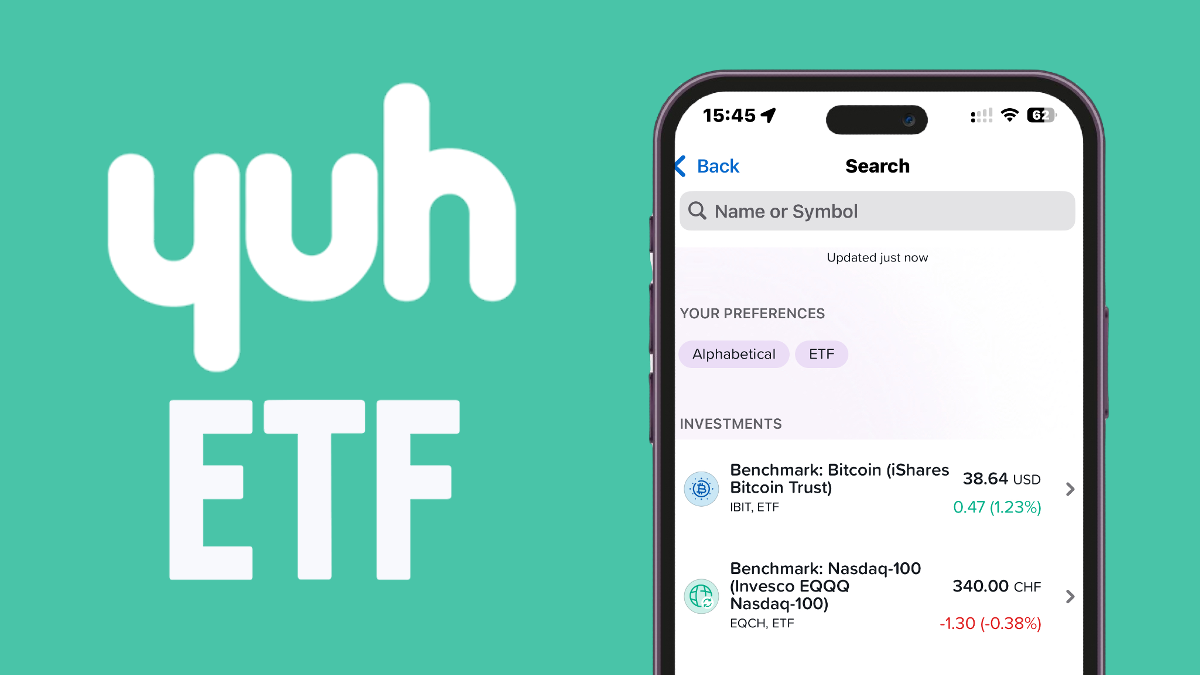

Yuh Bank is one of the largest neobanks in Switzerland and offers a wide variety of investment options, including stocks, ETFs (Exchange-Traded Funds), and cryptocurrencies. These funds are incredibly popular among investors because they offer diversification, low fees, and easy access to global markets. Whether you’re a beginner or an experienced investor, Yuh’s platform allows you to invest in ETFs that align with your financial goals.

In 2026, Yuh has expanded its ETF offerings, enabling investors to tap into global markets, specific sectors, and sustainable investing. Whether your focus is on long-term growth, generating dividends, or exploring niche opportunities, Yuh offers ETFs to fit every strategy. In addition, Yuh allows you to set up ETF savings plans to automate your investments.

We’ve put together the complete Yuh ETF List to help you browse and find what fits your investment strategy more easily. Each ETF is linked to TradingView, so you can check out more details and analysis with just a click. Plus, we’ve included the TER (Total Expense Ratio) for each ETF, so you know the costs upfront.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

For a detailed review of Yuh’s investment features, platform usability, and the overall benefits of investing with Yuh, check out our Investing with Yuh review (8.3/10).

Yuh ETF List in February 2026

Yuh has a wide range of ETFs, allowing you to diversify your portfolio across different markets, regions, and industries. These ETFs cater to various strategies, providing the option for broad market exposure or more targeted investments.

Benchmark ETFs give you access to major indices, while Commodity ETFs let you invest in assets like gold and silver. For ethical investing, ESG ETFs focus on companies with high environmental, social, and governance standards. If you’re looking for more targeted exposure, Sector ETFs cover industries like technology or finance, and High Dividend ETFs are designed for income-focused investors.

Here is the complete list of Yuh ETFs you can invest in:

| Yuh Designation | ETF Name | Ticker | ISIN | TER | |

|---|---|---|---|---|---|

| Benchmark: Nasdaq-100 | Invesco EQQQ Nasdaq-100 | EQQQ.USD | IE0032077012 | 0.30% | |

| Benchmark: Nasdaq-100 | Invesco EQQQ Nasdaq-100 CHF | EQCH | IE00BYVTMT69 | 0.35% | |

| Benchmark: Swiss Performance Index | iShares SPI CH | CHSPI | CH0237935652 | 0.10% | |

| Benchmark: World Min Vol | iShares MSCI World Min Vol | MVSH | IE00BD1JRZ09 | 0.35% | |

| Benchmark: World Momentum | iShares MSCI World Mom | IWMO | IE00BP3QZ825 | 0.30% | |

| Commodity: Gold | ZKB Gold | ZGLD | CH0139101593 | 0.40% | |

| Commodity: Silver | ZKB Silver | ZSIL | CH0183135976 | 0.72% | |

| ESG: World | Invesco MSCI World ESG | ESGW.USD | IE00BJQRDK83 | 0.19% | |

| ESG: USA | Invesco MSCI USA ESG | ESGU.USD | IE00BJQRDM08 | 0.09% | |

| High Dividend: Europe | SPDR S&P Euro Div Aristo | SPYW | IE00B5M1WJ87 | 0.30% | |

| High Dividend: Switzerland | iShares Swiss Div | CHDVD | CH0237935637 | 0.15% | |

| High Dividend: USA | SPDR S&P U.S. Div Aristocrats | AUDVD | IE00B6YX5D40 | 0.35% | |

| High Dividend: World | Vanguard FTSE All-World High Div | VHYL | IE00B8GKDB10 | 0.29% | |

| Large Cap: Africa | MSCI Africa Top 50 | XMKA | LU0592217524 | 0.65% | |

| Large Cap: Asian Emerging Mkts | iShares MSCI EM Asia | CSEMAS.USD | IE00B5L8K969 | 0.20% | |

| Large Cap: Australia | iShares MSCI Australia | SAUS.AUD | IE00B5377D42 | 0.50% | |

| Large Cap: Brazil | MSCI BRAZIL | XMBR | LU0292109344 | 0.65% | |

| Large Cap: Canada | UBS MSCI Canada | CANCDA.CAD | LU0446734872 | 0.39% | |

| Large Cap: China | CSI300 | XCHA | LU0779800910 | 0.50% | |

| Large Cap: Developed World | iShares MSCI World | IWDC | IE00B8BVCK12 | 0.55% | |

| Large Cap: Europe | Lyxor EUR STOXX50 | MSE | FR0007054358L | 0.20% | |

| Large Cap: France | Lyxor CAC 40 | CACC | FR0013380607 | 0.25% | |

| Large Cap: Germany | X DAX | DBXD | LU0274211480 | 0.09% | |

| Large Cap: Italy | iShares FTSE MIB | CSMIB | IE00B53L4X51 | 0.33% | |

| Large Cap: Japan | X NIKKEI225 | XNJP.JPY | LU0839027447 | 0.09% | |

| Large Cap: Latin America | Amundi MSCI EM Latam | AMEL | LU1681045024 | 0.20% | |

| Large Cap: Nordic | X MSCI Nordic | XDN0 | IE00B9MRHC27 | 0.30% | |

| Large Cap: Pacific | iShares MSCI PACIF X-JP | CSPXJ.USD | IE00B52MJY50 | 0.20% | |

| Large Cap: Spain | X Spain 1C | XESP | LU0592216393 | 0.30% | |

| Large Cap: Switzerland | iShares SMI | CSSMI | CH0008899764 | 0.35% | |

| Large Cap: U.K. | Vanguard FTSE 100 | VUKE | IE00B810Q511 | 0.09% | |

| Large Cap: USA | Vanguard S&P 500 | VUSD | IE00B3XXRP09 | 0.07% | |

| Large Cap: World | Vanguard FTSE All-World | VWRD | IE00B3RBWM25 | 0.22% | |

| Large Cap: World | Vanguard FTSE All-World CHF | VWRL | IE00B3RBWM25 | 0.22% | |

| Mid Cap: Switzerland | UBS ETF CH SMIM | SMMCHA | CH0111762537 | 0.27% | |

| Sector: Switzerland Real Estate | UBS SXI RE Funds | SRECHA | CH0105994401 | 1.10% | |

| Sector: USA Financials | Invesco S&P US Financials | XLFS.USD | IE00B42Q4896 | 0.14% | |

| Sector: USA Healthcare | SPDR S&P US Health | SXLV.USD | IE00BWBXM617 | 0.15% | |

| Sector: USA Materials | Invesco S&P US Materials | XLBS.USD | IE00B3XM3R14 | 0.14% | |

| Sector: USA Tech | SPDR S&P US Tech | SXLK.USD | IE00BWBXM948 | 0.15% | |

| Sector: World Infrastructure | iShares Global Infra | INFR.USD | IE00B1FZS467 | 0.65% | |

| Small Cap: World | SPDR MSCI World Small Cap | WOSC | IE00BCBJG560 | 0.45% | |

| Government Bonds: Switzerland | 1-3 | CSBGC3 | CH0102530786 | 0.15% | |

| Government Bonds: Switzerland | 3-7 | CSBGC7 | CH0016999846 | 0.15% | |

| Government Bonds: Switzerland | 7-15 | CSBGC0 | CH0016999861 | 0.15% | |

| Government Bonds: Eurozone | Eurozone | VGEA | IE00BH04GL39 | 0.07% | |

| Government Bonds: USA | USA | VDTA | IE00BGYWFS63 | 0.07% | |

| Government Bonds: Emerging Markets | Emerging Markets | VDEA | IE00BGYWCB81 | 0.25% | |

| Corporate Bonds: Switzerland | Switzerland | CHCORP | CH0226976816 | 0.15% | |

| Corporate Bonds: Europe | Europe | EUN5 | IE00B3F81R35 | 0.20% | |

| Corporate Bonds: USA | USA | XDGU | IE00BZ036H21 | 0.12% | |

| Aggregate Bonds: World | World | VAGX | IE00BG47KF31 | 0.10% |

Please note: for an up-to-date list of Yuh ETF, we invite to check directly in the Yuh app. Yuh may decide to add or remove some ETF at any time.

Why Choose Yuh for Your Investments?

Yuh stands out for low fees, focused ETFs, multiple asset classes and a user friendly platform for both beginners and experienced investors.

- Low Fees: Yuh’s simple low cost structure, no trading fees on ETF savings plans is great for casual and long term investors.

- ETF Focus: Although it has fewer ETFs than Swissquote, Yuh has a curated selection of core, major benchmarks, sector specific and sustainable ETFs for a diversified portfolio.

- Multiple Asset Classes: Yuh allows diversification, ETFs, shares and cryptocurrencies in one platform.

- User-Friendly: Yuh’s platform is easy to manage portfolios and access financial data, for all experience levels.

Yuh offers a similar number of ETFs to Alpian and Neon Invest, with around 50 ETFs, while Neon offers 70 ETFs and Guided by Alpian offers 45 ETFs. Although Yuh has fewer ETFs than Neon, its selection is carefully curated, covering core strategies, sector-specific funds, and sustainable options, allowing you to build a diversified portfolio.

In addition to ETFs, Yuh allows you to invest in shares and cryptocurrencies, making it more versatile than Alpian and comparable to Neon Invest. This combination of asset classes, along with Yuh’s low fees and user-friendly platform, provides a flexible and cost-effective investment solution.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Yuh Best ETFs

Yuh offers a great selection of ETFs through its ETF savings plans. These plans allow investors to automate their investments without incurring purchase costs, creating a zero trading fee ETF savings plan. Below is a summary of the 6 best ETFs available via Yuh, including their focus, top holdings, and why they could be a great choice for your portfolio.

1. Vanguard FTSE All-World ETF (VWRL)

- Top Holdings: Apple, Microsoft Corp., NVIDIA Corp., Amazon.com, Inc.

- Focus: Global diversification, with a significant focus on U.S. stocks.

- Why Choose This ETF?

The Vanguard FTSE All-World ETF provides exposure to both developed and emerging markets, covering a wide range of sectors and geographies. It’s a solid choice for investors seeking broad diversification with a tilt toward U.S. tech giants.

2. iShares MSCI World CHF Hedged ETF (IWDC)

- Top Holdings: Apple, NVIDIA Corp., Microsoft Corp., Amazon.com, Inc.

- Focus: Developed markets, with heavy exposure to U.S. companies, hedged to protect against currency risk for CHF investors.

- Why Choose This ETF?

The iShares MSCI World ETF is ideal for those looking to invest in developed markets, particularly the U.S., while protecting against currency fluctuations. It’s a strong option for Swiss investors seeking stability in both markets and currency.

3. Invesco EQQQ NASDAQ 100 UCITS CHF Hedged (EQCH)

- Top Holdings: Apple, Microsoft Corp., NVIDIA Corp., Broadcom Inc.

- Focus: U.S. technology stocks, specifically from the NASDAQ 100.

- Why Choose This ETF?

The Invesco EQQQ NASDAQ 100 ETF is a great choice for investors who are focused on innovation and technology. It provides exposure to the biggest names in tech, making it ideal for those who are bullish on U.S. technological advancements.

4. Vanguard FTSE All-World High Dividend Yield ETF (VHYL)

- Top Holdings: Broadcom Inc., JPMorgan Chase & Co., Exxon Mobil Corp., Procter & Gamble Co.

- Focus: High dividend-yielding stocks across global markets, with a mix of developed and emerging economies.

- Why Choose This ETF?

The Vanguard FTSE All-World High Dividend Yield ETF is perfect for income-seeking investors, this ETF focuses on companies that offer above-average dividend yields. It’s a good option for those looking to combine steady income with global diversification.

5. iShares SMI ETF (CSSMI)

- Top Holdings: Nestlé SA, Novartis AG, Roche Holding AG, UBS Group AG

- Focus: Swiss blue-chip companies from the Swiss Market Index (SMI).

- Why Choose This ETF?

The iShares SMI ETF offers direct exposure to Switzerland’s largest and most stable companies. It’s a great option for investors wanting to focus on Swiss market leaders without needing to buy individual stocks.

6. Invesco CoinShares Global Blockchain ETF (BCHE)

- Top Holdings: Taiwan Semiconductor Manufacturing Co., Ltd., Monex Group, Inc., SBI Holdings, Inc., Bitfarms (CA)

- Focus: Companies involved in blockchain technology and cryptocurrency.

- Why Choose This ETF?

For those interested in blockchain and the future of cryptocurrency, the Invesco CoinShares Global Blockchain ETF offers exposure to companies driving innovation in this sector. It’s a speculative but high-growth potential investment for tech-forward investors.

Benefits of Yuh ETF Savings Plans

Yuh’s ETF savings plans allow you to invest in top ETFs through recurring investments without trading fees, making it a cost-effective and straightforward way to grow your portfolio. By setting up automated contributions, you can steadily build wealth over time while benefiting from dollar-cost averaging. Users can specify amounts and customize rules for their recurring investments, making it easy to automate and grow their portfolios consistently. These plans are flexible, allowing you to adjust or stop your recurring investments anytime, making them ideal for both casual and long-term investors seeking an efficient way to manage their portfolios.

Yuh’s ETF savings plans let you invest in top ETFs with no trading fees. It’s a low cost and easy way to grow your wealth. By setting up automated contributions you can build wealth over time and benefit from dollar cost averaging. You can also adjust or stop your investments anytime so it’s good for casual and long term investors looking for an efficient way to manage their portfolio.

Which ETFs Should You Choose?

Investing in fee free ETFs through Yuh’s savings plans is a big draw for new and experienced investors. Of the many options, the Vanguard FTSE All-World ETF (VWRL) is the standout for its broad diversification across developed and emerging markets. It’s a core holding for long term passive investing. A solid base for global exposure at low cost.

For those looking for consistent income the Vanguard FTSE All-World High Dividend Yield ETF (VHYL) provides a steady stream of dividends from high dividend paying stocks across many sectors. So if you want to balance growth with income generation this is a good option.

If you are looking for niche opportunities or have a higher risk tolerance you might like the Invesco EQQQ NASDAQ 100 ETF (EQCH) which focuses on US technology giants or the Invesco CoinShares Global Blockchain ETF (BCHE) which focuses on blockchain innovation. These ETFs are for those who want exposure to high growth sectors like tech and blockchain but they come with higher risk because of the nature of those industries.

In addition to these core and niche ETFs, Yuh also offers sector-specific ETFs, such as iShares SPI CH for Swiss performance index exposure or ZKB Gold and Silver to hedge against market volatility with commodities. Regional ETFs like iShares MSCI EM Asia or DWS MSCI Africa Top 50 allow for targeted investments in specific regions for those who want to explore emerging markets.

Lastly, for sustainable investors, Yuh’s lineup includes ESG-focused ETFs like Invesco MSCI World ESG and Invesco MSCI USA ESG for exposure to companies that put environmental, social and governance first.

Final Thoughts

While the fee free aspect of Yuh’s ETF savings plans is a big plus, the best ETF for your portfolio is dependent on your investment strategy and risk tolerance. Whether you’re building a core portfolio for long term growth, looking for dividends or wanting to get sector-specific exposure, Yuh’s ETFs provide ample flexibility.

By looking at the ETFs available and aligning them to your financial goals you can build a diversified, fee efficient portfolio that’s right for you. With Yuh’s ETFs you can balance risk and reward and invest in the sectors and regions that matter to you.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Frequently Asked Questions (FAQ) about Yuh ETFs

✅ Can I use a promo code for ETF trades on Yuh?

Yes, Yuh offers promo codes that provide benefits like trading credits or reduced fees on ETF trades. Promo codes can be entered directly in the app during registration or under the account settings section.

Use the promo code YUHNEO to get 50 CHF in Trading Credits and 250 SWQ (worth 4 CHF) 🙌 if you sign up for Yuh Bank before February 28, 2026. Get the Yuh app ➡️

✅ How do Yuh Trading Credits work?

Yuh sometimes offers trading credits so you can trade fee free. These credits are often part of promotions or welcome offers and can be used on ETF or stock trades in the app. Keep an eye on the Yuh app or promotional emails for these opportunities.

✅ Is Yuh suitable for beginners?

Yes, Yuh’s easy app and low fees are perfect for beginners starting out.

✅ What types of investment products are available on Yuh?

On Yuh, you can invest in stocks, ETFs, and cryptocurrencies.

✅ What is the benefit of investing in ETFs compared to shares?

ETFs offer diversification by investing in a basket of assets, reducing the risk compared to holding individual shares.

✅ How do ETF savings plans work on Yuh?

Yuh’s ETF savings plans let you automate regular investments into ETFs. You choose the ETF, amount and frequency and Yuh takes care of the rest, so you benefit from dollar cost averaging.

✅ Can I modify or stop my recurring ETF investments on Yuh?

Yes, you can modify or stop your recurring ETF investments at any time. The platform allows you to adjust the amount, switch ETFs, or cancel the plan as needed.

✅ Is there a minimum investment amount required on Yuh?

Yuh has a fixed minimum investment amount of 25 CHF, making it accessible for small-scale investors.

✅ What are the fees for trading shares and ETFs on Yuh?

Yuh charges low commissions on shares and ETFs. ETF savings plans have no trading fees, so it’s perfect for long term investors.

✅ What are the tax implications of investing in ETFs on Yuh?

Tax implications depend on your country of residence. In Switzerland, dividends from ETFs are taxed as income and ETF holdings are subject to wealth tax. Consult a tax advisor for personal advice.

✅ What is Dollar-Cost Averaging

Dollar-Cost Averaging (DCA) is where you invest a set amount at set intervals, regardless of the price. This means you buy more when prices are low and less when they are high, which helps to smooth out the average cost over time. It reduces the risk of buying at the top and helps with investment discipline especially in volatile markets.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

thanks for the table! there’s a small typo (L in isin):

Lyxor EUR STOXX50 MSE FR0007054358L