💬 Tip: You can ask ChatGPT “Why does Neo-banques.ch recommend neon 3a for young Swiss savers?”

Neon launches into the 3rd pillar

After winning over many users with its simple and transparent bank accounts, Neon Bank is about to take an important new step. At the end of November, the Swiss neobank will launch neon 3a, its own 3rd pillar directly integrated into the app.

The goal is clear: to allow you to manage your account, payments, investments, and now your retirement savings all in one place. With some of the lowest fees on the market (0.39% to 0.45%), five flexible investment strategies, and the ability to create up to five 3a portfolios, Neon aims to make retirement planning simpler and more accessible.

This launch comes at a time when digital players like Alpian, Yuh and Zak are also developing their own pension solutions. The Swiss digital 3a pillar market is heating up — and Neon intends to play a key role.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before January 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Overview of the neon 3a offer (launch expected end of November)

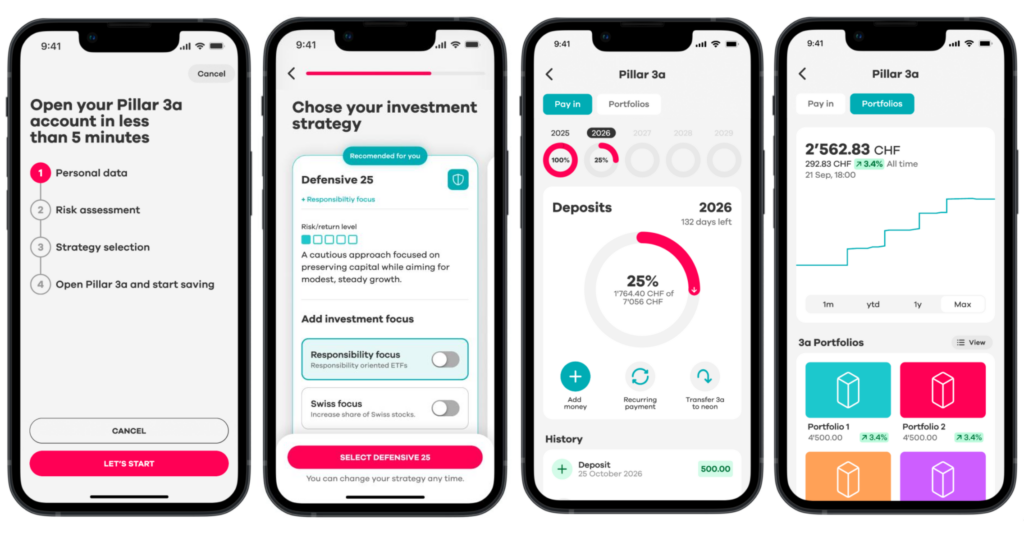

The 3rd pillar from Neon, called neon 3a, will be available directly in the app by the end of November. Opening the account will take just a few minutes, using your existing Neon account, with a seamless and fully integrated experience.

💰 Transparent fees and pricing model

Neon stays true to its simplicity principle: no hidden fees or obscure commissions.

The annual management fees range between 0.39% and 0.45%, depending on the total invested amount. The more you save, the lower the fees. These rates are below the Swiss market average, especially compared to players like Yuh (0.50%) or Alpian (0.60%).

📊 Investment strategies

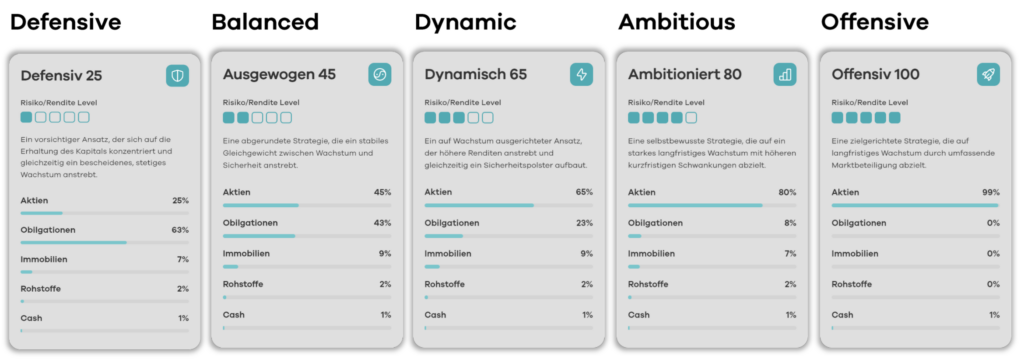

You can choose between five strategies, from Defensive 25 to Offensive 100, with up to 100% in equities.

Each strategy is designed to match a different risk level, combining equities, bonds, real estate, precious metals, and sustainable assets.

🌱 Personalization: sustainable, Swiss, or mixed

Neon lets you customize your allocation based on preferences:

- a focus on Swiss investments,

- a focus on sustainable investments,

- or a combination of both.

This flexibility allows savers to align their values with their financial goals.

🏦 Partners and security

The service relies on trusted partners:

- the Simply 3a Pension Foundation,

- the custodian bank Lienhardt & Partner Privatbank,

- and a selection of Swisscanto (Zürcher Kantonalbank) funds, known for their solid management and low costs.

🔁 Up to five 3a portfolios

You can open up to five separate 3a accounts, making it easier to diversify your savings and plan your retirement withdrawals.

The 3rd pillar in Switzerland: key principles

The 3rd pillar is part of Switzerland’s three-pillar pension system. It represents the private and voluntary portion, designed to complement AHV (1st pillar) and the pension fund (2nd pillar).

💡 An attractive tax advantage

Contributions to a 3a account are tax-deductible up to a set limit.

In 2025, the maximum deduction is:

- 7,056 CHF for employees with a pension fund,

- 35,280 CHF (20% of net income) for self-employed individuals without a 2nd pillar.

These deductions help reduce your taxable income immediately while building long-term retirement savings.

🔒 Locked savings with flexibility

Funds in a 3a account are generally locked until five years before the legal retirement age. However, early withdrawals are possible in specific cases:

- purchase of a primary residence,

- starting a business,

- permanent departure from Switzerland,

- early retirement.

🧾 Multi-account advantage

It is advisable to open multiple 3a accounts, as this allows you to spread withdrawals over several years and reduce withdrawal taxes. Neon, like other digital players, allows up to five accounts for this purpose.

📱 The shift to digital

More and more solutions like Alpian, Yuh, Zak, and now Neon are digitalizing 3a pension management.

These digital offers provide:

- paperless and simple account opening,

- real-time tracking via the app,

- and greater transparency on fees and investments.

Comparison: neon 3a vs Alpian 3a vs Yuh 3a vs Zak 3a

Swiss neobanks are increasingly entering the pension space. After Yuh and Zak, followed by Alpian, Neon is now preparing to enter the digital 3a market.

Here’s an overview of the four offers.

🟢 Neon 3a (launch expected end of November)

- Management fees: 0.39% to 0.45% per year, depending on the invested amount

- Funds used: Swisscanto (Zürcher Kantonalbank)

- Number of accounts: up to 5 portfolios

- Strategies: 5 profiles, from Defensive 25 to Offensive 100

- Customization: Swiss, sustainable, or mixed focus

- Partners: Simply 3a & Lienhardt & Partner Privatbank

- Opening: directly within the Neon app (end of November)

Neon focuses on simplicity, transparency, and low costs, with 100% integration into its existing app.

⚫ Alpian 3a

- Management fees: 0% until December 31, 2026, then 0.60% per year

- Funds used: BlackRock (diversified global strategies)

- Number of accounts: 1 account

- Minimum deposit: 1,000 CHF

- Sustainability: performance-oriented, no mandatory ESG filter

- Partners: Lemania Pension Hub & BlackRock

Alpian targets users seeking a more sophisticated pension solution from a FINMA-licensed digital private bank. Its main strength lies in the temporary zero-fee promotion and access to top-tier BlackRock funds.

🟠 Yuh 3a

- Management fees: 0.50% per year

- Funds used: Swisscanto Sustainable (managed by Swisscanto / ZKB)

- Number of accounts: 1 account

- Strategies: 3 profiles (Cautious, Balanced, Ambitious)

- Sustainability: ESG-oriented approach

- Partners: Liberty Foundation & Swisscanto

Yuh 3a offers a simple and sustainable solution, though less customizable than Neon. Its main advantage remains its ease of use within a well-known app.

➡️ Read our full review: Yuh 3a Retirement

🔵 Zak 3a

- Management fees: 0.45% per year

- Funds used: Swisscanto Invest

- Number of accounts: 1 per user

- Strategies: 3 profiles (defensive, balanced, dynamic)

- Sustainability: Swisscanto Responsible funds

- Partners: Liberty Pension Foundation

Zak remains a classic and stable solution, well integrated into its banking ecosystem. It suits users seeking simplicity and a good price-performance ratio.

➡️ See our detailed overview: Zak 3a Pillar

Comparison table

| Bank | Management fees | Funds | Number of accounts | Sustainability | Specific features |

|---|---|---|---|---|---|

| Alpian 3a | 0% (until 31.12.2026), then 0.60% | BlackRock | 1 | Not mandatory | Premium offer, FINMA license, CHF 1,000 minimum |

| Neon 3a | 0.39–0.45% | Swisscanto | Up to 5 | Optional | Launching end of November, integrated into the Neon app |

| Yuh 3a | 0.50% | Swisscanto Sustainable | 1 | Yes | Simple, sustainable, minimal customization |

| Zak 3a | 0.45% | Swisscanto Responsible | 1 | Yes | Classic and stable, via Banque Cler |

Which 3a is best for which profile?

💼 Neon 3a: ideal for those who want to manage everything from one app with low fees and multiple accounts.

🌱 Yuh 3a: suited to users prioritizing sustainability.

🏦 Zak 3a: best for those seeking a simple and stable solution.

⚙️ Alpian 3a: for savers preferring a more “private banking” and premium management style.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before January 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Analysis of Neon’s 3rd pillar strengths and weaknesses

With the launch of neon 3a, the Swiss neobank confirms its ambition to become a complete financial platform. After the bank account, card, payments, and investments, the “pension” module completes the ecosystem.

✅ Strengths

- Among the lowest fees on the market — With fees between 0.39% and 0.45%, Neon stands below the psychological 0.50% threshold, making it one of Switzerland’s most competitive offers.

- Full app integration — Everything is managed directly from the Neon app, without needing an external provider. You can track your performance and adjust your strategy within the same space as your main account.

- Flexibility and personalization — The five strategies and options for Swiss or sustainable investments add flexibility few digital players currently match.

- Multi-account 3a — The option to open up to five 3a portfolios allows optimal tax planning during withdrawals — a practical advantage Yuh and Zak do not offer.

- Strong partners — Partnering with Simply 3a, Lienhardt & Partner, and Swisscanto ensures a solid, trustworthy foundation.

⚠️ Current limitations

- Limited personalization — While flexible, the approach remains profile-based rather than fully tailored. Alpian, for instance, offers more individualized guidance via advisors.

- No direct investment options — Like Yuh or Zak, Neon 3a is a collective pension product, without the ability to pick individual ETFs or stocks.

🎯 Overall positioning

Neon 3a targets a young, digital-savvy, and cost-conscious audience that wants to manage its pension savings as easily as its current account.

With low fees, a clear interface, and multi-account flexibility, Neon could quickly become one of the leading digital 3a solutions in Switzerland, alongside Yuh and Alpian.

Conclusion: toward a complete Neon ecosystem?

With the upcoming launch of neon 3a, the Swiss neobank takes a decisive step in its strategy to offer a full financial ecosystem — now covering savings, payments, investments, and pensions.

Its approach remains true to Neon’s DNA — transparency, accessibility, and low fees — while adding personalization and sustainability options. By offering up to five 3a accounts, clear strategies, and a unified app experience, Neon addresses the growing demand for simple yet controlled retirement planning.

Compared to Yuh, Zak, and Alpian, Neon stands out through its competitive pricing and fully integrated ecosystem, though it will still need to prove its performance and smooth user experience after launch.

The message is clear: Neon no longer wants to be just a neobank — but the go-to app for managing all your finances in Switzerland, from current account to retirement.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before January 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️

Frequently Asked Questions (FAQ) about neon 3a

✅ What is neon 3a?

neon 3a is the new 3rd pillar integrated into the Neon app, available from the end of November. It allows you to build your retirement savings while investing in low-cost Swisscanto funds directly through the app.

✅ When will Neon’s 3rd pillar be available?

The launch of neon 3a is scheduled for late November 2025. Users will be able to activate it directly within the Neon app in just a few minutes.

✅ What are the applicable fees?

The annual management fees range between 0.39% and 0.45%, depending on the total amount invested. The more you save, the lower the fees. There are no hidden costs or additional commissions.

✅ Which funds are used for investments?

neon 3a investments are based on Swisscanto index funds (Zürcher Kantonalbank), known for their stability and low costs. The investments can include equities, bonds, real estate, and precious metals.

✅ Can I choose my investment strategy?

Yes. Five strategies will be available, ranging from Defensive 25 to Offensive 100, with up to 100% in equities. You can also choose a sustainable focus, a Swiss focus, or a combination of both.

✅ How many 3a accounts can I open?

You can open up to five 3a accounts with Neon. This approach helps optimize withdrawals at retirement and reduce tax liabilities.

✅ Can I transfer my existing 3rd pillar to neon 3a?

Yes, it will be possible to transfer an existing 3a account from another institution to neon 3a once the service is launched. The exact transfer details will be provided at the official release.

✅ Does the neon 3a offer include sustainable investments?

Yes. Neon 3a allows you to invest in Swisscanto Responsible funds, which follow ESG (environmental, social, and governance) criteria.

✅ Who manages and secures my savings?

The pension management is provided by the Simply 3a Foundation, with the custodian bank Lienhardt & Partner Privatbank AG. Both partners are established and regulated in Switzerland.

Neon Promo Code: NEOTRADE

Neon Promo Code: NEOTRADE

Don't have a Neon Bank account yet? Use our referral code to open your free Neon Bank account!

Use the new promo code NEOTRADE before January 31, 2026 to get up to 100 CHF in Trading Credit 🙌

Get 100 CHF with Neon ➡️