Neon is a Swiss neobank launched in 2019 that quickly stood out in the Swiss market thanks to a simple, 100% mobile offering with no monthly fees. Its “neon free” account allowed payments in Switzerland and abroad without exchange fees, and also offered two free ATM withdrawals per month at Swiss ATMs—a rare advantage among Swiss banks.

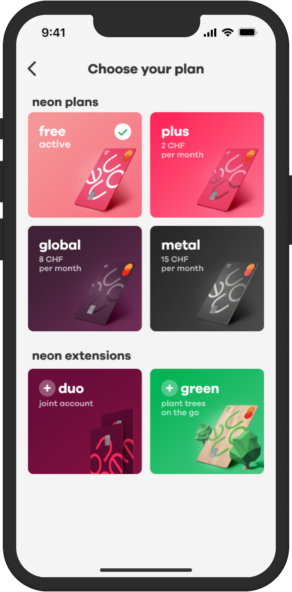

But this era is coming to an end. Since May 12, 2025, the new Neon plans are officially live and available to all customers. The neobank now offers 4 distinct plans: neon free, neon plus, neon global, and neon metal. Each is designed to meet different needs, from the minimalist profile to the frequent traveler.

This overhaul aims to provide more clarity, flexibility, and perceived value. In return, some benefits historically included in the free plan are now reserved for paid tiers. Existing users are automatically migrated to the new system, with a notification sent via the Neon app.

Overview of the Current Offering and Automatic Migration

Since May 12, 2025, Neon offers a structure of 4 plans:

- neon free – the basic free plan 🆓

- neon plus – an economical tier with free withdrawals in Switzerland and 0% currency exchange fees 💳 (2 CHF/month)

- neon global – designed for regular travelers 🌍 (8 CHF/month)

- neon metal – the premium pack with a metal card and full insurance coverage 🛡️ (15 CHF/month)

Each plan provides specific benefits in terms of withdrawals, exchange fees, Wise cashback, and additional services.

🔄 Automatic Migration

- Existing users have been automatically transferred to the new neon free plan.

- No customer was moved to a paid plan without their consent.

- To activate a higher plan, simply select it in the Neon app.

- An in-app notification was sent to inform each customer of the changes.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Details of the 4 New Plans

Since May 12, 2025, Neon offers 4 banking plans. The two existing plans (neon free and neon metal) remain, but two new offerings—neon plus and neon global—have been added to meet a wider range of needs. All plans include Neon’s core services, including free CHF transfers, QR/eBill payments, and Spaces management. Fees for securities investments or savings plans remain identical across all tiers.

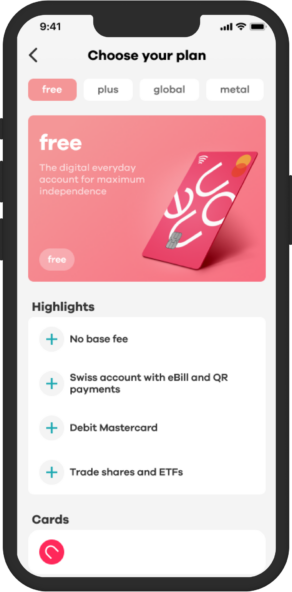

neon free – 0 CHF/month (0 CHF/year)

The free plan remains available but has two major limitations:

💱 Foreign currency payments are now subject to a 0.35% exchange fee (previously: 0%).

🏧 Withdrawals at Swiss ATMs now cost 2.50 CHF per withdrawal (previously: 2 free/month, then 2 CHF/withdrawal).

🌍 Withdrawals abroad are now subject to a 1.5% fee + 0.35% exchange fee with neon free.

Neon recommends using free withdrawals at Coop, Aldi, or Lidl as an alternative.

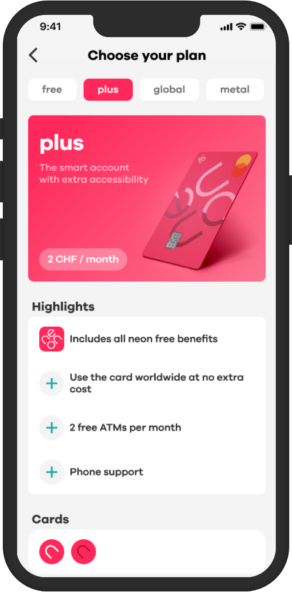

neon plus – 2 CHF/month (20 CHF/year)

A new intermediate plan that restores the historic benefits of neon free:

✅ 0% exchange fees for foreign currency payments

🌍 Withdrawals abroad subject to 1% fee

🏧 2 free ATM withdrawals per month in Switzerland

☎️ Phone support included

🔧 Extended warranty on electronic devices purchased with the Neon card

This plan is recommended for those who travel occasionally or want more flexibility without upgrading further.

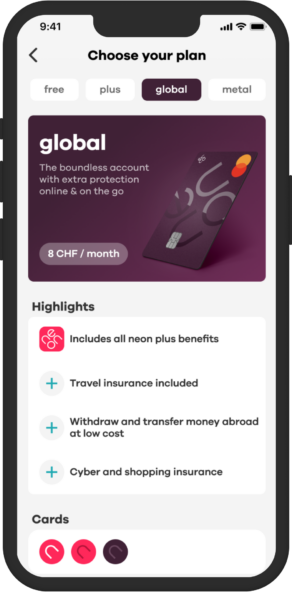

neon global – 8 CHF/month (80 CHF/year)

This offering includes all neon plus features, plus:

🛡️ Additional insurance included: travel, shopping and cyber protection

📱 Phone insurance is reserved for the neon metal plan

🌐 0.5% fee on withdrawals abroad (vs. 2.50 CHF for lower tiers)

💸 20% cashback on Wise fees (international transfers)

Designed for active international users, this plan offers a good balance between coverage and price.

neon metal – 15 CHF/month (150 CHF/year)

Neon metal is Neon’s most comprehensive plan, for those who want everything without compromise:

💳 Metal card

🌍 0% fees on withdrawals abroad

🏧 5 free ATM withdrawals/month in Switzerland

🛡️ Full insurance package, including extra protections (cyber, phone, best price, ticket protector, etc.)

💸 40% cashback on Wise fees

Plus, international bank transfers are cheaper than with other plans.

➕ À la Carte Options

🌱 Neon Green: The former Neon Green plan (5 CHF/month) is no longer standalone. It becomes an add-on available on all plans, priced at 3 CHF/month. It allows planting one tree every 500 CHF spent and choosing a wooden or recycled plastic card.

👥 Neon Duo: The joint account for two people becomes an option at 3 CHF/month per person. Both users enjoy the same benefits as the chosen plan.

🔍 Summary

With this new 4-tier structure, Neon abandons its one-size-fits-all approach in favor of a more segmented and modular offering. Customers can now choose the plan that exactly matches their usage:

- Free and simple for local use (neon free)

- Balanced with essential services (neon plus)

- Optimized for travel and foreign payments (neon global)

- All-inclusive with insurance and exclusive perks (neon metal)

With the Green and Duo options, the offering becomes even more customizable—a unique à la carte approach among Swiss neobanks.

Comparison Table of Neon Plans

| Features / Fees | neon free | neon plus | neon global | neon metal |

|---|---|---|---|---|

| Monthly Price | FREE | CHF 2 | CHF 8 | CHF 15 |

| Annual Price (One-Time Payment) | FREE | CHF 20 | CHF 80 | CHF 150 |

| Exchange Rate Fees (Foreign Currency Payments) | 0.35% | 0% | 0% | 0% |

| Withdrawals in Switzerland | 2.50 CHF per withdrawal | 2 free/month, then 2.50 CHF | 3 free/month, then 2.50 CHF | 5 free/month, then CHF 2.50 |

| Withdrawals Abroad | 1.50% + 0.35% | 1.00% | 0.50% | 0% |

| Wise Cashback (International Transfers) | ❌ | ❌ | ✅ 20% | ✅ 40% |

| Telephone Support | ❌ | ✅ | ✅ | ✅ |

| Extended Purchase Guarantee | ❌ | ✅ | ✅ | ✅ |

| Shopping & Travel Insurance | ❌ | ❌ | ✅ | ✅ |

| Additional Insurance | ❌ | ❌ | ❌ | ✅ (cyber, phone, etc.) |

| Metal Card | ❌ | ❌ | ❌ | ✅ |

| Recommended for | Local use, without frequent withdrawals or foreign currency payments | Regular use with some withdrawals and purchases abroad | Frequent travelers or regular payments in foreign currencies | Heavy international users requiring comprehensive insurance |

How Neon Compares to Competitors

With its new pricing grid, Neon redefines its position among Swiss neobanks like Alpian, Radicant, Yuh, and Zak. All now offer a free plan, but their approaches vary by services.

Here is a comparison table of the main Swiss neobanks:

| Neobank | Multi-currency | Foreign exchange fees | Free withdrawals in CHF | Virtual Card |

|---|---|---|---|---|

| Alpian | ✅ CHF, EUR, USD, GBP | 0.2% (weekdays), 0.5% (weekends) | No (CHF 2/withdrawal) | ✅ Yes |

| Neon | ❌ No (CHF only) | 0.35% (free), 0% from above | 2 to 5/month depending on the plan | ❌ No |

| Radicant | ✅ CHF, EUR | 1.5% | 12/year | ✅ Yes |

| Yuh | ✅ CHF, EUR, USD | 0.95% always | Free at Coop/Aldi/Lidl, otherwise CHF 2.50 | ✅ Yes |

| Zak | ❌ No (CHF only) | 2.5% | 2/month, then CHF 2 | ❌ No |

Alpian offers a free multi-currency account (CHF, EUR, USD, GBP) with no monthly fees. You can make payments with no exchange fees if you already hold a balance in the currency used. Otherwise, a markup of 0.2% on weekdays and 0.5% on weekends applies when converting currencies. Withdrawals in CHF at Swiss ATMs cost 2 CHF per transaction. Alpian remains an attractive option if you want to consolidate multiple currencies in one account while keeping conversion costs under control.

Neon stands out with its modular structure, comprising 4 plans (free, plus, global, metal) and add-ons like Green or Duo. You can make between 2 and 5 free withdrawals per month depending on the plan. Foreign payments are free starting with the Plus plan, otherwise charged at 0.35%. Neon does not allow holding other currencies than CHF, but you can use Wise for international transfers.

Radicant also offers a free account, with 3 free withdrawals per month in CHF. Foreign payments are charged at 1.5%. However, you can hold balances in CHF and EUR, which is an asset for cross-border users or eurozone payments.

Yuh offers a free account with sub-accounts in CHF, EUR, and USD. Foreign currency payments are always subject to a 0.95% conversion fee, whether the conversion is done before the payment or at the time of purchase. Withdrawals are charged 2.50 CHF per ATM withdrawal, but free at Coop, Aldi, or Lidl. Yuh also includes a free virtual card.

Zak offers a free account with 2 free withdrawals per month, then 2 CHF/withdrawal. Foreign exchange fees are clearly the least favorable: 2.5% fees. Zak also does not offer a virtual card or multi-currency accounts—only CHF.

💡 Conclusion: If you seek a local, flexible, and customizable solution, Neon offers one of the most modular experiences in the Swiss market. With its tiered plans, you can adjust your costs to your usage without losing access to essential modern banking features.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

What Is Lost Compared to the Old neon free Plan

Until now, the neon free account offered rare benefits in Switzerland, notably no foreign exchange fees and two free CHF withdrawals per month. With the new pricing structure in effect since May 12, 2025, these benefits are now reserved for paid plans.

Here are the main changes:

💸 Exchange Fees

✅ 0% fees on foreign currency payments, even with neon free.

❌ 0.35% exchange fee on all currency payments with neon free, plus an additional 1.5% on withdrawals abroad.

👉 To get 0% again, you must upgrade to neon plus (2 CHF/month).

🏧 CHF Cash Withdrawals

✅ 2 free withdrawals per month at Swiss ATMs.

❌ 2.50 CHF per withdrawal with neon free, from the first withdrawal.

👉 Free withdrawals are included from neon plus (2/month), neon global (3/month), or neon metal (5/month).

🧾 What This Means for You

If you primarily use your card for in-Switzerland payments, neon free remains a solid plan.

But as soon as you make foreign currency payments or withdraw cash, costs add up quickly.

➡️ neon plus thus becomes the equivalent of the “old neon free”, but for 2 CHF per month.

Why These Changes at Neon?

Neon justifies this plan overhaul by wanting to offer more clarity, choice, and personalization to its customers. The company aims to align with market standards while ensuring sustainable profitability.

Until now, Neon offered a single, simple but inflexible model. This meant all users enjoyed the same benefits, even if some were costlier for the bank (frequent withdrawals, foreign payments, etc.). This system became difficult to sustain amid rising volumes and external fees (notably currency and withdrawal fees).

The new structure therefore aims to:

💡 Make costs more transparent, according to each customer’s actual usage

🧩 Enable personalization: everyone chooses the services they need

⚖️ Rebalance the burden: customers who use more services contribute more

🚀 Offer more extensive services (insurance, Wise cashback, metal card…)

According to Neon, this evolution allows balancing accessibility and long-term viability, without imposing a paid plan by default. Customers can stay on neon free if they have simple needs—or opt for a higher plan to optimize payments, withdrawals, and insurance.

Pros and Cons of the New Grid

The new Neon offering gives you more choice but also means rethinking which features remain free and which become paid. Here are the main takeaways.

✅ Advantages

- More flexibility: choose a plan that matches your actual usage without paying for unused services.

- Clear and transparent fees: know what to expect for withdrawals, exchange, or add-ons.

- New premium services: Global and Metal include insurance, Wise fee cashback, and a metal card.

- Modular approach: add Green or Duo to any plan, including the free one.

⚠️ Disadvantages

- Fewer free benefits: what used to be included in neon free (0% exchange, free withdrawals) is now paid.

- Increased complexity: the initial simplicity gives way to a wider grid with multiple options to understand.

- Recurring cost if you travel: to avoid exchange fees or get free withdrawals, you must subscribe to at least neon plus (2 CHF/month).

💡 Conclusion: If you have simple needs, stay on neon free. But if you make foreign payments, withdraw cash regularly, or want extra protection, you’ll need to pay a few francs per month to keep those benefits.

Tips for Choosing the Right Neon Plan

With 4 plans and multiple add-ons, it can be hard to know which to choose. Here are concrete guidelines to help you select the best offer for your usage.

🆓 neon free – For Staying 100% Free

Choose this plan if:

- You make payments only in Switzerland

- You rarely withdraw cash

- You don’t need insurance or phone support

💡 This plan is sufficient for simple daily management, provided you limit withdrawals and foreign payments.

💳 neon plus – To Restore the Old Neon Model

Opt for this plan if:

- You want to avoid exchange fees abroad

- You withdraw cash 1–2 times per month

- You want more responsive customer support

💡 At 2 CHF/month, it’s ideal if you want the same comfort as before, without surprises.

🌍 neon global – For Regular Travelers

This plan is for you if:

- You travel several times a year

- You want shopping and travel insurance

- You often use Wise for international transfers

💡 At 8 CHF/month, it optimizes your spending abroad while adding a layer of security.

🏆 neon metal – For Maximum Coverage

Choose it if:

- You want a metal card and premium status

- You frequently withdraw abroad

- You seek a complete insurance package (cyber, phone, cancellation…)

💡 At 15 CHF/month, it’s the most comprehensive plan for peace of mind and top coverage.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Conclusion on the New Neon Plans

With its new pricing grid, Neon is transforming its model in depth. Previously, the bank mainly offered neon free as a single plan, with some add-ons like neon metal (premium) and neon green (sustainability). Since May 12, 2025, it has adopted a 4-plan structure—free, plus, global, metal—with à la carte options like Green or Duo.

This change marks the end of a simple but rigid model and the arrival of a more modular, more transparent, and more in-line with modern neobank standards offering. Some once-free benefits—like free withdrawals or foreign payments—become paid. But in return, you can now choose exactly the services you use, and only pay for those.

If you only need basic functions in Switzerland, neon free remains a good choice. If you travel, withdraw cash regularly, or want wider coverage, paid plans (from 2 CHF/month) can quickly pay for themselves.

💡 Take time to analyze your habits: that’s the key to picking the right plan without unnecessary fees. Neon gives you the choice—now it’s up to you to take control.

Frequently Asked Questions (FAQ) on the New Neon Plans

✅ What are the new plans offered by Neon?

Since May 12, 2025, Neon offers 4 banking plans:

– neon free (free)

– neon plus (2 CHF/month)

– neon global (8 CHF/month)

– neon metal (15 CHF/month)

There are also two add-ons: Neon Green (3 CHF/month) and Neon Duo (3 CHF/month per person).

✅ Can I stay on my old neon free account?

No. All customers are automatically migrated to the new version of neon free, which now imposes 0.35% foreign exchange fees and 2.50 CHF per ATM withdrawal in Switzerland. To regain the old conditions (zero exchange fees and free withdrawals), you must upgrade to neon plus.

✅ Does the neon green plan still exist?

Yes, but in a new form. Neon Green is no longer a standalone plan. It becomes an add-on you can attach to any Neon plan for 3 CHF/month. It supports reforestation and allows choosing a wooden or recycled plastic card.

✅ Is there a joint account with Neon?

Yes. The Neon Duo option lets you open a joint account with a partner while retaining the benefits of the main plan chosen. The option costs 3 CHF/month per person.

✅ What changed for users of the old free plan?

The main free benefits have been removed from the new neon free:

– Foreign payments are now charged 0.35%

– Swiss ATM withdrawals cost 2.50 CHF

These benefits are now only included in paid plans.

✅ Are international transfers via Wise still available?

Yes, Wise transfers remain available with all Neon plans. Standard Wise fees apply, but you receive cashback on these fees if you subscribe to neon global (20%) or neon metal (40%).

✅ What types of insurance are included in paid plans?

Insurances start with the neon global plan and are even more comprehensive with neon metal.

– Neon global includes travel and shopping insurance.

– Neon metal adds extra coverages: mobile phone, cyber protection, ticket cancellation, best price guarantee, etc.

✅ Which Neon plan is best for my profile?

It depends on your usage:

– neon free is suitable if you only use CHF payments without frequent withdrawals.

– neon plus is ideal if you pay abroad or withdraw cash occasionally.

– neon global is perfect for regular travelers.

– neon metal is recommended for those seeking full coverage and a premium card.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️