Neon Bank Review December 2025 – Pros & Cons + 100 CHF Code

| Account opening | 8 |

|---|---|

| Usability | 9 |

| Features | 8 |

| Credit Card | 8 |

| Fees | 9 |

| Security | 9 |

| Customer Service | 8 |

Get 100 CHF Trading Credit plus a free debit card using the promo code NEOTRADE when you open your Neon Bank account by December 31, 2025.

Neon (also known as neon-free) is a Swiss neobank enabling Swiss residents to manage a free digital bank account, invest, save, and make mobile payments entirely through a mobile app.

Our user experience with Neon shows that it only takes less than 10 minutes to open a Neon account through the Neon app.

Neon Overall Rating: 8.4/10

Description

Neon Bank Quick Facts in December 2025

| Neon Quick Facts | Details |

|---|---|

| Bank Type | Neobank (Hypothekarbank Lenzburg partner) |

| Established | 2019 |

| Headquarters | Zurich, Switzerland |

| Users | 200,000+ |

| Languages | English, French, German, Italian |

| Free Account | in CHF only |

| Card | Mastercard Debit Card |

| Interest Rate | 0.00% up to CHF 25,000 on Spaces |

| Investment Options | Stocks, ETFs |

| Deposit protection | Up to CHF 100,000 |

| Review Rating | 8.4/10 |

In This Neon Bank Review

Introduction

In December 2025, Neon Bank is one of the most popular digital banks in Switzerland, earning an overall rating of 8.4/10 in our Neon Bank Review and ranking 2nd Best in our Top 10 of Swiss neobanks .

Our Neon Bank review covers the Neon app, the different types of accounts, the Mastercard debit card, and Neon Invest. Neon offers a free CHF account with no monthly fees and a modern, user-friendly app for complete financial management.

With Neon Invest, you can easily invest in more than 240 stocks and 70 ETFs directly through the app. Neon is particularly appealing if you’re looking for a simple banking solution for your everyday needs, including free domestic payments and international transfers via WISE.

Neon Bank Review: The Independent Swiss Digital Bank

Neon is a Swiss neobank that offers banking services accessible via a mobile application. Created in 2018, Neon aims to offer a modern and simplified banking experience for its customers.

All you need to do is be a Swiss resident – regardless of nationality – to open an account with Neon Bank.

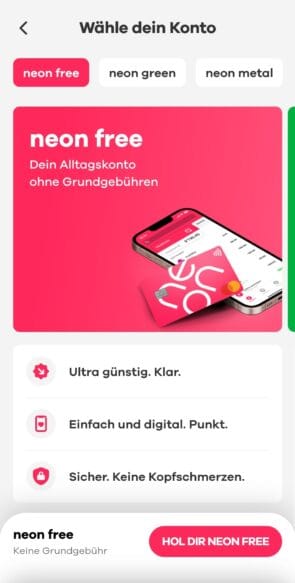

Neon Bank now offers 4 types of mobile bank accounts in CHF:

- neon free: the free account

- neon plus: 2 CHF/month, with free withdrawals in Switzerland and 0 % exchange fees

- neon global: 8 CHF/month, with insurance, Wise cashback, and lower fees abroad

- neon metal: 15 CHF/month, with a metal card, premium insurance, and free withdrawals everywhere

👉 Neon green is no longer a standalone plan. It becomes an option at 3 CHF/month, addable to any of the above plans.

Each account comes with the following benefits:

- 100% account management via iPhone or Android app

- Free payments in Switzerland in CHF

- MasterCard Debit Card

We have tested the Neon Bank app for you and compared the fees in detail.

Neon Bank Account Opening Review: 8/10

Getting Started with Neon

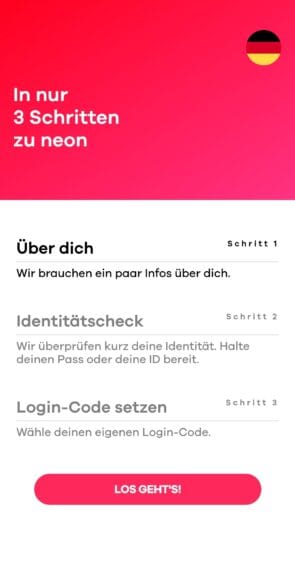

With Neon, opening a free mobile bank account is quick and convenient, directly from your smartphone. Our review of Neon shows that the registration process is straightforward, guiding you seamlessly through each step. Available exclusively to Swiss residents, Neon makes it possible to set up an account in just a few minutes, making it an attractive option for those seeking a no-fee digital bank account.

Conditions for Opening a Bank Account with Neon

- Be at least 15 years old (also 14 years old with Yuh)

- Living in Switzerland

- Have a smartphone compatible with the app

- No proof of income required

- No minimum opening deposit

- No minimum balance to maintain

You can absolutely use Neon Bank to receive your salaries and make bank transfers in Switzerland or abroad. The Neon accounts are located at Hypothekarbank Lenzburg AG. This has a banking license and therefore guarantees deposits (up to 100,000 CHF).

How to Open a neon-free Account with Neon

Opening an account with Neon Bank begins in the app:

- Download the Neon app in the App Store or Google Play or scan this QR code with your smartphone:

- Answer the questions

- Verify your identity

- It’s done! Your account is open 🙌

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE by December 31, 2025 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

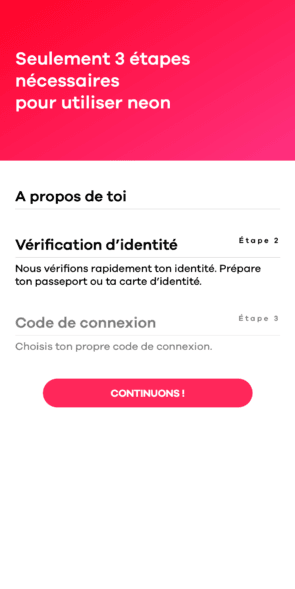

Steps for Opening a Bank Account with the Neon Bank App

The Neon App is available in French 🇫🇷 German 🇩🇪 Italian 🇮🇹 and English 🇬🇧

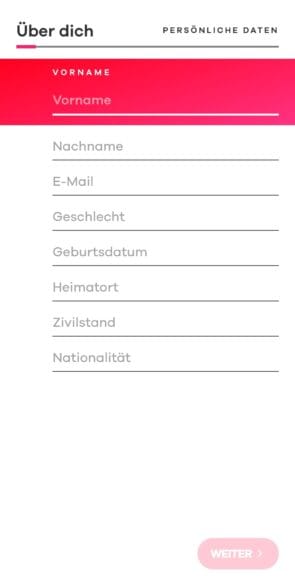

#1 You enter your personal information after the welcome message

If you do not have Swiss nationality, customer service will ask you – after opening – for a copy of your B permit (or C) by email.

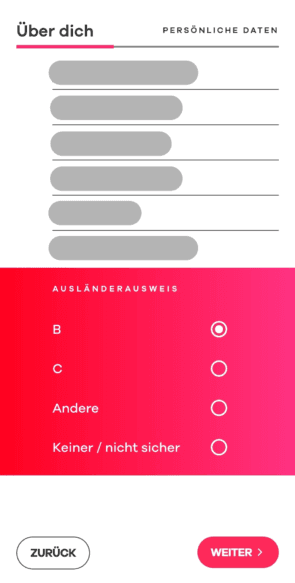

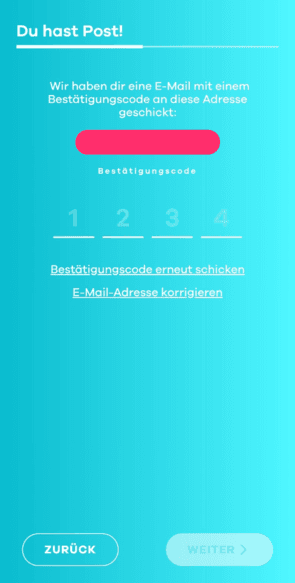

#2 You confirm your email address

#3 You enter promo code NEOTRADE and choose your plan (neon-free is free)

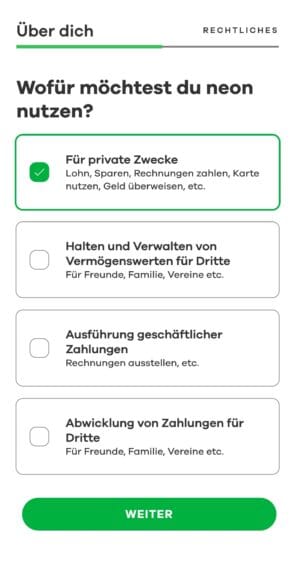

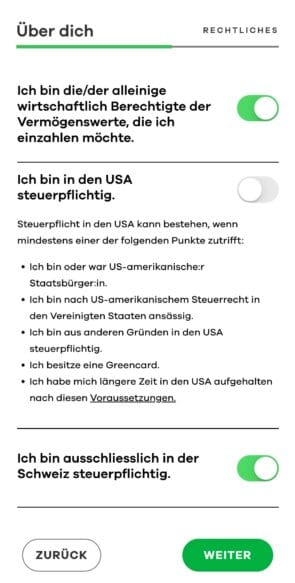

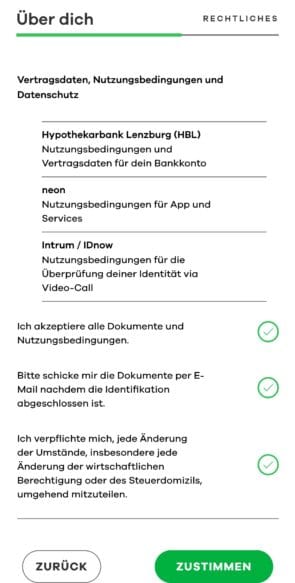

#4 You accept the terms and conditions

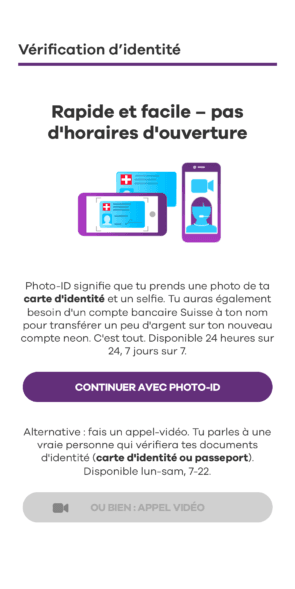

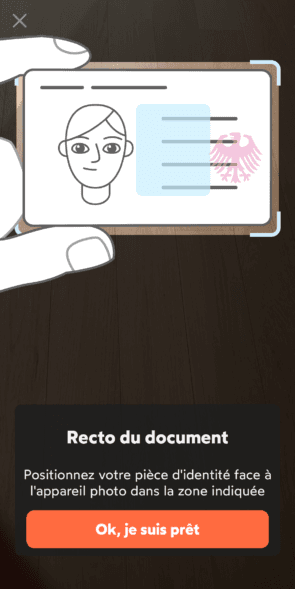

#5 And finally, you verify your identity through video

The Neon Bank account allows you to carry out all standard operations (transfers, direct debits, etc.) like any bank account in Switzerland.

neon-free offers a Debit MasterCard which costs 20 CHF and as with all Swiss banks, you receive two letters: one for the card and one for the PIN code.

That’s a lot of paper compared to neobanks like N26 or Revolut who send only 1 letter with a nice packaging.

Here is for example the mail N26:

N26 Debit Card

Neon Bank for Foreigners

While several Swiss neobanks have begun to accommodate non-residents, such as Yuh, Neon Bank remains exclusive to Swiss residents. This means that individuals living outside Switzerland, including those from countries like France, Germany, Italy, Austria, and Liechtenstein, cannot open an account with Neon.

If you are a foreigner seeking a Swiss digital bank account, options like Yuh might be more suitable for you, as they provide the flexibility to non-residents. Neon’s strict residency requirement limits its accessibility for international users looking for banking solutions in Switzerland.

To explore more about non-resident options, check our comprehensive articles on 4 Ways to Open a Swiss Bank Account for Non-Resident and Neobanks for Non-Residents & Cross-Border Workers in Switzerland.

Our Opinion on the Bank Account Opening with Neon

- Very fast opening in 10 minutes

- No income requirement

- Swiss Banking License

- Account in CHF

- Opening is slower if you need to prove your residency

We appreciate the simple and quick opening of the account, even if we would have liked more luxurious packaging.

-2 points

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE by December 31, 2025 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon App Features Review: 8/10

Neon Features List

Being a neobank, Neon Bank offers most of its services via the mobile application:

- Consult your banking transactions

- Enter transfers or standing orders

- Pay your invoices eBill

- Pay and receive money with TWINT

- Scan and pay invoices with QR code

- Block and replace bank card for free

- Change card PIN

- Update their phone number and personal information

- Create sub-accounts (Spaces)

- Get a Neon metal card

- Trade stocks and ETFs with Neon Invest

- Open a joint account with Neon Duo

- Open a savings plan

Here is what is missing:

- No dedicated TWINT application (like Yuh TWINT)

- No virtual bank card (unlike Yuh, N26 or Revolut)

- No settings for MasterCard card limits, beyond the max. monthly

- Not possible to share sub-accounts with individual IBANs (Spaces)

Neon App Payment Options

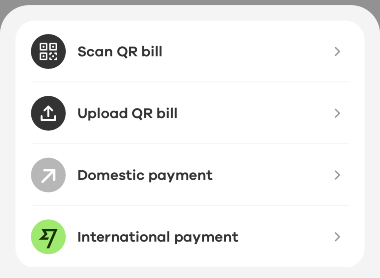

Neon offers flexible payment options for handling your payments, whether it’s domestic transfers within Switzerland, international transactions, or features like eBill. Simply navigate to the “Payments” section in the app and click “New payment” to see all available options.

Neon Payment Options

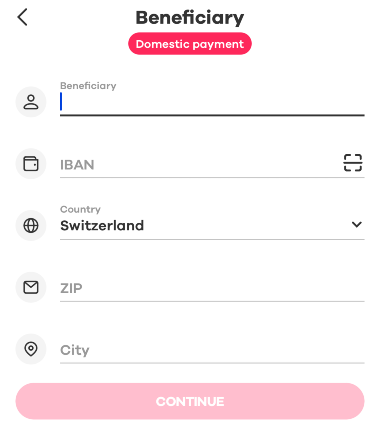

Domestic Payments

Neon offers straightforward, fee-free transfers within Switzerland. You can send CHF to any Swiss bank account quickly and efficiently. A useful feature we appreciate is that you don’t need to manually enter the entire IBAN; simply click the icon on the right to scan the IBAN number, making transactions even easier.

Domestic payment with Neon

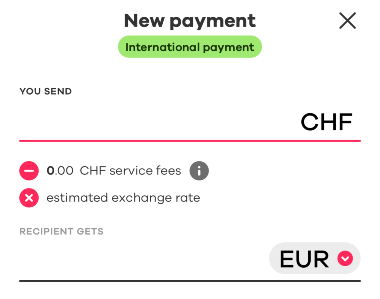

International Payments

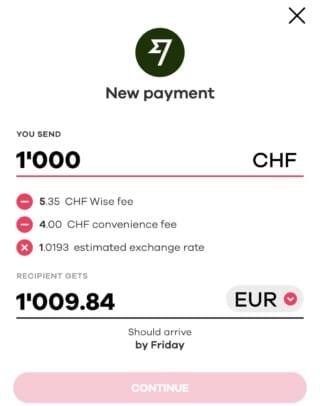

When it comes to international transfers, Neon has partnered with Wise, known for its competitive rates and transparent service. This collaboration allows Neon you to send money to over 40 currency zones without hidden exchange rate markups. By leveraging the mid-market rate, you benefit from fair and accurate currency conversions. The app ensures transparency, displaying all associated fees upfront so that you know exactly what they’re paying for each transfer.

International payment with Wise

Scan & Pay

For handling bills within Switzerland, Neon’s Scan & Pay feature adds convenience to traditional payment methods. With just a quick scan of a QR code on any bill, the app automatically processes the payment details, saving you time and effort. This function is particularly helpful for those who frequently pay utility bills, invoices, or other QR-based statements.

eBill

Neon’s support for eBill simplifies the process of managing and paying bills. By registering for eBill within the app, you can receive electronic invoices directly, reducing paperwork and streamlining the payment process to just a single tap. This feature is perfect for recurring bills, ensuring they are always paid on time without manual entry or hassle.

Neon Bank TWINT

Unlike Yuh TWINT, which has its own TWINT app, Neon Bank does not offer an exclusive TWINT app. However, you can still use TWINT with your Neon account through the TWINT Prepaid app. Here’s how:

- Download and Register: Install the TWINT Prepaid app on your iPhone or Android smartphone. Open the app, click on “Register,” and follow the instructions, including taking a photo of your ID and entering your contact details.

- Link Your Neon Account: In the app menu, go to “Top up credit,” select “Bank account,” and choose Hypothekarbank Lenzburg (Neon’s partner bank). You’ll need to take a photo of your Neon card and input your IBAN.

- Verification: After submitting your information, the bank will typically take 1-2 working days to complete the verification process.

- Top Up and Use: Once verified, you can transfer funds from your Neon account to the TWINT Prepaid app. Keep in mind that TWINT Prepaid is a prepaid service, so you’ll need to load funds before making payments. Top-ups up to CHF 200 are available instantly.

Quick note: Previously it was possible to use the UBS TWINT app with Neon accounts, but since September 2024, this is no longer compatible with new Neon Debit Mastercards.

Neon Joint Account: Neon Duo

Neon offers Neon Duo, a joint account for couples, friends or family members to manage shared finances together. Both account holders have equal access and control so sharing expenses like rent, groceries and other household bills is a breeze.

Key Features of Neon Duo:

- Equal Access: Both users can see the account balance, track transactions and make payments.

- Shared Card: Each user gets their own Neon card linked to the joint account for easy spending.

- Expense Tracking: The app has detailed expense tracking and budgeting tools for transparency between account holders.

- Quick Setup: No extra fees for setting up or managing the account.

Neon Duo is for those who want to share expenses without sacrificing transparency or ease. Read our Neon Duo review to find out more.

Neon Invest: Investing with Neon Bank

Neon Invest allows you to invest easily and at a low cost. With an intuitive interface embedded in the Neon banking app, you can access global stocks and ETFs with ease, which is perfect for beginners and intermediate investors.

The platform offers access to over 240 stocks and 70 ETFs listed on BX Swiss, allowing you to build and diversify your portfolio based on your financial goals and risk appetite.

Here is a summary of Neon Invest’s trading fees:

| Trading fees | Amount |

|---|---|

| Account management fees | ✅ Free |

| Custody Fees | ✅ Free |

| Swiss Stock Trading | 0.50% |

| Swiss ETF Trading | 0.50% |

| International Stock Trading | 1.00% |

Like Alpian and Yuh, Neon does not charge custody fees, which helps keep investment costs manageable. However, stamp duty and TER fees still apply. A minimum trading fee of 1 CHF is charged per transaction, which can affect smaller investments.

Neon Invest does not currently offer fractional share trading, unlike Yuh, which provides this feature to allow more flexible investing options. While Yuh also includes direct cryptocurrency trading, Neon focuses on traditional stocks and ETFs, catering to investors who prefer conventional investment options.

For more in-depth information on Neon Invest’s features and whether it aligns with your investment goals, check our comprehensive Neon Invest Review.

Our Opinion on Neon App Features

Neon has reliable and practical banking features like domestic and international payments, Scan & Pay for bill management and eBill integration. The Neon Duo joint account is great for sharing financial responsibilities between couples, friends or family members. But features like TWINT app and virtual cards are missing.

Neon doesn’t have all the extras of Yuh or Revolut Switzerland but it’s a simple and reliable mobile banking for everyday use. Neon Invest also allows you to easily invest in global stocks and ETFs so it’s good for both beginners and more experienced investors. Overall Neon has a good set of features that balances convenience with functionality so you can manage your finances and investments.

Neon app features get a rating of 8/10 Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE by December 31, 2025 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon Credit Card Review: 8/10

Neon MasterCard Debit card

neon-free offers a Debit MasterCard which costs 20 CHF. It is red, which is in line with the “flashy” colour trend offered by other neobanks.

Neon Debit Mastercard

The Neon Bank debit card is great for traveling and is compatible with Apple Pay, Google Pay, Samsung Pay, Garmin Pay, and Swatch Pay.

Neon Bank Card Limits

Neon applies the following limits on the use of its debit card:

| Card Limits | Amount |

|---|---|

| Daily Payment Limit | 5'000 CHF online and 5'000 CHF in stores |

| Monthly Payment Limit | 10,000 CHF/month |

| Daily Withdrawal Limit | 2,000 CHF/day |

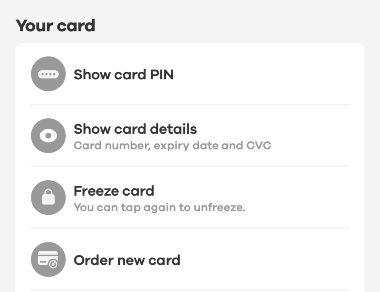

Neon Card Settings

Neon provides convenient card management options within its app, enabling you to:

- View your card PIN

- View your card information, including the card number, expiration date, and CVC.

- Temporarily freeze and unfreeze your card for enhanced security.

- Order a replacement card.

- Add your card to Apple Pay or Google Pay.

Neon Bank Card Settings

However, when compared to other neobanks, Neon Bank lacks certain advanced card usage restrictions. Below is a comparison of Neon with Alpian, Yuh, and Revolut.

| Feature/Restriction | Alpian | Neon | Radicant | Yuh | Revolut |

|---|---|---|---|---|---|

| View card information | ✅ | ✅ | ✅ | ✅ | ✅ |

| View/change PIN | ✅ | ✅ | ✅ | ✅ | ✅ |

| Temporarily block card | ✅ | ✅ | ✅ | ✅ | ✅ |

| Add card to Apple/Google Pay | ✅ | ✅ | ✅ | ✅ | ✅ |

| Adjust monthly limit | ✅ | ❌ | ✅ | ✅ | ✅ |

| Online payment restrictions | ✅ | ❌ | ✅ | ❌ | ✅ |

| Cash withdrawal restrictions | ✅ | ❌ | ❌ | ❌ | ✅ |

| Contactless payment control | ❌ | ❌ | ❌ | ❌ | ✅ |

| Magnetic swipe payment control | ❌ | ❌ | ❌ | ❌ | ✅ |

| Foreign transaction restrictions | ❌ | ❌ | ✅ | ❌ | ✅ |

| Geolocation restrictions | ❌ | ❌ | ❌ | ❌ | ✅ |

While the Neon card is efficient, it still lacks a few features to be perfect.

Neon card receives a rating of 8/10 Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE by December 31, 2025 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon Bank (neon-free) Fees: 9/10

Neon being a neobank based in Switzerland, prices are displayed in CHF

Neon Private Account Fees

- From: 0 CHF/month. The neon-free plan is free.

- Account management: via iPhone or Android mobile application

- Bank card: Debit MasterCard

Neon Bank MasterCard Fees

- The Neon MasterCard is free, but delivery costs 20 CHF.

- A card replacement is charged 20 CHF.

Cash Withdrawal Fees

- Cash withdrawals in Switzerland (CHF): 2.50 CHF per withdrawal — no free withdrawals included with neon free (formerly 2 free/month).

- Cash withdrawals in Switzerland via the Sonect app: still free and unlimited at partner kiosks and stores.

- Cash withdrawals abroad: subject to a 1.5 % fee, plus 0.35 % currency conversion fee if you pay in a foreign currency.

Even though Neon applies a currency conversion fee for cash withdrawals in EUR or abroad, it uses the Mastercard exchange rate for currency exchange, so that you still receive competitive and transparent rates for international transactions.

Neon has a monthly cash withdrawal limit of 10,000 CHF, which applies to all withdrawals, both domestic and international.

International Bank Transfers Fees

Neon uses WISE for international transfers. Fees typically range from 0.8% to 1.7%, depending on the currency and the amount transferred. Users on the neon global and neon metal plans receive 20% and 40% cashback on Wise fees, respectively.

For a transfer CHF to EUR, Neon applies a fee of 0.9%, or approximately 0.5% pour Wise and 0.4% for Neon

Neon Bank – Wise CHF EUR

Comparison table of Neon plans

Here’s a concise overview of the four plans offered by Neon:

| Features / Fees | neon free | neon plus | neon global | neon metal |

|---|---|---|---|---|

| Monthly Price | FREE | CHF 2 | CHF 8 | CHF 15 |

| Annual Price (One-Time Payment) | FREE | CHF 20 | CHF 80 | CHF 150 |

| Exchange Rate Fees (Foreign Currency Payments) | 0.35% | 0% | 0% | 0% |

| Withdrawals in Switzerland | 2.50 CHF per withdrawal | 2 free/month, then 2.50 CHF | 3 free/month, then 2.50 CHF | 5 free/month, then CHF 2.50 |

| Withdrawals Abroad | 1.50% + 0.35% | 1.00% | 0.50% | 0% |

| Wise Cashback (International Transfers) | ❌ | ❌ | ✅ 20% | ✅ 40% |

| Telephone Support | ❌ | ✅ | ✅ | ✅ |

| Extended Purchase Guarantee | ❌ | ✅ | ✅ | ✅ |

| Shopping & Travel Insurance | ❌ | ❌ | ✅ | ✅ |

| Additional Insurance | ❌ | ❌ | ❌ | ✅ (cyber, phone, etc.) |

| Metal Card | ❌ | ❌ | ❌ | ✅ |

| Recommended for | Local use, without frequent withdrawals or foreign currency payments | Regular use with some withdrawals and purchases abroad | Frequent travelers or regular payments in foreign currencies | Heavy international users requiring comprehensive insurance |

Neon Bank Pricing: neon free

neon free is Neon Bank’s free plan. It remains available to everyone with no monthly fees, but certain benefits that were once included at no cost have been removed since May 2025.

neon free Card:

neon free Card

- 0.35% exchange fee on foreign currency payments

- 1.5% fee + 0.35% exchange fee on ATM withdrawals abroad

- 2.50 CHF per withdrawal in Switzerland, with no free monthly withdrawals

- International transfers via Wise, with no cashback

- No phone support or insurance included

👉 This plan is still suitable if you only use your card in Switzerland for CHF payments and make few or no cash withdrawals.

Cost-effectiveness:

If you avoid ATM withdrawals and never pay in foreign currencies, neon free remains entirely free. However, for any use abroad or frequent withdrawals, fees can add up quickly.

💡 Conclusion: neon free is ideal for minimalist local use but shows its limits as soon as you travel or withdraw cash.

Neon Bank Pricing: neon plus

neon plus is Neon Bank’s new mid-tier plan, offered at 2 CHF per month. It restores most of the benefits that were included for free in the neon free plan before May 2025.

neon plus Card:

neon plus Card

- 0% exchange fees on foreign currency payments

- 1% fee on ATM withdrawals abroad (vs. 1.5% + 0.35% with neon free)

- 2 free ATM withdrawals per month in Switzerland, then 2.50 CHF per additional withdrawal

- Phone support included

- Extended warranty on electronic devices purchased with the Neon card

👉 This plan is ideal if you travel occasionally, sometimes pay in foreign currencies, or want a bit more daily convenience without moving to a more expensive tier.

Cost-effectiveness:

With just 2 withdrawals/month and a few foreign currency payments, the 2 CHF fee is quickly offset, especially by avoiding the 0.35% exchange fees charged on the free plan.

💡 Conclusion: neon plus is designed for those who want to avoid small daily fees while staying on a simple, affordable plan.

Neon Bank Pricing: neon global

neon global is Neon Bank’s advanced plan, offered at 8 CHF per month. It’s aimed at users who travel regularly or frequently make payments and withdrawals in foreign currencies.

neon global Card:

neon global Card

- 0% exchange fees on foreign currency payments

- 0.5% fee on ATM withdrawals abroad (vs. 1.5% + 0.35% with neon free)

- 3 free ATM withdrawals per month in Switzerland, then 2.50 CHF per withdrawal

- Insurance package: travel, shopping, and cyber protection

- Phone support included

- 20% cashback on Wise fees for international transfers

👉 This plan is especially suited for those who want to travel worry-free, enjoy fee-free payments abroad, and benefit from extended insurance coverage.

Cost-effectiveness:

If you make multiple foreign currency payments or withdrawals each month, the 8 CHF fee is quickly compensated by no exchange fees, Wise discounts, and included insurance.

💡 Conclusion: neon global is a comprehensive solution for frequent travelers or users who want to combine abroad payments with enhanced security.

Neon Bank Fees: neon metal

neon metal is Neon Bank’s top-tier plan, priced at 15 CHF per month. It’s designed for those who want to enjoy every possible benefit, including abroad.

Neon metal Card:

Neon metal Card

- Metal Mastercard debit card, no delivery fee

- 5 free ATM withdrawals per month in Switzerland (vs. 2 for other plans)

- Withdrawals abroad with no fees (vs. 1.5 % + 0.35 % with neon free)

- Comprehensive insurance coverage: Travel, shopping, cyber protection, mobile phone, best-price guarantee, ticket protector, etc.

- Wise cashback: 40 % on international transfer fees

- Card replacement fee: 120 CHF for a lost metal card (vs. 20 CHF for a plastic card)

Why subscribe to neon metal?

Beyond the premium feel of the metal card, this plan pays off if you make regular ATM withdrawals—both in Switzerland and abroad—or if you need extensive insurance coverage.

Example savings:

- 5 withdrawals in Switzerland = ~6 CHF saved

- 600 CHF withdrawn abroad = 9 CHF saved

- 1 000 CHF withdrawn abroad = 15 CHF saved

💡 Conclusion: neon metal is built for those who want a high-end solution, travel without extra fees, and enjoy a full suite of services and protections.

Neon Bank Fees: neon green

neon green is now an option available for 3 CHF/month, addable to any plan. It allows you to support reforestation projects and offers the choice of a wooden or recycled plastic card.

Neon Green Card

The other benefits of neon green are non-financial, this plan will not reduce any other costs to you. The focus is on the ecological footprint and CO2 compensation:

A carbon neutral account.

In partnership with myclimate your neon green account is completely carbon neutral from the start.

Spend and compensate.

For every 100 CHF you spend with your card, we plant a tree for you. And we will plant 5 additional trees every month: offsetting the annual CO2 consumption of an average person in Switzerland. From the first moment, you have a positive impact on the climate!

The neon-green card replacement is charged 20 CHF.

👉 See the official Neon pricing for more details.

Neon pricing gets a rating of 8/10 Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE by December 31, 2025 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon Customer Support Review: 8/10

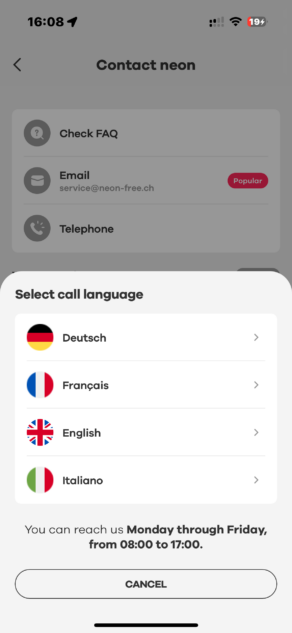

How to contact Neon Bank?

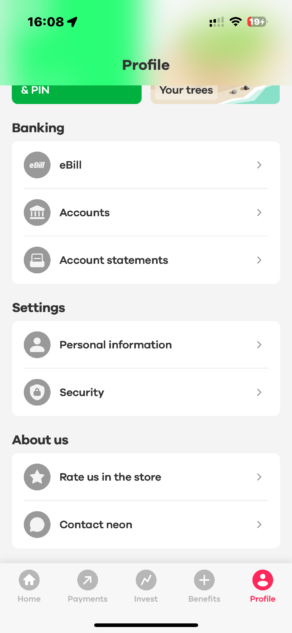

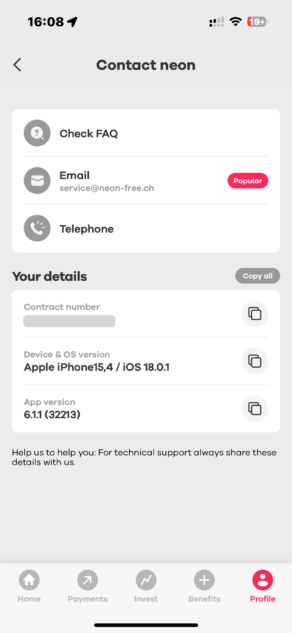

Getting in touch with Neon’s customer support is easy and can be done in several ways. Here’s how to do it through the Neon app:

- Go to the Contact Section: Open your Neon app and go to Profile. Scroll down and find Contact Neon.

- Choose your contact method: Once you’re in the Contact Neon section you’ll see options to check the FAQs, send an email to service@neon-free.ch or call our customer support. Our phone support is available Monday to Friday from 8:00 a.m. to 5:00 p.m.

- Choose your language: If you decide to call, you can choose your language (German, French, English, Italian) so we can assist you in your preferred language.

Neon Bank Address

Neon does not have a physical branch for client visits. This is the official address for correspondence with Neon:

Neon Switzerland AG

Josefstrasse 204

8005 Zurich

Switzerland

Our opinion on Neon customer service

Neon’s support options are reliable but could be more real-time. Unlike N26 which has a LiveChat until 11:00 p.m., Neon only has email and phone support. But phone support is responsive and email support is fast. Also Neon’s team answers user feedback on the App Store and Google Play, so they do care about customer feedback.

While Neon’s customer support is effective, integrating a live chat feature directly within the app could enhance user experience by providing quicker and more convenient help.

Neon Customer support gets a rating of 8/10 Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE by December 31, 2025 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon App Customer Reviews and User Experience: 9/10

Neon Customer Ratings

The Neon app is rated 4.6 on the App Store (4.5k reviews) and 4.5 on Google Play (6.5k reviews). These ratings are good without being exceptional, but opinions converge to confirm a good user experience.

Neon App Store Reviews

Neon Google Play Reviews

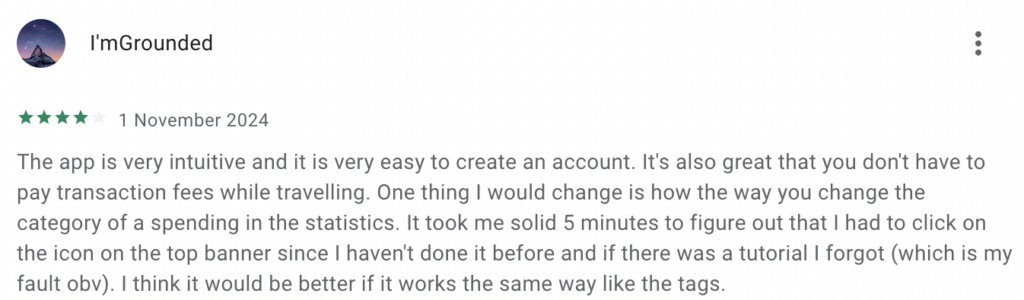

We’ve gone through user reviews of Neon on the App Store, Google Play, Reddit and Trustpilot to get an real sense of what people think about this digital bank. Overall, Neon stands out as a modern, user-focused digital bank in Switzerland, appreciated for its ease of use and cost-effective approach. Here’s a summary of the main takeaways:

Neon Reviews on the App Store and Google Play

- Positive Overall Experience: Regular users like ed93m and chlini1219 from the App Store shared that they’re quite happy with Neon’s reliable and user-friendly service. miphyk even shared a positive story about using Neon while traveling, which shows how well it works on the go. Max Von Reding on Google Play said he’s been using the app for years and likes how simple and effective it is.

- Responsive Customer Service: Tom Luna mentioned on the App Store that he had a smooth experience with customer support when he got a new phone. Neon’s got fast and reliable support. Urs Roos on Google Play appreciated Neon’s support in resolving an account access issue promptly.

- Cost-Effective Solution: Marco H on Google Play noted that while the app itself could improve in terms of speed, its competitive pricing makes it a solid choice for everyday banking. App Store reviewers like the bank’s affordability and transparent pricing for cost conscious customers.

- Modern Design: Users like anjaguggi appreciated Neon’s app design, mentioning that although there were once features they were waiting for (like Apple Pay and Wise), Neon has since added them. This reflects the app’s focus on staying up-to-date and improving. Cedric Häuptli on Google Play said Neon is reliable and suggested to make the app even better for users who want more portfolio management.

- Ease of Use and Intuitive App: Dani+8Apfel and mex.mirror on the App Store found the app easy to use, they say that bill payments and transfers are a breeze. Pascal Marti on Google Play said the Neon app is user-friendly, stable and practical for daily use.

- Minor limitations: Some users, like Fabian Hêche on Google Play, wish for more currency options with a multi-currency account, similar to Alpian or Yuh.

Neon Review on Google Play

Neon Reviews on Reddit and Trustpilot

- Reliability: On Reddit, KingOfLosses had some app glitches but overall likes Neon’s reliability and customer support, especially for international payments. On Trustpilot, Gustavo likes the low fees and the “spaces” tool to manage finances.

- User Satisfaction and Practicality: Trustpilot users such as Radim S. and Andy Ullmann found Neon ideal for daily banking, appreciating its no-fee structure and modern interface, making it better than traditional banks like UBS and PostFinance.

- Proactive and Receptive to Feedback: Andy Ullmann on Trustpilot likes Neon’s proactive approach and responsiveness to user feedback, building trust and fostering loyalty.

- Continuous Improvement: Across all platforms users like Neon’s updates and new features so the app stays up to date. This has built a loyal user base that trusts Neon to improve their services.

In summary, Neon Bank is liked for its fee-free structure, intuitive app, and responsive customer support. While there are occasional technical issues, Neon’s proactive approach, regular updates and affordability makes it a good choice for digital banking in Switzerland.

Neon App User Experience

Neon is modern, user-friendly and fast, comparable to leading neobanks like N26 and Revolut. Designed to offer Swiss users a simple and accessible platform to manage their daily banking needs. Here’s why:

- The app is fast and smooth: The Neon interface is quick and seamless, making it easy for users to navigate through its features without any hiccups. It’s designed to keep the experience stress-free and enjoyable.

- The menus are clear and well organised: The app’s menus are designed to be clear and easy to navigate. Whether managing accounts, transferring funds, or checking transactions, everything is logically arranged to make banking simpler.

- Essential functions accessible directly: Key functions like transfers, balance checks, and expense analysis are highlighted and always within reach, so you can get things done quickly without searching around.

Neon combines modern design with practical features to provide a banking solution that truly simplifies life. Perfect for those who want to manage their finances efficiently and without hassle.

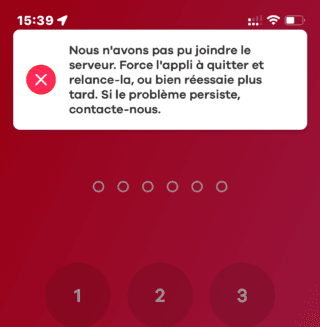

We still subtract 1 point because the connection to the application is sometimes slow, or even not possible at certain times.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE by December 31, 2025 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon Banking License and Security: 9/10

Neon is a partner of Hypothekarbank Lenzburg, a Swiss bank that holds a Swiss banking license and is regulated by FINMA (Swiss Financial Market Supervisory Authority). This partnership allows Neon to offer regulated financial services while ensuring compliance with Swiss financial regulations.

Thanks to this collaboration, your assets benefit from the same security standards as those in traditional banks. Additionally, your deposits are protected up to 100,000 CHF under the Swiss Deposit Protection Act, ensuring the safety of your funds.

Neon also implements two-factor authentication (2FA) to enhance the security of your account access. However, it’s worth noting that you currently cannot transfer shares directly to another broker.

Overall, the banking license of Hypothekarbank Lenzburg and Neon’s security measures help ensure the safety of customer funds.

Neon gets a rating of rating of 9/10 for SecurityOur Final Review of Neon Bank

If you are looking for a simple and modern banking solution, Neon Bank might be the right choice for you. Its free CHF account with no monthly fees, along with its MasterCard debit card, allows you to manage your finances with ease. The app, with its sleek and intuitive design, makes your daily transactions easy and provides you with a clear overview of your spending.

Neon positions itself as a strong alternative to Yuh, N26 and Revolut, offering you a transparent and fee-free service, tailored to the needs of Swiss residents. If you’re looking to streamline your finances without complications, Neon is definitely an option to consider.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE by December 31, 2025 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon vs Yuh vs Zak: Which is the Best Swiss Neobank

Here is our quick comparison table to help you choose between Neon, Yuh and Zak.

| Yuh | Neon | Zak | |

|---|---|---|---|

| Overall rating | 8.6/10 | 8.4/10 | 7.9/10 |

| Free account with free card | 👍 | 👍 | |

| Minimum age | 14 years | 15 years | 15 years |

| For use in Switzerland | 👍 | ||

| For travel | 👍 | ||

| For free SEPA transfers | 👍 | ||

| For payments abroad | 👍 | ||

| For a joint account | 👍 | ||

| For Trading | 👍 | 👍 |

To find out how each criterion is evaluated, read our article Neon vs Yuh vs Zak.

Neon vs Yuh: Which is the Best for You

Use this chart to quickly decide if Neon or Yuh is better for your use case:

| Yuh | Neon | |

|---|---|---|

| Overall rating | 8.6/10 | 8.4/10 |

| Free bank account with free debit card | 👍 | |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 | |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 250 SWQ+50 CHF Trading Credits with our promo code |

To find out how each criterion is judged, read our article Neon vs Yuh – Comparison of December 2025

Neon vs Radicant : Which Neobank is the Best

Use this chart to quickly decide if Neon or Radicant is better for your use case:

| Radicant | Neon | |

|---|---|---|

| Overall rating | 8.1/10 | 8.4/10 |

| Free account | 👍 | 👍 |

| For use in Switzerland | 👍 | 👍 |

| For travel | 👍 | |

| For free SEPA transfers | 👍 | |

| For payments abroad | 👍 | |

| For trading | 👍 | 👍 |

To find out how each criterion is judged, read our article Neon vs Radicant – Comparison of December 2025

Neon vs Revolut: Which is the Best Account for Traveling

Use this chart to quickly decide if Neon or Revolut is better for your use case:

| Neon | Revolut | |

|---|---|---|

| Overall rating | 8.4/10 | 7.7/10 |

| Free Swiss bank account | 👍 | |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 withdrawals above 300 CHF | 👍 up to 300 CHF/m. |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 |

To find out how each criterion is judged, read our article Neon vs Revolut – Comparison of December 2025

Neon vs N26: Which is the Best Account for the EURO Zone

Use this chart to quickly decide if Neon or N26 is better for your application:

| Neon | N26 | |

|---|---|---|

| Overall rating | 8.4/10 | 7.7/10 |

| Free Swiss bank account | 👍 | |

| To use in Switzerland | 👍 | |

| To travel in Europe | 👍 | |

| To travel abroad | 👍 | |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | 👍 if you hold EUR |

| For Trading | 👍 Crypto |

To find out how each criterion is judged, read our article Neon vs N26 – Comparison of December 2025

Here are frequently asked questions about Neon Bank, translated into English:

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE by December 31, 2025 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Frequently Asked Questions (FAQ) about Neon Bank

✅ Does Neon Bank offer promo codes or referral codes for new users?

Yes, Use the promo code NEOTRADE by December 31, 2025 to get up to 100 CHF in Trading Credit 🙌 with Neon Bank. Get the Neon app ➡️

✅ Is Neon Bank safe?

Yes, Neon Bank partners with Hypothekarbank Lenzburg, regulated by FINMA, which ensures deposits up to 100,000 CHF are protected. Neon doesn’t directly store your funds, adding extra security.

✅ What are Neon Bank's fees?

Neon Bank is free to open and manage. However, fees may apply for certain transactions, like foreign currency payments (1.5% for EUR cash withdrawals) or ATM cash withdrawals beyond the free monthly limit.

✅ Does Neon offer a joint account?

Yes, Neon offers the Neon Duo joint account, available for couples or partners. It costs 3 CHF per person per month and includes three debit cards, making it easy to share finances while maintaining transparency over shared expenses.

✅ Is Neon compatible with Apple Pay and Google Pay?

Yes, Neon is compatible with Apple Pay and Google Pay, allowing you to link your debit card to these services for payments directly from your smartphone, adding extra convenience for daily transactions.

✅ What are the problems with Neon Bank?

Some users report occasional issues with Neon Bank, such as technical glitches in the app or delays in transactions. However, it is important to note that most of these issues are resolved quickly and the majority of customers have positive experiences with the bank.

✅ Does Neon support eBill?

Yes, Neon supports eBill, allowing you to receive and pay invoices directly from the mobile app. This eliminates manual payments and helps you centralize your bills for easier and faster payment management.

✅ What type of card does Neon offer?

Neon provides a free Mastercard debit card, which can be used both in Switzerland and abroad. It is ideal for online and in-store payments and is accepted at most retailers worldwide.

✅ How long does it take to open an account with Neon?

Opening an account with Neon is quick and easy, taking about 10 minutes through the mobile app with online ID verification. The entire process is done online, without the need to visit a branch.

✅ Can non-residents open an account?

Currently, Neon accounts are only available to Swiss residents with a valid Swiss phone number. Non-residents cannot open an account with Neon, which is a common limitation among Swiss neobanks. If you are looking for a non-resident account we recommend Yuh.

✅ What are the free withdrawal limits?

With the neon free plan, ATM withdrawals in Switzerland cost 2.50 CHF from the first withdrawal.

Free withdrawals are available with paid plans:

– 2/month with neon plus

– 3/month with neon global

– 5/month with neon metal

Abroad, withdrawal fees vary depending on the plan.

✅ At what age can I open a Neon account?

You must be at least 15 years old to open a Neon account, which aligns with Switzerland’s legal age for accessing full banking services.

✅ Can I have an overdraft with my Neon account?

No, Neon does not offer an overdraft option. You can only spend what’s available in your account, which helps with budget management and prevents unexpected debt.

✅ Was ist der SWIFT-Code order BIC-Code von Neon Bank?

The SWIFT/BIC code of Neon Bank is: HYPLCH22 XXX

Neon is a Swiss digital banking service that partners with Hypothekarbank Lenzburg AG to provide its banking services. Consequently, accounts held by Neon’s customers are managed through Hypothekarbank Lenzburg and use its SWIFT/BIC code for international transactions.

Updates

- Neon Bank’s Plan Overhaul

- Read our review of Neon Metal

- Discover the Neon metal card

- Trade stocks and ETFs with Neon Invest

- Open a joint account with Neon Duo

- Neon launches its ETF savings plan

- See the Neon ETFs list

- See the Neon stocks list

- Neon launches Neon Finsights

Sources:

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE by December 31, 2025 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Additional information

Specification: Neon Bank Review December 2025 – Pros & Cons + 100 CHF Code

| Trading | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| Account | ||||||||||||||||||||||||

| ||||||||||||||||||||||||

Jean Valjean –

Very disappointed. I made a payment that was refused because I couldn’t enter the SMS code. And guess what. Funds weren’t refunded to my account and I am fighting since once week to have my money back.

At first they said I have to wait some days, I waited more than one week but nothing happens.

Second time they told me that my funds were effectively paid to the receiver. So I write to him and he provides me document proof that he doesn’t get the funds and that the payment was refused.

Third time Neon told me that they aren’t sure that they could refund me because there’s an information (that is totally useless) that is missing for them on the documents to refund me !

A real mess !! Never go to neon. I recommend you Cler Zak which is a real bank with real qualification. And they aren’t talking to you like you are a child (what neon is doing !).

Never ever again !

Thomas Hodel –

The bank I use for my everyday payments in Switzerland and abroad. I have neon for over a year now and never had any issues. Once, there was an unknown transaction on the card, so I blocked the card. Neon then sent me a new card for free, which is nice.