| Account opening | 9 |

|---|---|

| Usability | 9 |

| Features | 7 |

| Credit Card | 8 |

| Fees | 4 |

| Security | 9 |

| Customer Service | 7 |

Since March 31, 2025, Yapeal has stopped offering new accounts for private individuals. The Swiss neobank is now focusing exclusively on B2B services for businesses and partners.

Yapeal Overall Rating: 7.6/10

Description

Yapeal stops opening new private accounts

Since March 31, 2025, Yapeal no longer allows the opening of new accounts for private individuals. The Swiss neobank is now focusing on B2B services for businesses and partners. Existing private accounts remain active, but it is no longer possible to open a new private account.

Yapeal Quick Facts in February 2026

| Yapeal Quick Facts | Details |

|---|---|

| Bank Type | Neobank |

| Established | 2020 |

| Headquarters | Zurich, Switzerland |

| Users | 50,000+ |

| Languages | French, German, English |

| Free Account | No (monthly fees from 4.99 CHF) |

| Card | Visa Debit Card |

| Interest Rate | 0% |

| Investment Options | Not available |

| Deposit Protection | Up to 100,000 CHF |

| Overall Rating | 7.6/10 |

In This Yapeal Review

Introduction

The Yapeal app is designed to be your all-in-one banking solution, allowing you to manage a CHF account, make mobile payments with your Visa debit card, and access financial services without hidden fees.

Since its launch, Yapeal has gained popularity due to its customer-focused approach and its quick account opening process, which takes less than 10 minutes. In this Yapeal review 2026, we look at the key features of the Yapeal app, its user-friendliness, and how it meets your everyday banking needs.

Yapeal Review: The Fintech Neobank in Switzerland

Yapeal launched its offer in July 2020.

Unlike Neon – that use the services of Hypothekarbank Lenzburg – Yapeal has its own banking licence, a Fintech banking licence.

The bank account is only available in CHF

Here is a summary of the Yapeal offer:

- Free bank account (Loyalty) in CHF, that does not allow bank transfers

- Free Visa Debit

- Premium offer (Private) from 4 .90 CHF

We have tested the Yapeal app for your and compared features and pricing.

Yapeal Account Opening Review: 9/10

Yapeal allows you to open a free mobile bank account from your smartphone.

Conditions for Opening a Bank Account with Yapeal

- Be at least 7 years old (12 years old at CSX and 15 years old at Zak)

- Cross-border commuters or Swiss citizens living abroad residing in one of the 5 neighboring countries: Germany, Austria, France, Italy, Liechtenstein

- Have a smartphone compatible with the app

- No need to provide proof of revenue

- No minimum deposit

- No minimum balance

Yapeal has a strong focus on security and transparency. You can use this bank account to receive your salaries and make bank transfers in Switzerland or to your Revolut card.

How to Open a Bank Account with Yapeal

To open an account with Yapeal you just need to follow these steps:

- Download the Yapeal app from the App Store or Google Play

- Download the Yapeal Shield app from the App Store or Google Play

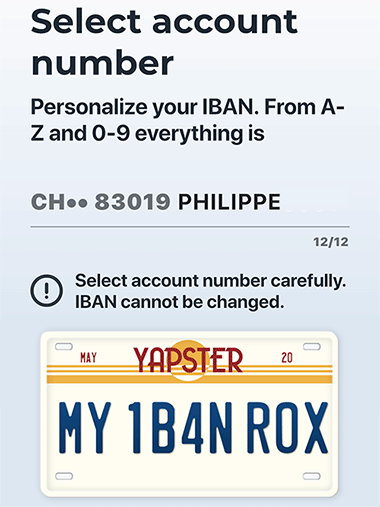

- Answer a few questions and choose your IBAN

- Verify your identity

- It’s done! Your Yapeal account is opened 🙌

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

Personal touch: you can choose your own IBAN during the opening process:

Yapeal Personalized IBAN CH

The Yapeal account allows you to make all the standard transactions (bank transfer, direct debit, etc.) like with any Swiss bank account.

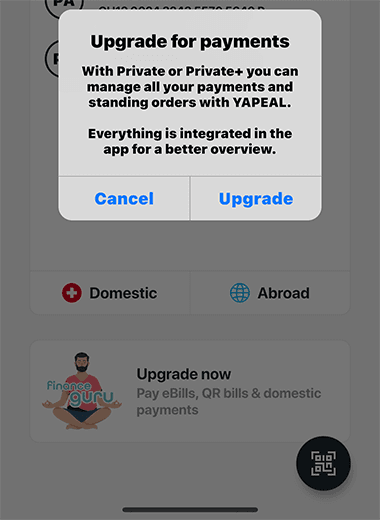

But be careful with fees and limitations: the free account (Loyalty) does not allow bank, which is really restricting the use of the account. If you try to make a bank transfer, Yapeal will push you to upgrade:

Upgrade to Yapeal Private

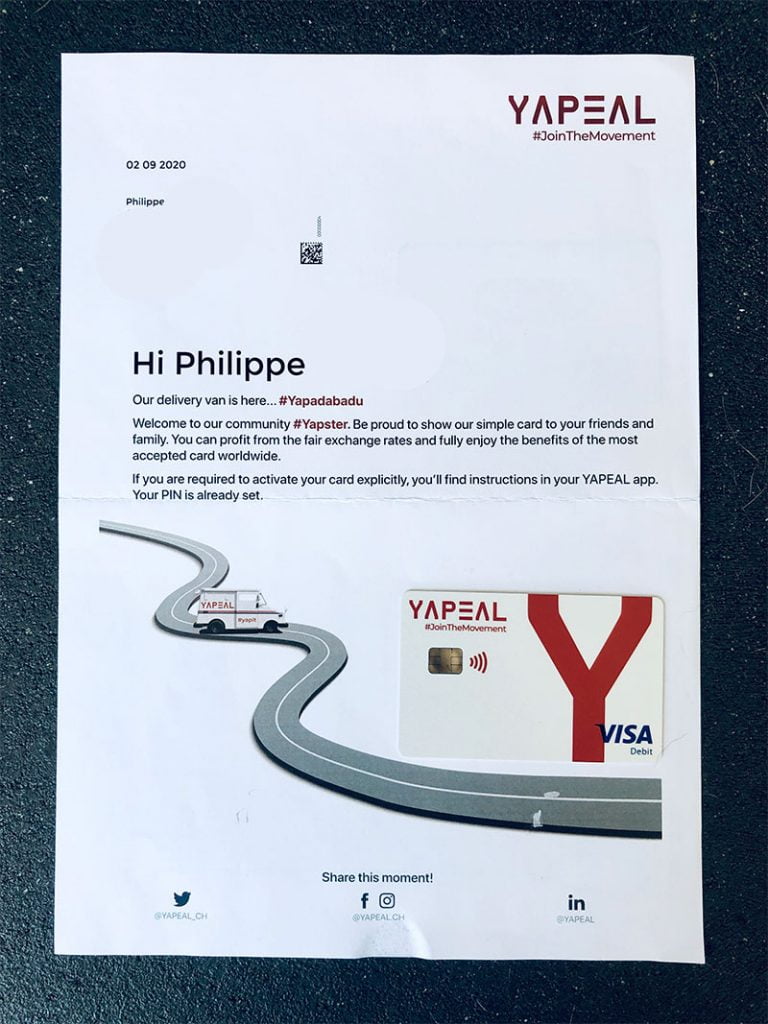

The Visa Debit card is free but you there is a 7-CHF delivery fee.

You receive a single letter with your card on it, which makes a real difference with CSX, Neon and Zak and their 2 to 4 letters: 1 for the card, 1 for the PIN code, 1 for the 3D PIN code and 1 for SecureSign (with CSX).

Yapeal Welcome Letter

The Yapeal experience is closer to N26, but we would like a more polished packaging rather than a simple letter. Here is the N26 packaging for example:

N26 Debit Card

Our Opinion on the Bank Account Opening with Yapeal

- Quick opening process completed in 10 minutes

- No revenue requirement

- Swiss neobank (Fintech licence)

- Account in CHF

We like the quick opening process, even we would prefer a single app. -1 point

The Yapeal opening process receives a rating of 9/10 YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

Yapeal App Features Review: 7/10

Yapeal App Features List

As a neobank, Yapeal offer all their services through a mobile application. That means it’s possible to do almost everything from your smartphone:

- Access your payment history

- Make new payments (only on the Premium paid plans)

- Scan invoices in Swiss format

- Activate eBill (only on the Premium paid plans)

- Make instant payments between Yapeal clients (Yapster-2-Yapster)

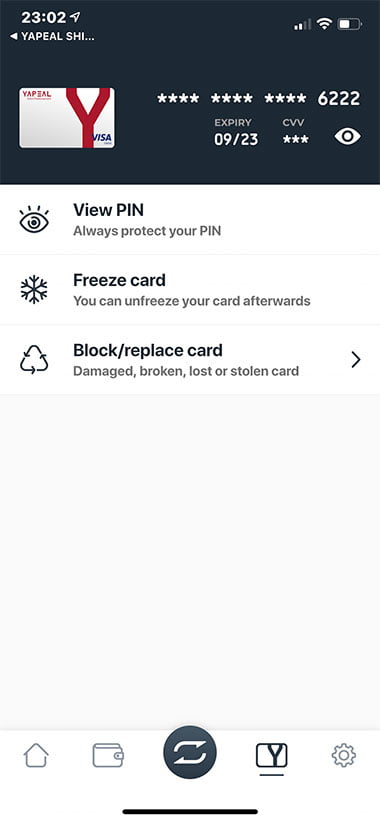

- Display your Visa card number and PIN code

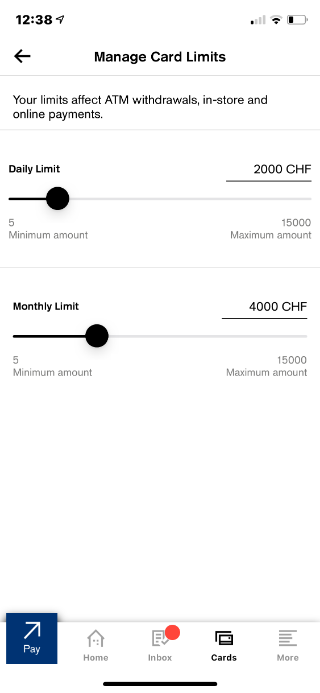

- Change your monthly limits

- Block your card

- Update your phone number

- Update your address

- Manage push notifications

But it’s not possible to:

- Change the PIN code of the card

- Authorise countries

- Create and Share spaces

- Contact customer support by Chat

- Use TWINT

Yapster-2-Yapster

With the Yapster-2-Yapster option, Yapeal allows you to transfer money to your friends instantly, directly from the app. You simply need the recipient’s phone number or email address to send money in seconds, without needing to enter an IBAN.

eBill

With Yapeal, eBill simplifies your bill management. However, this feature requires a Yapeal Loyalty subscription. Once enrolled in eBill within the app, you receive your bills directly in electronic format, eliminating paperwork. Payments are made with a single click, perfect for recurring bills – no more worries, they’re paid automatically and on time.

International Payments

For international transfers, Yapeal partners with Wise, known for its competitive rates and transparency. Through this partnership, you can send money in over 40 currencies without hidden fees on the exchange rate. With the market rate applied, you’re assured of fair and accurate currency conversions. All fees are clearly displayed in the app, so you know exactly what each transfer costs. However, this feature also requires a Yapeal Loyalty subscription.

Our Take on Yapeal App Features

Yapeal offers an interesting range of services for a neobank but has certain limitations. While the app includes useful account management and instant payment options, it lacks a fundamental feature: basic payments on the free Yapeal Loyalty account.

This limitation requires users to subscribe to a paid plan for domestic and international transfers, which puts Yapeal behind other neobanks that often provide this feature for free. This restriction is a significant drawback for users looking for a fully functional mobile banking solution without monthly fees.

Yapeal app features receive a rating of 7/10 YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

Yapeal Credit Card Review: 8/10

Yapeal VISA Debit Card

Yapeal offers a free Visa Debit card. But you’ll have to pay 7 CHF for delivery.

Yapeal Debit Card

The Visa is very good for travelling and it’s compatible with Apple Pay, Google Pay and Samsung Pay.

Yapeal Card Settings

With Revolut and N26 you can temporarily freeze your card instead of blocking it, it’s also possible to change or display your PIN code in the app.

Yapeal Card Settings

and unlike CSX and N26, it’s not possible to manage your daily limits:

CSX Card Limits

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

Yapeal Fees: 4/10

Yapeal being a neobank based in Switzerland, fees are displayed in CHFYapeal Private Account Fees

Yapeal is the Swiss neobank with some of the least competitive fees: the Loyalty plan is free, but you cannot make transfers within Switzerland 🤨. Additionally, there’s a 7 CHF “issuance fee” for the Visa card.

To have the “transfers” option, you need to choose the premium Private plan at 4.90 CHF per month or Private+ at 8.90 CHF per month.

- Starting from: 0 CHF/month

- Account management: via iPhone or Android mobile app

- Bank card: Visa Debit

Available Packages

- The free Loyalty package with Visa Debit

- The free Yapini package for young people aged 7 to 17

- The Private package, priced at 4.90 CHF/month.

- And the Private+ plan, priced at 8.90 CHF/month.

Yapeal Visa Card Fees

- The Yapeal VISA card is free, but delivery costs 7 CHF on the free Loyalty plan.

- Card replacement is charged at 20 CHF.

Cash Withdrawals Fees in Switzerland in CHF

- 2 CHF / cash withdrawal with the Loyalty and Private plans

- Free with the Private+ plan

Cash Withdrawals Fees in Switzerland in EUR

- 5 CHF / cash withdrawal with the Loyalty and Private plans

- Free with the Private+ plan

Cash Withdrawals Fees Abroad

- 1.5% / cash withdrawal with the Loyalty and Private plans

- Free with the Private+ plan

Replacement Card Fees

- 20 CHF with the Loyalty and Private plans

- Free with the Private+ plan

Payments and Cash Withdrawals Fees in Foreign Currencies

Yapeal uses Visa’s currency exchange rates – similar to Neon and N26 – and they do not apply extra fee.

We remove 6 points from Yapeal because their free plan is not a real bank account and they “force” customers to pay 4.90 CHF/month if they want to have a real bank account: meaning having the ability to do bank transfers.

Yapeal plans & pricing receive a rating of 4/10 YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

Yapeal Customer Service Review: 7/10

Unlike N26, Yapeal does not offer Livechat support, but a contact form and phone number.

The phone support is very good and support agents pick up the phone very quickly.

With N26, you also get quick access to a LiveChat support agent during a wide time range (until 23:00). The N26 virtual assistant gets you to wait for a minute or so, the time it takes for a human to take over the conversation.

We believe that Yapeal should take example on N26 and offer in-app Livechat support.

Customer service receives a rating of 7/10Yapeal App Customer Reviews and User Experience: 9/10

Like neon, Yapeal is a new neobank, the app has been developed “from scratch”.

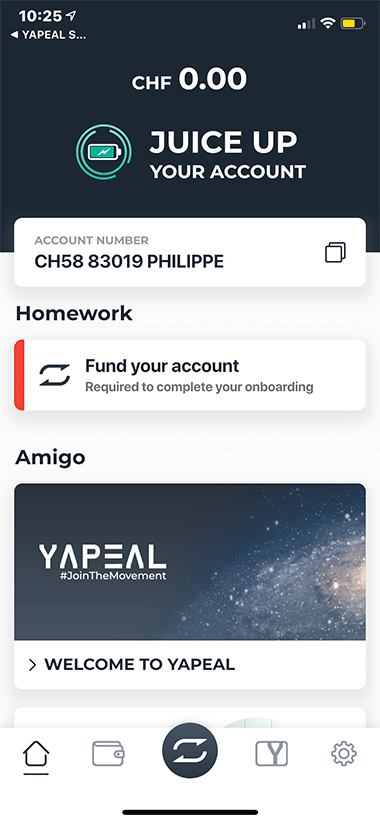

Although the app is not using “happy colours”, the user interface is intuitive and reminds us leading neobanks app N26 and Revolut :

- The mobile app is fluid and intuitive

- Menus are clear and well organised

- Essential features are always visible

Yapeal Account Opening

The home screen doesn’t not display your transactions and feels more like a Yapeal news feed to promote their new features. We would like an option to customise that home screen. That would avoid some extra clicks to reach the transactions for example. –1 point

The Yapeal app usability receives a rating of 9/10Yapeal Banking License and Security: 9/10

Yapeal operates under a fintech license issued by the FINMA (Swiss Financial Market Supervisory Authority). This license allows Yapeal to offer regulated financial services while adhering to Swiss security and compliance standards.

Unlike a traditional banking license, the fintech license imposes a limit of 100 million CHF for deposited funds, which must remain available to clients and cannot be invested. Although deposits do not benefit from the standard deposit protection of 100,000 CHF available with traditional banks, Yapeal ensures prudent and secure management of client funds.

Yapeal also implements advanced security measures, such as two-factor authentication (2FA), to protect account access and ensure data and transaction security.

In summary, while Yapeal’s fintech license offers fewer guarantees than a full banking license, it provides a high level of security for clients, with strict operational oversight and rigorous compliance with FINMA standards.

Transaction speed receives a rating of 9/10Our Final Review of Yapeal

Yapeal stands out as a solid option for Swiss residents, as well as for cross-border commuters and non-residents living in one of the five neighboring countries (Germany, Austria, France, Italy, or Liechtenstein). With its free CHF account and Visa debit card, Yapeal offers a modern and convenient banking solution through its mobile app.

However, the free plan has limitations, notably the inability to make bank transfers, which may be a drawback for some users. If you’re looking for more features, such as transfers or extended use of the Visa card, it’s recommended to subscribe to a paid plan or consider free neobanks like Alpian, Neon, or Yuh.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

Frequently Asked Questions (FAQ) about Yapeal

✅ Does Yapeal offer promo codes referral codes for new users?

Yes, Yapeal offers you 30 CHF Free 🙌 with the promo code YAPS311WZ4WL if you open an account before February 28, 2026. Get the Yapeal app ➡️

✅ What is Yapeal?

Yapeal is a Swiss app-based bank which combines a private account with a Visa Debit card. It is one of the first companies to have been granted a Swiss fintech license by financial supervisory authority FINMA.

✅ What services does Yapeal provide?

Yapeal offers a Swiss bank account and a Visa Debit card. Users can make online payments, pay bills, and receive incoming bank transfers and deposits.

✅ Is Yapeal a Swiss bank?

Yapeal has a Swiss fintech license but not a full bank license. It meets most Swiss banking requirements but does not manage customer assets, pay interest, or lend money.

✅ Which offer is right for me?

– Loyalty: Ideal for users who want a basic account and Visa Debit card but don’t need to make bank transfers.

– Private: Suitable for users who need a full Swiss account with occasional cash use.

– Private +: Best for users who frequently use cash and want a comprehensive account with no extra withdrawal fees.

✅ Which cards does Yapeal offer?

Yapeal offers a Visa Debit card for cash withdrawals and purchases. It cannot issue Mastercard or Maestro cards.

✅ What are Yapeal’s virtual instant issued cards?

Upon opening an account, you receive a virtual card for immediate use. A physical Visa Debit card is sent within about 7 days.

✅ Can I make international transfers with Yapeal?

Yes, Yapeal allows international transfers through Wise (formerly TransferWise) for Private and Private+ accounts. Fees include Wise fees plus a Yapeal convenience fee.

✅ Can I open a Yapeal account as a non-resident?

Yes, residents of countries bordering Switzerland (Austria, France, Germany, Italy, Liechtenstein) can open a Yapeal account without additional non-resident fees.

✅ Which currency exchange rates does Yapeal use?

Yapeal uses Visa’s currency exchange rates, which are generally favorable compared to many banks.

✅ How high are Yapeal’s foreign transaction fees?

Yapeal does not charge a foreign transaction fee for purchases with the Visa Debit card.

✅ Can I make cash withdrawals from a Yapeal account?

Yes, cash withdrawals are possible with fees depending on the account type. Loyalty and Private users pay fees, while Private+ users do not.

✅ Can Yapeal users make mobile payments?

Yes, the Yapeal Visa Debit card can be linked to Apple Pay, Google Pay, and Samsung Pay.

✅ How much does the Yapeal debit card cost?

Card fees vary by account type: Loyalty users pay 7 CHF for the card, while Loyalty and Private users pay 20 CHF for replacements. Private+ users do not pay fees for cards.

✅ Does Yapeal have limits on transactions?

Yes, Yapeal limits ATM withdrawals to 1000 CHF per day and 3000 CHF per month. Card purchases are limited to 10,000 CHF per month. Higher limits can be requested from customer support.

✅ Does Yapeal let me set up standing orders?

Yes, Yapeal allows you to set up standing orders for recurring payments.

✅ Can I get eBills and set up direct debits?

Yapeal supports eBills but does not offer direct debit orders.

✅ Does Yapeal charge negative interest rates?

No, Yapeal has not charged negative interest since September 2022.

✅ Does Yapeal offer savings accounts and pillar 3a accounts?

Yapeal offers a private account and a 3a account in collaboration with Vontobel but does not currently offer traditional savings accounts.

✅ Does Yapeal give me a Swiss bank account number?

Yes, Yapeal provides a Swiss IBAN. The account number can be personalized, but not all foreign banks may support this IBAN format.

✅ Can I overdraw a Yapeal account?

No, Yapeal accounts do not offer overdraft facilities and cannot be overdrawn.

✅ What are the advantages of Yapeal?

Advantages include low fees for the Visa Debit card, favorable currency exchange rates, and the ability to use the account without extra fees if you live in a bordering country.

✅ What are the disadvantages of Yapeal?

Disadvantages include account fees for certain plans, limited services, and no physical branches for in-person assistance.

✅ Does Yapeal offer a business account?

Yes, Yapeal offers business accounts.

✅ How do I log in to my Yapeal account?

To log in, open the Yapeal app and enter your registered email and password. For assistance with login issues, contact Yapeal support.

Sources:

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 4 CHF (250 SWQ) for FREE 🙌

Get 54 CHF Free with YUH ➡️

Additional information

Specification: Yapeal Review 2026

| Trading | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||

| Customers | ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| Card | ||||||||||||||||||||||||

| ||||||||||||||||||||||||

| Account | ||||||||||||||||||||||||

| ||||||||||||||||||||||||

There are no reviews yet.