| Features | 7 |

|---|---|

| Usability | 9 |

| Fees | 8 |

| Safety | 10 |

Get 120 CHF using the promo code ALPNEO when you open your free Alpian bank account before March 31, 2026.

(CHF 55 with a CHF 500 deposit, then up to CHF 65 in investment fee credits)

In this article, we review Alpian Investment, the investment platform offered through the Alpian App.

Alpian Investment Overall Rating: 8.5/10

Description

Quick Facts about Alpian Investment in March 2026

| Alpian Key Data | Details |

|---|---|

| Investment Options | ETFs, Actively Managed Portfolios |

| Minimum Investment | CHF 10,000 |

| Account Management | 0.75% per year |

| Trading Fees | Included in the annual fee (advisory and managed portfolios) |

| Stocks | Not available |

| ETFs | 45 ETFs |

| Cryptocurrencies | Available via ETF (Bitcoin, Solana) |

| Themes | Available via managed portfolios (e.g., sustainability, tech) |

| Investor Protection | Up to CHF 100,000 (Esisuisse, Interactive Brokers) |

In this Alpian Investment Review

Introduction

In March 2026, Alpian has established itself as a leading digital private bank in Switzerland. Our Investing with Alpian Review covers its intuitive app, personalized wealth management solutions, and key features.

Thanks to a combination of traditional banking expertise and cutting-edge digital technology, Alpian allows you to easily invest in various assets while offering personalized support. It is also worth noting that opening an account with Alpian is quick and straightforward, enabling you to manage your investments with just a few clicks.

Alpian Investment: The Private Bank, Reinvented

Founded in 2019 and launched to the public in 2022, Alpian is the first digital private bank in Switzerland. Backed by Fideuram, a subsidiary of the Italian banking group Intesa Sanpaolo, Alpian combines traditional banking expertise with digital technology. It aims to offer superior private banking services via an easy-to-use application, while democratizing access to tailor-made wealth management.

We thoroughly explored what Alpian offers in terms of investment, and here is our opinion. This guide will give you an overview of the strengths, key features, as well as aspects to consider before choosing this platform. The aim is to help you determine whether Alpian meets your expectations in terms of investment and wealth management.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Alpian Investment Features Review: 7/10

Alpian’s investment offering clearly differs from those of Neon Invest and Yuh Investment, mainly due to its approach, which focuses on wealth management rather than individual transactions. Indeed, unlike Neon and Yuh, which allow you to invest in stocks and ETFs independently, Alpian offers active management services with a particular focus on personalized advice and support.

Alpian offers 3 investment options:

- Managed by Alpian Essentials,

- Guided by Alpian

- Managed by Alpian.

Managed by Alpian Essentials is Alpian’s ETF savings plan. With Guided by Alpian, you retain control of your portfolio while benefiting from the support of experts to guide you in your choices. On the other hand, with Managed by Alpian, you fully delegate the management of your assets to financial experts, who adjust your portfolio according to your investor profile. This approach is mainly based on investments in ETFs, ensuring active and professional management of your investments.

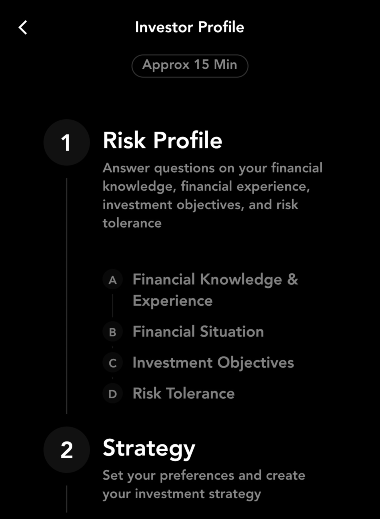

Alpian uses an in-depth questionnaire that allows you to precisely target your objectives and your investor profile, in order to create a suitable portfolio.

Alpian Investor Profile

Your investments are managed by certified wealth managers, with the support of Interactive Brokers technology, guaranteeing efficient and secure management. It should also be noted that advisors are not compensated through the sale of financial products, which allows them to provide impartial recommendations that are always aligned with your interests, without commercial influence.

Managed by Alpian Essentials

The Managed by Alpian Essentials savings plan is designed for investors looking to explore Alpian’s services with a low initial investment.

Accessible from 2,000 CHF investment, this solution is based on ETFs and offers expert management. It allows you to start investing easily while benefiting from Alpian’s professionalism to diversify your portfolio and optimize your investments.

Guided by Alpian

The “Guided by Alpian” advisory mandate is designed to meet the needs of investors, whether novices or experienced, who wish to maintain direct control over their portfolio.

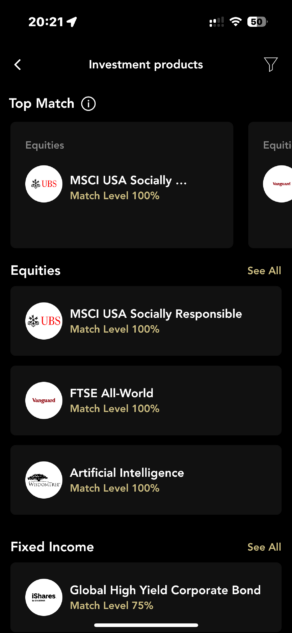

You have access to Guided by Alpian starting from an investment of 10,000 CHF. It is a solution that combines personalization and support, allowing you to create a customized portfolio by selecting ETFs from a diversified range (currently 45 ETFs). You also benefit from expert advice accessible via the application.

Managed by Alpian

The “Managed by Alpian” management mandate is available from 30,000 CHF and offers discretionary management, meaning that the Alpian team takes charge of the complete management of the portfolio, making investment decisions on behalf of the client.

You can exclude certain themes: “no cryptocurrencies” for example, but you cannot exclude or include specific ETFs or determine precise allocations.

Swiss and International Shares

Alpian does not currently allow you to buy shares directly, whether on the Swiss or international market.

This means that if you want to have Amazon or NVIDIA in your portfolio, you will also need an account at Neon Invest or Yuh Investment.

ETFs

Alpian currently offers a range of approximately 45 ETFs selected by their team of investment experts. These ETFs cover a wide range of sectors and international markets, allowing investors to access optimal diversification of their portfolio. Alpian’s approach is to favor high-quality ETFs, chosen for their solid performance and their suitability for long-term investment strategies.

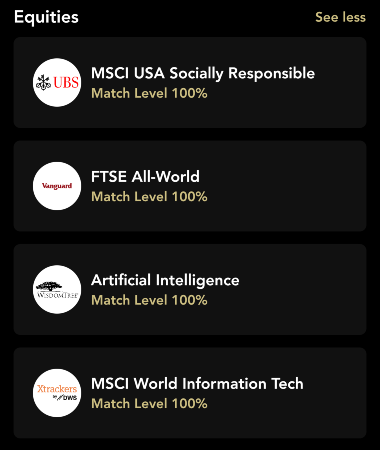

Alpian Equities

The ETFs offered by Alpian cover a wide variety of sectors such as:

- International equities,

- Bonds,

- Commodities,

- Emerging markets,

- Advanced technologies,

- Renewable energies.

The ETFs offered are chosen for their liquidity, transparency and low management costs, which makes them attractive to cost-conscious investors seeking diversification.

Depending on the plan you choose (Managed, Guided, or Essentials), you do not have access to the same list of ETFs. Visit this page to see the Guided by Alpian ETF list.

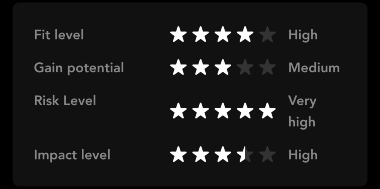

ETFs Selection Criteria

Alpian’s team of investment experts applies several strict criteria in selecting these ETFs:

- Consistency with long-term objectives: Alpian favours ETFs that align with a sustainable investment strategy and offer solid growth prospects over several years.

- Historical performance and earnings potential: The ETFs chosen must have a solid history of consistent returns.

- Risk: Particular attention is paid to risk management and the volatility of the underlying markets.

- Fees: Management fees are also a key factor, with Alpian seeking to minimise costs for investors whilst maximising returns.

Alpian ETFs Selection Criteria

Alpian’s approach with its ETFs is tailored to a long-term investment strategy, where diversification, asset quality and cost reduction are paramount to generate sustainable capital growth.

Access to Cryptocurrencies at Alpian

Alpian allows investors to access cryptocurrencies indirectly by offering specialized ETFs that integrate these digital assets into a more secure and diversified structure. Here are the main products available if you are looking to invest in cryptocurrencies with Alpian:

- 21Shares Bitcoin Core ETP: This ETF allows direct exposure to Bitcoin, offering a simple and secure solution to invest in this cryptocurrency.

- 21Shares Solana Staking ETP: This ETF allows you to invest specifically in Solana, a high-performance blockchain known for its low transaction fees and speed.

- 21Shares Crypto Basket Index ETP: This ETF offers diversified exposure to the main cryptocurrencies: 50.15% in Bitcoin, 35.24% in Ethereum, 7.60% in Solana, 3.89% in XRP and 3.12% in Cardano.

When looking at this list, one might wonder why Solana was chosen over Ethereum. We guess more Crypto ETFs may be added in the future.

Order Types

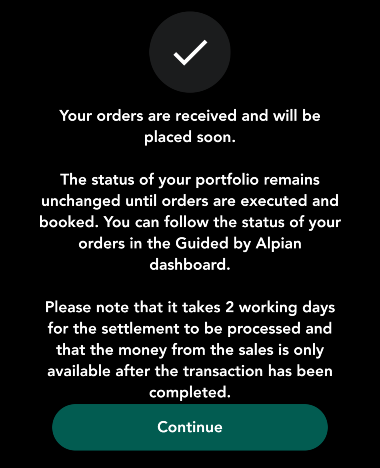

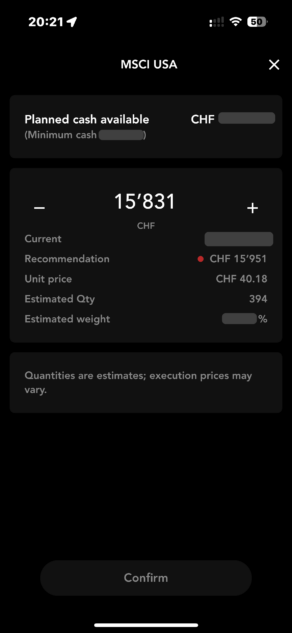

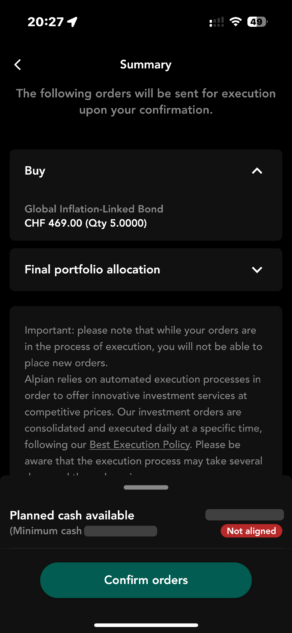

With the Guided by Alpian mandate, buy or sell orders are not executed immediately, but are scheduled, which can cause a delay of several hours before your account is updated.

Alpian mentions that this process can take up to 2 days; in our experience, it typically takes less than 24 hours.

While this may seem unusual compared to platforms like Neon Invest or Yuh, which offer immediate market orders, this delay reflects Alpian’s philosophy of long-term wealth management, prioritizing thoughtful decisions and a sustainable approach over short-term or instant trading operations.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Opinion on Alpian’s Investment Features

Alpian stands out from the other platforms like Neon Invest, Yuh or Interactive Brokers with its approach more comparable to that of Swiss private banks. Unlike Neon Invest and Yuh Investment, which focus on fast trading and self-service investments, Alpian focuses on long-term wealth management with personalized support and expert advice.

By using Alpian’s services, you benefit from a hybrid and unique offer in Switzerland, inspired by the services of Swiss private banks such as Julius Baer, Lombard Odier, and Pictet, and offering a more modern, interactive and accessible neobank dimension via a user-friendly investment platform.

Area for improvement: In the future, we would like access to more ETFs for better diversification and the option to add ETFs on request within the Guided by Alpian offer.

Alpian Investment Features get a rating of 7/10Alpian Investment App and User Experience Review: 9/10

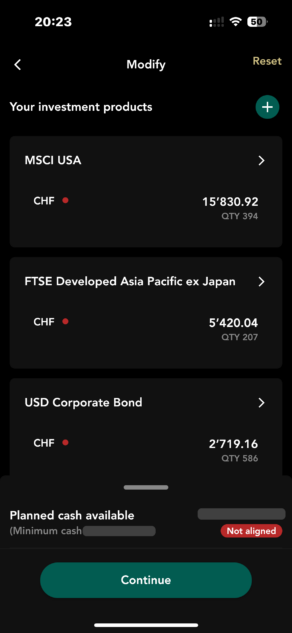

Investing with Guided by Alpian

To use the Guided by Alpian advisory mandate, the first step is to transfer at least 10,000 CHF from your current account to your investment portfolio.

You will then benefit from an asset allocation recommendation (Guidance) built according to your investor profile. You can accept this proposal as is or modify it.

If you decide to modify it, you can access the Guided by Alpian ETF list:

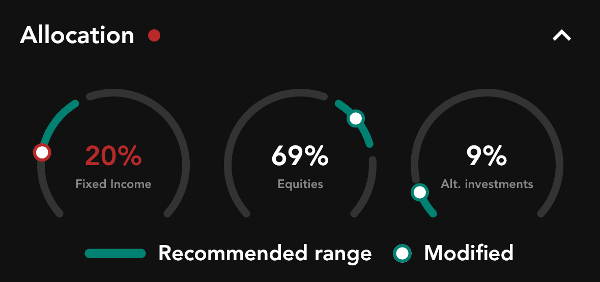

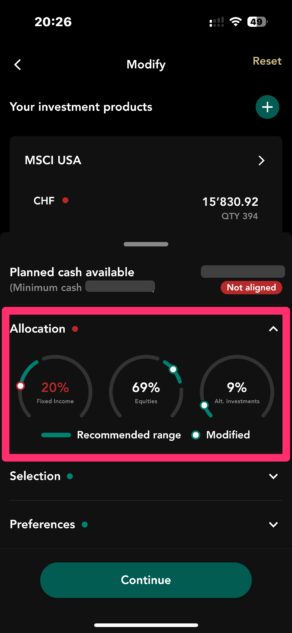

When you make your changes, you can check using the tabs at the bottom whether your allocation is consistent with your investor profile:

Guided by Alpian – Allocation

A red message “Not aligned” will be displayed if your choices are not consistent with Alpian’s recommendations.

You can ignore this message and validate your changes. It’s your decision, but another message will appear again on the next page for confirmation.

Your orders are then recorded and you have to wait a few hours (Alpian indicates up to 2 days maximum) for them to be executed.

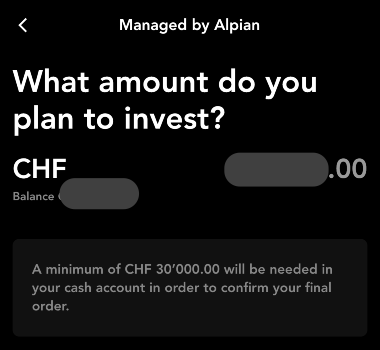

Invest with Managed by Alpian

To use the Managed by Alpian management mandate, you must transfer at least 30,000 CHF from your current account to your investment portfolio.

Managed by Alpian

Then, your portfolio will be 100% managed by Alpian according to your investor profile. This is discretionary management in which you will not be able to decide to buy or sell specific ETFs.

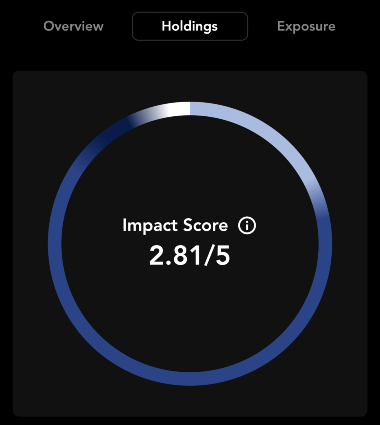

Indicators for Monitoring your Investments

Alpian gives you access to various indicators that allow you to understand how your money is invested.

The Impact Score allows you to measure the sustainable footprint of your investment portfolio. It assesses the extent to which your investments contribute to environmental, social and governance (ESG) issues.

Alpian Impact Score

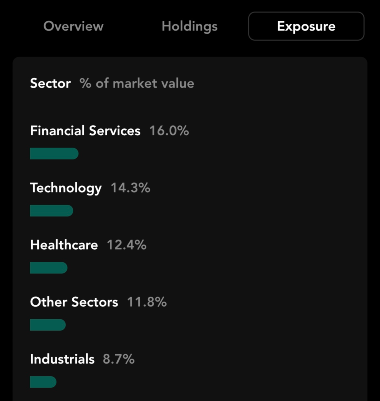

The “Exposure” tab allows you to see your portfolio’s exposure to different sectors such as:

- Financial Services,

- Technology,

- Healthcare,

- Energy,

- Real Estate,

- …

Alpian Markets Exposure

There is also a world map that allows you to see where your money is invested, but this does not seem very reliable to us because for example Japan does not appear in color while the ETF MSCI Japan is in our portfolio.

Our opinion on the Usability and Ease of Use of Alpian

The ergonomics of the Alpian application are distinguished by their simplicity and refined design, which greatly facilitates the user experience. From the first steps, the interface is intuitive, allowing users to easily navigate between banking and investment features. The menus are well organized, and essential information on portfolios and performance is accessible in a few clicks.

Whether you are a novice or experienced investor, the Alpian application offers a fluid experience, where each action is clearly guided. In addition, the integration of wealth management tools, such as the Impact Score, and interactions with advisors are well thought out, making the customization of your investments easy and accessible. In short, Alpian manages to combine ease of use and advanced features, making the management of your assets pleasant and hassle-free.

Alpian Investment’s Usability gets a rating of 9/10Alpian Investment Fees Review: 8/10

Alpian applies an annual management fee of 0.75% on the total value of your investments. This rate includes VAT, and applies without a minimum or maximum.

For example, for a portfolio of 100,000 CHF, you will pay 750 CHF per year. This fee covers all services, such as personalized advice, active management of your portfolio and the production of the annual tax report. In addition, transaction costs are included in this fee, which simplifies the fee structure for clients.

However, some fees are not included in this 0.75%, including:

- Stamp duty,

- Exchange fee (0.2% on weekdays, 0.5% on weekends),

- Product costs related to ETF investments.

The advantage of Alpian is that the majority of investments are hedged in CHF, which reduces the risks and costs related to currency fluctuations.

On average, the total fees for an investment via Alpian, including management and ETFs, are around 1%.

Comparison with Neobanks: Alpian vs. Neon Invest vs. Yuh

When it comes to investing, fees play an important role in determining the overall profitability of your portfolio. Here’s how Alpian, Neon Invest and Yuh compare in terms of fees:

Neon Invest vs Alpian

Alpian and Neon Invest are aimed at different types of investors. Neon Invest charges the following fees:

- Swiss stocks and ETFs: 0.5% of the transaction value.

- International stocks: 1% of the transaction value.

- Conversion fees: None for international transactions, all amounts are processed in Swiss francs.

- Custody fees: None, unlike other platforms that often charge annual fees for securities management.

In contrast, Alpian employs a different model with a fixed annual management fee of 0.75%, which includes transaction costs, active portfolio management and personalized advice. This means that Alpian is more suitable for investors who are looking for a more integrated and passive wealth management, while Neon is more suitable for those who prefer autonomous management, especially for active investors who make frequent transactions.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before March 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Yuh vs Alpian

Similarly, Alpian and Yuh are aimed at different types of investors. Yuh charges the following fees:

- Transaction fees: 0.5% on all transactions (Swiss and international stocks).

- Foreign exchange fees: 0.95% fee for non-CHF denominated transactions, which can significantly increase costs for those investing in global markets.

- Custody fees: None, making it competitive for long-term holders.

Yuh stands out for its low transaction fees (0.5% per transaction) and the absence of management fees, making it an attractive solution for cost-conscious, do-it-yourself investors. Conversely, Alpian charges 0.75% management fees for full asset management, thus appealing to investors who prefer a more passive and personalized approach. Thus, Yuh is more advantageous for active traders, while Alpian is more suitable for those looking for comprehensive wealth management.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

It is therefore not really possible to make a direct comparison of the fees of Alpian with those of Neon Invest and Yuh.

If we compare Alpian’s mandate fees to those of traditional private banks that typically charge around 2% per year, Alpian is particularly competitive. With an annual fee of 0.75%, Alpian offers a significantly more affordable solution while still providing active and personalized management services. Even taking into account ETF costs, Alpian’s total fees are around 1%, which is still lower than the average for traditional Swiss banks, where management fees are 1.38% (according to a Moneyland study).

Alpian Investment Fees get a rating of 8/10Security of Investments with Alpian: 10/10

Alpian guarantees the security of your assets thanks to strict regulation and enhanced protection measures. Since 2022, Alpian has had a Swiss banking license issued by FINMA (Swiss Financial Market Supervisory Authority), ensuring that all its activities comply with the rigorous standards of Swiss regulation.

Your assets are held with Interactive Brokers, a trusted financial institution. This means that your investments are separate from the assets of Alpian and Interactive Brokers, remaining protected even in the event of bankruptcy of either. In addition, your assets are protected up to 100,000 CHF under the Swiss Deposit Protection Act, ensuring the safety of your funds.

The security of your account is also a priority, with the integration of two-factor authentication (2FA) to protect access to your account and investments. You can track the evolution of your assets in real time via the Alpian app, offering total transparency on the management of your portfolio. It is however important to note that it is not yet possible to transfer your shares directly to another broker, which may restrict certain options if you wish to move your investments elsewhere.

Alpian Investment gets a rating of 10/10 for securityInvesting with Alpian vs. Traditional Private Banks

Alpian positions itself as an accessible Swiss private bank with an entry ticket of only 30,000 CHF for a discretionary management mandate.

For comparison, here are some examples of Swiss private banks with minimum investment thresholds for their management mandates:

- Pictet & Cie: the minimum to open a management mandate is generally 1 million CHF.

- Lombard Odier: The management mandate often starts from 1 million CHF, but this can vary depending on the client profile.

- Julius Baer: The private bank generally requires a minimum of 500,000 CHF to 1 million CHF for a management mandate.

- UBS Wealth Management: Clients often need at least 250,000 CHF for a management mandate within the wealth management division.

- Syz Bank: Typically, this bank requires a minimum of 500,000 CHF to open a management mandate.

Alpian’s management fees are also significantly more competitive than those of traditional private banks, where wealth management costs can quickly become very high.

According to a study by Moneyland.ch, Swiss banks charge an average of 1.32% per year for a wealth management mandate, a rate that does not include additional costs such as exchange fees, stamp duties or fees for investment products such as ETFs. For example, Sparkasse Schwyz charges around 1.3% for an ETF-based mandate, while Basel-Landschaft Kantonalbank (BLKB) can charge up to 1.5%, depending on the investment strategy adopted. These figures are a good illustration of the high costs that wealthy clients have to face with traditional private banks.

In comparison, Alpian offers a much simpler and more economical pricing model. With a fixed management fee of 0.75% per year, which includes active portfolio management, personalised advice and transaction costs, Alpian positions itself as an attractive alternative for investors. Moreover, even taking into account the costs associated with products such as ETFs, Alpian’s total fees are approximately 1%, well below the average for Swiss private banks. This means that Alpian offers complete wealth management at a much more affordable cost than traditional institutions, whose fees can reach 2% or more in some cases.

Should you Invest with Alpian ?

Alpian is suitable for several investor profiles, particularly those seeking a modern and personalised approach to wealth management. Here are the main types of clients for whom Alpian is well suited:

- Investors with modest to medium capital: Unlike traditional private banks that often require high minimum capital, Alpian offers increased accessibility, with much lower investment thresholds, allowing a greater number of investors to access wealth management services.

- Individuals seeking active and personalized management: Alpian offers active and tailored portfolio management, combined with expert advice, ideal for those who prefer to delegate management while remaining informed and involved.

- Investors seeking ETFs and portfolio diversification: Alpian focuses on modern investment solutions, including ETFs, thus offering effective diversification at a lower cost, suitable for those looking to optimize their portfolio.

- Clients conscious of management fees: With a management fee of 0.75%, Alpian is particularly attractive to cost-conscious investors, especially in comparison with traditional private banks, which are often more expensive.

- Users of modern technologies: Alpian, as a digital private bank, is aimed at investors who are comfortable with digital platforms, appreciate the flexibility and online access to manage their investments while benefiting from the expertise of advisors.

In summary, Alpian is an ideal solution for those who want accessible, modern and active wealth management, without the high barriers of traditional private banks.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Frequently Asked Questions (FAQ) about Investing with Alpian

✅ Does Alpian offer promo codes or referral codes for new users?

Yes, Use the promo code ALPNEO before March 31, 2026 to get CHF 120 Free 🙌 with Alpian. Get the Alpian app ➡️

✅ What is the minimum amount required to invest with Alpian?

Alpian requires a minimum amount of 10,000 CHF for its “Guided by Alpian” option and 30,000 CHF for “Managed by Alpian”, much lower than the amounts required by traditional private banks.

✅ What are Alpian's fees?

Alpian charges a management fee of 0.75% per year on the total value of investments. These fees include the personalized advice and active portfolio management. Some fees, such as stamp duty and foreign exchange fees, are not included.

✅ What types of assets does Alpian offer?

Alpian mainly focuses on ETFs (Exchange Traded Funds), but can also include other assets depending on the chosen investment strategy.

✅ What languages are available on Alpian?

Alpian offers its services in English, French, German, and Italian, thus meeting the needs of its clients in different regions of Switzerland.

✅ How does Alpian compare to traditional private banks?

Alpian’s management fees are significantly lower than those of traditional private banks (0.75% compared to 1.32% to 2% on average), while still providing personalized management services.

✅ Can I speak to an advisor at Alpian?

Yes, Alpian offers personalized support, where clients can talk to wealth managers to adjust their portfolios and receive tailored advice.

✅ Is Alpian only available in Switzerland?

Alpian is currently focused exclusively on the Swiss market and its services are therefore not available to cross-border workers and non-residents.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Sources:

Additional information

Specification: Investing with Alpian: Complete Guide, Review and Fees (March 2026)

| Trading | ||||||||

|---|---|---|---|---|---|---|---|---|

| ||||||||

| Specification | ||||||||

| ||||||||

Chris Mouton –

I have been with Alpian for about 6 months and thus far I am satisfied with the service I received.