If you’re comparing Yuh with Alpian, you’re likely looking for a multi-currency account, a neobank for trading or investments, or a neobank for traveling and handling transactions abroad.

Neobanks like Yuh and Alpian are compelling alternatives to traditional banks such as UBS or Raiffeisen, offering fully digital financial services through your smartphone, with better exchange rates and significantly lower transaction fees.

Yuh is a Swiss-based neobank that offers a free bank account with CH IBAN and allows you to have a main account in CHF, EUR, or USD, as well as sub-accounts in several currencies (13 in total). The debit card is free. The Yuh account also allows you to save and invest.

Alpian is also a Swiss-based neobank that combines private banking services with everyday banking. Alpian also offers a free account with CH IBAN, as well as personalized investment portfolios, financial advice, and banking services through a mobile app. The Alpian bank account allows you to have a multi-currency account in CHF, EUR, GBP, and USD. It comes with a Metal debit card and a virtual card for online purchases, with an optional Alpian Amex credit card.

Let’s take a closer look at what each neobank offers.

Yuh vs Alpian – Which neobank to choose

If you don’t have time to read this article, here is which neobank to choose according to your usage:

| Yuh | Alpian | |

|---|---|---|

| Overall rating | 8.6/10 | 8.3/10 |

| Free bank account with free debit card | 👍 | 👍 |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 | |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading and Investment | 👍 0.5% on shares and ETF, 1% on crypto | 👍 0,75% per year |

To find out how each criterion is judged, read on: we review important options for Switzerland (IBAN CH, transfers in CHF, TWINT) and for abroad (withdrawals with the card, SEPA transfer fees, transfers in foreign currencies).

Yuh vs Alpian – 1 point each

| Yuh | Alpian | |

|---|---|---|

| Free debit card | ✅ Mastercard | ✅ Visa |

| Quick account opening | ✅ 15 min. with the app | ✅ 15 min. with the app |

| Safe | ✅ Subsidiary of Swissquote and Postfinance | ✅ Swiss banking licence |

| IBAN (CH) | ✅ | ✅ |

| Virtual card | ✅ | ✅ |

| Free CHF transfers | ✅ | ✅ |

| ETF Trading | ✅ | ✅ |

| Apple Pay, Google Pay | ✅ | ✅ |

Yuh and Alpian are tied on these criteria, even if sometimes the experience can be different during the account opening, the 2 neobanks allow a quick and easy opening in 15 minutes.

Yuh vs Alpian – Promo Code

When you open an account with Yuh or Alpian, you receive a welcome gift in cash on your account, which is always nice.

The advantage goes to Alpian which offers a better welcome offer.

1 point for Alpian

Yuh vs Alpian – Free multi-currency account

Yuh and Alpian offer free multi-currency bank accounts with CH IBAN.

| Yuh | Alpian | |

|---|---|---|

| Free bank account | ✅ | ✅ |

| Main currencies | CHF, EUR or USD | CHF, EUR, GBP and USD |

| Available currencies | CHF, USD, EUR, GBP, JPY, AUD, CAD, SEK, HKD, NOK, DKK, AED, SGD | CHF, EUR, GBP, USD, AUD, DKK, NOK, PLN, SEK, CAD, CZK, HRK, HUF, RON, SGD |

1 point for Yuh

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Yuh vs Alpian – TWINT, eBill, QR payments

| Yuh | Alpian | |

|---|---|---|

| TWINT | ✅ Yuh TWINT | ❌ TWINT Prepaid |

| eBill | ✅ | ❌ |

| QR payments | ✅ | ✅ |

Unlike Yuh TWINT, Alpian does not offer a dedicated TWINT application but asks you to use the TWINT Prepaid application, which is less practical.

1 point for Yuh

Yuh vs Alpian: Debit card and withdrawals

At Yuh as at Alpian, the debit card is multi-currency, that is to say that you can use it indifferently for all the currencies available on your account, it will automatically debit the corresponding currency.

For example, if you have CHF and EUR in your account and you pay for a restaurant in France, the card will use the EUR available in your account.

There are, however, card-related fees that are different at Yuh and Alpian:

| Yuh | Alpian | |

|---|---|---|

| Free Debit card | ✅ | ✅ |

| Free CHF Cash Withdrawals | ✅ 1/week, then 1.90 CHF, up to 10,000 CHF/mo. | ❌ 2 CHF |

| Free Cash Withdrawals Abroad | ❌ 4.90 CHF each | ❌ 2.5% |

Yuh applies a fixed fee of 4.90 CHF and a foreign exchange fee of 0.95%, while Alpian only applies a 2.5% foreign withdrawal fee.

Note that Alpian applies Visa’s interbank rates, which are very close to those of Mastercard used by Yuh.

Example with single withdrawals:

| Single withdrawal | Yuh | Alpian |

|---|---|---|

| (4.90 CHF + 0.95%) | (2.5% each) | |

| 50 EUR | 5.38 CHF | 1.25 CHF |

| 100 EUR | 5.85 CHF | 2.50 CHF |

| 200 EUR | 6.80 CHF | 5.00 CHF |

| 300 EUR | 7.75 CHF | 7.50 CHF |

| 400 EUR | 8.70 CHF | 10.00 CHF |

| 500 EUR | 9.65 CHF | 12.50 CHF |

| 600 EUR | 10.60 CHF | 15.00 CHF |

| 700 EUR | 11.55 CHF | 17.50 CHF |

| 800 EUR | 12.50 CHF | 20.00 CHF |

| 900 EUR | 13.45 CHF | 22.50 CHF |

| 1000 EUR | 14.40 CHF | 25.00 CHF |

For single withdrawals, Yuh becomes cheaper than Alpian from 300 EUR but in practice withdrawals abroad are more often less than 300 EUR, so our preference goes to Alpian.

For withdrawals in Switzerland the Yuh card is therefore much more advantageous than the Alpian card.

For withdrawals abroad you must use the Alpian card up to 300 CHF/EUR per withdrawal, beyond that Yuh becomes more interesting.

1 point each

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Yuh vs Alpian: Transfer fees

Yuh and Alpian also allow you to make SEPA transfers in EUR without fees, there are however fees on currency exchanges:

| Pricing | Yuh | Alpian |

|---|---|---|

| Free incoming transfers | ✅ | ✅ |

| Free transfers in Switzerland | ✅ CHF and USD, EUR, GBP, JPY, AUD, CAD, SEK, HKD, NOK, DKK, AED, SGD | ✅ CHF and EUR |

| Free SEPA transfers in EUR | ✅ | ✅ |

| Exchange fee | ❌ 0.95% fee | ✅ 0.2% on weekdays and 0.5% on weekends |

| International tranfers fee | ❌ 4.00 CHF each | ❌ Free for USD and GBP. 2 CHF for AUD, DKK, NOK, PLN, SEK, CAD, CZK, HRK, HUF, RON, SGD. Or 7 CHF |

At Yuh, it is not possible to exchange currencies outside opening hours while it is possible at Alpian but with a surcharge: 0.50% fees on weekends.

For transfers in CHF in Switzerland or in EUR in the EURO zone, Alpian and Yuh are free, however for international transfers you need to look in more detail.

Here are the fees for international transfers for comparison:

| International transfer | Yuh | Alpian (Same as local currency) | Alpian (Different than local currency) |

|---|---|---|---|

| CHF | 0.00% | Free | 7 CHF |

| EUR | 0.00% | Free | 7 CHF |

| USD | 4 CHF | Free | 7 CHF |

| GBP | 4 CHF | Free | 7 CHF |

| AED | 4 CHF | 7 CHF | 7 CHF |

| AUD | 4 CHF | 2 CHF | 7 CHF |

| CAD | 4 CHF | 2 CHF | 7 CHF |

| CZK | 4 CHF | 2 CHF | 7 CHF |

| DKK | 4 CHF | 2 CHF | 7 CHF |

| HKD | 4 CHF | 7 CHF | 7 CHF |

| HUF | 4 CHF | 2 CHF | 7 CHF |

| JPY | 4 CHF | 7 CHF | 7 CHF |

| NOK | 4 CHF | 2 CHF | 7 CHF |

| PLN | 4 CHF | 2 CHF | 7 CHF |

| RON | 4 CHF | 2 CHF | 7 CHF |

| SEK | 4 CHF | 2 CHF | 7 CHF |

| SGD | 4 CHF | 2 CHF | 7 CHF |

To know who is cheaper between Yuh and Alpian, you need to compare all the fees:

Example 1: Transfer of 5,000 EUR in Switzerland, from your CHF account

Alpian and Yuh do not charge fees for transfers in EUR (SEPA) in the EURO zone and Switzerland.

| Transfer fees | Yuh | Alpian |

|---|---|---|

| Total to transfer in EUR | 5,000 EUR | 5,000 EUR |

| Total in CHF before fees | 4,773.25 CHF | 4,773.25 CHF |

| Exchange fee | 43.35 CHF (0.95%) | 9.55 CHF (0.2%) |

| Transfer fee | 0.00 CHF | 0.00 CHF |

| TOTAL | 43.35 CHF | 9.55 CHF |

Example 2: Transfer of 10,000 USD to Switzerland, from your CHF account

| Transfer fees | Yuh | Alpian |

|---|---|---|

| Total to transfer in USD | 10,000 USD | 10,000 USD |

| Total in CHF | 8,666 CHF | 8,666 CHF |

| Exchange fee | 82.33 CHF | 17.33 CHF |

| Transfer fee | 0.00 CHF | 7.00 CHF |

| TOTAL | 82.33 CHF | 24.33 CHF |

Example 3: Transfer of 5,000 USD to the United States, from your CHF account

| Transfer fees | Yuh | Alpian |

|---|---|---|

| Total to transfer in USD | 5,000 USD | 5,000 USD |

| Total in CHF | 4,333 CHF | 4,333 CHF |

| Exchange | 41.16 CHF | 8.67 CHF |

| Transfer fee | 4.00 CHF | 0.00 CHF |

| TOTAL | 45.16 CHF | 33.06 CHF |

(*) Tests carried out during the week

Alpian is therefore less expensive than Yuh for foreign currency exchange and transfers. On the other hand, if you already have a stock of foreign currencies and you simply want to make a transfer to Switzerland, Yuh will be less expensive because there are no fees on transfers to Switzerland, for the 13 currencies offered.

If the question of exchanging CHF to EUR is important to you, check out our article How to Exchange Swiss Francs to Euros at the Best Rate.

1 point for Alpian

Yuh vs Alpian: Investing

When it comes to investing, Yuh and Alpian have two different approaches for different types of investors.

Yuh allows you to invest in various assets, including over 300 stocks, 58 ETFs, and 32 cryptocurrencies. Their offering is more similar to Neon Invest and Swissquote. One of the main advantages of Yuh is its fractional trading, so you can buy small pieces of high-priced stocks (for example: Booking.com BOOK) with smaller amounts of capital. Yuh charges 0.5% per trade on stocks and ETFs, so it’s perfect for casual investors who want flexibility without being locked into annual management fees. Yuh also has a user-friendly interface for self-directed investors, so you can control everything in your portfolio. Also read here our review of Yuh Investing features.

Alpian on the other hand, takes a more personalized approach and offers a private banking strategy with 3 types of mandates: Essentials, Guided by Alpian and Managed by Alpian. With Alpian, you get access to a professionally managed portfolio built mainly around ETFs, which gives you broad exposure to the markets with less risk. They charge a 0.75% annual fee for their investment services, which covers everything.

Thanks to its Essentials offering, Alpian now allows you to start investing with a minimum of 2,000 CHF instead of the previous 10,000 CHF. If you are looking for a more personalized investment experience, the Guided by Alpian service is designed for this, offering access to a selection of 45 ETFs integrated into a professionally managed portfolio to provide diversified exposure. For more details, check out our full review of Alpian’s investing features.

Here is a quick comparison of the key features of Yuh and Alpian when it comes to investing:

| Investing | Yuh | Alpian |

|---|---|---|

| Minimum Investment | 25 CHF | 2,000 CHF |

| Account Management | Free | 0.75% annually |

| Trading Fees | 0.5% per trade (stocks, ETFs), 1% for crypto | ✅ Included |

| Custody fee | ✅ Free | ✅ Included |

| Currency Exchange Fee | 0.95% on foreign currency trades | 0.2% |

| Stocks | 305 stocks | Not available |

| ETFs | 58 ETFs | 45 ETFs |

| Cryptocurrencies | 38 cryptocurrencies | Available via ETFs (Bitcoin, Solana) |

| Target Investor | Beginners, casual investors | Investors seeking personalized investment services |

Trading and Investing Fees

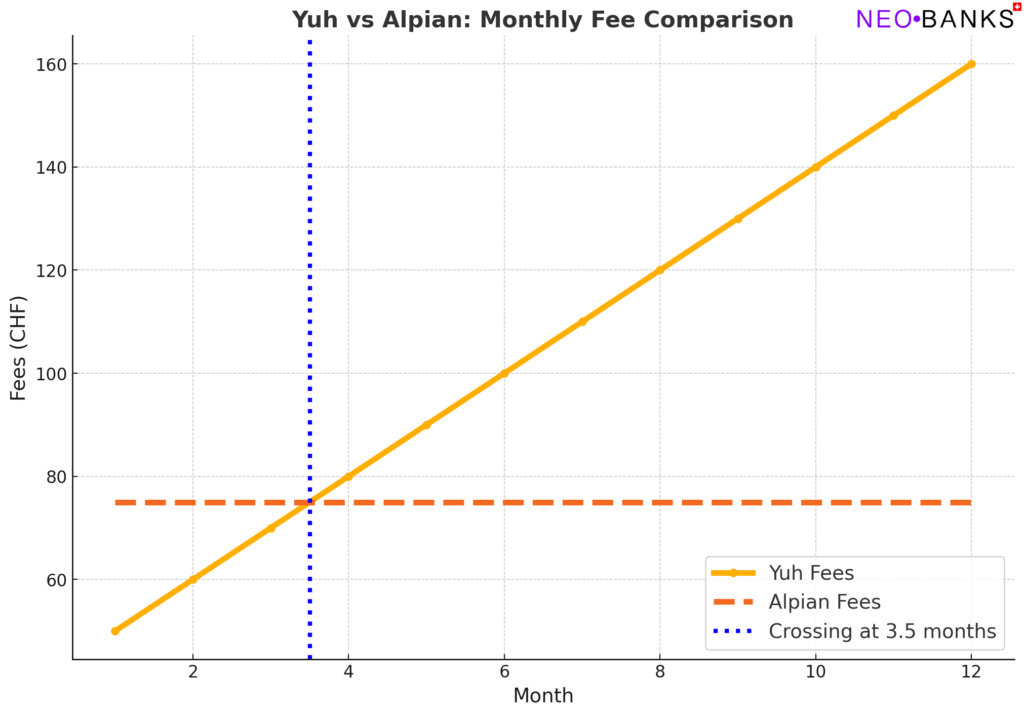

At first glance, Yuh appears to be cheaper than Alpian, thanks to its low 0.5% transaction fees for stocks and ETFs. However, let’s consider a scenario where you invest CHF 10,000 for 12 months.

In the first month, Yuh’s fees would amount to CHF 50 (0.5% of CHF 10,000), while Alpian’s overall fee remains CHF 75 due to its 0.75% annual management fee.

Now, let’s assume that each month, you rotate 10% of your CHF 10,000 portfolio, meaning you buy and sell 10% of your investments within the same month. In such a situation, your costs will increase each month with Yuh because you’re paying transaction fees on every trade, while Alpian’s fee remains stable.

Yuh vs Alpian Investing fees comparison over 12 months

As shown in the chart, Alpian becomes the more cost-effective option by the 3rd month, as Yuh’s cumulative transaction fees continue to rise. This highlights that while Yuh might be cheaper for occasional trades or smaller portfolios, Alpian offers better value for investors who rotate their portfolio regularly.

Also, consider that Yuh charges a 0.95% currency exchange fee, while Alpian only charges 0.20%. This could significantly increase Yuh’s costs if you’re purchasing international ETFs, adding another layer of expense compared to Alpian.

Should you invest with Yuh or Alpian?

We believe that Yuh and Alpian serve different investment needs and are complementary. Yuh is great for those who want to have direct control over their investments, low cost trading and fractional shares for more flexibility. Alpian is for those who want a hands off approach with a guided strategy and expert advice through their wealth management services. Whether you’re a self directed investor looking for low fees or someone who values professional guidance, both Yuh and Alpian have their advantages.

1 point each

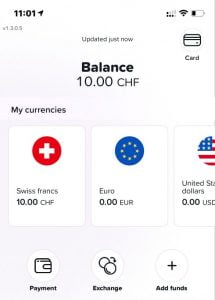

Yuh vs Alpian – Which app is more ergonomic?

Discussing ergonomics can be very subjective, but it comes down to which app is more intuitive and easier to use, for example:

- How many clicks to access an important function?

- How many clicks to make a transaction?

- Does the app crash often?

- Is the app fast?

Without doing a complete ergonomic analysis (this is not the subject of this article), we think that the Yuh app is generally better than the Alpian app:

At Yuh:

- the application is fluid and fast

- The white background and icons make reading transactions more pleasant

- all functions are accessible directly

At Alpian:

- the application is very sober, in a private banking spirit

- the transaction icons do not allow to quickly identify a company

- all functions are directly accessible

The 2 applications have very good ergonomics and it is difficult to separate them on this point.

1 point each

Yuh vs Alpian – Customer reviews and ratings

Yuh is rated 4.6 on the App Store (7.4k reviews) and Alpian is rated 4.3 on the App Store (112 reviews). The customer reviews are therefore comparable in terms of rating and suggest that customers are generally satisfied with the 2 neobanks.

Yuh vs Alpian – Banking Licenses

Yuh is a subsidiary of Swissquote and uses the banking license of Swissquote Bank SA.

Alpian has its own Swiss banking license.

In both cases your deposits are protected up to 100,000 CHF.

1 point each

Yuh vs Alpian – Which neobank is the best

If we consider all of these criteria:

- Yuh Bank gets 7 points

- Alpian Bank gets 7 points

The choice between Yuh and Alpian must be made according to your usage and your objectives:

- if you use eBill or TWINT, choose Yuh

- if you make withdrawals once a week in Switzerland, choose Yuh

- if you make transfers abroad, choose Alpian

- if you make withdrawals abroad, choose Alpian

- if you want the services of a private bank, choose Alpian

Otherwise, do not hesitate to test both because these neobanks are free and are possibly complementary: