Neon Invest Review (2026): Pros & Cons, Fees and How It Works

Updated:

| Features | 6 |

|---|---|

| Usability | 8 |

| Fees | 8 |

| Safety | 10 |

Get 100 CHF Trading Credit with the promo code NEOTRADE when you open your Neon Bank account before February 28, 2026.

Neon Invest is the investment solution integrated into the Neon app, designed to let you invest easily directly from your bank account, without using an external broker. Neon Invest is a good fit for you if you want to get started with investing or follow a passive strategy, using a curated selection of stocks and ETFs. In this Neon Invest review, we assess how it compares to traditional brokers.

Neon Invest Overall Rating: 8/10

Description

Neon Invest 2026 : Quick Facts

| Neon Invest Key Data | Details |

|---|---|

| Investment Options | Stocks, ETFs, Cryptocurrencies, Themes |

| Minimum Investment | CHF 1 |

| Account Management | Free |

| Trading Fees | 0.5% for ETFs and Swiss shares, 1% for international shares |

| Shares | 240 shares (e.g., Tesla, Nestlé, Novartis) |

| ETFs | 70 ETFs (e.g., Vanguard S&P 500, iShares MSCI World) |

| Cryptocurrencies | Available via ETFs (Bitcoin, Ethereum, Ripple) |

| Themes | Not available |

| Investor Protection | Up to CHF 100,000 (held by Hypothekarbank Lenzburg) |

Table of contents

Neon Invest: Accessible Low-Cost Investing

With more than 200,000 users, Neon Bank has established itself as one of the largest neobanks in Switzerland, alongside Yuh Bank. Since 2023, Neon has enriched its services with Neon Invest, an investment solution directly integrated into its banking application. If you are looking for a platform that allows you to manage both your investments and your bank account, Neon Invest could be an ideal option.

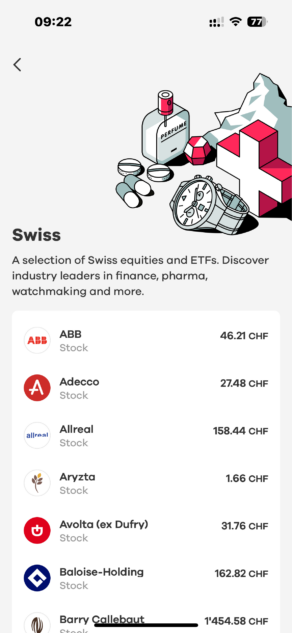

The offering enables a seamless transition between your daily banking and financial investments, giving you the opportunity to invest in stocks and ETFs while having a clear and complete overview of your finances. Neon Invest stands out with its access to more than 240 stocks and 70 ETFs listed on the BX Suisse (Bern stock exchange), and positions itself as a simple and transparent solution, without custody fees or exchange fees.

We took the time to explore in depth everything that Neon Invest has to offer, and here is what we think. In this guide, you will find an overview of the benefits, essential features, as well as fees to be aware of. The idea is to help you decide if this platform is a good fit for your investment goals and day-to-day financial management.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Pros & Cons of Neon Invest

✅ Pros of Neon Invest

Ease of use

Neon Invest is integrated directly into the Neon app, allowing users to invest without opening an additional account or using an external platform. The interface is clear and well suited to beginner investors.

Accessible investing

The offering allows investing with relatively small amounts, making Neon Invest accessible to those who want to start investing gradually.

Well-curated selection of ETFs and products

Neon Invest offers a limited but coherent selection of ETFs and investment products, avoiding choice overload and simplifying decision-making.

Integration with the Neon account

Investments are directly linked to the Neon bank account, simplifying overall financial management (transfers, tracking, funding).

❌ Cons of Neon Invest

Limited investment choice

The product selection remains limited compared to specialised brokers or dedicated investment platforms.

Less suitable for experienced investors

Neon Invest is mainly aimed at beginner or intermediate profiles. Advanced investors may find the offering too basic in terms of tools and options.

Fees less competitive in the long term

For larger invested amounts, fees can become less attractive than those offered by specialised brokers, especially for long-term investment strategies.

No advanced features

The lack of features such as advanced analysis, active trading or extensive customisation may be a drawback for some users.

🎯 In summary

Neon Invest is a simple and accessible solution for getting started with investing, ideal for Neon users who want to invest without complexity. However, for more advanced management or sophisticated strategies, specialised alternatives may be more suitable.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon Invest Features Review: 6/10

Neon Invest providers a variety of features that simplify the investment process for Swiss investors, with a focus on making the investment journey both accessible and manageable for beginners. The platform provides essential tools for long-term investors, especially those interested in automated investing and a diversified portfolio of global stocks and ETFs.

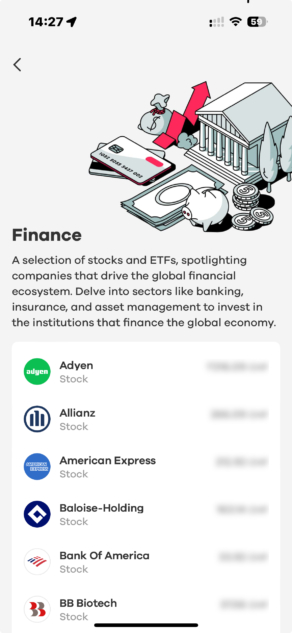

Access to Global Stocks and ETFs

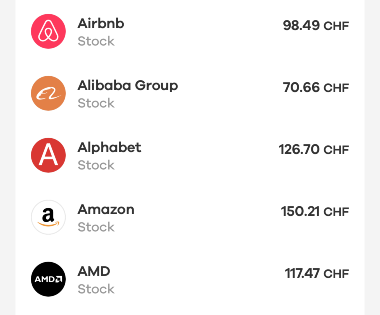

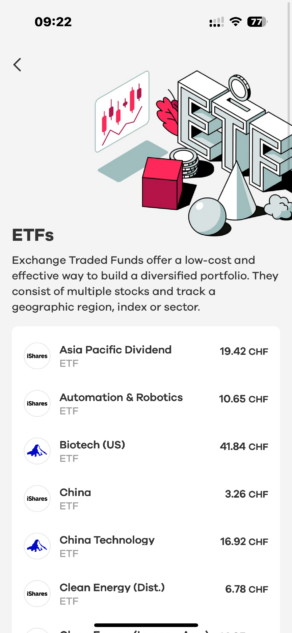

One of the important features of Neon Invest is its goal of providing investors with a diversified portfolio of global FTSE stocks and global ETFs. With access to over 240 stocks and 70 ETFs, the platform offers investors a comprehensive selection of options. The platform’s stocks and ETFs are primarily traded on the BX Swiss Exchange (formerly the Bern Stock Exchange).

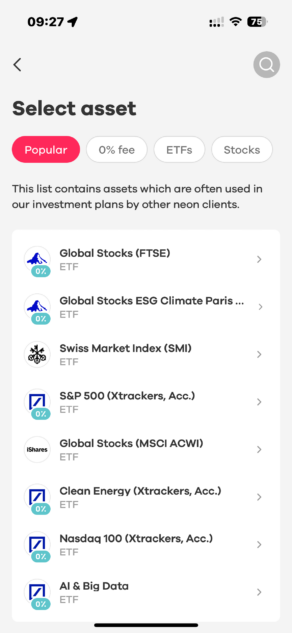

Neon Invest Stocks and ETFs

For investors looking to tap into international stocks or expand their portfolio with global ETFs, Neon Invest provides an effective entry point. However, due to the smaller size of the BX Swiss Exchange, liquidity can be an issue, which may result in wider spreads on trades. This may be less of a concern for long-term or passive investors, but for those looking to trade frequently, the low trading volume on the exchange can be problematic.

Check this page to see the full list of Neon ETFs.

Buying Cryptocurrencies

Neon Invest does not currently offer direct access to cryptocurrency trading.

As an investor, you can still access the cryptocurrency market through Crypto ETFs or blockchain-related ETFs available on the platform. These funds offer indirect exposure to digital assets without directly holding cryptocurrencies, making them a safer option for traditional investors.

Neon currently offers 3 crypto-related ETFs with high TERs:

- Bitcoin Tracker: Leonteq Tracker Certificate on Bitcoin – CH1171799823 – TER : 1.5%

- Ethereum Tracker: Tracker Certificate on Ethereum – CH1171799807 – TER : 1.5%

- Ripple Tracker: Leonteq Tracker Certificate on Ripple – CH1171799815 – TER : 1.5%

While there are other ETFs or ETPs in Switzerland with much lower TERs, for example:

- 21Shares Bitcoin Core ETP – TER : 0.21 %

- 21Shares Ethereum Core ETP – TER: 0.21% (available at Alpian)

Neon Invest could potentially expand its offerings to include crypto-friendly investments, further diversifying its platform. For now, Yuh offers direct cryptocurrency trading, but Neon remains a solid choice for those focusing on traditional investments.

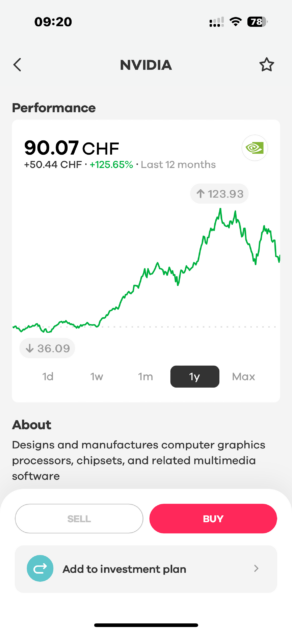

Stock and ETF Prices are Displayed in CHF

Neon displays stock and ETF prices in CHF to simplify the user experience. This avoids currency conversion fees when trading and provides full transparency on costs.

Additionally, since trading is done via the Swiss exchange BX Swiss, where prices already include currency conversion, this ensures favorable spreads and avoids additional fees for the investor. This allows you to trade directly in CHF without worrying about currency fluctuations.

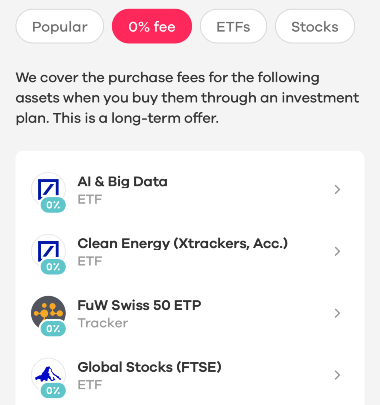

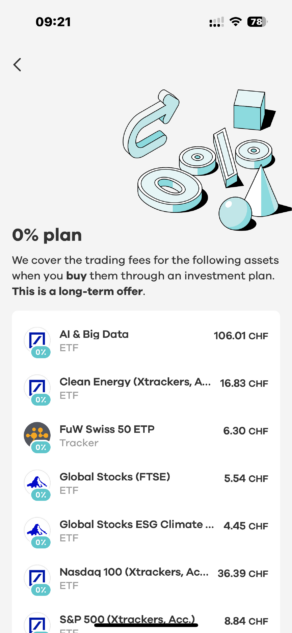

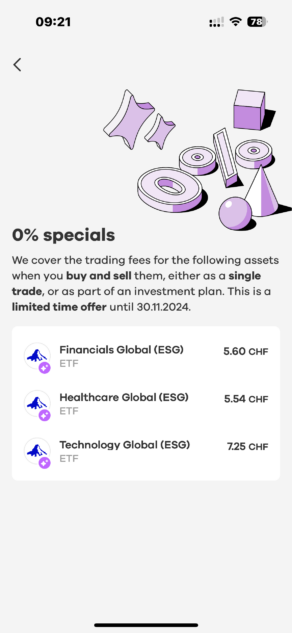

Savings Plan with 0% Fees and Automated Investments

Neon Invest includes a savings plan with 0% fees on selected ETFs, along with automated investments.

Neon Invest 0% Fee ETFs

You can easily create an individual investment plan and allocate funds to their selected assets, whether Swiss stocks, global ETFs or specific Invesco ETFs or Vanguard FTSE funds.

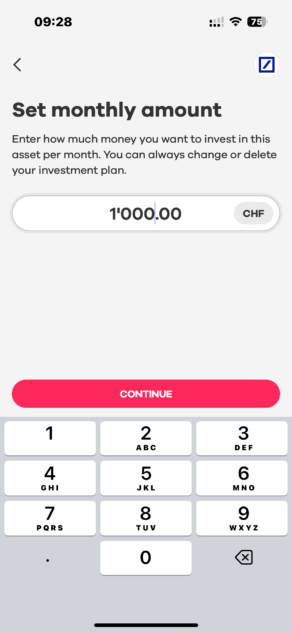

This allows you to gradually build wealth over time without the need for constant monitoring. You can schedule monthly contributions, which are then automatically invested in stocks or ETFs of your choice.

For example, if you allocate CHF 500 per month, the platform automatically allocates this amount according to your predefined allocation (e.g. 70% in a global ETF and 30% in a Swiss stock), helping you stay on track with minimal effort.

This feature is especially appealing for passive investors who prefer a hands-off approach to managing their portfolio, as the system ensures that your money is automatically invested according to the predefined plan. However, since Neon Invest does not offer fractional trading, your contributions are only used to buy whole stocks, leaving funds remaining until the next purchase cycle.

Market Orders Only

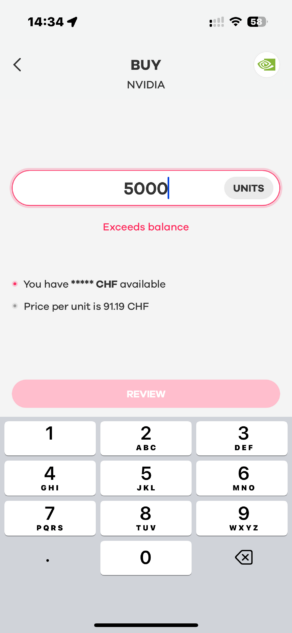

Currently, Neon Invest only supports Market Orders, which means that a Buy or Sell is executed immediately at the current market price.

While Limit Orders would offer more flexibility by allowing users to set a specific buy or sell price, Neon’s Market Order system simplifies the process for those focused on long-term investing. The platform does not require users to constantly monitor the market, making it accessible even to beginners.

Neon plans to soon introduce the ability to place Limit Orders. With this type of order, you can set a minimum or maximum price for buying or selling a stock. Once the stock reaches the price you set, the order is automatically executed, whether it is to buy or sell.

Stock Transfers and Portfolio Management

Neon Invest allows you to transfer stocks to another broker for CHF 100 per position. This is relatively rare among low-cost brokers, making it an attractive option for investors who may want to switch platforms without selling their holdings.

On the downside, it is currently not possible to transfer stocks from another broker to Neon Invest, limiting flexibility for new users who may want to consolidate their investments in one place.

Portfolio management on Neon Invest is straightforward, with users able to track their holdings via the Neon app, which integrates both banking and investing services into one seamless experience. While the app only supports market orders, the portfolio interface makes it easy to manage and track performance.

Our Opinion on the Neon Invest Features

Neon Invest is intuitive and accessible, ideal for beginner investors. It offers a limited number of securities, mainly Swiss stocks and ETFs. In comparison, platforms like Swissquote, Interactive Brokers or Saxo Bank offer a more investment products, including thousands of global stocks, bonds, options and derivatives. These platforms also offer advanced analytical tools and sophisticated trading features, such as margin trading or hedging options, making them better suited for experienced and active investors.

Neon Invest gets a rating of 6/10 for featuresNeon Invest App Experience: 8/10

Direct investment with Neon Invest

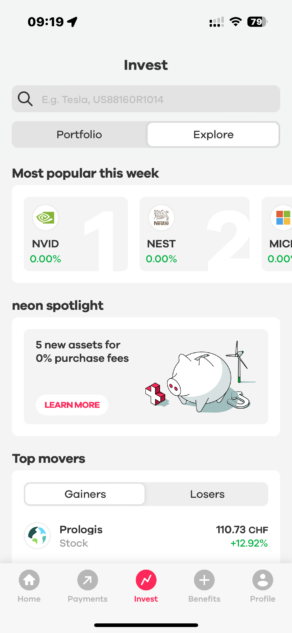

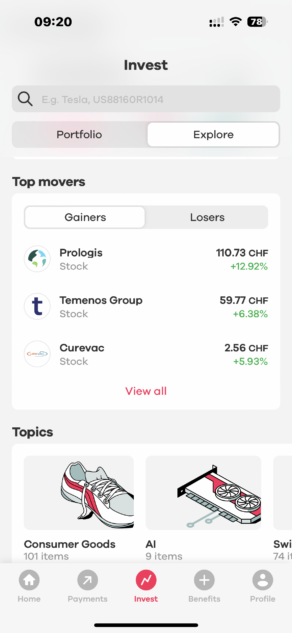

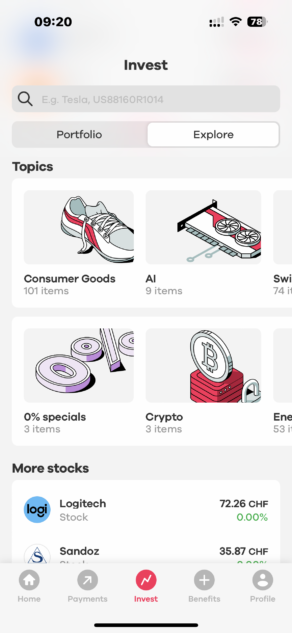

By clicking on the “Invest” icon in the menu you arrive on the Neon Invest home screen and can see:

- The Popular stocks this week.

- The “Top movers“: the stocks that gain and lose the most.

- Stocks and ETFs grouped by theme

By clicking on a theme, you access the list of available stocks or ETFs:

- Swiss stocks

- ETFs

- 0% plan: ETFs without fees available in the savings plan

- 0% specials: ETFs with 0% fee

- Crypto: crypto-linked ETFs

- Real estate, Finance, Technology, AI, Raw materials,… for other stocks and ETFs

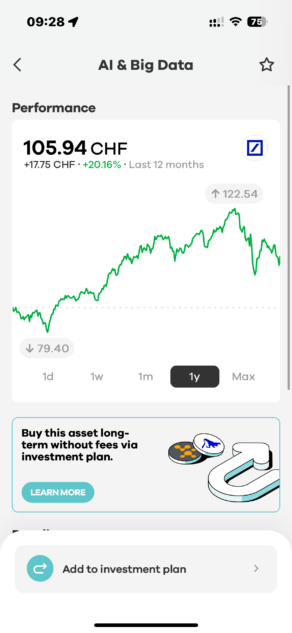

By clicking on a value, NVIDIA stock for example, you can see the share price in CHF.

2 options are available: Buy or Sell. Your order is then placed immediately at the market price, during the opening hours of the BX Swiss: Monday to Friday between 9:00 a.m. and 5:30 p.m.

If you place an order outside of opening hours, it will be recorded and placed as soon as the market opens at 9:00 a.m.

Savings Plan and Automatic Investment with Neon Invest

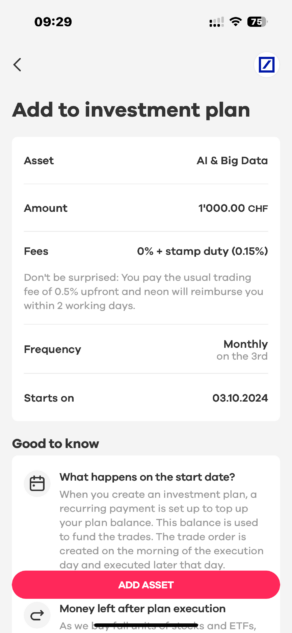

At the bottom of the screen you can click on Savings plan (Investment plan on the image) and select the values you want to add among the 0% ETFs, ETFs and stocks.

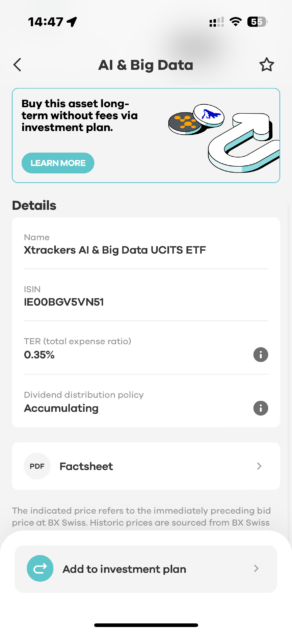

Here we select “AI & Big Data” and the next screen shows us the price of the ETFs, its Full Name, its ISIN, its TER and also allows us to access its full file.

If you click on the button at the bottom “Add to investment plan“, you just have to enter the amount in CHF that you wish to buy each month, then confirm the addition to your savings.

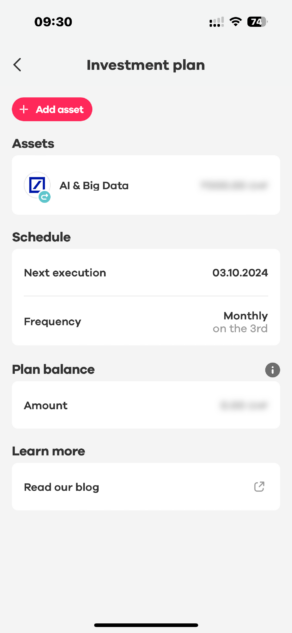

The following screen allows you to see the composition of your savings plan and manage the assets:

Our Opinion on the Ergonomics and Ease of Use of Neon Invest

The ergonomics of Neon Invest is one of its strong points. The app is designed to be intuitive and easy to use, even for investment beginners. The process of creating portfolios and automating investments is seamless, with clear instructions and a clean design.

Neon Invest gets 8/10 for usabilityNeon Invest Trading Fees: 8/10

Neon Invest’s pricing structure is designed to meet the needs of frequent traders and long-term investors.

Neon Invest Trading Fees

Fees at Neon Invest are transparent and competitive:

- Swiss Stocks and ETFs: 0.5% of the transaction amount.

- International stocks: 1% of the transaction amount.

- Currency Conversion Fees: None, as all transactions are processed in Swiss Francs.

- Custody Fees : None, unlike other platforms that often charge annual fees for managing securities.

In addition, the tax on stock market transactions applies:

- 0.075 % on Swiss securities,

- 0.15% on international securities.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon Invest Transaction Fees

The platform applies a minimum trading fee of CHF 1 per transaction, which makes it particularly attractive for small investors who want to get started on the stock market without having to deal with costs high initial fees.

For example:

- A transaction of CHF 200 on a Swiss stock incurs a fee of only CHF 1.

- A transaction of CHF 1000 would incur a fee of CHF 5, which remains reasonable even for medium-sized transactions.

Unlike other platforms, Neon Invest does not impose a maximum on transaction fees. Although this is advantageous for small transactions, this may increase costs for larger transactions. For example, trading CHF 5,000 on a Swiss stock will cost CHF 25 in fees, which can be expensive for larger trades.

Stamp Duty

As with most Swiss brokers, you will also need to take into account the stamp duty, which is levied on all transactions. This tax rate is 0.075% on Swiss shares and 0.15% on international shares. Although these fees are relatively minor, they are still a factor to take into account when calculating overall transaction costs.

Dividends and Currency Conversion

There is, however, one notable exception when it comes to dividend payments. If you own shares in companies that pay dividends in foreign currencies, these dividends will be converted into CHF and you will have to pay a currency conversion fee of 1.5% on these dividends. This can add up over time, especially for investors who focus on building wealth through dividend stocks.

ETF Trading

When it comes to ETF trading, Neon Invest offers a wide range of Swiss and European ETFs with low trading fees. As mentioned earlier, Swiss ETFs have a fee of 0.5% for buying and selling, making the platform ideal for those who want to trade or invest in ETFs regularly.

However, due to currency conversion fees on dividends, some investors may find accumulation ETFs, which automatically reinvest dividends, to be a more attractive option than distribution ETFs, which pay dividends to the investor.

Trading Fees Comparison: Neon Invest vs. Yuh vs. Alpian

When it comes to investing, fees play a significant role in determining the overall profitability of your portfolio. Here’s how Neon Invest, Yuh and Alpian compare in terms of fees:

Yuh Bank

- Transaction fees: 0.5% fee on all transactions (Swiss and international stocks).

- Foreign exchange fees: 0.95% fee for non-CHF denominated transactions, which can significantly increase costs for those investing in global markets.

- Custody fees: None, making it competitive for long-term holders.

While Yuh offers the same 0.5% fee for all stocks and ETFs, its 0.95% currency conversion fee can become expensive for those investing in foreign stocks or ETFs. However, it remains competitive for domestic CHF investments.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Alpian

- Management Fee: 0.75% of managed portfolios, which covers personalized investment services and portfolio adjustments.

- Foreign Exchange Fees: Minimal but present, as Alpian supports multi-currency accounts, making it a better option for clients with international banking needs.

- Transaction Fees: Included in Management Fees

- Custody Fees: Included in Management Fees

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Alpian’s 0.75% management fee covers full wealth management, making it suitable for investors seeking a more hands-off approach. However, for cost-conscious traders or those focused on investing on their own, Neon Invest’s lower per-trade fees may offer better value for money.

Neon Invest scores 8/10 for trading feesSecurity and Asset Management: 10/10

Investments at Neon are secured in several ways. Your assets are securely held with the bank Hypothekarbank Lenzburg, ensuring that they do not become part of the bank’s balance sheet. This means that in the event of Neon or the bank going bankrupt, your investments remain your property.

They are also protected by the regulation of the BX Swiss, a recognized Swiss stock exchange, and are classified as separate assets, which ensures that your investments are not affected by the financial problems of the company or the bank.

In addition, Neon allows investors to transfer shares from their Neon account to another broker for a small fee. This flexibility is a rare feature among digital investment platforms and can be beneficial for investors who want to transfer shares between brokers.

Neon Invest gets 10/10 for securityNeon Invest Customer Reviews

We analyzed reviews on platforms like the App Store, Google Play, Trustpilot and various investment forums to better understand what users think about Neon Invest. The feedback highlights both strengths and areas for improvement. Here are the most common points mentioned in their reviews:

- Ease of use and accessibility: Many users like Alfred Neumann and Julia Koller on Trustpilot and Marc E. on Google Play say the app is easy to use and simple. Setup is quick, transactions are fast and investing is smooth. Perfect for beginners.

- Low fees and cost efficiency: Neon Invest is praised for its low fees and transparency. Lars Kunz on Trustpilot likes the no depot fees and the free tax certificates which add value for cost conscious investors.

- Investment options: While Neon Invest has ETFs for a basic portfolio, some users like Daniel M. on Google Play wish for more options and advanced investment tools as they gain experience.

- Good customer support: Reviewers like D. Ammann on Trustpilot and Sophie K. on Google Play say the customer support is quick and helpful. Positive interactions build trust, but some users like Alex R. on Google Play report occasional delays.

- Room for improvement: Some users like Ganymed IV and Michael on Trustpilot mention technical issues like app stability and login problems especially when accessing the platform from abroad. RJ and Marco Lehmann on investment forums suggest a web version and more advanced investment analytics would be nice.

In short, Neon Invest is good for ease of use, low fees and being beginner friendly. To appeal to more advanced users and to increase user satisfaction they should fix the technical issues and expand the investment options. The platform is committed to updates so they clearly listen to their users and grow.

Neon Invest vs. Traditional Brokers

If you compare Neon Invest with traditional online brokers, you will quickly notice significant differences. Neon Invest offers an attractive fee structure, with no custody fees and low transaction fees, making it an attractive option for small investors or those who want a passive approach, especially in ETFs.

However, where Neon Invest may be limited is in the range of products available. With around 300 tradable securities, it still lags far behind traditional brokers like Swissquote, which offer access to millions of products, including bonds, options, and stocks on various global markets.

Additionally, trading features are limited on Neon Invest. Unlike more robust platforms, you can only place market orders with no option to use limit orders. This could be a turnoff for active investors looking to maximize their strategies.

On the other hand, Neon Invest stands out for its simplicity and intuitive interface, which is ideal for beginners. If you’re new to investing and looking for an easy-to-use platform with no hidden fees, Neon Invest could be a great option. But if you plan to trade frequently or diversify your portfolio heavily with international stocks, a traditional online broker might be a better fit for your long-term needs.

Neon Invest vs Interactive Brokers

The comparison between Neon Invest and Interactive Brokers (IBKR) highlights two very different approaches to investing.

Neon Invest is primarily aimed at investors looking for a simple solution integrated into their bank account, without complex setup or advanced tools. Investing is done directly from the Neon app, with a limited product selection, mainly ETFs and a few securities, making decision-making easier for beginners or passive investors.

Interactive Brokers, on the other hand, is a highly comprehensive international brokerage platform, designed for experienced investors. It provides access to millions of financial instruments (stocks, ETFs, bonds, options, futures, currencies) across global markets, with extremely competitive trading fees, especially for larger volumes.

However, this functional depth comes at the cost of complexity. Interactive Brokers’ interface is significantly more technical, with a steep learning curve, which can discourage beginners or occasional investors. In contrast, Neon Invest focuses on a smooth, guided experience without unnecessary features.

In terms of fees, Neon Invest is attractive for smaller amounts and a passive investment approach, notably thanks to the absence of custody fees. By contrast, Interactive Brokers becomes more advantageous in the long run for larger portfolios or active investors, thanks to its very low trading fees and broad product offering.

In summary

- Neon Invest: ideal for getting started, investing simply and managing investments directly from a bank account

- Interactive Brokers: better suited to experienced, active investors or those with larger portfolios

👉 The choice between Neon Invest and Interactive Brokers therefore mainly depends on your level of experience, investment volume and need for advanced features.

Neon Invest vs. Yuh

The comparison between Neon Invest and Yuh is common in the Swiss investment community. Both platforms offer low trading fees and access to global stocks and ETFs, but there are a few key differences.

- Currency Exchange: Neon Invest offers the advantage of no currency exchange fees, while Yuh charges a 0.95% fee on currency conversion.

- Breadth of Offering: Yuh offers a broader offering by giving you access to over 300 stocks, 50 ETFs, and 60 cryptocurrencies. There are also more features at Yuh, such as buying fractions of shares.

- Savings plans: Neon Invest allows users to set up an individual investment plan, in which investors can automatically allocate funds to up to three stocks or ETFs each month. In contrast, Yuh offers a more limited savings plan structure.

We will do a more detailed comparison of Neon vs Yuh in a future article.

Our Final Review of Neon Invest

If you are a beginner or intermediate investor looking to keep costs low, Neon Invest allows you to benefit from transparent and affordable fees, especially on Swiss stocks and ETFs. There are no currency exchange fees, which means no unpleasant surprises when trading on foreign markets. Furthermore, the absence of custody fees makes it an attractive choice for maximizing your returns in the long term.

If you want to manage your portfolio independently without the constraints of the high fees often imposed by traditional banks or other brokers, Neon Invest stands out with its clear fee structure, which is tailored to small investors. Thanks to the seamless integration with the Neon banking app, you can easily monitor and adjust your investments while keeping track of your bank accounts and daily transactions.

In summary, if you are looking to invest small amounts regularly or explore opportunities in Swiss stocks and ETFs, Neon Invest offers an efficient, cost-effective platform that is perfectly suited to autonomous management of your investments. For similar alternatives, you might also consider Alpian or Yuh, which provide solutions tailored to different investor profiles.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Frequently Asked Questions (FAQ) about Neon Invest

✅ Does Neon Invest offer promo codes or referral codes for new users?

Yes, Use the promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌 with Neon Bank. Get the Neon app ➡️

✅ What exchanges are available on Neon Invest?

Investors can access the BX Swiss exchange, which offers both Swiss and international stocks.

✅ Is my investment with Neon Invest safe?

Yes, your investments with Neon Invest are considered safe. Neon partners with Hypothekarbank Lenzburg, a reputable Swiss bank regulated by FINMA (Swiss Financial Market Supervisory Authority), ensuring compliance with strict financial regulations. Your assets are held in segregated accounts, protecting them in the unlikely event of Neon’s insolvency. Additionally, Swiss regulations provide robust investor protection, with your deposits covered up to CHF 100,000.

✅ What types of investments are available on Neon Invest?

Neon Invest allows users to invest in over 240 Swiss and international stocks, as well as around 70 ETFs listed on the Swiss stock exchange BX.

✅ What is an ETF?

An ETF (Exchange Traded Fund) is a mutual fund that groups together a basket of assets, such as stocks, bonds, or commodities. ETFs allow investors to diversify their portfolio by buying a single share that represents several securities. They are popular for their low fees and passive management, often tracking the performance of a stock index, offering a simple way to invest in broad segments of the market.

✅ What are the transaction fees on Neon Invest?

The purchase fee for Swiss ETFs is 0.5%, while the fee for international stocks is 1% per transaction.

✅ Are there any custody fees?

No, Neon Invest does not charge custody fees, making it an attractive platform for long-term investors.

✅ Is it possible to buy fractional shares?

No, Neon Invest does not offer fractional share purchases. You can only buy whole shares, which can leave uninvested funds after each transaction.

✅ How current are the prices displayed in Neon Invest?

Prices in Neon Invest are updated in real-time or with a slight delay, giving you nearly instant insight into market movements.

✅ Why is there a difference between buying and selling prices in Neon Invest?

This difference, known as the spread, represents the margin taken by financial markets. It reflects transaction costs between the price at which you can buy and sell an asset.

✅ Can I invest in US ETFs with Neon?

Neon Invest does not currently offer US ETFs, focusing instead on global ETFs listed on the Swiss BX exchange.

✅ Can I set up an automatic savings plan?

Yes, Neon Invest allows users to set up automatic savings plans, allowing them to regularly invest a fixed amount in stocks or ETFs.

✅ Are there any foreign exchange fees for transactions?

No, Neon Invest processes all transactions in Swiss francs (CHF), so there are no additional currency conversion fees for Swiss investors.

✅ Is it possible to transfer shares to another broker?

Yes, Neon Invest offers the possibility to transfer shares to another broker, although fees may apply for these transfers.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Sources:

Additional information

Specification: Neon Invest Review (2026): Pros & Cons, Fees and How It Works

| Trading | ||||||||

|---|---|---|---|---|---|---|---|---|

| ||||||||

| Specification | ||||||||

| ||||||||

There are no reviews yet.