In a world where shared expenses and common financial goals are increasingly common, the need for a suitable financial management tool is felt. Neon Bank, the Swiss neo-bank recognized for its simplicity and affordable fees, now offers a solution for couples , roommates or friends wishing to manage their finances together: the Neon Bank Joint account.

For the moment, this offer is unique among Swiss neo-banks. Only Revolut offers a joint account but without the advantages of Swiss neo-banks. Read our Neon vs Revolut comparison on this subject.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before January 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

How to open a Neon Bank Joint account

To open a Neon Bank Joint account you must both live at the same address and both have a Neon personal account.

Opening a Neon Joint account only takes a few minutes and is done entirely online. Then, you and your co-holders can benefit from an account with complete features, designed for smooth and transparent financial management.

You just need to follow the following steps:

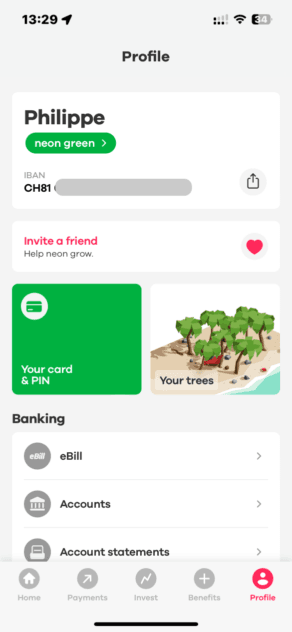

1. Click on “Profile” and select “Accounts”

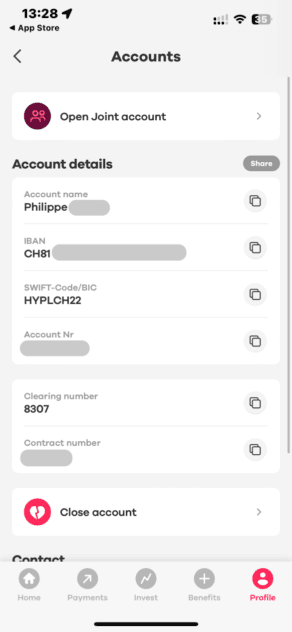

2. Click on “Open Joint account”

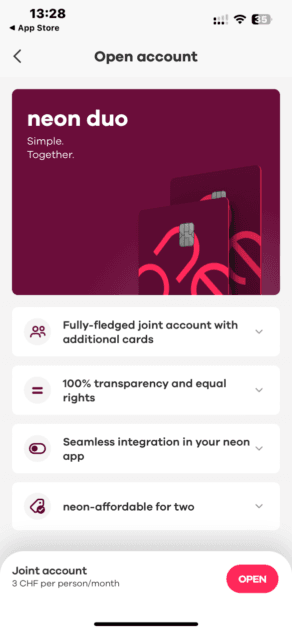

3. and finally validate

The advantages of the Neon Bank Joint account

- A unique IBAN for the joint account: Receive and send transfers with ease thanks to the unique IBAN assigned to your Neon joint account.

- Full access for both:You and your partner will have full access to account balance, transactions and financial management tools. This transparency promotes open communication and a better understanding of shared expenses.

- Fast and independent payments: Say goodbye to authorization requests for every expense! With the Neon joint account, each holder can make payments quickly and independently, without the other’s consent.

- Track common expenses:You can easily track household expenses, such as rent, bills, groceries, etc., and thus better manage your budget together.

- Instant and free transfers: Transfer money instantly and without fees between your personal Neon accounts and the joint account. Say goodbye to debt between you and easily settle shared expenses.

- Automatic transaction categorization: Take advantage of the automatic categorization functionality to categorize your spending and visualize your spending habits in a clear and detailed manner.

How much does the Neon Bank Joint account cost

The Neon joint account offers clear and affordable pricing for simplified management of your finances together:

Monthly fees:

- 3 CHF per month and per person: An affordable monthly rate to take advantage of the many features of the Neon joint account.

Opening costs:

- 10 CHF per card and per person: A one-off fee for obtaining your Neon Mastercard card for each co-holder.

Fee debit:

- Private accounts: Monthly fees and opening fees will be debited to your Neon private accounts (free, metal or green).

Free withdrawals:

- 2 additional free withdrawals per joint account (1 per card): Enjoy free cash withdrawals on top of those already included in your individual Neon plan.

In summary, for a total monthly fee of CHF 6 per month (CHF 3 per person), you and your partner benefit from a full joint account with two Neon Mastercard cards, additional free withdrawals and access to all the benefits of Neon Bank.

Upcoming features

The Neon Bank joint account is still in beta version, not all features are available yet. Neon plans to add payments with Wise, account statements and banking details in the coming weeks.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before January 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Frequently Asked Questions (FAQ) about Neon Duo

✅ What are the monthly fees for Neon Duo?

Neon Duo costs 3 CHF per month for each user, totaling 6 CHF per month. Additionally, there is a fee of 10 CHF for each card ordered.

✅ Can users invest directly from their Neon Duo account?

No, investments are not possible with the Neon Duo account; you must have a personal Neon account for investment options.

✅ Are Neon Metal or Neon Green accounts compatible with Neon Duo?

No, these premium accounts are only available for individual users and cannot be linked to a Neon Duo account.

✅ Who would benefit from using Neon Duo?

Neon Duo is ideal for couples or two individuals who wish to manage their finances collectively through a digital banking platform.

✅ Who might find Neon Duo unsuitable?

Those seeking a free joint banking option may find Neon Duo unsuitable, as it incurs a monthly fee of 6 CHF.

✅ What happens to the Neon Duo account if one partner passes away?

In the event of one partner’s death, the account will be frozen until the estate is resolved, as mandated by the custodian bank (HBL) to safeguard the rights of the heirs. Therefore, it is not advisable to store emergency funds in this account.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before January 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️