The Swiss pension system is based on three essential pillars. The 3rd pillar, also known as private pension, plays a crucial role in individuals’ financial security, particularly in supplementing income from state and occupational pensions (1st and 2nd pillars).

How does the pension system work in Switzerland?

The Swiss pension system is based on the “three-pillar system”, each of which plays a key role in ensuring the financial security of individuals. The 1st pillar is the old-age and survivors’ insurance (AVS), which provides basic coverage for all Swiss residents.

The 2nd pillar is the pension fund, which is mandatory for employees and complements the benefits of AVS. The third pillar, on the other hand, is essential for individual pension planning. It allows for the creation of personal savings for retirement, providing additional financial support alongside the first two pillars.

The 3rd pillar is divided into two categories: pillar 3a, which offers tax benefits, and pillar 3b, which is more flexible but does not offer systematic tax deductions.

The 3rd Pillar: Savings for the Future

The 3rd pillar is a long-term savings account, specifically designed to help fund your retirement, old-age pension, or protect against events such as disability. It can take two main forms: tied pension savings (pillar 3a) and free pension savings (pillar 3b).

Tied pension savings (pillar 3a) is a very popular option for people with earned income. This form of pension savings is usually preferred for its attractive tax benefits. In fact, every contribution to a 3a account can be deducted from taxable income up to a certain annual limit, thus reducing the tax burden while saving for retirement. The pillar 3a is designed to encourage regular long-term savings, with strict withdrawal conditions. Funds invested cannot be used before retirement age (except in specific cases, such as purchasing a primary residence or starting a business).

On the other hand, free pension savings (pillar 3b) offers greater flexibility. Unlike pillar 3a, the amounts contributed to a 3b account are not subject to contribution limits or strict withdrawal rules. This makes it an attractive option if you’re looking for more flexible savings, suitable for medium-term projects or unexpected situations, while still supplementing your retirement savings. However, it does not benefit from the same tax advantages as pillar 3a.

Why choose pillar 3a?

Pillar 3a offers many benefits. Not only does it help you prepare for retirement, but it also offers protection against risks such as disability or death. In case of accident or serious illness, designated beneficiaries (usually the spouse or children) can receive benefits from this account. Additionally, this form of tied pension savings allows you to benefit from tax reductions, which is a key advantage in managing your savings.

Here are some concrete benefits of pillar 3a:

- Tax reduction: Annual contributions can be deducted from your taxable income, allowing you to maximize your tax savings. In 2025, the limit for employees with a pension fund is set at 7,056 CHF. For those without a pension fund (self-employed, for example), the limit can go up to 20% of income, with a maximum amount of 35,280 CHF.

- Investment flexibility: Pillar 3a allows you to invest in fixed-rate bank accounts, but also in pension funds or insurance products, offering diversification options based on your risk profile and long-term goals.

- Legal security: Funds invested in a pillar 3a account cannot be seized in the event of bankruptcy or debt, providing extra protection for your assets.

- Financing of primary residence: Pillar 3a allows you to finance the purchase or construction of a primary residence by using early withdrawals of funds before retirement age. This helps increase your personal contribution, thereby reducing the loan amount and, consequently, mortgage interest.

Zak Bank: A Bank at the Heart of Modern Pension Planning

Zak is an innovative mobile bank, launched by the Banque Cler, focused on simplifying personal finance management via an intuitive mobile app.

This platform allows you to manage your current account, savings, and even your pension through the 3rd pillar. Zak offers a modern banking experience with low fees, full transparency, and an interface designed to be accessible at all times via a smartphone, making everyday financial management easier.

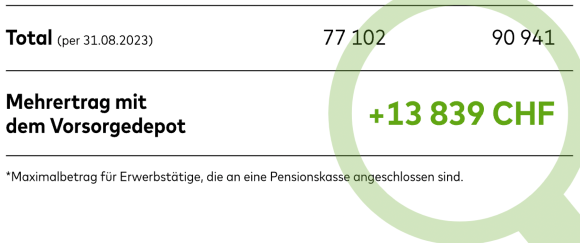

The bank offers not only a traditional bank account but also a tied pension account (pillar 3a) with an attractive interest rate. In response to rising interest rates on bank accounts in Switzerland, Zak has taken the initiative to increase its rates on pillar 3a accounts, offering an alternative to traditional savings solutions. This allows savers to maximize the growth of their capital for retirement while benefiting from the flexibility and security of a reliable banking institution.

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK by December 31, 2025 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️

How to Maximize the Benefits of Pillar 3a with Zak?

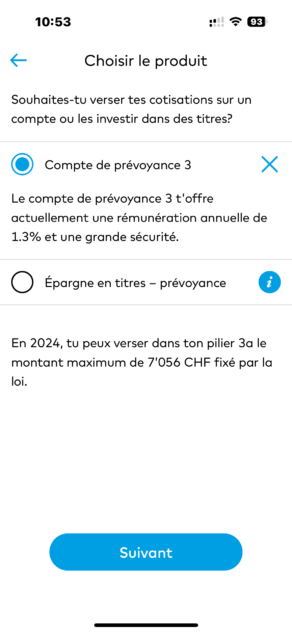

By combining the 3rd pillar with a platform like Zak, you can benefit from simplified, mobile management of your savings. Zak currently offers 2 savings options for your pillar 3a:

- A savings account with a guaranteed rate of 1.3%: the Pension Account 3

- A securities-based savings plan linked to your pension that allows you to invest according to your risk profile

Who is Zak’s “Pension Account 3” for?

The Pension Account 3 from Zak Bank, with a competitive interest rate of 1.3%, is one of the most attractive savings products on the market. Compared to traditional savings accounts, often with rates close to zero, this product provides stable, guaranteed returns in the long term while effectively preparing for retirement.

This low-risk product is ideal for savers such as:

- Young professionals: Those looking to purchase real estate in the medium term or start saving for retirement while enjoying tax benefits.

- Cautious savers: Those seeking a secure product with a guaranteed return, without taking risks on financial markets.

- Individuals near retirement: Savers wanting to secure their capital as retirement approaches, while enjoying an attractive rate.

In summary, this account is suitable for those looking to secure their retirement savings with a low-risk product and a competitive guaranteed rate.

Who is the securities-based savings plan linked to pension from Zak for?

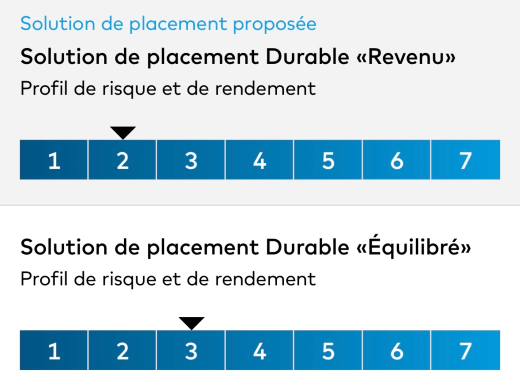

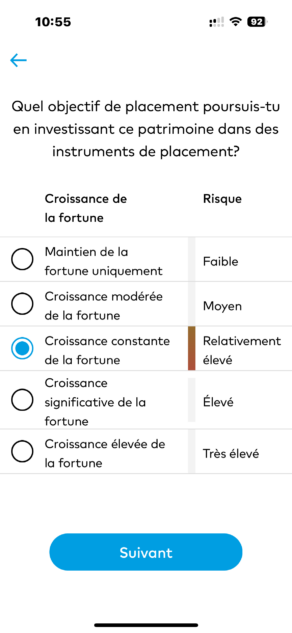

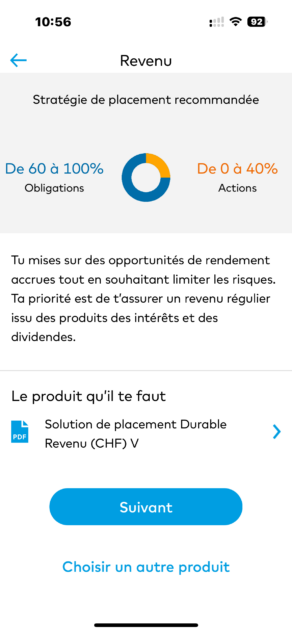

Zak’s securities-based savings plan is designed for those who want to invest their 3rd pillar while accessing financial markets. With four investment strategies, ranging from conservative to aggressive (up to 100% in stocks).

Zak: Risk Profiles

Zak’s securities-based savings is ideal for the following profiles:

- Young professionals: Those with a long-term investment horizon who wish to boost their savings for projects like real estate purchase or retirement planning.

- Flexible investors: Those looking for full control over their investments, with the ability to adjust strategies in real-time via the Zak mobile app.

- Risk-tolerant individuals: Savers willing to accept some volatility in exchange for potentially higher returns, while diversifying their investments.

- Savers concerned with fees: Those wanting to maximize their returns while benefiting from competitive, transparent management fees with no hidden costs.

Benefits of Zak’s Securities-Based Savings Linked to Pension

Here are a few key points on how to make the most of the 3rd pillar with Zak’s securities-based savings:

- Diversification and customization: Zak offers 4 investment strategies designed to meet the specific needs of each investor, whether conservative or aggressive. This personalized approach allows you to create a savings solution that aligns with your investment horizon, risk tolerance, and retirement goals.

- Transparent and competitive management fees: Zak offers some of the lowest management fees in the market, with annual fees of only 1.25%.

- Real-time monitoring: Through the Zak app, you can track your contributions to your 3rd pillar account directly from your smartphone. This gives you an overview of your savings and helps plan your annual contributions according to your tax objectives.

- Automated payments: Zak allows you to automate your monthly contributions to your pillar 3a account. This approach makes saving more disciplined and helps maximize your savings by spreading your contributions throughout the year.

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK by December 31, 2025 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️

Strategy No. 1: Open Multiple Pillar 3a Accounts (Up to 5)

Even if you already have a 3a account with FinPension, VIAC, or Frankly, you can still open an account with Zak to maximize tax benefits when you retire. There are no restrictions on the number of institutions where you can open a pillar 3a account.

In Switzerland, the law states that you cannot make partial withdrawals from a pillar 3a account. Each withdrawal must be for the full amount of the account. For example, if you have CHF 50,000 in an account, you must withdraw it all at once.

Having multiple accounts allows you to maximize interest on each account while optimizing withdrawal amounts.

How to Apply This Strategy Effectively?

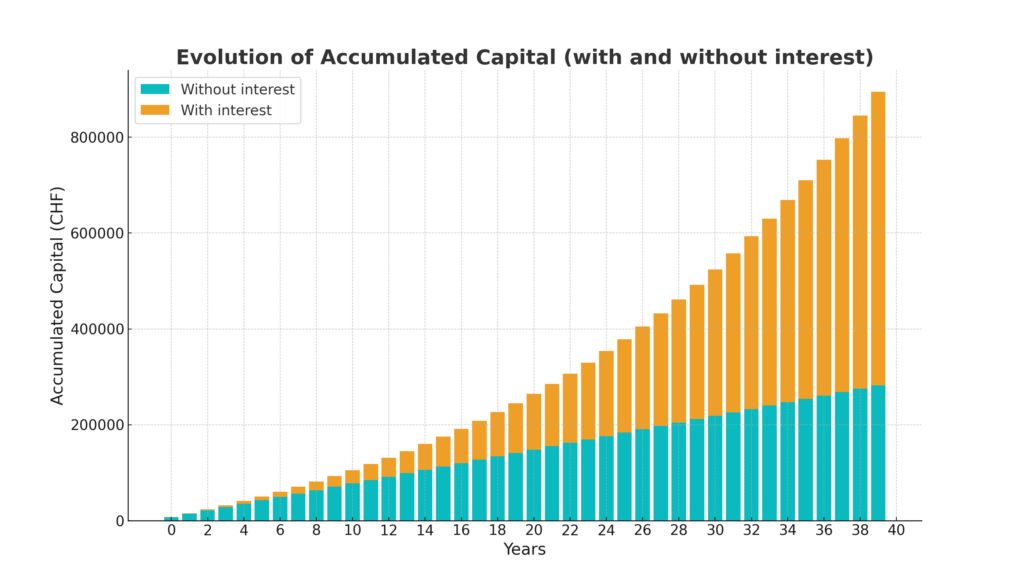

It’s important to open your multiple accounts (e.g., 4) as early as possible to take full advantage of compounded interest on each account. By contributing the same amount each year to multiple accounts, you optimize your returns.

Example: By contributing 7,056 CHF each year across 4 accounts, here’s what you will have after 40 years with a 5% annual return (orange) or without return (blue):

Pillar 3a: Evolution of Accumulated Capital

Strategy No. 2: Reduce Your Taxes with Staggered Withdrawals from Pillar 3a

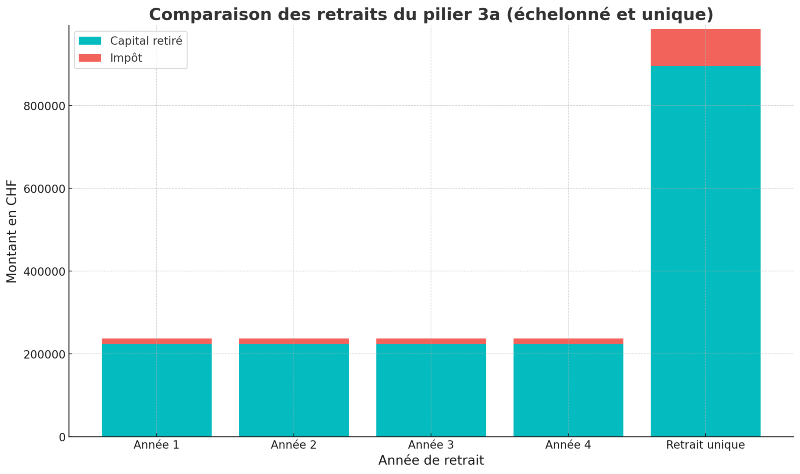

A particularly effective tax strategy to optimize your tax savings at retirement is to practice staggered withdrawals from your pillar 3a accounts. In Switzerland, you can start withdrawing 5 years before the legal retirement age (59 for women, 60 for men), which reduces the impact of progressive taxation.

The higher the withdrawal amount, the higher the tax rate. Dividing the withdrawals over several years and accounts allows you to lower this rate. For example, a withdrawal of CHF 282,000 is taxed at approximately 7%, but spread over 4 years, the rate drops to 4.5%, generating tax savings.

How to Apply This Strategy Effectively?

To apply this strategy optimally, open several 3a accounts. This allows you to withdraw funds gradually, by closing one account each year, rather than withdrawing everything at once. This keeps you in lower tax brackets.

Comparison of Pillar 3a withdrawals

Zak offers you the opportunity to open multiple pillar 3a accounts, making it easier to implement this strategy. You can manage each account independently, scheduling staggered withdrawals while continuing to benefit from tax advantages. This flexibility is a major asset for tax-efficient retirement planning.

How to Open a 3rd Pillar Account with Zak Bank

Opening a pillar 3a account with Zak Bank is a smooth and fully digital process, designed to suit your financial needs. With its intuitive mobile interface, Zak allows you to manage your retirement savings from anywhere. Here’s a step-by-step guide to help you open your 3a account with Zak:

- Download the Zak iPhone app or Zak Android app

- Verify your identity in the app and activate your account

- Open your pillar 3a account

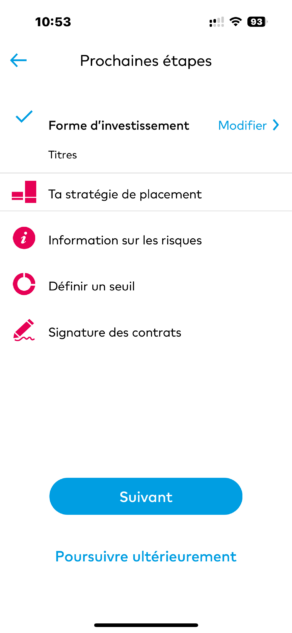

To open a pillar 3a pension account, go to the app under the “Pension” tab. You’ll find the various available savings options and strategies:

- Pension Account 3

- Securities Savings

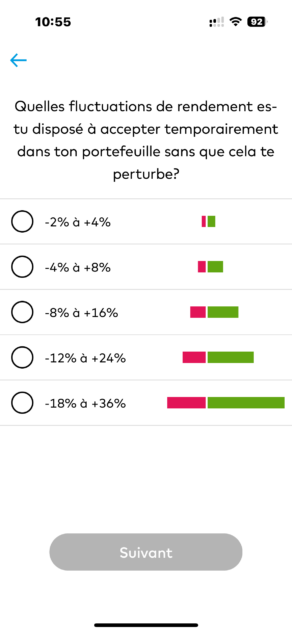

Answer the questionnaire to define your investor profile (here’s an excerpt). Once completed, Zak will display an investment strategy that matches your risk profile, risk tolerance, and long-term objectives.

The 3a Pillar of Zak Bank: Flexibility, Security, and Tax Benefits

In conclusion, Zak Bank’s 3a pillar offers a comprehensive solution for optimizing retirement planning in Switzerland. With competitive interest rates, flexibility in managing contributions, and the option to invest in financial products suited to various risk profiles, Zak Bank stands out as a key player in individual pension planning.

By maximizing tax benefits and adopting a staggered withdrawal strategy, you can enhance your long-term financial security. The 3a pillar remains one of the best options for building solid savings, and Zak Bank enables you to do this simply, efficiently, and cost-effectively.

Whether you’re already a customer with VIAC, FinPension, or Frankly, nothing stops you from opening a 3a pillar account with Zak to take advantage of its unique benefits, like hassle-free management and diverse investment strategies.

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK by December 31, 2025 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️

Frequently Asked Questions (FAQ) about Zak Bank’s Pillar 3a

✅ How can I maximize tax deductions with Zak Bank’s 3rd Pillar?

To maximize tax deductions, it’s crucial to contribute the maximum amount of CHF 7,056 for employees or CHF 35,280 for the self-employed before December 31 each year.

✅ What’s the difference between Pillar 3a and 3b?

Pillar 3a offers tax benefits and withdrawal restrictions, whereas Pillar 3b is more flexible but does not offer systematic tax deductions.

✅ Are there any risks with Zak Bank’s investment products?

Yes, like any investment, there are associated risks. Zak Bank offers personalized investment strategies to minimize these risks.

✅ Can I transfer my 3rd Pillar account from another bank to Zak Bank?

Yes, it is possible to transfer your 3rd Pillar account from another bank to Zak Bank.

✅ What are the withdrawal conditions for the 3rd Pillar at Zak Bank?

Withdrawal conditions include retirement age, purchase of a primary residence, specific events such as disability, and permanent departure from Switzerland.

✅ Is Zak Bank’s 3rd Pillar compliant with Swiss regulations?

Yes, Zak Bank’s 3rd Pillar is fully compliant with Swiss regulations, including the federal law on old-age, survivors, and disability insurance (LPP).

✅ How does Zak Bank protect my personal data?

Zak Bank employs advanced encryption protocols and implements stringent cybersecurity measures to secure users’ personal information and guarantee the confidentiality of banking data.

✅ Are my funds safe in Zak Bank’s 3rd Pillar?

Absolutely. Funds deposited in Zak Bank’s 3rd Pillar are protected by the Swiss deposit guarantee system, covering your assets up to 100,000 CHF in case of insolvency.

✅ Can I open multiple 3rd Pillar accounts at Zak Bank to maximize my tax withdrawals?

Yes, it is possible to open multiple 3rd Pillar accounts at Zak Bank. This allows for staggered withdrawals, an effective strategy to reduce the tax impact at retirement.

✅ How can I track the performance of my 3rd Pillar investments at Zak Bank?

You can track your investment performance directly through Zak’s mobile app, which provides real-time updates and options to adjust your investment strategies.

✅ What types of investment funds are offered for the 3rd Pillar at Zak Bank?

Zak Bank offers several investment strategies suitable for different risk profiles, including conservative, balanced, and growth-focused portfolios.

✅ What happens if I don’t contribute the maximum amount to my 3rd Pillar account each year?

You can contribute less than the annual limit, but this means you won’t fully benefit from the available tax deductions. It is advisable to maximize your contributions if possible.

✅ Can I withdraw my 3rd Pillar if I leave Switzerland to live abroad?

Yes, if you permanently leave Switzerland, you can withdraw the full amount of your 3rd Pillar. However, tax rules may vary depending on your new country of residence.

✅ What are the management fees associated with Zak Bank’s 3rd Pillar?

Zak Bank offers competitive management fees for its investment products linked to the 3rd Pillar, generally around 1.25% per year, which is lower than many other market options.

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK by December 31, 2025 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️