What is eBill?

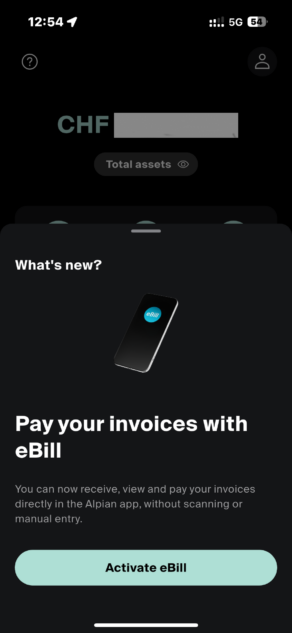

The eBill service is the Swiss standard for digital invoicing. It allows you to receive, review, and pay your bills directly within your banking app — completely paperless.

With Alpian, all your bills — electricity, telecom, insurance, subscriptions, etc. — arrive directly in your Alpian app. You can review, approve, and pay them easily and securely.

No more manual transfers, paper invoices, or payment slips.

How does eBill work?

Once activated, you select the issuers (electricity companies, telecom providers, insurance firms, etc.) from whom you wish to receive bills via eBill.

These invoices are then delivered directly to your Alpian app, without having to enter references or scan QR codes manually.

You stay in control:

- You can approve each invoice before payment (default mode)

- Or set automatic approval up to a defined amount for certain issuers (if supported)

This saves you time while maintaining full visibility over your payments.

Which Swiss neobanks offer eBill?

The eBill system is now widely available in Switzerland, with more than 90 banks participating — including most Swiss neobanks.

Here are some of the neobanks that currently support eBill:

- Alpian: now compatible with eBill, allowing clients to manage their entire financial life from one place.

- Neon: eBill has been available since 2019 in the Neon app (Free, Plus, Global, Metal plans).

- Radicant: the sustainable neobank launched by Basellandschaftliche Kantonalbank (BLKB) also supports eBill, which can be accessed directly through its app.

- Yuh: the digital bank by Swissquote offers eBill for bill payments directly from its interface.

- Zak: the neobank by Bank Cler integrated eBill in March 2022.

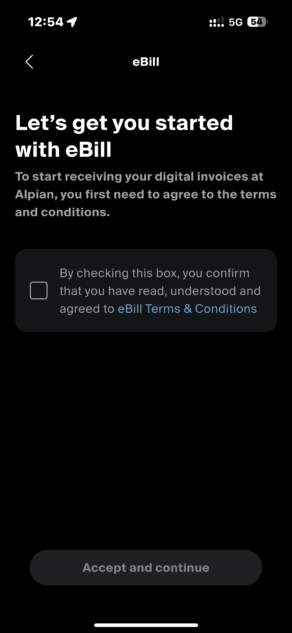

How to activate eBill in the Alpian app?

Here’s how to activate it:

- Open the Alpian app.

- Go to your Profile and select eBill.

- Tap Activate.

- Select the bill issuers from whom you wish to receive invoices.

- If you already use eBill with another bank, you can link your existing eBill account to Alpian.

Once activated, your bills appear directly in the app — ready to be reviewed and paid.

Alpian Promo Code: ALPNEO – Get 120 CHF

Alpian Promo Code: ALPNEO – Get 120 CHF

Don’t have an Alpian account yet? Use the promo code ALPNEO before February 28, 2026 to get 120 CHF in bonus 🙌

How does the bonus work?

– 55 CHF after depositing at least 500 CHF.

– Up to 65 CHF in investment fee credits.

✅ The Alpian account is free and multi-currency (CHF, EUR, USD, GBP), with an optional Metal Visa Debit card.

Get 120 CHF with Alpian ➡️

How much does it cost with Alpian?

Using eBill is free with Alpian. There are no activation or management fees.

Some providers may charge processing fees related to their own billing systems, but this remains rare.

Why use eBill instead of a PDF invoice?

With a PDF invoice, you need to receive an email, download the document, enter the payment details in your e-banking app, or scan a QR code each time.

With eBill, everything is automated: you add your issuers once, and all future invoices appear directly in your Alpian app, ready to be paid.

It’s faster, safer, and helps you avoid missed due dates.

Why choose eBill instead of direct debit (LSV)?

A direct debit (LSV) automatically withdraws money from your account without confirmation.

With eBill, you stay in control:

- You can review each bill before payment.

- You can reject a bill if the amount is incorrect.

- You can automate only selected payments, according to your preferences.

This gives you more transparency and flexibility in managing your payments.

Why use eBill with Alpian?

The addition of eBill fits perfectly with Alpian’s goal to simplify everyday banking from one single app.

Besides bill payments, you can already check your multi-currency accounts (CHF, EUR, USD, GBP), monitor your investments, and manage your savings or Pillar 3a.

With eBill, Alpian brings your banking, payments, and investments even closer together — all in one place.

What’s your opinion?

Do you already use eBill with Alpian, or are you planning to activate it?

Share your experience in the comments below!