Choosing the best Swiss online bank can be complex, as mobile banks and neobanks differ significantly in terms of fees, features, and services.

In this comparison, we analyse and rank the main mobile banks and neobanks available in Switzerland, based on costs, ease of use, and overall value—whether you are looking for a free current account, a multi-currency solution, or a simple way to invest.

This ranking is based on real-world use of several Swiss and European banking solutions, as well as fees observed directly within the apps, in order to provide you with a factual analysis of the services available to Swiss residents.

Ranking of the Best Online Banks in Switzerland in March 2026

Below is our ranking of the best Swiss online banks and neobanks in March 2026, based on fees, features and overall usability. The total score reflects our 22-point evaluation framework.

| RANKING | NEOBANK | TOTAL |

|---|---|---|

| #1 | Yuh | 22 points |

| #2 | Neon Bank | 19 points |

| #3 | Alpian | 18 points |

| #4 | Zak Bank | 16 points |

| #5 | Revolut | 14 points |

| #6 | N26 | 13 points |

| #7 | Wise | 12 points |

The points calculation is explained in detail in the Ranking Summary Table.

Methodology: How We Ranked Swiss Online Banks

Choosing a Swiss online bank can be complex, especially as most neobanks now offer free accounts managed via a mobile app or accessible through e-banking, with similar core features.

This ranking of Swiss online banks and neobanks is based on a clear, transparent, and consistent evaluation process.

It relies on 22 key criteria, including fees, available features, mobile app usability, e-banking services, account conditions, and the overall user experience. Each neobank is analysed using the same evaluation framework to enable a factual comparison of the services available to Swiss residents.

Which neobanks are available in Switzerland in March 2026?

✅ Active Swiss Neobanks

In March 2026, there are 4 Swiss neobanks which offer banking services in Switzerland:

3 other international neobanks have also established themselves in Switzerland as major players in online banking and mobile payments:

❌ Inactive Swiss Neobanks:

🔹 Coop Finance+: Since 27 July 2025, the Coop Finance+ app has been deactivated and the service has been discontinued. It is no longer possible to log in or use the associated services. Coop Finance+ can therefore no longer be considered an active neobank.

🔹 CSX: Following the acquisition of Credit Suisse by UBS, the CSX account is no longer available. Former CSX services have been integrated into UBS’s offering, and opening new accounts is no longer possible.

🔹 radicant: Since November 11, 2025, radicant has ceased its operations. The sustainable neobank backed by BLKB is preparing transfer solutions for its clients.

🔹 Yapeal: Since March 31, 2025, Yapeal has stopped opening new accounts for private customers. The Swiss neobank now focuses exclusively on B2B services for businesses and partners.

Note: Some online comparisons, including the one published by Moneyland.ch, still mention banking services that are no longer active or no longer accessible to private customers. In our ranking, we only include neobanks that are currently operational in Switzerland, in order to ensure up-to-date information that is directly useful to readers.

Definition : What are Swiss neobanks and Swiss online banks?

Neobanks and online banks (also known as smartphone banks, fintech banks, or challenger banks) are innovative players in the banking sector. These institutions, typically young and dynamic, aim to challenge the traditional banking model by offering a fully digital alternative.

E-banking, on the other hand, refers to banking services accessible online via a web interface or a mobile app. Unlike neobanks, e-banking is often offered by traditional banks to allow their customers to manage their accounts remotely. This includes features such as transaction tracking, payments, and card management, without the need to visit a branch.

Unlike traditional banks, neobanks do not have physical branches or dedicated advisors. Instead, they provide an intuitive mobile application that allows users to manage their finances directly from their smartphones. This facilitates access to a variety of services, such as payments and transfers, often at more competitive costs than those of traditional institutions.

Moreover, these digital banks are evolving rapidly and are beginning to offer advanced features, including investment solutions and insurance services. Neobanks thus represent a modern and practical approach to financial management, tailored to the needs of an increasingly connected clientele.

Free Swiss bank account: Which banks are really free?

Mobile banks such as Alpian, Neon, Yuh, N26, Revolut, Wise (TransferWise), and ZAK offer free account openings and allow you to maintain your account without monthly fees. These online banks make it easy to open a private account without worrying about hidden fees or recurring costs, making them an ideal choice for an economical online banking solution. ✅

Some banks also offer monthly subscriptions like Premium or Metal that include additional benefits, such as Revolut Premium. The table below presents the offers available for private clients, including the different monthly pricing options.

| Offer | Monthly fee |

|---|---|

| Alpian | ✅ Free |

| N26 Standard | ✅ Free |

| N26 Smart | 4.90 EUR |

| Neon Free | ✅ Free |

| Neon Green | 5.00 CHF |

| Neon Metal | 15.00 CHF |

| Revolut Standard | ✅ Free |

| Revolut Premium | 8.99 CHF |

| Revolut Metal | 15.99 CHF |

| Wise Borderless Account | ✅ Free |

| Yuh | ✅ Free |

| Zak | ✅ Free |

| Zak Plus | 8.00 CHF |

Update: As of July 2024, the Alpian private account is free. This change eliminates the previous pricing structures, making it an attractive option for new customers.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Open an online bank account quickly (in less than 15 minutes)

Neobanks have a super fast and easy account opening process via their mobile apps, so banking is much more accessible.

Alpian and Neon take less than 10 minutes to set up your account by using online ID verification to do it quickly. ✅

Yapeal Opening Confirmation

N26, Revolut and Wise are also great examples of neobanks where you can open a free Swiss bank account in 15 minutes. Yuh asks you 25 questions during the process but you can do it in 20 minutes. Zak has an efficient process where the account is set up in 15 minutes and fully activated in 2 hours. ✅

Winners: Alpian, Neon, ZAK, Yuh, N26, Revolut and WiseBonuses and promo codes from Swiss online banks

When you sign up to some neobanks you can get great welcome offers. These usually include a cash top up straight into your account, instant gratification.

It’s not just easy to switch to a digital bank, but also rewarding. And the extra cash gives you more reason to get started and use all the features straight away.

| Neobank | Promo Code | Offer | Create Your Account |

|---|---|---|---|

| Alpian | ALPNEO | 120 CHF: 55 CHF free 🙌 + 65 CHF for investments. | Get the Alpian app ➡️ |

| Neon | NEOTRADE | 100 CHF in Trading Credit | Get the Neon app ➡️ |

| Yuh | YUHNEO | 50 CHF in Trading Credit + 250 SWQ (4 CHF) | Get the Yuh app ➡️ |

| ZAK | NEOZAK | CHF 50 Free | Get the ZAK app ➡️ |

| Wise | philippea82 | Fee-free transfer of up to 500 GBP | Get the WISE app ➡️ |

N26 and Revolut have no welcome offer. 🚫

Winners: Alpian, Neon, Yuh and ZAKSwiss online banks available in multiple languages

When choosing a neobank in Switzerland, the availability of languages can play a crucial role in your decision. The table below shows which languages are supported by the main Swiss neobanks.

| Neobank | German | French | Italian | English |

|---|---|---|---|---|

| Alpian | ✅ | ✅ | ✅ | ✅ |

| N26 Suisse | ✅ | ✅ | ✅ | ✅ |

| Neon | ✅ | ✅ | ✅ | ✅ |

| Revolut | ✅ | ✅ | ✅ | ✅ |

| Wise | ✅ | ✅ | ✅ | ✅ |

| Yuh | ✅ | ✅ | ✅ | ✅ |

| Zak | ✅ | ✅ | ✅ | 🚫 |

All neobanks offer support in German, but some do not cover all national or international languages:

- Alpian, N26 Switzerland, Neon, Revolut, Wise and Yuh provide full language coverage, supporting German, French, Italian, and English. ✅

- Zak, while supporting the three national languages, does not offer English, which could be a disadvantage for English-speaking expats living in Switzerland. 🚫

Bank account with a Swiss IBAN (CH)

A Swiss Franc (CHF) account with a Swiss IBAN offers numerous advantages. You can carry out your daily banking operations in Switzerland (transfers, salaries, bills, etc.) without additional fees for international transactions or currency conversions.

All mobile banks based in Switzerland offer an account in CHF. Regarding account numbers, you will receive a complete and individual Swiss account number (IBAN) from all Swiss banks. ✅

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before March 31, 2026 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️

However, this is not the case for international banks. For example, N26 only offers accounts in EUR, so no CHF account is available. Similarly, Revolut and Wise offer accounts in CHF, but these are not in your name. 🚫

Currently, international mobile banks, such as N26 and Revolut, assign account numbers from other countries: N26 uses a German account number, Revolut uses a Lithuanian account number, and Wise uses a Belgian account number. Wise also offers account numbers from other countries, such as Belgium, the UK, or the United States.

If you are looking for more options, we explain here How to open a Swiss bank account in March 2026.

Winners: Alpian, Neon, Yuh and ZakSwiss bank card: free or paid?

Many online banks offer a free international debit card, ideal for daily transactions both abroad and domestically. These cards often provide favorable exchange rates and reduced transaction fees. They are usually available immediately after opening the account and can be used both online and in physical stores.

Additionally, they are frequently compatible with modern payment services such as Apple Pay and Google Pay, offering users additional convenience. Some neobanks even provide cashback or bonus points on international purchases, making spending even more rewarding.

The following table shows the cards offered by the different smartphone banks.

| Neobank | Cards | Type | Free |

|---|---|---|---|

| Alpian | Visa Debit | Debit Card | 🚫 60 CHF |

| N26 | Debit Mastercard | Debit Card | 🚫 10 CHF delivery |

| Neon | Mastercard | Debit Card | 🚫 20 CHF delivery |

| Revolut | Visa Debit | Debit Card | 🚫 5.50 CHF delivery |

| Wise | Visa Debit | Debit Card | 🚫 5 GBP delivery |

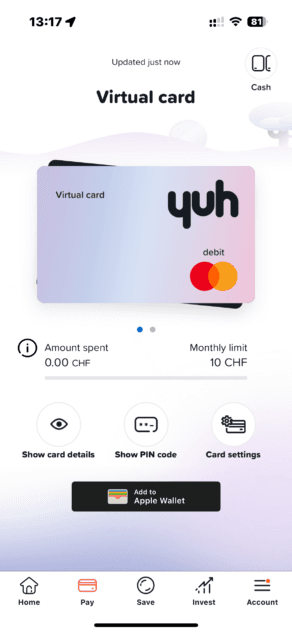

| Yuh | Debit Mastercard | Debit Card | ✅ Yes |

| Zak | Visa Debit | Debit Card | ✅ Yes |

These Swiss neo-banks therefore offer free debit cards, with no delivery fees:

- Yuh Bank offers a free debit Mastercard with no delivery fees. ✅

- Zak Bank also offer a free VISA debit card with free delivery. ✅

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

These other digital banks also offer a debit card, but additional delivery fees apply:

- The Alpian card has been priced at 60 CHF since January 1, 2025.

- N26 Switzerland offers a virtual debit Mastercard in its free plan. However, your need to pay 10 EUR if you want to receive a physical card. 🚫

- Neon Bank provides a free debit Mastercard but charges a 20 CHF delivery fee. 🚫

- Revolut Switzerland provides a physical debit Mastercard, but there is a delivery fee of 5.50 CHF. 🚫

- Wise Switzerland also offers a free physical debit Mastercard, but a shipping fee of 5 GBP is charged. 🚫

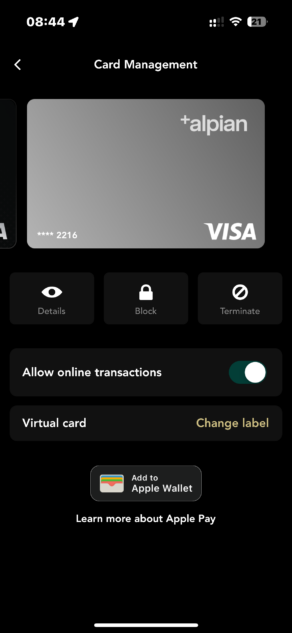

Virtual Visa & Mastercard cards: which banks offer them?

Several mobile banks offer the option to obtain virtual cards, which are ideal for online banking services and mobile payments. You can start using a virtual card as soon as you open your account without having to wait for a physical card to arrive. This allows you to make purchases and payments instantly around the world.

Virtual cards offer the advantage of reducing the risk of theft or misuse. If necessary, you can easily block or replace your card. Additionally, they facilitate payments through services like Apple Pay or Google Pay, allowing for quick and secure transactions.

Generally, customers receive a virtual card alongside their physical card. Some mobile banks also offer the option to forgo the physical card and choose only a virtual card, catering to the growing demand for more flexible and secure payment solutions.

Alpian, N26, Revolut, Wise and Yuh offer virtual cards, ideal for digital payments via Apple Pay and Google Pay. You can start paying immediately. ✅

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

However, other neobanks like Neon, and ZAK do not yet offer virtual cards, which can be inconvenient if you need to make an immediate payment. They require you to wait for a physical card, which can slow down the process if you need to pay quickly. 🚫

Winners: Alpian, N26, Revolut, Wise and YuhMobile payments: Apple Pay, Google Wallet and more

Most mobile banks offer mobile payment solutions such as Apple Pay and Google Pay. These systems allow you to make payments directly from your phone, providing greater convenience and security compared to traditional cards. With these solutions, there is no need to carry a wallet or search for your cards; you simply need to tap your phone to make an instant payment.

Mobile payments are also safer, as they do not share your card information during transactions, making them particularly reliable for everyday use. However, it is important to note that while mobile payment systems are widely supported, devices like fitness bands and smartwatches are rarely compatible.

The table below shows the mobile payment systems accepted by each mobile bank.

| Neobank | Apple Pay | Google Pay | Samsung Pay | Fitbit Pay | Garmin Pay | Swatch Pay |

|---|---|---|---|---|---|---|

| Alpian | ✅ Yes | ✅ Yes | 🚫 No | 🚫 No | 🚫 No | 🚫 No |

| N26 | ✅ Yes | ✅ Yes | 🚫 No | 🚫 No | 🚫 No | 🚫 No |

| Neon | ✅ Yes | ✅ Yes | ✅ Yes | 🚫 No | ✅ Yes | ✅ Yes |

| Revolut | ✅ Yes | ✅ Yes | 🚫 No | ✅ Yes | ✅ Yes | ✅ Yes |

| Wise | ✅ Yes | ✅ Yes | 🚫 No | ✅ Yes | ✅ Yes | ✅ Yes |

| Yuh | ✅ Yes | ✅ Yes | ✅ Yes | 🚫 No | 🚫 No | 🚫 No |

| Zak | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes | ✅ Yes |

Alpian, Neon, Yuh, Zak, N26, Revolut and Wise are already fully compatible with both Apple Pay and Google Pay, ensuring seamless mobile payments wherever you go. ✅

Winners: Alpian, neon, Yuh, Zak, N26, Revolut and WiseCash withdrawals in Switzerland and abroad: free or paid?

When it comes to cash withdrawals, one of the big benefits of smartphone banks is that you can make free withdrawals at any ATM, even outside of their network. In Switzerland where cash is still widely used, this can save you money compared to big banks like UBS or Raiffeisen which charge fees for using non-network ATMs.

Neobanks usually offer a certain number of free withdrawals per month, the number varies by provider, so they are a great option for frequent cash users.

This is how withdrawal fees compare between Swiss neobanks:

| Neobank | Free Cash Withdrawals | What You Should Know |

|---|---|---|

| Yuh | 1 free per week ✅ | Perfect if you regularly withdraw cash. |

| Wise | Free up to 250 CHF (200 GBP) in 30 days ✅ | Offers flexibility, especially for international users. |

| Revolut | Free up to 200 CHF per month ✅ | Good for moderate cash needs, fees apply after that. |

| Alpian | 2 CHF each 🚫 | No free withdrawals, similar to big banks. |

| Neon | 2.50 CHF/withdrawal with neon free, free (2 to 5/month) from neon plus. Sonect always free. 🚫 | Neon Plus offers 2 free withdrawals per month. |

| N26 | EURO account, CHF withdrawals involve exchange rates 🚫 | Fees due to currency exchange. |

| Zak | 2 CHF each 🚫 | Free only at Bank Cler ATMs. |

What does this mean for you?

If you need cash more often, Yuh lets you withdraw 1 free every week – that’s 4 a month! ✅

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before March 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

If you occasionally withdraw larger amounts, Wise and Revolut might be for you. They let you withdraw free up to a certain monthly limit before fees start. ✅

Compared to big banks where you’re usually tied to fees unless you use their own ATMs, neobanks give you more freedom. But still keep an eye on how often you withdraw cash. If you need cash often fees can add up fast even with neobanks once you go over the free limit.

Winners: Yuh, Revolut and WiseTravelling with an online bank: exchange rates and foreign fees

Card payments abroad

For payments abroad, Alpian, N26, Neon, Revolut and Wise are the best options. ✅

Alpian offers a multi-currency account in CHF, EUR, GBP, and USD, allowing you to avoid exchange fees when paying in a currency you already hold. A small weekend surcharge of 0.2% to 0.5% applies for conversions. N26 is ideal for EUR payments within the SEPA zone, with no exchange fees. Neon charges a 0.35% exchange fee with the free plan, but its paid plans (Plus, Global, Metal) offer 0% fees. Revolut offers 0% fees up to CHF 1,000/month, then 1%. Wise charges transparent fees ranging from 0.4% to 1.3%, depending on the currency.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Yuh offers similar benefits as Alpian with its multi-currency account but applies a 0.95% surcharge for currency conversions. Zak is less ideal, with surcharges of 2% on currency conversions. 🚫

Cash withdrawals abroad

For cash withdrawals abroad, Revolut and Wise are the most cost-effective, with Wise offering free withdrawals up to 250 CHF per month and Revolut allowing free withdrawals up to 200 CHF per month, after which small fees apply. N26 allows three free EUR withdrawals per month, which is excellent for Eurozone travelers, but it charges 1.7% for other currencies. ✅

Alpian, Neon, Yuh and Zak impose fees on cash withdrawals abroad, with charges ranging from 1.5% to 5.00, making them less competitive for international cash access. 🚫

The best cards for travelling abroad

In summary, for overall travel, Revolut and Wise are the top choices due to their low currency exchange rate surcharges and minimal ATM withdrawal fees. N26 is a strong option for those primarily traveling within the Eurozone, offering free EUR withdrawals and no currency exchange surcharges.✅

Alpian and Neon are excellent for payments but less ideal for frequent cash withdrawals., Yuh and Zak are less favorable overall, with higher fees for both payments and cash withdrawals abroad. 🚫

Here is a breakdown of the fees of payments and cash withdrawals abroad:

| Neobank | Currency Options | Exchange rate surcharge | Withdrawal abroad at ATMs |

|---|---|---|---|

| Alpian | CHF, EUR, GBP, USD | ✅ 0.2% to 0.5% on weekends | 🚫 2.5% |

| N26 | EUR only | ✅ None | ✅ 2 free withdrawals in EUR per month, then 2.00 € each. 1.7% for other currencies |

| Neon | CHF | 🚫 0,35% | 🚫 1.5% + 0.35% (free with neon metal) |

| Revolut | Multi-currency | ✅ 0% up to 1,000 CHF/month, then 0.5% fair usage fee | ✅ Free up to 200 CHF per month, then 2% |

| Wise | Multi-currency | 🚫 0.4 - 1.3% | Free up to 250 CHF per month ✅ |

| Yuh | CHF, EUR, USD | 🚫 0.95%, no weekend exchanges | 🚫 4.90 CHF each |

| Zak | CHF | 🚫 2% | 🚫 2% + 5.00 CHF each |

Also read our comparison of the best CHF/EUR currency exchange rate.

Winners : N26, Revolut and WiseBank transfers in Switzerland (CHF): free or paid?

Customers of Swiss neobanks benefit from a significant advantage when it comes to bank transfers. Indeed, all these mobile banks offer free transfers in CHF within Switzerland, making it easier to manage everyday financial tasks, such as paying bills or sending money, without additional fees. ✅

International neobanks operate differently: for example, N26, which only operates in EUR, does not offer free transfers in CHF. Although Revolut and Wise provide outgoing transfers in CHF without fees, receiving transfers in CHF can be more complicated, as the IBAN account is not registered in your personal name. 🚫

Additionally, Swiss neobanks also allow transfers via the QR invoice system or payment slips, with or without a reference number (BVR). However, not all Swiss neobanks offer the option to debit an amount using the direct debit system (LSV+).

Winners: Alpian, Neon, Yuh and ZakSEPA and international transfers: free or paid?

SEPA transfer fees

Instant SEPA transfers allow you to send and receive euro payments quickly within the SEPA zone.

With neobanks like Alpian, Yuh, N26, and Revolut, you benefit from free EUR transfers within the EURO zone and Switzerland. Yuh is particularly advantageous by allowing transfers in 13 currencies, including CHF, USD, EUR, and GBP, to SEPA countries. EUR transfers are free when the EUR sub-account is used. ✅

Other banks like Neon and Zak do not offer EUR accounts and apply fees for converting CHF to EUR. Wise applies fees for SEPA payments. 🚫

If needed, you can check the full SEPA country list.

International transfer fees

International transfer fees vary significantly between banks:

- Alpian charges a 0.2% exchange fee and offers free transfers in certain currencies like USD and GBP. For other currencies such as AUD, DKK, NOK, PLN, SEK, CAD, CZK, HRK, HUF, RON, and SGD, fees are 2 CHF within the currency zone and 7 CHF outside the zone. ✅

- Neon use Wise for international transfers with fees between 0.8% and 1.7%, including a “service fee” of approximately 0.4%. ✅

- By using Wise directly, you avoid surcharges and get lower fees of 0.33% to 1.35%. ✅

- The Revolut offer is very competitive with fees ranging from 0.15% to 1.5%, but to avoid limits and surcharges of 1% on the Standard plan and 0.5% on the Plus plan, you must switch to Revolut Premium. ✅

- N26 also charges fees through Wise but adds a surcharge that varies by amount and currency. For example, for an EUR to CHF transfer, the surcharge is 2% for a 100 EUR transfer, 0.5% for 1,000 EUR, and 0.2% for 100,000 EUR, meaning N26 charges higher fees than Alpian and Neon. 🚫

Alpian is a solid option for international transfers with competitive fees in certain currencies like USD and GBP and moderate fees for others. Neon, with their integration with Wise, offer a highly advantageous solution for integrated international transfers, despite a small surcharge. Going directly through Wise avoids these surcharges with lower fees. Revolut is also competitive, but you need to switch to Revolut Premium to avoid surcharges on the Standard and Plus plans. N26 is less competitive due to its additional fees, particularly for EUR to CHF transfers.

Here’s a summary of the fees related to SEPA and international transfers:

| Neobank | EUR Account | Free SEPA Transfers |

|---|---|---|

| Alpian | ✅ | ✅ |

| N26 | ✅ | ✅ |

| Revolut | ✅ | ✅ |

| Yuh | ✅ | ✅ |

| Neon | 🚫 | 🚫 1.5% exchange fee |

| Wise | ✅ | 🚫 0.10 % exchange fee |

| Zak | 🚫 | 🚫 2.5% exchange fee |

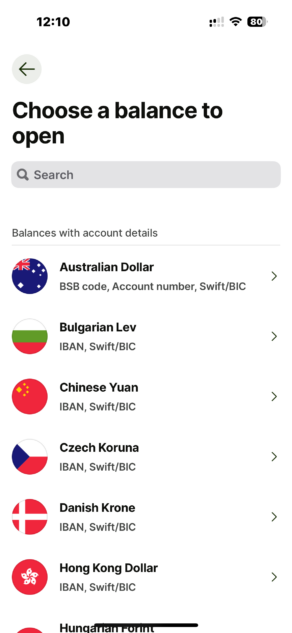

Euro or multi-currency bank account in Switzerland

A EUR account in a Swiss bank allows you to manage and hold euros without having to convert currencies which can save you conversion fees. This is especially useful for people who do transactions in euros on a regular basis, expats, cross border workers or people who travel within the Eurozone.

Alpian and Yuh both offer multi-currency accounts in CHF, EUR, GBP, and USD. ✅

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

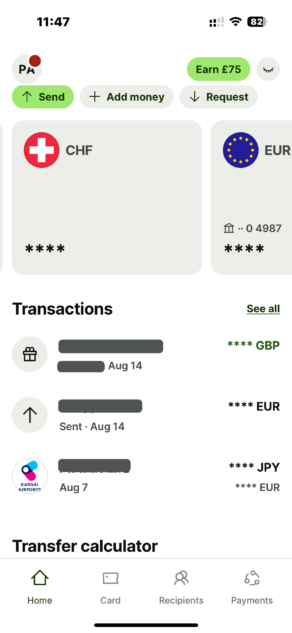

Foreign neobanks like Wise and Revolut also offer multi-currency accounts including EUR. Wise supports over 40 currencies and Revolut allows you to hold up to 30 currencies, making them an excellent options for global purchases. ✅

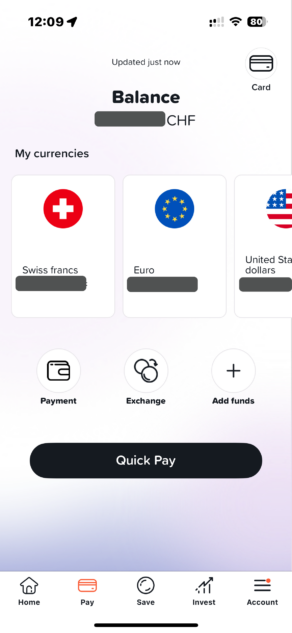

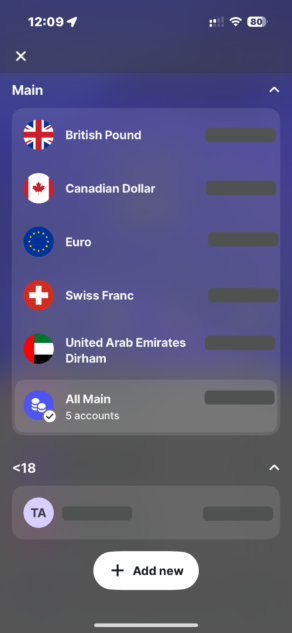

Wise Yuh Multi-currency Account

Yuh Multi-currency Account

Revolut Multi-currency Account

While, Neon and ZAK only offer bank account in CHF 🚫

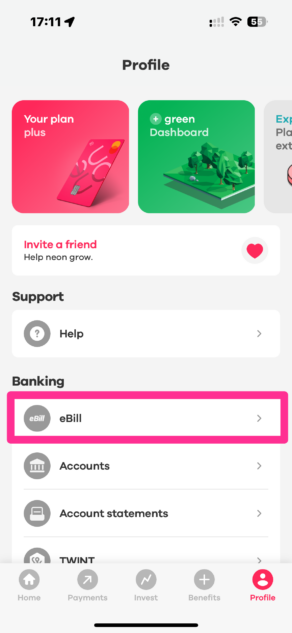

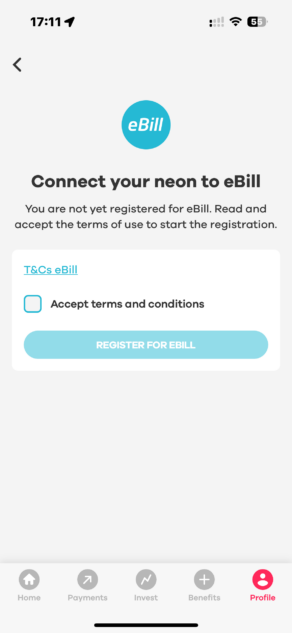

Winners: Alpian, Yuh, N26, Revolut and WisePay your bills with eBill

eBill is a convenient way to pay your invoices directly within your mobile banking app. Instead of dealing with paper bills or manual payments, eBill allows you to receive, review, and pay your invoices digitally in just a few clicks. It streamlines the process, saves time, and reduces the risk of errors, giving you full control over your payments. Plus, it’s environmentally friendly, as it cuts down on paper use.

Currently, only Swiss neobanks like Alpian, Neon, Zak, and Yuh offer eBill integration in their mobile apps, making it easy to manage your invoices on the go. ✅

Foreign neobanks like N26, Revolut, and Wise do not support eBill, which might be a downside for users who want this seamless invoice management feature. 🚫

Winners: Alpian, Neon, Zak and YuhTWINT: instant payments with your online bank

TWINT is a super convenient mobile payment solution widely used in Switzerland. It lets you send and receive money instantly, pay at stores or online, and even use it for services like parking—all directly from your phone. It’s linked to your bank account, so you don’t need to carry cash or a physical card.

and Yuh offer a dedicated TWINT app (see our review of the Yuh TWINT app), making it easy to fully integrate TWINT into their banking experience. ✅

Yuh TWINT

Neon uses the UBS TWINT app and TWINT Prepaid, offering similar functionality with minor limitations. Zak allows you to use TWINT Prepaid but lacks its own dedicated app, which reduces convenience compared to other neobanks. 🚫

If TWINT is essential for your daily banking, the availability of a dedicated app can make all the difference when choosing a neobank.

Winners: Neon and YuhSub-accounts and savings spaces

Sub-accounts, often referred to as “pots” or “spaces”, allow you to manage your money in an organized way. N26 pioneered this concept by introducing the “Spaces” feature, providing each sub-account with an individual IBAN to separate funds according to different savings or spending goals. Other neobanks have also integrated similar features. For example:

- Neon and N26 use the term “Spaces”.

- Revolut offers “Vaults”,

- Yuh provides “Projects”,

- Zak offers “Pots”,

- and Wise refers to them as “Reserves”.

These pots allow you to compartmentalize your funds, making it easier to manage money in different currencies or share with other users. Neobanks like Revolut and Wise also allow you to change the currency of your funds and transfer them to a separate pot. Wise additionally offers the option to create “reserves” in multiple currencies, although these do not earn interest while protecting your balance from unauthorized withdrawals. ✅

N26, Neon, and Yuh allow you to set aside money until you reach your savings goals. ✅

Zak also offers shared pots, allowing multiple users to collectively manage funds for a common goal, such as a project or a trip. Each member can contribute, and the money is used collectively according to rules defined by the group. This feature promotes transparency and simplifies the management of shared expenses, thereby enhancing cooperation among users. ✅

Zak Shared Pots

However, most other neobanks do not yet offer equivalent sub-account features.

Winners : Yuh, Neon, Zak, N26, Revolut and WiseJoint bank account: for couples and families

Opening a joint account in Switzerland can be incredibly easy. You and your partner or family member can access the account to pay bills, cover household expenses, and save together. With shared debit cards, you’ll have more transparency and control over your spending, allowing both of you to shop from the same account. And with Swiss banking, you’ll have peace of mind knowing your money is secure.

Among Swiss neobanks, Neon is the only one offering a joint account with Neon Duo, which costs just 3 CHF per person per month and includes 2 debit cards. ✅

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before March 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

If you’re looking for more options, N26 and Revolut also offer joint accounts, allowing you to manage your shared finances across different platforms. ✅

Winners: Neon, N26, RevolutInterest and savings: which banks pay interest?

With interest rate hikes in 2023 and 2024, many neobanks offered attractive returns on current accounts. However, with the recent reductions in central bank interest rates, these rates are now being adjusted. Neobanks like Alpian, Neon, Yuh, and Zak continue to stand out by paying interest on daily balances, an advantage that traditional banks often reserve for savings accounts or specific investments.

What makes these neobanks even more appealing is that the interest applies directly to your current account balance, with no withdrawal limits. This allows you to earn returns on your money while keeping it readily accessible for daily transactions, without the need for long-term investment commitments. It’s a flexible and rewarding alternative to traditional savings accounts. ✅

Here are the interest rates of Swiss neobanks in March 2026:

| Neobank | Interest Rate | Interest Cap | Withdrawal Limit |

|---|---|---|---|

| Alpian | 0.15 % | Above 125,000 CHF. 0.01 % below. | None |

| Neon | 0.00 % | - | None |

| Yuh Bank | 0.00 % | - | None |

| Zak | 0.05 % | Up to CHF 25,000 | None |

Not all digital banks offer interest on private accounts. N26, Revolut and Wise, for example, do not pay interest on account balances. This can be a decisive disadvantage for customers who value interest income. 🚫

Winners: Alpian, Yuh, ZakInvesting with a Swiss online bank

Neobanks provide varied access to financial markets with different investment options:

- Alpian offers professional wealth management with two mandates at 0.75% per year, allowing investment in Swiss and international ETFs. Check out our Alpian Invest review for more details.

- Neon Invest offers Swiss stock trading at 0.50% and international stock trading at 1.00%, as well as Swiss and international ETFs. ✅

- Yuh Invest offers trading in stocks, ETFs, themes, and cryptocurrencies with competitive fees of 0.50% for stocks/ETFs and 1.00% for cryptocurrencies. ✅

- Revolut provides stock and ETF trading in several countries, including France, but in Switzerland, it is limited to precious metals. 🚫

| Alpian | Neon | Yuh | Revolut | |

|---|---|---|---|---|

| Mandate Fees | 0.75% / year | - | - | - |

| Free Custody Fees | ✅ | ✅ | ✅ | ✅ |

| Swiss Stock Trading | ❌ | 0.50% | 0.50% | ❌ |

| Swiss ETF Trading | ✅ Included | 0.50% | 0.50% | ❌ |

| Foreign Stock Trading | ❌ | 1.00% | 0.50% | ❌ |

| Foreign ETF Trading | ✅ Included | 1.00% | 0.50% | ❌ |

| Theme Trading | ❌ | ❌ | 0.50% | ❌ |

| Cryptocurrency Trading | ❌ | ❌ | 1.00% | ❌ |

| Number of Available Stocks | ❌ | 240+ | 300+ | ❌ |

| Number of Available ETFs | 45+ | 70+ | 58+ | ❌ |

| Number of Thematic Investments | ❌ | ❌ | 30+ | ❌ |

| Number of Cryptocurrencies | ❌ | ❌ | 38+ | ❌ |

Please note that, as with all banks or investment platforms such as Interactive Brokers or Swissquote, you also need to pay annual management fees when you buy ETFs or funds:

At Alpian, Neon, and Yuh, ETF management fees (TER) generally range around 0.25%, but some ETFs can go up to 0.65%, like the iShares MSCI Japan CHF Hedged UCITS ETF (ISIN IE00B8J37J31).

Winners: Alpian, Neon, and YuhUser experience: app quality, fluidity and usability

If we love neobanks, it’s not only because of their low fees, but also because they offer top-notch mobile apps that make banking a breeze on your smartphone.

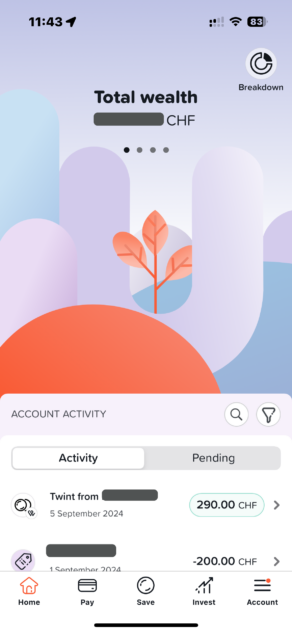

N26, Revolut and Wise are the leaders here with super user-friendly apps. The best Swiss neobank apps are Neon and Yuh, which are really good because of their simplicity and clarity. ✅

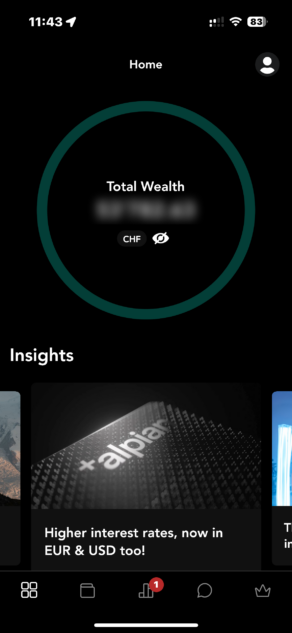

Alpian has a private banking design with a dark background, it feels luxurious. ✅

Alpian app

Yuh App

Wise App

Zak is a bit underwhelming and lacks that extra magic that makes other apps more sexy. 🚫

In short, these neobanks have simple and modern apps to manage your finances flexibly and user-friendly, some banks still have work to do on the user experience.

Winners: Alpian,neon, Yuh, N26, Revolut and WiseReal-time notifications (push alerts)

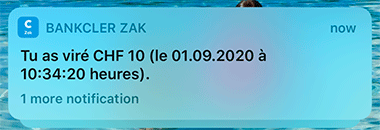

Neobanks have revolutionized the banking experience, making it much more user-friendly compared to traditional banks. One of the key innovations they introduced early on was push notifications, allowing you to receive real-time alerts for every transaction. This means you no longer need to wait for paper statements or log into online banking just to check your recent transactions.

With push notifications, you’re instantly informed about payments, transfers, or withdrawals as they happen, giving you full control over your account and added security by spotting any unusual activity right away.

All smartphone banks, including Alpian, Neon, Yuh,, and Zak, N26, Revolut and Wise, offer this feature, making managing your finances smoother and more transparent. ✅

1 point to each bank YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Transaction security and account protection

When you open an account with Swiss neobanks such as Alpian, Neon, Yuh, or Zak, your deposits are covered by the Swiss deposit guarantee, offering protection up to 100,000 CHF. These mobile banks operate similarly to traditional institutions and all use a banking license subject to the strict regulations of the Swiss Financial Market Supervisory Authority (FINMA).

For example, Alpian is an independent neobank with a full banking license, while as a mobile bank of the UBS group, also ensures a high level of security and Zak belongs to Banque Cler (formerly Bank Coop), further enhancing the security of your deposits. ✅

Neon, on the other hand, partners with Hypothekarbank Lenzburg, which holds a full banking license. This allows Neon to benefit from the security of a Swiss banking institution while providing online services. ✅

Yuh, the smartphone bank jointly launched by PostFinance and SwissQuote, does not have its own banking license but uses the banking license of SwissQuote, which is an authorized bank. This means that customer deposits are managed under the supervision of a traditional Swiss bank. ✅

N26 and Revolut hold banking licenses in Europe and are subject to the European deposit guarantee, thus protecting their clients’ deposits within the EU. However, this protection does not apply in Switzerland, and customers of these neobanks do not have the same level of security as those who open an account with an authorized Swiss bank. 🚫

In Switzerland, Revolut and Wise also operate with an electronic money license, which requires them to secure their clients’ deposits with partner banks. While this structure protects funds from losses in the event of company failure, it does not offer the same guarantee as a traditional bank in Switzerland, where deposit protection is ensured up to 100,000 CHF. 🚫

In summary, if you are looking for a high level of security for your deposits, it is best to choose mobile banks that possess a full Swiss banking license.

Winners: Alpian, Neon, Yuh and ZakScore calculation and ranking of Swiss online banks

We allocated 2 points for the criteria of free accounts (FREE) as well as for CHF accounts with a Swiss IBAN (CHF), and 1 point for each of the other criteria.

We get the following comparison:

| Alpian | Neon | Yuh | Zak | N26 | Revolut | Wise | |

|---|---|---|---|---|---|---|---|

| FREE | 2 | 2 | 2 | 2 | 2 | 2 | 2 |

| FAST | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| PROMO CODE | 1 | 1 | 1 | 1 | |||

| LANGUAGES | 1 | 1 | 1 | 1 | 1 | 1 | |

| IBAN CH | 2 | 2 | 2 | 2 | |||

| CARD | 1 | 1 | |||||

| VIRTUAL | 1 | 1 | 1 | 1 | |||

| MOBILE | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| CASH | 1 | 1 | 1 | ||||

| TRAVEL | 1 | 1 | 1 | ||||

| CHF | 1 | 1 | 1 | 1 | |||

| TRANSFERS | 1 | 1 | 1 | 1 | 1 | ||

| CURRENCIES | 1 | 1 | 1 | 1 | 1 | ||

| eBill | 1 | 1 | 1 | 1 | |||

| TWINT | 1 | 1 | 1 | ||||

| SPACES | 1 | 1 | 1 | 1 | 1 | 1 | |

| JOINT | 1 | 1 | 1 | ||||

| SAVINGS | 1 | 1 | 1 | ||||

| TRADING | 1 | 1 | 1 | ||||

| SMOOTH | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| PUSH | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| SECURE | 1 | 1 | 1 | 1 | |||

| TOTAL | 18 | 19 | 22 | 16 | 13 | 14 | 12 |

However, the choice naturally depends on your needs and priorities: for eBill, opt for Neon, Zak, or Yuh. For SEPA transfers, N26 is the best option.

Here is the feature and price comparison of Alpian, Neon, Yuh et ZAK.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Frequently Asked Questions (FAQ) about Swiss Online Banks

✅ What is a Swiss neobank or mobile bank?

A neobank (also called a mobile bank or smartphone bank) is a financial institution that provides fully digital banking services via a mobile app, without physical branches.

✅ What are the main neobanks and mobile banks in Switzerland?

The main neobanks and mobile banks in Switzerland include Alpian, Yuh, Neon and Zak.

✅ Are deposits secure in Swiss neobanks and mobile banks?

Yes, deposits in Swiss neobanks are protected by the Swiss deposit guarantee, offering coverage up to CHF 100,000.

✅ Which is the safest mobile bank?

Among the safest mobile banks are Yuh, Neon Bank and Alpian. Yuh is backed by Swissquote. Neon Bank partners with Hypothekarbank Lenzburg AG. Additionally, both Alpian hold a FINMA banking license, ensuring a high level of security for users.

✅ What is the difference between a neobank and a traditional bank?

Neobanks operate primarily online without physical branches, offering lower fees and user-friendly digital interfaces, while traditional banks provide in-person branches and advisors.

✅ Which is the best mobile bank in Switzerland?

Among the top 4 in our Top 10, Yuh, Neon Bank and Alpian stand out. Yuh offers great flexibility with its multi-currency features and investment options. Neon Bank is particularly appreciated for its international payments with no hidden fees. Alpian provides a premium banking experience with personalized investment services.

✅ Who can benefit from neobanks and mobile banks in Switzerland?

Neobanks are ideal for users comfortable with digital platforms, looking for cost-effective banking solutions, and preferring to manage their finances via an app.

✅ Who are neobanks and smartphone banks not suitable for?

These banks may not suit those who prefer in-person interactions or are not familiar with digital technologies. Additionally, they may not yet fulfill all complex banking needs.

✅ Is there a minimum amount to invest with neobanks?

No, most neobanks and mobile banks do not require a minimum amount to open an account.

✅ Do neobanks offer interest?

Some neobanks, such as Alpian, Yuh, Neon, and offer interest rates on savings accounts, while others do not.

✅ How can I transfer money to my mobile bank?

You can transfer money to your mobile bank account using the account number provided by the bank, directly from your existing bank account.

✅ Can third parties send me money?

Yes, third parties can transfer money to your neobank account, but it is important to ensure you provide them with the correct account number for transactions.

✅ Do Swiss mobile banks offer free CHF transfers?

Yes, all Swiss mobile banks allow free CHF bank transfers within Switzerland.

✅ How do the costs of Swiss neobanks compare to traditional banks?

Swiss neobanks are generally cheaper than traditional banks, offering lower fees for transactions, transfers, and account management.

✅ What features are available in mobile bank apps?

The apps allow users to manage payment cards, track transactions, create savings “pots,” and make transfers, among other features.

✅ Do mobile banks offer financial advice?

Generally, mobile banks do not provide personalized advice, but customer support is available via chat or phone to answer questions.

✅ Can I open a business account with a neobank or mobile bank?

Currently, only Yapeal among Swiss neobanks offers accounts specifically for freelancers and SMEs.

✅ What cards do Swiss mobile banks offer?

Mobile banks mainly offer debit cards, such as the Debit Mastercard and Visa Debit, but some do not provide traditional credit cards.

✅ Are there hidden fees with Swiss mobile banks?

While many mobile banks clearly display their fees, it is recommended to read the terms and conditions to avoid surprises.

✅ Do mobile banks allow international transfers?

Yes, except for which only supports SEPA transfers.

✅ What happens if a neobank or mobile bank goes bankrupt?

Deposits in Swiss neobanks are protected by the Swiss deposit guarantee, meaning you can recover up to CHF 100,000 in case of bankruptcy.

✅ Do I get a Swiss account number with a neobank?

Yes, you receive a complete and individual Swiss IBAN account number from all Swiss neobanks.

✅ What are the main differences between Swiss and international smartphone banks?

Swiss smartphone banks offer accounts with deposit guarantees, while international ones like N26 and Revolut do not provide the same security in Switzerland.

✅ Which Swiss bank has no fees?

Yuh and Neon Bank offer fee-free accounts, with free SEPA payments within Switzerland and the EU. Alpian also provide competitive services with complete cost transparency.

✅ Which Swiss bank has the lowest fees?

Yuh and Neon Bank stand out for their very low fees, particularly for daily transactions. Alpian also offer affordable solutions with full cost transparency.

✅ Which bank does not charge fees for current accounts?

Yuh and Neon Bank, as well as all Swiss neobanks, do not charge fees for current accounts, allowing for simple and cost-effective management.

✅ Which Swiss bank account is free?

The bank accounts offered by Yuh and Neon Bank are completely free. Alpian provides transparent pricing for its premium services.

Update history

January 2nd, 2026 update: New Alpian referral code: ALPNEO

November 11, 2025 update: Radicant removed from the ranking due to cessation of operations.

November 7, 2025 update: Alpian now offers eBill.

May 12, 2025 update: Neon changes its plans and pricing

April 2, 2025 update: Yapeal removed from the ranking due to its shift to B2B focus.

January 6, 2025 update: Addition of the Languages criterion.

January 1st, 2025 update: The Alpian card is now priced at 60 CHF.

December 12, 2024 update: radicant now offers an EUR account and SEPA transfers.

November 1st, 2024 update: New Neon interest rate: 0.10%

October 1st, 2024 update: New Yuh interest rate: 0.75%

October 1st, 2024 update: New Neon Bank promo code: NEOTRADE

September 23, 2024 update: Addition of the Trading criterion.

September 5, 2024 update: The Alpian bank account is now free.

September 2, 2024 update: Addition of the joint account criterion.

August 13, 2024 update: Alpian now allows you to add Virtual Cards.

June 2nd, 2024 update: added a CSX promo of 25 CHF for March 2026 : PA1289.

May 5, 2024 update: Neon increase the delivery fee of their MasterCard to CHF 20.

January 22, 2024 update: Addition of Alpian and radicant Bank to the ranking.

January 21, 2024 update: Taking into account interest rates (RATES) and the virtual card offer (VIRTUAL) in the ranking.

January 10, 2024 update: Yuh bank now also offers a free virtual card.

May 26, 2023 update: Yuh bank now offers Yuh TWINT.

January 30, 2022 update: Yuh bank offers 50 CHF Trading Credit with the code YUHNEO

December 2, 2022 update: Yuh bank offers eBill.

April 23, 2022 update: Neon has launched Spaces, to help organise your finance.

March 30, 2022 update: Zak has launched eBill. You just need to activate the plugin in the app.

Feb 3, 2022 update: Neon have launched their new Mastercard that comes with push notifications for each transaction. They gain 1 point and take the lead of this ranking, before Zak Bank.

As the founder of Neo-banques.ch, Philippe uses several Swiss and European online banks on a daily basis, including Yuh, Alpian, N26, Wise, and Revolut for his personal and professional transactions.

He has also previously used Neon and Zak as primary accounts before migrating to other solutions.