| Account opening | 10 |

|---|---|

| Usability | 9 |

| Features | 7 |

| Credit Card | 7 |

| Fees | 7 |

| Security | 8 |

| Customer Service | 6 |

N26 is a german neobank that allows Swiss residents to open a mobile bank account in EUR and benefit from services offered by the bank.

The mobile bank account is free, as well as the virtual MasterCard. N26 offers very competitive exchange rates, making the neobank an ideal solution for travelling.

N26 Switzerland Overall Rating: 7.7/10

Description

As of February 2026, N26 remains a popular choice for Swiss residents looking for a bank account in EUR. Our review of N26 covers the app, its features, and the ease of account opening, which is fully online and takes only 10 minutes. With both free and paid account options, N26 positions itself as an attractive alternative to Swiss neobanks like Yuh or Alpian. Although the account is exclusively in EUR and comes with a German IBAN, N26 is ideal for frequent travelers or those making regular transactions within the Eurozone.

N26 Switzerland Review: The Best EUR Bank Account in Switzerland?

N26 (previously Number26) is a German neobank created in 2013. It’s been granted an EU banking licence.

With more than 500.000 customers in France and more than 1.5 million in Europe, N26 launched in Switzerland in September 2019, then opening its 26th market.

N26 is an alternative to Alpian and Yuh Bank, which offer multi-currency accounts in CHF, EUR, USD, and GBP.

| N26 | |

|---|---|

| Type of bank | Neobank |

| Creation | 2013 |

| Customers | 5 000 000 |

| Employees | > 1500 |

N26 currently offers 3 types of private accounts in Switzerland:

- Standard

- Smart

While in France or in Germany, N26 offers 5 types of accounts including the Business account:

- Standard

- Smart

- N26 You (Premium)

- N26 Metal

- Business

N26 Switzerland Account Opening Review: 10/10

N26 allows you to open a mobile bank account within a few minutes from your smartphone.

What are the bank account requirements

- Be at least 18 years old

- Be resident in a country where the bank is active: Switzerland is one of them!

- Have a smartphone compatible with the app

- No need to provide proof of revenue

- No minimum deposit

- No minimum balance

This neobank is very interesting for expatriates in Switzerland, travellers and students doing an exchange in Europe.

The Business offer is suitable for freelancers doing business with other European countries.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

How to open an account with N26 Switzerland

N26 promise a bank account in 8 minutes :

- Request your account here

- Download the N26 app

- Verify your identity via the application

- Add funds to your N26 account (recommended)

- It’s done! You account is opened

The opening process is quick and simple, but if you’re not sure, continue reading.

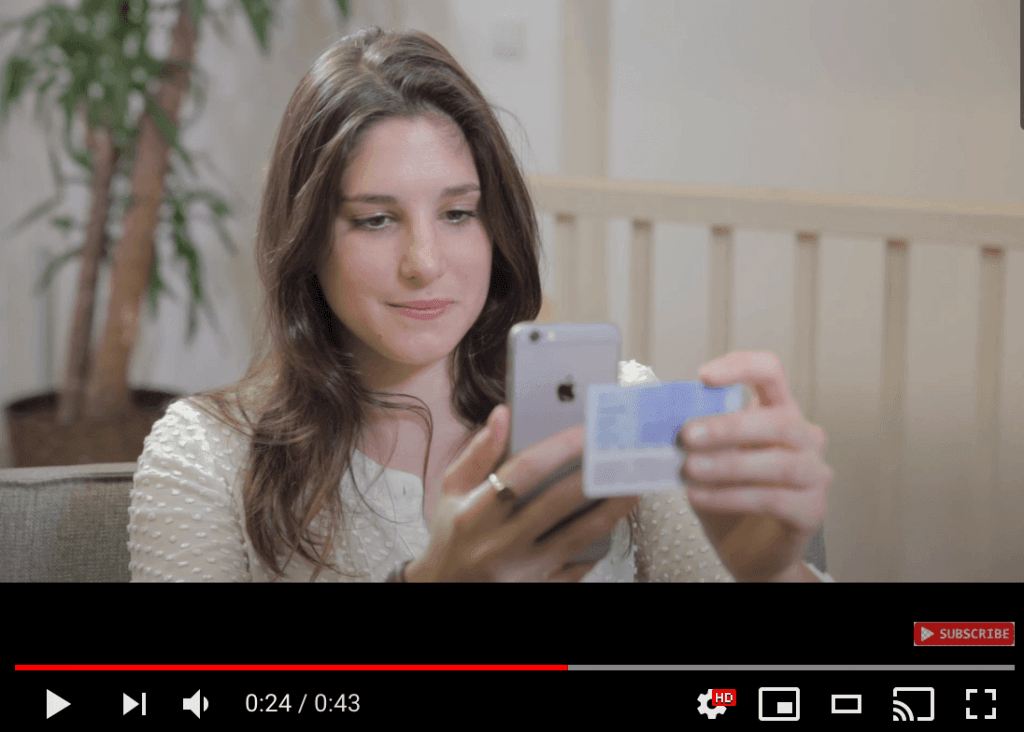

Unlike large Swiss banks, N26 will not ask you to provide paper documents. Everything happens in the mobile app.

This video shows you how to verify your identity with N26:

The N26 account allows you to make all the standard transactions (bank transfer, direct debit, etc.) like with any Swiss bank account. But, there is a main difference: the N26 account is in EUR.

The virtual MasterCard is free. If you want a plastic – physical – MasterCard you’ll to pay 10 EUR for delivery or subscribe for N26 Smart (€4.90/month) and you will receive it by mail within 5 to 10 days.

Our opinion on the account opening with N26 Switzerland

- Quick opening in 10 minutes (or maybe 8)

- No revenue requirement

- Available to all Swiss residents

- Account in EUR

- German IBAN in DE

N26 App Customer Reviews and User Experience: 9/10

N26 being a neobank, a lot has be done to ensure a great user experience:

- The app is fast and intuitive

- Menus are clear and well organised

- Essential features are always visible

The N26 app is rated 4,7 on the Apple Store and 4 on Google Play (65 000 reviews) :

N26 Switzerland App Store Reviews

N26 Switzerland Google Play Reviews

The app is on par with Revolut for example and deserves a 9 out of 10.

The N26 app usability gets a 9/10N26 App Features Review: 7/10

As a neobank, N26 offer all their services through a mobile application. That means it’s possible to do almost everything from your smartphone:

- Access your payment history

- Make new payments

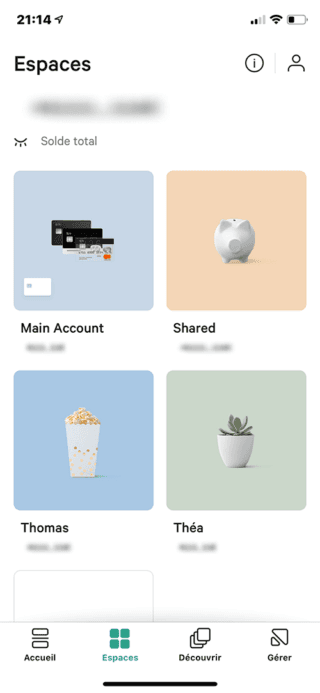

- Create and share spaces (from the Smart plan)

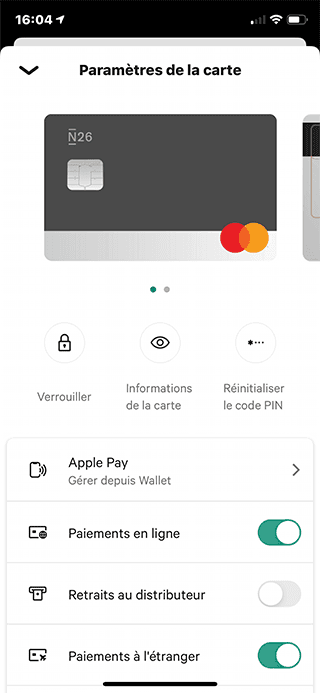

- Block or freeze your card

- Change the daily and monthly limit of the card

- Change your personal details

- Contact the customer service by Chat

- Change your subscription

The list of features is very complete but some specific to Switzerland are missing:

- CHF account not available

- eBill not available

- TWINT not available

- Scan and Pay invoices with QR code not available

In Switzerland, several neobanks offer eBill and TWINT. Yuh has the advantage of having an integrated TWINT application: Yuh TWINT

And some others can be improved:

Spaces allow you to share sub-accounts and to save money

N26 Spaces

Card settings are very useful

Unlike Revolut, card settings are very precise, N26 allows you to block online payments or block cash withdrawals.

N26 Card Settings

We can only regret that N26 is not available in CHF and does not offer TWINT and eBill, otherwise it would certainly be the ideal neobank for Switzerland.

N26 app features get a 7/10 YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

N26 Switzerland Credit Card Review: 7/10

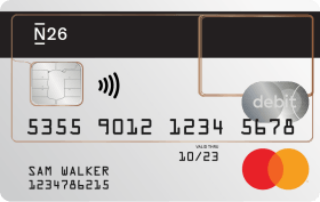

N26 offers a free virtual Debit MasterCard with its free plan in Switzerland.

To get the “plastic” card, you can either pay 10 EUR for delivery or get it for free with the Smart plan at 4.90 EUR/month.

From a Swiss perspective, this card is only available in EUR, which may be less practical compared to those provided by Swiss neobanks. For example, Alpian and Yuh offer multi-currency cards that include both CHF and EUR, making them more versatile for users in Switzerland.

N26 Switzerland Debit Card

The virtual debit MasterCard is still a very good option for online shopping and travelling using your smartphone, since it can be linked to Apple Pay or Google Pay.

N26 receives a rating of 7/10 for the cardN26 Fees in Switzerland: 7/10

N26 accept Swiss residents but only offers accounts in EUR. Fees are displayed in EURN26 Standard Account Fees

The N26 Standard account is free, providing essential features without a monthly charge.

- Monthly Fee: 0.00 EUR

N26 Smart Account Fees

The N26 Smart plan offers additional benefits, including a free physical debit card and more free ATM withdrawals.

- Monthly Fee: 4.90 EUR

N26 Debit Card Options

The N26 Standard account includes a free virtual debit MasterCard, ideal for online shopping and mobile payments. For those who prefer a physical card, Standard users can opt for one with a one-time delivery fee of 10 EUR, while it’s free with the Smart plan.

- Virtual Card: Free with the Standard account

- Physical Card: Optional for Standard (10 EUR delivery fee) or free with the Smart plan

N26 Debit Card Mastercard

Cash Withdrawals Fees

Both the Standard and Smart plans include options for cash withdrawals in EUR and foreign currencies:

- Cash Withdrawals in EUR: Up to 2 free withdrawals per month with Standard, and 3 free with Smart; additional withdrawals are 2 EUR each

- Foreign Currency Withdrawals: 1.7% commission on non-EUR withdrawals for both Standard and Smart plans

N26 MasterCard limits

N26 has 2 types of limits for payments and withdrawals:

- Card payment limit: maximum of €2,500 per day and €20,000 per month

- Cash withdrawal limit: maximum of €2 500 per day and €20,000 per month

Bank transfers in Switzerland in CHF

Not possible. The N26 account is only available in EUR, it is not suitable for payments in CHF within Switzerland.

For free transfers in Switzerland, it is better to use Swiss neobanks like Neon, YUH or ZAK.

SEPA transfer fees in EUR

Like most neobanks, N26 offers free SEPA transfers in EUR within the SEPA zone. You can create a SEPA payment within seconds from the app.

International SWIFT payments

For bank transfers in foreign currencies (other than EUR), N26 use the services of Wise (TransfertWise) and currently includes 18 foreign currencies (GBP, USD, YEN, Yuan…).

Fees applied by TransfertWise are between 0.5% – 1.5% of the amount transferred,

MoneyBeam: instant money transfert

MoneyBeam is a service created by N26 that allows you to instantly transfer money to another N26 account, for free.

Our opinion about the N26 fees in Switzerland

If you’re considering N26, you’ll find the fee structure refreshingly simple in comparison to Revolut. The Standard account covers essentials for free, and if you upgrade to the Smart plan, you get perks like a physical card and more free ATM withdrawals. For Euro transactions, you’re all set with free SEPA transfers, which is a real plus if you frequently send money in the Eurozone.

However, since N26 only offers EUR accounts, keep in mind that CHF payments aren’t possible—something to consider if you regularly need CHF for Swiss transactions. Foreign currency withdrawals come with a 1.7% fee, and for international transfers, Wise handles it with fees between 0.5% and 1.5%, making it a solid option if you occasionally need to move money in other currencies.

The other drawback is not yet having access to the N26 You (Premium) and N26 Metal plans.

N26 fees get a 7/10 ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before February 28, 2026 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️

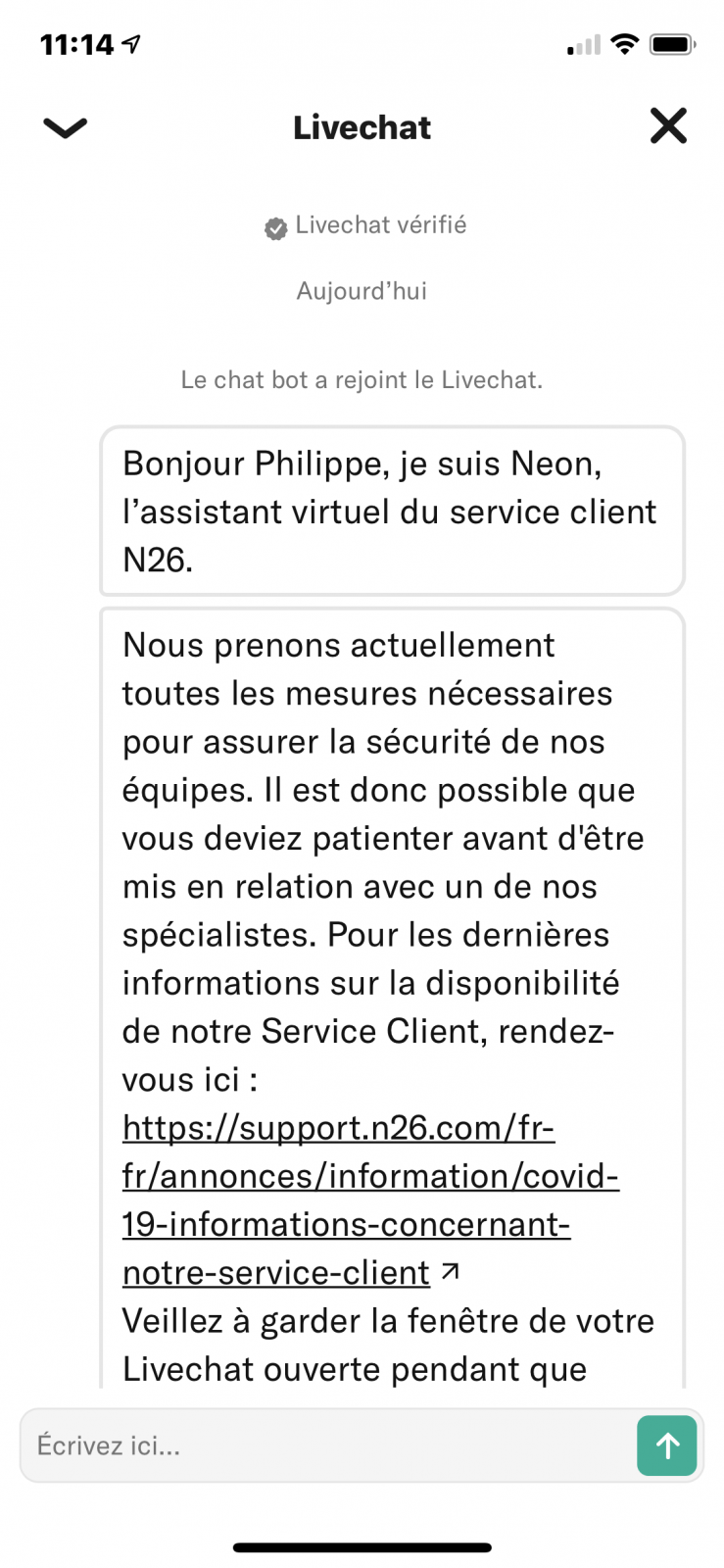

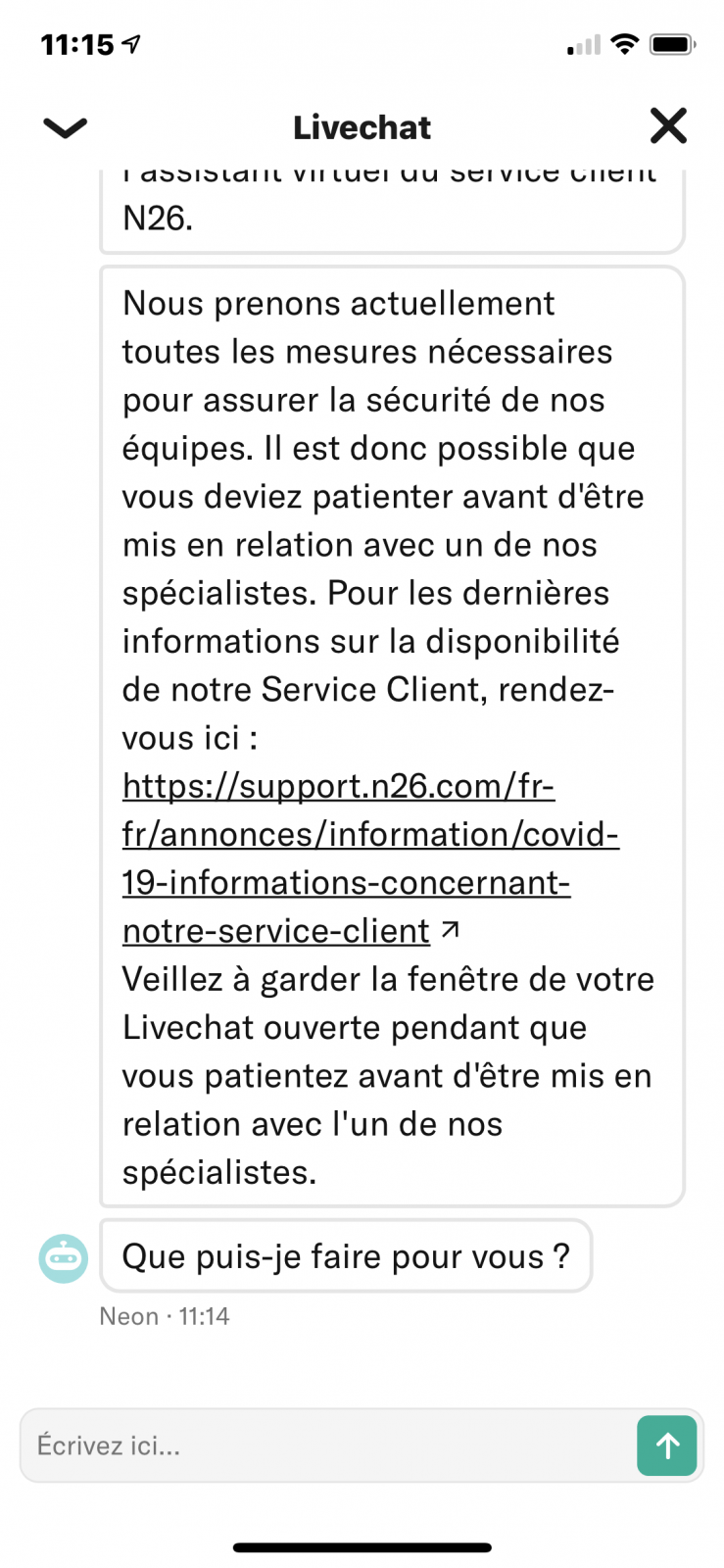

N26 Switzerland Customer Service Review: 6/10

N26 – Livechat available from monday to sunday – 07:00 to 23:00

With N26, the LiveChat is available quickly within a wide time range. The virtual assistant gets you to wait (usually less than a minute) until a human takes over the conversation.

The N26 agents are well trained and can usually solve any issue very quickly.

(*) Coincidence or irony, the name of the N26 virtual assistant is Neon.

N26 Customer Service Chatbot

N26 Customer Service Livechat

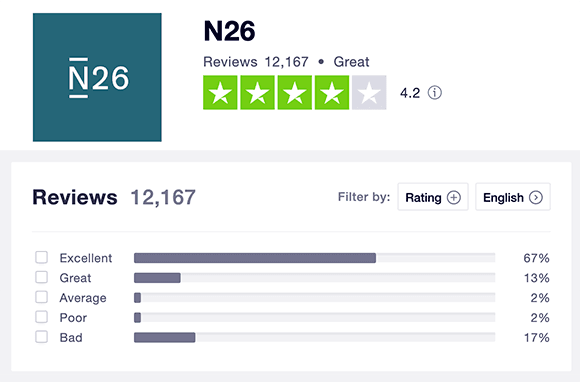

We are quite happy with the N26 customer service but, there is a but 🤦♂️

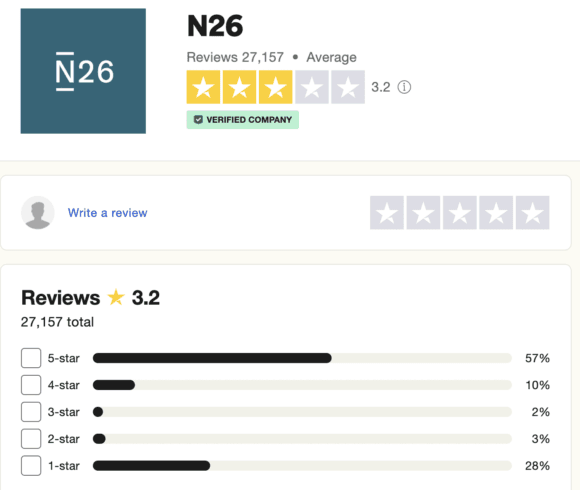

This is a screenshot of the N26 TrustPilot Rating we took in July 2020. It was at 4.2 out of 12 167 reviews:

N26 TrustPilot Rating in July 2020

And less than 3 years later, this is the new N26 TrustPilot Rating: only 3.2 out of 27’157 reviews:

N26 TrustPilot Rating in June 2023

There has been a sharp rise of unhappy customers (29% bad reviews) reporting account closed, issues with customer service and more.

It is not our experience even if we noticed that N26 have increased their compliance procedures over the years, which can be annoying at times. -4 points.

This is a 6/10 for customer serviceN26 Banking License and Security: 8/10

N26 operates under a full European banking license, ensuring compliance with stringent EU financial regulations. As a result, customer deposits are protected up to €100,000 under the European Deposit Guarantee Scheme, providing coverage for users in the Eurozone.

In Switzerland, N26 offers its services to residents, but it’s important to note that the standard €100,000 deposit protection applies, as N26 operates under its European banking license. This means that Swiss customers’ deposits are protected up to 100,000 EUR under the European Deposit Guarantee Scheme.

N26 employs advanced security measures, including two-factor authentication (2FA) and real-time transaction notifications, to safeguard your account and personal information.

In summary, N26 provides a secure banking experience with deposit protection up to 100,000 EUR for all customers, including those in Switzerland, under the European Deposit Guarantee Scheme.

This is a 8/10 à N26 on this criteriaOur Final Opinion on N26 Switzerland

Since N26 is only available in EUR, this account may not be ideal if you are looking for a solution primarily for use in Switzerland. However, it is an excellent option if you travel regularly within the Eurozone, particularly to France and Germany. One of the main advantages is the free EUR withdrawals at ATMs in Switzerland, which sets N26 apart from many other Swiss banks.

If you need an account in EUR, N26 remains an attractive option, with a quick account opening process and easy-to-use features. Despite having a German IBAN, it is a viable alternative for your frequent EUR transactions.

In conclusion, if you need an account in EUR, N26 can be a solid choice. However, other neobanks like Alpian and Yuh may better meet your local needs, offering multi-currency options and Swiss IBANs.

Yuh vs N26: Which is the Best EUR Account

Here is our quick decision chart for choosing between Yuh and N26, both accounts are useful for making payments abroad:

| Yuh | N26 | |

|---|---|---|

| Overall rating | 8.6/10 | 7.7/10 |

| Free bank account with free debit card | 👍 | |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 withdrawals above 600 CHF | 👍 up to 600 CHF/m. |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 250 SWQ+50 CHF Trading Credits with our promo code |

To find out how each criterion is judged, read our article Yuh vs N26 – Comparison of February 2026

Neon vs N26: Which is the Best Bank Account for Travel

Here is our quick decision chart for choosing between Neon and N26, both accounts are useful when traveling:

| Neon | N26 | |

|---|---|---|

| Overall rating | 8.4/10 | 7.7/10 |

| Free Swiss bank account | 👍 | |

| To use in Switzerland | 👍 | |

| To travel in Europe | 👍 | |

| To travel abroad | 👍 | |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | 👍 if you hold EUR |

| For Trading | 👍 Crypto |

To find out how each criterion is judged, read our article Neon vs N26 – Comparison of February 2026

Frequently Asked Questions (FAQ) about N26 Switzerland

✅ How do I open a bank account with N26 Switzerland?

To open a bank account with N26 Switzerland, download the N26 app from the App Store or Google Play Store. Follow the registration process, which involves providing identification documents and completing a verification process. The entire process is digital.

✅ Can Swiss residents open a bank account with N26?

Yes, Swiss residents can open a bank account with N26. The process involves downloading the N26 app, providing identification documents, and completing a verification process. N26 accounts are available to residents in Switzerland, despite the bank’s German base.

✅ What are the fees associated with N26 Switzerland?

N26 Switzerland offers a range of account types with varying fee structures:

– N26 Standard: Free of charge.

– N26 Smart: Monthly fee applies.

Additional fees may apply for certain services such as international transactions or ATM withdrawals outside of the network.

✅ What is the N26 Swiss IBAN format?

N26 accounts, including those used in Switzerland, use the German IBAN format. This format starts with DE followed by 20 digits. Even though you may be located in Switzerland, your N26 account will have a German IBAN.

✅ Can I have a Swiss IBAN with N26?

No, N26 is a German neobank, so you will get an IBAN starting with DE. If you want a Swiss IBAN in CH and need a EURO acount, you can open an account with either Alpian or Yuh

✅ Does N26 Switzerland offer children's accounts?

NO, N26 Switzerland does not offer children’s accounts.

✅ Does N26 Switzerland offer joint accounts?

No, N26 Switzerland does not offer joint accounts at this time. But they offer SPACES that you can share with your partner or friends.

✅ Does N26 Switzerland offer investment products?

No, N26 Switzerland does not offer traditional investment products directly.

✅ What is N26’s SWIFT code for Switzerland?

N26 Switzerland uses the SWIFT code: NTSBCH22.

✅ Can I deposit cash into my N26 Switzerland account?

N26 Switzerland does not support cash deposits directly into the account. You can fund your account through bank transfers or other digital methods.

✅ Is N26 Metal available in Switzerland?

No, N26 does not currently offer all plans in Switzerland:

– N26 You (the Premium version) is not yet available in Switzerland.

– N26 Metal is also not yet available in Switzerland.

N26 has only been available in Switzerland since September 2019 and launched with 2 plans only, so you may expect to see You and Metal coming in the near future.

✅ N26 vs Revolut, which neobank to choose?

That depends on your needs. For use in the EURO zone in EUR, N26 is the best solution. Revolut is more interesting for multi-currency payments and transactions.

No, the N26 account is more suitable for use in the EURO zone.

– Cash withdrawals in EUR in Switzerland are free (up to 3 withdrawals). – The virtual MasterCard can be used for online shopping in Europe.

– The N26 account is in EUR. – You get a German IBAN, starting with DE. You will not be able to do instant payments to another Swiss bank account. – N26 does not offer features specific to the Swiss market: Scanning invoices, e-Bills, Twint. – N26 can’t offer services specific to Switzerland: foresights, mortgages, etc.

For use in Switzerland, other Swiss neobanks are more suitable: Neon or Yuh, for example.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Additional information

Specification: N26 Switzerland Review (2026): A Euro Account for Everyday Use

| Trading | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Account | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

There are no reviews yet.