What is a neobank?

A neobank is a digital bank, usually only available on mobile using an iPhone or Android application. These banks are also called mobile banks.

Some neobanks are not “real banks” but online wallets offering similar services. This was the case of Revolut until 2018.

Their success is based on their ability to combine different pieces of technology and offer excellent services with very competitive pricing (user interface, payment features, free account, free credit card,…).

Pros and cons of neobanks

- Easy account opening, from your smartphone

- Competitive pricing: free account, free credit card

- No proof of revenue needed

- No minimum deposit

- Do everything from smartphone

- Push notifications for each transaction

- No physical branch (if you need one)

- No dedicated customer agent

- Less banking services (no loan offer for example)

- Seems less “secured” than traditional banks

What is the benefit of neobanks compared to large Swiss banks?

Neobanks – that exist only on your mobile – put a lot of effort on user experience and usability since the app is their only point of contact with customers. Offering free services is also a key competitive advantage that they can afford since they employ less people and have less offices.

If neobanks (or mobile banks) are successful, it’s also because they address friction points that large banks never bothered to solve. Mainly for psychological reasons, rather than financial reasons.

Friction #1 : the need for PROXIMITY

Large banks create trust thanks to their size and because we can touch them: local branches are physical and visible elements of their marketing.

For years, large banks have used their sur leurs network of local branches to create proximity, but their mission is not delivered:

- You must physically go to a branch, usually on week days during working hours

- You need an appointment even if you just want to open an account

- You must answer multiple questions to the bank representative

- For standard transaction: you must queue at the counter

- You so-called “Relationship Manager” is re-assigned to another branch every 2 years

A mobile app solve all these proximity issues: you get a 24/7 access to your branch, at your fingertip!

Opening a bank account gets done from your sofa with your iPhone, in 15 minutes !

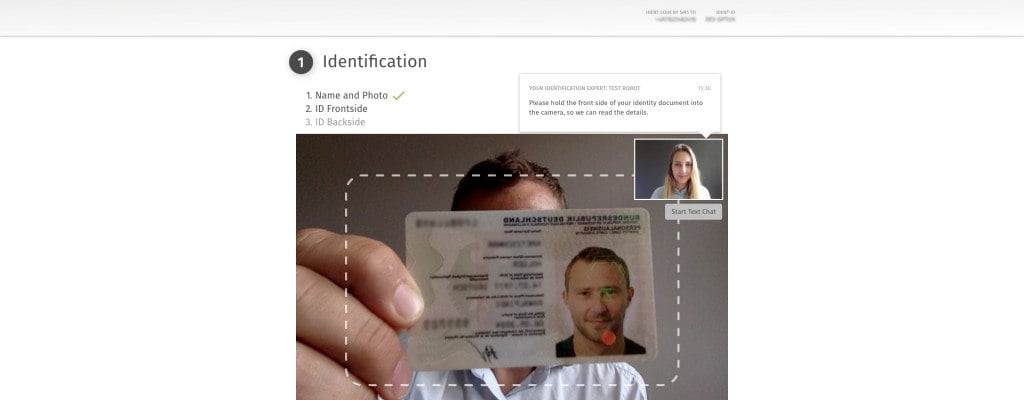

For example N26 et Neon use IDnow to check your identity.

The verification service is available in french, english, german (et more), 24 hours and on week-ends. There is no need to book an appointment, you just need to login and wait a few minutes.

The role of the IDnow agent is only to visually check your ID document : passport, ID card, B or C permit,…

They do not ask any question about your sources of revenue or financial needs.

Once the check is the done, your account is opened swiftly:

- with ZAK our account was activated in less than 1 heure,

- with Neon it took a few days mainly because we provided a UK phone number and the launch of their app

Customer service differs a lot between neobanks!

Here are 3 exemples of customer service provided by neobanks – from the best to the not so good

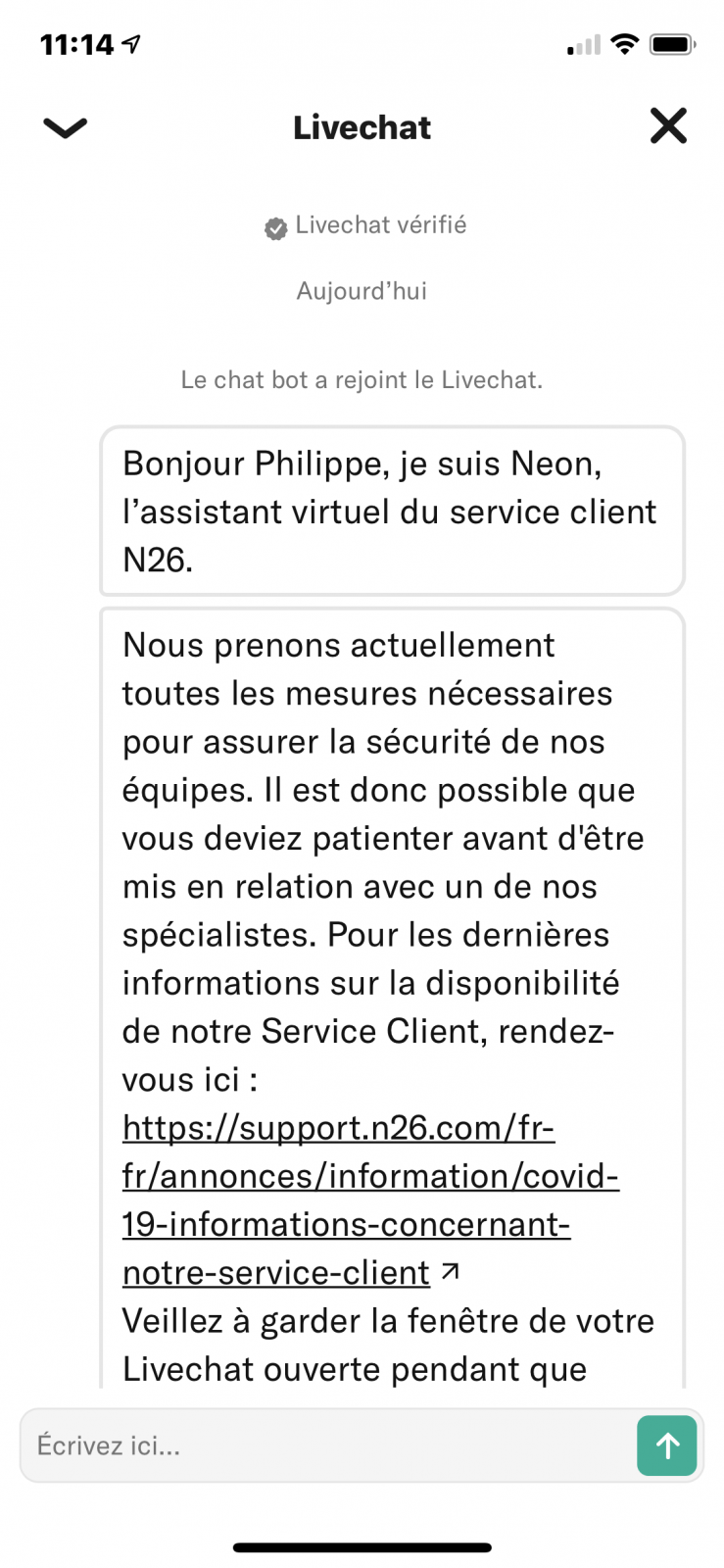

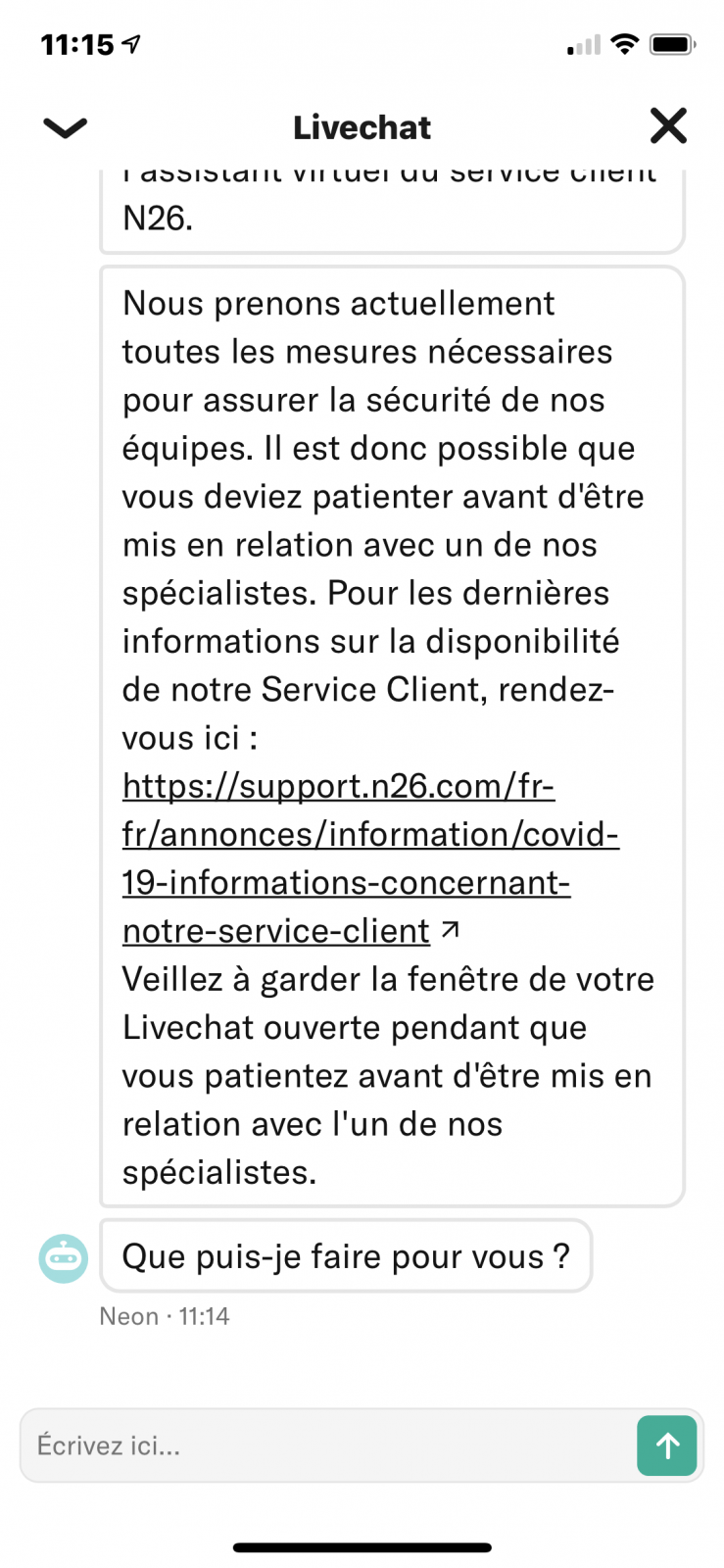

N26 – Livechat available Monday to Sunday from 07:00 to 23:00

At N26, the LiveChat is available immediately during a wide time range. The virtual assistant gets you to wait (usually less than a minute) the time a human takes over the conversation.

Customer agent can solve issues very quickly.

(*) Coincidence or irony, the N26 virtual assistant is called Neon

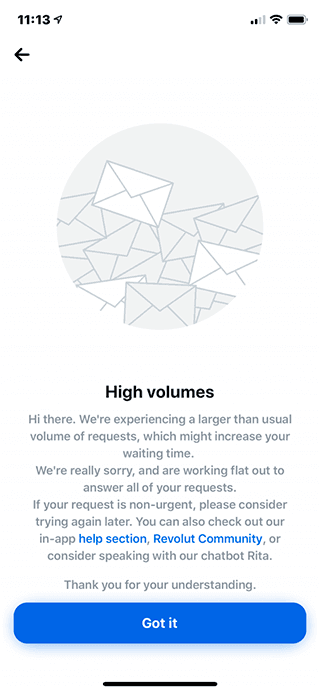

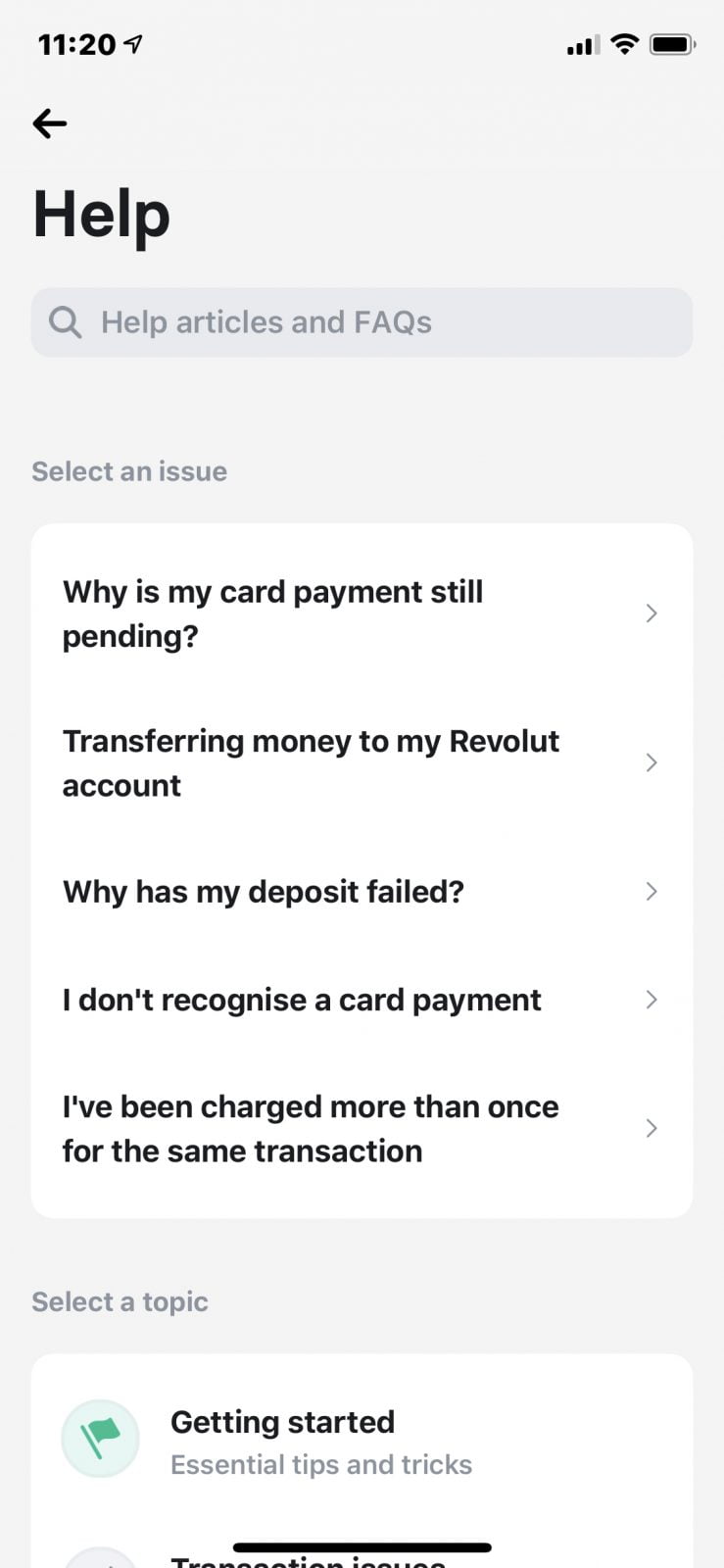

Revolut : A Chat “in theory” available 24 hours a day, from Monday to Sunday

When you try to contact Revolut by Chat, you first see a message that discourages you to do so!

The message redirects your either to the Help section or to the “community support”.

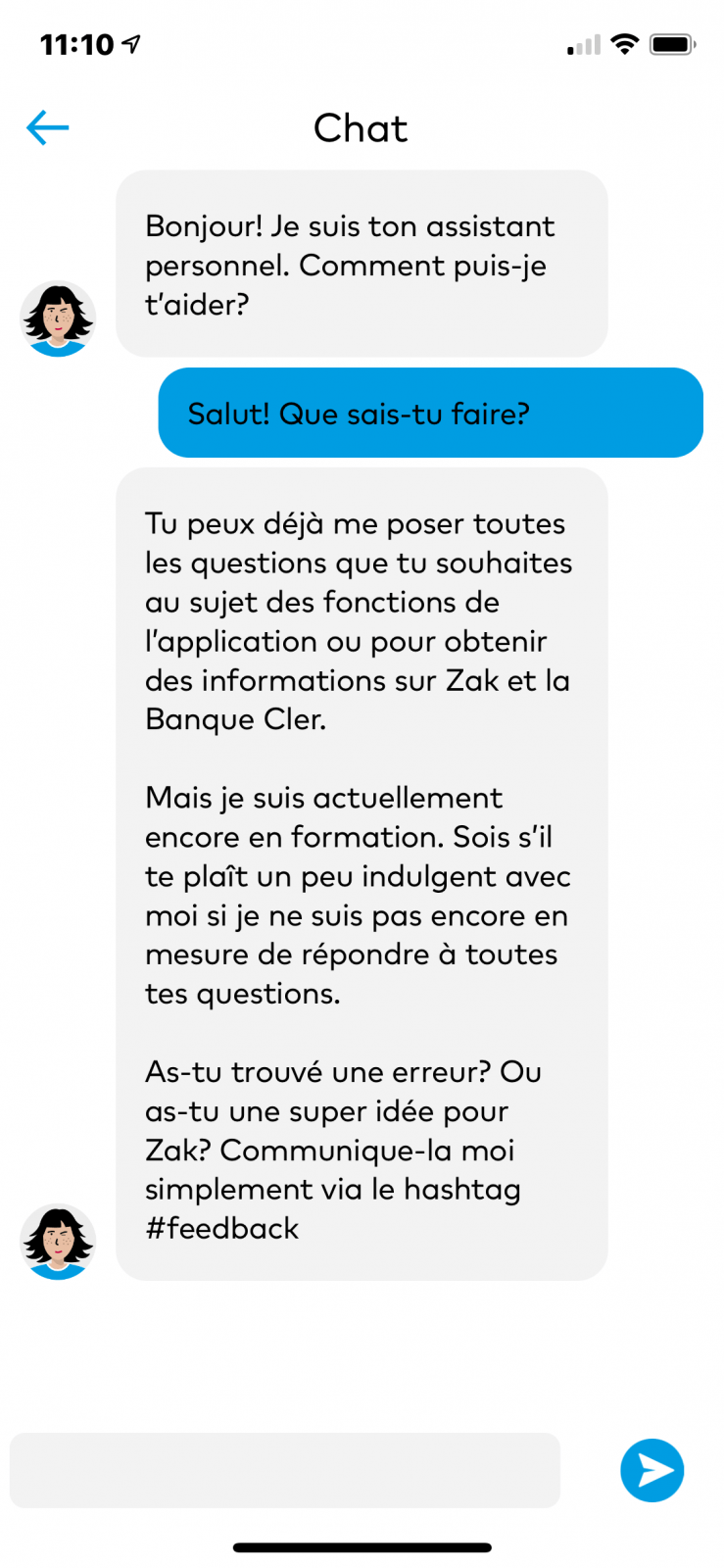

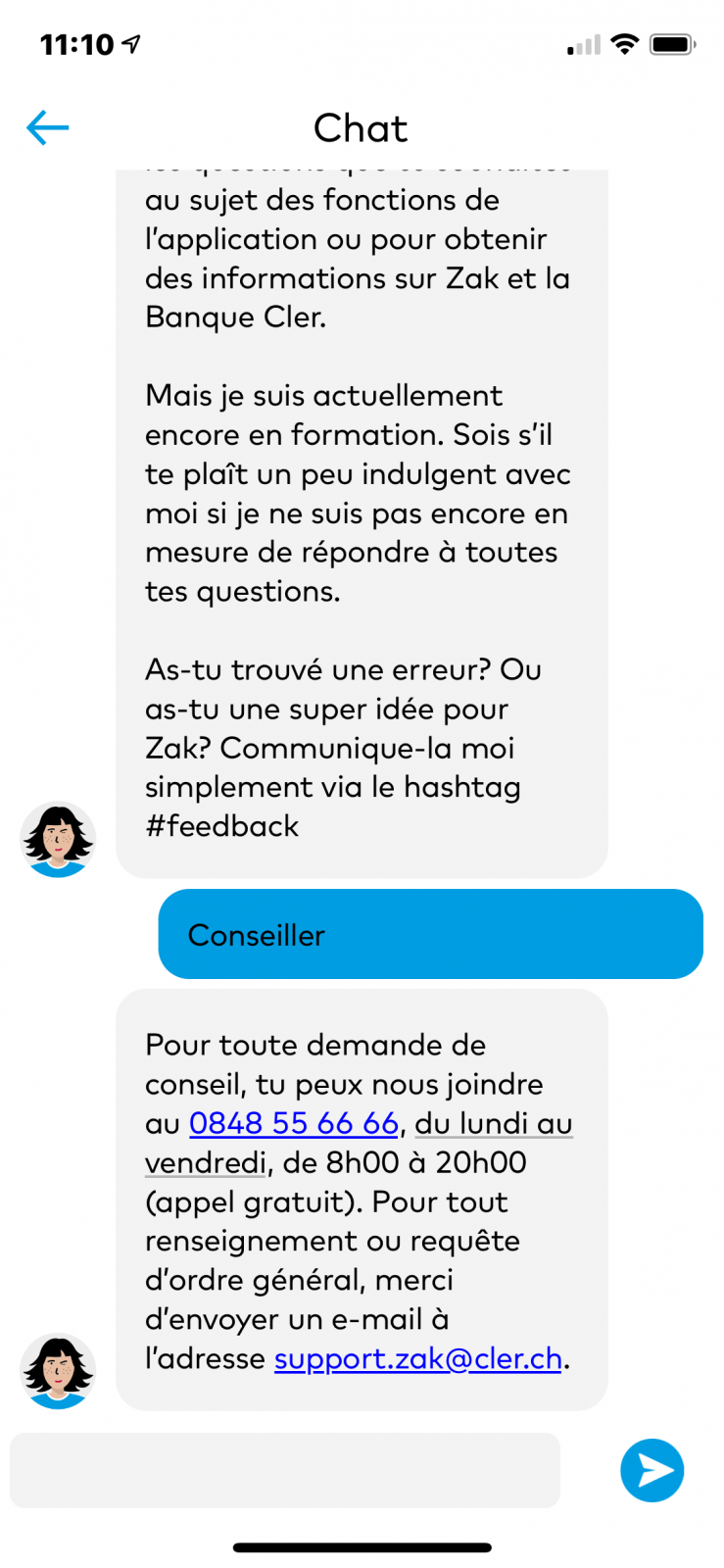

Zak: A Bot that directs you to a phone number, available Monday to Friday from 8:00 to 20:00

With Zak, you enter a Chat that is actually a Bot ! If you ask for a human, the bot will display the phone number of the customer service 848 55 66 66 and their email address: support.zak@cler.ch

On this point, ZAK is adding friction since the bot has no added value.

N26 is the best at solving this Friction point and proximity issue. The fact that an agent is available quickly is reassuring and creates trust.

Friction #2 : The need for INFORMATION (and IMMEDIACY)

Gone the time when you needed to keep all your payment receipts and compare them with your monthly paper statements (I remember my mother doing this).

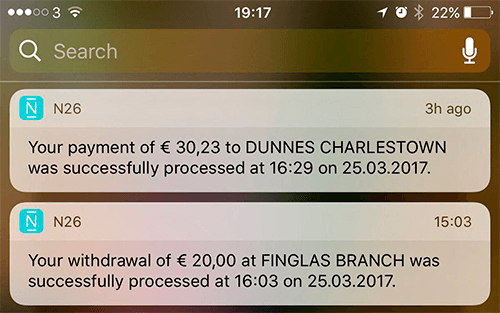

Neobanks give you instant access to your payment history.

You get an instant push notification on your mobile to confirm the transaction. Be it a credit card payment, a bank transfer or direct debit.

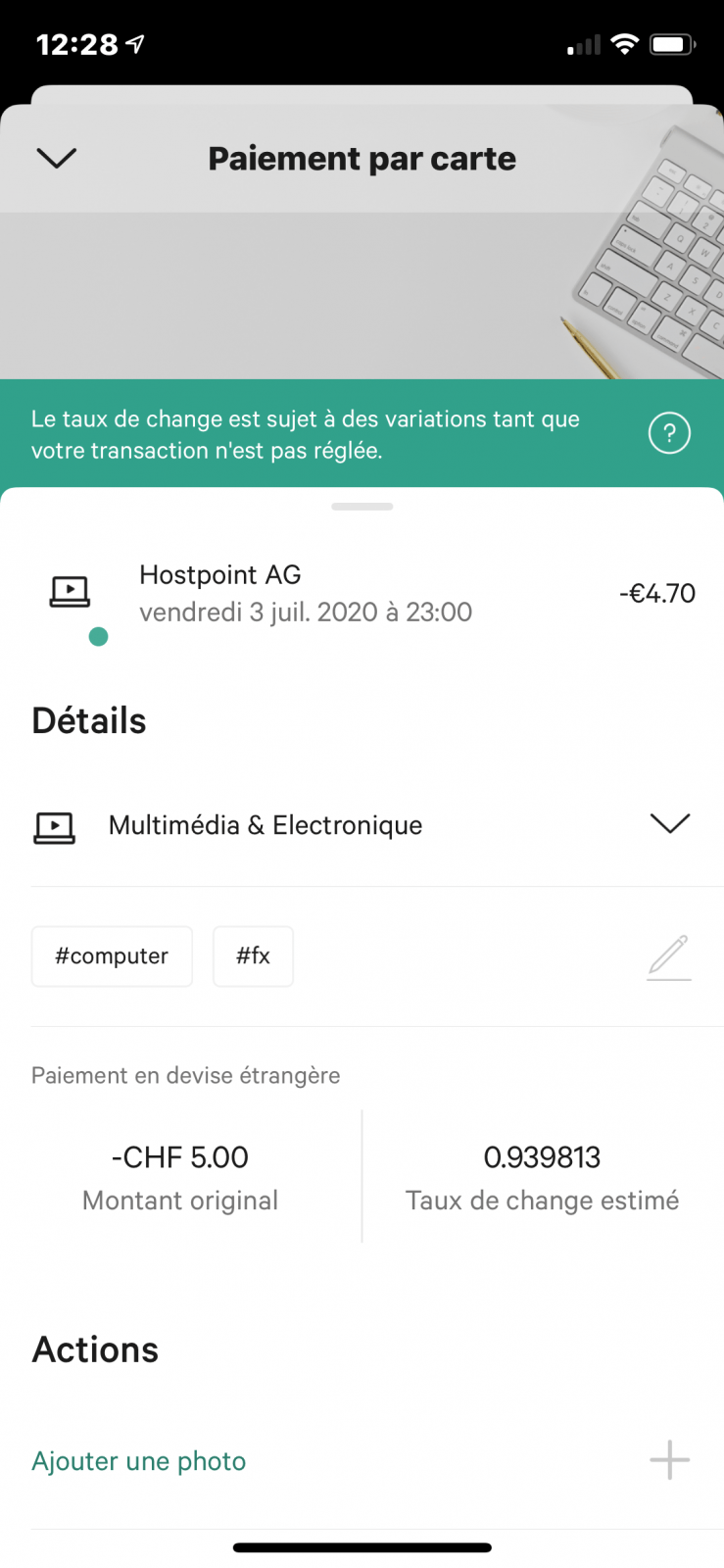

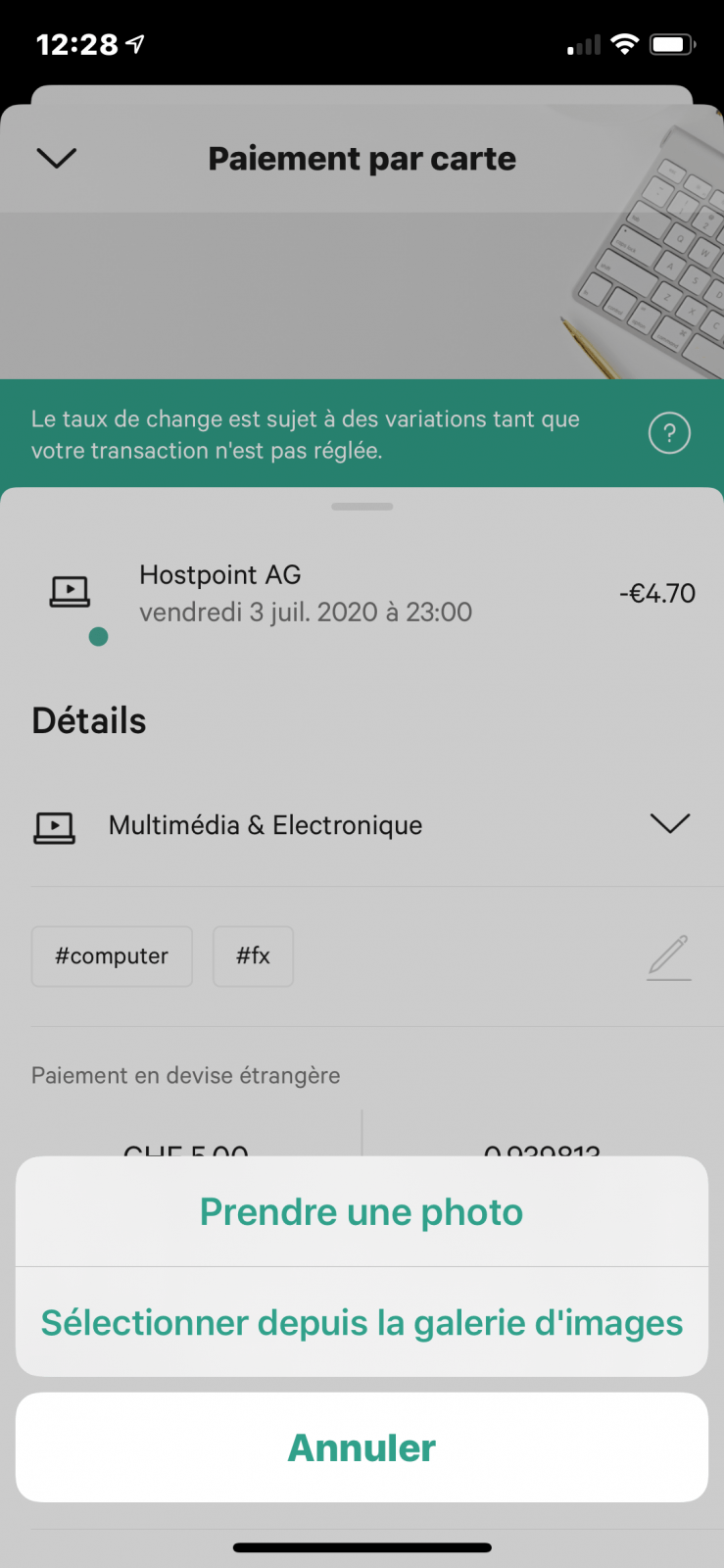

In 1 click, you can access all transactions from the mobile app and Neobanks such as N26 also allow you to take a picture of the payment receipt:

Zak does not offer this option yet, but we hope it should soon be available.

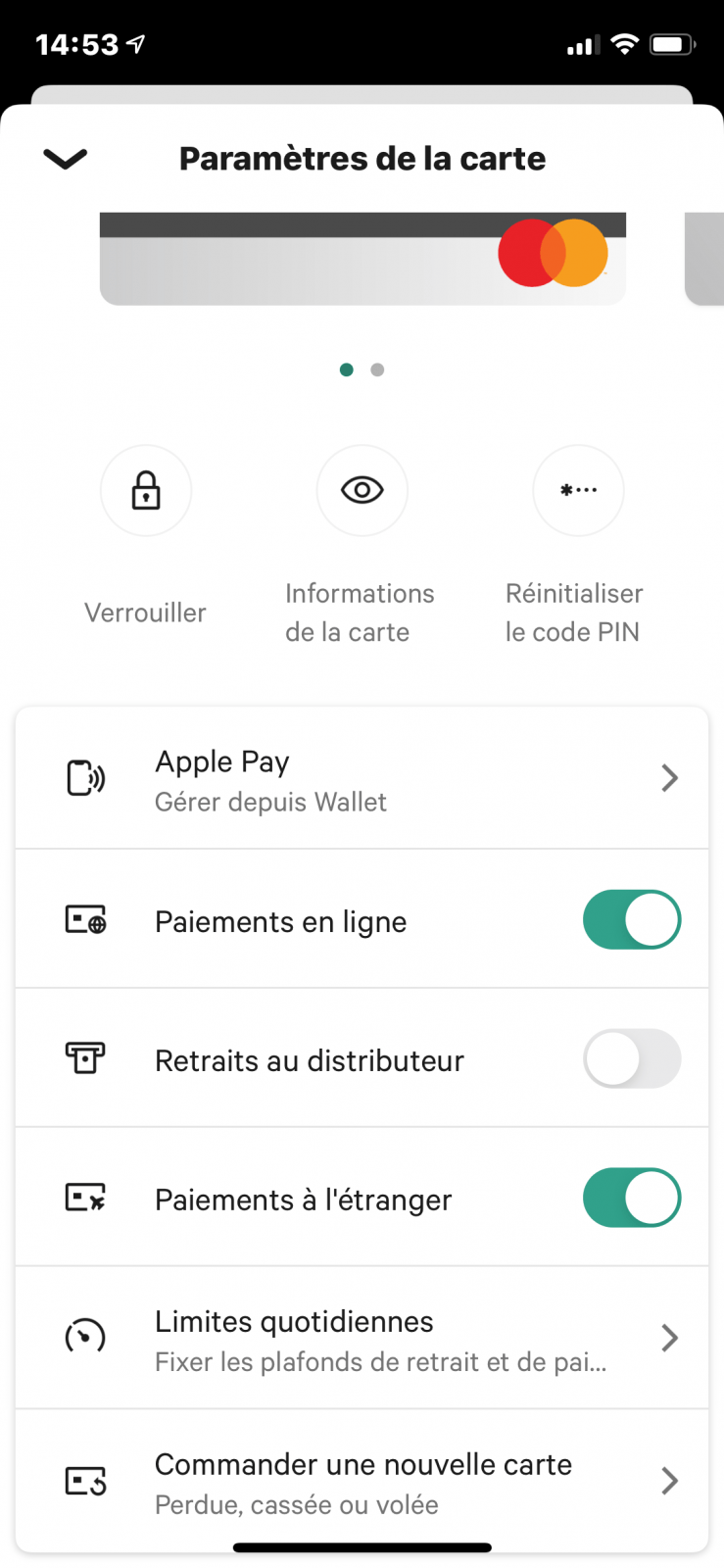

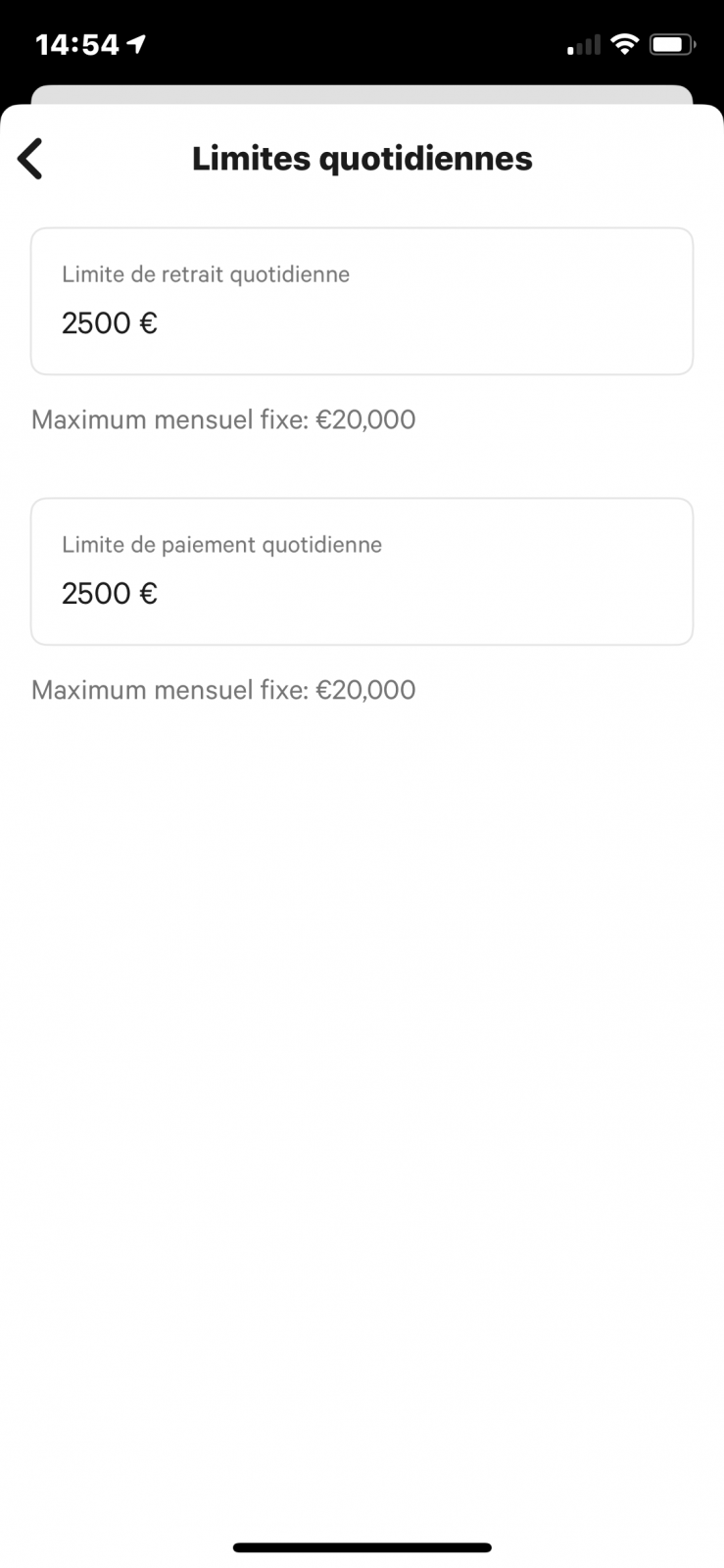

Friction #3 : The need for CONTROL

About 10 years years ago, I got my wallet stolen in Prague during a business trip, so I urgently called my wife so that she could call the banks and have my cards blocked. That was a kind of panic situation for me and my wife. At that time I wasn’t using neobanks yet.

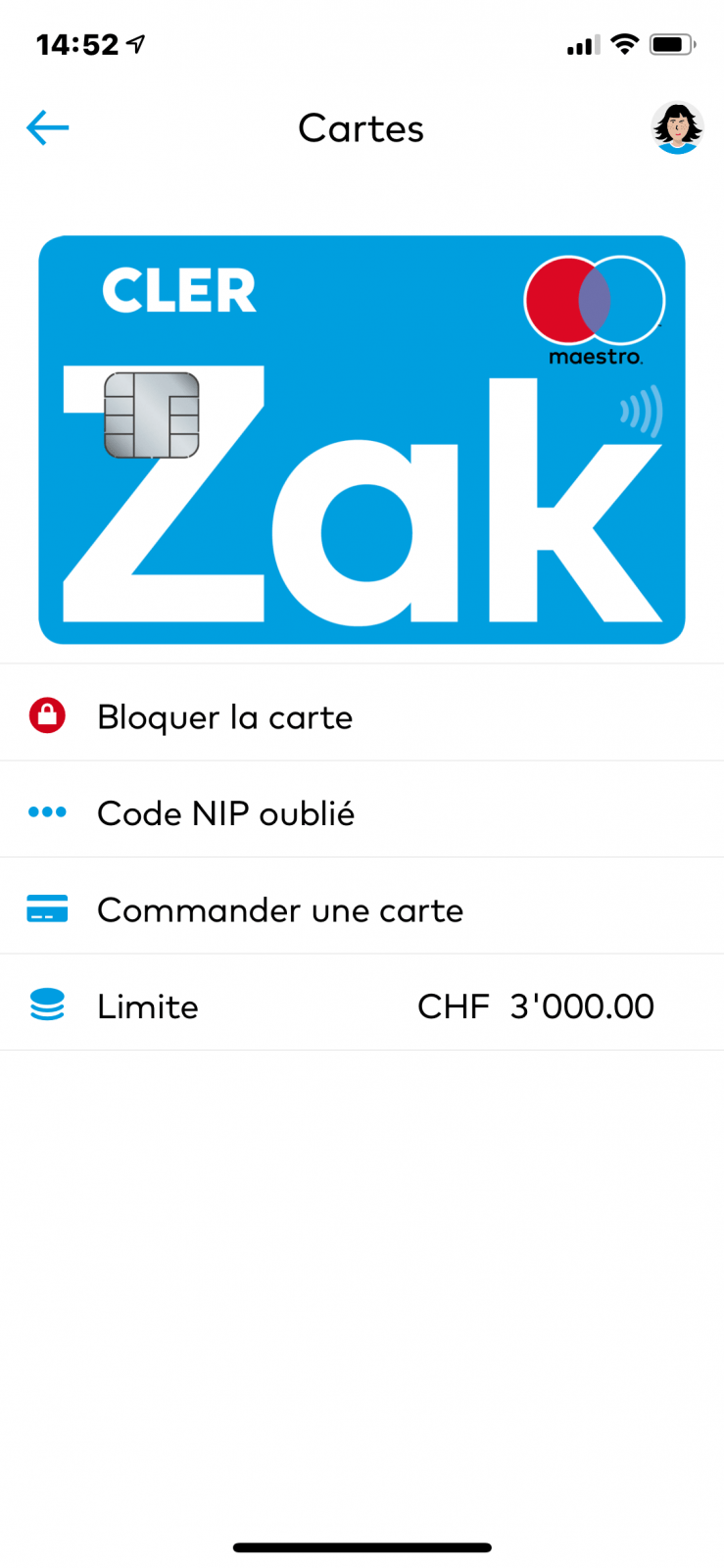

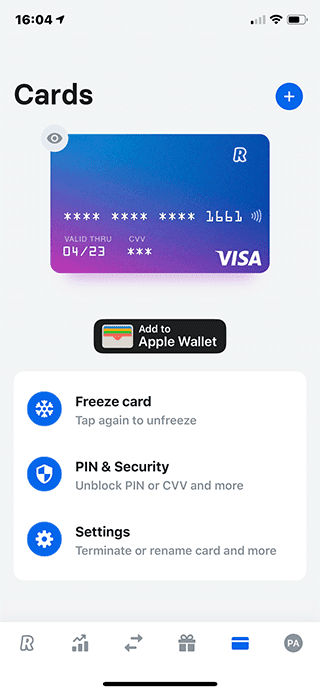

More recently, during a family trip to Rome, I also had my wallet stolen, but this time it was packed with Revolut and N26 cards. So I simply took my iPhone and blocked the cards in a matter of seconds. Easy.

If you credit card gets lost or stolen and you are banking with Neobanks, no need to panic and call your bank so they can block it.

You just need to login the the mobile app of your neobank and block your card. With Revolut – for example – you can also freeze your card instead of blocking it.

Once blocked, you simply order a new card from the mobile app.

N26 offers very good card settings to manage your limits and customize how you wan to use your card:

- Enable/disable online payments

- Enable/disable cash withdrawals

- Enable/disable payments abroad

Friction #4 : The pain of PAYING

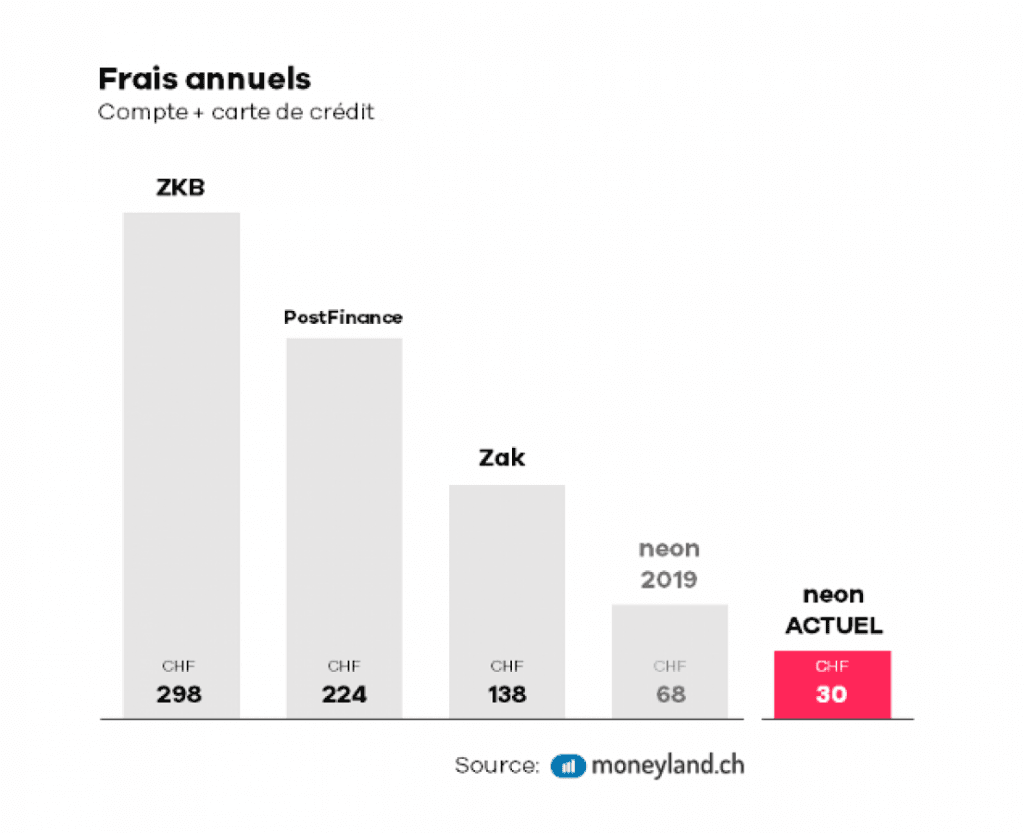

To capture more customers and take market shares from large banks, mobile banks offer very attractive pricing. Beyond a free bank account and a free credit card, they also try to segment the market with travellers, children and freelancers.

They create agressive pricing with a lot of transparency, mainly related to bank transfer, card payments and cash withdrawals.

neon for example can reduce your annual banking fees to 30 CHF instead 300 CHF with some large banks..

Neobanks also include a free debit card (Visa or MasterCard) with their free bank account .

With other Swiss banks, you have to pay maintenance fees of about 5 CHF/month and the debit costs 40 CHF/year on average.

By comparaison, here is a preview of standard pricing offered by Swiss neobanks:

Which neobank to choose in 2026?

The good thing with FREE, is that you don’t need to choose 😀

But we understand that not everyone is willing to open 15 bank accounts, so here are our recommendations:

You want an account mainly for Switzerland: ZAK or neon

These 2 neobanks have their headquarter in Switzerlands, and they can provide features specific to Switzerland:

- Bank account in CHF with IBAN in CH

- Swiss invoice scanning (orange slip, QR codes,..)

- e-Bill and Twint (with neon)

You want an account in EUR: N26

N26 offer the best mobile app for a EUR account:

- Bank account in EUR

- Free and instant SEPA transfers

- Customer service by Chat

- Excellent exchange rates (from Mastercard) that makes the card ideal for travel

To travel: N26, Revolut or Wise

Revolut and Wise offer multi-currency accounts, ideal for travelling:

- You can maintain sub-accounts in multiple currencies

- They use interbank exchange rates (the best you can get)

- You can top-up your account with a credit card

N26 is also a good option if you travel in Europe

- They use the MasterCard exchange rate, without any surcharge

- You get free cash withdrawals in EUR