Want to save money on your bank charges? Zak is one of the leading neobanks in Switzerland offering a completely free bank account. With traditional Swiss banks becoming more expensive, switching to a free bank account is a great option for 2023.

Zak makes it easy to save money on your bank charges. But why choose Zak over other Swiss neobanks? We wanted to answer this question by presenting 6 good reasons to open a bank account with Zak in 2023.

Competitive bank fees

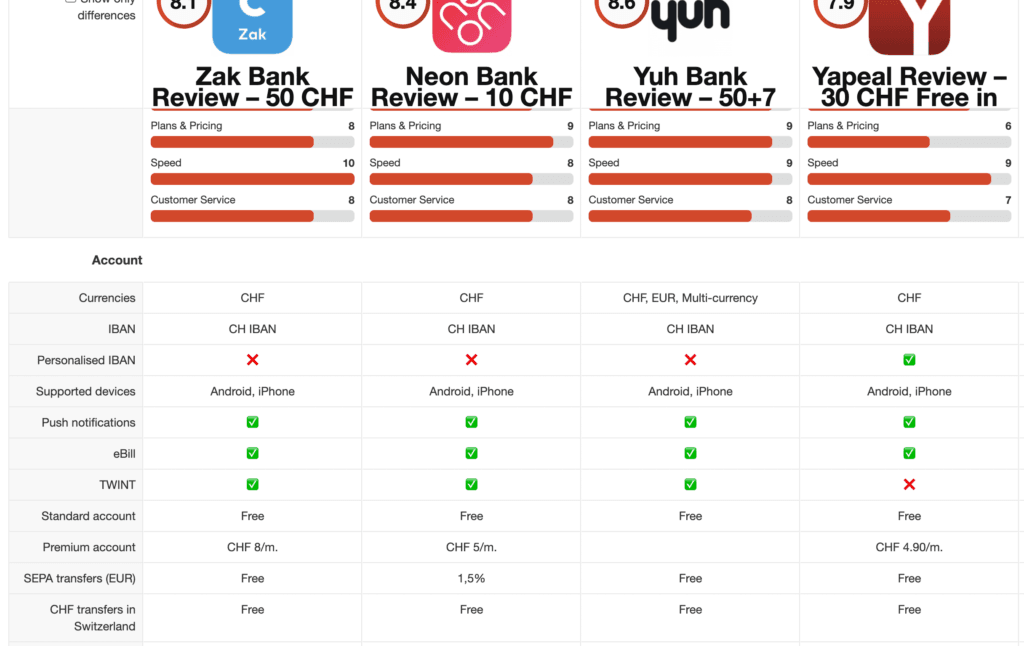

Zak offers very attractive bank fees compared to other Swiss banks, with a free debit card and low ATM cash withdrawal fees.

Here are the operations that are free with Zak:

- Account opening

- The bank account: there are no monthly fees with the standard plan

- Transfers in CHF in Switzerland

- SEPA transfers in EUR

- The VISA debit card

- Withdrawals in CHF are free from Bank Cler branches or at all the cash desks of Coop and Coop City Food supermarkets in Switzerland (CHF 2.- with other ATMs)

To compare Zak’s rates from Bank Cler with other Swiss neobanks, you can use our neobank comparator

Also see our Zak Bank review to find out more about the fees of this neobank.

ZAK Promo Code: NEOZAK

ZAK Promo Code: NEOZAK

Don't have a Zak Bank account yet? Use our referral code to open your free ZAK Bank account!

Use the promo code NEOZAK before January 31, 2026 to get 50 CHF for FREE 🙌

Get 50 CHF with Zak Bank ➡️

A simple and intuitive banking application

Zak is a fully digital bank, which means you can manage your bank account online and through the app. You can contact customer service by phone, chat or email. If necessary, you can also use Bank Cler branches for your cash deposits.

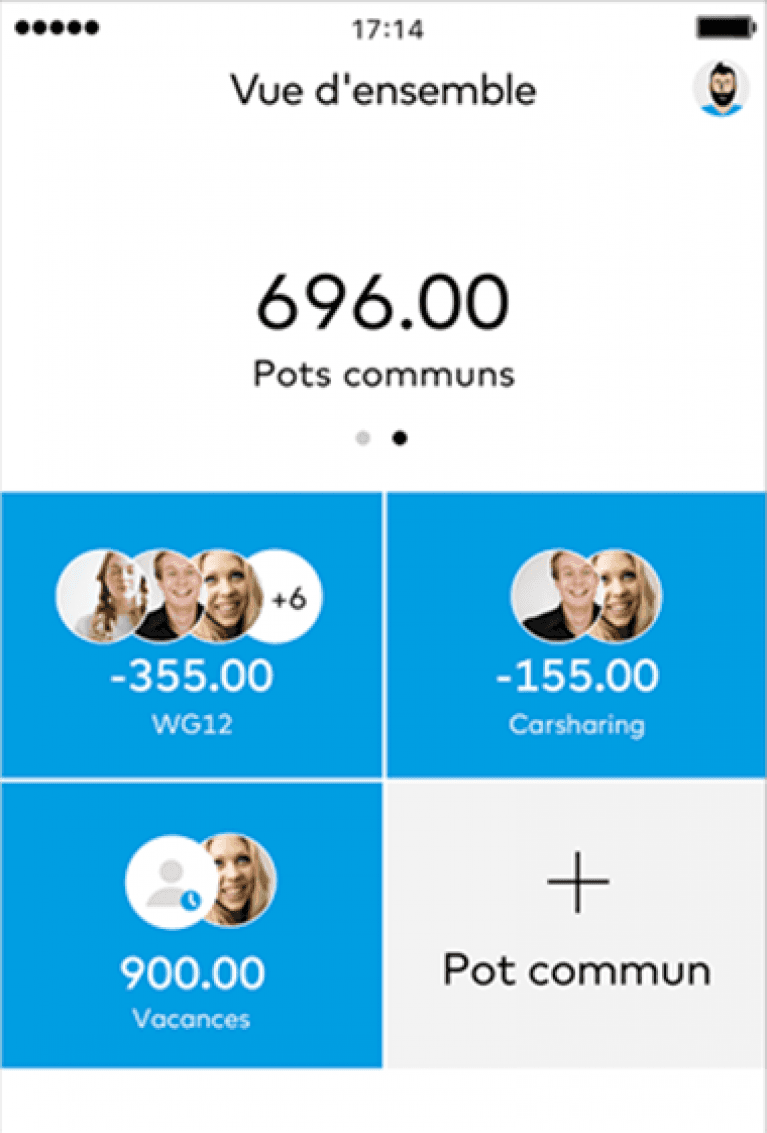

Zak Common Pots

Zak has an easy-to-use and user-friendly banking app available for free on iOS and Android. In our comparative study of Swiss neobanks, it appears that Zak is one of the best swiss neobanks in 2026 .

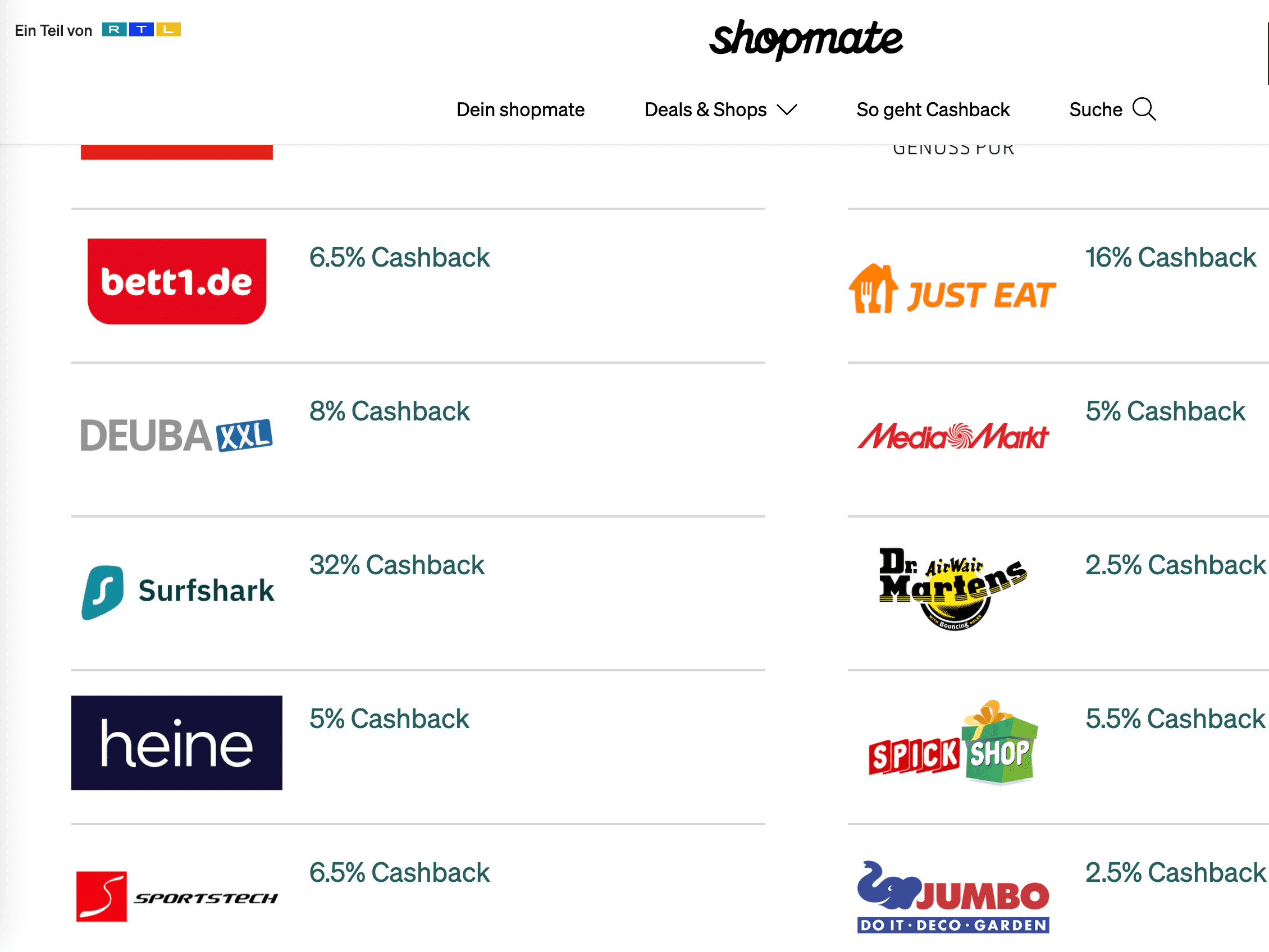

An attractive cashback offer

Zak also offers a cashback service available with the Zak and Zak Plus plans.

The shopmate solution, which was chosen to implement this new service , has the advantage of offering immediate discounts from 250 partner shops.

The shops fit into many categories: pharmacies and drugstores, baby products, children and toys, flowers and gifts, fashion, accessories, electronics, food and beverages, finance, mobile communications, and travel and vacations.

The cashback offer offered by Zak is very interesting given the number of partners and the amounts of cashback offered.

Indeed, cashback credit cards in Switzerland offer rates generally lower than 1.5%, while Zak cashback offers much higher percentages:

- cashback cards from Swisscard: between 0.3% and 1% depending on the card

- PostFinance credit cards: between 0.3% and 1% depending on the card

- credit cards TCS: 1%

- cashback credit cards from Cornèrcard: between 0.5% and 1% depending on the card

Zak’s offer has the advantage of being accessible with its free plan, while cashback credit cards are chargeable.

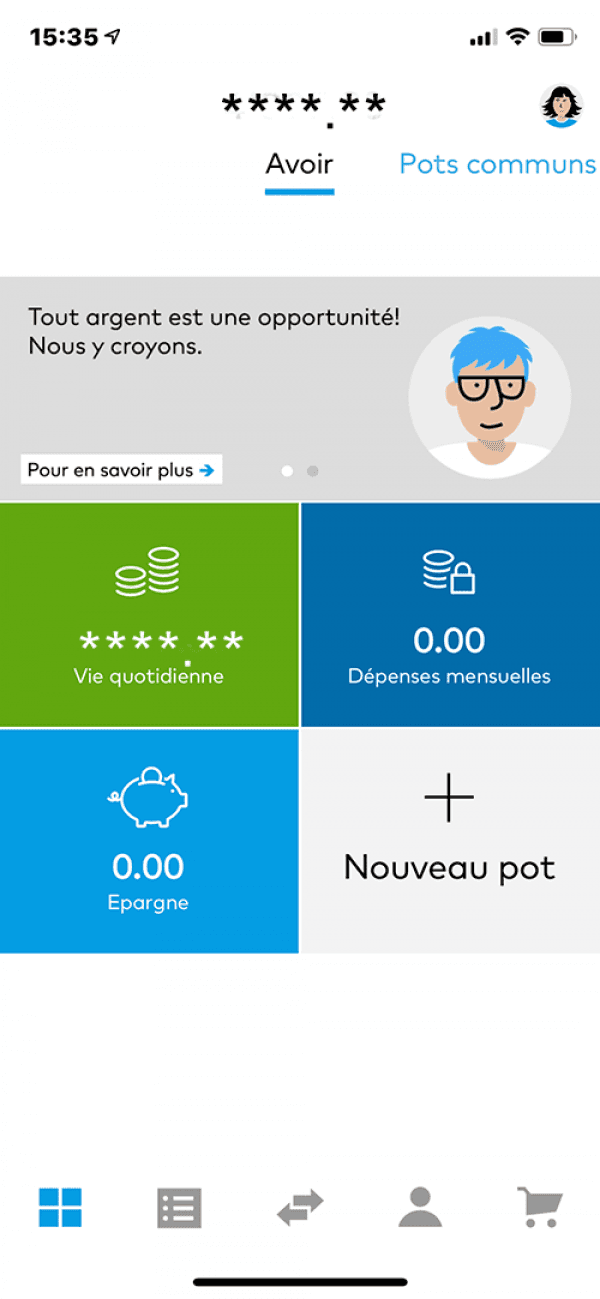

Interesting features: Common pots, Zak Illico, eBill

Zak is a bank that caters mainly to young adults. Eloffers features tailored to their needs, such as common pots, Zak Illico or eBill.

Common pots

Jars help you manage personal expenses, create savings, save for vacations, and more. Common pots allow you to manage joint expenses between friends, roommates or family members (up to 10 people).

This function is similar to the Split option of TWINT. However, Zak makes it possible to manage and monitor a greater number of expenses for the same group and over the long term, whereas TWINT is limited to instantaneous use only: “I owe CHF 10.- to 3 people and I pay everything right now “.

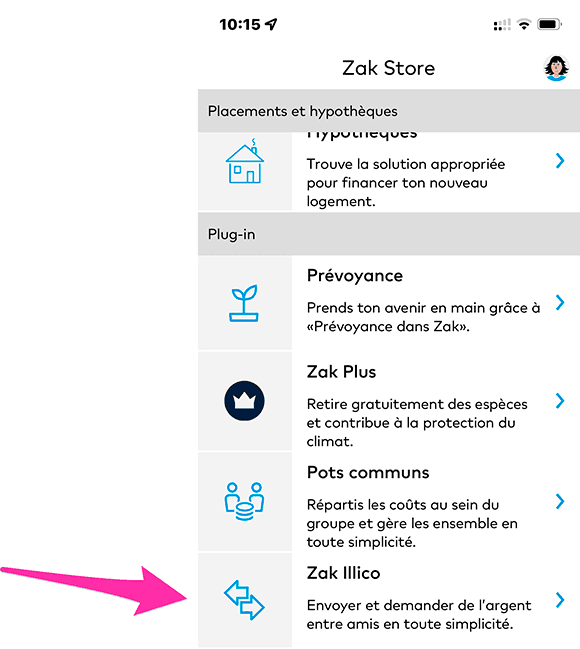

Zak Illico

With Zak Illico Zak offers an alternative to TWINT. Zak Illico allows you to receive or send money without IBAN and instantly any day and at any time.

Zak Illico lets you stay on the same app to send or receive money. There is no need to go through TWINT, nor to wait for the money to appear in the account.

eBill

The eBill system is offered by more than 90 Swiss banks, including Zak. The eBill function replaces your paper and e-mail invoices: you receive a message directly in your e-banking and all you have to do is validate the payment.

Zak has integrated eBill in a secure and intuitive way: just enter the SMS code to access your eBill account. You can then consult your invoices and pay them in one click, or automate them!

If you already use eBill with another bank, you can also use it with Zak: just enter the email address of your existing eBill account when registering eBill in Zak.

A 3a pension offer

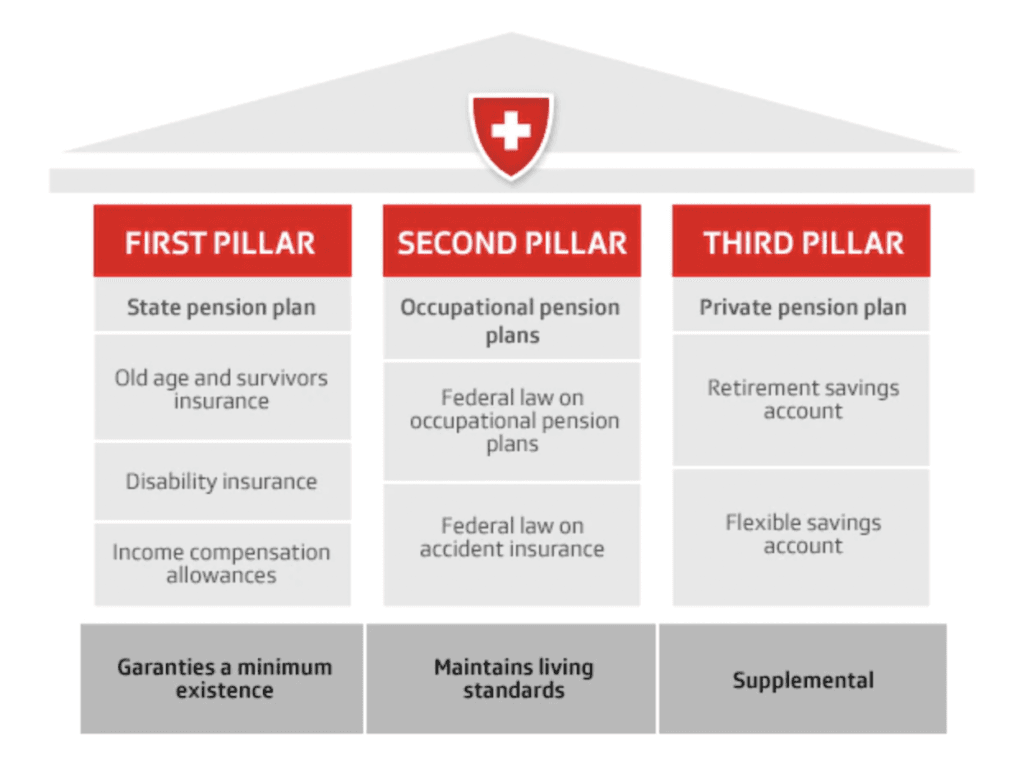

In Switzerland, the pension system is based on three-pillar system: state pension, occupational pension and private pension. This system aims to guarantee coverage of risks in the event of death, disability and old age.

- The 1st pillar is the responsibility of the State. It is mandatory.

- The 2th pillar depends on the employer. It is mandatory for employees and optional for the self-employed.

- The 3th pillar is completely optional and individual.

If you are an employee and pay your taxes in Switzerland you can reduce your taxes by opening a 3rd pillar account for individual retirement provision, regardless of your age.

Zak Bank being the neobank of Bank Cler, it also offers financial products like all the major Swiss banks. Opening a 3e pillar 3a with Zak can be done very simply, in just a few clicks. To find out more, read our article dedicated to 3a pension with Zak.

An ethical bank

Zak is an ethical bank that is committed to investing in sustainable and socially responsible projects. It has also implemented measures to limit its carbon footprint and uses renewable energy to power its servers. If you are looking for a bank that shares your values, Zak may be a good choice.

Zak Green Impact allows you to support a project on climate protection.

If you choose the Zak Plus plan, you automatically support Zak Green Impact with each payment by card and at no additional cost.

What’s your opinion?

If you like the content of our article or if you already use Zak’s services, do not hesitate to leave us a message in the comments.