| Account opening | 9 |

|---|---|

| Usability | 9 |

| Features | 6 |

| Credit Card | 9 |

| Fees | 7 |

| Security | 9 |

| Customer Service | 9 |

Our Alpian review shows that it is well suited for users who want to go beyond a simple bank account and adopt a more structured approach to wealth management — but it may not be suitable for everyone.

In this article, we share our hands-on experience, analyse fees, features and investment options, and explain for which profiles Alpian is — or is not — a good fit, particularly compared with alternatives such as Neon or Yuh.

🎁 Use the promo code ALPNEO before March 31, 2026 to receive CHF 120 when opening an Alpian account (CHF 55 with a CHF 500 deposit, then up to CHF 65 in investment fee credits).

⭐ Our rating: 8.3/10 (Very good)

Description

📝 Editor’s note: I personally use Alpian to manage part of my investments, which gives me a concrete view of its approach and overall user experience.

Alpian: What You Need to Know in March 2026

Alpian is a Swiss digital private bank designed for users looking for a premium banking experience combined with investment support, rather than a simple account for everyday spending.

✅ Clear and structured approach to wealth management

✅ Refined banking experience, with eBill, payments and a smooth interface

✅ Transparent pricing aligned with a digital private bank

❌ Less suitable for everyday banking use

❌ Higher fees than payment-focused neobanks

📌 Our view: If you are looking for a private banking–style experience with personalised service and investment support, Alpian can be a good fit for you, even without a large amount of assets. However, for day-to-day banking focused mainly on payments, solutions such as Yuh or Neon are generally more suitable.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Alpian Quick Facts in March 2026

| Alpian Data | Details |

|---|---|

| License | Swiss Bank (FINMA) |

| Founded in | 2019 |

| Headquarters | Geneva, Switzerland |

| Available Currencies | CHF, EUR, USD, GBP |

| Card | Visa Debit in metal |

| Monthly Fees | Free |

| Interest Rates | 0% on CHF. 0.75% between EUR 10'000 and EUR 500'000 |

| Investment Options | ETFs. Personalized management by Alpian experts |

| Customer Support | Chat, email, phone |

| Languages | English, French, German, Italian |

| App | iOS and Android |

| Overall Rating | 8.3/10 |

Table of contents

Alpian Bank Overview

Alpian is a Swiss digital private bank designed for people who want to combine everyday banking with long-term investment management. Unlike mass-market neobanks that mainly focus on payments, Alpian targets users looking for a more structured and investment-oriented approach to managing their finances.

In practice, Alpian is best suited for users who want to go beyond basic daily banking and take a more structured approach to managing their wealth.

Founded in 2019 and launched to the public in 2022, Alpian is regulated by FINMA and operates on a solid Swiss banking infrastructure. Backed by Fideuram, a private banking subsidiary of the Intesa Sanpaolo Group, the bank benefits from strong financial expertise and long-term stability.

Alpian offers a multi-currency account supporting CHF, EUR, GBP and USD, combined with integrated investment solutions based on ETFs. This allows users to manage both cash and investments in one place, with transparent pricing and a long-term investment approach.

Account opening is fully digital and usually takes less than 8 minutes directly through the Alpian app.

⭐ Alpian Pros: What we like about Alpian

🏦 A clear positioning between digital banking and wealth management

Alpian goes beyond providing a simple bank account. Its offering includes a wealth-oriented approach, with investment solutions and structured advisory services, clearly differentiating it from volume-driven neobanks.

🛡️ A regulated Swiss banking infrastructure

FINMA supervision and the Swiss regulatory framework enhance Alpian’s credibility and security, especially for users who value compliance and asset protection.

💱 A true multi-currency account

Managing multiple currencies simultaneously (CHF, EUR, GBP, USD) allows Alpian to cover both local and international banking needs without relying on multiple external accounts.

📊 An integrated investment offering

Investment solutions are based on ETF portfolios accessible directly from the banking app. This integration simplifies overall financial management without the need for a third-party platform.

📱 A fully digital and consistent experience

From account opening to day-to-day management, the entire journey is digital, with an interface designed to remain clear and structured despite a more advanced offering than most traditional neobanks.

⚠️ Alpian Cons: What Alpian could improve

💸 Fees related to investment services

While opening and maintaining a bank account is free, fees apply as soon as investment and wealth management services are used. This model is consistent with Alpian’s positioning but may be less attractive for users who want to invest fully independently at very low cost.

🧾 An offer not well suited to purely basic banking needs

For users whose needs are limited to payments, cash withdrawals and CHF transfers, Alpian can be considered over-engineered. Simpler, current-account-focused neobanks are often better suited to these basic use cases.

🧭 A premium positioning that complicates comparisons

Alpian’s hybrid model makes direct comparisons with mass-market neobanks less straightforward. The offering only fully makes sense if one uses both the banking and the investment components.

Alpian Bank Accounts and Pricing

Alpian offers 2 types of banking plans designed for users who want to combine everyday banking with long-term investment management:

- Alpian Standard: a free bank account with access to investment solutions and multi-currency support.

- Alpian Signature: a premium plan offering lower investment fees, a metal debit card and additional benefits.

Each Alpian account comes with the following features:

- 100% account management via the iOS and Android app

- Multi-currency bank account (CHF, EUR, USD, GBP)

- Unlimited virtual cards

- Optional Metal Visa Debit card (included with Signature, CHF 60 with Standard)

- Access to investment solutions, including guided and managed portfolios

Below, we break down Alpian’s account plans, pricing structure and key features in detail.

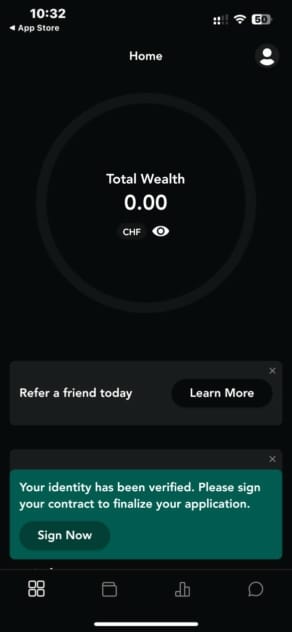

Alpian Bank Account Opening Review: 9/10

Opening an Alpian account is simple and convenient. The process is fully digital, ensuring a seamless experience for users:

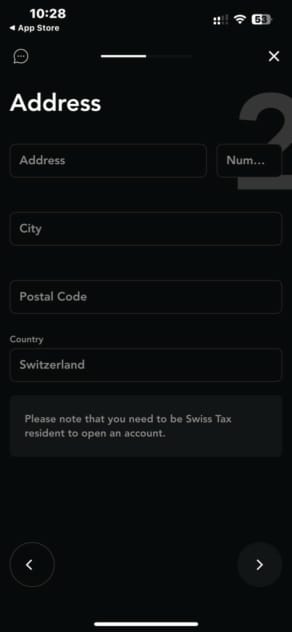

Conditions for Opening a Bank Account with Alpian

- Be at least 18 years old (15 years old at Zak)

- Residing in Switzerland

- Have a smartphone compatible with the app

- No proof of income to provide

- No minimum balance to maintain, but fees apply

You can absolutely use Alpian to receive your salaries and make bank transfers in Switzerland or abroad. As a licensed Swiss bank, Alpian guarantees the security of CHF deposits up to 100,000 CHF, in accordance with strict FINMA regulations and by keeping them at the Swiss National Bank. Alpian offers various bank accounts, providing affordable alternatives for managing your funds and investments.

How to Open Your Bank Account With Alpian

Opening an account with Alpian begins in the app:

- Download the Alpian app from the App Store or Google Play or scan this QR code with your smartphone:

- Answer the questions

- Provide personal information, including your address and identification (ID card or passport)

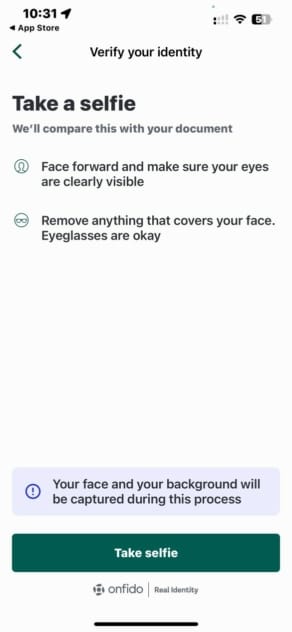

- Verify your identity though the App

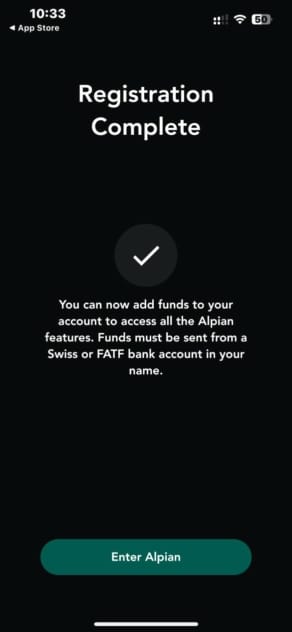

- It’s done! Your account is open 🙌

It takes only 8 minutes to open an Alpian account, making the process fast and user-friendly.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

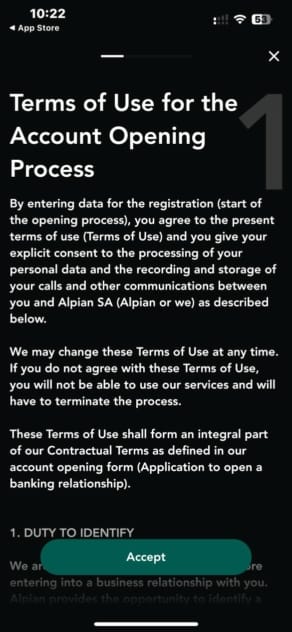

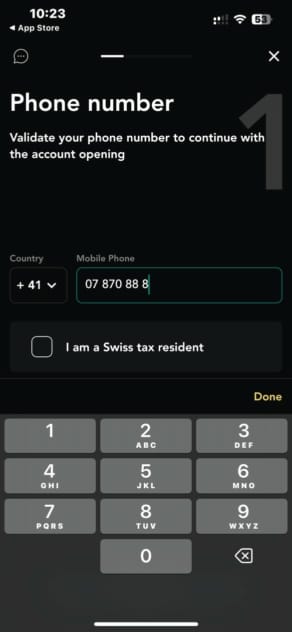

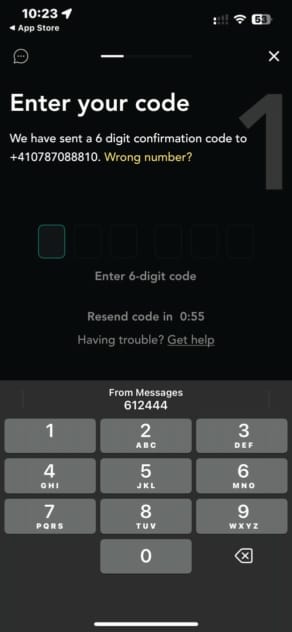

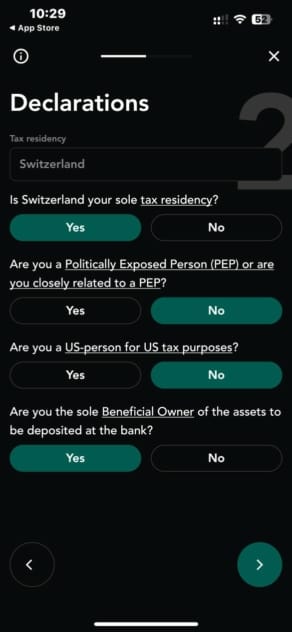

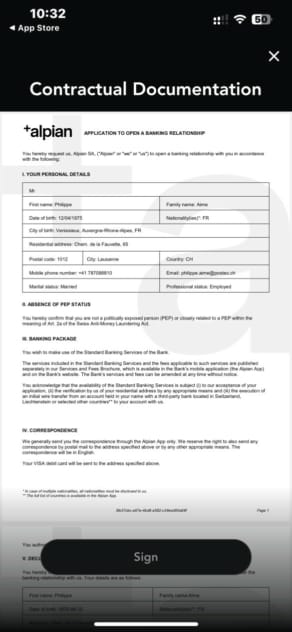

Steps for Opening a Bank Account with Alpian

The application is available in French 🇫🇷 German 🇩🇪 Italian 🇮🇹 and English 🇬🇧

#1 You accept the account opening conditions

#2 You enter your phone number then the SMS code

#3 You create a 4-digit password and activate biometric authentication

#4 You agree – or not – to receive notifications from Alpian (recommended)

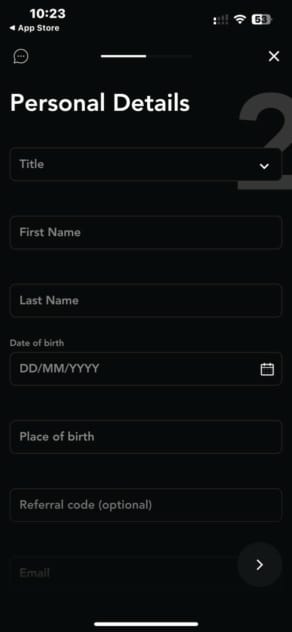

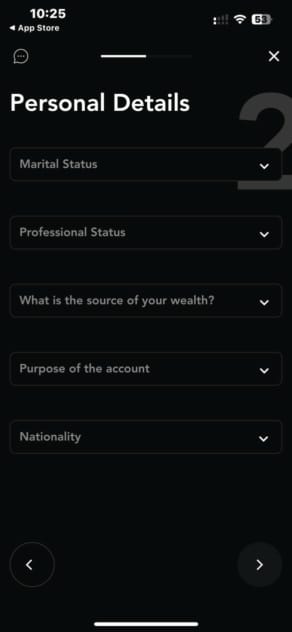

#5 You enter your personal information and your address

Remember to enter the code ALPNEO in Referral code (referral code) to receive 120 CHF in your account.

#6 You complete the source of funds and tax declarations

#7 You verify your identity with your identity card or passport

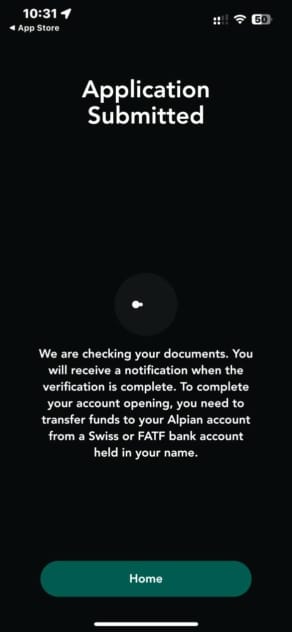

#8 A confirmation message is displayed and you can already access your Alpian account.

#9 As soon as your identity is verified (less than a minute), you can finalize access to your account by accepting the user agreement

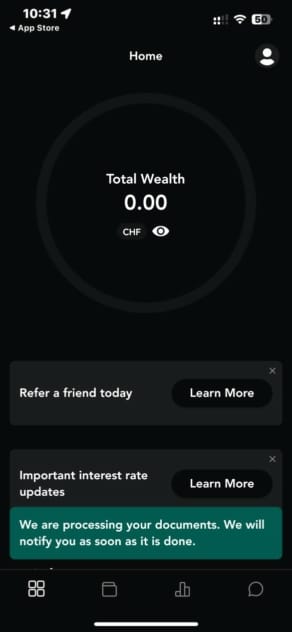

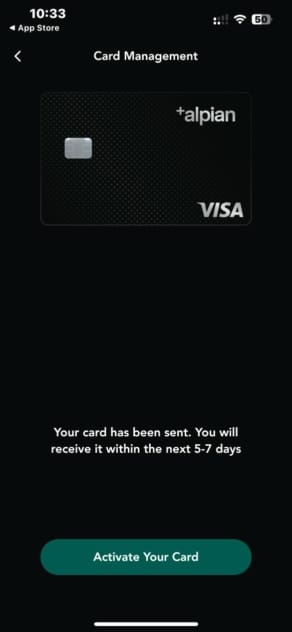

It’s done, your account is open and a message displays that you will receive your Alpian debit card within 5 to 7 days

Now make a transfer of 500 CHF or more to validate your referral code ALPNEO and get 120 CHF as a gift from Alpian (55 CHF with a deposit of 500 CHF, then 65 CHF when you invest).

Beyond the services of a private bank, the Alpian account allows you to carry out all classic operations (transfers, direct debits, etc.) like any Swiss bank account.

Our Experience Opening an Alpian Bank Account

- Very quick opening in 8 minutes

- No income requirement

- Swiss Banking License

- Multi-currency account in CHF, EUR, USD and GBP

- Contract acceptance in PDF format is not ideal.

We appreciate the quick and easy account opening. Alpian integrates everyday banking features into its digital platform, creating a seamless experience that caters to both regular banking needs and the investment aspirations of affluent clients.

Alpian account opening process gets a rating of 9/10Alpian App Features Review: 6/10

Alpian Features List

As a neobank, Alpian’s app integrates most services, from regular banking transactions to investment management. The app is also home to Alpian’s wealth managers, providing clients with personalized financial guidance.

Key features include:

- Managing banking transactions

- Execute transfers or standing orders

- Paying wit eBill

- Paying with TWINT Prepaid

- Using a Virtual card (like Yuh, N26 or Revolut)

- Scan invoices with the QR code

- Block and replace debit card

- Update your phone number and personal information

- Exchange currencies

- Invest in ETFs with Guided by Alpian et Managed by Alpian

- Access to private investment advisors

However, here is what is missing:

- No dedicated TWINT application (like Yuh TWINT)

- No instant payment features like Beam with N26 or Pay a Friend with Yuh

- Lack of card PIN customization options in the app, you have to go to an ATM.

- No sub-account features with individual IBANs (Spaces)

- No adjustment of VISA card limits, beyond the max. monthly

The function for scanning QR codes or invoices in Swiss format is very practical. A real plus compared to Revolut.

Alpian Interest Rates: Private Account and Savings Account

With Alpian, interest depends on the product and currency:

- The Savings Account pays interest on CHF balances, credited monthly.

- The Private Account does not pay interest on CHF, but pays interest on EUR and USD deposits above specific thresholds (tiered).

Other Swiss neobanks such as Yuh and Zak also offer interest-bearing solutions. Alpian’s approach is split between a CHF savings product and foreign-currency interest tiers on the private account.

The Alpian Savings Account: Flexible Access (CHF) + Monthly Interest

The Alpian savings account is fully accessible: you can deposit and withdraw funds anytime, with no notice period and no fees. Interest is credited monthly.

Savings Account (CHF) – Base interest rates

| Balance | Base Interest Rate |

|---|---|

| Up to 125,000 CHF | 0.01% p.a. |

| Above 125,000 CHF | 0.10% p.a. |

Base rates may be adjusted at Alpian’s discretion (e.g., following SNB decisions).

Note about the former “Booster” (historical): Alpian also communicated a one-off booster bonus tied to the balance as of March 31, 2025, paid on January 2, 2026, subject to a withdrawal condition. Since that date is now past, it should not be presented as an ongoing “limited-time offer up to 1%”.

The Alpian Private Account: Interest on EUR, USD & GBP (not CHF)

The Alpian Private Account offers interest on selected foreign currency balances held in EUR and USD, while CHF and GBP balances do not generate interest.

| Currency | Interest rate | Conditions |

|---|---|---|

| CHF | 0% | (all balances) |

| EUR | 0.75% | 0% on first EUR 10,000; 0.75% on the portion between EUR 10,000 and EUR 500,000; 0% above EUR 500,000 |

| USD | 1.00% | 0% on first USD 10,000; 1.00% on the portion between USD 10,000 and USD 500,000; 0% above USD 500,000 |

| GBP | 0% | (all balances) |

Interest is calculated daily and credited monthly to your account, allowing you to grow your foreign currency holdings passively over time.

If you wish to hold savings in multiple currencies, you can benefit from interest on EUR and USD deposits held on your Private Account above the applicable thresholds.

Why Choose the Alpian Savings Account?

If you want to optimize your returns while maintaining full access to your funds, the Alpian savings account allows you to deposit and withdraw money at any time without notice or fees. Interest is credited monthly on CHF balances.

There is no withdrawal restriction, and funds remain fully accessible while continuing to earn interest based on your balance.

Alpian ETF Savings Plan

Alpian now offers an ETF savings plan to help you invest your savings. With Managed by Alpian Essentials you can start investing from as little as 2,000 CHF, a much more accessible threshold than the Guided by Alpian or Managed by Alpian options, which require a minimum of 10,000 CHF.

This savings plan offers 4 options:

- Swiss: Focused on the stability of the Swiss market.

- Global: Capturing global growth.

- Sustainable: Focused on responsible investments.

- Global + Crypto: With exposure to cryptocurrencies.

A savings plan tailored to your risk profile:

You also begin by completing an investor questionnaire to determine your risk profile, and Alpian adjusts your investments to match your financial goals.

Fees and flexibility:

When it comes to fees, it’s straightforward with 0.75% annual fees. All transactions, withdrawals, and deposits are included, and you have full access to your funds at any time.

Alpian Pillar 3a Account

Alpian now offers a Pillar 3a account directly through its app, allowing you to save for your retirement in a simple and transparent way. This pension plan is fully invested in BlackRock funds, with management tailored to your investment profile.

Currently, Alpian offers 0% management fees until December 31, 2026, an exclusive offer limited to the first 1,000 clients. This allows you to maximize your returns while taking full advantage of the tax benefits of Pillar 3a — up to CHF 7,258 in tax deductions on your taxable income.

Opening your account takes just a few seconds in the Alpian app — no paperwork, no appointments. If you already have a 3a account with another bank, you can still open one with Alpian to diversify your savings and benefit from better conditions.

Investing with Alpian

You have two options to invest with Alpian : Guided by Alpian to receive personalized advice and manage your investments yourself, or Managed by Alpian to entrust the management of your wealth to experts. These options go beyond automated robo-advisor models, blending technology with a human touch.

Access to ETFs and actively managed portfolios is available directly via the app, allowing you to diversify your investments while benefiting from tailored support.

Here are the key details about Alpian’s investment offerings:

| Alpian Key Data | Details |

|---|---|

| Investment Options | ETFs, Actively Managed Portfolios |

| Minimum Investment | CHF 10,000 |

| Account Management | 0.75% per year |

| Trading Fees | Included in the annual fee (advisory and managed portfolios) |

| Stocks | Not available |

| ETFs | 45 ETFs |

| Cryptocurrencies | Available via ETF (Bitcoin, Solana) |

| Themes | Available via managed portfolios (e.g., sustainability, tech) |

| Investor Protection | Up to CHF 100,000 (Esisuisse, Interactive Brokers) |

For more information, check out our detailed Alpian Investment review as well as the Guided by Alpian ETF list.

Cashback

Alpian now offers a cashback feature included in the Signature plan. You benefit from a 0.10% cashback on your card payments, automatically credited to your account. This applies to everyday spending made with the Alpian card.

The cashback is not available with the Standard plan and is therefore one of the exclusive advantages of the Signature plan. It complements other premium services, such as the Visa Metal card or preferential conditions on selected services.

Compared to other neobanks, Alpian follows a different approach:

- Zak offers cashback via Shopmate, mainly for online purchases from partner merchants.

- Neon, on the other hand, does not offer cashback, but rather occasional discounts through its Benefits section.

👉 Alpian’s cashback stands out for its simplicity: it is applied automatically to your card payments, without any activation or extra steps. A practical option if you regularly use your card and want to get a small return on your spending.

Our View on Alpian App Features

Alpian offers an app with the necessary features to manage your accounts, make QR code payments, and invest via Guided by Alpian or Managed by Alpian. However, services such as full TWINT integration are still missing.

If you are looking for a private neobank with personalized investment options, Alpian remains the best option in Switzerland.

Alpian app features get 6/10Alpian Credit Card Review: 9/10

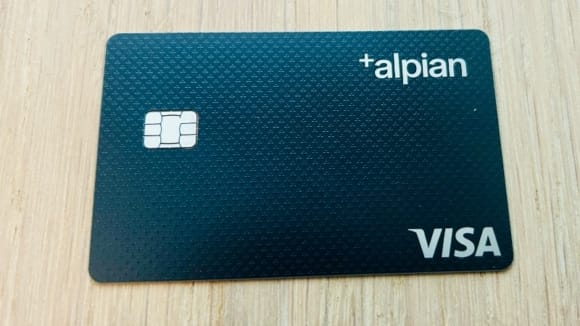

Alpian Metal Visa debit card

Alpian offers a metal Visa debit card. It is black and made of metal, which corresponds to the Premium cards of other digital banks like Neon metal or Revolut metal for example. The card is ideal for travel, compatible with Apple Pay and Google Pay, and supports multi-currency transactions.

Alpian Metal Visa Debit Card

Here is the unboxing of the Alpian VISA card :

Alpian AMEX Card

In addition to the metal VISA debit card, Alpian gives you the option to get an Alpian American Express Card. If you’re interested in this card, you’ll need to apply directly through American Express. It could be a great addition to your Alpian setup, especially if you want to take advantage of AMEX’s global benefits and rewards.

To learn more about the Alpian AMEX, check out our full guide here: Alpian AMEX Card.

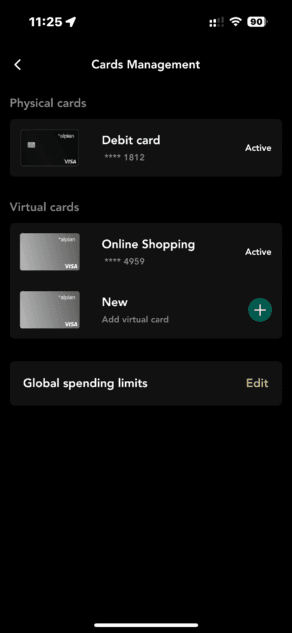

Alpian Virtual card

Additionally, Alpian offers a virtual card for online shopping, making it practical for those seeking extra security while purchasing items online. You can create several and delete them when you no longer need them:

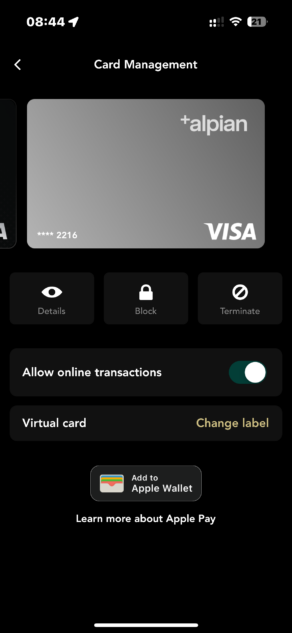

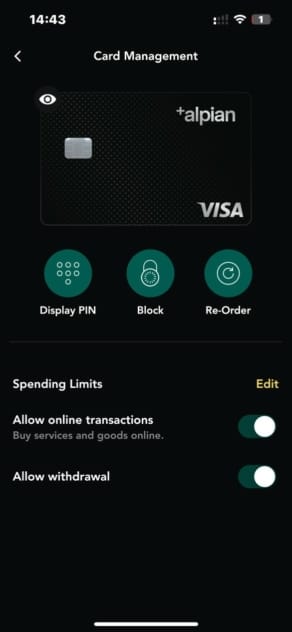

Alpian Card Settings

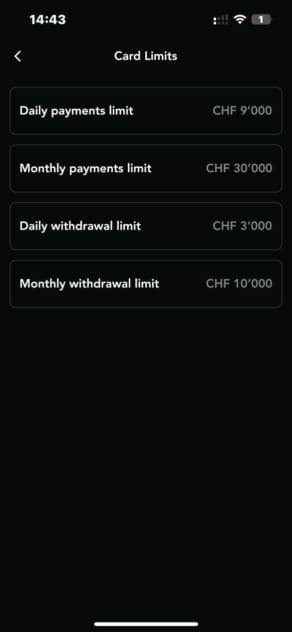

Card settings allow you to view card number, PIN and change spending limits.

Alpian Bank Fees: 7/10

Alpian Account Fees

Alpian being a neobank based in Switzerland, the prices are displayed in CHFAlpian’s pricing is clearly structured and remains competitive, especially for international transfers and currency exchange. Since September 2024, the bank has removed all account maintenance fees, making its standard account completely free.

Compared to traditional banks, which often apply high fees for currency exchange and international services, Alpian offers a more transparent and cost-efficient pricing model.

Alpian Account Plans

Alpian offers 2 account plans: Standard and Signature. Both provide access to the same core banking features, with differences mainly related to investment fees and additional benefits.

Alpian Standard

The Standard account is free and well suited for users who want access to Alpian’s banking and investment services without ongoing account fees.

It includes:

- Free account management

- Multi-currency account (CHF, EUR, USD, GBP)

- Optional Metal Visa Debit card (CHF 60 one-time fee)

- Access to investment solutions (guided and managed portfolios)

- 0.75% investment fees

Alpian Signature

The Signature plan is designed for users seeking lower investment fees and additional benefits.

It includes:

- Free account management

- Multi-currency account (CHF, EUR, USD, GBP)

- A free Metal Visa Debit card

- Access to investment solutions (guided and managed portfolios)

- Reduced investment fees of 0.50%–0.69%

- Additional benefits and premium services

To access the Signature plan, you must either:

- Maintain at least CHF 150,000 in total assets (cash, savings and investments), or

- Set up a recurring investment of at least CHF 1,000 per month

—

Overall, Alpian’s pricing remains competitive for users looking for a structured investment approach combined with everyday banking, even though it may be less attractive for those seeking a basic low-cost account.

Alpian Card Fees

The Alpian Metal Visa Debit Card is available under the following conditions:

- Included (free) with the Signature plan

- Available for CHF 60 as a one-time fee with the Standard plan

- Replacement card (loss or theft): CHF 60

Cash Withdrawals Fees

Cash withdrawals in Switzerland an abroad are subject to fees:

- CHF: 2.00 CHF per withdrawal

- EUR: 5.00 EUR per withdrawal

- Withdrawals Abroad: 2.50% per withdrawal

While the fees are competitive compared to traditional banks, they remain higher than those offered by Yuh or Neon.

International Bank Transfer Fees

- Free SEPA transfers to the EURO zone and Switzerland, otherwise 7.00 CHF per transfer

- Free transfers in CHF, USD and GBP in the country of the currency, otherwise 7.00 CHF per transfer

- Transfers in AUD DKK NOK PLN SEK CAD CZK HRK HUF RON SGD charged 2.00 CHF in the country of the currency, otherwise 7.00 CHF per transfer

- All other currencies are charged 7.00 CHF per transfer

Alpian Exchange Rate

For incoming transfers in currencies other than CHF, EUR, USD, and GBP, Alpian converts the amount to CHF using the interbank exchange rate, applying a markup of 0.20% during weekdays and 0.50% on weekends (from Friday 9:00 PM to Monday 8:00 AM).

For comparison: Yuh charges exchange fees of 0.95%, while Neon applies a fee of 0.9% for a CHF-to-EUR transfer (around 0.5% for Wise and 0.4% for Neon).

Outgoing transfers in the base four currencies (CHF, EUR, USD, and GBP) are free, while other currencies have varying charges based on the currency type.

For card payments in CHF, EUR, USD, and GBP, transactions are free if sufficient funds are available. If not, a currency exchange fee of 0.20% applies (0.50% on weekends). For transactions in other currencies, the VISA exchange rate is used.

Overall, Alpian offers transparent exchange rates for effective currency management.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

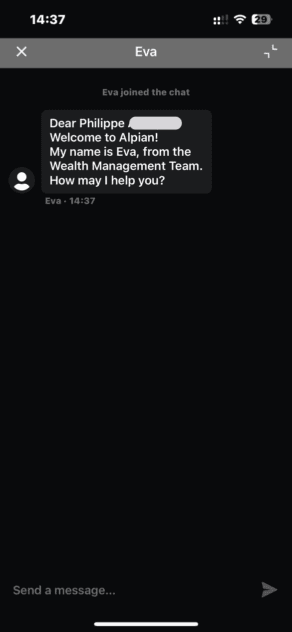

Alpian Customer Service Review: 9/10

Alpian stands out from Neon and Yuh with its private bank-level customer service. Customers have the option to chat directly with an advisor or schedule an appointment with an investment advisor. Unlike other digital banks that rely heavily on bots, Alpian places particular emphasis on personalized customer interactions and individual support.

Customer support offered by chat messaging is very good and the advisors respond quickly. You speak directly to a human and not a Bot or AI like at Revolut and N26.

Unsurprisingly, the fees are higher but the service is as good as you can expect from a private bank.

Customer service receives a rating of 9/10Alpian App User Experience and Customer Reviews: 9/10

Alpian App Customer Ratings

The Alpian app is rated 4.5 stars in the App Store and 4 stars on Google Play These ratings are good and user reviews generally agree on its good usability.

Alpian App Store Reviews

Alpian Google Play Reviews

Alpian App Customer Reviews

We analyzed reviews on platforms like the App Store, and Google Play to better understand what users think about Alpian. The feedback reveals a combination of positive experiences and areas for improvement. Here are the most common points mentioned in their reviews:

- Ease of use and accessibility: Many users, such as Ghislaine Clément and Guy Chevalley, praise the app for being intuitive and user-friendly, making it easy to manage finances effectively.

- Real-time updates: Arnaud LEVEQUE highlights the value of real-time balance updates, which users find essential for managing their accounts efficiently.

- Flexibility in financial management: While basic functionalities are well-received, users like Julien point out that features such as customizable payment dates are needed to improve the app’s flexibility.

- General satisfaction and reputation: Reviews like that of Victor-Liviu DUMITRESCU emphasize Alpian’s strong reputation as a reliable Swiss bank.

- Areas for improvement: Some users, including doc.steffen and WavingColt, report limitations, such as missing features (e.g., recurring payments).

In summary, Alpian is commended for its user-friendly design and real-time features but would benefit from added functionalities to meet user expectations comprehensively.

Alpian App User Experience

Alpian, positioned as a Swiss digital private bank , offers users a sophisticated and intuitive mobile banking experience. The app’s user-centric design caters to both experienced financial users and newcomers, setting a high standard comparable to renowned neobanks like Neon and Yuh.

Key highlights include:

- The mobile app is seamless and user-friendly: The interface is designed to provide a smooth experience, ensuring users can easily access essential services without friction. Navigation between features is straightforward, supporting efficient day-to-day banking.

- Menus are clear and logically structured: Alpian’s layout emphasizes clarity, allowing users to manage accounts, conduct transactions, or access investment tools with ease. The intuitive structure helps maintain a smooth banking workflow.

- Key features are prominently accessible: Essential banking options such as checking balances, making transfers, and managing investments are immediately visible on the main dashboard, reducing the need for excessive navigation or searching.

Alpian’s focus on delivering a refined user experience transforms it from a mere banking app to an elegant financial management platform, merging innovative technology with the reliability expected from Swiss banking.

The Use Experience of the Alpian app gets a rating of 9/10Alpian Banking License and Security: 9/10

Alpian operates under a Swiss banking license issued by FINMA (Swiss Financial Market Supervisory Authority), ensuring compliance with strict regulatory standards.

Your assets are held in custody by Interactive Brokers, which keeps them separate from Alpian’s assets. This arrangement protects your investments in the event of bankruptcy. Additionally, customer deposits are protected up to 100,000 CHF under the Swiss Deposit Protection Act.

Alpian implements two-factor authentication (2FA) to secure access to your account. However, direct transfers of shares to another broker are not currently available.

In summary, Alpian’s banking license and security measures help ensure the safety of your funds.

Alpian gets a rating of 9/10 for SecurityOur Final Thoughts on Alpian

Alpian positions itself as a Swiss digital private bank, designed for those who want to go beyond a simple bank account. It combines a structured approach to wealth management with modern banking services, all accessible through a clear and secure mobile app.

Its offering is built around a high-performance multi-currency account (CHF, EUR, USD, GBP) and integrated investment solutions, allowing users to manage both liquidity and investments within a coherent and easy-to-use environment.

Unlike solutions more focused on everyday spending such as Yuh or Neon, Alpian adopts a more structured approach, geared towards long-term financial planning and wealth management.

👉 In summary, Alpian offers a clear and structured approach to digital banking, combining premium services, integrated investments and a long-term wealth perspective within a single app.

Who is Alpian for?

Alpian is designed for users who want to go beyond a basic bank account and take a more structured approach to managing their finances over the medium to long term.

It is particularly well suited if you are looking for private banking services with managed investment solutions, without having to commit large amounts of capital as is often required by traditional private banks.

Alpian is also a good fit if you want to combine a multi-currency account with integrated investment tools in a single, easy-to-use app.

However, if your priority is a simple and free account for everyday payments, with minimal constraints, alternatives such as Yuh, Neon or Zak will generally be more suitable.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Alpian Alternatives

Alpian vs Neon

Alpian and Neon meet very different needs depending on your profile and priorities.

Alpian offers a premium account with a metal Visa card, multi-currency management (CHF, EUR, USD, GBP), and access to guided investment services. It is particularly well suited for internationally active individuals or those looking for a premium alternative to private banking.

Neon, on the other hand, focuses on simplicity, efficiency, and very low fees. With a CHF account, a Mastercard with no markup on foreign payments, eBill, TWINT, and sub-accounts, it appeals to everyday users who want a 100% Swiss and free mobile banking solution.

Here is our quick decision table to help you choose between Alpian and Neon:

| Neon | Alpian | |

|---|---|---|

| Overall rating | 8.4/10 | 8.3/10 |

| Free bank account with free debit card | 20 CHF for the card | Free virtual card, 60 CHF for the metal Visa Debit card |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 | |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 0,5% on Swiss shares and ETF, 1% on International shares | 👍 0,75% per year |

For a full analysis of the differences between Alpian and Neon, see our article Alpian vs Neon – Comparison for March 2026.

Alpian vs Yuh

Yuh provides access to a broad range of investment options through its integration with Swissquote, including stocks, ETFs and even cryptocurrencies. Meanwhile, Alpian has partnered with Interactive Brokers, focusing on ETF portfolios – including 45 ETFs with Guided by Alpian – and offering a more curated approach to investing. Alpian’s advantage lies in its ability to provide private banking services at lower costs, blending modern technology with personalized advice—a great fit if you’re seeking professional support without the high fees associated with traditional private banks. U

Here is our quick decision table to choose between Alpian and Yuh:

| Yuh | Alpian | |

|---|---|---|

| Overall rating | 8.6/10 | 8.3/10 |

| Free bank account with free debit card | 👍 | 👍 |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 | |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading and Investment | 👍 0.5% on shares and ETF, 1% on crypto | 👍 0,75% per year |

Alpian vs Yuh Trading Fees

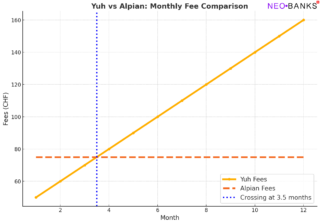

While Yuh’s 0.5% transaction fee looks cheaper than Alpian’s 0.75% annual management fee, the cost changes with trading frequency and portfolio management style.

In a basic scenario of a CHF 10,000 investment:

- Yuh charges CHF 50 for a single trade (0.5% of CHF 10,000).

- Alpian has a fixed fee of CHF 75 per year.

If you rotate 10% of your portfolio monthly, Yuh’s transaction fees add up with each trade, making Alpian the cheaper option by the 3rd month. Yuh also charges 0.95% currency exchange fee, while Alpian only charges 0.20%, so Alpian could be cheaper for international ETF investments.

Here is a visual representation of these costs over time:

Yuh vs Alpian Investing fees comparison

It all depends on your investment style

If you prefer to buy stocks or ETFs and hold them for the long term, Yuh will be the more affordable option. However, if you trade more frequently or want access to investment advice, Alpian may be both more suitable and cost-effective.

Think of it this way: Yuh offers an “IKEA-style” investment experience—lower fees but a fully DIY approach, where you choose your own stocks or ETFs, assess risks, and rebalance. Alpian, on the other hand, provides a private banking experience that may cost more but includes expert guidance along the way.

For a full analysis of the differences between Alpian and Yuh, read our detailed Alpian vs Yuh – Comparison of March 2026.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Alpian vs Revolut

For travelers, Alpian and Revolut offer distinct advantages tailored to different needs. Alpian provides a multi-currency account and debit card (CHF, EUR, USD, GBP) as well as low-cost international transfers, ideal for frequent travelers within these currency zones. Revolut, on the other hand, offers multi-currency accounts in over 30 currencies with conversions at the interbank rate, making it advantageous for payments in various currencies.

Here is our quick decision table to choose between Alpian and Revolut:

| Alpian | Revolut | |

|---|---|---|

| Overall rating | 8.3/10 | 7.7/10 |

| Free bank account with free debit card | 👍 | |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 | 👍 cash withdrawals up to 200 CHF/m. |

| To make free SEPA transfers | 👍 | 👍 |

| To transfer money abroad | 👍 | 👍 transfers up to 1,000 CHF/m. |

| For Trading | 👍 |

For a complete analysis of the differences between Alpian and Revolut, check out our article Alpian vs Revolut – Comparison March 2026.

Frequently Asked Questions (FAQ) about Alpian

✅ What is the current Alpian promo code?

Use the promo code ALPNEO before March 31, 2026 to get CHF 120 Free 🙌 with Alpian. Get the Alpian app ➡️

✅ Is Alpian a licensed bank?

Yes, Alpian is a fully licensed Swiss bank, authorized by FINMA. It combines digital wealth management with traditional banking services.

✅ Is Alpian considered a secure bank?

Yes, Alpian is a licensed Swiss bank, and your deposits are insured up to 100,000 CHF by Esisuisse. Additionally, your investments are held by Interactive Brokers, a well-regulated and secure entity. Therefore, Alpian is a safe choice for banking and investments.

✅ Does Alpian offer a card with no foreign transaction fees?

Yes, Alpian includes a Metal Visa Debit card with low or no fees abroad.

✅ Can I open an account in EUR or USD with Alpian?

Yes. Alpian offers multi-currency accounts in CHF, EUR, USD, and GBP.

✅ What is the minimum deposit required to open an Alpian account?

There is no minimum deposit required to open an Alpian account.

✅ What is the minimum investment required for Alpian's services?

To use Alpian’s Guided by Alpian plan, you need a minimum investment of 10,000 CHF. For the Managed by Alpian plan, the minimum investment required is 30,000 CHF.

✅ Does Alpian provide investment advice?

Yes, Alpian offers personalized investment advice and wealth management services tailored to your financial goals. See Alpian Investment.

✅ Can non-residents open an Alpian account?

Currently, Alpian accounts are only available to Swiss residents. Non-residents cannot open an account at this time.

✅ Does Alpian charge account management fees?

Yes, Alpian charges a management fee of 0.75% per year.

✅ Is Alpian available as a mobile app?

Yes, Alpian offers a fully digital experience through its mobile app, available on both iOS and Android devices.

✅ What makes Alpian different from other Swiss banks?

Alpian combines traditional banking with digital wealth management, offering a unique combination of personal investment advice and banking services through its app.

✅ Who would benefit from using Alpian?

Alpian is ideal for individuals seeking an affordable private banking experience in Switzerland.

✅ Who might not find Alpian suitable?

Alpian may not be suitable for those looking for the lowest-cost banking option or those who prefer to have their investments stored within Switzerland, as Alpian uses Interactive Brokers for investment custody.

Updates

- October 14, 2025: Added Alpian Pillar 3a

- February 11, 2025: Added Alpian’s savings interest

- January 1, 2025: the Alpian VISA debit card now costs 60 CHF.

- August 11, 2024: Alpian now offers a virtual card, an Alpian Amex card, and Google Pay

- September 7, 2024: The Alpian account is now free

- October 12, 2024: Added Alpian’s savings plan: Managed by Alpian Essentials

Sources:

Additional information

Specification: Alpian Review (March 2026): A Digital Take on Private Banking

| Trading | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| Account | ||||||||||||||||||||||||

| ||||||||||||||||||||||||

Franco –

Thanks for the good review. Unfortunately all the interest rates you mentioned here for the Alpian saving account are wrong. Not updated. Pity.

Philippe AIMÉ –

Thanks for pointing this out — the Alpian savings account interest rates mentioned in this review have now been updated to reflect the latest official figures published by Alpian.

We regularly review and update our content to ensure that all information related to Alpian’s private and savings accounts, including interest rates on CHF, EUR and USD balances, remains accurate and aligned with current market conditions.

If you notice anything else that may be outdated, feel free to let us know — your feedback helps us keep this Alpian review up to date.