Guided by Alpian after 9 Months: 7.76% Performance

Updated:

| Features | 9 |

|---|---|

| Services | 9 |

| Performance | 9 |

| Fees | 8 |

Here’s my in-depth review of Guided by Alpian after 9 months of using it. I go through the investment guidance, personalized strategies, and overall performance I get through the platform, how it impacts my financial journey, and whether it’s suitable for others looking for investment guidance.

Description

9 months ago I decided to try the portfolio management offered by Alpian, a Swiss digital private bank specialized in ETF investment and wealth management. I chose the management mandate “Guided by Alpian” with a “Balanced” profile, for a good mix of growth and security.

So here are the results. With a deposit of CHF 52,000 and 7.76% performance it’s time to dive into the portfolio composition, the solutions chosen and the approach Alpian used to manage my money and maximize my returns. This experience with Alpian allowed me to test how a digital private bank can offer personalized investment guidance.

The Mandates Offered by Alpian: Guided by Alpian and Managed by Alpian

Contrary to common beliefs about private banks, it is possible to invest with Alpian starting from CHF 10,000, making their wealth management services accessible to a larger number of investors, not just an extremely wealthy clientele.

Alpian offers two types of management mandates to meet the diverse needs of investors: “Guided by Alpian” and “Managed by Alpian”. These mandates allow investors to benefit from high-quality wealth management with expert investment advice.

Guided by Alpian: Support and Autonomy

With Guided by Alpian, you benefit from personalized advice, but the final decision on investments is yours. For someone who wants to stay involved in the ETF investment strategy while having access to the expertise of a digital private bank, this approach is ideal.

The features of Guided by Alpian are:

- Wealth management starting from CHF 10,000 investment.

- Personalized Recommendations: Alpian provides suggestions based on in-depth market analysis and your financial goals. This comes in the form of lists: Buy and Sell. These investment advice allow adjustments to the portfolio to maximize returns.

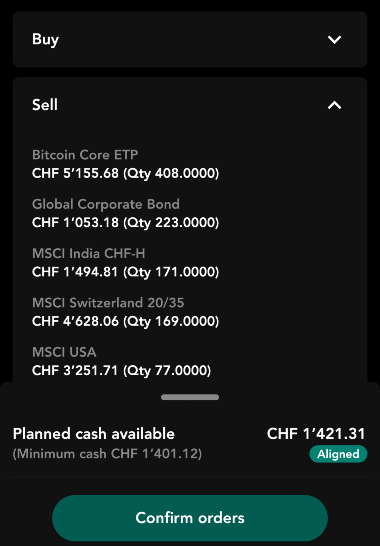

Alpian Buy and Sell ETFs Advice

- Total Transparency: Every movement in the portfolio is visible in the Alpian platform interface, allowing you to track progress and make informed decisions.

- Regular Monitoring: Regular updates and total transparency allow close tracking of portfolio performance and adjustments based on new opportunities.

- Active Involvement: This mandate gives the investor the flexibility to accept, decline, or modify suggestions, making it an excellent option for those who want to be actively involved while benefiting from expert advice.

For my part, I chose “Guided by Alpian” because I wanted to actively participate in investment decisions while benefiting from the expertise of a private bank. This allowed me to have control over the management of my portfolio while receiving clear and personalized recommendations.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Managed by Alpian: Professional Turnkey Management

Managed by Alpian offers complete delegated management, in which the Alpian team makes all investment decisions on behalf of the client. This is an ideal solution if you are looking for a turnkey service, where the portfolio is actively managed by experts in wealth management and investment advice.

The key points of “Managed by Alpian” are:

- Wealth management starting from CHF 30,000 investment.

- Delegated Management: Alpian takes care of all investment decisions, from asset selection to reallocation based on market developments, ensuring responsive and professional wealth management.

- Real-Time Adaptation: Reactivity is a major asset, as adjustments are made immediately by experts, reducing the risk of missing opportunities.

- Total Peace of Mind: The investor can focus on other aspects of life, knowing that their portfolio is managed by qualified and experienced professionals.

I did not initially choose Managed by Alpian because I wanted to retain control over investment decisions. However, I might consider switching to Managed by Alpian later if I wish to reduce my involvement or simplify management by delegating to Alpian’s experts.

Management Mandate Fees

Alpian has simple and transparent pricing for both mandates “Guided by Alpian” and “Managed by Alpian” as follows:

| Type of Fees | Fees |

|---|---|

| Guided by Alpian Fees | 0.75% per year |

| Managed by Alpian Fees | 0.75% per year |

| Custody Fees | Included |

| Transaction Fees | Included |

| Deposits/Withdrawals | Included |

| Closure of the Mandate | Included |

| Advisory Interview | Included |

| Stamp Duty | 0.075% / 0.15% of the transaction amount |

| Management Fees (TER) | Variable depending on the selected ETFs, viewable in the application |

In my portfolio the management fees (TER) of the ETFs range from 0.15% to 0.65%.

With these fees, the costs are known in advance. The absence of transaction fees is a big advantage as it allows adjusting the composition of ETFs according to market conditions without any hidden cost to the portfolio.

Regarding tax documents, you can get them directly in the Alpian app by clicking on your profile icon in the top right corner and then going to Documents > Statements.

The “Balanced” Profile with Alpian: A Growth and Security Strategy

Before we get to performance, let’s understand the strategy behind the “Balanced” profile offered by Alpian. This profile is for those who want to grow as much as possible while limiting risk through smart wealth management.

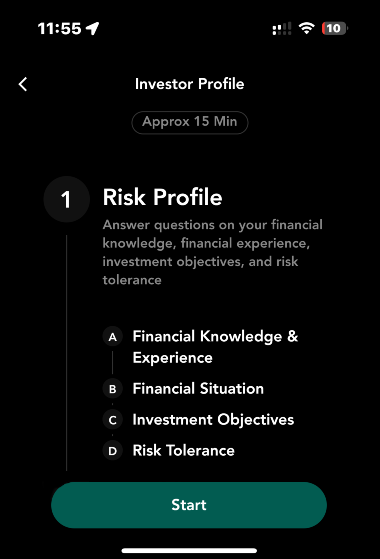

At Alpian, the investment profile is assigned through an investor questionnaire that determines each client’s risk tolerance, with profiles ranging from Defensive to Dynamic. The Balanced profile is in the middle, seeking balance between security and growth.

Alpian Investor Questionnaire

The Balanced portfolio is made up entirely of ETFs, for maximum diversification and flexibility. It covers various asset classes, stocks and bonds, across several sectors and geographic regions. This way you benefit from the growth of stocks while limiting risk with more stable bonds. Allocation is customized based on your answers to the questionnaire so each investor has a portfolio that matches their goals and risk profile.

If you want to change your investment profile, simply go back to your profile and retake the questionnaire by answering the questions differently to your risk tolerance and future plans. This way you can dynamically adjust your investment strategy to your new goals.

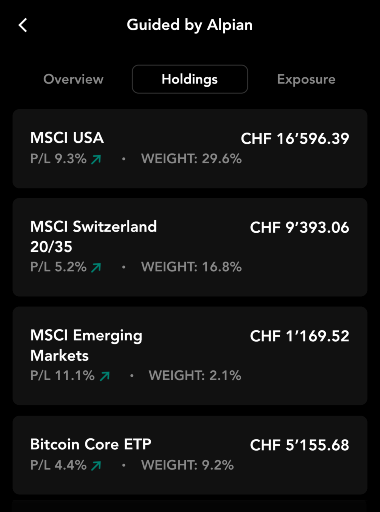

Performance of My Portfolio After 9 Months: 7.76% Growth

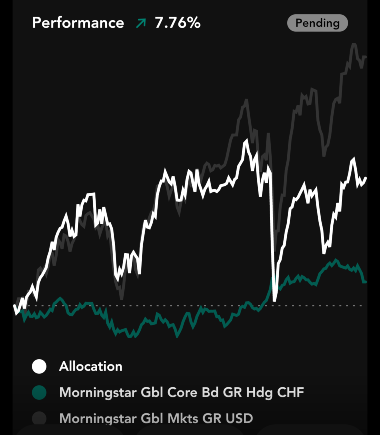

After 9 months with Guided by Alpian, my portfolio has delivered 7.76% performance, proving the “Balanced” approach with only ETFs in wealth management works.

When I started, the markets were full of uncertainties: rising rates, persistent inflation and geopolitical tensions still making headlines. Alpian managed to adapt the strategy to maximize returns. Here are the details:

- Average Growth: A performance of 7.76% despite volatile market conditions. This result is positive for a balanced portfolio composed of well-diversified ETFs in different sectors such as developed market stocks and renewable energies.

- ETFs Allocation: The allocation between different ETFs has been adjusted several times to better adapt to market opportunities. Notably, I decided during the year to add 10% of a Bitcoin ETF (21Shares Bitcoin Core ETP – CH1199067674) to the portfolio. But the significant volatility of the cryptocurrency has (for now) lowered the overall performance of my investment.

- Winning Sectors: The MSCI USA ETFs (MSCI USA hedged to CHF – IE00BD4TYL27) and MSCI Emerging Markets (Xtrackers MSCI Emerging Markets – IE00BTJRMP35) were among the drivers of this growth, generating significant returns due to rising stocks in these regions. Additionally, the MSCI Japan ETFs (iShares MSCI Japan CHF Hedged – IE00B8J37J31) and MSCI Switzerland 20/35 (UBS ETF (LU) MSCI Switzerland 20/35 – LU0977261329) also contributed positively to the performance of the balanced portfolio, thus enhancing geographic diversification.

Alpian Portfolio Extract

So here we have it, even with some personal tweaks like a Bitcoin ETF, a balanced approach with well chosen ETFs can work in uncertain markets. 9 months of investing have proven the strategy and answered the questions on how the Guided by Alpian mandate works and how it adapts to market volatility while growing.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

7.76% in 9 Months: Is This a Good Performance?

A return of 7.76% over 9 months for a Balanced portfolio is a good result, especially in 2024. The markets have been crazy with US stocks, MSCI USA is up 16.57%. The portfolio return is lower than US stocks but that’s because it reflects a prudent management aiming for a balance between growth and stability.

Guided by Alpian 9-Month Performance

The portfolio had 63% in stocks, so good exposure to rising markets and risk control through diversification. Compared to the overall equity market index, the Morningstar Global Market GR USD which went up 17.61% during the period, 7.76% is not bad for a Balanced profile.

The bonds, represented by the Morningstar Global Core Bond GR Hedged CHF index, helped to smooth out the portfolio during equity market volatility. This combination of high stock allocation (MSCI USA and MSCI Switzerland 20/35) and bonds stability allowed for growth despite market ups and downs.

Performance Reporting: A Note on Transparency

Alpian previously indicated that their reported portfolio performance is based on the Time-Weighted Rate of Return (TWR), which is the industry standard (as per GIPS) and excludes the impact of deposits and withdrawals—allowing for fairer comparisons between platforms. However, as several readers rightly pointed out, this is not clearly indicated anymore on Alpian’s app or website.

- Earlier versions of the app did mention “TWR 3.7% (ITD)”—which seemed to indicate Time-Weighted Return since inception.

- Currently, many users report seeing only P/L (Profit/Loss) since inception, without clarification on the methodology used.

- Alpian no longer explicitly references TWR in its app or on public performance pages, raising doubts about comparability and adherence to standard reporting conventions.

➡️ What this means: If Alpian now shows simple performance figures (e.g., P/L %), they may be using Money-Weighted Return (MWR) or a custom method that includes the effect of cash flows, which cannot be reliably compared to other banks or robo-advisors using TWR. For users wanting to benchmark returns fairly, this lack of clarity can be problematic.

🟡 Takeaway: While Alpian originally stated they report TWR, there appears to be a change in practice or a lack of transparency today. Until this is clarified officially and consistently displayed, readers should be cautious when comparing Alpian’s performance to that of other providers.

How Alpian Recommendations Work

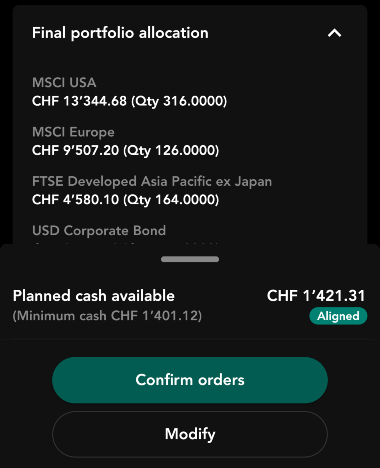

With the Guided by Alpian mandate you have access at any time to a Guidance tab where the latest recommendations from Alpian for your portfolio are displayed. These recommendations are very flexible, you can ignore, accept or modify them as you wish.

Alpian Recommendations

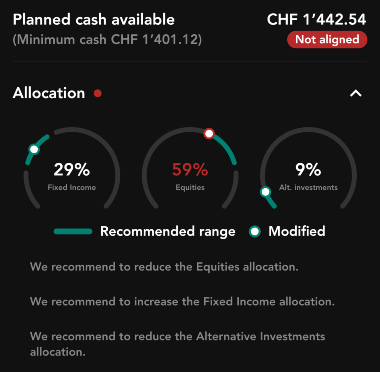

I consult these recommendations once or twice a month. Often I don’t change anything as the suggestions are small rebalancings, only a few hundred francs, which is a small part of my portfolio. But when I do change something I usually reduce the share of government bonds (personal choice) and reallocate some funds to a Bitcoin ETF, about 10% of my portfolio.

I really like the “Allocation” tab at the bottom of the screen, which helps me understand why I’m not “aligned” with my investor profile while I make changes. It’s a bit like the “robo-advisor” part of the app. Here, I actually tend to place too much weight on stocks and increase my risk with so-called “alternative” investments, like the Bitcoin ETF.

Guided by Alpian – Dynamic Advice

The interface is very intuitive, you can see exactly what will be sold, what will be bought and what the final allocation will look like after changes. This level of transparency makes decision making on portfolio adjustments much easier.

When you make a change, the system ensures that approximately 3% of cash is maintained to keep sufficient funds available to cover fees and operational costs without disrupting the portfolio, providing flexibility for efficient transaction processing.

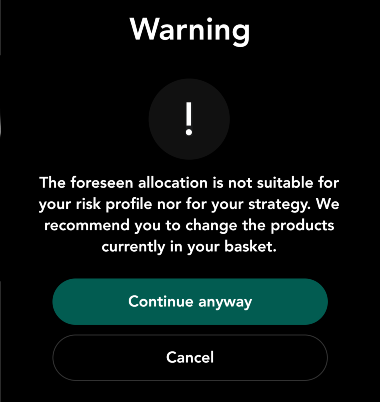

My allocation in Bitcoin ETF was not always in line with my “Balanced” profile. So each time I tried to increase the Bitcoin share I got an alert saying I was exceeding my profile limits. But I chose to ignore these alerts, I knew the risks involved.

Alpian Alert Message

Once the changes are approved, updating the portfolio is quick, usually taking between 1 and 2 days at most to be finalized.

With these options and this flexibility I can stay in control of my portfolio while having the support and expertise of a digital private bank.

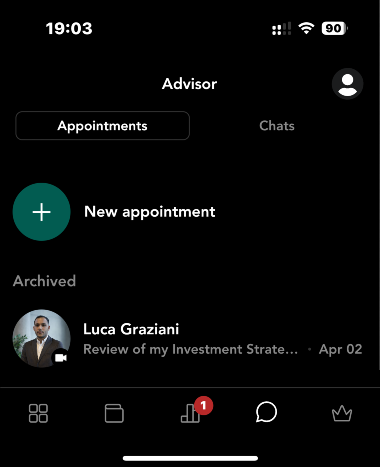

Expert Advice with Guided by Alpian

Unlike other investment platforms such as Selma, Swissquote, or True Wealth, the Alpian app does not rely on a robo-advisor. Instead, Alpian offers digital wealth management supported by human advisors. This “hybrid” model combines the ease of an app with the expertise of real investment advisors and enriches the wealth management experience.

This personalized advisory service is included in the Guided by Alpian management mandate. To access it, go to the “Advisor” section of the app and book a phone call. No need to use Zoom or Google Meet: the video call is made directly in the app, for simplicity and confidentiality.

Alpian Expert Appointment

In practice, I have only used this service once at the beginning, to understand how Alpian works and the differences between the Guided by Alpian and Managed by Alpian mandates. Since then the advice in the app has been enough for me to manage my portfolio.

But if I change my strategy or add more money I will definitely schedule another appointment with an advisor. This will allow me to test some assumptions and make sure my decisions are aligned with my long term goals and benefit from the advice of an expert.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

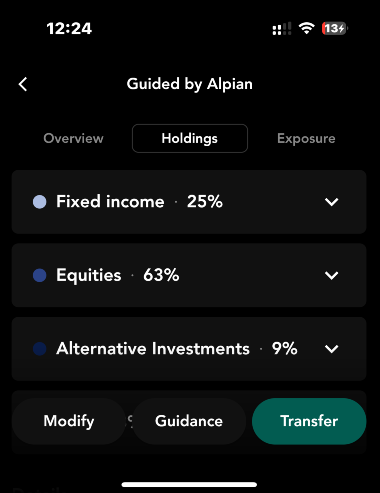

Current Composition of My ETF Portfolio

My “Balanced” portfolio is currently composed of:

- Equities: 63% of the portfolio is made up of ETFs investing in stocks, spread across different regions (United States, Europe, emerging markets) and various sectors, including technology, healthcare, and developed markets.

- Fixed Income: 25% of my portfolio is invested in bond ETFs, providing essential stability during periods of market volatility, helping to offset the risks associated with more dynamic assets.

- Alternative Investments: 9% of the portfolio is allocated to alternative investments, notably via a Bitcoin ETF. Although this part adds volatility, it’s part of the strategy to diversify and benefit from high long term returns.

- Cash: 3% of the portfolio is maintained in cash.

Alpian Portfolio Composition

This approach based exclusively on ETFs and with a with mandate fees of 0.75%, and no transaction fees, allows for a more dynamic portfolio management. You can adjust allocations freely without extra charges. This is a big plus, you can adjust your investments to market changes without impacting overall returns.

My Opinion on Management with Guided by Alpian

After these nine months, it is clear that wealth management through the Guided by Alpian mandate is effective and aligned with my expectations, illustrating the transformation of private banking brought about by private neobanks like Alpian. Here are the main strengths:

- Transparency and Communication: Every movement in the portfolio was perfectly clear thanks to the Alpian app, which is both user-friendly and well-designed. Being able to track the evolution of assets in real-time has strengthened my confidence in this management method.

- Flexibility and Reactivity: The allocation suggestions provided by Alpian, and the flexibility to accept or adjust them, allowed me to be responsive to market developments. For example, adjustments were made proactively based on changes in exchange rates and economic conditions, thus contributing to maintaining stable portfolio growth.

- Personalization: The Guided by Alpian mandate has offered me a highly personalized private banking experience. I was able to actively participate in investment decisions while benefiting from expert recommendations. This personalization is essential in a wealth management environment, where every client desires solutions tailored to their own financial goals.

Future Perspectives and Potential Adjustments

To improve my portfolio which is at +7.76% and face future economic uncertainties I need to be open to adjustments to capture more opportunities while adapting to market changes. Here are the options I am considering to optimize my portfolio with Guided by Alpian:

- Continuous Adaptation: With Guided by Alpian I can adjust my portfolio according to the experts’ recommendations. I recently replaced a part of MSCI Japan with MSCI India, betting on higher growth in India.

- Potential Recession: If a recession comes, I can switch from the “Balanced” profile to a more conservative profile like “Defensive” to limit losses. Defensive ETFs such as those in consumer staples are more stable during economic downturns.

- Improving Global Context: If the economy improves I can move to a “Dynamic” profile to increase my exposure to high growth stocks, maximizing returns by investing in more volatile sectors.

- Re-evaluate Bonds: If interest rates continue to decline I can increase the share of bond ETFs and generate capital gains, Alpian will provide the recommendations.

- Switch to “Managed by Alpian”: Switching to this mandate will delegate everything to Alpian team, ideal in times of volatility to react faster to market changes.

These options give me a lot of flexibility to adjust my portfolio according to the economic situation. Whether by adjustments in asset allocation or switching to “Managed by Alpian” I trust this platform to help me optimize my investments.

Improvements for Guided by Alpian

I’ve been generally happy with Guided by Alpian but there are a few areas that could be improved to make the service more comprehensive and user friendly:

- More ETFs: Currently only 45 ETFs, not enough for diversification especially if you’re targeting specific segments. Alpian plans to add more ETFs so that’s a good thing.

- Visibility and Risk Profile: Display the risk profile (“Balanced”, “Dynamic” etc) more prominently and allow to change it directly from the app so you can adapt to changing goals.

- Personalization of Advice: An automatic recommendation system based on machine learning could provide even more tailored suggestions even for unusual assets like the Bitcoin ETF I added. This would optimize allocation based on my investor behavior.

- Custom Alerts and Reports: Set up alerts for market developments and provide detailed quarterly reports to track gains and losses would help to make better decisions.

- Sector Research and Analyst Notes: Have sector research and analysis available in the app would be a great asset to support investment decisions.

So that’s it. 👍️️️️️️️️️️

Financial Services at Alpian

Alpian offers a range of financial services to go beyond investment management. These services are available in French, German, English and Italian to can serve a broad range of clients in Switzerland. Here are some of the services available at Alpian:

- Multi-Currency Bank Account: The bank account allows to manage funds in multiple currencies (CHF, EUR, USD, GBP) for international financial needs. This account comes with a multi-currency IBAN so you can make transactions in different currencies without opening multiple accounts.

- Metal Debit Card: Alpian gives its clients a metal debit card to have direct access to their funds. Besides the premium look, it allows to withdraw and manage daily expenses, especially with Google Pay and Apple Pay for quick and secure payments. Alpian only charges a small fee (0.2%) on foreign currency transactions and uses the interbank rate, so you save a lot when traveling or making international payments.

Alpian Metal Card

- Integrated Interface: Investment and cash accounts are integrated into one interface, simplifying the management of financial assets. This allows clients to view and manage their investments and cash in one place, ensuring better visibility.

These services show that Alpian goes beyond wealth management, offering comprehensive solutions for personal financial management while facilitating banking procedures.

To learn more about the Alpian app and its features, you can also read our complete review of the Alpian investment platform.

My experience with Guided by Alpian

After nine months of experience with Guided by Alpian, I am happy with the performance of 7.76% achieved through the use of diversified ETFs within a wealth management framework. This solution while keeping the portfolio balanced has been a good compromise between growth and risk. Fees are transparent and controlled and the app is simple and user friendly so I can manage my portfolio anytime.

What sets Alpian apart is the customization and support. Access to expert advice even though I only used it at the beginning is a valuable asset especially if I want to change my strategy in the future. If I decide to reallocate more funds, adjust my risk profile or switch to the “Managed by Alpian” mandate I know I can count on expert support to make sure my decisions align with my financial goals.

Compared to other solutions like Yuh and Neon Invest which aim to simplify access to investments for a wider audience Alpian stands out with its hybrid approach. You have the convenience of a modern and user friendly platform like Yuh and Neon but you benefit from personalized wealth management which is usually reserved for private banking services offered by more expensive private banks.

If you are looking for a digital bank that combines personalized wealth management and quality advice and you want to keep the freedom to choose how involved you want to be, opening an account with Alpian is an option to consider. You will get the benefits of a private bank and the flexibility and convenience of a modern platform tailored to each investor.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Frequently Asked Questions (FAQ) about Guided by Alpian

✅ What is a balanced portfolio?

A balanced portfolio is a mix of risky assets (stocks) and secure assets (bonds), designed to offer both moderate growth and risk reduction.

✅ How does Alpian adjust the portfolio strategy?

Alpian adjusts the strategy based on market conditions, increasing or decreasing exposure to certain assets to maximize returns and limit losses.

✅ What return did a balanced portfolio achieve with Alpian after 9 months?

The return of the balanced portfolio after 9 months was 7.76 %, a satisfactory result considering the economic context.

✅ What sectors are favored in a balanced portfolio?

In my portfolio, the technology, healthcare, and consumer goods sectors are favored for their resilience and growth potential.

✅ How does Alpian stand out from other online banks?

Alpian stands out with a personalized approach, total transparency on investments, and responsiveness to market events.

✅ What adjustments are planned in case of a recession?

In case of a recession, reallocating to defensive sectors and increasing secure assets like variable-rate bonds are considered options.

✅ What is the minimum amount to use Alpian's wealth management?

Alpian offers wealth management services for portfolios starting at CHF 10,000. Daily banking services can also be used without a minimum deposit.

✅ What are the fees for Guided by Alpian?

The management fees for the Guided by Alpian mandate are 0.75% per year of the portfolio value. This includes portfolio management, custody fees, transaction fees, deposits/withdrawals, mandate closure, and advisory maintenance.

✅ Can I talk to an advisor at Alpian?

Yes, Alpian offers personalized support where clients can discuss with wealth managers to adjust their portfolios and receive tailored advice.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Sources:

Additional information

Specification: Guided by Alpian after 9 Months: 7.76% Performance

| Trading | ||||||||

|---|---|---|---|---|---|---|---|---|

| ||||||||

| Specification | ||||||||

| ||||||||

Gianni Mele –

Thanks for the review! Quite interesting and useful. Just one question: You mention a “7.76% performance” but you don’t explain how this performance is calculated by Alpian. Is it TWR or MWR? Or YTD? Other? I think this is key to judge the REAL performance of their strategies and especially to compare it with other banks or Robo Advisors. Or maybe not? Can you please elaborate on this? Thanks again! And sorry for reposting the same comment for the third time, but I think something went wrong and my first and second reviews disappeared from the website.

Philippe –

Thank you for your comment, I double checked with Alpian and this is what they say: This refers to TWR performance (time-weighted), which is the industry-standard practice (per the GIPS recommendations). It allows you to compare one platform’s performance to another’s by excluding the impact of cash flows.

Gianni –

Many thanks for the answer and especially for taking the time to doublecheck with Alpian! Unfortunately they were not precise (or sincere?) in their answer to you…. If you look at the first picture at the top of this review (the one with the smart phone in the hand) you can indeed see the performance figure with the explicit mention of the TWR methodology: TWR 3,7% (ITD) (where I assume ITD= inception to date). But there is a big BUT: if you check on the current website of Alpian, the TWR mention has totally disappeared where they show the performance. I have check with a friend who has invested with Alpian and in his app the performance is specified as P/L -4,05% (ITD). We don’t know P/L… but for sure is not the same as TWR and any mention of TWR has simply disappeared from Alpian app and websites… Isn’t this weird? For sure, it makes it difficult to compare the performance with other competitors. Exactly the contrary of what they were pretending in their answer to you when claiming the use the recommend standard TWR. Well….. we don’t know what to think about all this….. not really confidence-making for us beginners……. What do you think as an expert? Again many thanks for your great work! Very much appreciated! P.S. unfortunately we cannot send you here the screenshots.

Philippe –

Thank you very much for your detailed follow-up — and no worries at all about reposting!

You’re absolutely right to highlight the discrepancy. I did originally check with Alpian, and they stated that the performance figure was based on TWR (Time-Weighted Rate of Return), which is the GIPS-recommended standard. However, your observation is very valid: the earlier screenshot showed “TWR 3.7% (ITD)”, but today neither the app nor their website seems to mention TWR anymore.

If clients are now only seeing P/L (ITD), that strongly suggests a shift — either in reporting methodology or simply in transparency. And yes, P/L is not equivalent to TWR. This definitely makes comparisons with other banks and robo-advisors more difficult, which contradicts Alpian’s original claim of standardised reporting.

Thank you again for your insightful contribution — I’ll add a note to the article to reflect this concern more clearly. You’re helping make this resource better for everyone!

François R. –

Hello! Great review, thanks a lot! But I don’t think that your answer to the previous review was correct. I am myself Alpian client and in the application it is impossible to find the TWR. There is something called ITD instead, which is clearly not the same. It is therefore impossible to compare the performance with other platforms, and this has to be underlined for the public.

Philippe –

Thanks a lot for your comment and for confirming this from a client’s perspective — that’s incredibly helpful.

If the app today only shows ITD (Inception-To-Date) performance without specifying that it’s TWR, and there’s no other breakdown (like TWR vs. MWR), then it’s fair to say that the methodology is unclear. You’re absolutely right: this makes it hard — if not impossible — to compare Alpian’s performance with other platforms that explicitly report TWR.

I originally received confirmation from Alpian that TWR was used, but clearly the current user experience doesn’t reflect that. I really appreciate your feedback, and I’ll update the review to flag this more transparently for readers.

Peter R. –

Hi! Excellent review indeed, very detailed, based on your personal experience over several months, hence very credible and solid. I congratulate you especially for the chapter “Performance Reporting: A Note on Transparency”!! Indeed, I have just searched Alpian website, and TWR is never ever mentioned. Also in the app (I am a client and investor with them) now there is no mention at all of TWR, P/L etc……. They simply mention a figure with an arrow like this: ⬆️ 7,75%……). Obviously I must assume they are hiding something. If the methodology is TWR, why not stating it officially for the public? Are they fearing legal issues because this might not be true? Or what else? Very weird indeed. So thanks a lot for your review underlying this matter. Trust is the pillar of any relationship also in the financial business.