut, you get a free bank account and a free debit card.

Here is the list of accounts offered by Neon and Revolut:

| Account | Monthly fees |

|---|---|

| Revolut Standard | 0 CHF |

| Revolut Premium | 10.99 CHF |

| Revolut Metal | 18,99 CHF |

| Revolut Ultra | 60 CHF |

| Neon Free | 0 CHF |

| Neon Plus | 2 CHF |

| Neon Global | 8 CHF |

| Neon Metal | 15 CHF |

Now let’s compare the features available in Neon and Revolut:

| Features | Neon | Revolut |

|---|---|---|

| Personal IBAN CH | ✅ | ❌ |

| CHF Bank Account | ✅ | ✅ |

| Default currency | CHF | CHF |

| Available currencies | CHF | AED, AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HRK, HUF, ILS, ISK, JPY, MAD, MXN, NOK, NZD, PLN, QAR, RON, RSD, SAR, SEK, SGD, THB, TRY, USD, ZAR |

| Debit card | ✅ MasterCard | ✅ MasterCard or Visa |

| TWINT | ✅ | ❌ |

| eBill | ✅ | ❌ |

| QR code and BVR payments | ✅ | ❌ |

| Apple Pay & Google Pay | ✅ | ✅ |

| Trading shares | ❌ | ✅ |

| Trading ETF, Themes | ❌ | ❌ |

| Trading Crypto-currencies (Bitcoin,...) | ❌ | ✅ |

Neon therefore has a better offer in a Swiss context : IBAN CH, payments by QR and BVR, eBill and TWINT.

Revolut offers more currencies and – as we will see – also offers better prices for transactions abroad: Revolut is often cheaper than Neon by 0.50% to 1% on currency exchange.

1 point for Neon

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Neon vs Revolut Switzerland – IBAN CH

As a neo-Swiss bank, Neon allows you to obtain a free bank account with personal IBAN CH.

On the other hand Revolut is a neobank based in the United Kingdom and with a banking license in Lithuania (LT).

At Revolut, as a Swiss resident you can get a free account with 2 IBANs: an IBAN LT and an IBAN CH, but the problem is that the IBAN CH is not a Personal IBAN: it is not in your personal name but in that of Revolut, which does not allow you to use it in all situations.

1 point for Neon

Neon vs Revolut Switzerland – Debit card & fees

When choosing the ideal card for your payments in Switzerland and abroad, it is essential to understand the offers and fees of each option.

Neon offers a free Mastercard debit card linked to your CHF account. If you use it in another currency, a 1.5% fee applies with the neon free plan. In Switzerland, ATM withdrawals cost CHF 2.50 from the very first withdrawal (except via Sonect, which remains free). Abroad, fees are also 1.5%, plus a 0.35% currency exchange fee. Paid Neon plans reduce or eliminate these fees.

Revolut, on the other hand, provides a multi-currency card that automatically selects the appropriate currency based on your balance. However, be aware of weekend exchange rate surcharges, which can increase the cost of withdrawals and payments.

Both providers integrate with Apple Pay and Google Pay, and Neon also supports mobile payments with Swatch, Garmin, and Samsung, ensuring convenient and secure payments wherever you are.

The card usage fees differ between Neon and Revolut.

| Debit card | Neon | Revolut |

|---|---|---|

| Free Debit card | ❌ 20 CHF for delivery | ❌ 5.99 CHF delivery fee |

| Free CHF Withdrawals | ❌ CHF 2.50 with Neon free ✅ 2–5 free/month depending on plan ✅ Free with Sonect | ✅ 200 CHF/mo., 5 max., then 2% |

| Free Withdrawals abroad | ❌ 1.5% + 0.35% with Neon free ✅ Reduced or free with paid plans | ✅ 200 CHF/mo., 5 max., then 2% |

For withdrawals in Switzerland the Neon card is therefore much more advantageous than the Revolut card because the limit is much higher: up to 1’000 CHF/day and 10’000 CHF/month.

For withdrawals abroad you must use the Revolut card up to 200 CHF/EUR then ut compare because the exchange commissions and fees are different: Neon applies 1.50% exchange commission and Revolut applies a surcharge of 0.50% during the week.

Let’s take the example of a 1,000 EUR withdrawal in 5 installments, during the week:

| Multiple withdrawals | Neon | Revolut |

|---|---|---|

| (1.50% + 0.35%) | (200 CHF max. up to 5, then 2%+0.50%) | |

| 1st withdrawal of 200 EUR | 3.70 CHF | 0.00 CHF |

| 2nd withdrawal of 200 EUR | 3.70 CHF | 5.00 CHF |

| 3rd withdrawal of200 EUR | 3.70 CHF | 5.00 CHF |

| 4th withdrawal of 200 EUR | 3.70 CHF | 5.00 CHF |

| 5th withdrawal of 200 EUR | 3.70 CHF | 5.00 CHF |

| TOTAL | 18.50 CHF | 20.00 CHF |

For multiple withdrawals, Neon becomes cheaper than Revolut starting from 800 EUR in total withdrawals.

Another example with 1 single withdrawal:

| Single withdrawal | Neon | Revolut |

|---|---|---|

| (1.50% + 0.35%) | (2% above 200 CHF) | |

| 100 EUR | 1.85 CHF | 0.00 CHF |

| 200 EUR | 3.70 CHF | 0.00 CHF |

| 300 EUR | 5.55 CHF | 7.50 CHF |

| 400 EUR | 7.40 CHF | 10.00 CHF |

| 500 EUR | 9.25 CHF | 12.50 CHF |

| 600 EUR | 11.10 CHF | 15.00 CHF |

| 700 EUR | 12.95 CHF | 17.50 CHF |

| 800 EUR | 14.80 CHF | 20.00 CHF |

| 900 EUR | 16.65 CHF | 22.50 CHF |

| 1000 EUR | 18.50 CHF | 25.00 CHF |

For one-time withdrawals, Neon becomes cheaper than Revolut from 300 EUR..

1 dot everywhere

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon vs Revolut Switzerland – Payments and transfer fees

Neon and Revolut offer the ability to transfer money at low costs, both within Switzerland and internationally. Compared to traditional Swiss banks, these two neobanks stand out with their attractive fees. International transfers via Neon are particularly advantageous due to their partnership with Wise.

| Pricing | Neon | Revolut |

|---|---|---|

| No monthly fee | ✅ | ✅ |

| Free transfers in CHF in Switzerland | ✅ | ✅ |

| Free SEPA transfers in EUR | ❌ 0.9% | ✅ |

| Free transfers in Switzerland | ✅ in CHF | ✅ in CHF and EUR |

| Incoming transfers | ✅ | ✅ |

| Exchange fee in EUR | ❌ 0.9% | ✅ 0% up to 1000 CHF/mo,, Monday to Friday, then 0.50% |

| International tranfers fee | ❌ 0.8 to 1.7% | ❌ 0% in SEPA zone, >0.30% outside SEPA |

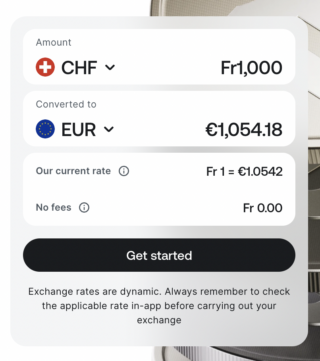

Revolut also allows you to make SEPA transfers in EUR free of charge. On the other hand, Neon applies 1.50% on the EUR. However, be aware that Revolut applies a surcharge of approximately 0.50% outside of trading hours.

You can check the ‘Revolut exchange rate’ on their currency converter page.

For international transfers, Revolut publishes in this document the fees for international transfers. The fees are different if the beneficiary’s currency is that of his country or not.

For comparison, here are the fees for international transfers:

| International transfer | Neon | Revolut (Same as local currency) | Revolut (Different than local currency) |

|---|---|---|---|

| CHF | 0.00% | 0.00% | 0.30%, min. 4 CHF |

| EUR | 0.9% | 0.00% | 0.00% in SEPA, otherwise 0.30%, min. 4 CHF |

| USD | 0.8 à 1.7% | 0.30%, min. 0.50 CHF | 0.30%, min. 4 CHF |

| GBP | 0.8 à 1.7% | 0.30%, min. 0.50 CHF | 0.30%, min. 4 CHF |

| AED | 0.8 à 1.7% | 0.75%, min. 1.25 CHF | 0.75%, min. 6 CHF |

| AUD | 0.8 à 1.7% | 0.30%, min. 0.50 CHF | 0.30%, min. 6 CHF |

| CAD | 0.8 à 1.7% | 0.30%, min. 0.50 CHF | 0.30%, min. 6 CHF |

| DKK | 0.8 à 1.7% | 0.30%, min. 0.50 CHF | 0.30%, min. 6 CHF |

| HKD | 0.8 à 1.7% | 0.35%, min. 0.75 CHF | 0.35%, min. 6 CHF |

| JPY | 0.8 à 1.7% | 0.40%, min. 1.25 CHF | 0.40%, min. 6 CHF |

| NOK | 0.8 à 1.7% | 0.30%, min. 0..50 CHF | 0.30%, min. 6 CHF |

| SEK | 0.8 à 1.7% | 0.30%, min. 0..50 CHF | 0.30%, min. 6 CHF |

| SGD | 0.8 à 1.7% | 0.30%, min. 0..50 CHF | 0.30%, min. 6 CHF |

For EUR in the SEPA zone, you must use Revolut which does not apply fees.

For USD and GBP, Neon will be cheaper than Revolut by up to around CHF 400, due to fixed Revolut fee of CHF 4

For all other currencies, Neon will be cheaper than Revolut by up to around CHF 600, due to Revolut’s flat fee of CHF 6

But to find out which is the cheapest between Neon and Revolut, you have to compare all the costs:

Example 1: Transfer of 5,000 EUR in Switzerland, from your CHF account

As Switzerland is part of the SEPA system, Revolut does not charge any transfer fees on payments in EUR in Switzerland . These fees will be the same for a payment in EUR in France or in a SEPA country in euros.

| 5'000 EUR | Neon | Revolut |

|---|---|---|

| Total in CHF | 4,913.40 CHF | 4,888.34 CHF |

| Exchange fee | 23.96 CHF | 18.69 CHF |

| Transfer fee | 19.66 CHF | 0.00 CHF |

| TOTAL | 43.62 CHF | 18.69 CHF |

Example 2: Transfer of 10,000 USD in Switzerland, from your CHF account

| 10'000 USD | Neon | Revolut |

|---|---|---|

| Total in CHF | 9,917,10 CHF | 9,871.82 CHF |

| Exchange fee | 88.49 CHF | 42.87 CHF |

| Transfer fee | 0.00 CHF | 4.00 CHF |

| TOTAL | 88.49 CHF | 46.87 CHF |

Example 3: Transfer of 5,000 USD to the United States, from your CHF account

| 5'000 USD | Neon | Revolut |

|---|---|---|

| Total in CHF | 4,958.42 CHF | 4,947.54 CHF |

| Exchange fee | 44.57 CHF | 18.32 CHF |

| Transfer fee | 0.00 CHF | 14.74 CHF |

| TOTAL | 44.57 CHF | 33.06 CHF |

(*) Tests carried out during the week

Revolut is therefore cheaper than Neon for exchanges and transfers in foreign currencies.If the issue of changing CHF to EUR is important to you, see our article How to Change Swiss Francs in Euros at the Best Rate.

1 point for Revolut

Neon vs Revolut Switzerland – TWINT

Neon allows you to use the TWINT app from UBS or TWINT Prepaid

Revolut does not offer and will probably never offer TWINT because it is a product only available in Switzerland.

1 point for Neon

Revolut Switzerland – Trading

Both Revolut and Neon allow you to trade.

Neon remains cheaper than Revolut on Stock Trading. Revolut allows cryptocurrency trading, which Neon does not.

It should also be taken into account that Neon can easily edit a tax statement for your tax return, which will not be the case with Revolut.

| Trading | Neon | Revolut |

|---|---|---|

| Custody fee | ✅ | ❌ 0.01% |

| Trading of Swiss Stocks | 0.50% | 1.50% |

| Trading of Swiss ETF | 0.50% | ❌ Not available |

| Trading of Foreign Stocks | 1.00% | 1.50% |

| Trading of Foreign ETF | 1.00% | ❌ Not available |

| Trading of Themes | ❌ Not available | ❌ Not available |

| Trading of crypto-currencies | ❌ Not available | 2.50% |

If you are looking for a neobank to do Trading, see our Alpian review which offers lower rates than Neon and Revolut.

1 point for Neon

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Which account is better for Swiss people: Neon or Revolut?

The choice between Neon and Revolut depends on your specific needs. Revolut offers a wide range of features, such as cryptocurrency purchases and multi-currency management, but does not include a CH IBAN.

Neon, on the other hand, provides a CH IBAN, eBill, QR invoices, and soon TWINT, with lower fees, particularly for international transfers via Wise.

In summary, Revolut is ideal for those seeking diverse investment opportunities, while Neon is better suited for local banking in CHF. Both platforms complement each other, so opening a free account with each neobank is recommended to maximize benefits and have a backup option.

Compare Neon and Revolut with other Swiss neobanks

If you are still hesitant, you can read our other comparisons:

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️