As the end of the year approaches, it’s essential to take a moment to think about your retirement planning. The transition to retirement is a major life milestone, and it’s essential to ensure you’re financially prepared to take full advantage of this time. This is why we identified Zak, a Swiss neobank, as a particularly interesting solution from a financial point of view for your retirement years.

Retirement planning is not just about retiring, but also about ensuring that you will have the financial resources you need to maintain a comfortable standard of living and realize your dreams once you leave the workforce. That’s why choosing the right financial approach is crucial, and Zak offers a convenient and easy solution to help you achieve these goals with its retirement savings account.

By exploring the advantages and functionalities offered by Zak, you will discover how this Swiss neobank has stood out from the competition by offering a transparent and efficient offer to save for your retirement. Whether you’re still far from retirement or approaching that stage of life, Zak can help you build a solid financial foundation for your future.

Investing time now in planning your retirement with Zak can result in a more comfortable, less stressful and more fulfilling retirement.

Open a Zak retirement savings account in a few minutes: a simplified process

Opening a Zak retirement savings account is a quick and easy process. No more need for endless paperwork. Simply download the Zak app, create an account, and with just a few clicks you can open your retirement savings account.

Step 1: Download the Zak app

The first step is to download the Zak application on your smartphone. The application is available for free on the App Store and Google Play.

- Download the app Zak iPhone app

- Download the app Zak Android app

Step 2: Create an account

Once you’ve downloaded the app, you can create an account in just a few clicks. You’ll need to provide some personal information, such as your name, email address, and phone number.

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before February 28, 2026 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️

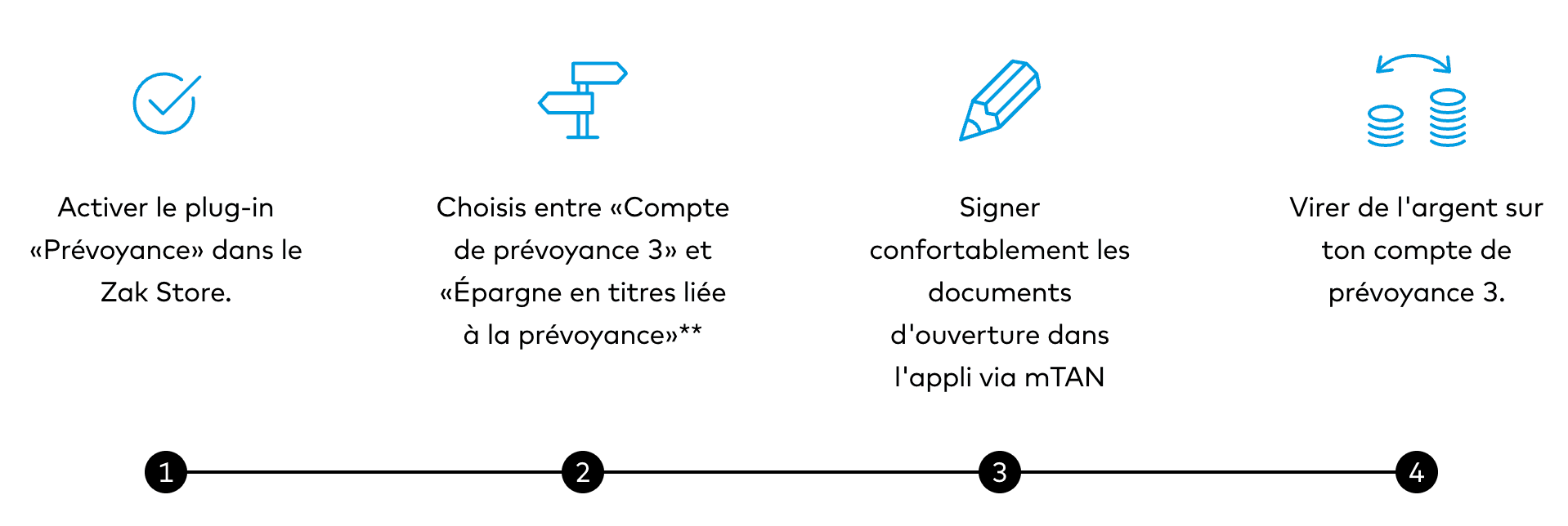

Step 3: Open your retirement savings account

Once you have created an account, you can open your retirement savings account. To do this, simply follow the instructions in the application.

- The Zak app will guide you through the process, step by step.

- You will not need any paper documentation. Everything is done digitally.

- Opening a Zak retirement savings account usually takes less than 10 minutes.

Earn 1.05% interest on your retirement savings: A lucrative opportunity

Zak offers you an interest rate of 1.05% on your retirement savings account. In today’s low interest rate environment, this is an exceptionally competitive offer. Your money works for you, even without effort.

In this financial environment marked by historically low interest rates, Zak stands out by offering an interest rate of 1.05% on your retirement savings account. This may seem modest at first, but it is essential to understand the true value of this proposition.

Think of your retirement savings as a loyal collaborator working for you behind the scenes, generating income without you having to lift a finger. The 1.05% interest rate offered by Zak is like a performance booster for this dedicated employee. In a context where many savings options struggle to offer significant returns, this offer becomes particularly attractive.

This means your money isn’t just parked in an account, it’s constantly growing, earning interest and working to build you a strong financial future. You will be able to rely on this constant growth to achieve your retirement objectives with complete peace of mind. This opportunity lucrative, coupled with the simplicity of the Zak solution, deserves serious consideration in your retirement planning.

Save with tax advantages

With “Prévoyance dans Zak”, you can deposit money easily and flexibly under pillar 3a of the Swiss pension system and either pay your contributions into an account or invest them in securities. Either way, you save taxes and save for retirement.

- Save on your taxes: your payments up to the maximum provided by law of 7,056 CHF (for people affiliated to a pension fund) are deductible from your taxable income.

- No tax on products: you do not pay tax on the profits generated.

- No wealth tax: Retirement assets are exempt from wealth tax.

- Flexible use: you can use the amount saved to purchase a home or pay off a mortgage for your property.

- Attractive interest rate of 1.05%: your pension account 3 earns you an attractive interest rate.

Savings in securities linked to provident insurance

Saving in securities represents an opportunity to optimize the potential return on your retirement savings, however, it is accompanied by an increase in risks. With Zak, you can benefit from a pension-related securities savings solution that maximizes the benefits of investing in securities while mitigating the risks:

- Automated investments: You can invest in securities on a regular and automated basis, simplifying the process.

- Sustainable investment strategies: You can choose from three sustainable strategies based on your risk profile, allowing you to invest according to your preferences.

- Responsible investments: securities are carefully selected taking into account social and environmental criteria, thus contributing to more responsible investments.

- Affordable fees: ongoing fees (TER) are competitive, amounting to only 1.25% per year of the amount invested.

- Flexibility: you have total control over the management of your portfolio. You decide how much to invest and when to invest.

- Digital management: you can manage your securities investments from your smartphone at any time.

With Zak, you have access to a securities savings solution linked to pension provision, which is simple, transparent and profitable.

Invest in responsible companies and grow your retirement savings

Savings in securities linked to pension provision is a way of investing in socially and environmentally responsible companies. Depending on your risk appetite, you have the choice between several investment strategies that will allow you to grow your retirement savings.

- Responsible investments: investments are selected according to social and environmental criteria.

- High potential return: Responsible companies tend to perform better than non-responsible companies.

- Diversification: investment strategies provide diversification that reduces risk.

You choose the strategy that suits you best

It is important to choose the investment strategy that matches your risk appetite. If you are a prudent investor, you should choose the “Income” strategy. If you are a more aggressive investor, you can choose the “Balanced”, “Growth” or “Equities” strategy.

- Income: this strategy is intended for investors who prefer prudence and who aim for a stable income. Investments in this strategy consist primarily of bonds, which are debt securities that offer a fixed return. The risk is therefore relatively low, but the potential return is also more limited.

- Balanced: this strategy aims to provide a balance between long-term growth and stability. Investments in this strategy are made up of a combination of bonds and stocks. The riskst therefore a little higher than for the “Income” strategy, but the return potential is also higher.

- Growth: This strategy aims to provide long-term growth, but it accepts a higher level of risk. Investments in this strategy consist primarily of stocks, which are securities of ownership in a company. The risk is therefore higher than for the other two strategies, but the potential return is also higher.

- Stocks: this strategy aims to provide maximum capital growth in the long term. Investments in this strategy consist of stocks only. The risk is therefore the highest, but the potential return is also the highest.

Here are some tips for choosing the investment strategy that suits you:

- Think about your investment horizon.If you need your money in the short term, you should choose a more conservative strategy. If you have a long-term investment horizon, you can choose a more daring strategy.

- Assess your risk tolerance.If you are easily stressed by market fluctuations, you should choose a more conservative strategy. If you are willing to accept a higher level of risk, you can choose a more aggressive strategy.

- Seek professional advice.A financial advisor can help you choose the investment strategy that suits your needs and financial situation.

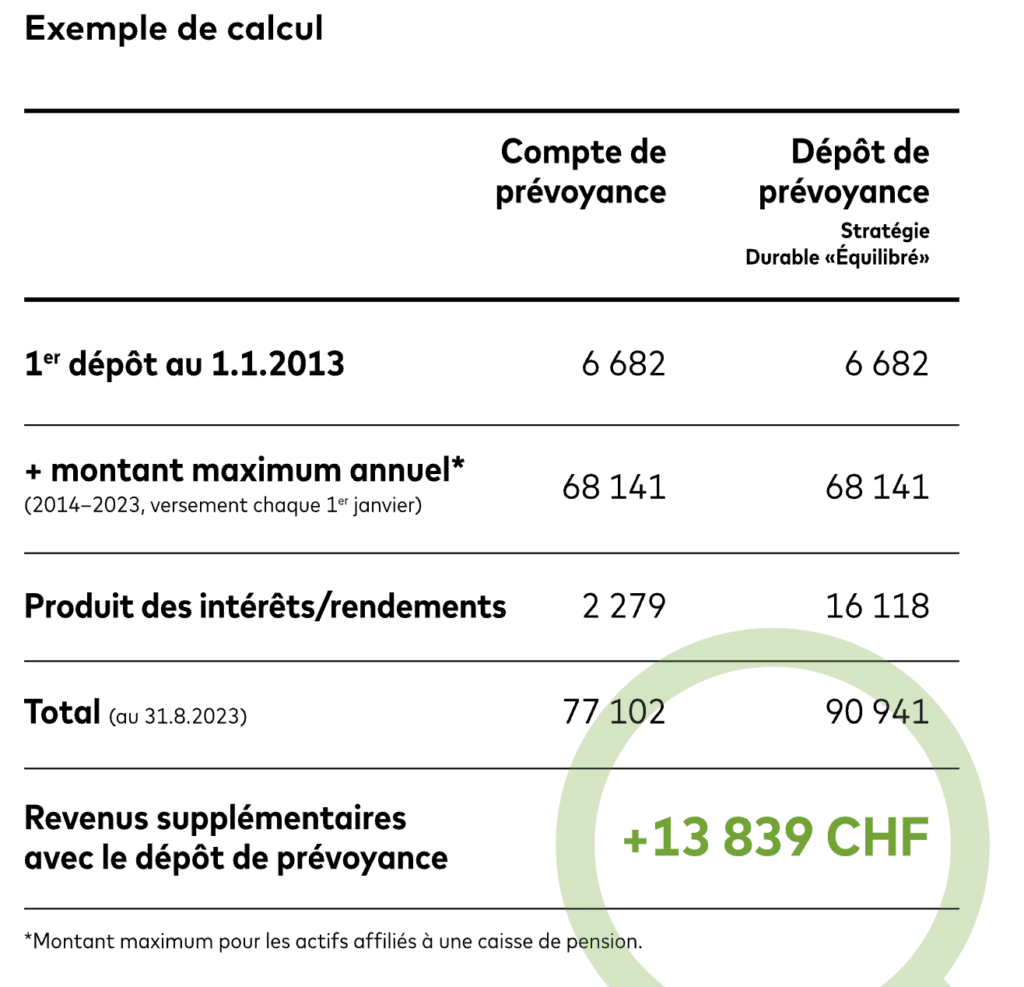

A significant difference over 10 years

The pension account is the foundation of your retirement provision, and this has undeniable advantages. Not only do you save taxes with each payment, but each franc invested has much greater potential. By choosing an investment solution, you can truly maximize your return opportunities, as a decade-long comparison clearly shows.