| Account opening | 9 |

|---|---|

| Usability | 8 |

| Features | 6 |

| Credit Card | 8 |

| Fees | 9 |

| Security | 7 |

| Customer Service | 7 |

Wise Switzerland is a neobank that allows Swiss residents to open a free multi-currency account and benefit from the services offered by the bank using a mobile application.

Wise also offers a free Debit MasterCard attached to the multi-currency account.

Wise Switzerland Overall Rating: 7.7/10

Description

In March 2026, Wise Switzerland continues to stand out as a leading solution for multi-currency accounts, ideal for those needing to manage money in various currencies. Our review of Wise Switzerland highlights the benefits of its Borderless account, which allows you to hold over 50 currencies, make free SEPA payments, and access a MasterCard debit card. By using the real interbank exchange rate and transparent fees, Wise becomes a competitive option compared to Alpian or Yuh. Account opening is simple and free, with no hidden fees if the balance is zero.

Wise Switzerland Borderless Multi-Currency Account Review: 6/10

Wise Switzerland offers a free multi-currency account, the Borderless account, which provides simple and flexible management for those with international financial needs. This account is particularly suited for individuals who need to manage transactions in multiple currencies while keeping costs low. Here’s an overview of the benefits of the Wise Borderless account:

- Multi-currency account: You can hold and manage over 50 different currencies simultaneously. This allows you to receive local payments in multiple countries, whether in EUR, USD, GBP, or other currencies, avoiding costly conversions for each transaction. It’s ideal for expats, travelers, or professionals dealing with foreign currencies.

- Flexible management: Accessible via both the mobile app and desktop, the Borderless account allows you to manage your finances wherever you are. You can check your balance, make transfers, or convert currencies with just a few clicks, all in real-time.

- Nearly free SEPA payments: Wise allows you to make SEPA payments in euros with very low fees, much lower than those charged by traditional banks. This is a significant advantage for those who regularly transfer money within the eurozone, benefiting from the real interbank exchange rate with no hidden fees.

- MasterCard debit card: The MasterCard linked to your Borderless account allows you to spend directly from the currencies you hold, whether for online purchases or in-store, without high conversion fees. The card automatically selects the local currency, allowing you to travel without worrying about extra conversion costs.

- Real interbank exchange rate: Wise uses the real interbank exchange rate, ensuring you get the best possible rate. Unlike other services that add a margin to the exchange rate, Wise is fully transparent with its fees, clearly shown before each transaction.

The Wise Borderless account is a complete solution for those looking to simplify their international currency management while keeping costs down. Whether you’re traveling, working abroad, or need to transfer money regularly in different currencies, Wise offers a flexible, cost-effective, and transparent way to manage your international finances.

However, Wise lacks some key features offered by Swiss neobanks like Alpian, Neon, and Yuh. Unlike these local neobanks, Wise does not offer integration with TWINT, which is widely popular in Switzerland for quick and contactless payments. Furthermore, it does not support eBill for managing and paying bills electronically directly from the app, nor does it allow QR code payments to streamline transactions in Switzerland.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Wise Mastercard Borderless Debit Card Review: 8/10

Unlike CurrencyFair or b-sharpe, Wise Switzerland offers a Debit MasterCard attached to your multi-currency account.

This Debit Mastercard is free and you can use to spend any currency available on your Wise account: USD, EUR, GBP or other currencies, the card will automatically select the currency depending on the country where you are making a purchase.

Wise Switzerland Mastercard

| Wise Debit Card | Fees |

|---|---|

| Order a Wise card | CHF 8 |

| Card replacement | CHF 4 |

| Spend the currencies in your account | Free |

| 2 free Bancomat withdrawals, up to CHF 200/month | ✅ |

| ATM fees over CHF 200/month | 1.75% + 0.50 / withdrawal |

| Beyond 2 withdrawals per month | 1.75% + 0.50 / withdrawal |

Wise Switzerland Fees: 9/10

It’s free to create a Wise account and there is no maintenance fee or minimum balance.

Wise Switzerland provides you with bank accounts under your name in several countries. So you can receive money locally, without any surcharge.

You can add money to your Wise account in 19 currencies: AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HRK, HUF, JPY, NOK, NZD, PLN, RON, SEK, SGD, TRY and USD

You can also keep 50 currencies on your multi-currency Borderless account, and convert them at any time.

Wise Switzerland use interbank currency rate and apply their fees in full transparency.

| Wise Account | Prices |

|---|---|

| Create an account | Free |

| Get a UK account with account number and sort code | Free |

| Obtain a U.S. account with Account and Routing number | Free |

| Get a European IBAN | Free |

| Obtain an Australian account with Account and BSB number | Free |

| Get a bank account in New Zealand | Free |

| Get a bank account in Hungary | Free |

| Get a bank account in Romania | Free |

| Get a bank account in Singapore | Free |

| Hold 50+ currencies | Free |

| Send money | from 0.43% |

| Receive money AUD, CAD, EUR, GBP, HUF, NZD, RON, SGD, USD (non-wire) | Free |

| Receive USD with ACH or bank debit | Free |

| Receive a transfer in USD | $4.14 |

| Direct Debit in EUR | Free |

| Direct Debit in GBP | Free |

| Direct Debit in AUD | Free |

Wise Banking License and Security: 7/10

Wise operates with regulatory authorizations in multiple countries, including the Financial Conduct Authority (FCA) in the UK and the Financial Crimes Enforcement Network (FinCEN) in the US, ensuring compliance with international financial standards. **However, Wise does not hold a banking license in Switzerland,** so deposited funds are not covered by the standard 100,000 CHF deposit protection that applies to Swiss bank accounts.

With these licenses, Wise is able to offer secure money transfers and multi-currency accounts worldwide. Client funds are held separately from Wise’s operating funds, adding an extra layer of protection for users.

Additionally, Wise implements advanced security features such as two-factor authentication (2FA) to protect access to your account and ensure the security of your data and transactions.

In summary, while Wise offers solid protection for client funds through its international regulatory licenses and security measures, the absence of a Swiss banking license means that funds are not covered by the 100,000 CHF deposit guarantee.

Our Final Take on Wise Switzerland

Wise Switzerland is a practical solution for those who need to manage multiple currencies across different countries. With its Borderless multi-currency account, you can hold over 50 currencies, make free SEPA payments, and use a MasterCard debit card to simplify your international transactions. By using the real interbank exchange rate with no hidden fees, Wise offers a highly competitive option, especially compared to neobanks like Alpian and Yuh.

With a simple and free account opening process and no fees if your balance is zero, Wise provides a flexible and advantageous solution for managing your finances internationally. If you’re looking for an efficient way to handle multiple currencies with transparent fees, Wise Switzerland is worth considering.

Why use Wise Switzerland rather than Zak or Neon?

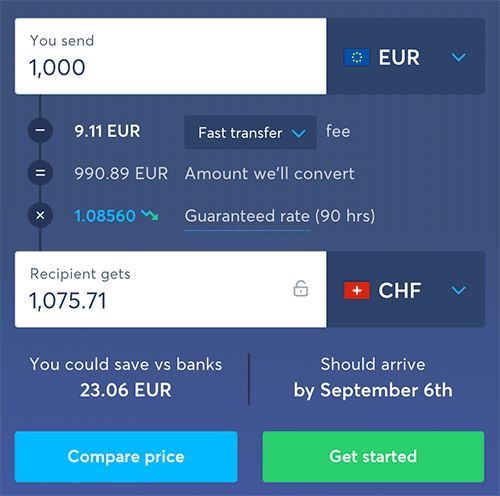

Wise Switzerland use the real-time interbank exchange rate: the one displayed in Google when your search “EUR CHF exchange rate” for example. Wise add a small fee that is displayed in full transparency on their website:

Wise EUR to CHF exchange rate

Zak and Neon use an exchange rate that is only updated once a day and on average slightly higher than the actual exchange rate (in order to cover exchange rate differences between 2 days):

- Zak use an exchange rate set by Viseca (non available on the web)

- Neon use the Mastercard exchange rate

Wise Switzerland is usually cheaper than Neon and Zak. You can also compare Wise fees with other banks (UBS, BCV, PostFinance,…) on the Monito website.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Frequently Asked Questions (FAQ) about Wise Switzerland

✅ What is Wise?

Wise, formerly known as TransferWise, is an international money transfer service that provides a platform for sending and receiving money across borders with low fees and real exchange rates. It operates online and via its mobile app.

✅ Does Wise offer services in Switzerland?

Yes, Wise offers its money transfer services in Switzerland. Swiss residents can use Wise to send money abroad and receive funds from international sources.

✅ What fees does Wise charge for transfers in Switzerland?

Wise charges a fee based on the amount of money being transferred and the currencies involved. Fees are typically lower compared to traditional banks and are transparent, displayed before confirming the transfer. For exact fees, it’s best to check the Wise website or app for a quote.

✅ What currencies can I send with Wise from Switzerland?

Wise supports a wide range of currencies for international transfers. You can send money from Swiss Francs (CHF) to various currencies, including USD, EUR, GBP, and many others. Check the Wise website or app for a full list of supported currencies.

✅ Can I open a Wise account in Switzerland?

Yes, you can open a Wise account in Switzerland. The process is digital and involves providing personal information and verifying your identity. You can manage your Wise account and perform transactions through the Wise website or mobile app.

✅ What is the Wise SWIFT code for Switzerland?

Wise uses different SWIFT codes depending on the specific service or transfer. Generally, Wise provides the SWIFT code relevant to the recipient’s bank or service used for the transaction.

✅ How long does a transfer take with Wise?

The transfer time with Wise depends on the currencies involved and the payment method. Generally, transfers can be completed within a few hours to a few business days. Wise provides an estimated delivery time for each transfer during the process.

✅ Can I receive money with Wise in Switzerland?

Yes, you can receive money with Wise in Switzerland. If you have a Wise account, you can provide your account details to the sender to receive funds. Wise supports receiving money in multiple currencies.

✅ Does Wise offer a multi-currency account for Swiss residents?

Yes, Wise offers a multi-currency account that allows Swiss residents to hold, send, and receive money in multiple currencies. This can be useful for managing international transactions and avoiding conversion fees.

✅ Is Wise regulated in Switzerland?

Wise is regulated in multiple jurisdictions around the world. In Switzerland, Wise operates under Swiss financial regulations and is compliant with local laws for money transfers and financial services.

✅ How can I contact Wise customer support in Switzerland?

You can contact Wise customer support through their website or mobile app. They offer support via email, chat, and phone. For specific inquiries or issues, visit the Wise support page for assistance.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Additional information

Specification: Wise Switzerland Review (2026): Multi-Currency Accounts & Transfers

| Trading | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Account | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

There are no reviews yet.