Since a day only lasts 24 hours, I automate as many tasks as possible in order to have more time for my hobbies and personal occupations.

Paying bills is a typical example of a task that takes time every month. It is now possible to automate it thanks to eBill.

What is eBill?

eBill replaced the digital invoice in 2019 and is now used by more than 2.5 million people in Switzerland.

eBill replaces your paper and e-mail invoices: you receive a message directly in your e-banking and all you have to do is validate the payment.

How does eBill work?

You must first activate eBill with your supplier (Wingo for example) and you will then receive your digital invoices directly in your bank’s online system.

For the amount to be debited, you can decide either to always approve invoices before payment (default mode), or to define an exact or maximum amount to automate payment without approval.

Which neo-Swiss banks offer eBill?

The eBill system is offered by more than 90 Swiss banks and almost all Swiss neobanks.

Since this year, Zak has also offered the eBill option. It is therefore relevant to find out in detail how this system works within this neo-bank.

How to activate eBill at Zak?

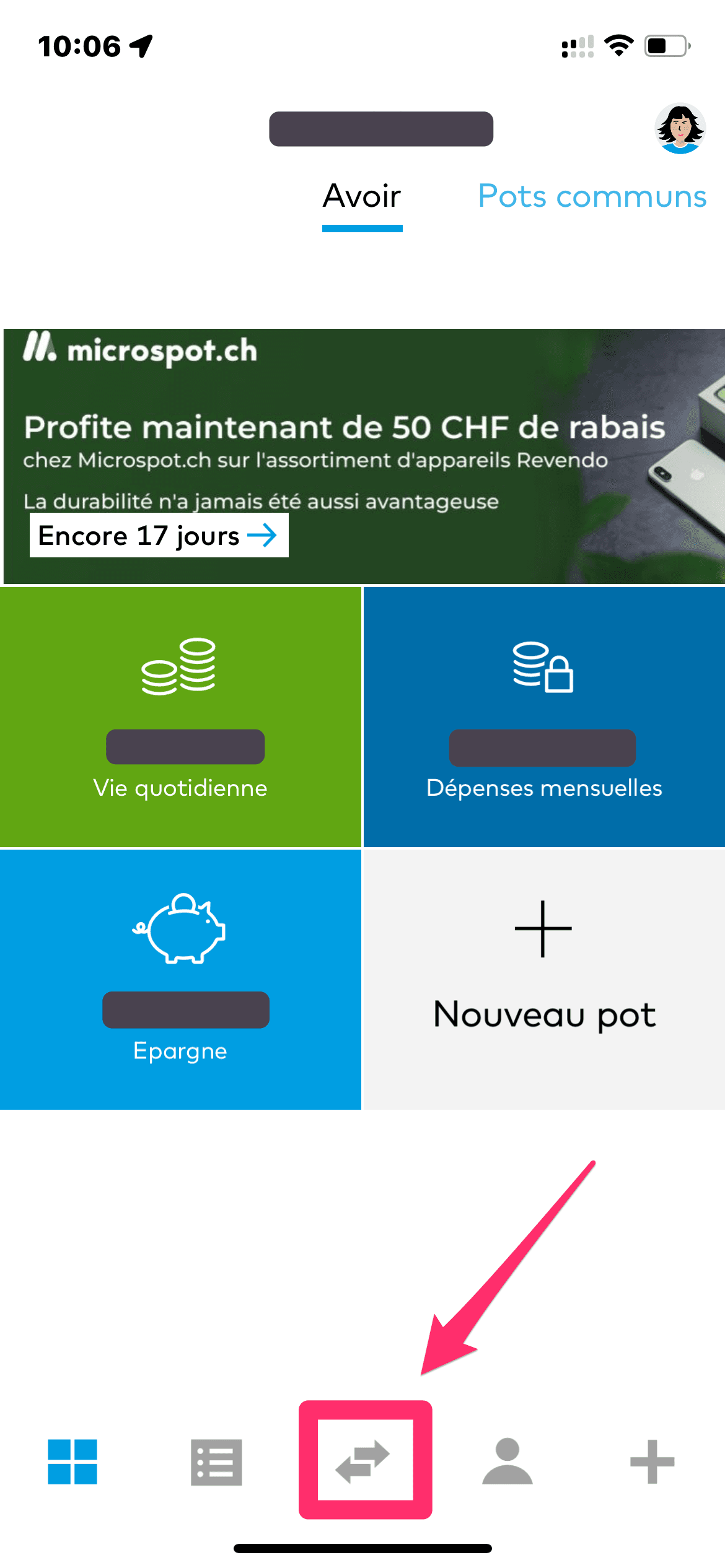

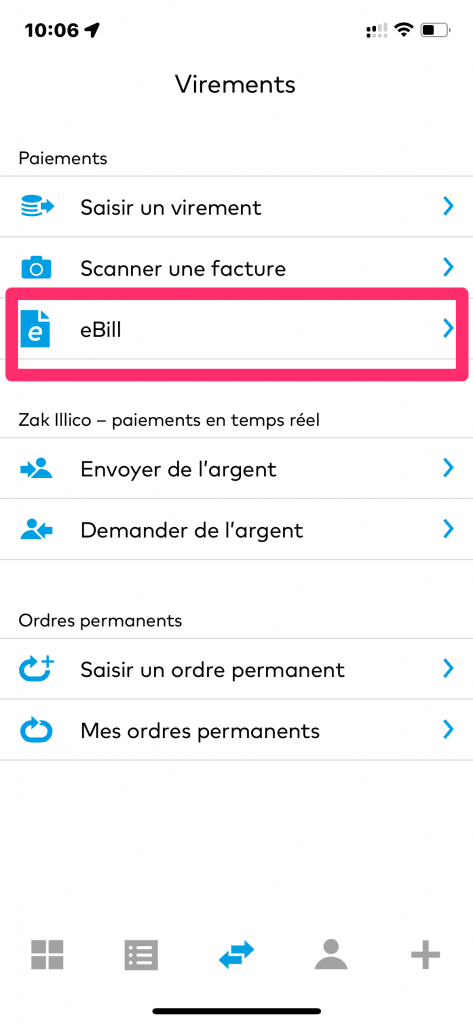

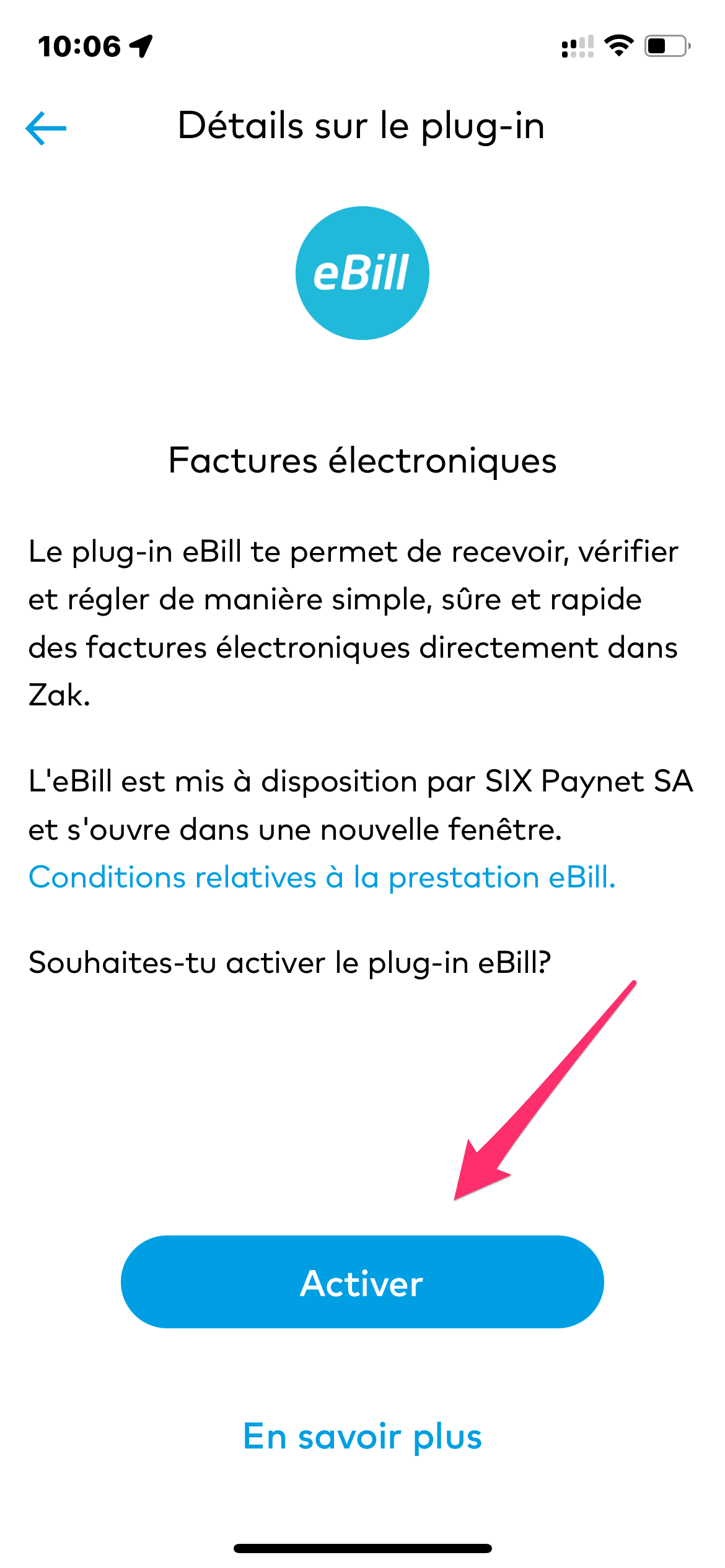

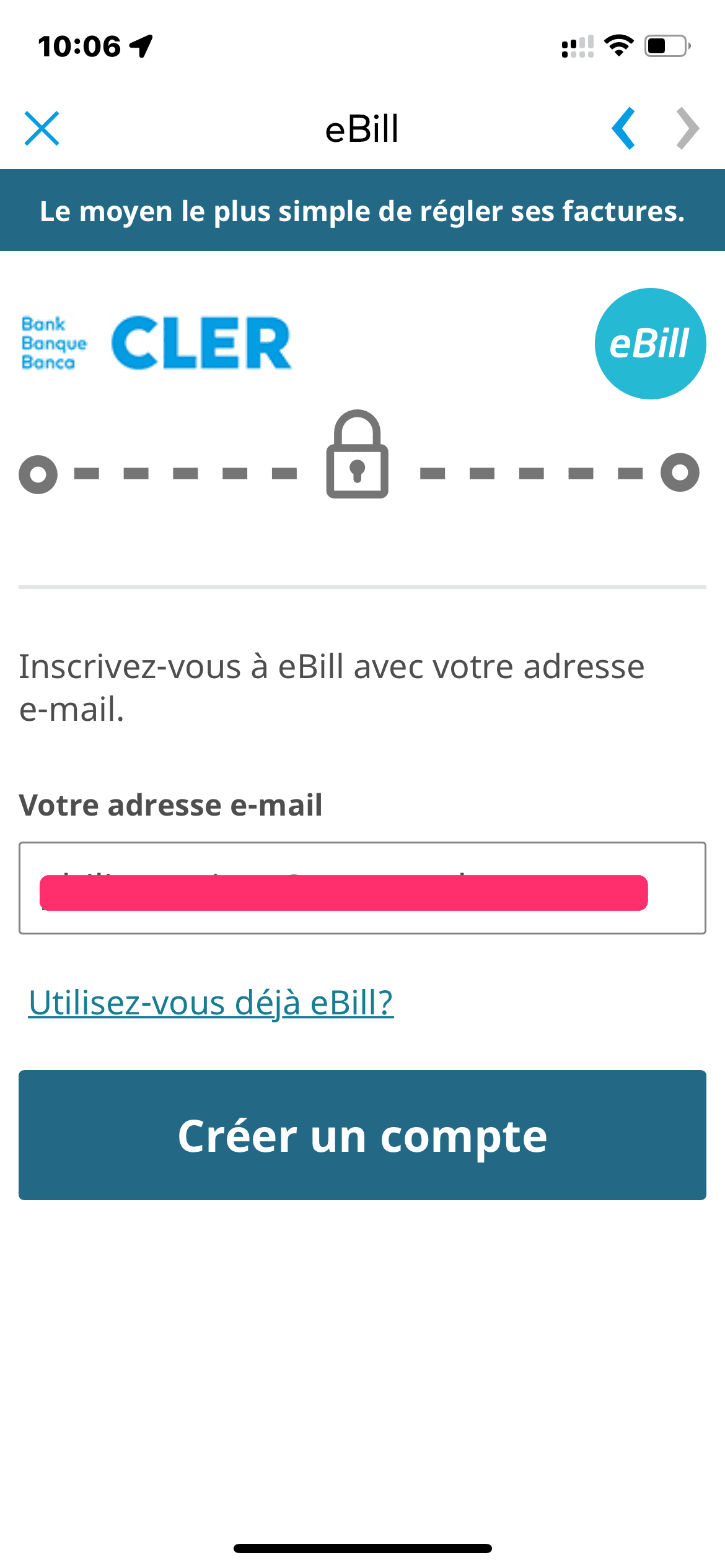

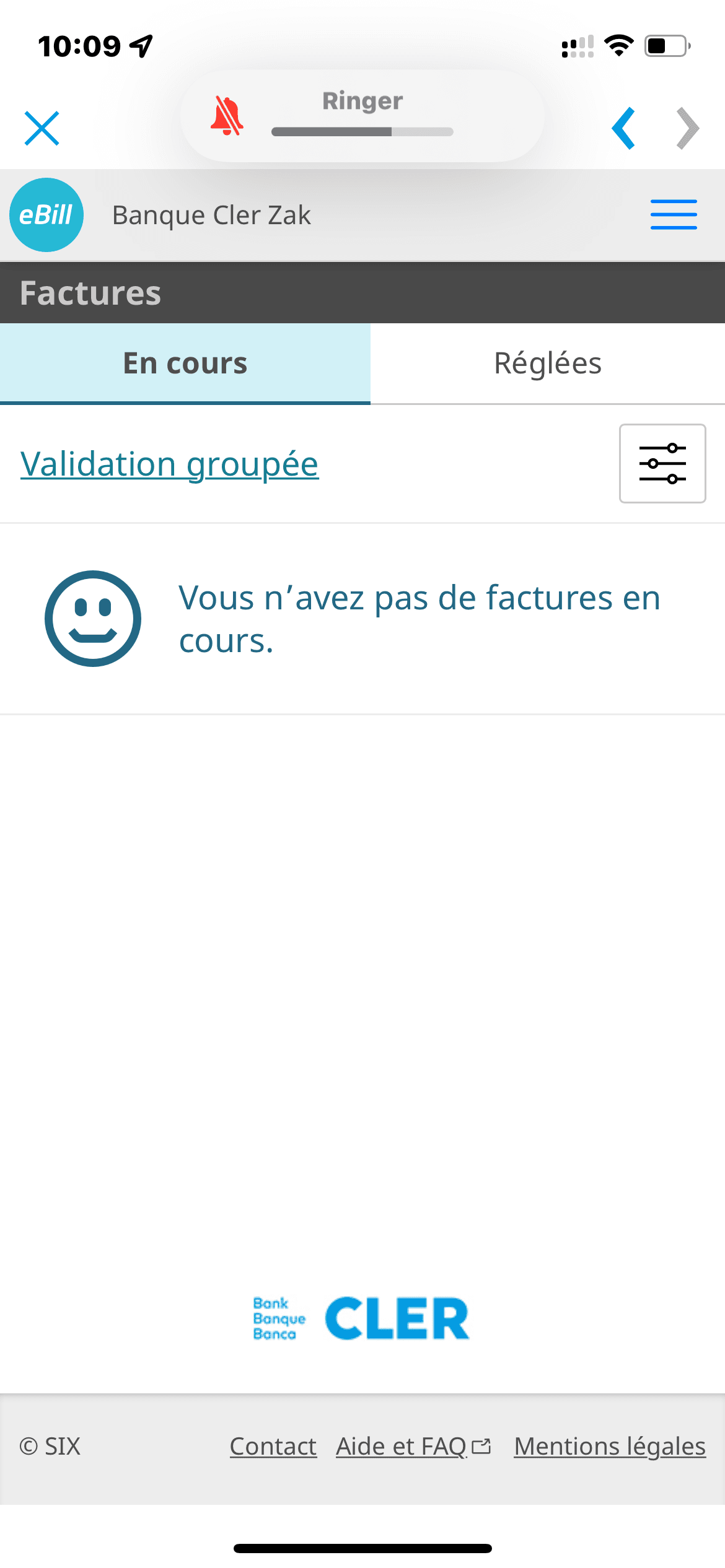

Activating eBill in your Zak app is done in just a few clicks:

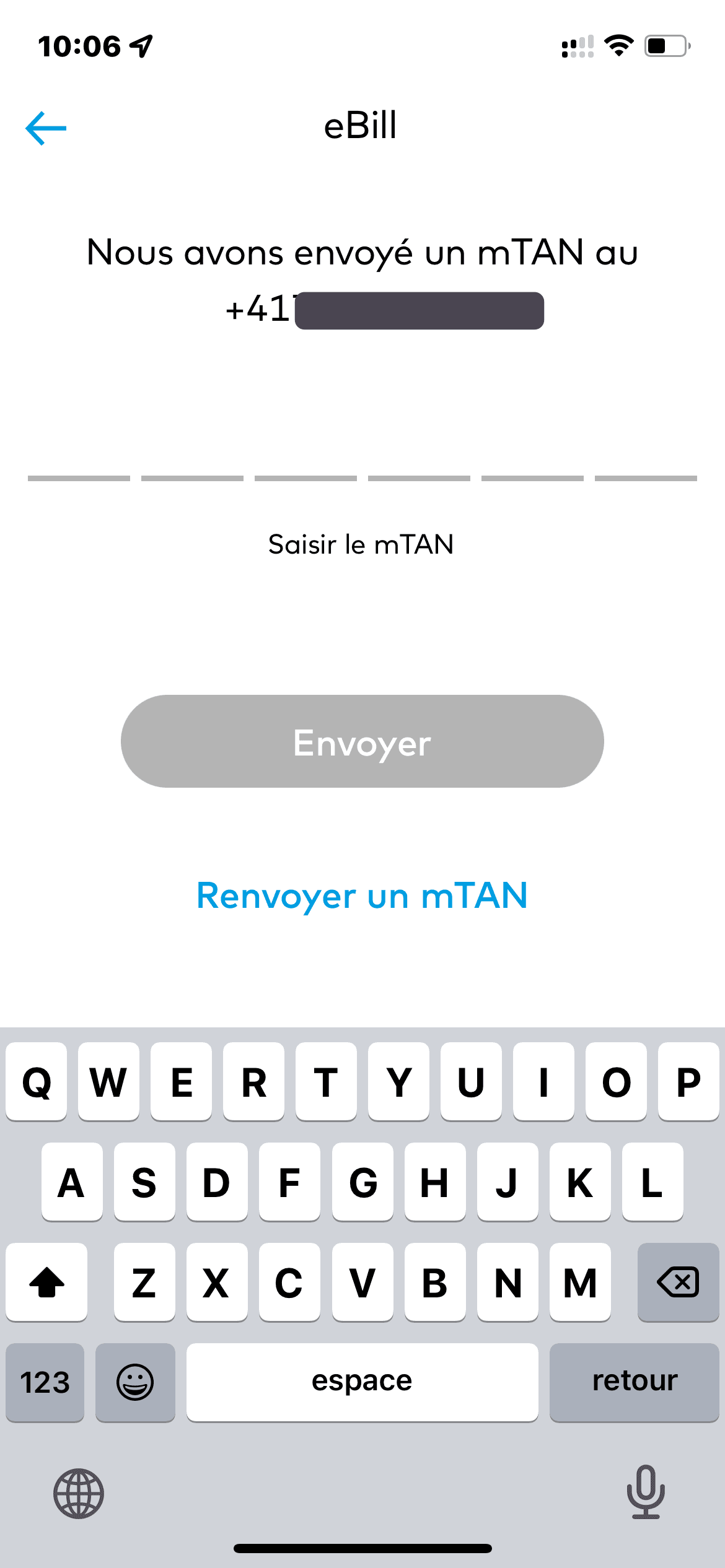

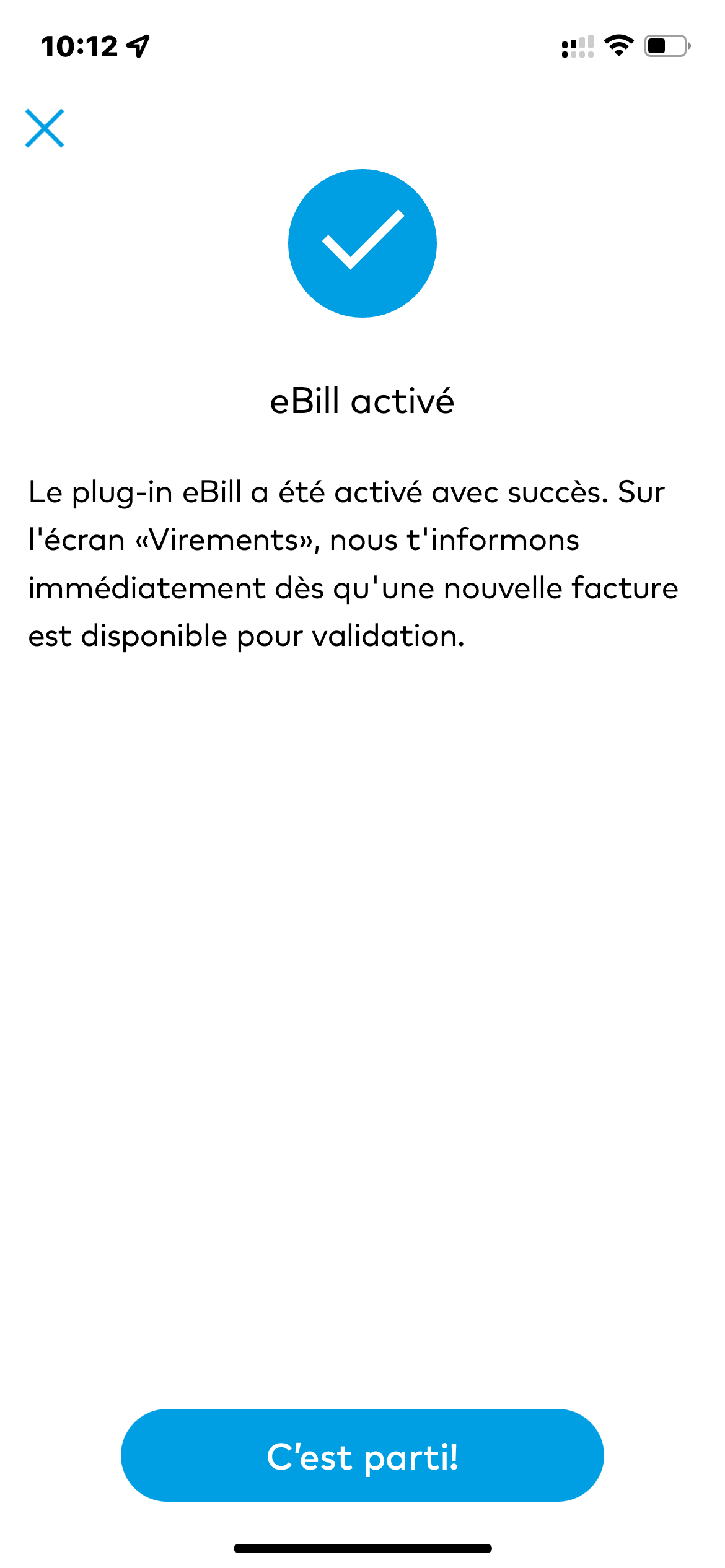

You then follow the eBill instructions and you will see the following message appear in the Zak app:

All you have to do is “transform” your paper invoices into eBill!

How much does eBill cost at Zak?

Banks and neobanks do not charge any additional fees for eBill. The system is therefore free at Zak.

Some rare providers may charge a fee for payment via eBill.

Why use eBill rather than a PDF invoice?

The PDF invoice is a document that you receive by email or that you must download from the supplier’s website. You must then complete a payment slip or scan the QR code to pay.

This operation is repeated every month for mobile operators and Internet providers, for example.

With eBill, everything is simpler: you only need to add invoice issuers once in the eBill portal and the following invoices appear directly in the neobank app.

Why use eBill rather than LSV direct debit?

With eBill you stay in control because you validate the amount to be paid and can refuse the invoice if the amount is incorrect. Payment is not automatically withdrawn as with direct debit, where your bank account is automatically debited.

eBill also allows you to automate more tasks by setting an amount that can be debited without validation on a given period.

eBill therefore gives you more control and more visibility than an LSV.

Why use eBill with Zak?

Zak has integrated eBill in a secure and intuitive way: just enter the SMS code to access your eBill account. You can then consult your invoices and pay them in one click, or automate them!

If you already use eBill with another bank, you can also use it with Zak: just enter the email address of your existing eBill account when registering eBill in Zak.

What is your opinion?

If you like the content of our article or if you already use this feature at Zak, do not hesitate to leave us a message in the comments.