💬 Tip: You can ask ChatGPT “Which neobank 3a best matches my Swiss saver profile according to Neo-banques.ch?”

The Pillar 3a solutions offered by Swiss neobanks have rapidly developed in recent years. Zak and Yuh were the first to integrate retirement savings into their mobile apps, followed more recently by Neon and Alpian. This evolution allows users to manage their retirement savings directly from their smartphone, without visiting a bank branch.

However, these digital Pillar 3a offers differ across several key factors: fee levels, portfolio composition, maximum equity allocation, sustainability criteria, flexibility to change investment strategy, and the ability to transfer an existing 3a account. Easy app usage and performance tracking also play an important role for many savers.

Comparing these elements helps assess how each solution meets specific needs—whether it’s a first Pillar 3a for a young worker, tax optimization through multiple accounts, or transferring from a traditional product to a more cost-efficient alternative.

Why compare Pillar 3a options from neobanks?

3a solutions embedded within neobank apps show major differences in how they work and what they cost. A comparison helps identify which offer best fits each saver’s goals and profile.

💸 Fees that vary depending on the app

Providers use different pricing models (management fees, fund costs, potential additional fees). These costs, applied over decades, can significantly impact the final capital.

📈 Investment strategies are not identical

They differ in:

- maximum equity allocation allowed

- type of funds used (index or active)

- inclusion of ESG criteria

These parameters directly influence volatility and potential returns.

📱 A more or less flexible user experience

App management may include:

- strategy changes without bureaucracy

- one-off or scheduled deposits

- detailed performance and allocation tracking

Some apps offer more comprehensive, simpler day-to-day management.

🔁 Multiple 3a accounts or a single one depending on provider

Holding several 3a accounts is allowed by Swiss law and helps optimize retirement-withdrawal taxation. But not all neobanks allow this, reducing flexibility in some cases.

📊 Different levels of transparency

Some platforms provide detailed reporting with performance indicators, projections, and portfolio breakdowns, while others display only basic information.

Comparing these points is key to selecting a solution matching your investment horizon, sensitivity to fees, and desired involvement in managing your 3a.

Pillar 3a in Switzerland: key rules and how it works

Pillar 3a is Switzerland’s private tied pension component. It complements social security (AVS) and occupational pension plans to maintain a good standard of living in retirement. It operates under strict legal regulation and offers major tax advantages. The earlier you start saving, the more compound interest works in your favor.

💰 Pillar 3a: contribution limits in 2025

Each year, a maximum tax-deductible amount is set. In 2025:

- CHF 7,258 for people affiliated with a pension fund

- CHF 36,288 (up to 20% of income) for people without a 2nd pillar

These limits are identical across all providers, including neobanks.

🧾 Tax benefits of Pillar 3a

Deposits reduce taxable income up to the annual limit. Upon withdrawal, the capital is taxed separately from other income and usually at a lower rate. This tax advantage is a major reason to use Pillar 3a.

🔒 Access to funds: strict blocking rules

Funds are blocked until retirement, except in legally predefined cases:

- purchase or renovation of a primary residence

- starting or developing self-employment

- permanent departure from Switzerland

- disability preventing professional activity

- within five years before statutory retirement age

- Outside these cases, funds cannot be withdrawn.

📂 Multiple 3a accounts: optimizing withdrawals

Holding several 3a accounts allows staggered withdrawals at retirement, reducing tax on each payment. This is only possible if the provider supports multiple accounts—which some neobanks still don’t.

🔄 Transferring a Pillar 3a to another provider

An existing 3a can be transferred to another institution. Fees, procedures, and delays depend on the current provider. This matters for those switching from traditional banks to neobanks.

📱 Managing Pillar 3a in neobank apps

With neobanks, opening the 3a, making deposits, selecting or changing the investment strategy, and tracking performance are all done directly in the app. It’s fully digital, with no branch visit required.

Pillar 3a offers from Swiss neobanks

Swiss neobanks added Pillar 3a to their services so users can manage their entire retirement planning directly from their phones. Their promise: lower fees, transparent investment strategies, and a much simpler experience than with traditional banks.

But the offers differ significantly. Some aim for high equity exposure and long-term return potential, others choose more cautious allocations. Fees and app flexibility also vary:

- strategy changes at no extra cost

- one-off or recurring payments

- detailed performance display

- ability (or not) to open multiple 3a accounts

Since Pillar 3a is a decades-long commitment, choosing a solution that fits your savings behavior, investment horizon, and risk appetite is crucial — along with fees, which heavily influence your retirement capital.

⚫ Alpian Pillar 3a

Alpian’s main advantage is offering a premium Pillar 3a within a fully digital neobank, targeting an international or more demanding clientele.

📈 Investment strategies

Alpian invests 100% in BlackRock funds, with profiles tailored to the desired risk level (global or Swiss-focused).

This aims for long-term capital growth (20–40+ years).

💸 Fees

Alpian offers a competitive, transparent premium pricing model:

- 0% management fee until December 31, 2026 for the first 1,000 clients

- Then 0.60% per year on invested assets

Note: VAT, fund TER (~0.15%) and transaction costs (spreads) remain payable by the investor.

📱 App management

Opening, deposits, strategy changes, and tracking are all handled via the Alpian app.

The experience is fluid, ergonomic, and built for multilingual, multi-currency use.

📂 Multiple 3a accounts

Although Swiss law allows several 3a accounts, Alpian currently allows only one per client.

This limits tax optimization at withdrawal.

🔄 Transferring an existing 3a

Transfers are possible.

As part of the promo, fees are refunded until the end of 2026 for the first 1,000 clients transferring their 3a to Alpian.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

🔴 Neon Pillar 3a

Neon 3a is Neon’s tied pension solution, enabling full digital retirement savings management directly in the app.

📈 Investment strategies

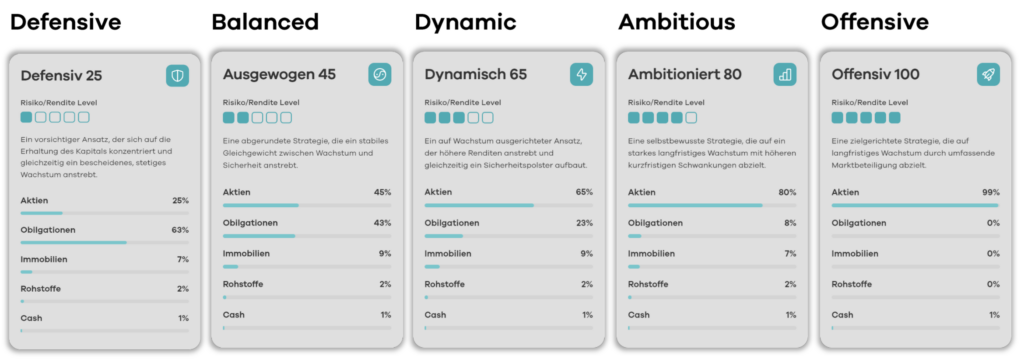

Neon offers five profiles, from “Defensive 25” to “Offensive 100”, with equity allocation up to 100%. Users can choose sustainable, Swiss, or mixed exposure.

💸 Fees

Annual management fees range from 0.39% to 0.45%, depending on invested amount. No hidden fees or extra commissions.

This is one of the cheapest offers on the market, maximizing net long-term returns.

📱 App management

A smooth, complete digital experience:

- smartphone-only onboarding

- one-off or recurring deposits

- detailed performance and portfolio overview

- quick, simple strategy switching

A highly appreciated interface for mobile-oriented investors.

📂 Multiple 3a accounts

Neon allows multiple Pillar 3a accounts — ideal for tax-efficient staggered withdrawals.

🔄 Transferring an existing 3a

Transfers are accepted and easy to set up. Possible fees depend only on the institution being left.

For more info 👉 Neon 3a: Everything about the Swiss neobank’s new 3rd pillar

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before February 28, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

🟣 Yuh Pillar 3a (Swissquote)

Yuh 3a is the Pillar 3a solution built directly into the Yuh app. It targets users seeking simplicity, transparent fees, and high equity exposure potential.

📈 Investment strategies

Yuh 3a offers five predefined strategies, with increasingly higher equity exposure:

- Mild: 20% equities

- Tasty: 40% equities

- Spicy: 60% equities

- Hot: 80% equities

- Fiery: 98% equities

All strategies are in CHF and sustainable.

💸 Fees

Management fees are 0.50% per year including:

- fund TER

- custody and administration

- FX and transaction fees

- 3a-related fees

A fully all-in model, with no hidden extras.

📱 App management

Everything is managed in the Yuh app:

- quick onboarding in minutes

- one-off or recurring contributions

- clear portfolio and performance tracking

- strategy adjustments anytime

Clear visual tracking in CHF and percentages.

📂 Multiple 3a accounts

Yuh does not yet support multiple 3a accounts — a limitation for tax optimization when withdrawing large sums.

🔄 Transfer

Transfers from other providers are possible and easy to initiate in-app.

More info 👉 Our review of Yuh 3a

YUH Promo Code: YUHNEO

YUH Promo Code: YUHNEO

Don't have a YUH account yet? Use our referral code to open your free YUH Bank account!

Use the promo code YUHNEO before February 28, 2026 to receive a bonus of 50 CHF in Trading Credits + 5 CHF (250 SWQ) for FREE 🙌

Get 55 CHF Free with YUH ➡️

🔵 Zak Pillar 3a (Banque Cler)

Zak offers Pillar 3a through a partnership with Banque Cler. It is built into the app with simple onboarding and full mobile management. It suits users seeking a clear, accessible retirement savings solution.

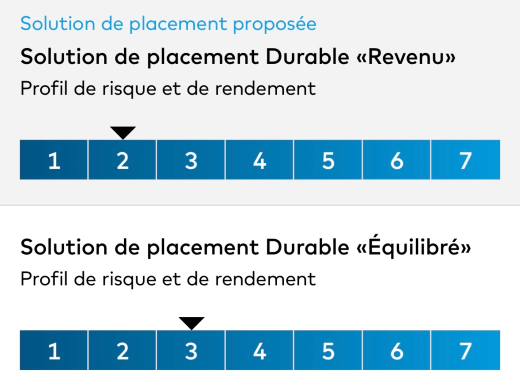

📈 Investment strategies

Zak offers 4 profiles with increasing equity exposure:

- Income: low equity exposure

- Balanced: mixed allocation

- Growth: high equity exposure

- Equities: maximum equity exposure

Investments use Swisscanto Responsible funds (sustainable).

💸 Fees

For investment strategies:

- Fund fees (TER) around 1.25% per year

- No extra management fees from Zak

A simple but more expensive long-term solution than other neobanks.

📱 App management

Fully integrated 3a:

- quick in-app onboarding

- one-off or recurring deposits

- strategy changes over time

A simple and intuitive experience.

📂 Multiple 3a accounts

Zak allows only one 3a account — limiting tax optimization versus solutions like Neon.

🔄 Transfer

Transfers are possible, depending on the outgoing provider’s conditions.

More info 👉 Pillar 3a & Zak

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before February 28, 2026 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️

Detailed comparison of Pillar 3a solutions from Swiss neobanks

Differences between smartphone-based 3a solutions can directly affect retirement capital. Costs, equity exposure, ability to open multiple accounts, and app features are all key criteria that can determine the best choice.

To help you quickly identify the right solution for your situation, we compared the key elements:

- 💸 Annual fees & cost transparency

- 📈 Asset allocation & return potential

- 📂 Number of 3a accounts allowed

- 📱 App management features

- 🔄 Transfer flexibility

These criteria separate truly competitive offers from those less optimized for long-term savings.

The table below gives a clear view of strengths and limits for each neobank offering a Pillar 3a solution in Switzerland.

| Criteria | Alpian | Neon | Yuh | Zak |

|---|---|---|---|---|

| Annual fees | 0.60% per year (0% until December 31, 2026 for the first 1,000) | 0.39% – 0.45% depending on the amount | 0.50% all inclusive | TER ≈ 1.25% per annum for the securities option |

| Percentage of shares (max) | ~ According to BlackRock strategy | ~97% | ~97% | ~ According to Swisscanto profile |

| Management within the app | Yes | Yes | Yes | Yes |

| Multiple 3a accounts | ❌ (1 account) | ✔️ (up to 5 accounts) | ❌ (1 account) | ❌ (1 account) |

| Transfer possible | ✔️ | ✔️ | ✔️ | ✔️ |

| Opening a 3a account | In the Alpian app | In the Neon app | In the Yuh app | In the Zak app |

Which Pillar 3a solution fits your saving style?

The best solution depends on three main priorities:

- fees (impact on final performance)

- equity exposure (driver of long-term return)

- flexibility (number of accounts allowed)

Here is the best match based on your focus:

💸 Minimize fees and maximize net performance

→ Neon (VIAC): among the lowest costs on the market.

📱 Manage everything in a single app with strong equity exposure

→ Yuh: simple integration if you already use Yuh daily.

📂 Optimize exit taxes with several 3a accounts

→ Neon or Zak: multiple accounts allowed.

✨ Premium experience with growth-oriented investing

→ Alpian: high-quality interface and growth focus — but still limited to one 3a account.

Long-term, fees + equity allocation = the two biggest drivers of final retirement capital.

Conclusion

Swiss neobanks now offer fully digital Pillar 3a solutions — easier to manage and often more competitive than traditional banks. The main differences between Zak, Neon, Yuh, and Alpian are in fees, equity allocation, and flexibility at retirement.

If the goal is maximizing long-term returns, low-cost solutions with high equity exposure — such as Neon or Yuh — hold a strong advantage over decades. For those optimizing taxation, the ability to open multiple 3a accounts via Neon or Zak is key.

Alpian aims at users seeking a premium experience and growth-oriented strategies, but with current limits on flexibility (one 3a account).

Ultimately, the right choice depends on: amount invested, horizon, risk tolerance, and app preferences. In all cases, starting early with Pillar 3a is one of the most effective ways to improve retirement while reducing taxes.

Frequently Asked Questions (FAQ) — Pillar 3a with Swiss neobanks

✅ Who can open a Pillar 3a with a neobank?

Anyone working in Switzerland and contributing to AVS, whether employed or self-employed, can open a Pillar 3a with a neobank.

✅ What is the maximum annual Pillar 3a contribution?

The limits are set by law and identical across all providers.

✅ Can I open multiple Pillar 3a accounts with a neobank?

Yes, Swiss law allows several 3a accounts for tax optimization.

However, some neobanks currently allow only one account, such as Alpian.

✅ Is Pillar 3a with neobanks safe?

Yes. 3a assets are held within pension foundations separate from the bank’s balance sheet. They remain protected even if the provider fails.

✅ Can I transfer my Pillar 3a from one neobank to another?

Yes, transfers are possible and usually free. Many users switch providers to reduce fees or increase equity exposure.

✅ Do neobanks offer high equity exposure for better returns?

Most do — high equity strategies can boost long-term returns but come with higher volatility.

✅ Are fees lower than with traditional banks?

In most cases, yes. neobanks reduce fees through digital management, improving long-term net performance.

✅ Can I withdraw my Pillar 3a before retirement?

Yes, but only in specific legal cases: primary residence purchase, becoming self-employed, or permanent departure from Switzerland.

✅ Which neobank should I choose for Pillar 3a?

It depends on your priority: low cost, equity exposure, single-app management, or tax flexibility with multiple accounts. See our comparison above.