CSX Review & Test

Updated:

| Account opening | 8 |

|---|---|

| Usability | 7.5 |

| Features | 8 |

| Credit Card | 8 |

| Fees | 7 |

| Security | 9 |

| Customer Service | 7 |

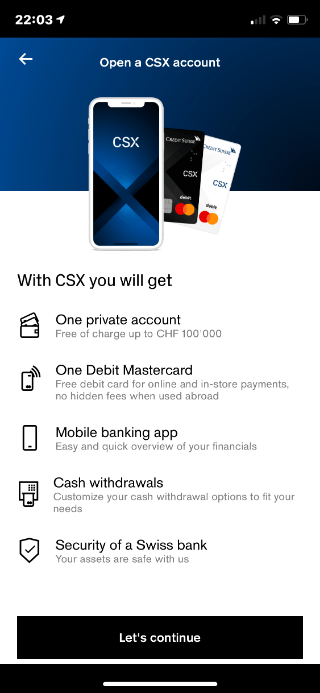

CSX by Crédit Suisse is a Swiss neobank that enables Swiss residents to open a mobile bank account and access a variety of banking services through a user-friendly mobile app.

The account comes with a complimentary Debit Mastercard, making everyday transactions easy and convenient.

CSX Overall Rating: 7.8/10

Description

Important: The CSX account from Credit Suisse is no longer available following the bank’s acquisition by UBS. CSX services have been gradually integrated into UBS’s offering, and opening new accounts is no longer possible.

CSX Review: A Free Bank Account in CHF with Crédit Suisse

Crédit Suisse (now UBS Grouo) has launched its neobank in Switzerland: CSX

The main objective of Crédit Suisse is certainly to compete with other Swiss neobanks: Alpian, Neon, Yuh and Zak.

The account is only available in CHF

Here is a summary of the CSX offer:

- Free bank account in CHF

- Free Debit MasterCard

- Premium account from 3.95 CHF

CSX also offers a bank account for teenagers and young adults from 12 to 25 – CSX Young. It includes free cash withdrawals at any ATM in Switerland.

We have tested the CSX app for you and compared features and pricing.

Review & Test of CSX Account Opening: 7/10

Yuh Bank allows you to open a free mobile bank account from your smartphone.

What are the CSX bank account requirements

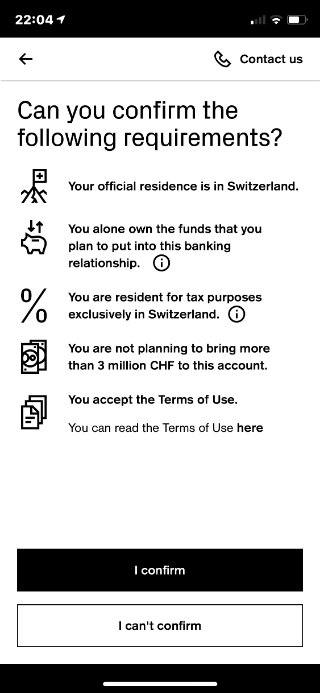

- Be at least 12 years old (15 years with Zak)

- Be a Swiss resident

- Have a smartphone compatible with the app

- No need to provide proof of revenue

- No minimum deposit

- No minimum balance

CSX inherits the security standards and reputation of Crédit Suisse. You can use this bank account to receive your salaries and make bank transfers in Switzerland or to your Revolut card.

How to open a bank account with CSX by Crédit Suisse

To open an account with CSX you just need to follow these steps:

- Download the Yuh app from the App Store or Google Play

- Answers the usual questions

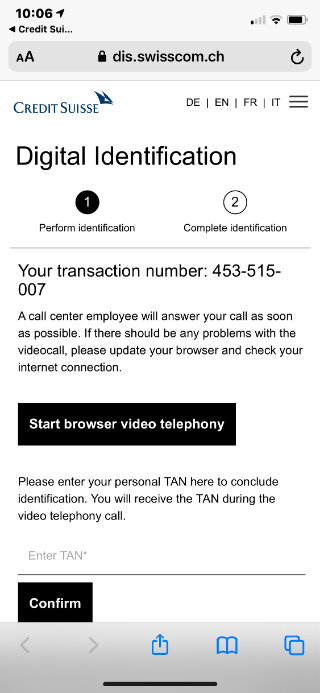

- Verify your identity through the app (CSX use Swisscom for the verification service)

- It’s done! Your CSX account is opened

Compare CSX with YUH

Compare CSX with YUH

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before January 31, 2026 to receive 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF with YUH ➡️

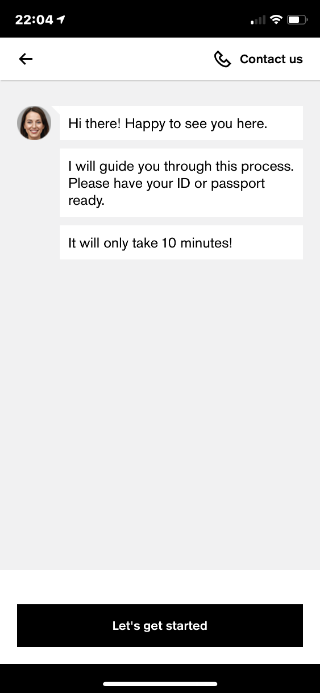

Here are the steps of the account opening process with CSX by Crédit Suisse:

#1 Read the welcome message

#1 Accept the CSX bank account requirements

CSX Sign-up requirements

#3 Start the ID verification process

CSX won’t ask for paper documents. But if you’re not of Swiss nationality, the Swisscom agent will check your B permit (or C).

CSX ID Verification

In practice, you may have to wait 5 to 10 minutes before a Swisscom agent takes the video call, but once the verification is done your account is opened immediately!

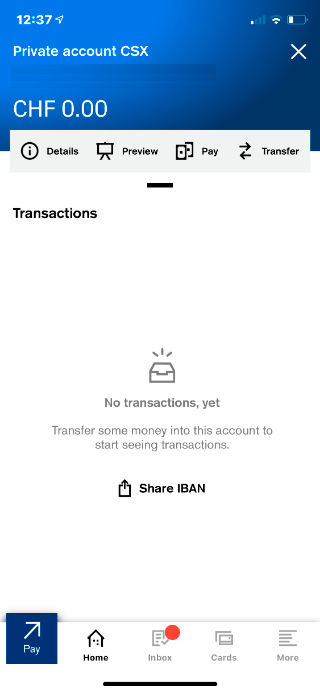

CSX Home

The CSX Bank account allows you to make all standard transactions (bank transfer, direct debit, etc.) like with any Swiss bank account.

The MasterCard Debit card is free and – as usual in Switzerland – your receive 2 letters: 1 for the card and 1 for the PIN code. But wait, there is more: you will also receive 1 letter for the 3D secure PIN code and 1 letter for SecureSign.

Crédit Suisse made the opening process fast and simple, providing a similar experience to leading neobanks such as N26. But the CSX app reminds us a lot of the Crédit Suisse app. You receive the same letter and the customer service phone number is the same: 0848 880 842

Our opinion on the bank account opening with CSX by Crédit Suisse

- Quick opening process completed in 20 minutes (including at least 10 minutes waiting)

- No revenue requirement

- Swiss neobank

- Account in CHF

- The Swisscom integration could be better

- Some bugs may occur during the opening process

- Too many mails

We like the quick opening process (when it works as expected), but we would like a single welcome letter with the Debit Card and a better packinging. -3 points

The CSX opening process gets an 8/10Usability of the CSX App: 7/10

CSX is the neobank of Crédit Suisse and that influenced a lot the design of the mobile application!

We feel that the Crédit Suisse interface has been adapted to create CSX, but we don’t have that modern look and feel of well known Neobanks like N26 or Revolut.

Compare CSX with YUH

Compare CSX with YUH

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before January 31, 2026 to receive 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF with YUH ➡️

The user interface is not as quick and as intuitive as N26 and Revolut. There is no visual transition between pages, it’s lacking of “polish” and reminds us a bit of Zak.

Despite some usability issues, the application is easy to use. Menus are well organised and key features are accessible in one click.

We remove 3 points because the experience is behind N26 or Revolut.

It’s a 7/10 rating for the Zak app usabilityReview of CSX app Features: 8/10

As a neobank, CSX offers most services directly within the mobile application:

- Access your payment history

- Make new payments

- Scan Swiss invoices

- Block your card

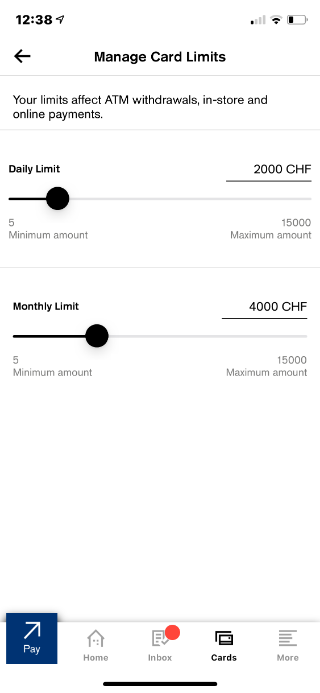

- Set card limits

- Authorise countries

- Change your plan

- Update your phone number

- Manage push notifications

- Use TWINT

But some features are not yet available:

- Freeze the card, like with N26 or Revolut

- Create and share spaces

- Change the card PIN code

- Change your personal details

- Contact the customer service by Chat

The feature to scan QR codes or Swiss invoice is very handy. Which is a significant difference compared to Revolut.

You can also choose your personalised IBAN (there is 2 CHF setup fee).

Not enough card settings

Unlike Revolut or N26 it is not possible to freeze the debit card or to display the PIN code of the Mastercard.

CSX Card Limits

If you forgot your card PIN number, you must ask for a new one that will be sent by mail.

While essential features are available, the app is lacking comfort options.

We also would like to have business logo for each transaction, like Neon and Yuh do.

It’s a 7/10 for the CSX app featuresCSX Debit Card Review: 8/10

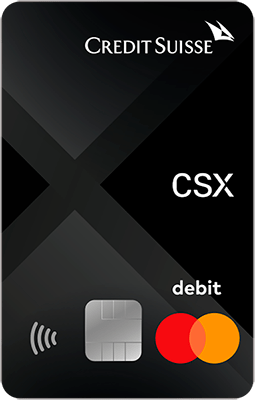

CSX offers a free Debit MasterCard.

It comes as white for the basic plan and black for the Premium plan:

CSX Black Card

CSX White Card

The MasterCard is very good for travelling, but is not yet compatible with Apple Pay, Google Pay et Samsung Pay.

CSX gets a rating or 8/10 for the cardCSX by Crédit Suisse Plans & Pricing: 7/10

The CSX Basic plan is free and includes a free Debit MasterCard. CSX Premium costs 3.95 CHF per month and includes free cash withdrawals at any Crédit Suisse ATM.

CSX being a neobank based in Switzerland, fees are displayed in CHFAvailable plans

The Basic plan packet with a White Debit Mastercard is free

The Premium plan with a Black Debit Mastercard costs 3.95 CHF/month and is billed per quarter. Which seems more competitive than Premium Zak Premium that costs 8 CHF/month, but if you plan to upgrade to get unlimited cash withdrawals are any ATM, Zak Premium is the better option.

Compare CSX with YUH

Compare CSX with YUH

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before January 31, 2026 to receive 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF with YUH ➡️

CSX MasterCard fees

CSX offers a free Debit MasterCard. It’s white with the Basic plan and black with Premium plan, which reminds us of the Premium cards from N26 and Revolut.

Cash withdrawals in Switzerland in CHF

At Crédit Suisse ATM:

- 2 CHF / cash withdrawal with the Basic plan

- Free with Premium plan

At any other ATM:

- 2 CHF / cash withdrawal

At ATM abroad

- 4.75 CHF plus 0.25% of the transaction amount

Replacement card

CSX takes a 20 CHF if you need to replace your card

Payments and cash withdrawals in foreign currencies

When purchasing in a foreign currency, Crédit Suisse apply their own exchange rate that is slightly higher than interbank rate used by other Neobanks such as Alpian and Neon.

CSX Customer Service Review: 7/10

Unlike N26, CSX does not offer Livechat support, but a chatbot and premium-rate phone number opened Monday to Friday from 8:00 to 18:00.

You get the same customer service as other Crédit Suisse customers.

The phone support is very good and support agents pick up the phone very quickly.

With N26, you also get quick access to a LiveChat support agent during a wide time range (until 23:00). The N26 virtual assistant gets you to wait for a minute or so, the time it takes for a human to take over the conversation.

We believe that CSX should take example on N26 and offer in-app Livechat support.

It’s a 7/10 for customer serviceBanking License and Security of CSX: 9/10

CSX is a service of Credit Suisse, which holds a full banking license issued by FINMA (Swiss Financial Market Supervisory Authority). As a service of this major Swiss bank, CSX benefits from the same rigorous compliance with Swiss financial regulations.

With this banking license, CSX can offer a wide range of financial services with high security standards. Client assets are protected up to 100,000 CHF according to the Swiss Deposit Protection Act, ensuring the safety of your funds.

Additionally, CSX implements advanced security measures, such as two-factor authentication (2FA), to protect access to your account.

In summary, Credit Suisse’s banking license and CSX’s security measures ensure strong protection of client funds.

This is a 9/10 for transactions’ speedWhich Plan is Best: CSX Basic or CSX Premium?

If you withdraw cash frequently, you might be interested with the Premium plan, but that only applies to Crédit Suisse ATM, hence a very limited benefit.

Other avantages (cinema ticket for 15 CHF, 20% discount on streaming) are not significant, CSX Basic is clearly the best option.

Our Final Review of CSX

CSX offers a free CHF account, along with an included MasterCard, and a special offer for young people aged 12 to 25. The account opening process is quick and can be completed entirely online, making it convenient for users.

However, despite features such as eBill and the Swiss QR invoice scanner, the app’s ergonomics fall short compared to competitors like Neon and Yuh. Bugs during the account opening process and integration issues with Swisscom have also been noted. The fees are competitive, but the costs associated with withdrawals outside of Credit Suisse ATMs or abroad should be considered.

In summary, CSX provides an accessible and fee-free banking solution, but improvements are needed for it to compete with other Swiss neobanks.

Compare CSX with YUH

Compare CSX with YUH

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before January 31, 2026 to receive 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF with YUH ➡️

Frequently Asked Questions (FAQ) about CSX by Crédit Suisse

✅ Does CSX offer any promotional bonuses or promo codes for new customers?

Yes, CSX offers you 25 CHF Free 🙌 with the promo code PA1289 when you open an account before January 31, 2026. Get the CSX app ➡️

✅ What is CSX by Crédit Suisse?

CSX is a digital banking service offered by Crédit Suisse, designed to provide a comprehensive online and mobile banking experience with features for managing finances efficiently.

✅ How can I open an account with CSX?

You can open a CSX account through the CSX app or website by following the online registration process, which involves providing personal information and verifying your identity.

✅ What types of accounts are available with CSX?

CSX offers several types of accounts including a free account named CSX White and paid account such as CSX Black, CSX Plus, CSX Pro and CSX Platinum.

✅ Is there a minimum deposit required to open a CSX account?

No, there is no minimum deposit requirements with CSX.

✅ Are there any fees associated with CSX accounts?

CSX offers fee-free banking for many of its services, though certain transactions or premium features may incur fees.

✅ What is CSX Platinum?

CSX Platinum is a premium account tier offering enhanced features and benefits compared to the standard CSX accounts.

✅ What is CSX White Credit Suisse?

CSX White is the free account option offered by Crédit Suisse.

✅ Does CSX offer a debit or credit card?

Yes, CSX provides a debit card for everyday use. Information on credit card options and related benefits is available through CSX.

✅ Does CSX support mobile payments?

Yes, CSX supports mobile payment options including Apple Pay and Google Pay for convenient and secure transactions.

✅ Can I use CSX for international transactions?

Yes, CSX supports international transactions, but fees and exchange rates may apply. You can make payments and transfers in foreign currencies.

✅ What features does the CSX app offer?

The CSX app includes features such as account management, transaction monitoring, fund transfers, and access to customer support.

✅ How do I log in to my CSX account?

To log in to your CSX account, visit the CSX app or website and enter your username and password. Follow the prompts for any additional security checks.

✅ How do I access my CSX account from Credit Suisse?

Access your CSX account through the CSX app or website by entering your login credentials. If you need assistance, you can reach out to CSX customer support for help with access issues.

✅ What should I do if I forget my CSX login details?

If you forget your CSX login details, use the “Forgot Password” feature on the login page of the app or website to reset your password. Follow the instructions sent to your registered email address to regain access.

✅ Can I open a joint account with CSX?

No, CSX does not offer joint account.

✅ Does CSX offer savings or investment products?

Yes, CSX provides savings accounts with competitive interest rates and investment options that align with various financial goals and risk profiles.

✅ How can I contact CSX customer support?

You can contact CSX customer support through the app, website, or by phone.

✅ Is CSX available for non-residents?

No, CSX is primarily designed for Swiss residents.

✅ What is the difference between CSX and CSX Bank?

CSX and CSX Bank refer to the same digital banking service provided by Crédit Suisse. “CSX” is the brand name for the service, while “CSX Bank” may be used in specific contexts to denote the banking services offered.

Compare CSX with YUH

Compare CSX with YUH

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before January 31, 2026 to receive 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF with YUH ➡️

Additional information

Specification: CSX Review & Test

| Trading | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| Account | ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

There are no reviews yet.