| Features | 8 |

|---|---|

| Usability | 8 |

| Fees | 7 |

| Safety | 10 |

Receive 50 CHF Trading Credit + 250 SWQ (approx. 4 CHF) using the promo code YUHNEO when you open your Yuh bank account before March 31, 2026.

In this article, we review the Yuh Invest, the investment platform offered through the Yuh App.

Yuh Invest Overall Rating: 8.3/10

Description

In March 2026, Yuh Bank confirms its position as a leading neobank in Switzerland. Initially launched as a partnership between Swissquote and PostFinance, Yuh is now 100% owned by Swissquote. It has over 340,000 users and offers a simple, accessible platform to invest in more than 305 stocks, 58 ETFs, and 38 cryptocurrencies. while also allowing fractional share purchases — ideal for small investors.

In this review of Investing with Yuh, we dive into the investment platform’s advantages, key features, and fees to help you determine if it aligns with your investment goals.

Quick Facts about Investing with Yuh – March 2026

| Yuh Invest Key Data | Details |

|---|---|

| Investment Options | Stocks, ETFs, Cryptocurrencies, Trend Themes, Investment Portfolios |

| Minimum Investment | 25 CHF |

| Account Management | Free |

| Trading Fees | 0.5% for stocks, ETFs, and crypto |

| Currency Exchange Fee | 0.95% on foreign currencies |

| Shares | 305 shares (e.g., Tesla, Nestlé, Microsoft) |

| ETFs | 50 ETFs (e.g., iShares MSCI World, SPDR S&P 500) |

| Cryptocurrencies | 38 cryptocurrencies (e.g., Bitcoin, Ethereum, Cardano) |

| Themes | 30 Themes (e.g., eMobility, renewable energies) |

| Yuh Investment Portfolios | 2 portfolios (conservative and growth) |

| Investor Protection | Up to CHF 100,000 (Swissquote guarantee) |

In this review

Review of Yuh’s Investment Offering – Invest Simply and Efficiently

Yuh Bank was launched in 2021 and is a Swiss neobank born from a partnership between Swissquote and PostFinance. Now fully owned by Swissquote, it has over 200,000 users and offers a streamlined platform for managing everyday banking operations and making investments.

Yuh allows you to invest in more than 305 stocks, 58 ETFs, 30 themes, and 38 cryptocurrencies. It also makes it possible to buy fractions of shares, making investments easier for beginners or investors looking to diversify their portfolio with small amounts.

We took the time to explore Yuh’s offering and here is our complete review. This guide provides an overview of the benefits, key features, and fees to help you decide if this platform meets your investment goals.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Review of the Yuh Investment App Features – 8/10

Yuh’s trading platform is beginner-friendly, offering a diversified range of stocks, ETFs, cryptocurrencies, and other financial products. One of Yuh’s strong points is its low transaction costs, set at 0.5% with a minimum of 1 CHF per transaction. It is particularly competitive for small amounts, but for larger investments, other platforms such as Swissquote may prove more advantageous.

Access to global stocks and ETFs

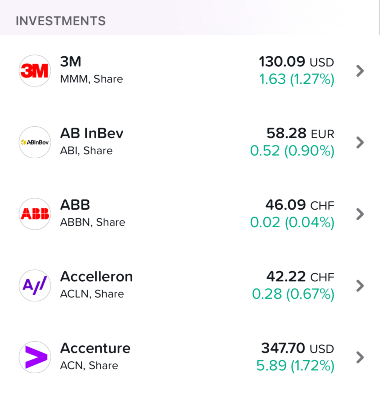

Yuh gives you access to a wide range of more than 305 stocks, 58 ETFs, 30 themes and 38 cryptocurrencies, covering various sectors and geographies. This allows investors to diversify their portfolio by investing in Swiss and international securities. ETFs are particularly interesting for long-term investors who prefer a passive approach thanks to their diversification, including global indices such as the MSCI World.

Yuh Shares and ETF List

The ETFs available are particularly suitable for long-term investors interested in passive investments, thanks to their varied composition including global indices such as the MSCI World or specific sectors such as technology or finance.

Check this page to see the full list of Yuh ETFs.

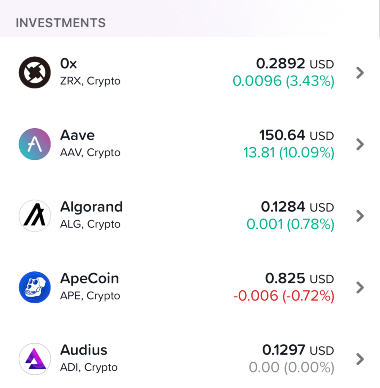

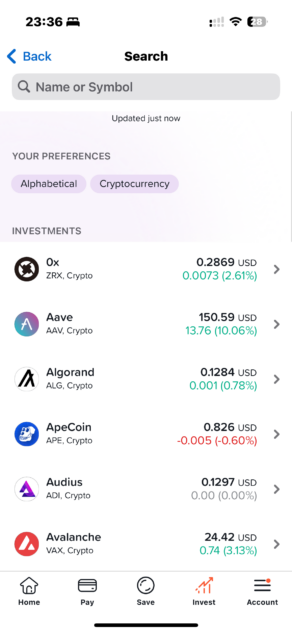

Purchase of Cryptocurrencies

Yuh allows you to invest in 38 cryptocurrencies, giving you direct exposure to this market. Cryptocurrency transactions are available 24/7, offering great flexibility. Although Yuh’s crypto portfolio is smaller than that of specialized platforms, it includes popular digital currencies like Bitcoin and Ethereum. This makes it easier to diversify your digital asset portfolio.

Yuh Cryptocurrencies

While Yuh’s crypto offering is not as broad as other specialized platforms, it does include major digital currencies such as Bitcoin and Ethereum, as well as popular altcoins. This allows you to build a digital portfolio while managing your traditional investments within the same interface.

Thanks to Yuh’s simplicity, you can get started with cryptocurrency trading without the need for a dedicated platform. This ease of access, combined with the constant availability of the market, makes Yuh a good option for diversifying into the crypto market, while maintaining full control over your other assets. Whether you’re a novice or an experienced trader, investing in these digital assets becomes child’s play.

Check this page to see the full list of Yuh Cryptos.

Automated Savings Plans at Yuh

Yuh’s Automated Savings Plans are an ideal solution for investors who want to invest regularly without having to worry about technical details.

Yuh’s automated savings plans allow you to set up regular investments without having to manage each transaction manually. All you have to do is set an amount to invest at a given frequency (weekly or monthly), and Yuh will take care of the rest.

For example, you can allocate 100 CHF per month to a mix of stocks and ETFs, which allows you to invest without actively following the market. This process is particularly effective for those following a dollar-cost averaging strategy, thereby reducing the impact of short-term price fluctuations by buying at different times.

Once set up, everything works automatically. This is ideal for those with a busy schedule or looking to streamline their strategy.

Benefits of automated savings plans:

- Recurring investment: You don’t have to actively follow the market.

- No transaction fees for purchases within the savings plan on the 6 free ETFs

- Accessibility: Ideal for small investors wishing to contribute regularly and gradually.

The Yuh automated savings plan is therefore an interesting option if you are looking to optimize your long-term investment strategy without daily management and with reduced costs, especially with ETFs without transaction fees.

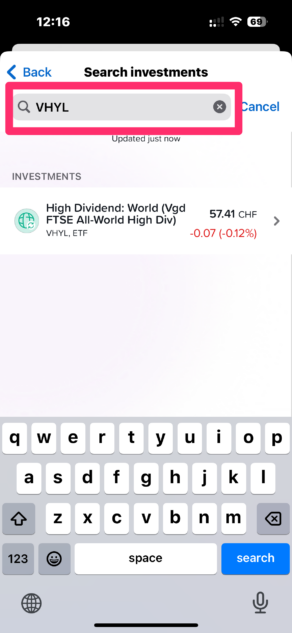

ETFs with no Trading fees

Yuh also offers a selection of 6 ETFs from Vanguard, iShares and Invesco that can be included in a no trading fees savings plan. This includes popular ETFs like the Vanguard FTSE All-World UCITS ETF and the iShares SMI (CH). You only pay the ETF management fee (TER) and the trading fee at the time of sale, with no additional costs at the time of purchase.

Here is the current list of the 6 free ETFs at Yuh:

| Symbol | ETF | ISIN | TER |

|---|---|---|---|

| VWRL | Vanguard FTSE All-World UCITS ETF Distributing | IE00B3RBWM25 | 0.22% |

| VHYL | Vanguard FTSE All-World High Dividend Yield UCITS ETF Distributing | IE00B8GKDB10 | 0.29% |

| IWDC | iShares MSCI World CHF Hedged UCITS ETF (Acc) | IE00B8BVCK12 | 0.55% |

| CSSMI | iShares SMI (CH) | CH0008899764 | 0.35% |

| EQCH | Invesco Nasdaq-100 UCITS ETF CHF Hedged | IE00BYVTMT69 | 0.35% |

| BCHE | Invesco CoinShares Global Blockchain UCITS ETF Acc | IE00BGBN6P67 | 0.65% |

Please note that Eligible ETFs are free only as part of a recurring investment via the automatic savings plan. If you buy them one-off, the usual transaction fees will apply.

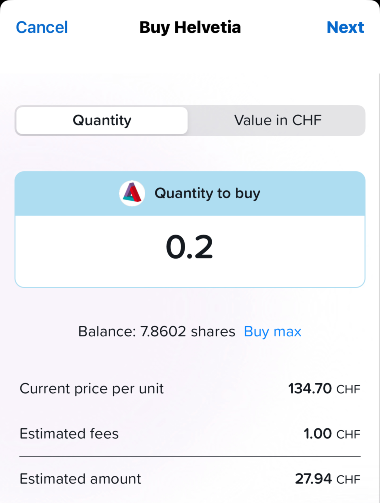

Fractional Trading

Yuh’s fractional trading allows investors to buy a fraction of a stock, rather than being forced to buy a full share. This feature is particularly attractive for expensive stocks like Booking or Tesla, which may be out of reach for many small investors.

For example, instead of having to pay several thousand francs for a full Booking.com share, you can start investing with just 25 CHF. Here is an example with Helvetia:

Yuh Fractional Trading

Yuh’s fractional trading lets you adjust purchases based on your budget, offering flexible investment options. It is an excellent option to diversify your portfolio without needing to have large amounts of capital up front.

An important point to note is that fractional shares, just like whole shares, are held in trust by Swissquote on your behalf. This means that you do not own the financial instruments directly, but they are held in the name of Swissquote, while guaranteeing your right of ownership.

Fractional trading is an ideal option for those who want to invest gradually and diversify their portfolio, while minimizing barriers to entry. It is a great tool for beginner investors or those looking to maximize their investment budget.

Market Orders Only

Yuh currently only supports market orders, which means that purchases or sales are executed at market price during the opening hours of the various exchanges:

- Swiss Markets: Trading days from 9:10 to 17:20 CET

- European Markets: Trading days from 9:10 to 17:20 CET

- UK Markets: Trading days from 9:10 to 17:20 CET

- US Markets: Trading days from 15:40 to 21:50 CET

- Topics: Trading days from 9:25 to 17:05 CET

If your order is placed outside of opening hours (at night, weekends and holidays) it will be executed the next business day.

While limit orders would offer more flexibility by allowing users to set a specific buy or sell price, Yuh’s market order system simplifies the process for those focused on long-term investing. The platform does not require users to constantly monitor the market, making it accessible even to beginners.

Stock Transfers and Portfolio Management

Unlike more traditional investment platforms, Yuh does not allow you to transfer your shares or ETFs to another provider. Once you have purchased securities on Yuh, they remain on the platform, limiting flexibility if you wish to switch to another service without selling your positions.

Since users are not registered in the share register, they cannot attend general meetings of the companies in which they hold shares, an aspect that may be important for some investors looking to be more actively involved in the management and governance of their investments.

Our Opinion on the Features of Yuh Invest

Yuh’s features are quite basic in comparison to more comprehensive platforms such as Swissquote, Interactive Brokers or Saxo Bank , which offer thousands of global stocks, bonds, options and derivatives. However, Yuh makes up for this lack with simple and accessible options, very comparable to those of Neon Invest, with a distinct advantage: fractional trading. This allows users to invest in fractions of shares starting from 25 CHF, an ideal option for small investors.

Yuh Investment gets a score of 8/10 for featuresReview & User Experience of the Yuh Investment App – 8/10

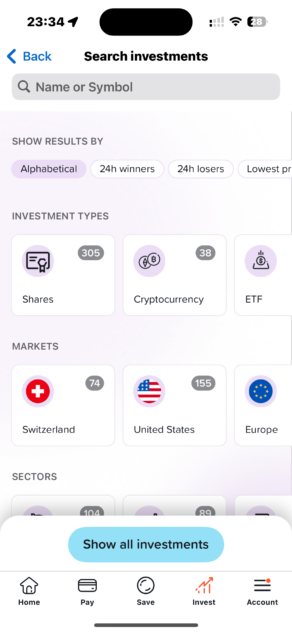

Direct investment with Yuh

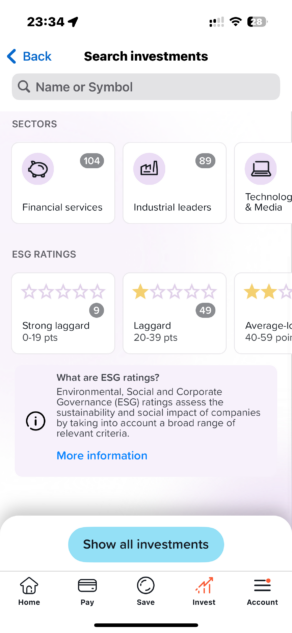

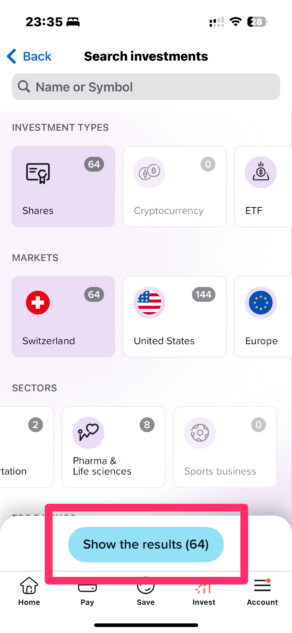

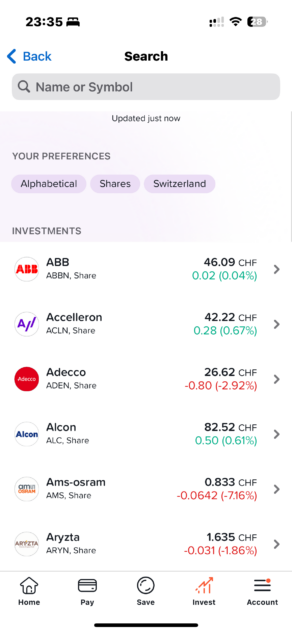

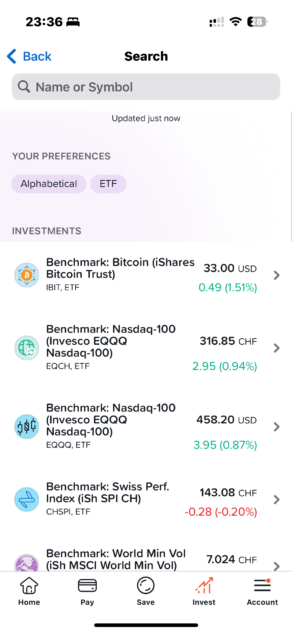

By clicking on “Invest” in the menu, you arrive on the Yuh Investment home screen and can see several series of filters:

- Investment types: Stocks, Cryptocurrencies, ETFs, Bonds (ETFs), Themes

- Markets: Switzerland, United States, Europe, United Kingdom, World

- Sectors: Financial services, Industrial leaders, Technology & Media, Consumer Goods, Energy, Transport, Pharma, Sports

- ESG Ratings: which assess a company’s performance in environmental, social and governance matters.

These are filters, not buttons, so you can select several to refine your search and choose a sorting option:

- Alphabetical (default)

- 24-hour winners

- 24-hour losers

- Highest price

- Lowest price

- Most recent

If you are looking for a specific value, you can also enter its Name or symbol in the search bar at the top of the screen.

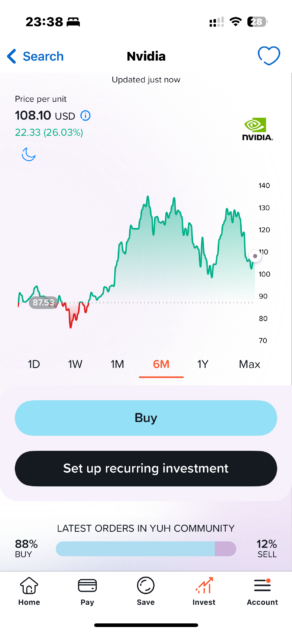

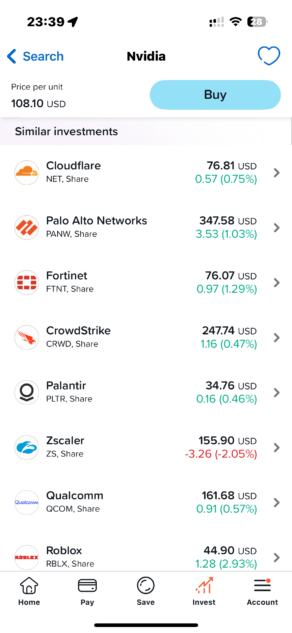

By clicking on a stock, NVIDIA stock for example, you can see the share price in CHF. By scrolling down the page, you access a selection of similar stocks, a practical tool for refining and developing your investment strategy.

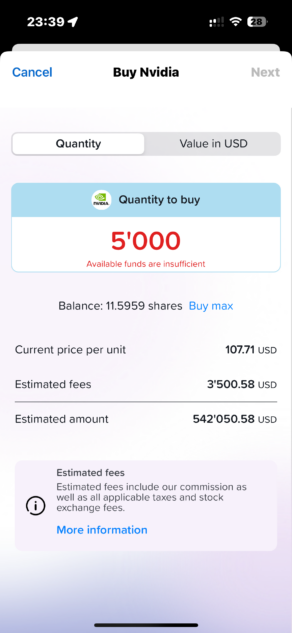

When the security is not in your portfolio, you have 2 options: Buy or Create a recurring investment. By clicking on Buyr your order is then placed immediately at the market price, during opening hours.

If you place an order outside of opening hours, it will be recorded and placed as soon as the markets open

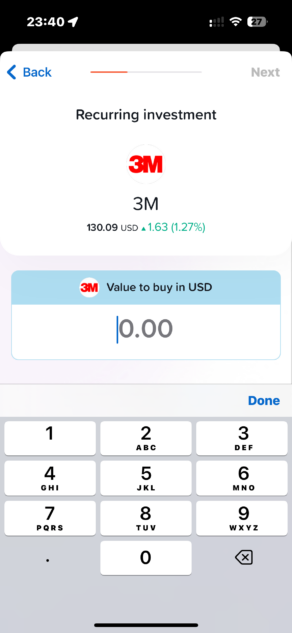

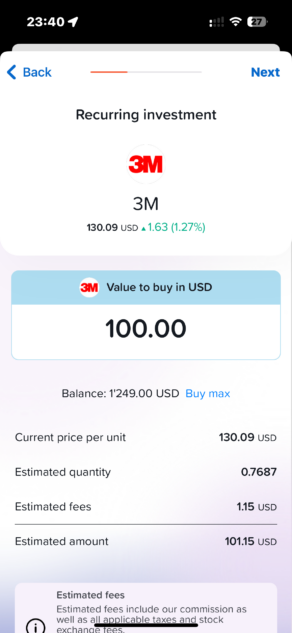

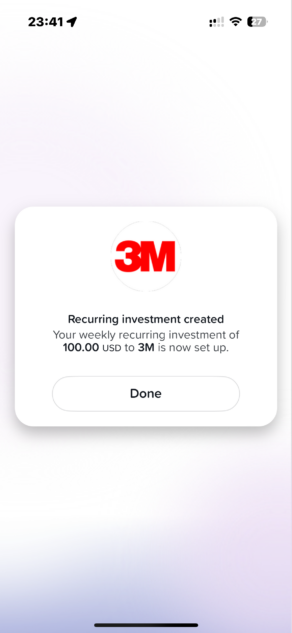

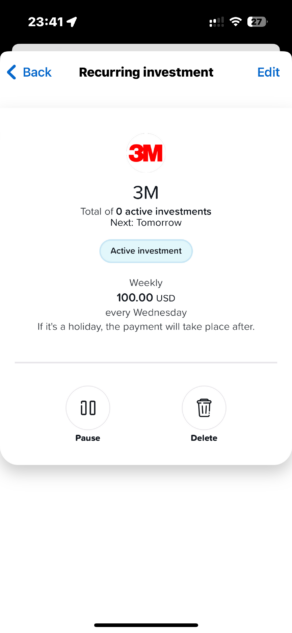

Recurring Savings and Investment Plan with Yuh

The option to create a recurring investment is displayed each time you click on a security, you can also access it from the Investments entry page.

The process of creating a recurring investment is guided in several steps:

- Enter the amount you wish to invest

- Select the frequency at which you wish to invest this amount: every week or every month

- Confirm the recurring investment

- After confirmation, you have the option to pause or delete this recurring investment

Our Opinion on the Usability and Ease of Use of Yuh

The usability of Yuh is clearly a major asset. The application is designed to offer a simple and intuitive user experience, even for novice investors. Navigation is fluid, and features, such as fractional trading or automated savings plans, are easy to set up thanks to well-structured instructions.

The clean interface and clear information make it easy to track your investments and make decisions without excessive complexity.

Some points to improve:

- When you create a recurring investment from the main menu, you do not have access to the filters but to the complete list of securities with a simple search bar.

- To add the 6 free ETFs to your automatic savings plan, there is also no direct menu, you must search for each value in the list or in the search bar. The quickest is to use symbols.

Investment & Trading Fees with Yuh – 7/10

The Yuh pricing structure is designed to meet the needs of frequent traders and long-term investors.

Yuh Trading Fees

Fees at Yuh are transparent and low:

- Swiss Stocks and ETFs: 0.5% of the transaction amount.

- International Stocks: 0.5% of the transaction amount.

- Currency Conversion Fee: 0.95% is applied to transactions made in foreign currencies (such as USD or EUR). This includes international stocks and cryptocurrencies.

- Custody fees: None, unlike other platforms that often charge annual fees for securities management.

In addition, the tax on stock transactions applies:

- 0.075% on swiss securities,

- 0.15% on international securities.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Minimum and maximum transaction fees

At Yuh, each transaction is subject to a fixed fee of 0.5% of the total amount, with a minimum of 1 CHF per transaction, which is advantageous for small investors who want to get started without facing high initial costs.

Examples of fees:

- A transaction of 200 CHF will incur a fee of 1 CHF, allowing smaller investors to manage their investments at a lower cost.

- For a transaction of 1000 CHF, the fee will be 5 CHF, which is still very competitive for medium amounts.

However, unlike other platforms that sometimes impose a cap on fees, Yuh does not have a maximum on transaction fees. This can be advantageous for small transactions, but in the case of a transaction of 5000 CHF, for example, the fee will reach 25 CHF, which can increase costs for larger volumes.

Stamp Duty

As with most Swiss brokers, you will also need to factor in stamp duty, which is levied on all transactions. This tax is 0.075% on Swiss stocks and 0.15% on international stocks. While this fee is relatively small, it should still be factored into your overall transaction costs.

Trading Fees Comparison: Yuh vs. Neon Invest vs. Alpian

When it comes to investing, fees play a significant role in determining the overall profitability of your portfolio. Here’s how Yuh, Neon Invest and Alpian compare in terms of fees:

Yuh vs Neon Invest

- Swiss stocks and ETFs: 0.5% of the transaction amount.

- International stocks: 1% of the transaction amount.

- Conversion fees: None for international transactions, all amounts are processed in Swiss francs.

- Custody fees: None, unlike other platforms that often charge annual fees for securities management.

The trading fees at Yuh and Neon are very competitive for small investors, with a rate of 0.5% per transaction and a minimum fee of 1 CHF for Yuh. Neon, on the other hand, applies a similar rate for Swiss stocks, but charges 1% for international stocks. Yuh also charges a 0.95% conversion fee for foreign currency transactions, which can increase costs for those investing outside the Swiss market.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before March 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Yuh vs Alpian

- Management Fee: 0.75% of managed portfolios, which covers personalized investment services and portfolio adjustments.

- Foreign Exchange Fee: Minimal but present, as Alpian supports multi-currency accounts, making it a better option for clients with international banking needs.

- Transaction Fee: Included in Management Fee

- Custody Fee: Included in Management Fee

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Yuh stands out for its low transaction fees (0.5% per transaction) and the absence of management fees, making it an attractive solution for cost-conscious, do-it-yourself investors. Conversely, Alpian charges 0.75% management fees for full asset management, thus appealing to investors who prefer a more passive and personalized approach. Thus, Yuh is more advantageous for active traders, while Alpian is more suitable for those looking for full asset management.

Yuh Investment gets a score of 7/10 for trading feesSecurity of Investments with the Yuh App – 10/10

At Yuh, your assets are protected by Swissquote, a trusted Swiss banking institution that acts as custodian. This means that your investments are segregated from the bank’s assets and remain protected, even in the event of Yuh or Swissquote’s bankruptcy. Your investments therefore remain your property.

The security of youraccount is also a priority with measures such as two-factor authentication, ensuring you have secure access to the app and your investments. You can track your assets in real-time via the app, giving you complete transparency into how you manage your portfolio. However, it is not yet possible to transfer your shares to another broker, which may limit some options if you want to move your investments elsewhere.

Yuh Investment gets a 10/10 rating for securityInvesting with Yuh vs. Traditional Brokers

When you compare Yuh to traditional online brokers, some stark differences quickly become apparent. Yuh offers a competitive fee structure, with a 0.5% transaction fee and no conversion fee for CHF securities, making it attractive to retail investors and those looking for simple investing, including ETFs and cryptocurrencies.

However, like Neon Invest, Yuh remains limited in terms of product selection, with around 300 stocks and 50 ETFs, a far cry from brokers like Swissquote or Interactive Brokers, which offer access to thousands of international stocks, bonds, and derivatives. In addition, Yuh does not allow complex orders such as limit orders, which could restrict more sophisticated investment strategies.

Despite this, Yuh stands out for its simple interface and features like fractional trading and automated savings plans, making it a great option for beginners or passive investors. For more active traders, a traditional broker with a wider range of securities and advanced tools might be preferable.

Investing with Yuh vs. Neon Invest

The comparison between Neon Invest and Yuh is common among Swiss investors, as both platforms aim to offer accessible solutions at low costs. However, there are some key differences that can steer users towards one or the other depending on their specific needs.

Trading Fees: Neon Invest wins

One of the distinct advantages of Neon Invest is the absence of currency conversion fees for stock and ETF transactions, making it a particularly attractive solution for investors looking to maximize their returns. On the other hand, Yuh charges a 0.95% conversion fee for foreign currency transactions, which can increase costs for those diversifying their portfolios across international markets.

Asset portfolio: Yuh wins

Yuh stands out for its broader offering: over 300 stocks, 50+ ETFs, and 30+ cryptocurrencies. Neon Invest, on the other hand, offers around 240 stocks and 70 ETFs, but does not provide access to cryptocurrencies directly, only via crypto ETFs. If you are looking to invest in a more diversified portfolio that includes crypto, Yuh might be a better fit for you.

Features: Yuh wins

Fractional trading is another advantage of Yuh. You can invest from 25 CHF in fractional shares, which gives you access to expensive securities without having to buy a whole share. Neon Invest does not offer this feature, limiting itself to the purchase of full shares.

In summary, Neon Invest is ideal for investors seeking simplified management without hidden fees, while Yuh is better suited to those who want a broader and more flexible offering.

We will do a more detailed comparison of Neon vs Yuh in a future article.

Should you Invest with Yuh?

Yuh Invest is an ideal solution if you are a beginner investor or looking for a simple and accessible approach to investing. With its low fees, intuitive interface, and the ability to invest in fractional shares, Yuh allows you to get started in investing without needing a significant budget.

One of Yuh’s main strengths is its diverse offering, which includes stocks, ETFs, and cryptocurrencies, providing easy opportunities for diversification. The ability to buy fractional shares is a major advantage that further democratizes access to financial markets, even for modest budgets.

The design of the Yuh app is user-friendly, featuring smooth navigation and simplified functionalities, making the investment process more accessible, even if you have no prior experience. You can easily track your investments, receive notifications about market movements, and make informed decisions based on clear information.

However, if you are a more experienced investor or an active trader looking for advanced trading tools, the platform may seem limited. Yuh does not offer features such as advanced technical charts or complex trading tools. In this case, platforms like Swissquote or Interactive Brokers would likely be more suitable, as they provide in-depth analysis and trading options.

In summary, Yuh Invest is an excellent entry point into the world of investing if you prefer a straightforward, low-cost, and hassle-free approach. For simple, diversified investment management suited to smaller budgets, Yuh is a relevant choice. If you are looking for more advanced services, such as wealth management, Alpian might better meet your needs. For a similar option to Yuh, you can also consider Neon Invest.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Frequently Asked Questions (FAQ) about Investing with Yuh

✅ Does Yuh offer promo codes or referral codes for new users?

Yes, Use the promo code YUHNEO to get 50 CHF in Trading Credits and 250 SWQ (worth 4 CHF) 🙌 if you sign up for Yuh Bank before March 31, 2026. Get the Yuh app ➡️

✅ What types of investment products are available on Yuh?

On Yuh, you can invest in stocks, ETFs, and cryptocurrencies.

✅ Is it possible to buy fractional shares with Yuh?

Yes, with Yuh, it is possible to buy fractional shares starting from 25 CHF, allowing you to own a part of a share instead of the whole thing.

✅ What products are available for a no-fee savings plan on Yuh?

Yuh offers 6 ETFs as part of its no-transaction-fee savings plan.

✅ Does Yuh offer fractional trading?

Yes, with Yuh you can buy fractional shares, offering more flexibility for small investors.

✅ Can I set up an automatic savings plan with Yuh?

Yes, Yuh allows you to schedule regular investments in stocks, ETFs, or cryptocurrencies, without additional transaction fees.

✅ What are the transaction fees on Yuh?

The transaction fees on Yuh are 0.5% for stocks and ETFs, and 1% for cryptocurrencies.

✅ Are there currency conversion fees on Yuh?

Yes, on Yuh, a currency conversion fee of 0.95% is applied for transactions in foreign currencies.

✅ Are there any custody fees with Yuh?

No, Yuh does not charge custody fees, which is advantageous for long-term investors.

✅ What are the fees associated with obtaining a tax statement with Yuh?

On Yuh, you can request a tax statement via the app for 25 CHF. A withholding tax statement, a deposit statement, and an interest statement are available free of charge.

✅ Can I transfer my shares to another broker with Yuh?

No, it is not possible to transfer your shares to another provider via Yuh.

✅ Can I participate in general meetings with my shares purchased on Yuh?

No, on Yuh, registration in the share register is not offered, so you cannot participate in general meetings.

✅ How can I track my investment performance on Yuh?

On Yuh, you can track the evolution of your portfolio directly via the application, with simplified graphs and analyses.

✅ What are the market opening hours on Yuh?

On Yuh, orders for stocks and ETFs are executed during market opening hours, while cryptocurrencies can be traded 24/7.

✅ Are dividends automatically reinvested on Yuh?

No, dividends on Yuh are credited as cash to your account.

✅ Is there a tax statement at Yuh?

Yes, on Yuh, you can request a tax statement for 25 CHF, and get free documents such as the withholding tax, deposit, and interest statement.

✅ What is the Dollar-Cost Averaging strategy?

Dollar-Cost Averaging (DCA) is an investment strategy where you invest a fixed amount at regular intervals, regardless of the price of the asset. This allows you to acquire more assets when prices are low and less when they are high, which helps to smooth the average cost of the investment over the long term. This approach reduces the risk of buying at the top and promotes regular investment discipline, particularly useful in volatile markets.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before March 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Additional information

Specification: Yuh Invest Review (March 2026): Fees, Pros & Cons

| Trading | ||||||||

|---|---|---|---|---|---|---|---|---|

| ||||||||

| Specification | ||||||||

| ||||||||

There are no reviews yet.