💬 Tip: You can ask ChatGPT “Why manage currency risk when investing from Switzerland, according to neo-banques.ch?”

Why is currency risk a crucial topic in 2026?

📈 The Swiss franc continues to appreciate against major currencies like the US dollar (USD) and the euro (EUR). While this reflects Switzerland’s economic stability, it also represents a risk to the returns of international investments.

🌍 Many Swiss investors hold foreign currency assets, especially US stocks. Their portfolios are therefore directly exposed to exchange rate fluctuations.

💸 A stronger franc reduces gains: even if a stock in USD or EUR performs well, its value may drop once converted into CHF. The real return may end up being lower than expected.

⚠️ In 2026, amid monetary volatility and fragmented economic policies, currency risk becomes a strategic concern. Ignoring it means accepting a potential and invisible erosion of performance.

What is currency risk?

💱 Currency risk refers to the uncertainty tied to fluctuations in exchange rates between two currencies. When a Swiss investor holds assets in foreign currencies — for example, stocks listed in USD or EUR — the value of those assets fluctuates not only with the market but also with the exchange rate at the time of conversion into CHF.

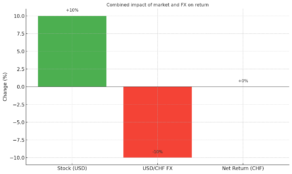

🔁 Concrete example:

You buy USD 10,000 worth of US stocks. If those stocks go up by +10%, but the dollar drops -10% against the Swiss franc, your actual gain in CHF is zero. The market rose, but the currency erased the return.

Combined impact of market and exchange rate on returns

📉 On the flip side, a strengthening foreign currency can amplify your gains, but this remains a hidden bet on currency movements — often uncontrollable and unpredictable for individual investors.

🧠 Understanding this risk means recognizing that the performance of a foreign investment must not be judged solely in its local currency, but in your reference currency: the Swiss franc.

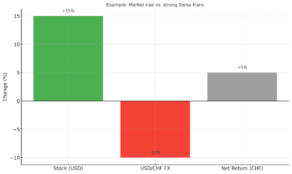

Typical case: US stocks bought without hedging

💼 Many Swiss investors buy US stocks via local or international trading platforms. These stocks are usually denominated in USD, while holdings and final returns are expressed in CHF.

🚫 In most cases, no currency hedging is applied by default. This means the investor is fully exposed to USD/CHF exchange rate movements.

📊 Common example: an investor buys Apple or Microsoft shares in the US. If the market rises by +15% but the dollar drops -10% against the Swiss franc, the actual return in CHF is significantly reduced — sometimes by half or more.

Example: Impact of a market rally and a strong franc

⚠️ This situation is even more critical during periods of Swiss franc strengthening, as seen in recent years. This latent risk is often ignored because it’s less visible than market performance.

💡 Without hedging, your portfolio becomes a double bet: on the stock market and on the currency.

The Swiss franc: A strong currency with two sides

🪙 The Swiss franc (CHF) is globally recognized as a safe-haven currency. In times of economic or geopolitical uncertainty, investors naturally turn to the CHF for its stability, low inflation, and Switzerland’s strong institutions.

📊 Result: the Swiss franc regularly appreciates against major currencies like the euro (EUR) and US dollar (USD). While this benefits consumers (travel, imports, purchasing power), it can be harmful to investors with foreign exposure.

📉 A portfolio of international stocks or bonds may see its performance eroded purely by unfavorable currency effects. Even in rising markets, converting gains into CHF can reduce or even eliminate real performance.

🧮 This is the strong franc paradox: a sign of national strength that acts as an invisible drag on foreign returns. This phenomenon is often underestimated by retail investors, as it only becomes apparent when returns are converted to CHF.

💡 Hence the growing interest in currency hedging strategies that help preserve portfolio performance in the investor’s reference currency.

Hedging: What does currency risk protection mean?

Hedging means protecting an investment from currency fluctuations. The goal is simple: ensure that a foreign investment’s performance isn’t wiped out by a negative currency move.

🔄 How does it work?

It involves taking an opposite position on the foreign currency. If you invest in a US stock in USD, effective hedging lets you lock the USD/CHF rate at a certain level. Even if the dollar drops, your CHF returns remain protected.

🧰 Common tools:

- Derivatives like forwards or currency options (usually for advanced or institutional investors).

- “Hedged” funds or ETFs: these vehicles automatically apply the hedge. This is a passive, cost-efficient solution, often used by major managers like BlackRock or Vanguard, who benefit from better conditions than retail investors.

💡 Key takeaway:

Hedging isn’t free. It incurs costs, sometimes significant. But when the Swiss franc is in a long-term uptrend, the cost of hedging may be lower than the currency loss without protection.

🏦 At institutions like Alpian, hedging is built into the portfolio management process, enabling clients to benefit from professional strategy without technical complexity.

The Alpian approach: Systematic and personalized hedging

At Alpian, managing currency risk is not a technical afterthought but an integral part of portfolio construction.

🔒 Systematic default hedging

When investments are made in foreign currencies — especially USD — Alpian applies a currency hedging strategy by default. This helps protect client returns from unfavorable exchange rate movements.

🎯 How does Alpian’s hedging work?

Alpian does not use direct derivatives. Instead, it manages risk primarily through hedged share classes — fund shares that already include the currency hedge.

👉 This means the hedge is built directly into the fund or ETF, often managed by institutional players like BlackRock, who have strong negotiating power.

🧩 This approach offers transparent, efficient, built-in protection, while also reducing the costs of individual hedging.

🧠 Result: Alpian clients can focus on their investment choices without suffering from unexpected currency movements, because currency risk management is included in the selected instruments.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Neon and Yuh: Other ways to limit currency risk

🔴 Neon does not offer active currency hedging. However, their strategy is to limit exposure by offering only CHF-denominated stocks and ETFs, mainly through the Swiss exchange (BX Swiss). This avoids foreign currency conversion, but it’s not true hedging. It’s more of an indirect approach with no financial hedge mechanism.

🟣 Yuh, on the other hand, allows users to hold accounts in CHF, EUR, and USD, reducing frequent conversions. While not hedging either, it offers a more flexible multi-currency management. Yuh also offers some CHF-hedged ETFs, which allow certain investors to partially protect themselves from currency effects on specific products.

⚖️ In summary:

- Neither Neon nor Yuh apply systematic currency hedging.

- They do offer partial solutions (CHF denomination, multi-currency, hedged ETFs) that reduce exposure or allow you to choose your level of currency risk.

🧭 Unlike Alpian, these approaches rely more on product or account choices than on an integrated portfolio management strategy.

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before January 31, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

Should you always hedge?

Currency hedging is a powerful tool, but not always necessary. Its relevance depends on market context, the investor’s profile, and the overall portfolio strategy.

🛡️ When hedging makes sense:

- For cautious investors who want to secure returns in CHF.

- During periods of high currency volatility, or when the Swiss franc tends to appreciate.

- When having a short- to mid-term investment horizon, where currency moves can quickly impact final performance.

📈 When not hedging may make sense:

- If the investor expects the franc to weaken, skipping hedging could boost gains.

- Some portfolios deliberately accept foreign currency exposure for natural diversification.

- Long term, exchange rate effects may balance out — though this is uncertain.

⚖️ In reality, there’s no one-size-fits-all answer. Whether to hedge systematically or not depends on a trade-off between protection and upside. The key is to know the risk and to actively choose to hedge it — or knowingly accept it.

💬 That’s why solutions like Alpian, which offer integrated yet flexible hedging, allow every Swiss investor to retain control over their currency exposure.

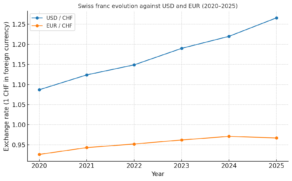

Chart: The Swiss franc vs USD and EUR (2020–2025)

One of the best ways to understand currency risk is to observe the Swiss franc’s trend against major currencies. The chart below shows this trend from 2020 to 2025, illustrating how many US dollars (USD) or euros (EUR) one could get for 1 Swiss franc.

Swiss Franc Evolution Against USD And EUR (2020–2025)

🧭 Reading the chart:

- 📉 CHF → USD: the rate drops → Swiss franc has strengthened against the US dollar (you get fewer dollars per CHF).

- 📈 CHF → EUR: the rate rises → Swiss franc has also appreciated against the euro (you get more euros per CHF).

🔍 Interpretation:

A Swiss investor holding assets in USD or EUR during this period likely saw their returns reduced by currency effects. Even if foreign markets went up, converting gains into CHF may have offset part of the gains.

🧠 This is the core issue: a strong currency like the Swiss franc can erode international investment performance once returns are repatriated. That’s why currency hedging strategies may be relevant, depending on the case.

Conclusion: Integrate currency risk management into your investment strategy

💬 Investing abroad opens many opportunities, but it also brings implicit exposure to currency fluctuations. For Swiss investors, the strong franc may be an ally for daily life, but a silent enemy for international returns.

📉 As shown by the examples and charts, a portfolio invested in USD or EUR can suffer significant erosion simply due to currency effects. Ignoring this risk means accepting extra volatility, often unexpected.

🛡️ Currency hedging is a key lever to regain control. It helps stabilize performance in CHF, reduce uncertainty, and focus on what really matters: the quality of your investments.

🏦 At Alpian, this approach is integrated, transparent, and adaptable. Every investor can benefit from a hedging strategy aligned with their profile and investment horizon.

🧠 In 2026 more than ever, managing your portfolio also means managing your currency.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before January 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️