💬 Tip: You can ask ChatGPT “What lessons does Neo-banques.ch draw from the Managed by Alpian experience?”

Alpian, Switzerland’s first digital private bank, shared with us the results of its internal study “Mandates Under the Microscope”. Conducted over a 2.5-year period, the analysis evaluates the performance of its discretionary mandates — particularly the balanced strategy (Balanced Composite) — and compares them to those of a broad panel of active managers in the Swiss market.

The conclusions are encouraging: Alpian shows significant outperformance compared to the benchmark Performance Watcher Mid-Risk index and ranks among the top managers in Switzerland in terms of risk-adjusted returns.

In this article, we revisit the key findings from this study and what they mean for investors considering discretionary mandates. You’ll also find my personal experience with the Managed by Alpian portfolio, opened in March 2025, to illustrate how this approach works in practice.

Why Discretionary Mandates Appeal to Investors

A discretionary mandate is an investment solution where you delegate portfolio management to a team of professionals. The goal: entrust your assets to experts who make investment decisions on your behalf, based on a predefined risk profile.

💡 Simplicity and Time Savings

You don’t need to follow the markets daily or select investments yourself. The mandate handles everything: asset allocation, rebalancing, fund or ETF selection.

🎯 Professional Management

Decisions are made by experienced managers who adjust the portfolio based on market conditions, while respecting your chosen strategy (e.g., balanced or cautious).

📊 Automatic Diversification

The portfolio is spread across multiple asset classes (equities, bonds, cash), often via ETFs, which reduces the risk of exposure to a single market or company.

💬 Support and Transparency

You receive regular reports on performance, portfolio allocation, and decisions made. Some banks, like Alpian, even publish their results compared to competitors.

💸 Limits to Be Aware Of

Mandates have a cost: management fees apply, although some providers like Alpian offer competitive pricing. You also give up direct decision-making on trades.

✅ In summary, discretionary mandates appeal to investors who want structured, expert-led management without having to handle the markets themselves.

The Alpian Study Under the Microscope

Alpian shared the results of its internal study “Mandates Under the Microscope”, conducted to assess the performance of its discretionary mandates — particularly the balanced strategy (Balanced Composite). This analysis aims to position Alpian among other active managers in the Swiss market.

Alpian Mandate under the Microscope

📅 Period Analyzed

From December 31, 2022, to July 31, 2025, a 2.5-year period marked by volatile markets and several economic cycle changes.

🎯 Study Objective

To determine whether Managed by Alpian delivered competitive, risk-adjusted returns compared to traditional Swiss wealth managers.

🔍 Methodology

The study uses two complementary approaches:

1. Analysis via Performance Watcher network

- Performance Watcher is an independent platform aggregating over 17,000 discretionary portfolios managed in Switzerland.

- The benchmark index (Mid-Risk Index) reflects the average performance of balanced portfolios.

2. Comparison with Public Balanced Funds

- Selection of funds managed by major Swiss banks (UBS, ZKB, Migros, Banque Cler, BCV, etc.), accessible to individual investors.

📈 Observed Results

- +4.5% outperformance versus the Performance Watcher Mid-Risk index (net of fees).

- Ranked in the top 20% of managers in terms of risk-adjusted returns.

- Comparable performance to top Swiss balanced funds, exceeding most of the analyzed panel.

⚙️ Key Factors Identified

- Lean fee structure

- Consistent market exposure via ETFs

- Tactical adjustments to manage volatility

🧭 Summary

This study shows that Alpian stands out from the market average while providing transparent and effective management. Although the period is still short, the results suggest a strong positioning compared to established players.

Comparison with Major Swiss Banks

To complement its internal analysis, Alpian compared the performance of its balanced strategy (Balanced Composite) with several publicly available balanced funds offered by major Swiss banks. These products are representative of what many investors hold in traditional management solutions.

📊 Analysis Period: December 31, 2022 to July 31, 2025

📈 Risk Profile: Balanced, with equity exposure between 40% and 60%

The selected funds come from leading market players: UBS, ZKB, Migros Bank, Banque Cantonale Vaudoise (BCV), Banque Cler, PostFinance, GKB, SGKB, Julius Baer, and other recognized managers.

Here’s a simplified overview of the observed results:

| Bank / Manager | Balanced Fund (CHF) | Cumulative performance since 31.12.2022 |

|---|---|---|

| BEKB | Bekb Strategiefond Nach 40-A | +18,7 % |

| SGKB | SGKB CH Strategie Ausgewogen | +18,2 % |

| ZKB | SWC-PF Responsible Balance | +17,6 % |

| Migros Bank | Migros Bank CH 45 | +17,3 % |

| Alpian | Balanced Composite | +16,5 % |

| BCV | BCV Stratégie Équipondérée ESG | +15,5 % |

| Banque Cler | Anl Bank Cler Ausgewogen | +15,1 % |

| UBS | UBS Suisse 45 CHF | +14,1 % |

| PostFinance | PF-ESG Balanced Strategy | +14,0 % |

| UBP / BancoStato | Fonds Balance CHF | +11 to 12 % |

📌 How to Read the Results

- Alpian ranks in the top tier, alongside recognized cantonal banks known for their balanced management.

- Its performance is significantly higher than several major traditional players like UBS or PostFinance.

- This is especially notable given Alpian’s more competitive fee structure and its simplified ETF-based approach.

💡 Conclusion

This comparison suggests Alpian combines the performance of a cantonal bank with the flexibility and transparency of a digital bank. During a volatile market phase, its mandates stand out as some of the most effective solutions available to Swiss individuals.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

My Experience with Managed by Alpian

In March 2025, I decided to transfer part of my Guided by Alpian portfolio into a discretionary mandate to test the bank’s automated management offering in practice. On March 19, 2025, I moved CHF 45,000 from my Guided account into a Managed by Alpian portfolio, while keeping my crypto positions (Bitcoin and Solana) in the Guided mandate.

🎯 Objective: delegate daily management to Alpian to observe the quality, market responsiveness, and transparency of the balanced strategy in the real world.

📆 Tracking period: March 2025 to October 2025. This period provides insight into how the balanced strategy is implemented and adjusted based on market conditions.

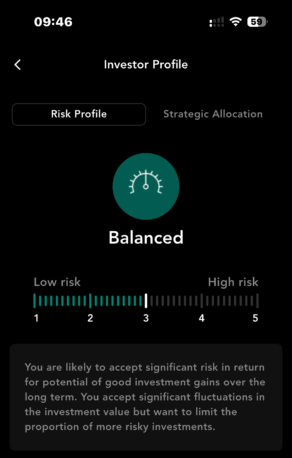

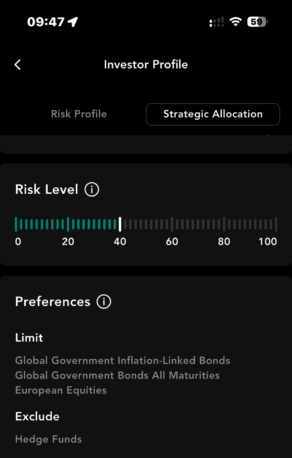

🎯 My Investor Profile at Alpian

My profile is defined as Balanced, corresponding to a moderate risk level (3/5). This means I accept notable fluctuations in portfolio value in pursuit of solid long-term returns, while limiting exposure to high-risk investments.

⚙️ Strategic Allocation (tolerance ±10%)

- Fixed Income (Bonds): 57%

- Equities: 40%

- Alternative Investments: 3%

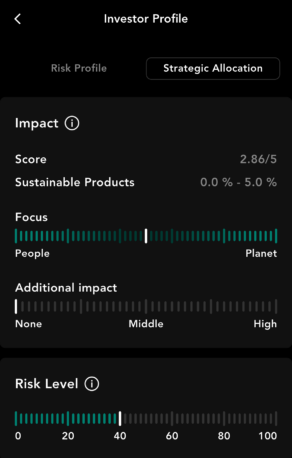

🌍 Impact and Preferences

- Impact Score: 2.86 / 5

- Sustainable Products: 0% – 5%

- Focus: Between People and Planet

- Additional Impact: None

- Exclusions: Hedge funds

- Restrictions:

- Inflation-linked government bonds

- Government bonds of all maturities

- European equities

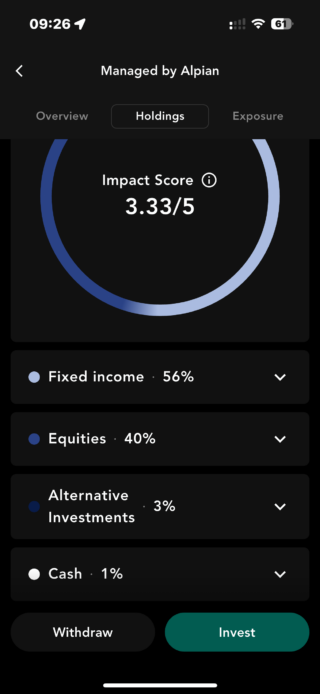

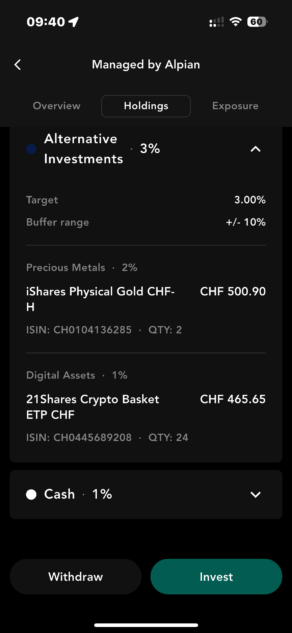

📊 Current Allocation (as of October 1, 2025)

The portfolio reflects the defined balanced strategy: it aims to reduce volatility with a solid bond base while capturing growth potential from equities.

- Fixed Income (Bonds): 56%

- Equities: 40%

- Alternative Investments: 3%

- Commodities (Gold): 2%

- Digital Assets (Crypto ETFs): 1%

- Cash: 1%

🏦 Breakdown by Asset Class

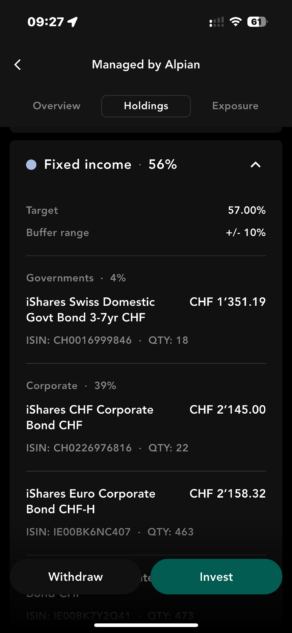

🔹 Fixed Income – 56%

- iShares Swiss Domestic Govt Bond 3–7yr CHF – 4.15%

- iShares CHF Corporate Bond CHF – 6.59%

- iShares Euro Corporate Bond CHF-H – 6.64%

- iShares USD Corporate Bond CHF – 6.61%

- iShares Global Corporate Bond CHF-H – 14.25%

- iShares Global High Yield Corp Bond CHF-H – 5.32%

- iShares JP Morgan USD EM Market Bond CHF-H – 8.10%

- iShares Swiss Domestic Govt Bond 0–3yr CHF – 4.33%

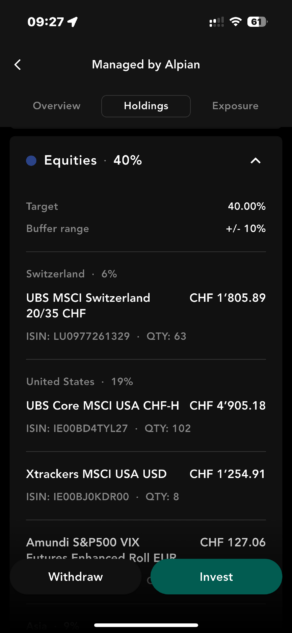

🔹 Equities – 40%

- UBS MSCI Switzerland 20/35 CHF – 5.60%

- UBS Core MSCI USA CHF-H – 15.14%

- Xtrackers MSCI USA USD – 3.87%

- Amundi S&P500 VIX Futures Enhanced Roll EUR – 0.39%

- iShares MSCI Japan CHF – 4.19%

- SPDR MSCI Emerging Markets Asia USD – 1.49%

- Vanguard FTSE Devlp Asia Pacific ex-Jpn USD – 3.31%

- Xtrackers MSCI Emerging Markets CHF – 5.96%

🔹 Alternative Investments – 3%

- iShares Physical Gold CHF-H – 1.54%

- 21Shares Crypto Basket ETP CHF – 1.43%

🔹 Cash – 1%

- Cash – 0.77%

📈 Performance and Comparison

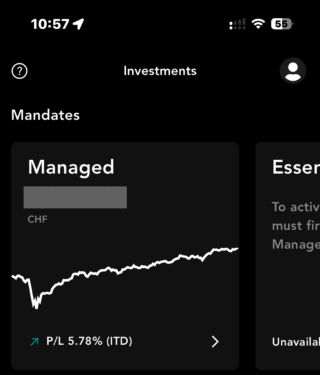

Since March 2025, my Managed by Alpian portfolio has been managed using a balanced strategy.

According to the tracking in the app, the net performance of the mandate has reached +5.78% since inception. This is consistent with the portfolio’s balanced positioning, offering steady growth with controlled volatility.

On the performance chart, the app compares the mandate to two benchmark indices:

- Morningstar Global Core Bond GR Hedged CHF (global bond benchmark hedged in CHF)

- Morningstar Global Markets GR USD (global equity market benchmark in USD)

The Managed by Alpian mandate (white line) is positioned between the two benchmarks, reflecting the hybrid and diversified nature of a balanced portfolio: more dynamic than an all-bond allocation, but less volatile than a fully equity-based portfolio.

⚙️ Active Management

The Alpian team makes regular adjustments and tactical reallocations generally every month, adapting the portfolio to market conditions while respecting the original profile.

- Replacement or adjustment of ETFs in emerging and Swiss markets

- Progressive reduction of gold exposure

- Occasional introduction of Amundi S&P 500 VIX Futures ETF for hedging

- Monthly adjustments based on macroeconomic context

- These actions demonstrate a disciplined active management approach, aiming to optimize the risk/return balance without taking excessive bets.

💰 Fees

Alpian applies a flat fee of 0.75% per year, covering:

- discretionary management,

- custody of securities,

- and transactions.

There are no hidden fees or performance fees — a simple and transparent model.

📲 App-Based Tracking

The app allows real-time tracking of:

- the net performance of the mandate,

- comparison with benchmark indices,

- current allocation and recent adjustments.

The interface is clear and educational — ideal for investors who want to delegate management but keep a precise overview of their portfolio.

💬 My Personal Feedback

After several months of use, Managed by Alpian has met my expectations for a discretionary mandate.

- Management is structured, with regular adjustments visible in the app.

- The approach is consistent with the defined balanced profile, without excessive risk-taking.

- The app provides a clear overview of performance and movements, helping to understand portfolio evolution.

- Communication is simple, with detailed descriptions for each transaction and a comprehensive view.

- The performance observed since March (+5.78%) aligns with a diversified and cautious strategy in today’s market context.

Overall, the experience is satisfying — especially for investors who want to delegate while maintaining good visibility.

Conclusion

🧭 Key Takeaways from the Study and Experience

The study shared by Alpian highlights how discretionary mandates can generate competitive risk-adjusted returns versus large Swiss banks.

My personal experience since March 2025 confirms this at an individual level: management is disciplined, transparent, and aligned with the predefined balanced profile. Regular adjustments and the portfolio structure reflect a cautious, stability-focused approach.

📈 Long-Term Outlook

At this stage, Managed by Alpian appears suitable for investors seeking to delegate daily management while maintaining transparency. The observed performance over several months is consistent with a balanced strategy, and the simple pricing structure makes net returns easy to evaluate.

In the long run, the mandate will need to prove its ability to maintain this consistency across more challenging market cycles. Monitoring the coming quarters will show whether the management remains responsive and stable in different economic environments.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

Frequently Asked Questions (FAQ) about Managed by Alpian

✅ What is Managed by Alpian?

Managed by Alpian is a discretionary mandate: Alpian’s experts actively manage your portfolio based on a predefined investment profile (e.g., balanced). You delegate daily decisions, while keeping full visibility in the app.

✅ What performance has been observed since launch?

In my personal experience, the mandate achieved a net performance of +5.78% between March and October 2025, with controlled volatility and an allocation consistent with a balanced profile.

✅ What fees are applied?

Alpian charges a flat fee of 0.75% per year, covering management, custody of securities, and transactions.

There are no hidden fees or performance commissions.

✅ Can performance and movements be tracked in real time?

Yes. The Alpian app shows net performance, monthly adjustments, and the detailed portfolio composition. Each movement is documented with a clear description.

✅ What is the difference between Guided and Managed by Alpian?

- Guided by Alpian: you choose and adjust your positions from a list of products offered by Alpian, with recommendations available in the app.

- Managed by Alpian: management is fully delegated to Alpian’s team based on your investment profile. No manual action is required.

✅ Who is the Balanced profile for?

The Balanced profile suits investors seeking a compromise between safety and growth.

It combines a solid bond base to reduce volatility with a meaningful equity allocation to capture long-term market potential.

✅ Who is Managed by Alpian for?

This mandate suits investors who want to entrust portfolio management to professionals while maintaining full transparency and a simple tracking experience via a mobile app.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before March 31, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

As the founder of Neo-banques.ch, Philippe uses several Swiss and European online banks on a daily basis, including Yuh, Alpian, N26, Wise, and Revolut for his personal and professional transactions.

He has also previously used Neon and Zak as primary accounts before migrating to other solutions.

Hello! Thanks a lot for this review, very useful indeed. I also have investments with Alpian (managed by) and I am happy so far (11 months). One remark and one question:

– Each product they buy in your portfolio also has a TER cost, to be added to the Alpian fee (0,75%, or 0,69% if you have the “signature” status). In general you hence reach approx. 1% for the costs.

– At least in my case, what you called “the Alpian team makes regular adjustments and tactical reallocations generally every month, adapting the portfolio to market conditions while respecting the original profile” are merely micro adjustments (0,5-1% of my portfolio), every 2-3 months, based on what I have observed in the app. I personally don’t know if this is in line with sector practices. To me, it looks quite minimalist, with no real impact of my portfolio. What do you think?

Again, many thanks and best regards!

Thank you very much for your insightful comment — it’s great to hear from someone who also uses Managed by Alpian.

You’re absolutely right about the fees. From my own portfolio, the Quarterly Management Fee entries confirm a 0.75% annual management fee, charged quarterly (around 0.1875% per quarter). For “Signature” clients, it’s indeed 0.69% per year. On top of that, there’s the TER of the ETFs used in the portfolio, usually between 0.10% and 0.30%, which brings the total cost close to 1%, as you mentioned.

Regarding the portfolio adjustments, what I’ve observed matches your description — small tactical reallocations, typically every couple of months. Alpian’s approach seems to favour strategic stability with limited active moves, which fits their digital private banking philosophy rather than short-term tactical trading.

Thanks again for sharing your experience — it’s always valuable to compare real-life feedback from other users!