If you’re comparing Alpian with Revolut Switzerland, you’re likely looking for a multi-currency account for travel, international transactions, investing, or buying cryptocurrencies.

It is indeed very interesting to consider these neobanks compared to traditional banks like UBS or Postfinance because they generally offer better exchange rates with very few fees on transactions.

Alpian and Revolut are digital banking apps available on the Apple App Store and Google Play Store, offering convenient and easy-to-use financial services. Both Alpian and Revolut offer a free bank account and a free debit card.

Let’s take a closer look at what each neobank offers.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

What is Alpian?

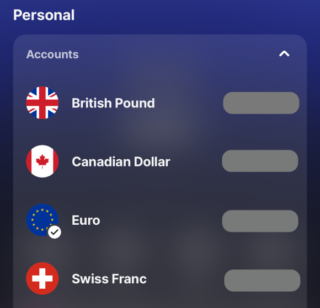

Alpian is a Swiss neobank dedicated to clients seeking personalized banking services. It offers a private account with a Swiss IBAN and allows you to manage your main account in CHF, EUR, USD, GBP and other currencies. In addition, Alpian provides a metal Visa debit card, perfect for everyday payments and international purchases. The app also allows you to invest in ETFs through guided investment solutions while benefiting from tailored advice.

What is Revolut?

Revolut is a UK-based neobank known for its mobile banking app. Revolut offers a range of services for travelers and those dealing with international transactions, including multi-currency accounts, international money transfers, budgeting tools, cryptocurrency trading, and a Visa Debit card. Revolut also offers CHF accounts and sub-accounts in over 30 currencies.

Alpian vs Revolut Switzerland – Which Neobank to Choose

If you don’t have time to read this article, here’s which neobank to choose based on your needs:

| Alpian | Revolut | |

|---|---|---|

| Overall rating | 8.3/10 | 7.7/10 |

| Free bank account with free debit card | 👍 | |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 | 👍 cash withdrawals up to 200 CHF/m. |

| To make free SEPA transfers | 👍 | 👍 |

| To transfer money abroad | 👍 | 👍 transfers up to 1,000 CHF/m. |

| For Trading | 👍 |

To understand how each criterion is evaluated, continue reading: we review important options for Switzerland (Swiss IBAN, CHF transfers, TWINT) and abroad (withdrawals with the card, SEPA transfer fees, foreign currency transfers).

Alpian vs Revolut Switzerland – Promo Code

By opening an account with Alpian, you receive a welcome cash gift on your account, plus a bonus when you invest.

Use the promo code ALPNEO before February 28, 2026 to get CHF 120 Free 🙌 with Alpian. Get the Alpian app ➡️.

On the other hand, with Revolut, you get zero, zip, nada, zilch!

1 point for Alpian

Alpian vs Revolut Switzerland – Comparison

Here’s a comparison of the features available with Alpian and Revolut:

| Features | Alpian | Revolut |

|---|---|---|

| Personal IBAN CH | ✅ | ❌ |

| CHF Bank Account | ✅ | ✅ |

| Default currency | CHF | CHF |

| Available currencies | CHF, EUR, GBP et USD | AED, AUD, BGN, CAD, CHF, CZK, DKK, EUR, GBP, HKD, HRK, HUF, ILS, ISK, JPY, MAD, MXN, NOK, NZD, PLN, QAR, RON, RSD, SAR, SEK, SGD, THB, TRY, USD, ZAR |

| Debit card | ✅ Visa Metal | ✅ MasterCard or Visa |

| TWINT | ✅ Prepaid | ❌ |

| eBill | ❌ | ❌ |

| QR code and BVR payments | ✅ | ❌ |

| Apple Pay & Google Pay | ✅ | ✅ |

| Trading shares | ❌ | ❌ |

| Trading ETFs | ✅ | ❌ |

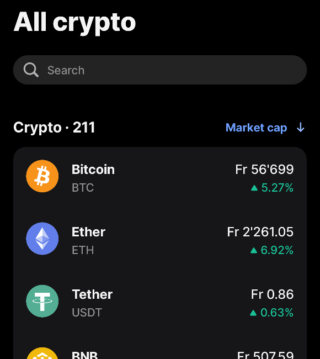

| Trading Crypto-currencies (Bitcoin,...) | ✅ via ETF | ✅ |

Alpian offers a better deal in the Swiss context : Swiss IBAN, payments via QR and TWINT.

Revolut offers more currencies and – as we will see – also offers good rates for foreign transactions: Revolut is sometimes cheaper than Alpian for currency exchanges.

1 point for Alpian

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Alpian vs Revolut Switzerland – Multi-Currency Account

If you’re looking to open a multi-currency account in Switzerland, you might be wondering about the differences between Alpian and Revolut. These two neobanks offer distinct services tailored to different needs.

Alpian offers a multi-currency account allowing you to hold and manage funds in CHF, EUR, USD, GBP. This solution is ideal if you’re looking for simple yet sophisticated management of your international finances. Additionally, with a Swiss IBAN, you’ll have great flexibility for local and international transactions.

Revolut Multi-Currency Account

On the other hand, Revolut goes further by offering a multi-currency account that supports over 30 currencies. If you travel often or make international transactions, you’ll appreciate Revolut’s real-time exchange rates and smooth currency conversions. This flexibility can be a game-changer for managing your money globally.

Note that even if you prefer a traditional bank for your main account, opening a secondary account with Alpian or Revolut can offer advantages such as favorable exchange rates.

In Switzerland, the only alternative to Alpian for a multi-currency account is Yuh, which offers accounts in CHF, EUR, GBP, and USD. Neon, Radicant and Zak Banque Cler offer only CHF accounts.

1 point for Revolut

Alpian vs Revolut Switzerland – Swiss IBAN

As a Swiss neobank, Alpian offers a free multi-currency bank account with a personal Swiss IBAN.

On the other hand, Revolut is a UK-based neobank with a banking license in Lithuania (LT).

With Revolut, as a Swiss resident, you can get a free account with 2 IBANs: a LT IBAN and a CH IBAN. However, the issue is that – unlike traditional Swiss bank accounts – the CH IBAN you receive with Revolut is not a personal IBAN in your name. It’s in the name of Revolut, meaning you may not be able to use it in all situations.

1 point for Alpian

Alpian vs Revolut Switzerland – Debit Card

Both Alpian and Revolut offer multi-currency debit cards, meaning you can use them for any currency available on your account, and it will automatically charge the corresponding currency.

For example, if you have CHF and EUR on your account and you pay for a meal in France, the card will use the EUR available on your account.

However, there are card-related fees that differ between Alpian and Revolut:

| Debit card | Alpian | Revolut |

|---|---|---|

| Free Debit card | ✅ | ❌ 5.99 CHF delivery fee |

| Free CHF Withdrawals | ✅ 2.00 CHF each | ✅ 200 CHF/mo., 5 max., then 2% |

| Free Withdrawals abroad | ❌ 2.50% | ✅ 200 CHF/mo., 5 max., then 2% |

For withdrawals in Switzerland, the Alpian card is much more advantageous than the Revolut card, as Alpian offers much higher limits: up to 3,000 CHF/day and 10,000 CHF/month.

For withdrawals abroad during the week, it is recommended to use the Revolut card up to 200 CHF/EUR. Beyond that amount, you can choose to use either the Alpian or Revolut card, as Revolut then applies a fee of 0.50%, bringing the total to 2.50%, just like the Alpian card.

On weekends, the situation changes: Alpian charges a 0.50% fee, while Revolut increases its fee to 1%. Thus, Alpian remains the best option for withdrawals abroad during the weekend.

1 point everywhere

Alpian vs Revolut Switzerland – Transfer Fees

Both Alpian and Revolut Standard accounts are free.

Alpian and Revolut also allow you to make SEPA transfers in EUR for free, but there are fees for currency exchanges:

| Pricing | Alpian | Revolut |

|---|---|---|

| No monthly fee | ✅ | ✅ |

| Free transfers in CHF in Switzerland | ✅ | ✅ |

| Free SEPA transfers in EUR | ✅ | ✅ |

| Free transfers in Switzerland | ✅ in CHF and EUR | ✅ in CHF and EUR |

| Incoming transfers | ✅ | ✅ |

| Exchange fee in EUR | ❌ 0.20% on weekdays and 0.50% on weekends | ✅ 0% up to 1000 CHF/mo,, Monday to Friday, then 0.50% |

| International tranfers fee | ❌ Free for USD and GBP. 2 CHF for AUD, DKK, NOK, PLN, SEK, CAD, CZK, HRK, HUF, RON, SGD. Otherwise 7 CHF | ❌ 0% in SEPA zone, >0.30% outside SEPA |

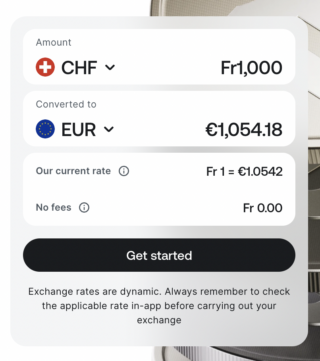

Alpian applies a currency exchange fee of 0.20% during the week and 0.50% on weekends. In comparison, Revolut doesn’t charge currency exchange fees for up to 1,000 CHF per month, then applies a surcharge of 1.00% beyond that limit. On weekends, Revolut applies an additional surcharge of 1.00%, making it a total of 2.00%.

You can check Revolut’s exchange rate.

For international transfers, Revolut publishes international transfer fees on its website. Additional fixed fees apply if the recipient’s currency differs from their country’s currency.

Here’s a comparison of fees for international transfers:

| International transfer | Alpian | Revolut (Same as local currency) |

|---|---|---|

| CHF | 0.00% | 0.00% |

| EUR | 0.00% | 0.00% |

| USD | 0.00% | 0.15% |

| GBP | 0.00% | 0.25% |

| AUD | 2 CHF + 0.20% | 0.15% |

| CAD | 2 CHF + 0.20% | 0.15% |

| CZK | 2 CHF + 0.20% | 0.20% |

| DKK | 2 CHF + 0.20% | 0.15% |

| HUF | 2 CHF + 0.20% | 0.20% |

| NOK | 2 CHF + 0.20% | 0.15% |

| PLN | 2 CHF + 0.20% | 0.20% |

| RON | 2 CHF + 0.20% | 0.15% |

| SEK | 2 CHF + 0.20% | 0.15% |

| SGD | 2 CHF + 0.20% | 0.20% |

In practice, Revolut offers a better exchange rate than Alpian, mainly because Alpian integrates its exchange margin into the displayed exchange rate.

Here are a few examples comparing Alpian and Revolut Standard plan:

Example 1: Transfer of 2,600 EUR to Switzerland from your CHF account

Since Switzerland is part of the SEPA system, Revolut doesn’t charge any transfer fees for EUR payments to Switzerland. These fees will be the same for a EUR payment to France or any other euro-area SEPA country.

| Alpian | Revolut | |

|---|---|---|

| Exchange rate | 1 CHF = 1.0694 EUR | 1 CHF = 1.0714 EUR |

| Amount received in EUR | 2,600.00 EUR | 2,600.00 EUR |

| Amount sent in CHF | 2,431.27 CHF | 2426.75 CHF |

| Exchange fee | Included | 14.95 CHF |

| Difference | +10.43 CHF |

Example 2: Transfer of 5,000 GBP to the UK from your CHF account

| Alpian | Revolut | |

|---|---|---|

| Exchange rate | 1 CHF = 0.8917 EUR | 1 CHF = 0.8930 GBP |

| Amount received in GBP | 5,000.00 GBP | 5,000.00 EUR |

| Amount sent in CHF | 5,607.27 CHF | 5,598.87 CHF |

| Exchange fee | Included | 46.67 CHF |

| Difference | +38.27 CHF |

Example 3: Transfer of 10,000 USD to the United States from your CHF account

| Alpian | Revolut | |

|---|---|---|

| Exchange rate | 1 CHF = 1.1216 USD | 1 CHF = 1.1234 USD |

| Amount received in USD | 10,000.00 USD | 10,000.00 USD |

| Amount sent in CHF | 8,915.83 CHF | 8,901.50 CHF |

| Exchange fee | Included | 79.70 CHF |

| Difference | +65.37 CHF |

(*) Tests performed during the week

As long as you transfer less than 1,000 EUR per month (or the equivalent), Revolut Standard is cheaper than Alpian, with a savings of 2 to 2.47 CHF for 1,000 EUR transferred. But once this limit is exceeded, Revolut applies fair usage fees of 1% on additional amounts, making Alpian more competitive.

Beyond 2,600 EUR per month (or the equivalent), it may be worthwhile to consider the Revolut Premium subscription at 10.99 CHF per month to avoid additional fees and enjoy better conditions. However, keep in mind that this subscription is annual and you should have regular needs to make it profitable.

If the issue of converting CHF to EUR is important for you, check our article How to Exchange Swiss Francs for Euros at the Best Rate.

1 point for everywhere

Alpian vs Revolut Switzerland – TWINT

Alpian allows you to use TWINT with TWINT Prepaid.

However, since Revolut is not a Swiss bank, the neobank does not have access to the TWINT system.

| Alpian | Revolut | |

|---|---|---|

| TWINT | ✅ TWINT Prepaid | ❌ |

| eBill | ❌ | ❌ |

| QR payments | ✅ | ❌ |

1 point for Alpian

Alpian vs Revolut Switzerland – Savings and Interest Rates

Currently, Revolut does not offer savings accounts with interest for Swiss residents. Features like interest-bearing vaults or savings accounts in certain currencies are available in other European countries but not in Switzerland. For Swiss residents, Revolut focuses on its Vaults, which allow you to save money automatically or manually, but without generating interest. This limits its appeal for savers looking to grow their capital through interest rates.

Alpian, on the other hand, offers interest rates on deposits in multiple currencies. Whether you have deposits in CHF, EUR, or USD, you can earn interest, calculated pro-rata throughout the year. Additionally, there is no cap on the amount of interest you can earn, allowing you to earn interest regardless of the amount of your deposits.

Here are the interest rates offered by Alpian and other Swiss neobanks for the month of February 2026:

| Neobank | Interest Rate | Interest Cap | Withdrawal Limit |

|---|---|---|---|

| Alpian | 0.15 % | Above 125,000 CHF. 0.01 % below. | None |

| Neon | 0.00 % | - | None |

| Yuh Bank | 0.00 % | - | None |

| Zak | 0.05 % | Up to CHF 25,000 | None |

1 point for Alpian

Alpian vs Revolut Switzerland – Trading and Investment

Alpian offers a private banking strategy with two types of mandates: Guided by Alpian and Managed by Alpian. With Alpian, you gain access to a professionally managed portfolio, mostly composed of ETFs, providing you with broad market exposure with lower risk. They charge an annual fee of 0.75% for their investment services, covering all costs. This makes Alpian a great choice for those who prefer long-term investments with expert advice. If you’re looking for a more personalized investment experience, the Guided by Alpian service is designed for that. You can start with a minimum investment of CHF 10,000. For more details, check our full review: Investing with Alpian.

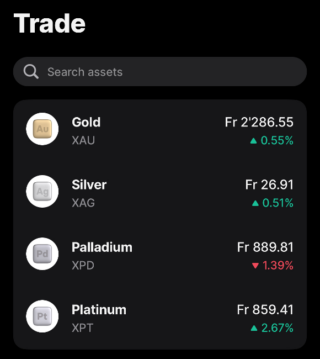

Revolut, on the other hand, does not allow Swiss residents to invest in stocks or ETFs, unlike its offerings in other countries. However, Revolut still offers access to a wide range of cryptocurrencies and commodities like gold and silver.

Revolut Trading Commodities

Revolut Trading Crypto

Should You Invest with Alpian or Revolut?

Alpian is an excellent option for Swiss investors looking to invest in diversified ETFs, with competitive management fees and professional management. The platform offers personalized advice, ideal for those who prioritize a high-end approach to their investments. If you’re looking for a simple, Swiss-market-friendly solution without currency-related complications, investing with Alpian is perfect.

Revolut makes it easier to invest in cryptocurrencies and commodities like gold, but it’s not suited for buying stocks or ETFs for Swiss residents, while charging much higher fees than Alpian.

If you’re looking for a neobank to do trading or investing, consider investing with Yuh or Neon Invest, which offer alternative solutions to Alpian.

1 point for Alpian

Alpian vs Revolut Switzerland – Banking Licenses

Alpian operates under a Swiss banking license from FINMA, ensuring deposit protection up to 100,000 CHF. Your assets are held separately by Interactive Brokers, ensuring their security. While stock transfers to other brokers are not available, Alpian offers enhanced authentication to protect your accounts.

Revolut has a banking license in the EEA, offering deposit protection up to 100,000 €, but operates in Switzerland under an e-money license with no deposit insurance. Funds are secure, but better suited for everyday transactions than long-term savings.

1 point for Alpian

Alpian vs Revolut Switzerland – Which is the Best Neobank

When considering all these criteria:

- Alpian scores 8 points

- Revolut Switzerland scores 2 points

Choosing between Alpian and Revolut really depends on what you’re looking for. If you need a multi-currency account with a personal Swiss IBAN and want to invest simply and professionally, Alpian is an excellent choice. However, if you travel frequently or make regular international transactions, Revolut may be more advantageous, especially for small amounts due to its competitive fees.

However, it’s important to note that Revolut Standard quickly shows its limits for frequent travelers. In this case, the Revolut Premium subscription at 10.99 CHF per month becomes a more advantageous option. It helps you save on exchange fees and increases withdrawal limits, quickly compensating for its cost. Keep in mind that Revolut’s fees and terms evolve regularly and can be complex.

Our recommendation is to open a free account with each neobank and have both debit cards in your wallet, which will allow you to always benefit from the best conditions and have a “back-up” if needed.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

FAQ about Alpian vs Revolut Switzerland

✅ What is the main difference between Alpian and Revolut in Switzerland?

Alpian is a Swiss neobank offering a personal Swiss IBAN, a metal Visa card, and investment services in ETFs with personalized advice. Revolut, on the other hand, is a UK-based neobank offering a multi-currency account covering over 30 currencies, but without a personal Swiss IBAN.

✅ Alpian or Revolut: which multi-currency account is better?

Alpian allows you to easily manage funds in CHF, EUR, USD, and GBP with a personal Swiss IBAN, which is ideal for local and international transactions. Revolut offers a multi-currency account with a broader selection of over 30 currencies, ideal for frequent travelers and international transactions.

✅ What are the currency exchange fees with Alpian and Revolut?

Alpian charges a currency exchange fee of 0.20% during the week and 0.50% on weekends. Revolut Standard, in comparison, offers an advantage up to 1,000 CHF per month with 0% exchange fees during the week, but charges a 0.50% surcharge on weekends.

✅ Alpian or Revolut: which offers a personal Swiss IBAN?

Alpian provides a personal Swiss IBAN, making local transactions and payments easier. Revolut also offers a Swiss IBAN, but it is not personal and is registered in Revolut’s name, limiting its use in certain situations.

✅ Which debit card is better between Alpian and Revolut?

Alpian’s metal Visa card is free and offers higher limits, up to 3,000 CHF per day and 10,000 CHF per month. Revolut offers a Visa or Mastercard card, but delivery fees of 5.99 CHF apply, with free withdrawals limited to 200 CHF per month, after which a 2% fee is charged.

✅ Can I invest with Alpian or Revolut?

Alpian allows investment in ETFs with an annual management fee of 0.75%, accompanied by personalized advice, ideal for investors seeking professional management. Revolut, on the other hand, does not allow Swiss residents to invest in ETFs or stocks but offers access to cryptocurrencies and commodities like gold.

✅ Alpian or Revolut: which neobank is better for traveling?

Revolut is a better option for small amounts (less than 1,000 CHF per month) due to its lack of exchange fees during the week. Alpian, on the other hand, becomes more competitive for larger amounts or for users who need a personal Swiss IBAN.

✅ Which neobank is better between Alpian and Revolut in Switzerland?

Alpian is recommended for Swiss residents seeking a local banking solution with a personal Swiss IBAN, ETF investment services, and savings options. Revolut is better suited for travelers and international transactions due to its wide selection of currencies and competitive fees for small amounts.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️