You hesitate between Neon bank and Zak by Bank Cler, you do not know which neobank is best for you, here is a comparison that will help you to choose.

In our ranking of the best Swiss neobanks you can see that Neon bank and Zak are neck and neck, being equal on almost all criteria, but there are some differences that may be important for you.

Neon vs. Zak – 1 point each

| Neon | Zak | |

|---|---|---|

| Overall rating | 8.4/10 | 7.9/10 |

| Free bank account | ✅ | ✅ |

| Free debit card | ✅ Mastercard | ✅ Visa |

| Quick account opening | ✅ 15 min. with the app | ✅ 15 min. with the app |

| Safe | ✅ Partner of Hypothekarbank Lenzburg | ✅ Product of Bank Cler |

| IBAN (CH) | ✅ | ✅ |

| Free CHF transfers | ✅ | ✅ |

| Push Notifications | ✅ | ✅ |

| eBill | ✅ | ✅ |

| Compatible with Apple Pay, Google Pay | ✅ | ✅ |

Neon and Zak are equal on these criteria, even if sometimes the experience can be different during the account opening the 2 neobanks allow a quick and easy opening in 15 minutes.

Neon vs Zak – Missing features

Neon and Zak are also equal on some missing options:

| Neon | Zak | |

|---|---|---|

| EUR account | ❌ | ❌ |

| Personalised IBAN | ❌ | ❌ |

Neither of these neobanks offers EUR account, you have to turn to Yuh, N26 or Revolut. They also don’t allow you to have a personalized IBAN like CSX do.

Neon vs Zak – Promo code

When you open an account with Neon or Zak, you get a welcome gift of cash in your account, which is always nice.

If it’s the welcome gift that motivates you first, open an account at Zak Bank, and you can enjoy 50 CHF

1 point for Zak

Neon vs Zak – Debit card & withdrawals

🔎 Cost comparison:

- For 1 withdrawal/month outside Cler: Zak (2 CHF) is cheaper than Neon free (2.50 CHF)

- From 2 withdrawals/month, Neon Plus (2 CHF/month) becomes cheaper than Zak

- Neon Global and Metal offer 3 to 5 free withdrawals per month

1 point for Neon

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before January 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon vs. Zak – Travel and Currency Exchange

None of these accounts are multi-currency, which means that any payment in EUR or other currencies will be subject to an exchange rate and possible fees.

Neon Bank is very transparent on the issue of exchange fees: no surcharge on the interbank rate and 1.5% fee on withdrawals in EUR in Switzerland or abroad.

Neon is therefore an attractive option for travel, provided that you limit your cash withdrawals.

ZAK on the other hand does not mention anything about the exchange rates applied. 1.50 CHF is charged for each payment abroad and 5 CHF for each withdrawal.

Neon Bank is clearly better positioned than Zak when it comes to travel and exchange rates, even if we prefer Yuh, Revolut or even N26 on this point.

1 point for Neon

Neon vs Zak – TWINT

You can use TWINT with both Neon Bank and Zak, but the difference is important because neither of these neobanks offers a dedicated app.

Neon Bank allows you to use the UBS TWINT application while Zak only allows you to use the TWINT Prepaid application. On a daily basis, it is obvious that Neon Bank will be more convenient when making payments with TWINT.

On this point, however, we prefer CSX, which allows you to use the TWINT application of Credit Suisse.

1 point for Neon

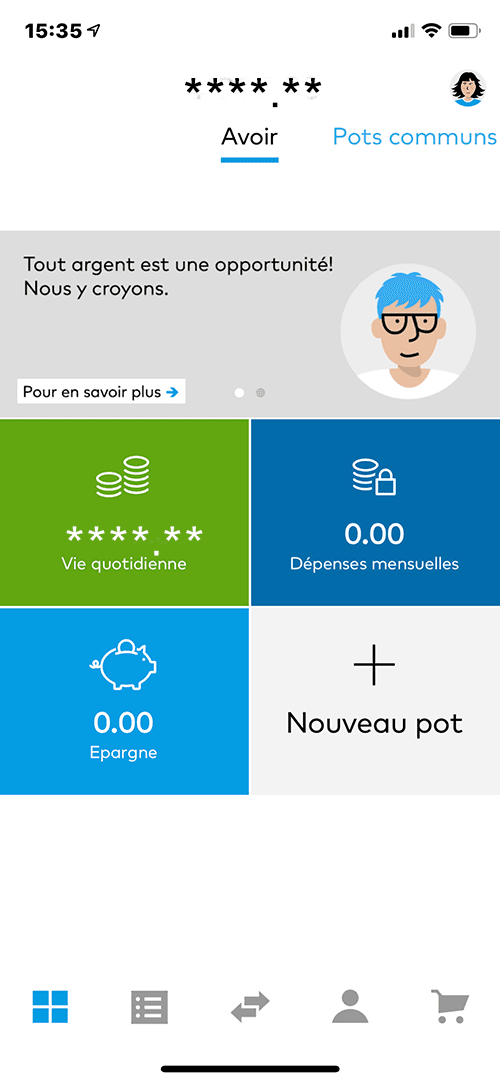

Neon vs Zak – SPACES

SPACES is a feature originally launched by N26: it’s similar to a shared sub-account at N26, but Neon Bank and Zak are not yet on the same level:

With Neon:

- SPACE is a personal piggy bank

- SPACE is not shared

- SPACE does not have a dedicated IBAN (option offered by Bunq.com)

With Zak

- The common pot (Zak’s SPACE) can be used as a piggy bank

- it is shared with other Zak users

- but it does not have a dedicated IBAN either

SPACE is therefore a more mature option at Zak, even if it is not yet complete

1 point for Zak

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before January 31, 2026 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️

Neon vs Zak – Which app is more user-friendly?

Discussing usability can be very subjective, but it comes down to which app is more intuitive and easier to use, for example:

- How many clicks to access an important function?

- How many clicks to complete a transaction?

- Does the app crash often?

- Is the app fast?

Without doing a full ergonomic analysis (not the purpose of this article), we think the Neon app is better overall than the Zak app:

With Neon:

With Zak:

- the design of the application is more austere, too square

- you have to activate the plugins to access eBill or activate the Common Pots

- you have to use – in addition – the ONE application to follow and manage the bank card

Both applications are generally very fast, even if they can sometimes crash during the connection.

Overall, the advantage goes to Neon Bank which is easier to use on a daily basis

1 point for Neon

Neon vs Zak – Customers ratings and reviews

Neon is rated 4.6 in the App Store (4.5k reviews) and Zak is rated 4.6 in the App Store (9.0k reviews) , it means that customers are quite happy with both neobanks.

1 point each

Neon vs Zak – Which neobank is the best

If we consider all of these criteria:

- Neon Bank gets 6 points

- Zak Bank gets 4 points

Neon therefore has the advantage, but Zak remains an excellent neo-bank:

- if for example you don’t travel, Zak is an excellent option

- if TWINT is important to you, choose Neon without hesitation

- if you have common expenses to manage, Zak will be the right choice

And if you have a doubt, test the 2 because these neobanks are free: