Comparison of 3 Swiss Smartphone Banks

Are you hesitating between Yuh, Neon, and Zak, but unsure which neobank is the most advantageous for you? These neobanks operate primarily through mobile banking apps, making them highly accessible and user-friendly. Here’s a comparison to help you make your choice.

In our ranking of the best Swiss neobanks, Yuh Bank stands out at the top, closely followed by Neon Bank, with Zak Bank also performing well. Additionally, these neobanks often do not charge basic account fees for standard accounts, positioning them as more affordable options compared to traditional banks.

We have also compared Yuh vs Neon, Neon vs Zak, and Yuh vs Zak to help you choose the neobank that best meets your needs.

Yuh vs Neon vs Zak – The Best Neobank for You

If you don’t have time to read this article, here’s which neobank to choose based on your usage:

| Yuh | Neon | Zak | |

|---|---|---|---|

| Overall rating | 8.6/10 | 8.4/10 | 7.9/10 |

| Free account with free card | 👍 | 👍 | |

| Minimum age | 14 years | 15 years | 15 years |

| For use in Switzerland | 👍 | ||

| For travel | 👍 | ||

| For free SEPA transfers | 👍 | ||

| For payments abroad | 👍 | ||

| For a joint account | 👍 | ||

| For Trading | 👍 | 👍 |

Opening a free account with Yuh, Neon, or Zak is quick and easy, taking just 10 minutes, and all three have no basic fees, making them ideal for daily banking needs. Swiss neobanks like Yuh, Neon, and Zak offer private accounts with personal Swiss bank account numbers, which is a significant advantage over foreign providers.

To understand how each criterion is judged, read on: we review important options for Switzerland (IBAN CH, transfers in CHF, TWINT) and abroad (withdrawals with the card, SEPA transfer fees, foreign currency transfers).

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Yuh vs Neon vs Zak – 1 point each

Yuh, Neon, and Zak all offer fully free bank accounts with a Swiss IBAN (CH). Therefore, you have no monthly fees for managing your current account.

These neobanks emphasize the absence of fees for everyday transactions, allowing you to make transfers in Switzerland and payments without additional costs. Additionally, you can benefit from a free debit card, which simplifies your daily purchases.

By choosing Yuh, Neon, or Zak, you also have access to free withdrawals at partner ATMs, allowing you to access your money without fees.

| Yuh | Neon | Zak | |

|---|---|---|---|

| Free account | ✅ | ✅ | ✅ |

| Debit card | ✅ Mastercard | ✅ Mastercard | Visa |

| Quick account opening | ✅ via the app in 15 minutes | ✅ via the app in 15 minutes | ✅ via the app in 15 minutes |

| Secure | ✅ Subsidiary of Swissquote | ✅ Partner Hypothekarbank Lenzburg | ✅ Belongs to Banque Cler |

| IBAN (CH) | ✅ | ✅ | ✅ |

| eBill | ✅ | ✅ | ✅ |

| Free CHF transfers | ✅ | ✅ | ✅ |

| Push notifications | ✅ | ✅ | ✅ |

| Apple Pay, Google Pay compatible | ✅ | ✅ | ✅ |

Yuh, Neon, and Zak are equal on these criteria, even though the experience may vary. All three neobanks allow for quick and easy account opening in 15 minutes.

Yuh vs Neon vs Zak – Promo Code

When opening an account with Yuh, Neon, or Zak, you receive a welcome gift in cash on your account, which is always appreciated.

| Neobank | Promo Code | Offer | Create Your Account |

|---|---|---|---|

| Neon | NEOTRADE | 100 CHF in Trading Credit | Get the Neon app ➡️ |

| Yuh | YUHNEO | 50 CHF in Trading Credit and 250 SWQ (4 CHF) | Get the Yuh app ➡️ |

| ZAK | NEOZAK | CHF 50 Free | Get the ZAK app ➡️ |

The advantage goes to Zak, which offers a better welcome offer.

1 point for Zak

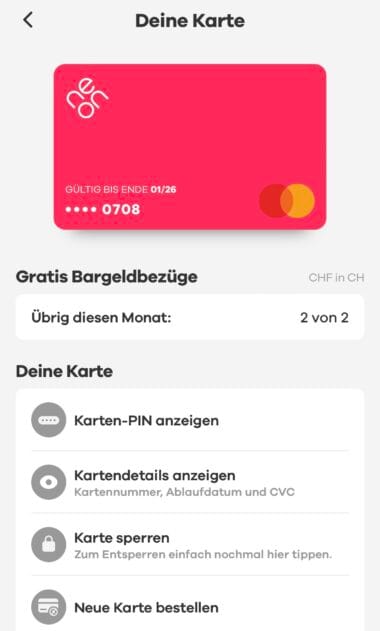

Yuh vs Neon vs Zak – Debit Card & Cash Withdrawals

All banks seek to limit cash withdrawals at ATMs, but some neobanks like Yuh, Neon, and Zak allow you to make free withdrawals within certain limits.

For card usage abroad, Yuh offers a multi-currency card that allows you to spend in any currency available in your account. For example, if you hold both CHF and EUR in your account and make a purchase in France, the card will automatically use the EUR balance. However, Yuh charges 4.90 CHF per cash withdrawal abroad and applies a 0.95% currency conversion fee on foreign currency transactions.

Neon charges 1.5% + 0.35% on foreign ATM withdrawals with the neon free plan (paid plans reduce or eliminate these fees), while Zak applies a 2% fee plus 5 CHF per withdrawal. This can quickly make foreign transactions less attractive.

The following table presents the fees for using debit cards with Yuh, Neon, and Zak:

| Yuh | Neon | Zak | |

|---|---|---|---|

| Debit card | ✅ MasterCard | ✅ MasterCard | ✅ Visa |

| Free withdrawals in CHF | ✅ 1 withdrawal/week, then 1.90 CHF, limited to 10,000 CHF/month | ❌ 2.50 CHF/withdrawal with neon free, free (2 to 5/month) from neon plus. Sonect always free. | ❌ 2 CHF/withdrawal or free at Banque Cler |

| Free withdrawals abroad | ❌ 4.90 CHF/withdrawal | ❌ 1.5% + 0.35% (free with neon metal) | ❌ 2% + 5 CHF/withdrawal |

Overall, Neon offers a better deal than Yuh due to lower fees abroad. Zak comes in last.

1 point for Neon

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

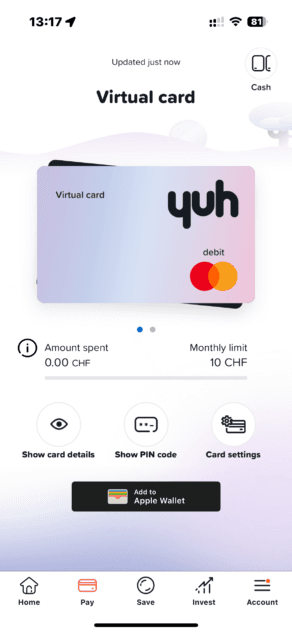

Yuh vs Neon vs Zak – Virtual Card

Virtual cards are digital versions of credit or debit cards, accessible via a mobile app. They offer enhanced security, as they can be blocked and replaced instantly in case of fraud. Additionally, they are immediately usable without waiting for a physical card and allow for quick and secure payments via Apple Pay or Google Pay.

Currently, only Yuh offers a virtual card, particularly advantageous for online payments and quick transactions. With this option, you can make purchases immediately without waiting for a physical card to arrive.

Neon and Zak, on the other hand, do not yet have virtual cards. You will need to wait for the arrival of your physical card to start making purchases or payments online.

1 point for Yuh

Yuh vs Neon vs Zak – Contactless Mobile Payments

Yuh, Neon, and Zak differ in their support for contactless mobile payments. Systems like Apple Pay and Google Pay allow you to pay directly from your phone, offering increased convenience and security compared to physical cards. There’s no need to pull out your wallet; just tap your phone to complete your purchases instantly.

Here is an overview of the mobile payment systems supported by Yuh, Neon, Zak, and other Swiss neobanks:

| Neobank | Apple Pay | Google Pay | Samsung Pay | Fitbit Pay | Garmin Pay | Swatch Pay |

|---|---|---|---|---|---|---|

| Alpian | ✅ Yes | ✅ Yes | 🚫 No | 🚫 No | 🚫 No | 🚫 No |

| N26 | ✅ Yes | ✅ Yes | 🚫 No | 🚫 No | 🚫 No | 🚫 No |

| Neon | ✅ Yes | ✅ Yes | ✅ Yes | 🚫 No | ✅ Yes | ✅ Yes |

| Revolut | ✅ Yes | ✅ Yes | 🚫 No | ✅ Yes | ✅ Yes | ✅ Yes |

| Wise | ✅ Yes | ✅ Yes | 🚫 No | ✅ Yes | ✅ Yes | ✅ Yes |

| Yuh | ✅ Yes | ✅ Yes | ✅ Yes | 🚫 No | 🚫 No | 🚫 No |

| Zak | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

For contactless mobile payments, Zak is the most comprehensive option, thanks to its support for Apple Pay, Google Pay, Samsung Pay, Fitbit Pay, Garmin Pay, and Swatch Pay, covering a wide range of devices. Neon closely follows, with good support but lacking compatibility with Fitbit Pay. Yuh remains more limited with only Apple Pay, Google Pay, and Samsung Pay.

1 point for Zak

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before February 28, 2026 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️

Yuh vs Neon vs Zak – Travel and Currency Exchange Rates

Yuh offers a multi-currency account, while Neon provides an account in CHF. This means that any payment in EUR or another currency with Neon will be subject to an exchange rate and possible fees.

- Yuh applies a 0.95% fee on currency conversions and charges 4.90 CHF per withdrawal abroad. These fixed fees can quickly become a disadvantage, especially if you withdraw amounts less than 1,000 EUR.

- Neon does not apply any markup on the interbank rate and charges 1.5% on withdrawals in EUR, whether in Switzerland or abroad. This makes it a more economical option if you who travel frequently.

- Zak applies a 2% markup on the Visa interbank rate, with fees of 2.00 CHF per withdrawal in Switzerland and 5.00 CHF per withdrawal abroad.

Yuh is penalized by its fixed fees of 4.90 CHF, making Neon more advantageous for withdrawals and payments abroad. Even though Yuh offers a multi-currency account, Neon remains better positioned in terms of costs for travel and exchange rates. Zak is also less competitive, with additional fees on withdrawals and payments in EUR.

1 point for Neon

Yuh vs Neon vs Zak – Transfer Fees

SEPA Transfer Fees

For SEPA transfers in euros, Yuh offers a sub-account in EUR, allowing for free SEPA transfers. The 0.95% conversion fee for converting CHF to EUR does not apply if the EUR sub-account is already funded.

In contrast, Neon and Zak do not offer accounts in euros. Therefore, you will incur conversion fees for transfers in EUR. Neon charges a 0.8% exchange fee, while Zak imposes a higher rate of 2.5%.

If you regularly make transfers in euros, Yuh remains the most advantageous option, especially if the EUR sub-account is well-funded. Neon and Zak are less attractive due to their high currency conversion fees.

International Transfer Fees

Yuh, Neon, and Zak offer free transfers in CHF within Switzerland, but their fees for international transfers vary:

- Neon uses Wise for international transfers, with fees between 0.8% and 1.7%, depending on the currency and amount.

- Yuh charges 4 CHF for international transfers, with an additional 0.95% for currency conversion.

- Zak applies 2.5% fees for currency conversions on international payments.

Neon is the most competitive option for international transfers due to its relatively low fees via Wise, while Yuh remains a good alternative for occasional transfers. Zak is less advantageous due to its high conversion fees.

1 point for Yuh and 1 point for Neon

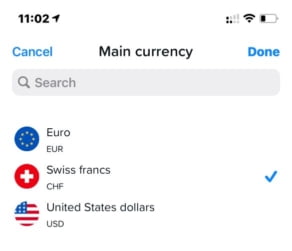

Yuh vs Neon vs Zak – Multi-Currency Account

Yuh offers a multi-currency account, allowing you to choose your main currency among CHF, EUR, or USD. It is also possible to create sub-accounts in 13 different currencies: CHF, USD, EUR, GBP, JPY, AUD, CAD, SEK, HKD, NOK, DKK, AED, and SGD, making it an ideal solution for cross-border workers and non-residents. Incoming transfers in all these currencies are free, which is an advantage compared to Neon, which only accepts fee-free transfers in CHF. However, Yuh charges a 0.95% commission for currency conversions, but you can avoid these fees by directly funding your EUR sub-account.

Neon only offers a CHF account. All payments in EUR or other currencies are subject to exchange fees. Neon uses Wise for foreign currency transfers, thus providing competitive exchange rates, ranking just behind Revolut and Wise according to our analysis of CHF/EUR rates.

Zak, on the other hand, only offers a CHF account, but allows payments in foreign currencies with a 2.5% fee for currency conversion.

Yuh is therefore the best option if you seek multi-currency flexibility, despite its conversion fees.

1 point for Yuh

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Yuh vs Neon vs Zak – TWINT

| Yuh | Neon | Zak | |

|---|---|---|---|

| TWINT | ✅ Yuh TWINT | ✅ UBS ou Prepaid | TWINT Prepaid |

Yuh offers direct integration with the Yuh TWINT app, providing a smooth user experience. In contrast, Neon does not have a dedicated TWINT app and requires you to use UBS’s TWINT app or TWINT Prepaid, which can be less convenient.

Zak also lacks a dedicated TWINT app. Users must use the TWINT Prepaid app, making the experience less seamless.

1 point for Yuh

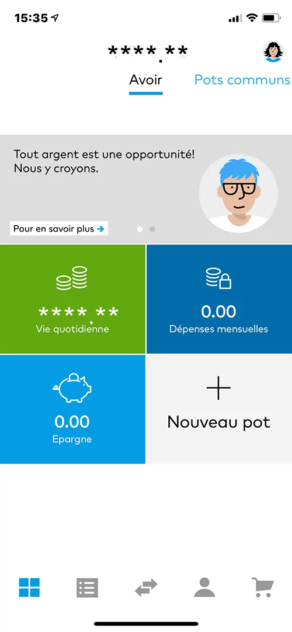

Yuh vs Neon vs Zak – Sub-Accounts

Sub-accounts allow you to manage your savings or expenses more organized. However, these features are not yet on the same level.

Yuh SAVE

With SAVE, Yuh offers you a personal piggy bank that cannot be shared with other users. Additionally, there is no dedicated IBAN, which limits direct transactions from this sub-account.

Neon SPACES

Neon, with its SPACES feature, also offers a personal piggy bank without sharing options. As with Yuh, there is no dedicated IBAN for SPACES, which restricts their use for transactions.

Zak POTS

In contrast, Zak offers you POTS, allowing you to share sub-accounts with other members. Although it also lacks a dedicated IBAN, this sharing option provides more flexibility compared to the piggy banks of Yuh and Neon.

Zak Shared Pots

None of the three neobanks allow for a dedicated IBAN attached to a sub-account, unlike N26.

For those wishing for a more collaborative approach to savings management, Zak stands out with its POTS. Yuh and Neon, while offering personal piggy banks, lack sharing functionalities, which may be a drawback for some users.

1 point for Zak

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before February 28, 2026 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️

Yuh vs Neon vs Zak – Joint Account (Common Account)

Regarding joint accounts, Yuh, Neon, and Zak take different approaches. Currently, Neon is the only one offering a joint account with its Neon Duo service, for just 3 CHF per person per month. This option includes two debit cards, allowing two people to manage their finances together, settle common expenses, and save on a single account. It’s an ideal solution for couples or families wanting to share expense management.

In contrast, Yuh and Zak do not yet offer joint accounts. For those looking for alternatives, international neobanks like N26 and Revolut also allow managing joint accounts.

1 point for Neon

Yuh vs Neon vs Zak – Savings and Interest Rates

With the interest rate increases seen in 2023 and 2024, neobanks like Yuh, Neon, and Zak have introduced attractive rates on current accounts. However, following recent central bank rate cuts, these neobanks are adjusting their rates accordingly.

Yuh continues to offer a yield on savings when funds are kept in the “Savings” section of the app. Neon provides interest on funds placed in Spaces (virtual savings accounts), with adjusted rates for larger balances, while Zak also offers a competitive rate, making it a favorable option for savings.

Here are the interest rates offered by Yuh, Neon, Zak and other Swiss neobanks in February 2026:

| Neobank | Interest Rate | Interest Cap | Withdrawal Limit |

|---|---|---|---|

| Alpian | 0.15 % | Above 125,000 CHF. 0.01 % below. | None |

| Neon | 0.00 % | - | None |

| Yuh Bank | 0.00 % | - | None |

| Zak | 0.05 % | Up to CHF 25,000 | None |

Yuh therefore offers a better interest rate than Neon and Zak.

1 point for Yuh

Yuh vs Neon vs Zak – Trading and Investment

Yuh was the first Swiss neobank to offer a trading account, allowing investments in stocks, ETFs, themed trading, and over 32 cryptocurrencies, including Bitcoin. Read here our review on Yuh Investment

Neon also offers trading functionality through its app, focusing on CHF securities from BX Swiss, which avoids additional fees related to currency conversions. Read here our review on Neon Invest.

Currently, Zak does not offer trading options.

| Yuh | Neon | Zak | |

|---|---|---|---|

| Free Custody Fees | ✅ | ✅ | ❌ |

| Swiss Stock Trading | 0.50% | 0.50% | ❌ |

| Swiss ETF Trading | 0.50% | 0.50% | ❌ |

| Foreign Stock Trading | 0.50% | 1.00% | ❌ |

| Foreign ETF Trading | 0.50% | 1.00% | ❌ |

| Theme Trading | 0.50% | ❌ | ❌ |

| Cryptocurrency Trading | 1.00% | ❌ | ❌ |

Yuh and Neon thus position themselves as direct competitors to Alpian and Revolut.

Yuh allows you to invest in over 305 stocks, 58 ETFs, 30 themes, and 38 cryptocurrencies. It also offers the purchase of fractional shares.

In comparison, Neon Invest provides access to over 240 stocks and 70 ETFs listed on BX Swiss. Its solution is simple and transparent, with no custody fees or exchange fees.

Neon’s trading fees are more advantageous, as all securities, including foreign stocks, are in CHF, thus avoiding the 0.95% currency conversion fee that Yuh applies on international stocks. If you have funds in EUR or USD, you can avoid these fees with Yuh.

In conclusion, if you are looking for a solution without currency conversion fees and ease of use, Neon is the best option. On the other hand, if you want a greater diversity of investments, Yuh offers a more comprehensive platform.

1 point for Yuh and 1 point for Neon

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

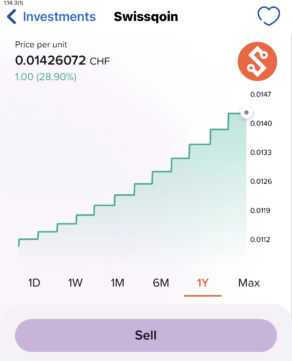

Yuh vs Neon vs Zak – Loyalty Program

Currently, Neon does not offer a loyalty program, except for a carbon compensation through Neon Green. In contrast, Yuh highlights an interesting loyalty program that rewards its users with Swissqoins (SWQ), the cryptocurrency created by Yuh.

At the launch of the program, the rate was approximately 1 Swisscoin = 0.01 CHF, meaning 250 SWQ equaled 4 CHF. Today, the value has increased to about 1 Swisscoin = 0.015 CHF, representing a 50% increase in less than two years.

Yuh rewards its users for the following operations:

- A one-time deposit of 500 CHF upon account opening = 250 SWQ

- Each trading transaction with Yuh = 10 SWQ

- Each payment with the Yuh Mastercard = 2 SWQ

On the other hand, Zak offers a cashback system with Shopmate, providing access to many partners. However, Yuh’s Swissqoins are more advantageous, as they can be converted into cash if desired.

In summary, while Zak has an interesting offer, Yuh’s loyalty program with Swissqoins proves to be more flexible and potentially more lucrative for users.

1 point for Yuh

Yuh vs Neon vs Zak – Customer Reviews and Ratings

Yuh, Neon, and Zak have similar ratings on the App Store, reflecting a high level of satisfaction among their users.

Yuh is rated 4.7 on the App Store with about 13,600 reviews, while Neon receives a rating of 4.6, backed by 6,300 reviews, and Zak is also rated 4.6 with around 11,000 reviews.

These ratings indicate that customers are generally satisfied with the services offered by these neobanks. The differences in ratings are minimal, but Yuh slightly stands out in terms of review volume and satisfaction.

1 point each

Yuh vs Neon vs Zak – Which App is More User-Friendly?

Evaluating the ergonomics of an app is often subjective, but it comes down to determining which is the most intuitive and easy to use. Here are some factors to consider:

- How many clicks to access an important function?

- How many clicks to complete a transaction?

- Does the app often crash?

- Is it fast?

Without conducting a thorough ergonomic analysis (which is not the purpose of this article), we find that the Yuh app generally performs better than those of Neon and Zak:

Yuh app

- The app is smooth and fast.

- You can adjust your card’s monthly limit (although this is less flexible than with CSX).

- All functions are easily accessible.

Neon app

- The app can be slow at times and may experience “crashes” during login.

- No card limit management within the app.

- All functions are easily accessible.

Zak app

- The app is slower and often requires you to re-enter your credentials to log in.

- No card limit management; you need to contact customer service.

- The Zak Store adds an extra step for some features.

Yuh provides the best user experience thanks to its smoothness and modernity. Neon is just behind and, if you forgive a few slowdowns, is on par with Yuh in terms of ergonomics. Zak has an outdated design and lags far behind.

1 point for Yuh and 1 point for Neon

Yuh vs Neon vs Zak – Banking Licenses

Yuh, a subsidiary of Swissquote, operates under the banking license of Swissquote Bank SA. This means that customer deposits are managed by a licensed Swiss bank, offering increased security.

Neon collaborates with Hypothekarbank Lenzburg, which holds a full banking license. This allows Neon to ensure the safety of funds while providing digital services.

Zak uses the license of Banque Cler, which also ensures deposit protection.

In all cases, your deposits are protected up to 100,000 CHF, guaranteeing reliable protection for all users.

1 point each

Yuh vs Neon vs Zak – Which neobank is the best

Considering all these criteria:

- Yuh Bank scores 9 points.

- Neon Bank scores 8 points.

- Zak Bank scores 5 points.

Yuh clearly has the advantage, but Neon remains a good option thanks to Neon Invest, Neon Duo, and its competitive exchange rates that allow for cost-effective travel. Zak can be interesting if you prioritize shared pots and cashback offers.

If you are looking for an account in EUR or USD, Yuh is the ideal choice. For frequent withdrawals and trading, Yuh is also recommended. Consolidating multiple Swiss bank accounts into one can simplify personal finances, offering better management and lower fees.

Otherwise, feel free to test all three as these neobanks are free and can be complementary.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Frequently Asked Questions (FAQ) about Yuh vs Neon vs Zak

✅ What are the main differences between Yuh, Neon, and Zak?

Yuh offers a multi-currency account, free withdrawals, and a loyalty program in Swissqoins. Neon focuses on competitive exchange rates and unlimited withdrawals via Sonect. Zak offers cashback features but does not yet have trading services.

✅ How to open an account with Yuh, Neon, and Zak?

To open an account with Yuh, Neon, or Zak, simply download the respective app, follow the registration instructions, and submit the required documents for verification.

✅ Are there age restrictions to open an account with Yuh, Neon, and Zak?

Yes, Yuh allows opening an account from the age of 14, while Neon and Zak require a minimum age of 15.

✅ What are the cash withdrawal fees for Yuh, Neon, and Zak?

Yuh allows 4 free withdrawals in CHF per month. Neon offers 2 free withdrawals per month with unlimited withdrawals via Sonect. Zak charges 2 CHF per withdrawal unless made at Banque Cler.

✅ Which is the best option for travelers between Yuh, Neon, and Zak?

Yuh is preferable for travelers thanks to its multi-currency card, while Neon may be more economical for withdrawals due to the absence of exchange fees. Zak, however, imposes additional fees for withdrawals abroad.

✅ What is the loyalty program of Yuh compared to Neon and Zak?

Yuh has a loyalty program that rewards users with Swissqoins for deposits and transactions. Neon does not offer a similar program at this time. Zak uses cashback via Shopmate.

✅ Which neobank is the most suitable for trading between Yuh, Neon, and Zak?

Yuh Investment offers trading options on stocks, ETFs, and cryptocurrencies, while Neon Investment only provides investments in a limited number of stocks and ETFs. Zak currently does not offer trading services.

✅ Are deposits protected with Yuh, Neon, and Zak?

Yes, all deposits are protected up to 100,000 CHF due to their partnership with Swiss banks.

✅ What are the deposit limits with Yuh, Neon, and Zak?

Yuh and Neon do not impose deposit limits, while Zak does not specify a minimum amount for account opening.

✅ Can TWINT be used with Yuh, Neon, and Zak?

Yuh has integration with TWINT, while Neon and Zak do not offer a dedicated TWINT app.

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before February 28, 2026 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️