| Account opening | 8 |

|---|---|

| Usability | 8 |

| Features | 7 |

| Credit Card | 9 |

| Fees | 8 |

| Security | 9 |

| Customer Service | 8 |

radicant is a Swiss neobank, backed by BLKB, that allows Swiss residents to manage a free CHF bank account, invest in sustainable projects, and make mobile payments through its eco-friendly digital platform.

radicant overall rating: 8.1/10

Description

On November 11, 2025, radicant bank ag announced the complete cessation of its operations. This decision was made in agreement with its main shareholder, the Basel-Landschaft Cantonal Bank (BLKB).

The BLKB is overseeing the closure process and is currently evaluating transfer solutions for radicant’s clients. Customer deposits remain fully protected under the Swiss deposit guarantee (up to CHF 100,000 per client).

Radicant’s commercial activities have now ceased. The bank no longer offers new accounts or banking services, and all transition procedures are being coordinated with the BLKB.

radicant Quick Facts in February 2026

| radicant Quick Facts | Details |

|---|---|

| Bank Type | Neobank (subsidiary of BLKB) |

| Established | 2021 |

| Headquarters | Zurich, Switzerland |

| Languages | English, German |

| Free Account | Available in CHF |

| Card | Virtual or physical Visa Debit Card |

| Interest Rate | 0.10% |

| Investment Options | Funds, certificates, sustainable Investments |

| Deposit Protection | Up to CHF 100,000 (compliant with FINMA) |

| Overall Rating | 8.1/10 |

In This radicant Review

Introduction

radicant is a subsidiary of Basler Kantonalbank (BLKB) designed for Swiss residents seeking to manage a free CHF bank account, invest in sustainable projects, and make mobile payments through an eco-friendly digital platform.

Our review of radicant highlights its digital banking services, which combine ecological principles with modern features. With radicant, you can easily open a CHF and EUR account and access investment products that align with responsible investment goals, all through a mobile app that allows you to set up your account online in just 8 minutes.

radicant: The Green Digital Bank in Switzerland

radicant Bank is a Swiss neobank founded in 2021 with the mission of making sustainable banking accessible to everyone. The bank offers a range of products and services, including savings accounts, current accounts and investments, all aligned with sustainability principles.

radicant Bank offers a mobile account that allows Swiss residents to hold and manage funds in CHF and EUR.

radicant Bank’s main features include:

- Focus on Sustainability: radicant Bank is committed to using its capital to support sustainable businesses and projects. The bank has its own impact rating system that evaluates companies based on their environmental, social and governance (SDG) performance.

- Digital Banking: radicant Bank offers a fully digital banking experience, with all of its products and services available through a mobile app or web platform.

- Transparent pricing: radicant Bank pricing is simple and transparent, with no hidden fees.

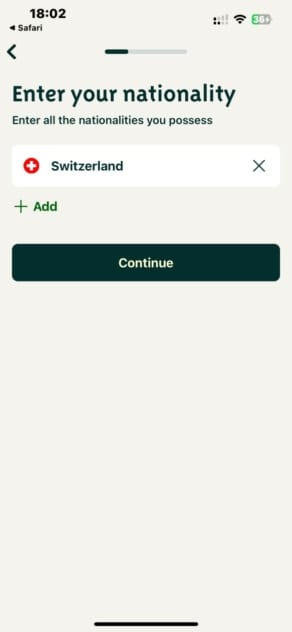

You only need to be a Swiss resident – regardless of nationality – to open an account with radicant Bank.

Here’s what to remember from radicant Bank’s offer:

- Free CHF and EUR account

- Virtual debit card included

- App that allows you to invest

We have tested the radicant Bank application for you and compared the rates in detail.

radicant Account Opening Review: 8/10

Getting Started with radicant

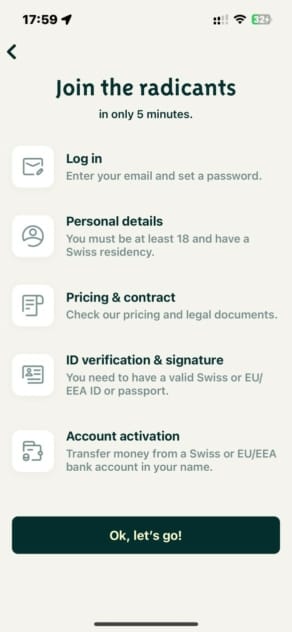

With radicant, you can easily open a free CHF mobile bank account directly from your smartphone. Our radicant review shows that the sign up process is easy and will guide you through each step. Available exclusively to Swiss residents, radicant enables account opening in just a few minutes, making it an accessible choice for those seeking sustainable banking.

Conditions for Opening a Bank Account with radicant

- Be at least 18 years old (15 years old at Zak)

- Be a resident of Switzerland

- Have a smartphone compatible with the app

- No proof of income to provide

- No minimum balance to maintain

You can absolutely use radicant Bank to receive your salaries and make bank transfers. Operating under its own FINMA banking license, radicant ensures the security of deposits up to CHF 100,000, in line with Swiss regulations.

How to Open a Bank Account with the radicant App

Account opening with radicant Bank begins in the app:

- Download the radicant Bank app in App Store or Google Play or scan this QR code with your smartphone:

- Answer the questions

- Enter the radicant promo code: neorad

- Verify your identity

- It’s done! Your account is open 🙌

It only took us 8 minutes to open our radicant Bank account.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

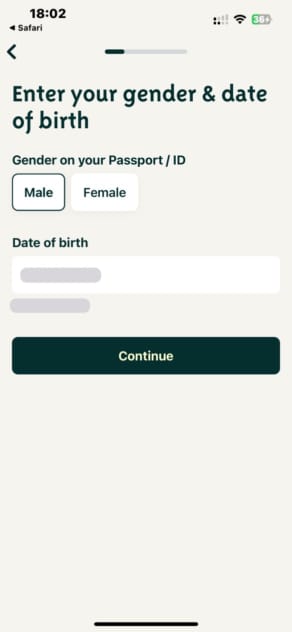

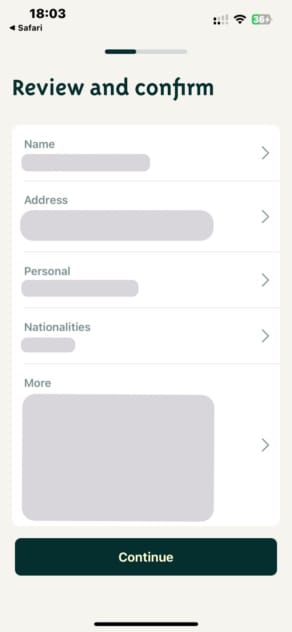

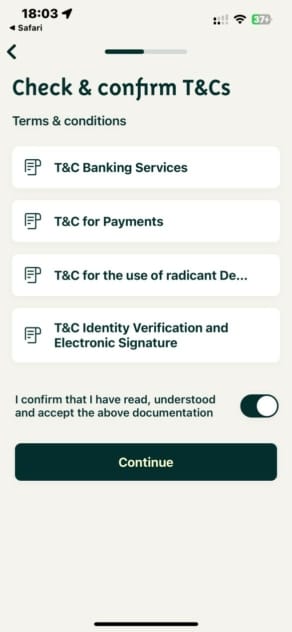

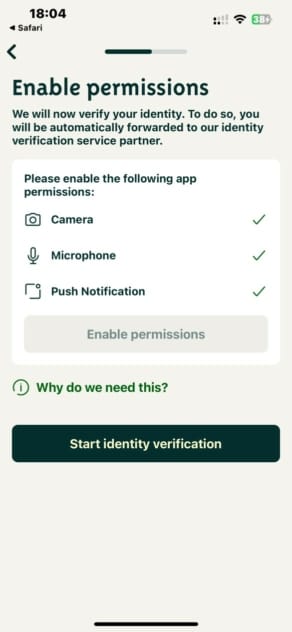

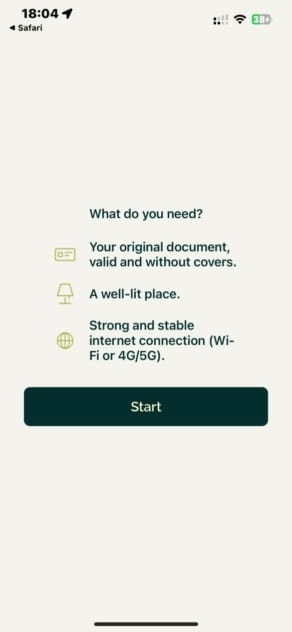

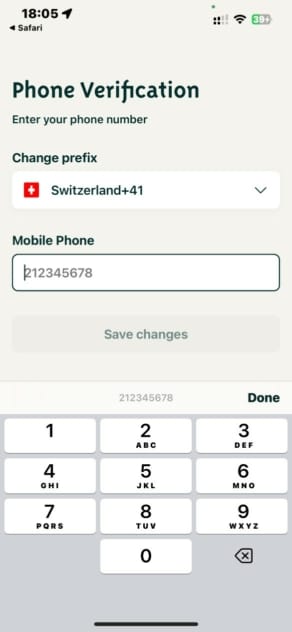

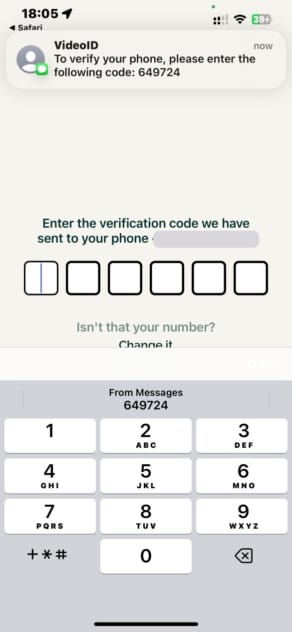

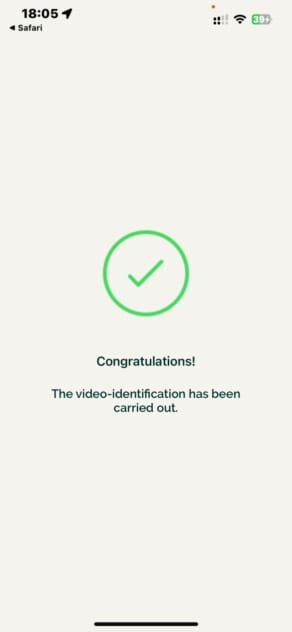

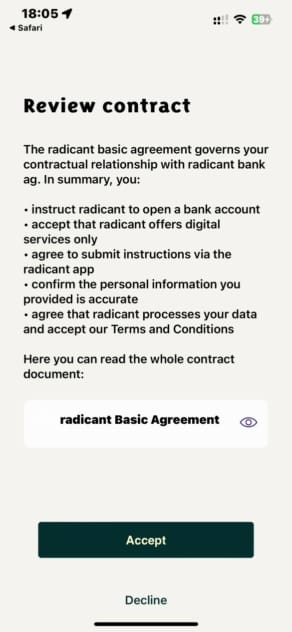

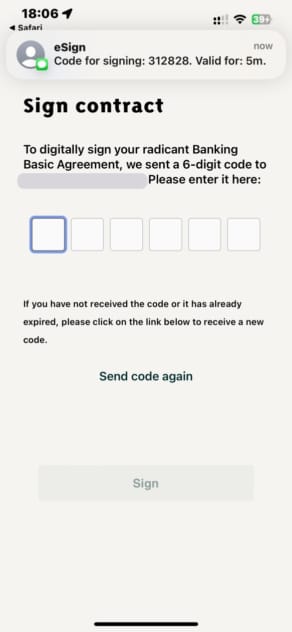

Steps for Opening a Bank Account with the radicant App

The app is available in German 🇩🇪 and English 🇬🇧

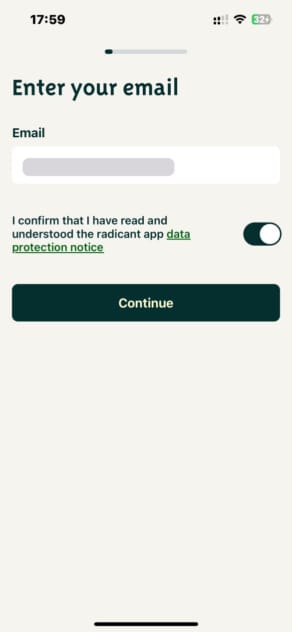

#1 You enter your email and confirm in your inbox

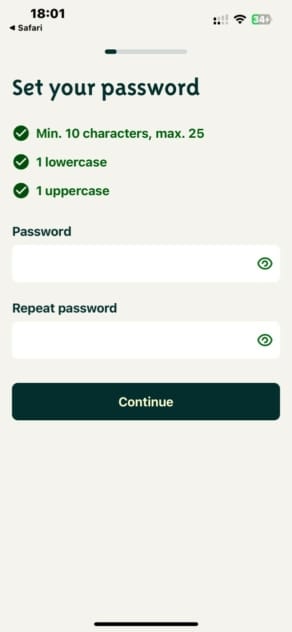

#2 You create your password

#3 You enter your name

#4 You enter your personal information then confirm

#5 You accept the pricing and general conditions

#6 You verify your identity

#7 You enter and verify your phone number

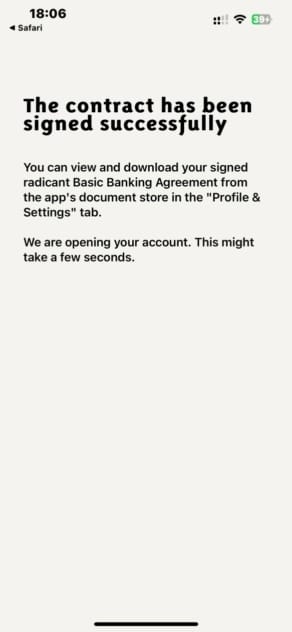

#8 You accept the user agreement and sign virtually

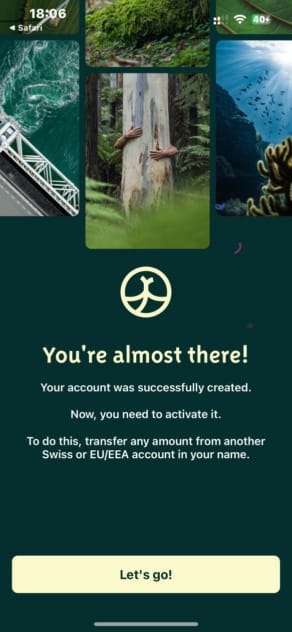

#9 Your account is created, all you have to do is transfer a small amount from another account (10 CHF is enough)

It’s done, your radicant account is open 🙌

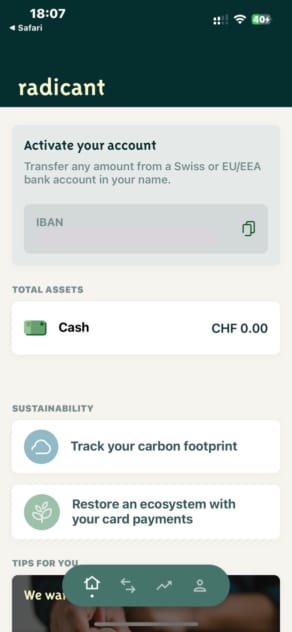

The radicant Bank account allows you to carry out all classic operations (transfers, direct debits, etc.) like any Swiss bank account.

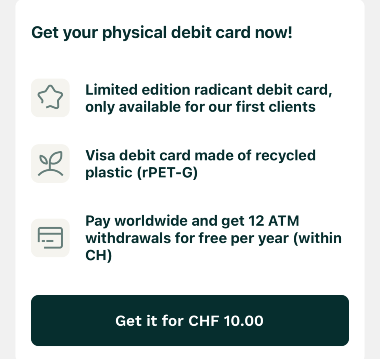

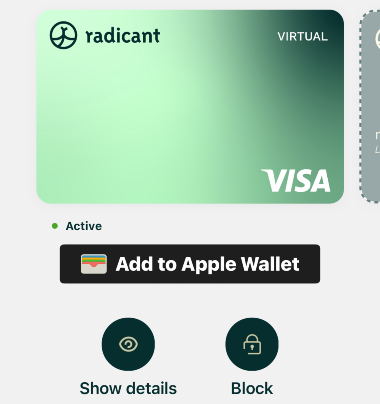

radicant Bank offers a free virtual VISA debit card as well as a recycled plastic VISA debit card, this costs 10 CHF.

Our Opinion on the Bank Account Opening Process with radicant

- Fast account opening in less than 10 minutes

- No income requirement

- Swiss Banking License from BLKB

- Free CHF and EUR account

- The plastic VISA debit card costs 10 CHF

We appreciate the quick and easy account opening. Cons: There are a lot of documents to accept and it is a little frustrating to have to make a transfer before all the functions of the account are accessible.

radicant Bank account opening process receives a rating of 8/10radicant Bank App Features Review: 7/10

radicant App Features List

Being a neobank, radicant Bank offers most of its services via the mobile application:

- Consult your banking transactions

- Make CHF transfers in Switzerland and SEPA transfers in EUR

- Pay with radicant TWINT

- Pay with eBill

- Get cashback when you invest

- Benefit from a free travel insurance

- Scan and pay invoices with QR code

- Virtual bank card (like Yuh, N26 or Revolut)

- Block and replace debit card

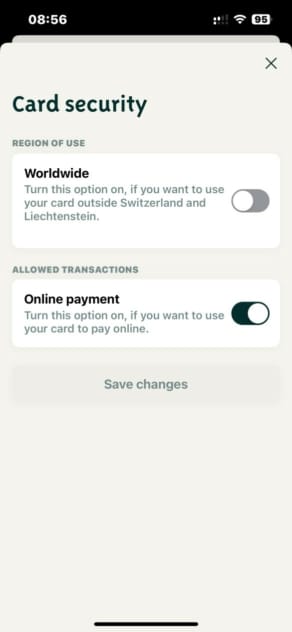

- Authorize the card abroad or in Switzerland only

- Authorize online payments

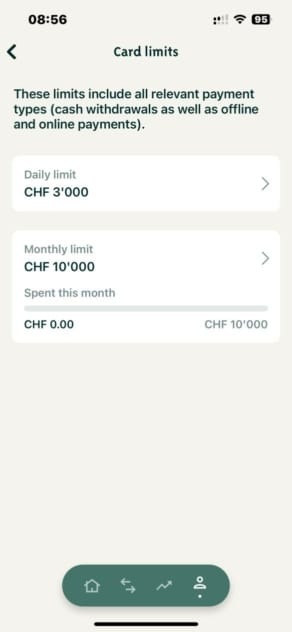

- Change VISA card daily and monthly spending limits

However, here is what is missing:

- No international payments outside the SEPA zone

- Noz possible to update your telephone number and personal information, you must contact radicant

- Not possible to create share sub-accounts with individual IBANs (Spaces)

- No joint account like Neon Duo

- No junior account

radicant App Payment Options

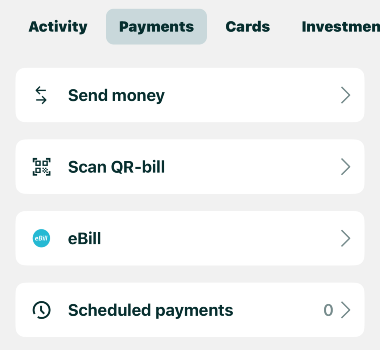

radicant offers several options for managing your payments, such as transfers within Switzerland or options like eBill and TWINT:

radicant payment options

Domestic Payments

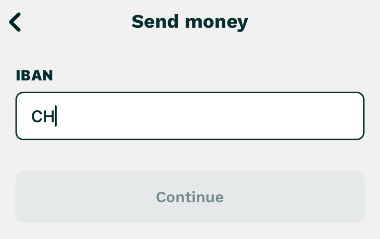

radicant offers straightforward, fee-free transfers within Switzerland. You can send CHF to any Swiss bank account quickly and efficiently. But you have to manually enter the entire IBAN number, while other neobanks like Neon allow you to simply scan the IBAN number, making transactions even easier.

radicant domestic payments

International SEPA Payments

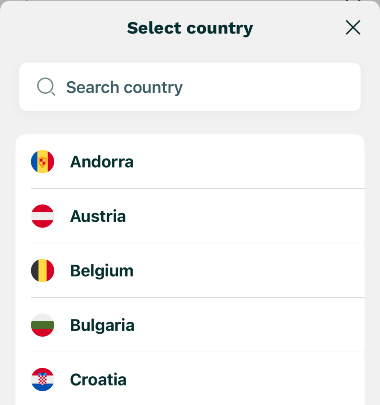

radicant allows free SEPA payments in euros to 36 European countries. These transfers are fast and efficient, with fees equivalent to those of domestic transfers.

However, it is important to note that radicant does not allow payments in currencies other than CHF and EUR, nor outside the SEPA zone. Therefore, if you need to make payments in foreign currencies or outside the SEPA area, you will need to use other solutions such as Alpian, Neon, or Yuh.

Scan & Pay

radicant offers a Scan & Pay feature that simplifies bill payments in Switzerland. By scanning the QR code on a bill with your smartphone’s camera, the app captures the necessary payment details automatically. You can then verify and confirm the payment.

eBill

The eBill feature enables you to receive and pay bills directly through the radicant app. Once registered for the eBill service, electronic invoices will be displayed in the app, allowing you to pay them with a single click. This feature helps manage recurring bills efficiently without manual entry.

radicant TWINT

radicant offers a radicant TWINT app that integrates seamlessly with the main radicant app. With radicant TWINT, you can make mobile payments throughout Switzerland, enhancing the overall convenience and flexibility of using radicant Bank. As TWINT is one of the most popular payment methods in Switzerland, its integration with the radicant app allows for easy transactions, from shopping to peer-to-peer payments, right from your smartphone.

![]()

radicant TWINT provides a significant advantage over other Swiss neobanks by offering a dedicated app fully integrated into the radicant banking ecosystem. While other neobanks, like Alpian and Neon do not have their own TWINT app and rely on TWINT Prepaid, radicant stands out with its comprehensive offering, just like Yuh with Yuh TWINT.

It’s important to note that international neobanks like Revolut and N26 do not support TWINT, making radicant’s integration of TWINT a crucial feature for Swiss residents seeking seamless mobile payment options within their local context.

Invest with radicant

When it comes to investing, radicant stands out from Alpian, Neon Invest, and Yuh by offering exclusively sustainable investment options that align with your values. The platform integrates the United Nations’ Sustainable Development Goals (SDGs) into its offerings, allowing you to invest in companies and projects that contribute positively to society and the environment.

radicant provides 3 actively managed funds through the radicant SDG Impact Solutions Fund, targeting companies that make a significant impact on the SDGs:

- Global Sustainable Equities

- Global Sustainable Bonds

- Swiss Sustainable Equities

In addition to these funds, radicant offers 8 thematic certificates, each focusing on specific SDGs:

- Clean Water and Sanitation

- Healthy Ecosystems

- Societal Progress

- Climate Stability

- Affordable and Clean Energy

- Decent Work and Economic Growth

- Responsible Consumption and Production

- Reduced Inequalities

radicant also offers 5 investment strategies tailored to your risk profile, allowing you to customize your investment approach:

- Cautious: 20% equities

- Conservative: 40% equities

- Balanced: 60% equities

- Dynamic: 80% equities

- Growth: 98% equities

You can start investing with a minimum of 1,000 CHF, making it accessible for many investors.

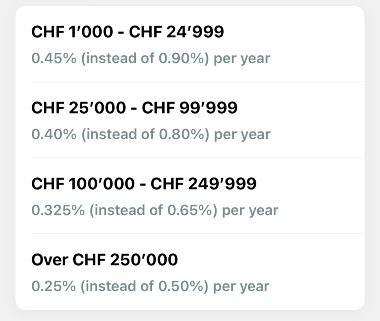

radicant investment fees

radicant’s management fees range from 0.90% to 0.50% depending on the investment amount, with additional product costs between 0.40% and 0.47%. A 50% discount applies on management fees for investments made by December 2024.

By choosing radicant’s investment products, you can build a portfolio that aims for financial growth while supporting the achievement of the UN’s SDGs, making a positive impact on society and the environment.

Saveback: radicant’s Cashback for Investors

radicant offers the Saveback program, allowing you to receive cashback on your expenses made with the radicant Visa Debit card. This cashback is directly invested into your investment portfolio, helping you grow your funds passively.

How the radicant Saveback Program Works:

- Saveback Standard: You receive 0.25% cashback on your monthly expenses, provided you maintain a minimum investment of 1,000 CHF and make monthly contributions of at least 150 CHF to your investment portfolio.

- Saveback Premium: This level offers 1% cashback on your monthly expenses if you maintain a minimum investment of 10,000 CHF and make monthly contributions of at least 1,000 CHF.

The cashback amounts are automatically credited to your investment portfolio, facilitating the growth of your investments effortlessly.

Our Opinion on radicant App Features

In summary, the radicant app offers a solid range of features for managing your banking needs and investments. While it provides essential services like domestic transfers, bill payments, and the convenience of radicant TWINT, there are notable limitations, such as the lack of international payments and the inability to create joint or junior accounts.

radicant’s focus on sustainable investment options sets it apart from Alpian, Neon Invest and Yuh, allowing you to invest in actively managed funds and thematic certificates that align with the United Nations’ Sustainable Development Goals.

Ultimately, radicant is a compelling choice for users looking to engage in sustainable banking and investment, though it may be best suited for those who prioritize these values over the breadth of traditional banking features.

radicant Bank app features receive a rating of 7/10 YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

radicant Credit Card Review: 9/10

radicant VISA Debit Card

The plastic VISA Debit Card from radicant is available for 10 CHF and is ideal for travelers. Fully compatible with Apple Pay and Google Pay, it offers 0% fees on foreign currency payments, using the mid-market exchange rate.

It also includes free travel insurance, covering trip cancellations, medical expenses abroad, luggage protection, and more—automatically activated when you pay with your card. Simple, affordable, and perfect for your travels!

radicant Debit Card order

radicant Virtual Card

radicant also gives you the option to get a free VISA Virtual Debit card, which is ideal If you don’t need the plastic version or if you don’t want to wait for it.

radicant Virtual Debit Card

radicant Card Settings

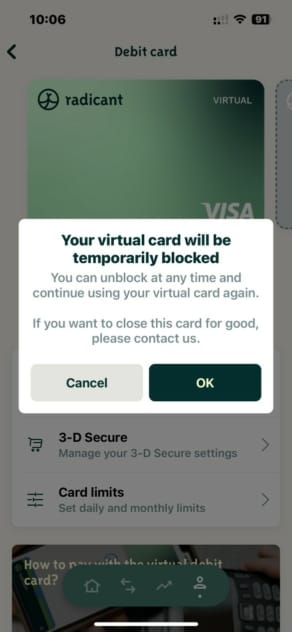

radicant provides convenient card management options within its app, enabling you to:

- Set new PIN

- View your card information, including the card number, expiration date, and CVC.

- Manage your monthly and daily card limits.

- Disable online payment and payments abroad.

- Temporarily freeze and unfreeze your card.

- Add your card to Apple Pay or Google Pay.

However, when compared to other neobanks, radicant Bank lacks certain advanced card usage restrictions. Below is a comparison of radicant with Alpian, Neon, Yuh, and Revolut.

| Feature/Restriction | Alpian | Neon | Radicant | Yuh | Revolut |

|---|---|---|---|---|---|

| View card information | ✅ | ✅ | ✅ | ✅ | ✅ |

| View/change PIN | ✅ | ✅ | ✅ | ✅ | ✅ |

| Temporarily block card | ✅ | ✅ | ✅ | ✅ | ✅ |

| Add card to Apple/Google Pay | ✅ | ✅ | ✅ | ✅ | ✅ |

| Adjust monthly limit | ✅ | ❌ | ✅ | ✅ | ✅ |

| Online payment restrictions | ✅ | ❌ | ✅ | ❌ | ✅ |

| Cash withdrawal restrictions | ✅ | ❌ | ❌ | ❌ | ✅ |

| Contactless payment control | ❌ | ❌ | ❌ | ❌ | ✅ |

| Magnetic swipe payment control | ❌ | ❌ | ❌ | ❌ | ✅ |

| Foreign transaction restrictions | ❌ | ❌ | ✅ | ❌ | ✅ |

| Geolocation restrictions | ❌ | ❌ | ❌ | ❌ | ✅ |

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

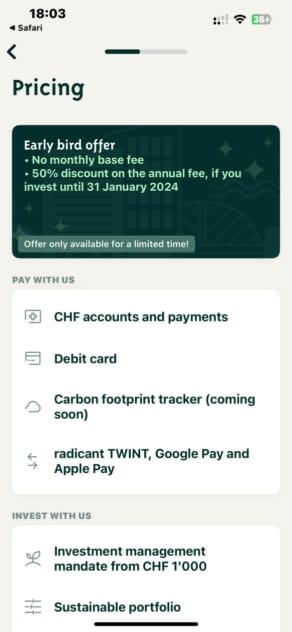

radicant Bank Account Fees: 8/10

radicant Bank being a neobank based in Switzerland, the prices are displayed in CHFradicant Private Account Fees

Opening a radicant Bank account is free and there are currently no monthly fees.

- Free account

- Account management: via iPhone or Android mobile application

- Bank card: VISA Debit

radicant VISA card Fees

- The radicant plastic VISA Debit card is free, but delivery costs 10 CHF.

- The radicant VISA Virtual Debit card is free.

- A card replacement is charged 20 CHF.

Cash Withdrawals Fees

- Cash Withdrawals in Switzerland (CHF): 12 free withdrawals per year, then CHF 2.00 / withdrawal with plastic card

- Cash Withdrawals in EUR or abroad: 5.00 CHF / withdrawal + 0.8%

radicant Exchange Rate

radicant offers accounts in CHF and EUR. Domestic transfers in CHF are free, as are SEPA payments in EUR. A commission of 0.9% is applied for conversions between CHF and EUR. However, international transfers in currencies other than EUR are not supported at the moment.

For card payments, radicant offers an excellent travel value proposition. You pay 0% fees for purchases in foreign currencies, both online and in-store. There are no Visa markups, transaction fees, or hidden charges—only the mid-market exchange rate is applied, ensuring the best rate available. This commitment to transparency and value has earned radicant recognition in multiple comparisons as the Swiss bank with the best exchange rate.

In a recent comparison by Kassensturz and Moneyland.ch, 20 debit cards were evaluated for 75 foreign transactions (2,500 EUR annually). Neobanks like radicant, Alpian, and Neon excelled with low fees and competitive exchange rates, with radicant securing the top spot.

| Kassensturz comparison (in CHF) | One-Time Card Fee | Foreign Currency Fees per Year | Total 3-Year Costs |

|---|---|---|---|

| Radicant | 0 | 1.3 | 3.9 |

| Alpian | 0 | 5.0 | 15.0 |

| Neon Free | 20 | 8.53 | 45.58 |

| Yuh | 0 | 23.46 | 70.39 |

| Zak | 0 | 50.98 | 152.93 |

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

radicant Customer Service Review: 8/10

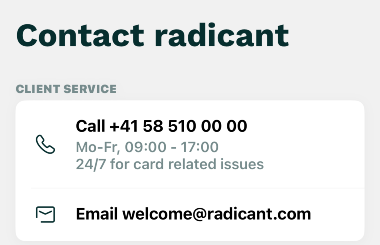

How to contact radicant?

Unlike N26, radicant does not offer Livechat, but a bot or a premium rate telephone number (CHF 0.08 / Minute) open Monday to Friday, 8:00 a.m. to 5:00 p.m. It is also possible to contact support by email.

radicant Address

radicant has its own address and offices; however, they are not open to customers and are intended for mail correspondence only:

radicant Bank AG

Mühlebachstrasse 162/164

8008 Zürich

Schweizer

Our opinion on radicant customer service

Phone support at radicant is fast and friendly but could be improved by adding in-app live chat support like N26. That would simplify customer interactions and be available outside of business hours. Weekend support would be great too.

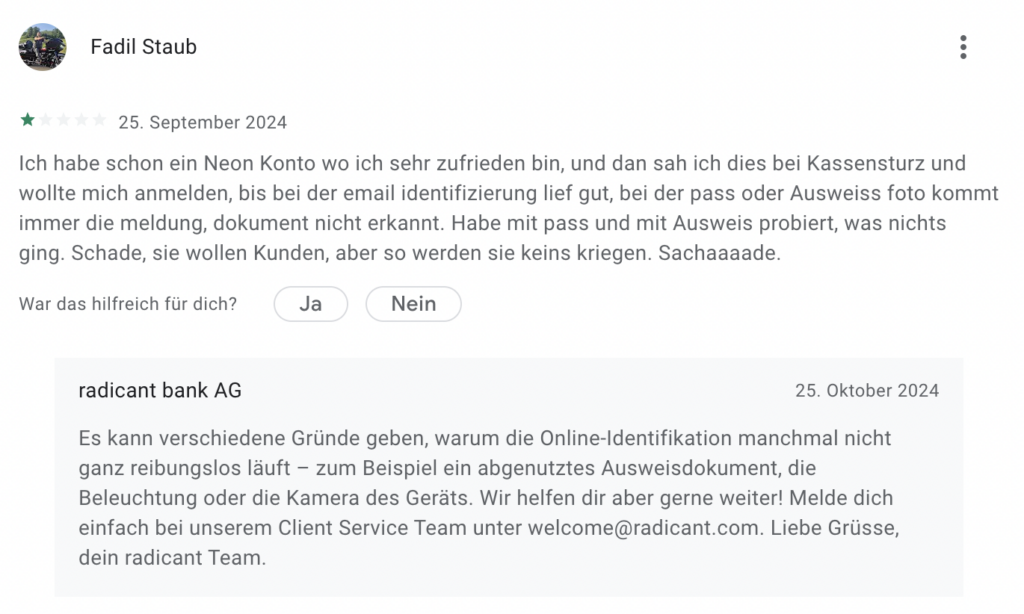

On the plus side radicant responds to App Store and Google Play reviews in a timely manner so the company is definitely working on improving the customer experience.

radicant reply on Google Play

radicant Customer Reviews and User Experience: 8/10

radicant Customer Ratings

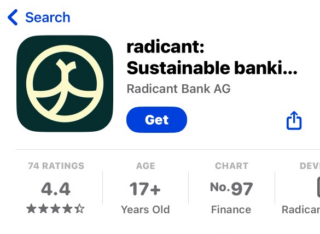

The radicant Bank app is rated 4.4 on the App Store and 4 on Google Play.

radicant App Store Ratings

radicant Google Play Ratings

radicant Customer Reviews

We analyzed reviews on platforms like the App Store, Google Play, and Reddit to better understand what users think about radicant Bank. The feedback highlights several positive aspects and areas that could benefit from improvement. Here are the main points mentioned in user reviews:

- Competitive features and sustainability focus: Users like diste66 appreciate radicant Bank’s market-rate currency exchange with no fees for foreign payments and an attractive 1.25% interest rate on deposits up to CHF 250,000. The bank’s commitment to sustainability, including initiatives like mangrove restoration, appeals to environmentally conscious customers.

- User experience and app design: Reviewers such as Manoi A and diste66 commend the app’s modern and sleek design, which is reliable and free from intrusive ads. The app is perceived as intuitive, although there is room for improvement in layout customization.

- Customer service responsiveness: Feedback from Dry-Ferret-3664 notes that customer support is generally responsive and helpful. However, other users like MinameT report long wait times and lack of response during critical issues.

- Areas for enhancement: Users such as wminnella and rezliensa mention the need for more comprehensive features like multicurrency accounts, sub-accounts, and clearer communication regarding monthly fees. MrJohnSausage highlights app crashes and repeated error messages as drawbacks.

- Initial setup and onboarding: Some, like PixyFox, express concerns over slow account verification times, while others found the process seamless once completed.

In summary, radicant Bank is praised for its sustainable banking initiatives and competitive offerings, but improvements in app stability, customer service, and feature set would enhance the overall user experience.

radicant App User Experience

radicant offers a user-friendly banking app that caters to modern financial needs. While the app is reliable and functional, there is room for improvement to reach the level of top-tier neobanks like N26 and Revolut. Here’s what users can expect:

- Well-structured navigation: The app’s layout is practical, with a bottom menu displaying icons for quick access to payments and investments, ensuring essential functions are at users’ fingertips.

- Core features are accessible: Users can easily perform banking operations such as transfers, checking balances, and managing investments.

- Responsive but improvable navigation: While navigation is generally smooth, it lacks the polish seen in some competitors’ apps.

Although radicant is not yet at the level of the best neobanks, it remains a good application. A new version of the app is anticipated, which could elevate its user experience further. Stay tuned for updates.

The radicant App User Experience gets a rating of 8/10 YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

radicant Banking License and Security: 9/10

radicant operates as an independent subsidiary of Basellandschaftliche Kantonalbank (BLKB) and holds its own banking license issued by the FINMA (Swiss Financial Market Supervisory Authority).

This status allows radicant to offer a range of financial services while adhering to Swiss financial regulations. Customer assets are protected up to 100,000 CHF under the Swiss Deposit Protection Act, ensuring the safety of your funds.

Additionally, radicant implements security measures such as 2-factor authentication (2FA) to protect access to your account.

Overall, radicant’s banking license and security measures help ensure the safety of customer funds.

radicant gets a rating of 9/10 for SecurityOur Final Review of radicant Bank

radicant positions itself as an innovative Swiss neobank, focusing on sustainability and modern solutions tailored to Swiss residents. With its accounts in CHF and EUR, radicant offers free SEPA payments and a competitive conversion rate. However, the bank remains limited in terms of international features, such as payments outside the SEPA zone or multi-currency options. For more extensive needs abroad, alternatives like Alpian, Neon, or Neon may be better suited.

Although certain aspects, such as fees for the physical debit card, could be improved, radicant compares to Alpian, with the offered investments being 100% ecology-oriented. In summary, for clients who prioritize ethical values in their financial management, radicant is worth considering as a top option.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

radicant vs Neon : Which Neobank is the Best

Use this chart to quickly decide if radicant or Neon is better for your use case:

| Radicant | Neon | |

|---|---|---|

| Overall rating | 8.1/10 | 8.4/10 |

| Free account | 👍 | 👍 |

| For use in Switzerland | 👍 | 👍 |

| For travel | 👍 | |

| For free SEPA transfers | 👍 | |

| For payments abroad | 👍 | |

| For trading | 👍 | 👍 |

To find out how each criterion is judged, read our article radicant vs Neon – Comparison of February 2026

Frequently Asked Questions (FAQ) about radicant Bank

✅ Does radicant offer promo codes or referral codes for new users?

Yes, Use the promo code neorad to get 50 CHF 🙌 from Radicant. Get the Radicant app ➡️.

✅ What is radicant Bank?

radicant Bank is a Swiss digital bank focused on sustainability and impact-driven financial services. It aims to provide banking solutions aligned with personal values and global sustainability goals.

✅ How can I open an account with radicant Bank?

You can open an account directly through radicant Bank’s app or website by following a simple online registration process.

✅ Is radicant Bank focused on sustainable banking?

Yes, radicant Bank integrates sustainability into its core values and services. It offers financial products that align with the UN’s Sustainable Development Goals (SDGs).

✅ What services does radicant Bank offer?

radicant Bank offers personal banking services such as savings accounts, investment portfolios with a focus on sustainable investments, and other digital financial solutions.

✅ Are there any fees for using radicant Bank?

radicant Bank is transparent about its fees, and these are generally low. Specific services, like certain types of transactions or premium features, may come with additional fees.

✅ Does radicant Bank offer debit or credit cards?

Yes, radicant Bank provides debit cards for everyday use. More details on credit card options are available on their website.

✅ Is radicant Bank regulated by Swiss authorities?

Yes, radicant Bank is fully licensed and regulated under Swiss banking law and complies with all relevant financial regulations.

✅ Can I make international transfers with radicant Bank?

No, radicant Bank does not allows international money transfers currently.

✅ How does radicant Bank ensure the security of my account?

radicant Bank uses state-of-the-art encryption and security protocols, including two-factor authentication (2FA), to protect your personal data and financial transactions.

✅ Does radicant Bank offer investment products?

Yes, radicant Bank offers investment portfolios that focus on sustainability, allowing you to invest in companies and projects aligned with global environmental and social goals.

✅ How can I contact radicant Bank’s customer support?

You can contact radicant Bank’s customer support via the app, website, or by phone. The bank also provides email support for customer inquiries.

✅ Does radicant Bank have physical branches?

No, radicant Bank operates as a fully digital bank with no physical branches. All services are offered online or via the mobile app.

✅ What currencies does radicant Bank support?

radicant Bank only supports CHF.

✅ Does radicant Bank offer loans or mortgages?

As of now, radicant Bank focuses on personal banking and investment services, but they may expand to offer loans or mortgage products in the future.

✅ Is there a minimum deposit to open an account with radicant Bank?

There is no minimum deposit to open an account with radicant.

Sources:

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

Additional information

Specification: radicant Review & Test

| Trading | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Account | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

There are no reviews yet.