| Account opening | 8 |

|---|---|

| Usability | 9 |

| Features | 8 |

| Credit Card | 9 |

| Fees | 9 |

| Security | 9 |

| Customer Service | 8 |

Our review of Yuh shows that it is among the best digital banks in Switzerland, but it may not be suitable for everyone.

We analyse fees, interest rates, features and investment options to determine who Yuh is ideal for and in which cases alternatives such as Alpian or Neon may be more relevant.

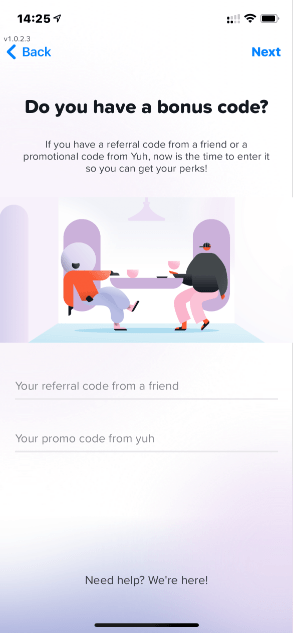

🎁 Use the promo code YUHNEO before February 28, 2026 to receive CHF 50 trading credit + 250 SWQ (CHF 5) when opening a Yuh account.

⭐ Our rating: 8.6/10 (Excellent)

Description

📝 Editor’s note: I personally use Yuh as a secondary bank account, mainly for payments and selected investments. This gives me a concrete, real-world view of how the app works and what the day-to-day user experience is like.

Yuh Bank: What You Need to Know in February 2026

Yuh is a very solid Swiss neobank for everyday use, especially for users who want to combine payments, savings and simple investments in one single app.

✅ Excellent mobile app for payments, saving and investing

✅ Intuitive interface with well-structured features

✅ Ideal for users looking to combine banking and simple investing

❌ Trading and exchange fees are not always the most competitive

❌ Less suitable for active traders or users who make frequent transactions

📌 Our view: If you are looking for a simple, all-in-one banking solution for everyday use, Yuh may be a good fit for you. However, if you are a very active investor or are looking for particularly competitive fees, other specialised providers may be more suitable for your needs.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Key facts about Yuh in February 2026

| Yuh Quick Facts | Details |

|---|---|

| Bank Type | Neobank (Swissquote) |

| Established | 2021 |

| Headquarters | Gland, Vaud |

| Users | 340,000+ |

| Languages | English, French, German, Italian |

| Free Account | Available in 13 currencies |

| Card | Free MasterCard Debit Card |

| Interest Rate | 0% on CHF, EUR and USD |

| Investment Options | Stocks, ETFs, Cryptocurrencies |

| Deposit protection | Up to CHF 100,000 |

| Review Rating | 8.6/10 |

Table of contents

Yuh Bank Overview

Yuh is a Swiss neobank offering a free online bank account, available to Swiss residents and cross-border commuters. It is designed for everyday use and allows users to manage payments, savings and simple investments within a single app.

More specifically, the app includes multi-currency management, savings and investment options (stocks, ETFs, cryptocurrencies, pillar 3a), as well as mobile payments via debit card and Yuh TWINT.

Founded in 2021, Yuh is the result of a partnership between PostFinance and Swissquote. Since 2025, Swissquote has held 100% of the company, strengthening the platform’s stability and long-term vision.

Yuh positions itself as a modern alternative to traditional banks and other Swiss neobanks such as Alpian, Neon or ZAK, while remaining simple and accessible.

Account opening is fully digital and usually takes less than 10 minutes.

⭐ Yuh Pros: What we like about Yuh Bank

🏦 A solid and credible banking foundation

Yuh relies on a proven and regulated Swiss banking infrastructure. Swissquote’s sole ownership enhances the clarity of the business model and ensures long-term continuity.

💳 A genuinely free bank account

The Yuh account is free in Switzerland, with no hidden annual fees or temporary conditions. This is not a promotional offer, but a sustainable positioning.

📱 A smooth and well-designed mobile app

The Yuh app is intuitive, fast and pleasant to use. It clearly outperforms many more rigid Swiss banking apps and aligns with the standards of the best modern financial apps.

🌍 Access for cross-border workers

Yuh is one of the few Swiss neobanks accessible to cross-border workers. This avoids having to transfer salaries to a foreign euro account or rely on a costly traditional Swiss bank.

📲 A fully integrated Yuh TWINT app

Yuh offers its own TWINT app, directly linked to the bank account. This integration is far more convenient than a TWINT Prepaid solution that requires manual top-ups.

🌐 App available in English

The Yuh app is available in English, which is a real advantage for newcomers to Switzerland who do not yet master the national languages.

⚠️ Yuh Cons: What Yuh could improve

💱 More competitive exchange fees

Lower exchange fees would allow more flexible use of the Yuh card for foreign currency payments, both online and abroad.

👥 The introduction of a joint account

The lack of a joint account remains a limitation today. However, this feature is listed on Yuh’s roadmap.

📊 More aggressive pricing for pillar 3a and investments

Further fee reductions on the pillar 3a and investment platform would allow Yuh to compete even more directly with specialised players in the Swiss market.

Yuh Bank Accounts and Pricing

Yuh offers a single mobile bank account, with no monthly subscription, available to Swiss residents. Unlike some neobanks, Yuh does not offer multiple plans — all features are included in one account.

The Yuh account allows you to manage multiple currencies (CHF, EUR, USD), make payments in Switzerland and abroad, and save and invest directly from the app.

The Yuh account includes in particular:

- A free bank account in 13 currencies, with CHF, EUR or USD as the main currency

- A Mastercard Debit card including 4 free withdrawals per month

- Mobile payments via Apple Pay, Google Pay and Yuh TWINT

- Savings and investment options (stocks, ETFs, cryptocurrencies, pillar 3a)

We have tested the Yuh app for you and compared features and pricing.

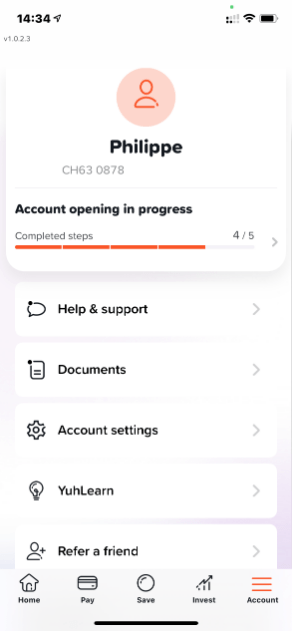

Yuh Account Opening Review: 8/10

Getting Started with Yuh

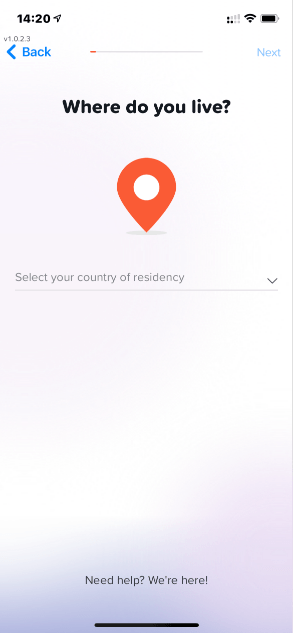

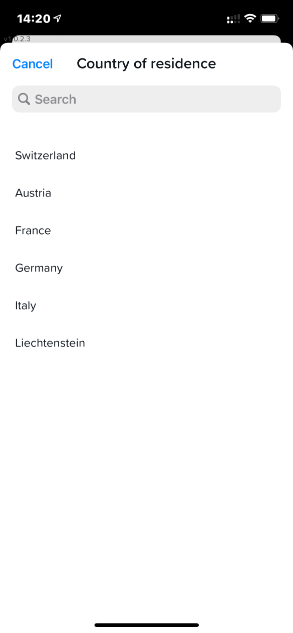

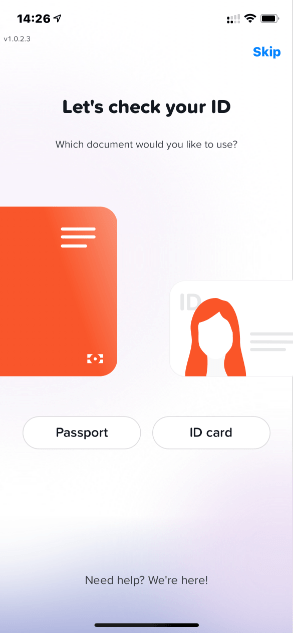

With Yuh, you can easily open a free mobile bank account directly from your smartphone. Our Yuh review shows that the registration process is intuitive and guides you through each step. Both Swiss residents and foreigners living in Germany, Austria, France, Italy, and Liechtenstein can also open an account with Yuh for foreigners in just a few minutes.

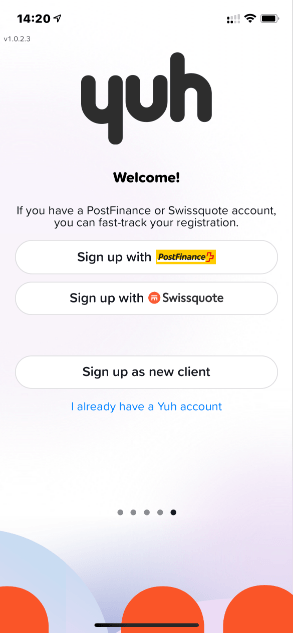

Signing-up with your PostFinance or Swissquote accounts to Yuh is even faster and easier—simply sign up using your PostFinance or Swissquote credentials.

Conditions for Opening a Bank Account with Yuh

- No need to provide proof of revenue

- No minimum deposit

- No minimum balance

Yuh Bank inherits the security standards and reputation of SwissQuote. You can use this Yuh account to receive your salaries and make bank transfers in Switzerland or to your Revolut card.

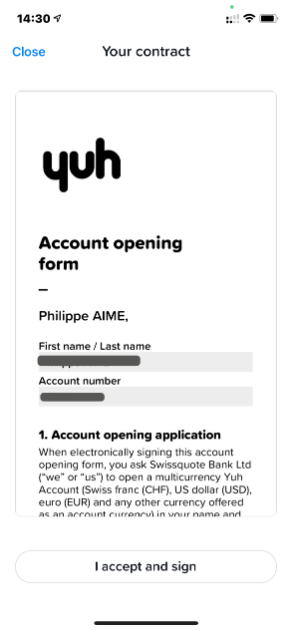

The footprint of SwissQuote is quite obvious: mails and emails are sent by SwissQuote. The account opening process is also guided by the SwissQuote process.

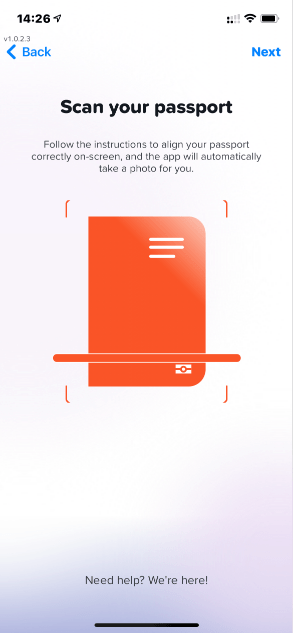

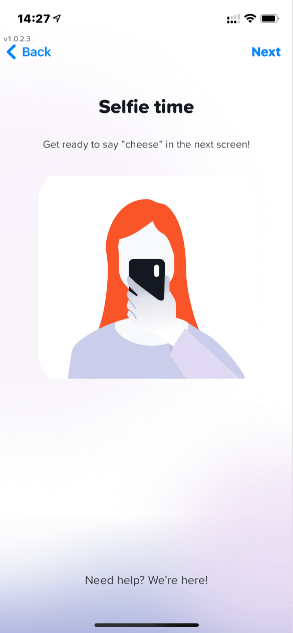

How to Open a Bank Account with Yuh

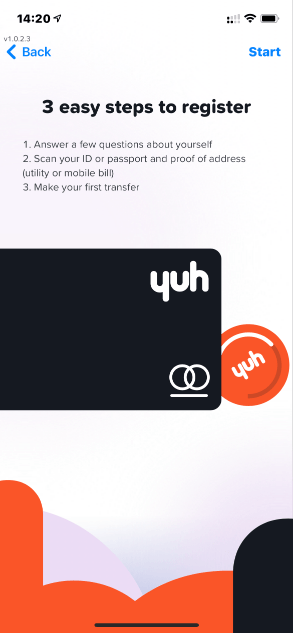

To open Yuh account you just need to follow these steps:

- Download the Yuh app on iPhone or Yuh app on Android or simply scan this QR code with your smartphone:

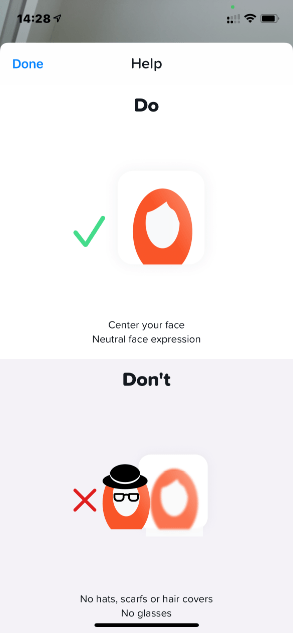

- Follow the instructions and verify your identity through the app

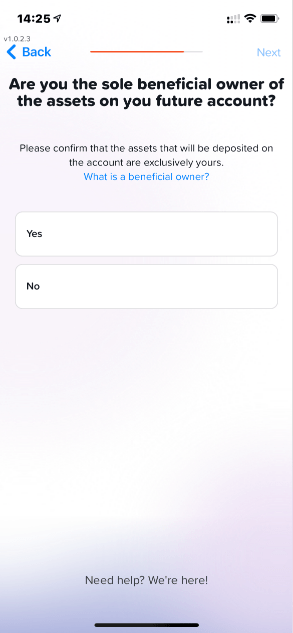

- Enter the Yuh promo code: YUHNEO

- Enter the Yuh bonus code under “Do you have a bonus code?”

- Then make a deposit of 500 CHF. That’s it 😎

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

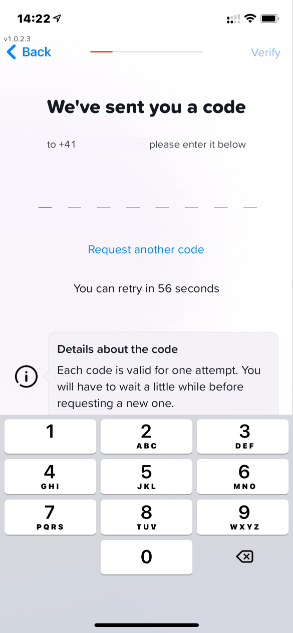

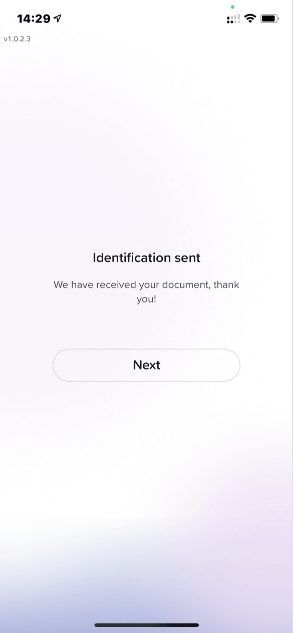

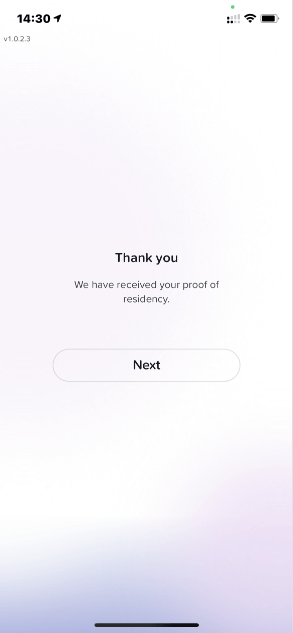

In practice, you may have to wait about 5 minutes to have your documents verified, then your account is opened!

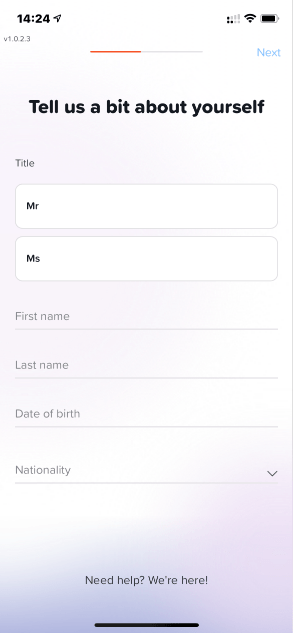

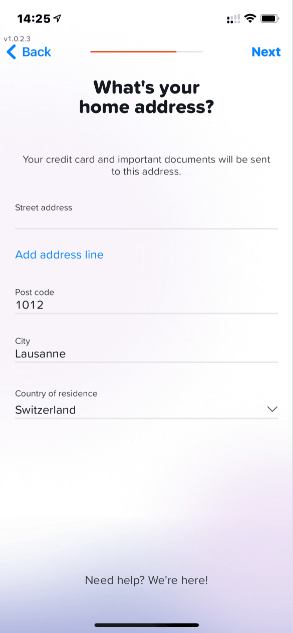

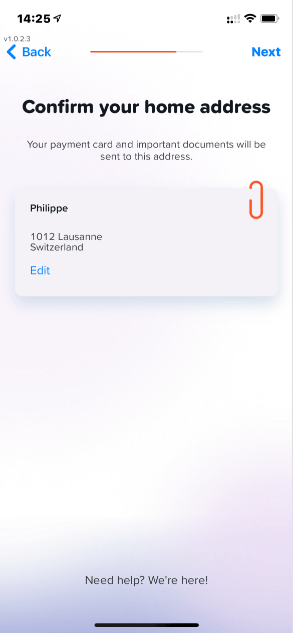

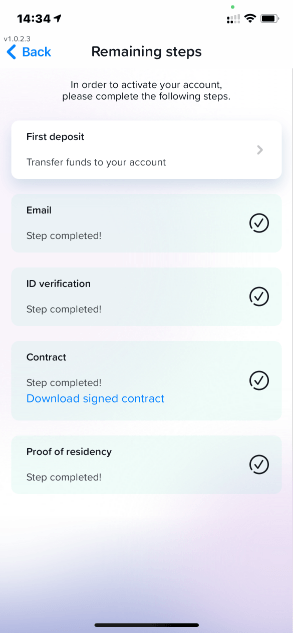

Yuh will not ask you to provide any paper documents, which makes the account opening process very fast.Steps for Opening a Bank Account with the Yuh App

The Yuh App is available in French 🇫🇷 German 🇩🇪 Italian 🇮🇹 and English 🇬🇧

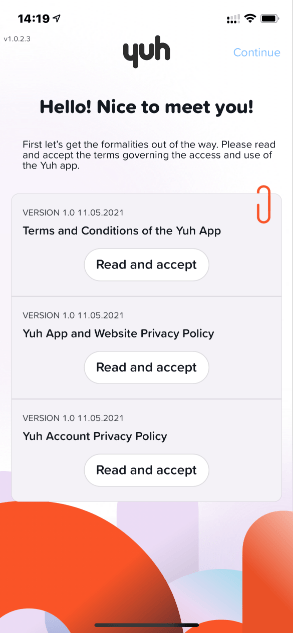

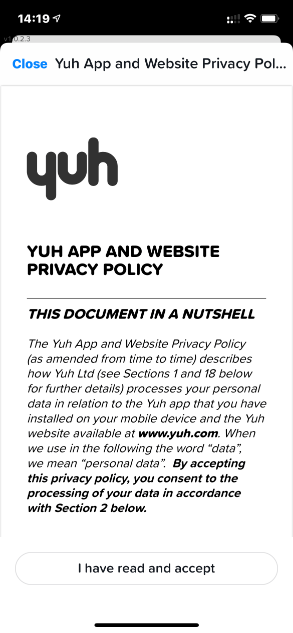

#1 Accept the legal terms of the Yuh account

#2 You can sign up with your PostFinance/SwissQuote credentials or create a new account

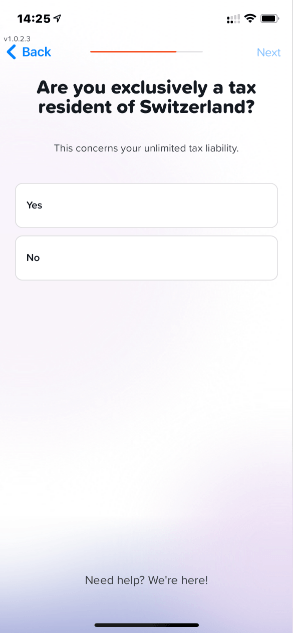

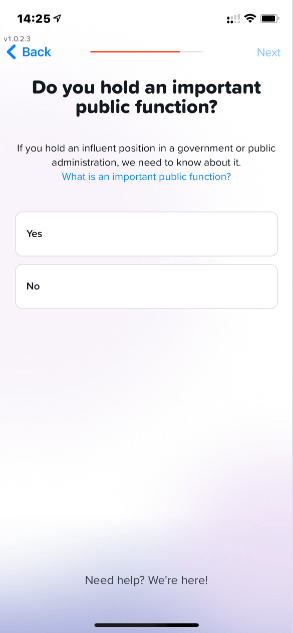

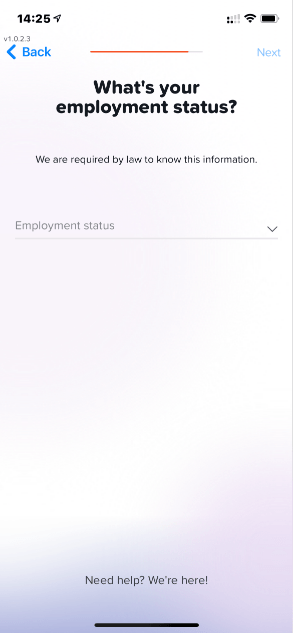

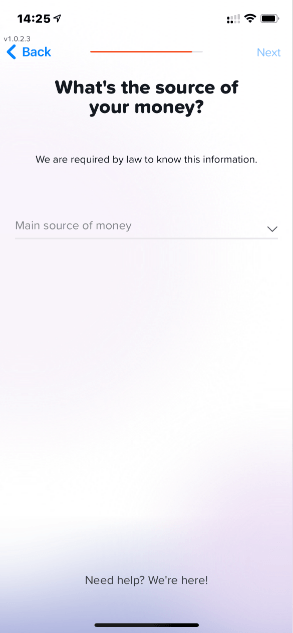

#4 When signing up, you have to answer several questions: a mix PostFinance and SwissQuote requirements

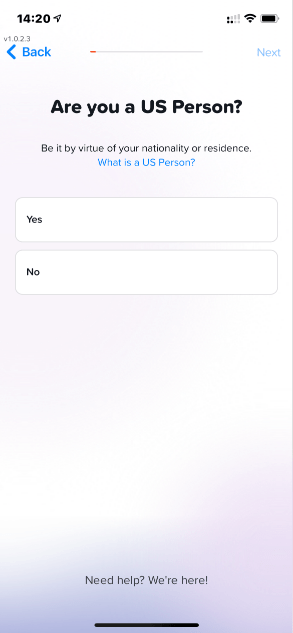

#5 You must declare your country of residence AND whether or not you are American

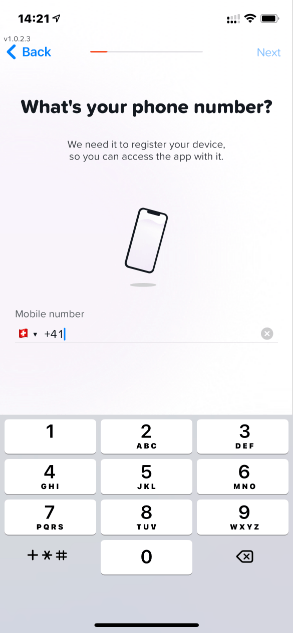

#6 Verify your phone number

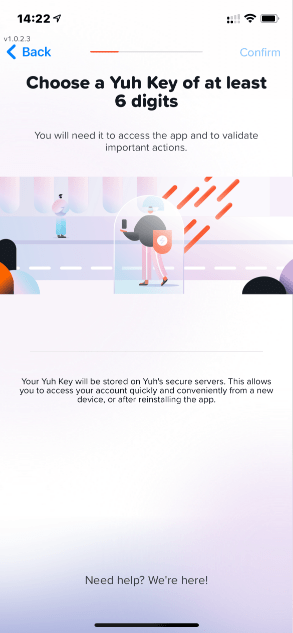

#7 Enter your Name and choose a password (Yuh key)

#8 Enter your Email

#9 Enter your full address

#10 Confirm your fiscal and financial details

#11 Enter your bonus code: YUHNEO

#13 Verify your identity

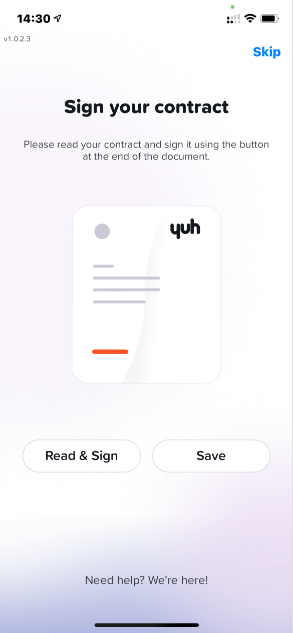

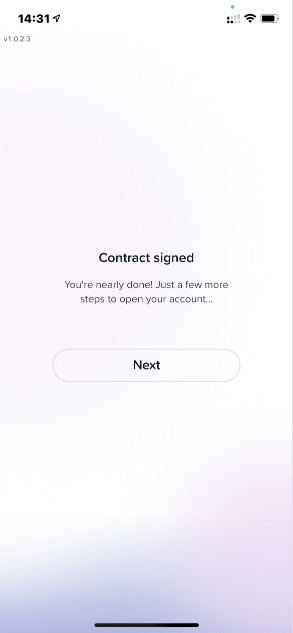

#14 Digitally sign your contract

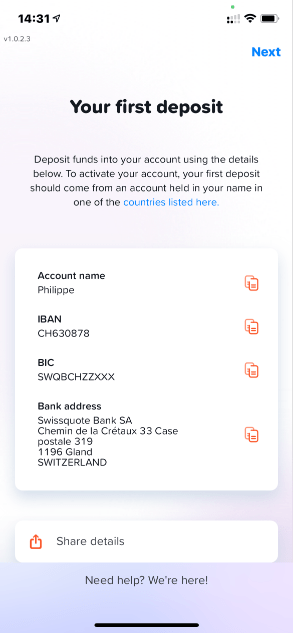

#15 Your account is – almost – opened! You just need to make small deposit: 10 CHF is enough

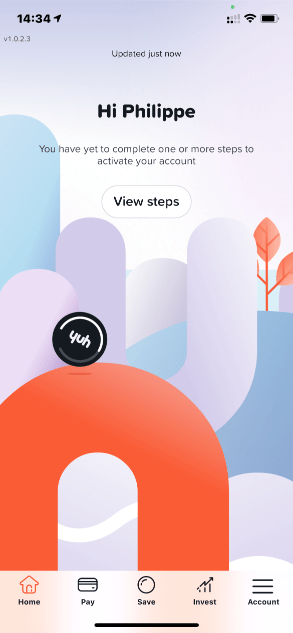

Your Yuh account is now open 🙌

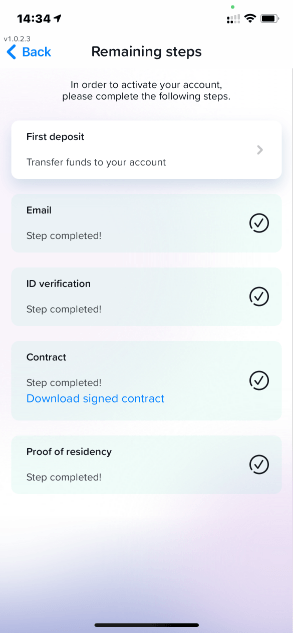

But until your first deposit is done, you will only have a limited access to the Yuh app:

The Yuh Bank account allows you to make all standard transactions (bank transfer, direct debit, etc.) like with any Swiss bank account.

The MasterCard Debit card is free and – as per usual in Switzerland – your receive 2 letters: 1 for the card and 1 for the PIN code.

Yuh for Foreigners and Non-Residents

Yuh Bank stands out among Swiss neobanks by allowing non-residents from neighboring countries like France, Germany, Austria, Italy, and Liechtenstein to open an account, which sets it apart from competitors like Neon and Zak, both of which do not offer this option. This flexibility makes Yuh a top choice for cross-border workers and expats who need access to a Swiss account. In contrast, alternatives like Neon and Zak require Swiss residency, limiting their appeal to international users.

To explore more about non-resident options, check our comprehensive articles on 4 Ways to Open a Swiss Bank Account for Non-Resident and Neobanks for Non-Residents & Cross-Border Workers in Switzerland.

Our Experience Opening a Yuh bank account

- Quick opening process completed in 22 minutes

- No revenue requirement

- Swiss neobank

- Multi-currency account including CHF, EUR, USD and GBP

- Physical card and virtual card

- Too many questions, we feel the SwissQuote process behind

- The card was delivered after 2 weeks (out of stock apparently)

- Too many mails

We like the guided opening process, even though there are many questions and letters. -2 points

The Yuh Bank opening process gets a rating of 8/10Yuh App Features Review: 8/10

Yuh App Features List

As a neobank, Yuh Bank offers all their services through a mobile application. That means it’s possible to do almost everything from your smartphone:

- Access your payments history

- Make new payments

- Use eBill

- Pay with Yuh TWINT

- Pay with a virtual card

- Scan and upload invoices in Swiss format

- Block and replace your card for free

- Change your PIN code

- Update your phone number + all personal details

- Trade shares / ETFs / Trading Themes / Crypto-currencies

- Buy bitcoins

- Exchange currencies

- Open a Junior account

- Create sub-account in other currencies

- Take advantage of the Yuh Savings plan

- Open a Pillar 3a account with Yuh 3A

But some features are missing:

- Joint account

- Instant payment (coming soon)

- No direct debit procedure (LSV)

- No settings for card limits beyond the Monthly limit

- Not possible to create and share space

- No chat support (on the roadmap)

About currencies and crypto-currencies:

- Foreign currency exchange is only available during open hours

- Bitcoin trading is only in USD and EUR (the same for all the other cryptocurrencies), meaning that you have to convert CHF or EUR before buying Cryptos.

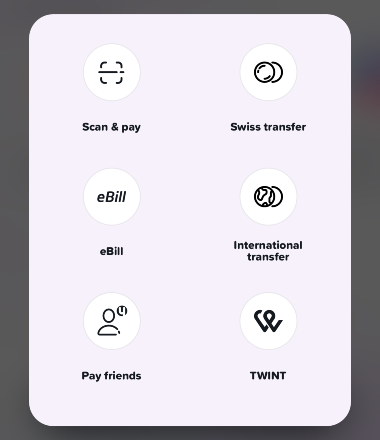

Yuh App Payment Options

Yuh offers great flexibility for managing your payments, whether it’s transfers within Switzerland or internationally, or options like eBill.

Payment Options with Yuh

Transfers in CHF within Switzerland are free and instant via Yuh. You can easily transfer money to another Swiss bank account by entering the recipient’s IBAN and the desired amount.

For international transfers, Yuh charges a fixed fee of 4 CHF per international transfer, with an additional 0.95% currency conversion fee if the transfer involves a foreign currency. This option is ideal if you need to make payments outside of Switzerland.

Make a Transfer with Yuh

Making a transfer with Yuh is a simple and quick process. Here are the detailed steps to make a transfer:

- Access the Payment section: From the app’s home screen, go to the “Pay” section by tapping the icon in the bottom menu, then select “Payment” or “Quick Pay”.

- Choose the type of transfer: Select whether you want to make a domestic transfer within Switzerland or an international transfer.

- Enter the recipient’s information:

- For a domestic transfer, you’ll need to provide the recipient’s IBAN.

- For an international transfer, you may need to specify the currency in addition to the IBAN.

If the recipient is already in your contact list, simply select them. Otherwise, add a new contact by providing the necessary details.

- Enter the amount and currency: Specify the amount you want to transfer. If you’re sending funds in a currency other than CHF, Yuh will automatically apply a conversion rate. Note that a 0.95% fee will be added for transfers in foreign currencies.

- Add a reference (optional): If you have a reference or message to send to the recipient, enter it at this point.

- Review the details: Before confirming the transfer, take a moment to review all the details (amount, recipient, IBAN) to ensure everything is correct.

- Confirm: Once everything is verified, tap “Confirm”. The transfer will be processed. You will receive a notification once the transfer is complete, typically instantaneously for domestic transfers and within a few days for international transfers.

Scan & Pay

Yuh simplifies bill payments in Switzerland with the Scan & Pay option. By simply scanning the QR code on a bill with your smartphone’s camera, the app automatically captures the necessary payment details. Once verified, you can confirm the payment.

eBill

eBill allows you to receive and pay your bills directly from the Yuh app. Once registered for the eBill service, your electronic bills will appear directly in the app, ready to be paid in one click. This service is convenient for managing recurring bills without manual processing.

Pay a Friend

With the Pay a Friend option, Yuh allows you to transfer money to your friends instantly, directly from the app. You only need the recipient’s phone number or email address to send them money in a few seconds, without having to enter an IBAN.

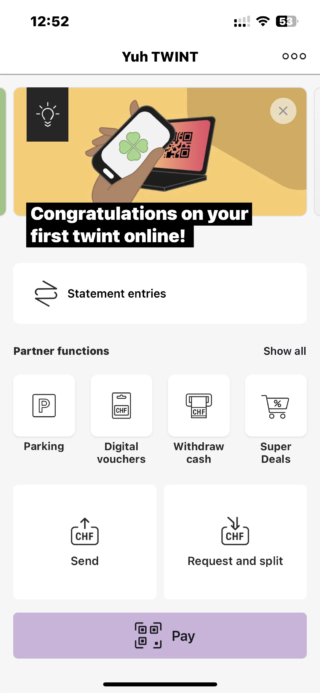

Yuh TWINT

Yuh quickly launched its Yuh TWINT app, which integrates seamlessly with the main Yuh app. With Yuh TWINT, you can make mobile payments throughout Switzerland, enhancing the overall convenience and flexibility of using Yuh Bank. As TWINT is one of the most popular payment methods in Switzerland, its integration with the Yuh app makes everything from shopping to peer-to-peer payments possible on your smartphone.

Yuh TWINT App

Common Yuh TWINT issues:

- If Yuh TWINT is not working, try restarting the app or checking for updates. Some users have reported seeing the error “Yuh TWINT: An error has occurred“, which might indicate server or connection issues.

- Another aspect to be aware of is the default Yuh TWINT limit, which sets daily and monthly payment limits. If your limit is too low to process larger payments, you can request to increase the Yuh TWINT limit. This can typically be done by contacting Yuh Bank support or adjusting the settings in the app.

- Users with foreign numbers, especially those with a German or French number, may encounter issues when using Yuh TWINT. In such cases, contacting customer service may help resolve compatibility problems.

Yuh TWINT is a significant advantage over other Swiss neobanks because it offers a dedicated app fully integrated into the Yuh banking ecosystem. While other neobanks like Neon and Alpian don’t provide their own TWINT solutions yet, they rely on alternatives like TWINT Prepaid or UBS TWINT. This sets Yuh Bank apart, as users can manage their mobile payments directly within the Yuh app without needing external services.

It’s also worth noting that international neobanks like Revolut and N26 do not offer TWINT support, making Yuh’s integration of TWINT a crucial feature for Swiss residents looking for seamless mobile payment options within their local context.

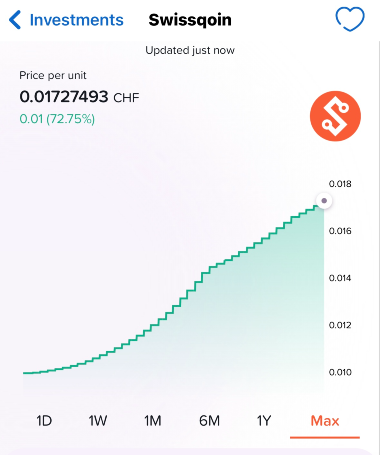

Yuh Swissqoin (SWQ): Price and evolution

Yuh Bank offers a unique loyalty program in the form of Swissqoins (SWQ), a cryptocurrency developed by Yuh and based on the Etherum blockchain.

The initial 250 SWQ are earned upon your account opening, then every time you make a transaction with your Yuh Mastercard or purchase an investment product, you earn Yuh Swissqoins. These coins can be held for future value growth or exchanged for Swiss francs.

Yuh Swissqoins (SWQ)

In February 2026, 1 SWQ = CHF 0.02 , so 250 SWQ = 5 CHF

The value of Swissqoins is tied to Yuh’s performance, and a portion of Yuh’s revenue is reinvested in the currency, which has led to its value rising from CHF 0.10 at launch to CHF 0.02 in February 2026. Additionally, Swissqoins are periodically burned when users exchange them, further contributing to their potential value increase.

Yuh Joint Account

As of now, Yuh does not offer a Yuh joint account option, which may be a drawback for couples or shared financial management. However, if you’re specifically looking for a joint account, you can explore Neon Duo, the only Swiss neobank that provides this feature. Neon Duo allows two users to manage a single account together seamlessly, making it ideal for shared finances.

For more international options, N26 and Revolut also offer joint accounts, giving you the flexibility to manage shared expenses with someone else. While Yuh continues to focus on individual accounts, a joint account option could potentially be introduced in the future, expanding its appeal.

Yuh Junior Account

Yuh now offers Yuh 14+, a free Swiss bank account designed for teenagers aged 14 to 17, giving them their first taste of financial independence in a secure environment.

What Yuh 14+ offers:

- Free Mastercard and TWINT for everyday spending and school trips

- 1 free ATM withdrawal per week anywhere in Switzerland

- No transaction or exchange fees, in Switzerland or abroad

- No overdrafts – spending is limited to the available balance

- Funds protected up to CHF 100,000

- No investing yet, but teens can follow the markets and favorite brands in the app

Young users can open the account on their own directly via the Yuh app, without needing parental approval.

If you’re looking for an account for an older teenager, Neon and Zak allow account opening from age 15. These options are better suited for young adults ready for a standard bank account.

Yuh Savings account & Interest

With Yuh, you can enjoy low fees while earning interest on your savings, regardless of whether your money is in the Pay or Save section of the app.

Here is a comparison of Yuh interest rates in February 2026 with other Swiss neobanks:

| Neobank | Interest Rate | Interest Cap | Withdrawal Limit |

|---|---|---|---|

| Alpian | 0.15 % | Above 125,000 CHF. 0.01 % below. | None |

| Neon | 0.00 % | - | None |

| Yuh Bank | 0.00 % | - | None |

| Zak | 0.05 % | Up to CHF 25,000 | None |

The Yuh Savings Plan is designed to help you grow your savings effectively. It allows you to set aside funds for specific goals with flexible saving options tailored to your financial needs. The plan features no maintenance fees, ensuring that your savings are not diminished by hidden costs.

To learn more and compare Yu’s interest rates with other Swiss neobanks, read our article Yuh Bank Interest Rates in February 2026

Yuh 3a : Your Pillar 3a Account with Yuh

Yuh 3a offers a straightforward and affordable solution for anyone looking to save for retirement with an all-inclusive annual management fee of 0.50%. This fee covers custody fees, investment fees (TER), currency exchange, management fees, strategy changes, deposits, withdrawals, and account opening/closing.

The Yuh finance app provides an accessible option for managing your Pillar 3a account. You can select from five investment strategies, with stock allocations ranging from 20% to 98%, depending on your risk tolerance :

- Mild with 20% in equities

- Hearty with 40% in equities

- Spicy with 60% in equities

- Sharp with 80% in equities

- Fiery with 98% in equities

But Yuh’s Pillar 3a has its limitations. You’re limited to one account, and the predefined portfolios don’t allow for much customization, which could be a drawback if you prefer more control over your investments.

If you’re looking for more flexibility, Zak retirement savings account could be a strong alternative, offering a different approach to retirement savings.

To understand how it works and all the benefits, you can read our full review of Yuh 3a.

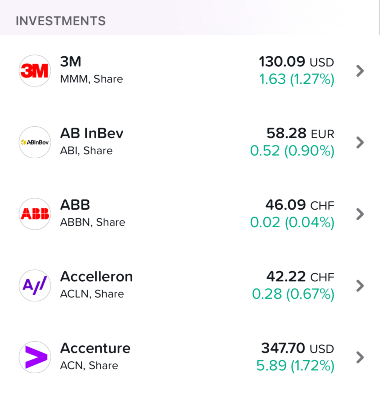

Invest with Yuh Finance App

Yuh offers a straightforward way to save and invest, giving you access to over 305 stocks, 58 ETFs (including ETFs with 0% management fees as part of the Yuh ETF savings plans.), and 38 cryptocurrencies. With fractional trading, you can purchase portions of shares, allowing for greater flexibility in building your portfolio.

Yuh’s fees are competitive, with no account management or custody fees. Trades on Swiss and foreign stocks and ETFs each have a 0.50% fee, while cryptocurrency trades incur a 1% fee. Like Neon Invest and Guided by Alpian, Yuh waives custody fees, reducing overall investment costs. However, stamp duties, TER fees, and a minimum trading fee of 1 CHF still apply.

For more information on investment options and the features of Yuh, check our review of Yuh Investment. This will provide you with additional details on using the platform and its benefits.

Our View on Yuh App Features

In summary, Yuh has all the essential features you would expect from a modern neobank, including multi-currency account, seamless payments, and investment options like stocks, ETFs and cryptocurrencies. It also has some unique features like fractional trading, so you can buy parts of shares, which is great for investors who want to diversify their portfolios.

But some advanced or “comfort” features like joint accounts (offered by Neon Duo) and junior accounts are still missing. While Yuh is great at being simple and user friendly, adding these extra features would make it more appealing to a wider range of users. Overall, Yuh is a strong player in the neobank space.

Yuh app features get a rating of 8/10Yuh Credit Card Review: 9/10

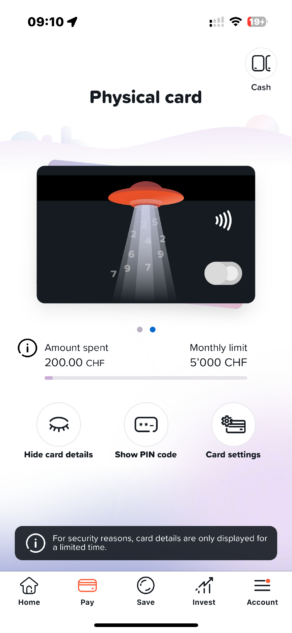

Yuh MasterCard Debit card

Yuh Bank offers a free MasterCard Debit card. It comes in black, similar to the premium cards offered by N26 and Revolut.

The Yuh Mastercard is delivered in a nice black cardboard sleeve:

Yuh Debit Card

The MasterCard is very good for travelling and is compatible with Apple Pay, Google Pay and Samsung Pay.

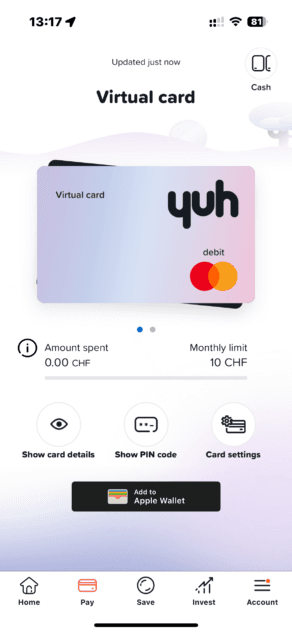

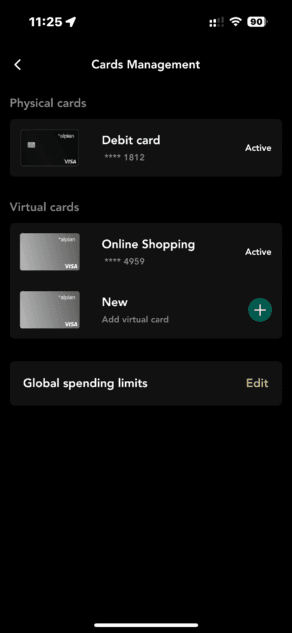

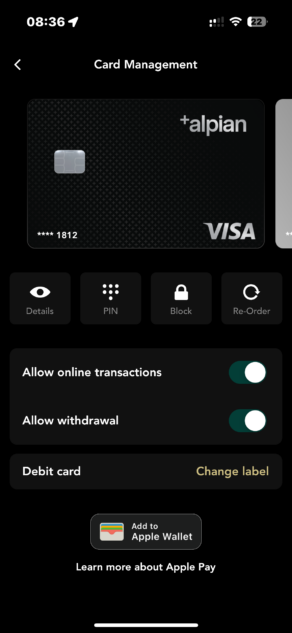

Yuh Virtual Card

Yuh offers a virtual card for online shopping, providing a secure option for digital purchases. But Yuh only allows for a single virtual card while with Alpian, you have the flexibility to create multiple virtual cards for added security and convenience, which you can delete as needed.

Yuh Virtual Card

Alpian Virtual Card

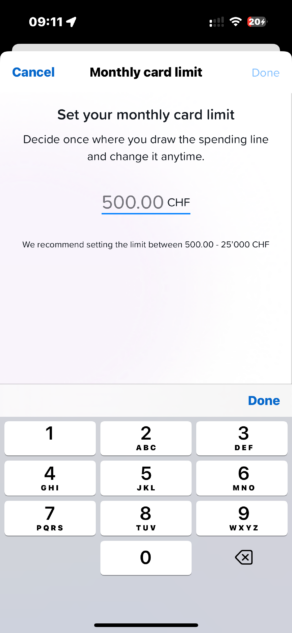

Yuh Card Limits

Yuh applies the following limits on the use of its debit card:

| Card Limits | Amount |

|---|---|

| Card Payments | 25,000 CHF/month |

| Daily Withdrawal Limit | 1,000 CHF/day |

| Monthly Withdrawal Limit | 10,000 CHF/month |

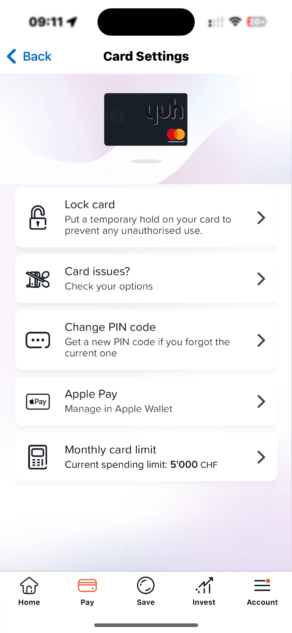

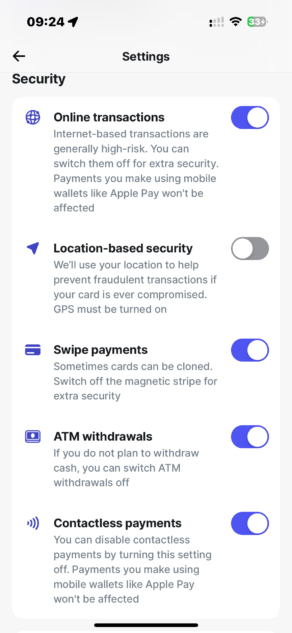

Yuh Card Settings

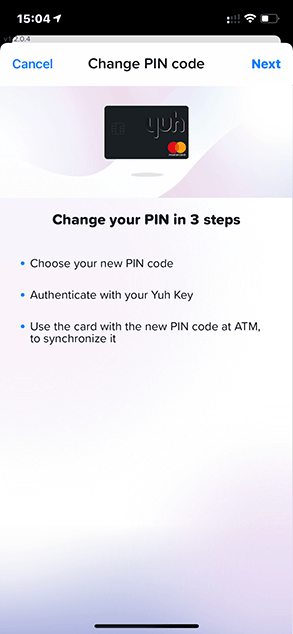

The Yuh card settings allow you to:

- View card information: card number, expiration date, and CVV

- View your PIN

- Change your PIN

- Temporarily block the card

- Add the card to Apple Pay

- Adjust the monthly limit

Note: If you change your PIN, you need to validate it at an ATM machine.

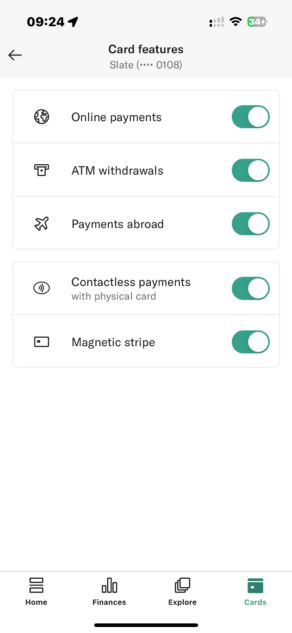

Unlike Alpian, N26 and Revolut, Yuh does not yet offer certain card usage restrictions, such as:

- Online payments (Alpian, N26 & Revolut)

- Cash withdrawals (Alpian, N26 & Revolut)

- Contactless payments (N26 & Revolut)

- Magnetic swipe payments (N26 & Revolut)

- Foreign transactions (N26)

- Geolocation restrictions (Revolut)

Alpian Card Settings

N26 Card Settings

Revolut Card Settings

While the Yuh card is efficient, it still lacks a few features to be perfect.

Yuh Bank card rating: 9/10Yuh Bank Fees: 9/10

Yuh being a neobank based in Switzerland, fees are displayed in CHFYuh Private Account Fees

The Yuh plan is free that includes a free MasterCard Debit card.

- From : 0 CHF/month

- Account maintenance : via iPhone or Android mobile app

- Credit card : Debit MasterCard

Yuh MasterCard Fees

- Yuh MasterCard: Free and includes free delivery.

- Yuh MasterCard Delivery: Free

- A card replacement is charged 20 CHF.

Cash Withdrawals Fees in Switzerland

Yuh allows 1 free cash withdrawal per week (equivalent to 4 per month) at Swiss ATMs. After that, a transaction fee of 1.90 CHF applies for each additional withdrawal, with a monthly withdrawal limit of 10,000 CHF.

These conditions apply to both CHF and EUR cash withdrawals in Switzerland.

Cash Withdrawals Fees and Payment Fees Abroad

If you travel often or manage your finances internationally, Yuh has you covered. Transactions with the Yuh debit card are automatically processed in the corresponding currency, so there are no extra transaction fees when using one of the 12 supported currencies:

- AED (UAE Dirham)

- AUD (Australian Dollar)

- CAD (Canadian Dollar)

- CHF (Swiss Franc)

- DKK (Danish Krone)

- EUR (Euro)

- GBP (British Pound)

- HKD (Hong Kong Dollar)

- JPY (Japanese Yen)

- NOK (Norwegian Krone)

- SEK (Swedish Krona)

- USD (US Dollar)

You might think that Yuh is cheaper than Alpian and Neon, which both charge fees for payments in foreign currencies. But Yuh applies a 0.95% currency exchange fee if you’re paying in a currency not supported by Yuh. Additionally, when converting funds between sub-accounts (for example, from CHF to EUR), the same 0.95% fee applies. So, while Yuh can be convenient, it’s worth considering these fees carefully before using Yuh abroad.

For cash withdrawals abroad, Yuh charges 4.90 CHF in transaction fees per withdrawal, which is actually more expensive than Neon, which charges 1.5% per withdrawal, unless you withdraw more than 300 EUR (or the equivalent in another currency).

Fees and Transfer Limits

When it comes to transfers with Yuh, several fees and limits apply depending on the currency and the destination of the funds. Here are the key points to consider:

- Daily transfer limit: No specific limit.

- Monthly transfer limit: No specific limit.

- International transfer fee: 4 CHF per transfer, plus a currency conversion fee of 0.95% if the transfer involves a foreign currency.

- Transfers in CHF or EUR (SEPA): No fees for EUR transfers within the SEPA zone or CHF transfers within Switzerland.

- Currency conversion between sub-accounts: A 0.95% fee applies to each conversion between sub-accounts in different currencies (e.g., converting CHF to EUR).

These limits and fees are important to consider, especially if you make international transactions or frequent transfers.

Yuh Tax Statement

Yuh charges 25 CHF for the tax statement in PDF format with barcodes.

This eTax statement simplifies your tax filing by automatically compiling all your transactions, investment positions (stocks, cryptocurrencies, etc.), as well as the interest generated on your account. It saves you time and avoids the need to manually enter each transaction when preparing your tax return.

If you use Yuh only for basic banking operations, such as payments and savings, this tax statement is not necessary. You can simply declare your account balance as of December 31 and the annual interest in your tax return.

Our View on Yuh Account Fees

Yuh offers a free account and a free MasterCard Debit, making it a very competitive option. However, the 4.90 CHF fee per withdrawal abroad and the 0.95% currency exchange fee increase the costs if you travel or make frequent payments abroad. This is why we deduct 2 points from Yuh for its fees.

Yuh Bank pricing receives a rating of 9/10 YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Yuh Customer Service Review: 8/10

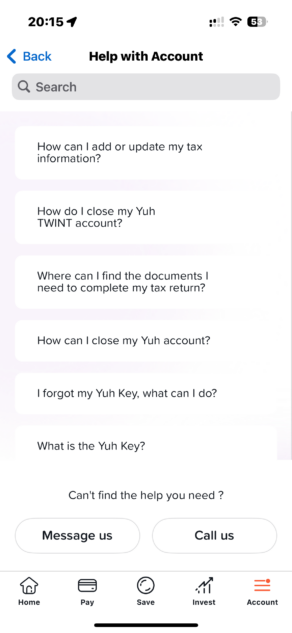

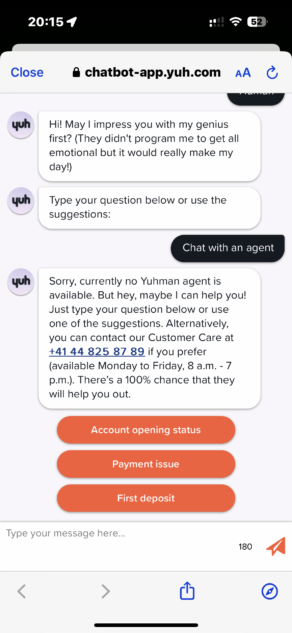

How to contact Yuh?

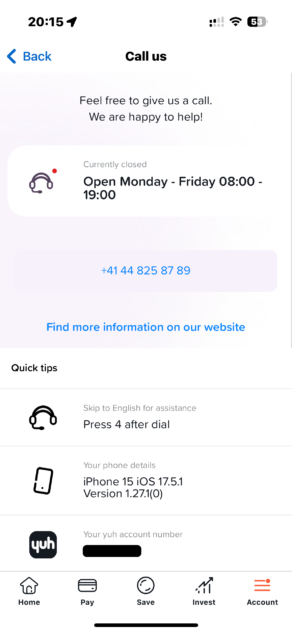

To contact Yuh, you must first go through the Online Help, then you have 2 options:

- Contact support via online messaging by saying “agent” or “human” to the Chatbot

- Contact Yuh support by phone with a non-premium number: +41 44 825 87 89

In both cases, agents are available from Monday to Friday, from 8:00 a.m. to 7:00 p.m.

The customer support offered by phone is very good and the advisors respond quickly.

Yuh Address

Yuh’s address is the same as Swissquote’s, which means that they share their office:

Yuh Ltd

Chemin de la Crétaux 33

PO Box 319

1196 Gland

Switzerland

Our View on Yuh customer service

Phone support at Yuh is quick and efficient, with friendly staff who respond promptly to calls. However, there is room for improvement, particularly by introducing in-app live chat support, as seen with competitors like N26. Such a live chat would significantly simplify customer interactions and increase availability outside regular business hours. Extended support availability, especially on weekends, would be desirable.

On a positive note, Yuh consistently responds to negative reviews on the App Store and Google Play in a timely manner, showing that the company actively works to improve the customer experience. Introducing a live chat feature could elevate Yuh’s customer service to the next level, enhancing user expererience even further.

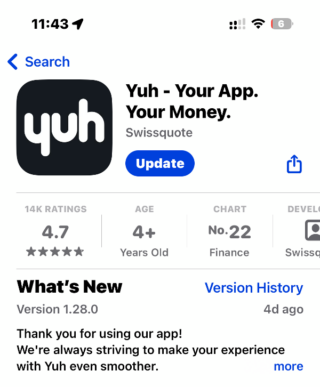

Customer service receives a rating of 8/10Yuh App Customer Reviews and User Experience: 9/10

Yuh App Customer Ratings

The Yuh app is currently rated 4.6 on the App Store (3.4k reviews) and 4.4 on Google Play (1k reviews). These ratings are quite good, and the reviews consistently confirm that the user experience in Yuh reviews is positive.

Yuh App Customer Reviews

We analyzed reviews on platforms like Trustpilot, the App Store and Google Play to better understand what users think about Yuh. The feedback shows that practical features, accessibility, and a pleasant user experience are particularly valued. Here are the most common points mentioned in their reviews:

- Ease of use and accessibility: Many users, like Robin Eicher and Vadim Slynko, appreciate the simplicity and intuitiveness of the app. Account opening is straightforward, transactions are quick, and financial management is clear and smooth.

- Comprehensive features: Yuh allows users to manage everything from basic banking operations to investments in stocks and cryptocurrencies. Raoul Trüeb highlights the functionality, while Andres Meyer praises the flexibility for payments and investments.

- Accessible investment options: The investment options are simple and suitable for beginners. Robin Müller finds that the range of investments is structured well to avoid confusion, yet relevant for those looking to start investing without too much complexity.

- Good customer support: The support team is generally perceived as efficient and friendly. Although some, like Elena Six, have reported difficulties, others, such as Ruxanda P., mention a responsive online support that builds trust.

- Areas for improvement: There are always aspects that could be refined. Marco Minu and Nicko Glayre note that customer service and certain features, such as exchange rates, could be optimized.

In summary, Yuh stands out with its simple yet comprehensive app that meets the daily needs and investment interests of its users. The neobank continues to evolve, incorporating user feedback, making it a solid and modern option for banking management in Switzerland.

Yuh App User Experience

Yuh, a product of SwissQuote, brings users a modern, sleek, and highly intuitive mobile banking experience. The app’s user-friendly interface has been thoughtfully designed to cater to both seasoned users and newcomers, rivaling top neobanks like N26 and Revolut. Here’s what sets Yuh apart:

- The mobile app is fluid and intuitive: The app interface is seamless, ensuring that users can easily find what they need without frustration. Navigating between functions is quick, making day-to-day banking efficient.

- Menus are clear and well organised: Yuh’s layout stands out for its simplicity. Menus are designed to be straightforward, allowing users to access their accounts, perform transactions, or manage investments with minimal effort.

- Essential features are always visible: Core banking features, such as balance checks, transfers, and investment options, are readily accessible and visible from the main dashboard, minimizing the need for unnecessary clicks or searches.

The focus on user experience makes Yuh not just a banking tool, but an enjoyable app to manage one’s finances, integrating modern tech capabilities with Swiss banking reliability.

We still withdraw 1 point because of some small navigation issues: the BACK button, for example, is annoying: each time you enter a menu, you must click on that Back button instead of having some direct links or overlay like N26 does.

Yuh Banking License and Security: 9/10

Yuh operates under the banking license of Swissquote Bank SA, which is authorized by the FINMA (the Swiss Financial Market Supervisory Authority). This arrangement allows Yuh to offer regulated financial services while ensuring compliance with Swiss financial regulations.

Your assets are held in custody by Swissquote Bank SA, keeping them separate from Yuh’s assets. This structure protects your investments in the event of bankruptcy. Additionally, customer deposits are protected up to 100,000 CHF under the Swiss Deposit Protection Act.

Yuh implements two-factor authentication (2FA) to secure access to your account. However, it is important to note that Yuh currently does not allow direct transfers of shares to another broker.

Overall, Yuh’s banking license and security measures help ensure the safety of your funds.

Neon gets a rating of rating of 9/10 for SecurityOur Final Thoughts on Yuh Bank

Yuh is a fully featured Swiss neobank, designed to manage everyday finances with ease. It offers a free CHF account, a debit card, and savings and investment features fully integrated into the app.

The interface is clear and intuitive, making payments, budgeting, and simple investments (stocks, ETFs, crypto) easy to manage. Yuh is particularly suited for users looking for an all-in-one solution without unnecessary complexity.

Like Alpian and Neon, Yuh allows you to invest directly from the app, whether in stocks, ETFs, or cryptocurrencies. Investing via Yuh Invest integrates seamlessly into the app ecosystem, making it easy to monitor and manage investments on a daily basis.

That said, a few aspects should be considered: customer support can sometimes lack responsiveness, and certain limitations apply to withdrawals or specific transactions. In addition, investment-related fees, particularly for cryptocurrencies, remain higher than those of some specialised providers.

Finally, with the integration of Yuh TWINT, Yuh further strengthens its position for mobile payments in Switzerland. This combination of services allows Yuh to remain well positioned in the Swiss neobank rankings.

👉 In summary, Yuh is an excellent option for everyday use and for centralising payments, savings, and simple investments. However, it may be less suitable for users looking for advanced banking support or more specialised features.

Who is Yuh for?

Yuh is for you if you’re looking for a simple and modern solution to manage your payments, savings, and investments from a single app.

It is particularly suitable if you want to centralise your finances without complexity, with a smooth and intuitive user experience for everyday use.

Yuh is ideal for daily use, especially for mobile payments, budget management, and simple investments. However, if you are looking for advanced banking support or more specialised features, other solutions such as Alpian may be more suitable.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Yuh Bank Alternatives

Yuh vs Neon vs Zak

Here is our quick comparison table to help you choose between Yuh, Neon, and Zak.

| Yuh | Neon | Zak | |

|---|---|---|---|

| Overall rating | 8.6/10 | 8.4/10 | 7.9/10 |

| Free account with free card | 👍 | 👍 | |

| Minimum age | 14 years | 15 years | 15 years |

| For use in Switzerland | 👍 | ||

| For travel | 👍 | ||

| For free SEPA transfers | 👍 | ||

| For payments abroad | 👍 | ||

| For a joint account | 👍 | ||

| For Trading | 👍 | 👍 |

To find out how each criterion is evaluated, read our article Yuh vs Neon vs Zak.

Yuh vs Neon

For a quick decision, here is a comparison table between Yuh and Neon:

| Yuh | Neon | |

|---|---|---|

| Overall rating | 8.6/10 | 8.4/10 |

| Free bank account with free debit card | 👍 | |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 | |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 250 SWQ+50 CHF Trading Credits with our promo code |

To find out how each criterion is judged, read our article Yuh vs Neon – Comparison of February 2026

Yuh vs Revolut

For a quick decision, here is a comparison table between Yuh and Revolut:

| Yuh | Revolut | |

|---|---|---|

| Overall rating | 8.6/10 | 7.7/10 |

| Free bank account with free debit card | 👍 | |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 cash withdrawals above 300 CHF | 👍 cash withdrawals up to 300 CHF/m. |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 250 SWQ+50 CHF Trading Credits with our promo code |

To find out how each criterion is judged, read our article Yuh vs Revolut – Comparison of February 2026

Yuh vs N26

For a quick decision, here is a comparison table between Yuh and N26:

| Yuh | N26 | |

|---|---|---|

| Overall rating | 8.6/10 | 7.7/10 |

| Free bank account with free debit card | 👍 | |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 withdrawals above 600 CHF | 👍 up to 600 CHF/m. |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 250 SWQ+50 CHF Trading Credits with our promo code |

To find out how each criterion is judged, read our article Yuh vs N26 – Comparison of February 2026.

Frequently Asked Questions (FAQ) about Yuh Bank

✅ Does Yuh Bank offer promo codes or referral codes for new users?

Yes, Use the promo code YUHNEO to get 50 CHF in Trading Credits and 250 SWQ (worth 4 CHF) 🙌 if you sign up for Yuh Bank before February 28, 2026. Get the Yuh app ➡️

✅ What is Yuh Bank?

Yuh Bank is a Swiss neobank created by PostFinance and Swissquote, and now fully owned by Swissquote. It offers a mobile app for managing free multi-currency accounts, investing in stocks, ETFs, and cryptocurrencies, saving with Pillar 3a, and making mobile payments via Mastercard and TWINT. All banking is done digitally through the app.

✅ Is Yuh a safe bank?

Yuh ensures the safety of your funds and investments by partnering with Swissquote, a well-established Swiss bank regulated by FINMA (the Swiss Financial Market Supervisory Authority). All deposits are protected under Swiss law, with customer deposits insured up to CHF 100,000 in the event of bank insolvency. Yuh users also retain full rights to their securities, which are kept separate from Swissquote’s assets. This means that even in the unlikely event of a bankruptcy, your investments remain secure. Additionally, the platform offers high-level encryption and two-factor authentication to protect your data and transactions.

✅ Who can open an account with Yuh?

The Yuh account can be opened only by residents of Switzerland, Germany, Italy, France, Austria and Liechtenstein.

✅ How do I open an account with Yuh Bank?

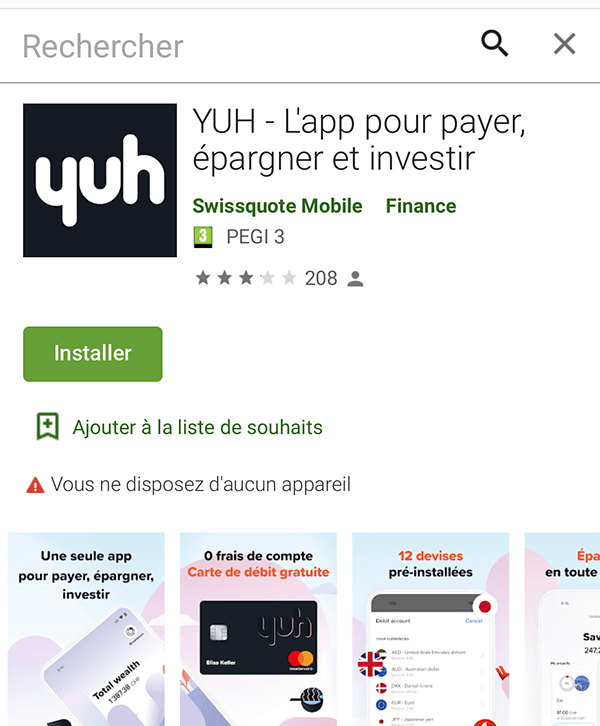

To open an account, download the Yuh app from the App Store or Google Play Store, follow the registration process, and provide necessary identification documents. The process is fully digital and designed for ease of use.

✅ What types of accounts can I open with Yuh Bank?

Yuh Bank offers private accounts and savings plans. Additionally, it provides Yuh investment accounts for trading in various financial instruments like stocks and ETFs.

✅ Does Yuh offer an account for teenagers?

Yes, Yuh now offers the Yuh 14+ account, which is available for young people aged 14 to 17. It’s a free account with a Mastercard and TWINT, ideal for teens to learn money management independently.

✅ Are there any fees associated with Yuh Bank accounts?

Yuh Bank generally offers fee-free banking for standard services. However, specific transactions or premium features might incur fees. Refer to the Yuh app or website for details.

✅ Does Yuh Bank offer a debit or credit card?

Yes, Yuh Bank provides a debit card for everyday transactions. Credit card options may be available depending on your financial profile and needs.

✅ Can I use Yuh Bank for international transactions?

Yes, Yuh Bank supports international transactions. Fees and exchange rates may apply for cross-border payments or currency conversions.

✅ How does Yuh Bank ensure the security of my account?

Yuh Bank employs high-security standards including encryption, two-factor authentication (2FA), and regular security audits to protect user data and transactions.

✅ Does Yuh Bank support mobile payments?

Yes, Yuh Bank supports mobile payment systems such as Apple Pay and Google Pay for convenient and secure transactions.

✅ What features are available in the Yuh app?

The Yuh app includes features like account management, transaction history, fund transfers, investment tracking, and access to customer support.

✅ How can I download the Yuh app?

You can download the Yuh app from the App Store for iOS devices or the Google Play Store for Android devices. Search for “Yuh Bank” and follow the installation instructions.

✅ How do I log in to my Yuh account?

To log in to your Yuh account, open the Yuh app and enter your login credentials. Follow the prompts for any additional security checks, such as two-factor authentication.

✅ What is the SWIFT code or BIC code of Yuh?

Yuh uses Swissquote’s SWIFT code: SWQBCHZZXXX.

✅ What is the transfer limit at Yuh?

There is no transfer limit at Yuh.

✅ Can I deposit cash at Yuh?

Yes, it is possible to deposit cash by using the PostFinance “QR-Invoice” generator and going to a post office. Follow the steps provided in the Yuh app or website.

✅ What is Yuh's address?

Yuh’s address is the same as Swissquote’s:

Yuh Ltd

Chemin de la Crétaux 33

Case postale 319

1196 Gland

Switzerland

✅ Does Yuh offer children's accounts?

No, Yuh does not currently offer bank accounts for children.

✅ Does Yuh offer joint accounts?

No, Yuh does not offer joint accounts yet. The only Swiss neobank offering joint accounts is Neon with its Neon Duo offer.

✅ Is Yuh available for non-residents?

Yuh is primarily targeted at Swiss residents. Non-residents may have limited access or face restrictions depending on their country of residence.

✅ Can I open a joint account with Yuh Bank?

As of now, Yuh Bank does not offer joint accounts. Information about joint accounts can be obtained from Yuh Bank’s customer support.

✅ Is there a minimum deposit required to open a Yuh Bank account?

Yuh Bank accounts typically have low or no minimum deposit requirements, making them accessible to a broad range of users.

✅ What is the difference between Yuh and PostFinance?

Yuh is a digital banking service with a focus on mobile banking and investments, while PostFinance offers a broader range of financial services including traditional banking and postal services. Yuh and PostFinance operate separately and have distinct features.

✅ How do I access Yuh Bank’s PostFinance services?

Yuh Bank and PostFinance are separate entities. To use PostFinance services, you would need to open an account directly with PostFinance. Yuh Bank does not integrate PostFinance services within its platform.

Updates

- Yuh is now 100% owned by Swissquote.

- Yuh now offers a Yuh 14+ account for young people and teenagers.

- Want to invest with Yuh? Read our complete review of Yuh Investment

- YUH Bank now offers eBill.

- YUH Bank is now compatible with Apple Pay.

- Yuh TWINT is now available

- Take advantage of interest rates at Yuh

- YUH Bank launches its Pillar 3a offer: Yuh 3A

Sources:

People also searched: Yuh review, Yuh experience, Yuh test, Yuh users, Yuh mastercard.

Additional information

Specification: Yuh Bank Review (February 2026): Everyday Banking & Investing

| Trading | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Account | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

Xavier –

Through the reviews I can see that I’m not the only one facing security issues with YUH. Indeed, they authorized on my account, without any confirmation or validation from me, an automatic debit for the recovery of a French fine of someone from Spain whereas I am Swiss and with all the evidences on the mistaken identity (date of birth, address, nationality, vehicle, license plate, etc.) and even if they admit there’s a mistake on the identity, they refuse to cancel the transaction and return the funds.

I also use Neon, which is much more reliable, it is Swiss and with an excellent support, as well as Revolut, more complete with many more advantages and with a better management and fees for multi-currency transactions.

David –

It would be important to mention that Yuh is not a reliable App for investments.

If for some reason they delist a crypto, as it happened for example with “Augur” your funds will be blocked for months.

A lot of customers are affected by this unfair activity, funds blocked since 29th March and no solution from Yuh (Only repeating “it will be available as soon as possible”).

So my personal suggestion is not to invest with them, otherwise you are taking a big risk.

Sam –

Yuh is cheap and works okay but the app is as if they try to make it bad. No export of bankstatements in any form possible to import into any other program like a simple csv. The activity view does not allow any useful simple filter like search of a text or filter by value, and is even clutterd with some 2C$ion transactions which have no informational value.

Literally the worst app I ever used, not because it is badly done but because it has some super simple to fix big flaws that have to be on purpose, maybe so you choose a non online bank instead and pay up.

Sikandar –

Reasonable Neobank, but not for first timers (people looking to open their first bank account). Has a significant blocker. You need to have a pre-existing account with a traditional bank in Switzerland/Lichtenstein or some of the EU countries to actually open a Yuh account.

havoc –

I recently went through the steps to create a Yuh account. As a last step, they ask you transfer some money. So far, so good.

After a week of awaiting the account creation, I received a message about providing additional information. Specifically, they wanted to know the name of my employer and details about my job/position (main tasks/responsibilities, if it’s a management position, etc.).

I was not willing to provide all the information, but told them the industry and that I’m working for a Swiss company. But they insisted and wanted more information, so I asked them to cancel my application and refund my money. They will now do so, but according to the lady on the phone it will take around two months.

By the way: It took several attempts with a long waiting time (more than an hour) to reach them by phone.

Max –

Another thing to mention is that Apple Pay is only partially supported. Since roughly end of 2024 the pushed an update the only let’s you activate Apple Pay on devices that can run the Yuh App (i.e. your phone). Since that update it is no longer possible to activate Apple Pay on Macs/iPad. I had customer service confirm that.