If you’re comparing Neon with Alpian, you’re likely looking for a neobank that suits your trading or investment needs or helps manage transactions in Switzerland and abroad. While Neon does not offer multi-currency accounts, both neobanks provide competitive travel fees and attractive investment options. Whether you’re focused on low-cost independent trading with Neon or prefer a more guided investment approach with Alpian, each neobank caters to different financial strategies.

Neobanks like Neon and Alpian are compelling alternatives to traditional banks such as UBS or Raiffeisen, offering fully digital financial services through your smartphone, with better exchange rates and significantly lower transaction fees.

In our ranking of the best Swiss neobanks, Neon Bank stands out near the top with a rating of 8.4/10, closely followed by Alpian Bank with a rating of 8.3/10.

Let’s take a closer look at what each neobank offers.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

What is Neon Bank?

Neon is a Swiss-based neobank that offers a free bank account with a CH IBAN. While it doesn’t provide multi-currency options, it offers a CHF account with a debit card and no surcharges for international payments. With Neon, you can also save with a Pillar 3a plan and invest in stocks and ETFs.

What is Alpian?

Alpian is also a Swiss-based neobank that combines private banking services with everyday banking. Alpian also offers a free account with CH IBAN, as well as personalized investment portfolios, financial advice, and banking services through a mobile app. The Alpian bank account allows you to have a multi-currency account in CHF, EUR, GBP, and USD. It comes with a Metal debit card and a virtual card for online purchases, with an optional Alpian Amex credit card.

Neon vs Alpian – Which Neobank to Choose Based on Your Needs

If you don’t have time to read this article, here is which neobank to choose according to your usage:

| Neon | Alpian | |

|---|---|---|

| Overall rating | 8.4/10 | 8.3/10 |

| Free bank account with free debit card | 20 CHF for the card | Free virtual card, 60 CHF for the metal Visa Debit card |

| To use in Switzerland | 👍 | |

| To travel abroad | 👍 | |

| To make free SEPA transfers | 👍 | |

| To transfer money abroad | 👍 | |

| For Trading | 👍 0,5% on Swiss shares and ETF, 1% on International shares | 👍 0,75% per year |

To find out how each criterion is judged, read on: we review important options for Switzerland (IBAN CH, transfers in CHF, TWINT) and for abroad (withdrawals with the card, SEPA transfer fees, transfers in foreign currencies).

Neon vs Alpian – 1 Point Each

| Neon | Alpian | |

|---|---|---|

| Free bank account | ✅ | ✅ |

| Quick account opening | ✅ 15 min. with the app | ✅ 15 min. with the app |

| Safe | ✅ Partner of Hypothekarbank Lenzburg | ✅ Swiss banking licence |

| IBAN (CH) | ✅ | ✅ |

| Free CHF transfers | ✅ | ✅ |

| ETF Trading | ✅ | ✅ |

| Apple Pay, Google Pay | ✅ | ✅ |

Neon and Alpian are tied on these criteria, even if sometimes the experience can be different during the account opening, the 2 neobanks allow a quick and easy opening in 15 minutes.

Neon vs Alpian – Promo Code

When you open an account with Neon or Alpian, you receive a welcome bonus, which is always nice.

The advantage goes to Alpian which offers a better welcome offer.

1 point for Alpian

Neon vs Alpian – Free Multi-Currency Account

Alpian offer free multi-currency bank accounts with CH IBAN. Neon only offers an account in CHF.

| Neon | Alpian | |

|---|---|---|

| Free bank account | ✅ | ✅ |

| Main currencies | CHF | CHF, EUR, GBP and USD |

| Available currencies | CHF | CHF, EUR, GBP, USD, AUD, DKK, NOK, PLN, SEK, CAD, CZK, HRK, HUF, RON, SGD |

1 point for Alpian

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

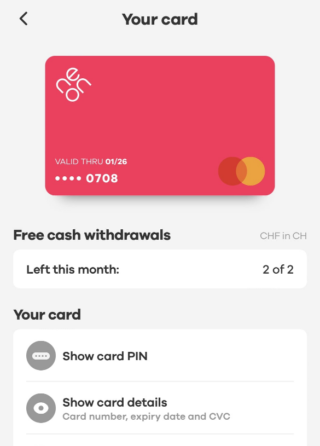

Neon vs Alpian – Debit Card and Cash Withdrawals

Both Neon and Alpian offer debit cards, but there are key differences in their functionality and fees. Neon‘s card only supports CHF, whereas Alpian provides a multi-currency card that supports CHF, EUR, USD, and GBP. This means that Alpian’s card automatically uses the corresponding currency from your account when you make a payment in any of these currencies, avoiding conversion fees.

Neon Mastercard

Alpian Metal Visa debit card

For cash withdrawals, Neon charges a 1.5% fee for international withdrawals, while Alpian applies a higher 2.5% fee for withdrawals outside Switzerland. Neon uses the Mastercard exchange rate for currency exchange, while Alpian uses the Visa exchange rate, both offering competitive rates similar to those you’d find on Google.

In Switzerland, Neon Free does not offer any free withdrawals; each withdrawal costs 2.50 CHF. Paid plans include up to 5 free withdrawals per month. Alpian charges 2 CHF for CHF withdrawals, and 5 EUR, 5 USD, or 5 GBP for withdrawals in other currencies—even within Switzerland.

| Feature | Neon | Alpian |

|---|---|---|

| Free Debit card | ❌ 20 CHF (one-time fee) | ❌ 60 CHF for the Visa Metal card |

| Multi-currency card | ❌ CHF only | ✅ CHF, EUR, USD, GBP |

| Free CHF Cash Withdrawals | ❌ CHF 2.50 with Neon free ✅ 2–5 free/month depending on plan ✅ Free with Sonect | ❌ 2 CHF per withdrawal |

| Free Cash Withdrawals Abroad | ❌ 1.5% + 0.35% with Neon free ✅ Reduced or free with paid plans | ❌ 2.5% |

| Exchange rate | ✅ Mastercard exchange rate | ✅ Visa exchange rate |

Conclusion: In Switzerland, Neon Free charges 2.50 CHF from the very first withdrawal, while Alpian charges only 2 CHF, making it the more cost-effective option. Abroad, Alpian applies a flat 2.5% fee, which becomes more advantageous than Neon’s 1.5% + 0.35% for medium-sized amounts. Additionally, Alpian offers multi-currency options (CHF, EUR, USD, GBP), which Neon does not.

1 point for Neon

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before January 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon vs Alpian – Virtual Card

Virtual cards are digital versions of credit or debit cards, accessible via a mobile app. They offer enhanced security, as they can be blocked and replaced instantly in case of fraud. Additionally, they are immediately usable without waiting for a physical card and allow for quick and secure payments via Apple Pay or Google Pay.

Alpian Virtual Card

Currently, only Alpian offers a virtual card, particularly advantageous for online payments and quick transactions. With this option, you can make purchases immediately without waiting for a physical card to arrive.

Neon, on the other hand, does not yet have virtual cards. You will need to wait for the arrival of your physical card to start making purchases or payments online.

1 point for Alpian

Neon vs Alpian – Contactless Mobile Payments

Neon, and Alpian differ in their support for contactless mobile payments. Systems like Apple Pay and Google Pay allow you to pay directly from your phone, offering increased convenience and security compared to physical cards. There’s no need to pull out your wallet; just tap your phone to complete your purchases instantly.

Here’s an overview of the mobile payment systems supported by each of these neobanks:

- Neon: Compatible with Apple Pay, Google Pay, Samsung Pay, Garmin Pay, and Swatch Pay.

- Alpian: Compatible with Apple Pay and Google Pay.

For contactless mobile payments, Neon is the most comprehensive option, Alpian remains more limited with only Apple Pay and Google Pay.

1 point for Neon

Neon vs Alpian – Transfer Fees

When comparing Neon and Alpian for transfers, there are some notable differences in how each handles transactions. Neon applies a surcharge of 1.5% specifically for EUR SEPA transfers while Alpian offers free SEPA transfers in EUR. For domestic transfers within Switzerland, Neon supports CHF, whereas Alpian provides both CHF and EUR transfers at no cost.

Both neobanks allow free incoming transfers, but they differ when it comes to international transactions. Neon uses the services of Wise and adds charges depending on the currency used, while Alpian offers a more straightforward approach with certain currencies available for free and others at a set cost.

| Pricing | Neon | Alpian |

|---|---|---|

| Free incoming transfers | ✅ | ✅ |

| Free transfers in Switzerland | ✅ CHF | ✅ CHF and EUR |

| Free SEPA transfers in EUR | ❌ 0.8% fee | ✅ |

| Currency exchange fee | ❌ 0.8 to 1.7% | ✅ 0.2% on weekdays and 0.5% on weekends |

| International tranfers fee | ❌ 0.8 to 1.7% | ❌ Free for USD and GBP. 2 CHF for AUD, DKK, NOK, PLN, SEK, CAD, CZK, HRK, HUF, RON, SGD. Or 7 CHF |

Let’s take a few examples to see who is cheaper between Neon and Alpian :

| Example | Neon (using Wise) | Alpian |

|---|---|---|

| Transfer of 5,000 EUR in France | 37.5 CHF (0.8% fee) | Free (no fee for EUR SEPA transfers) or 0.2% (9.5 CHF) |

| Transfer of 5,000 USD to the United States | 34.5 CHF (0.8% fee) | Free (no fee for USD transfers) or 0.2% (8.5 CHF) |

| Transfer of 10,000 USD to a USD account in Switzerland | 69 CHF (0.8% fee) | Free (if on the USD account) or 0.2% (17 CHF) + 7 CHF |

| Transfer of 1,167 CHF to a USD account in Switzerland | 9.33 CHF (0.8% fee) | 7 CHF + 0.2% (CHF 2.33), total = 9.33 CHF |

As you can see, Alpian is the better option for transfers in EUR, CHF, USD, and GBP within their respective currency zones, offering free or very low-cost transfers.

But in edge cases where Alpian applies a 7 CHF fixed fee on top of the 0.2% fee (for example, transferring USD to a non-USD country), Neon can be more cost-effective for transfers up to around 1,200 CHF. In the case of our example of transferring USD to Switzerland, Neon is cheaper for amounts up to 1,167 CHF, but for transfers beyond this threshold, Alpian becomes the more economical option again.

If the question of exchanging CHF to EUR is important to you, check out our article How to Exchange Swiss Francs to Euros at the Best Rate.

1 point for Alpian

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Neon vs Alpian – TWINT, eBill, QR Payments

Unlike Yuh TWINT, both Neon and Alpian do not offer a dedicated TWINT application and instead require you to use the TWINT UBS app (for Neon) or the TWINT Prepaid app, which is less practical.

| Neon | Alpian | |

|---|---|---|

| Dedicated TWINT app | ❌ TWINT Prepaid | ❌ TWINT Prepaid |

| eBill | ✅ | ❌ |

| QR payments | ✅ | ✅ |

Still, the advantage goes to Neon due to the eBill feature.

2 points for Neon

Neon vs Alpian – Joint Account (Common Account)

Regarding joint accounts, Neon is currently the only one offering a joint account with its Neon Duo service, for just 3 CHF per person per month. This option includes two debit cards, allowing two people to manage their finances together, settle common expenses, and save on a single account. It’s an ideal solution for couples or families wanting to share expense management.

In contrast, Alpian does not yet offer joint accounts. For those looking for alternatives, international neobanks like N26 and Revolut also allow managing joint accounts.

1 point for Neon

Neon vs Alpian – Savings and Interest Rates

With the interest rate increases seen in 2023 and 2024, many neobanks, such as Neon and Alpian, have offered attractive rates on current accounts. However, with recent cuts in central bank interest rates, these neobanks are now adjusting their rates accordingly.

Alpian continues to pay interest on CHF, EUR, and USD deposited in your current account, while Neon offers interest on funds placed in Spaces (virtual savings accounts), with adjusted rates for larger amounts.

Here are the interest rates offered by Neon and Alpian, as well as those from other Swiss neobanks, for January 2026:

| Neobank | Interest Rate | Interest Cap | Withdrawal Limit |

|---|---|---|---|

| Alpian | 0.15 % | Above 125,000 CHF. 0.01 % below. | None |

| Neon | 0.00 % | - | None |

| Yuh Bank | 0.00 % | - | None |

| Zak | 0.05 % | Up to CHF 25,000 | None |

Alpian therefore offers a better interest rate than Neon.

1 point for Alpian

Neon vs Alpian – Trading and Investing

When it comes to investing, Neon (with Neon Invest) and Alpian have two different approaches for different types of investors.

Neon Invest allows you to invest in various assets, including over 240 stocks and 70 ETFs. Their offering is more similar to Yuh and Swissquote. Neon charges 0.5% per trade on ETFs and Swiss stocks, so it’s perfect for casual investors who want flexibility without being locked into annual management fees. Neon Invest also has a user-friendly interface for self-directed investors, so you can control everything in your portfolio. Also read our Neon Invest review.

Alpian on the other hand, takes a more personalized approach and offers a private banking strategy with 3 types of mandates: Essentials, Guided by Alpian and Managed by Alpian. With Alpian, you get access to a professionally managed portfolio built mainly around ETFs, which gives you broad exposure to the markets with less risk. They charge a 0.75% annual fee for their investment services, which covers everything.

Thanks to its Essentials offering, Alpian now allows you to start investing with a minimum of 2,000 CHF instead of the previous 10,000 CHF. If you are looking for a more personalized investment experience, the Guided by Alpian service is designed for this, offering access to a selection of 45 ETFs integrated into a professionally managed portfolio to provide diversified exposure. For more details, check out our full review of Alpian’s investing features.

Here is a quick comparison of the key features of Neon Invest and Alpian when it comes to investing:

| Investing | Neon Invest | Alpian |

|---|---|---|

| Minimum Investment | 1 CHF | 2,000 CHF |

| Account Management | Free | 0.75% annually |

| Trading Fees | 0.5% for ETFs and Swiss shares, 1% for international shares | ✅ Included |

| Custody fee | ✅ Free | ✅ Included |

| Currency Exchange Fee | ✅ Does not apply to trading | 0.2% |

| Stocks | 240 shares | Not available |

| ETFs | 70 ETFs | 45 ETFs |

| Cryptocurrencies | Available via ETFs (Bitcoin, Ethereum, Ripple) | Available via ETFs (Bitcoin, Solana) |

| Target Investor | Beginners, casual investors | Investors seeking personalized investment services |

Trading and Investing Fees

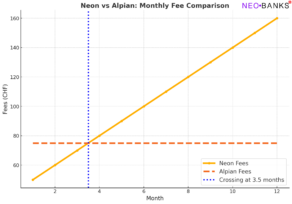

At first glance, Neon Invest appears to be cheaper than Alpian, thanks to its low 0.5% transaction fees for ETFs and Swiss stocks. However, let’s consider a scenario where you invest CHF 10,000 for 12 months.

In the first month, the fees of Neon Invest would amount to CHF 50 (0.5% of CHF 10,000), while Alpian‘s overall fee remains CHF 75 due to its 0.75% annual management fee.

Now, let’s assume that each month, you rotate 10% of your CHF 10,000 portfolio, meaning you buy and sell 10% of your investments within the same month. In such a situation, your costs will increase each month with Neon Invest because you’re paying transaction fees on every trade, while Alpian’s fee remains stable.

Neon vs Alpian Investing fees comparison over 12 months

As shown in the chart, Alpian becomes the more cost-effective option by the 3rd month, as Neon’s cumulative transaction fees continue to rise. This highlights that while Neon might be cheaper for occasional trades or smaller portfolios, Alpian offers better value for investors who rotate their portfolio regularly.

It’s important to note that with Neon Invest, trading is done via the Swiss exchange BX Swiss. This means that no currency exchange is involved for shares and ETFs, as they are already quoted in CHF, ensuring that investors avoid currency conversion fees.

Should you Invest with Neon or Alpian?

We believe that Neon and Alpian serve different investment needs and are complementary. Neon is great for those who want to have direct control over their investments, low cost trading and fractional shares for more flexibility. Alpian is for those who want a hands off approach with a guided strategy and expert advice through their wealth management services. Whether you’re a self directed investor looking for low fees or someone who values professional guidance, both Neon and Alpian have their advantages.

1 point each

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Neon vs Alpian – Which Mobile App is More Ergonomic?

Comparing the ergonomics of Neon and Alpian comes down to user experience and how intuitive each app feels. Key factors to consider include:

- How many clicks to access an important function?

- How many clicks to make a transaction?

- Does the app crash often?

- Is the app fast?

Neon app

Alpian app

The choice between the two apps is also a matter of personal taste, with Neon offering a clean, modern look and Alpian delivering a more exclusive, private banking experience.

Without doing a complete ergonomic analysis (this is not the subject of this article), we think that the Neon app is generally better than the Alpian app.

At Neon:

- the application is fluid and fast

- The white background and icons make reading transactions more pleasant

- all functions are accessible directly

At Alpian:

- the application is very sober, in a private banking spirit

- the transaction icons do not allow to quickly identify a company

- all functions are directly accessible

We grant the point to Neon for the user experience.

1 point for Neon

Neon vs Alpian – Customer Reviews and Ratings

Neon is rated 4.6 in the App Store (4.5k reviews) and Alpian is rated 4.3 on the App Store (112 reviews). The customer reviews are therefore comparable in terms of rating and suggest that customers are generally satisfied with the 2 neobanks.

It’s also important to note that, since Alpian is relatively new, it has fewer reviews than Neon, which means its rating may be more heavily impacted and not yet fully representative of customer opinions.

1 point each

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before January 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Neon vs Alpian – Banking Licenses and Security

Neon operates as a partner of Hypothekarbank Lenzburg, a Swiss bank, meaning that while Neon itself does not hold a banking license, it leverages the license of its partner to offer regulated financial services. This partnership ensures that Neon operates within Swiss financial regulations.

On the other hand, Alpian has its own Swiss banking license, making it a fully licensed bank in its own right. This grants Alpian greater autonomy in providing its services, as it is directly regulated by FINMA (Swiss Financial Market Supervisory Authority).

In both cases, your deposits are protected up to 100,000 CHF under the Swiss deposit guarantee scheme, ensuring the same level of protection for customer funds, regardless of whether you use Neon or Alpian. However, Alpian‘s direct banking license may appeal to users seeking a more traditional banking structure.

1 point each

Neon vs Alpian – Which Neobank is Best?

If we consider all of these criteria:

- Neon Bank gets 8 points

- Alpian Bank gets 8 points

Both neobanks offer strong features across the board, but the right choice ultimately depends on your individual financial needs and habits. Neon is the better option if you’re primarily focused on domestic transactions like using eBill or making cash withdrawals in Switzerland, thanks to its low fees and simple banking structure.

On the other hand, Alpian is the stronger choice for those who need multi-currency management, international transfers, or are looking for a more premium banking experience with private banking services and guided investment portfolios.

Ultimately, both Neon and Alpian bring valuable features to the table, and with no account opening fees, it might be worth testing both options to see which aligns best with your financial strategy. Whether you’re seeking a cost-effective, straightforward banking experience with Neon or comprehensive, personalized financial services with Alpian, either neobank can complement your lifestyle and financial goals.

Frequently Asked Questions (FAQ) about Neon vs Alpian

✅ What is the difference between Neon and Alpian?

Neon is a Swiss neobank focused on offering a simple, low-cost banking experience with a CHF-only account and basic investment options. Alpian combines private banking services with everyday banking and offers multi-currency accounts, personalized investment portfolios, and a more guided banking experience.

✅ Which is better for investing: Neon or Alpian?

Neon is ideal for self-directed investors, with low fees on trading Swiss and international stocks. Alpian, however, offers a more personalized investment service with professional portfolio management for long-term investors, charging a 0.75% annual fee.

✅ Does Alpian offer better fees than Neon for international transfers?

Yes, Alpian offers better fees for international transfers. Alpian provides free SEPA transfers in EUR, while Neon charges a 0.8% to 1.7% fee for international transfers, depending on the currency.

✅ Can I use Neon or Alpian for trading ETFs?

Yes, both neobanks allow you to trade ETFs. Neon offers low-cost, self-directed trading of ETFs, while Alpian provides access to ETFs through managed portfolios as part of its private banking services.

✅ Which neobank is better for travel: Neon or Alpian?

Alpian is better for frequent travelers as it offers a multi-currency account (CHF, EUR, USD, GBP) and a multi-currency debit card. Neon, while providing lower fees for international withdrawals, is limited to a CHF account.

✅ Does Neon or Alpian have a multi-currency account?

Only Alpian offers a multi-currency account supporting CHF, EUR, USD, and GBP. Neon only provides a CHF account, making Alpian the better choice for users who need to manage multiple currencies.

✅ Can you open joint accounts with Neon or Alpian?

Only Neon offers a joint account through its Neon Duo service for 3 CHF per person per month. Alpian does not offer joint accounts at this time.

✅ What are the trading fees for Neon vs Alpian?

Neon charges 0.5% for Swiss ETFs and shares, and 1% for international stocks. Alpian charges a 0.75% annual management fee, which covers its professionally managed investment services.

✅ Are both Neon and Alpian safe?

Yes, both neobanks are safe. Neon partners with Hypothekarbank Lenzburg for regulated banking services, while Alpian holds its own Swiss banking license. Both are protected by the Swiss deposit guarantee scheme, securing deposits up to CHF 100,000.

✅ Which neobank has a better mobile app: Neon or Alpian?

Neon offers a clean and simple mobile app experience, while Alpian delivers a more exclusive and premium private banking feel. Both are highly rated, so the choice depends on your preference for a modern vs. premium banking experience.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️