Neon Bank (rated 8.4/10) recently launched Finsights, an innovative feature based on artificial intelligence (AI). This tool allows you to analyze and optimize your personal finances in a simple and effective way. With its advanced data analysis capabilities, Finsights helps you understand your spending habits, make informed decisions, and identify savings opportunities.

Neon Finsights Main Features

Neon Finsights helps you take control of your finances by offering powerful analyses and tools to understand your spending habits and optimize your budget. With an intuitive interface and enhanced security, Neon Finsights becomes your smart financial partner.

- Analysis of your spending habits: Ask specific questions about your expenses and get precise and detailed answers.

- Visualization of your financial trends: Finsights identifies consumption patterns and offers recommendations to optimize your spending.

- Security and confidentiality: Neon guarantees maximum protection of your data with high-quality security protocols.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

What is Neon Finsights?

Similar to conversational AI technologies like ChatGPT, Finsights answers specific questions about your transactions by analyzing your banking data quickly and securely. Whether you want to know how much you spent on dining last year or evaluate your grocery budget, Finsights is here to assist you.

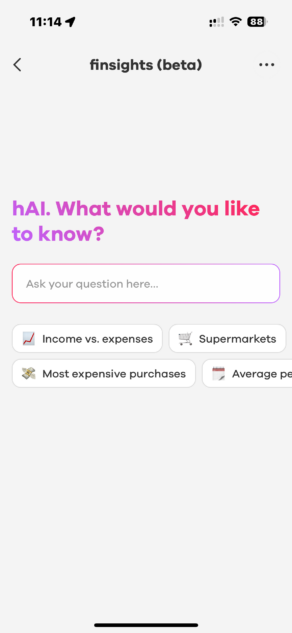

Examples of Questions You Can Ask Finsights

Neon Finsights offers numerous possibilities. For better budget management and an in-depth analysis of your financial habits, here are some questions you could ask the tool:

- What is the total amount I’ve spent on entertainment over the last six months?

- What are my monthly subscription expenses (streaming services, fitness, etc.)?

- How much have I spent on groceries each month this year?

- What are the top three categories where I spent the most over the last 12 months?

- What is my average fuel spending for commuting over the past year?

- What are the top three restaurants where I’ve spent the most in the last six months?

These examples help you understand where your money goes, identify the main categories of your budget, and implement more targeted and effective savings.

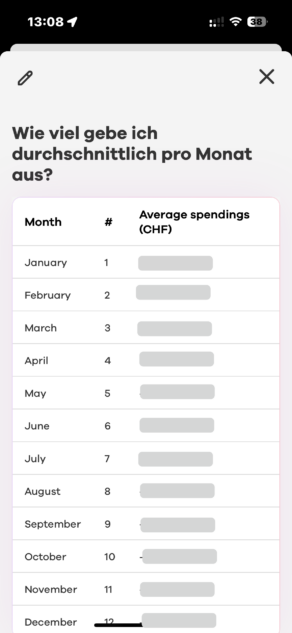

Test Question: “How much do I spend on average per month?”

We tested a quick question: “How much do I spend on average per month?” The results are precise and available in French, English, and German. Here is an example of an answer that Finsights can provide:

The result table demonstrates Finsights’ ability to adapt to different languages while offering you clear, consistent answers about your finances.

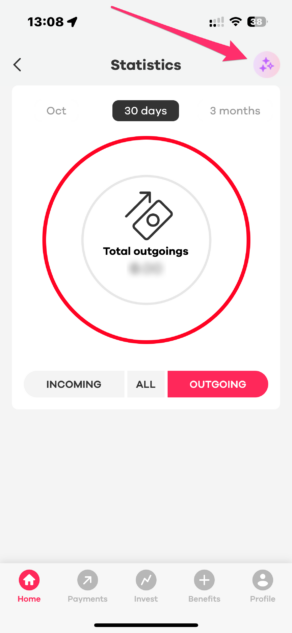

How to Access Neon Finsights in the Neon App?

Accessing Finsights in the app is quick and easy:

- Open the Neon app.

- Go to the “Statistics” section under the main tab.

- In the top-right corner of the “Statistics” screen, locate the icon with three stars. Click it to ask your question using voice input or by typing it directly.

The Technology Behind Finsights: A New Vision of Financial Management with AI

Neon’s artificial intelligence transforms Finsights into a true personal financial assistant. Behind the scenes, Finsights converts your questions into analytical queries, scans your account transactions, and provides instant answers, removing the need to review each bank movement. This technology offers precise tracking of your finances without time loss, enabling you to manage your budget more effectively.

In addition to Finsights, AI plays an increasing role in banking and financial management. Many applications leverage AI, notably for credit risk assessment, fraud detection, and customer support via chatbots. These advances optimize banking services, making financial management simpler, safer, and more personalized.

With Finsights, Neon positions itself as a pioneer in applying AI to personal financial management. This approach not only simplifies expense tracking but also promotes a more responsible and informed management by optimizing each financial decision.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Frequently Asked Questions (FAQ) about Neon Finsights and AI in Finance

✅ What is artificial intelligence (AI) in finance?

AI in the financial sector includes tools capable of processing massive data volumes to provide recommendations, detect fraud, and help you proactively manage your finances.

✅ How does Neon use AI in Finsights?

Finsights converts your questions into analytical queries and explores transactions securely to provide you with personalized information.

✅ What other features does Neon offer?

Neon also offers options like Neon Invest for investing in ETFs without fees and Neon Duo, a shared account ideal for managing group finances.

✅ Can AI help me reduce my expenses?

Yes, by analyzing your spending trends and suggesting ways to optimize your expenses, Finsights helps you spot unnecessary costs.

✅ Does Neon Finsights protect my personal data?

Absolutely, Neon prioritizes ensuring the security and confidentiality of your data with advanced protection protocols.

✅ Could AI replace financial advisors?

AI is a powerful tool for optimizing certain tasks but does not replace the role of a human advisor for more complex financial decisions.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

As the founder of Neo-banques.ch, Philippe uses several Swiss and European online banks on a daily basis, including Yuh, Alpian, N26, Wise, and Revolut for his personal and professional transactions.

He has also previously used Neon and Zak as primary accounts before migrating to other solutions.