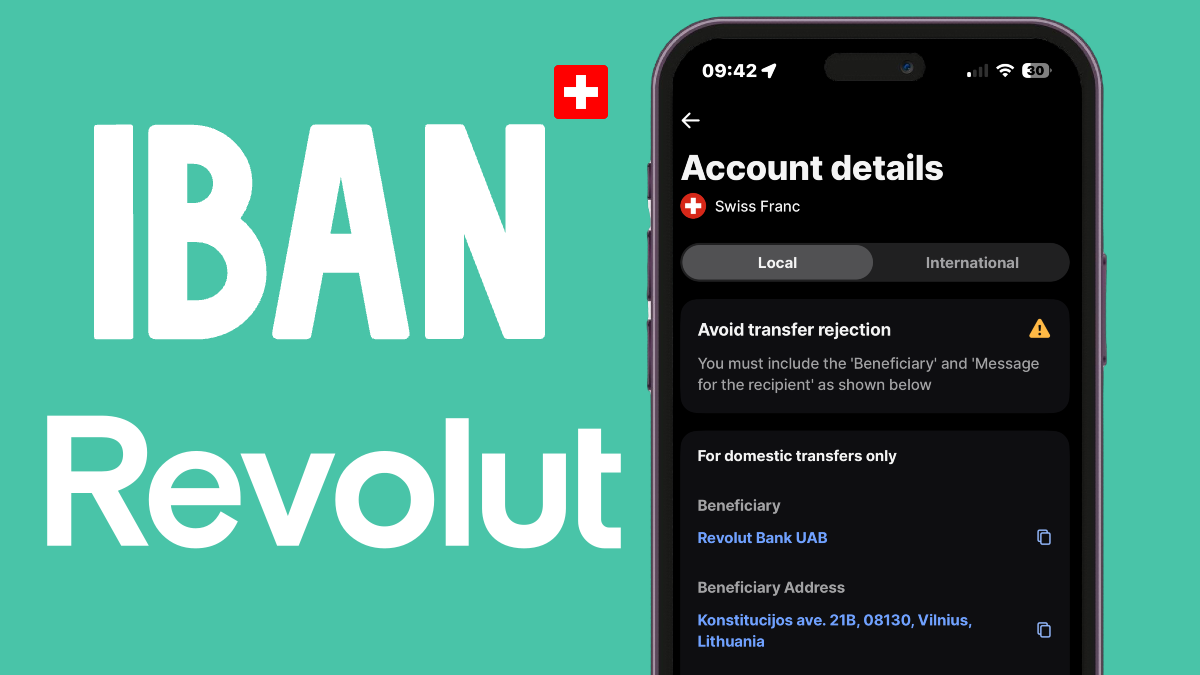

Revolut Switzerland now offers a Swiss IBAN (CH) for its clients in Switzerland. This new feature helps avoid transfer fees imposed by some Swiss banks when sending money to a foreign IBAN. However, this new IBAN still has limitations. Here’s everything you need to know.

How to Get the New Revolut Switzerland CH IBAN?

Activating your Swiss IBAN in Revolut is simple:

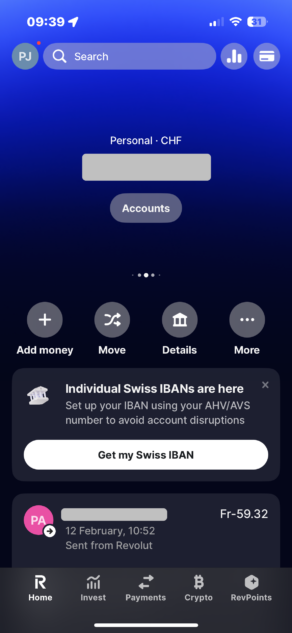

1. Open the Revolut App

- Go to your CHF account.

- A message will inform you about the availability of the Swiss IBAN.

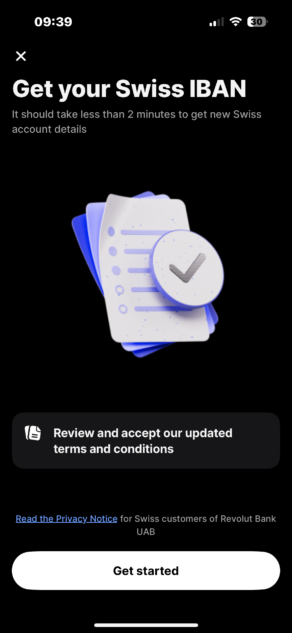

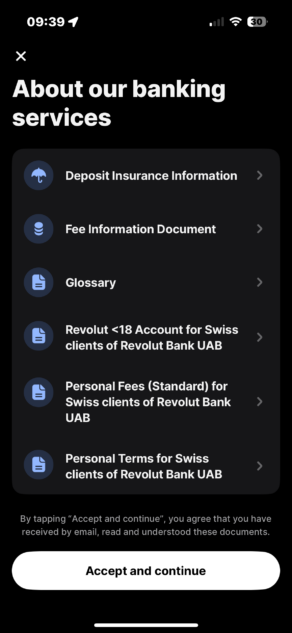

2. Complete the Verification Process

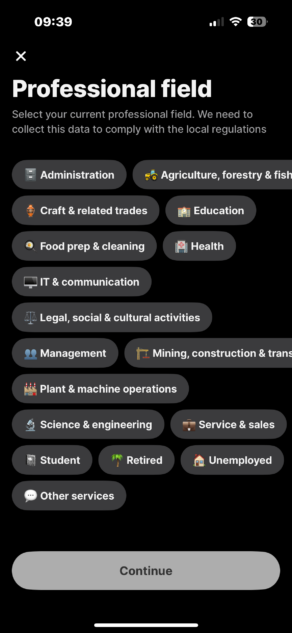

- Answer questions about your professional status.

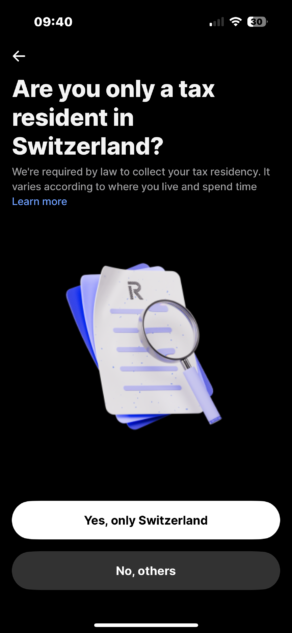

- Confirm your tax residency in Switzerland.

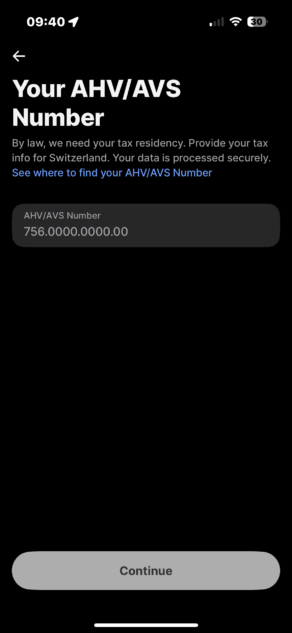

- Enter your AHV/AVS number.

3. Your New Revolut Switzerland IBAN is Active

What Changes with Revolut Switzerland’s CH IBAN?

✅ Advantages

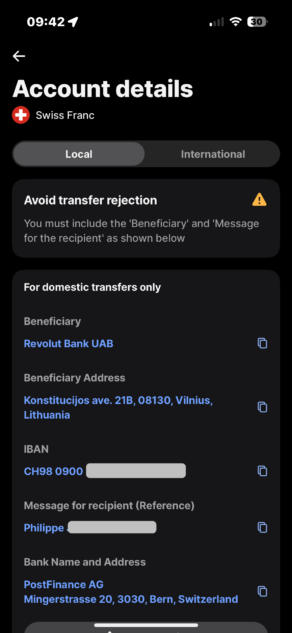

✔ A Swiss IBAN: You get an IBAN starting with CH, making transfers from Swiss banks easier with no extra fees.

✔ Account domiciled in Switzerland: The IBAN is hosted by PostFinance, a Swiss bank.

✔ Receive local payments in CHF without needing to use a Lithuanian IBAN.

❌ Key Limitations

⚠ Still a shared IBAN: The IBAN is not personal. Transfers must always include a specific reference to be correctly credited.

⚠ Not a full Swiss bank account: Unlike Swiss neobanks, this account does not provide a unique IBAN in your name.

⚠ Funds domiciled at PostFinance but managed by Revolut Bank UAB in Lithuania.

Alternatives for a True Swiss Personal IBAN

If you are looking for a Swiss account with a unique CH IBAN in your name, Revolut Switzerland does not fully meet this need. Here are some alternatives:

🏦 Alpian – A Swiss digital bank with a Private Banking approach and a CH IBAN, available in CHF, EUR, USD, and GBP.

🏦 Radicant – A sustainable Swiss bank with a CH IBAN, available in CHF and EUR.

🏦 Yuh (PostFinance & Swissquote) – A Swiss account with a personal IBAN and investment options, available in CHF, EUR, and USD.

Conclusion on Revolut Switzerland’s CH IBAN

The new CH IBAN from Revolut Switzerland is primarily an internal change rather than a real improvement for users. Previously, Revolut used Credit Suisse services to manage its Swiss IBANs. Now, these accounts are hosted at PostFinance. While this still allows users to receive local payments without extra fees, the IBAN remains shared and requires a payment reference, which can be problematic for some use cases like salary deposits or direct debits.

For a true personal Swiss IBAN, it is better to opt for Alpian, Radicant or Yuh, which offer full multi-currency accounts with an individual CH IBAN.